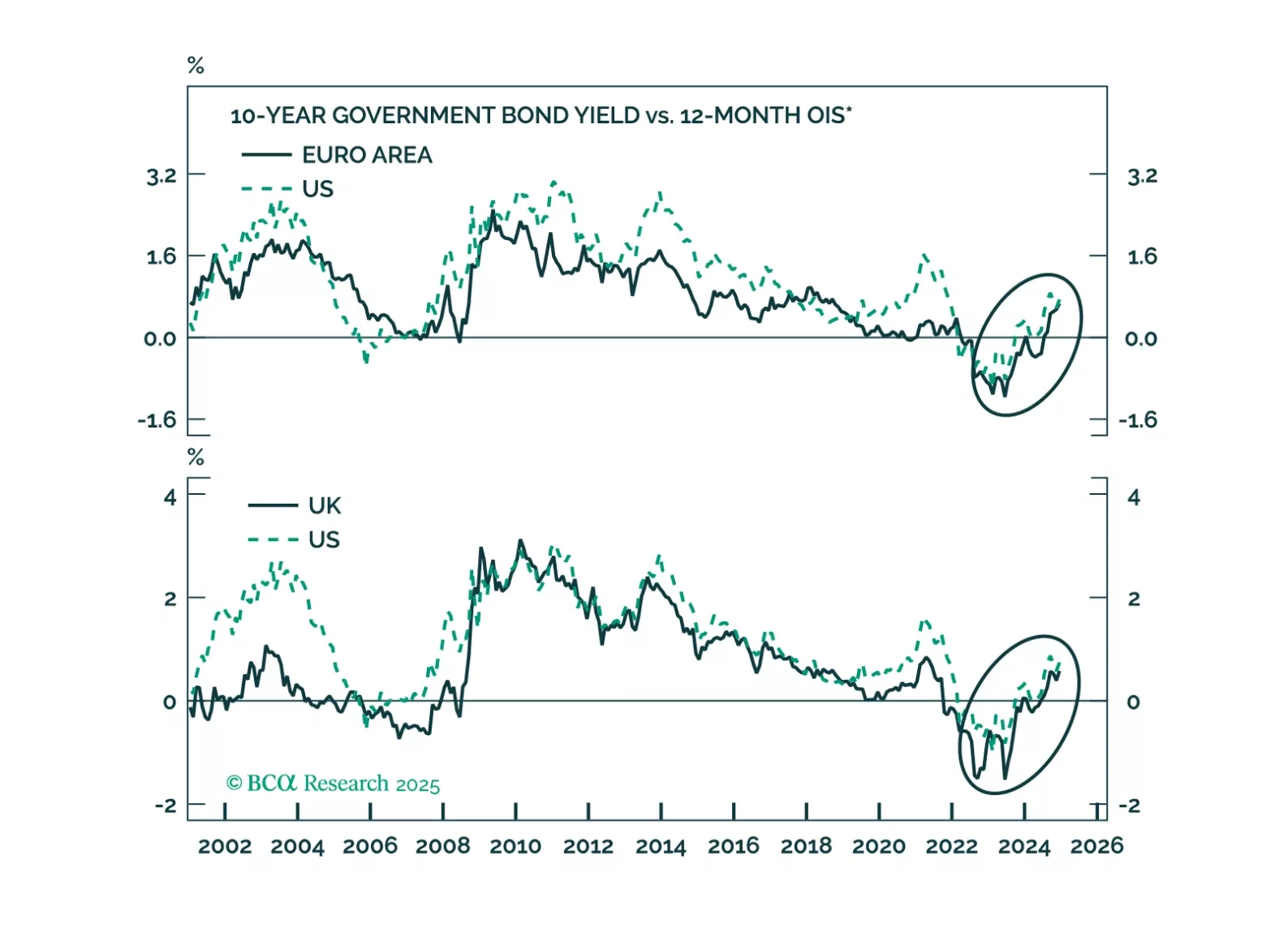

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

Our Portfolio Allocation Summary for January 2025.

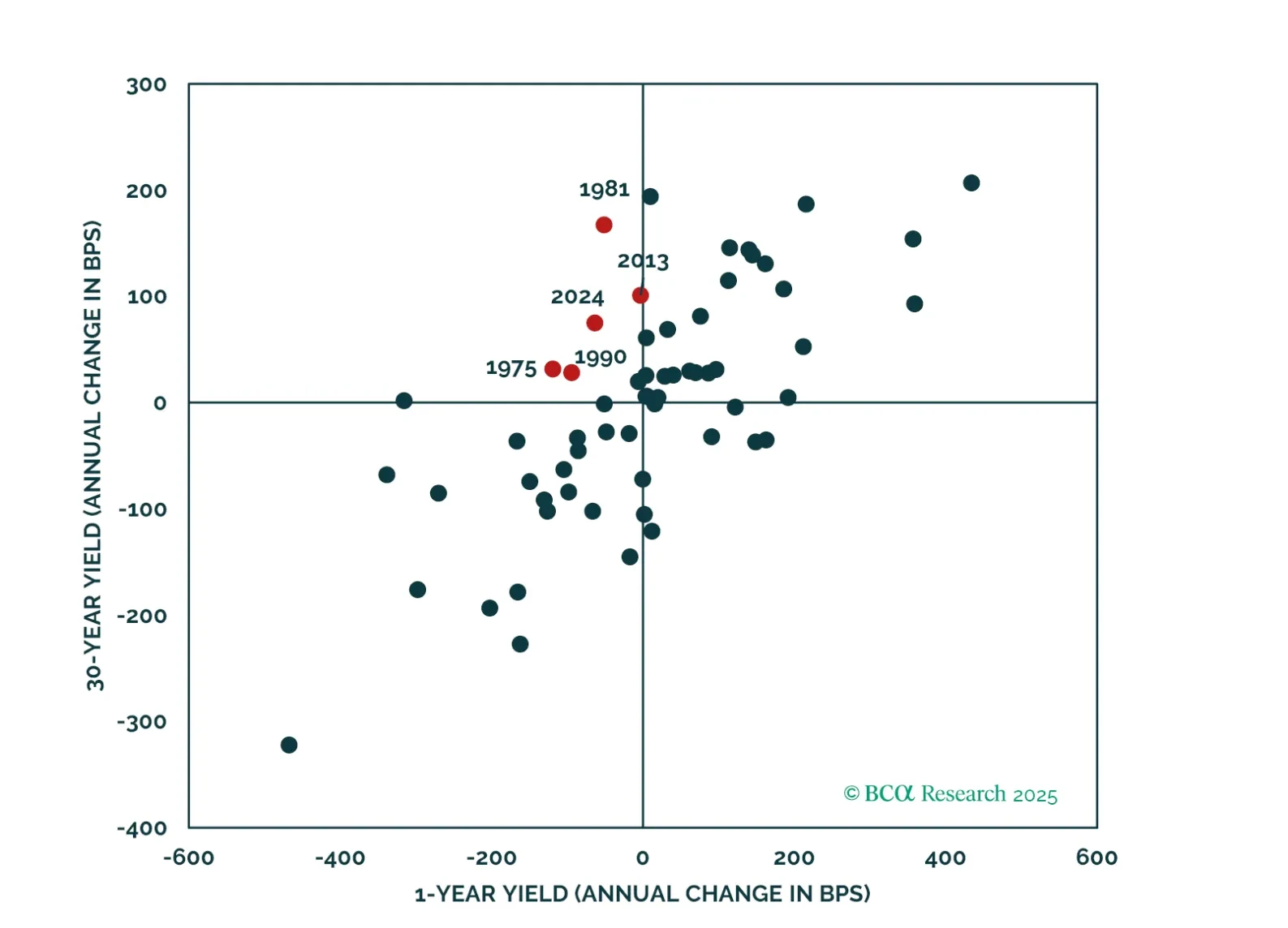

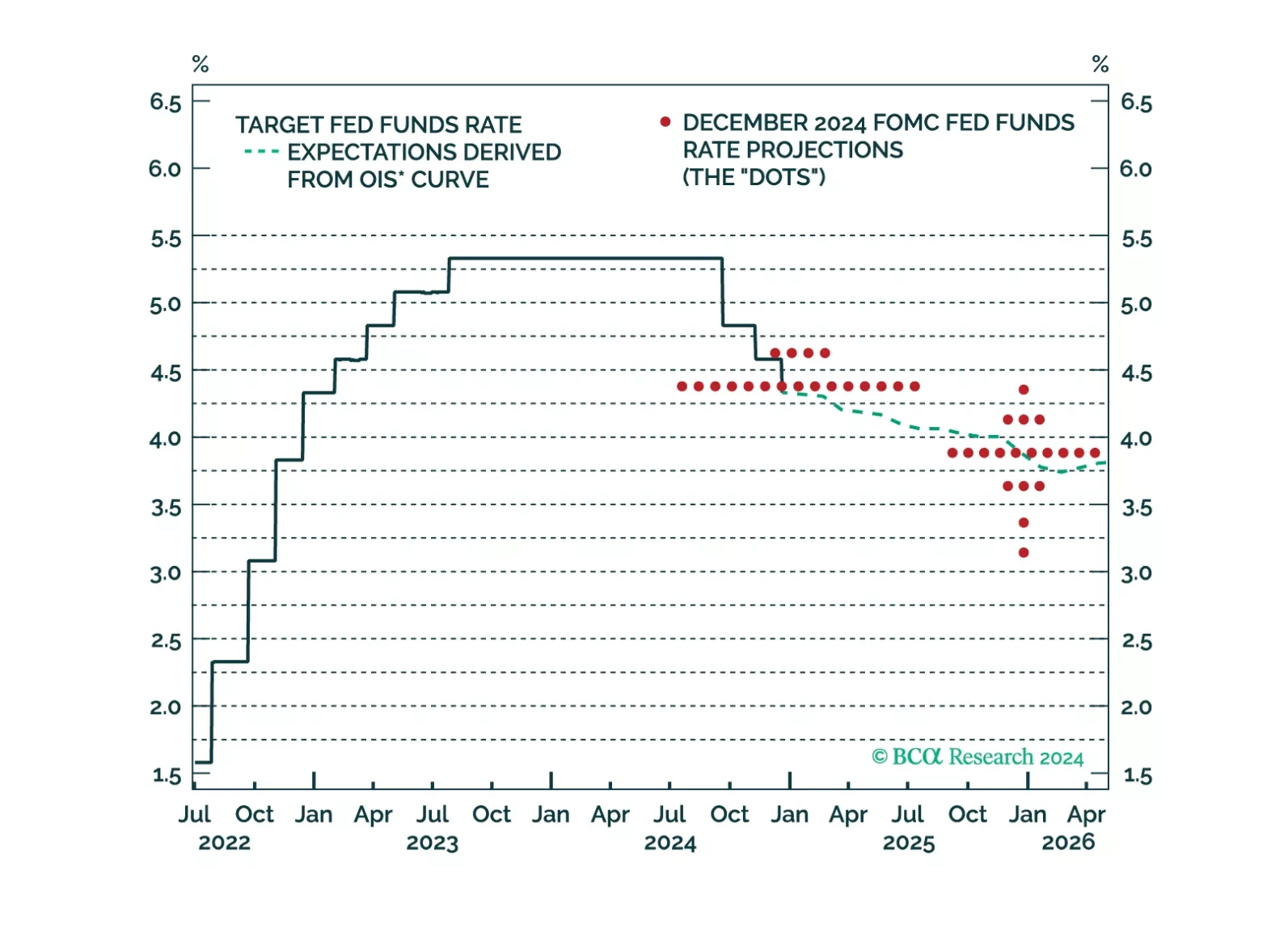

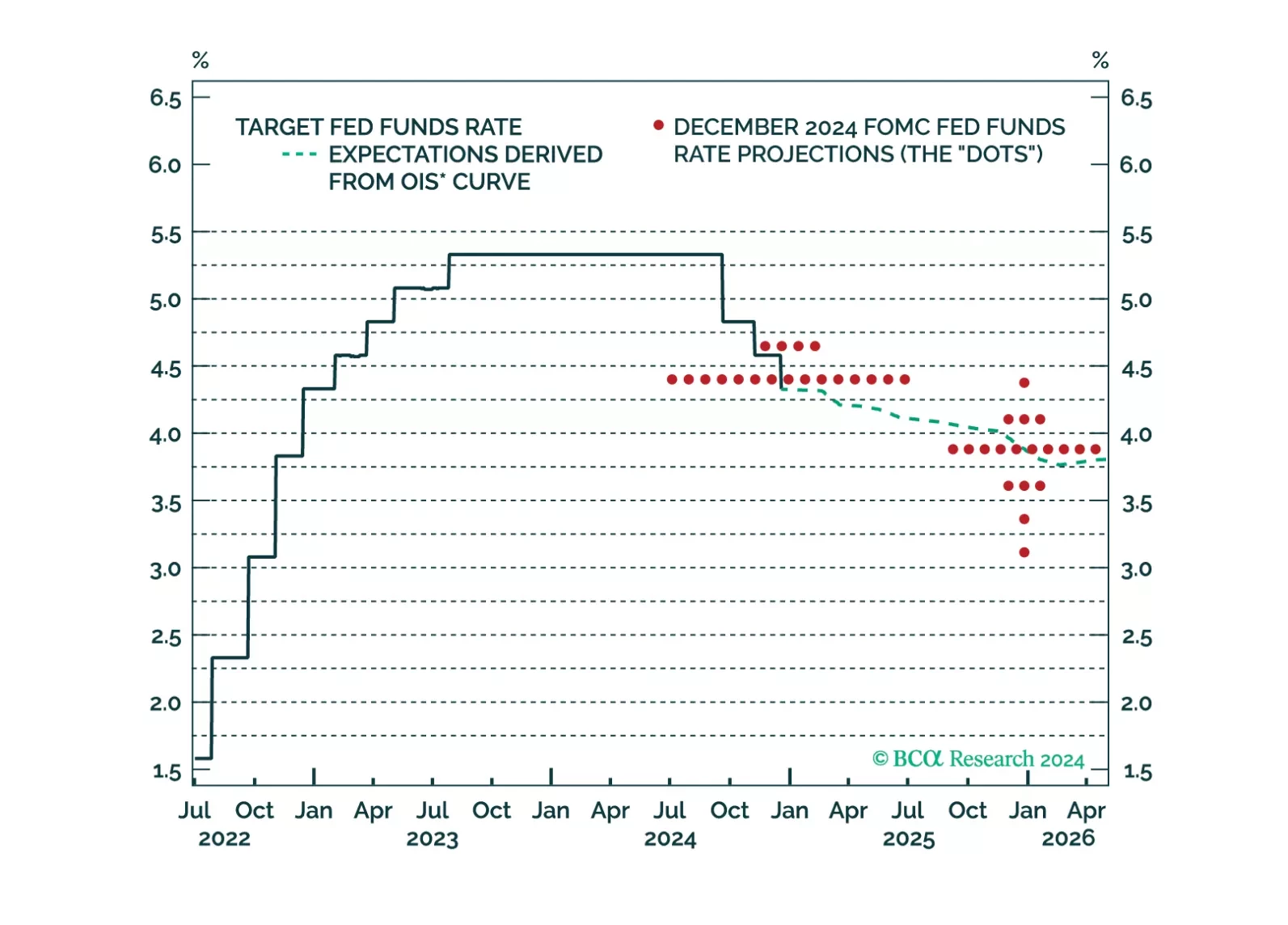

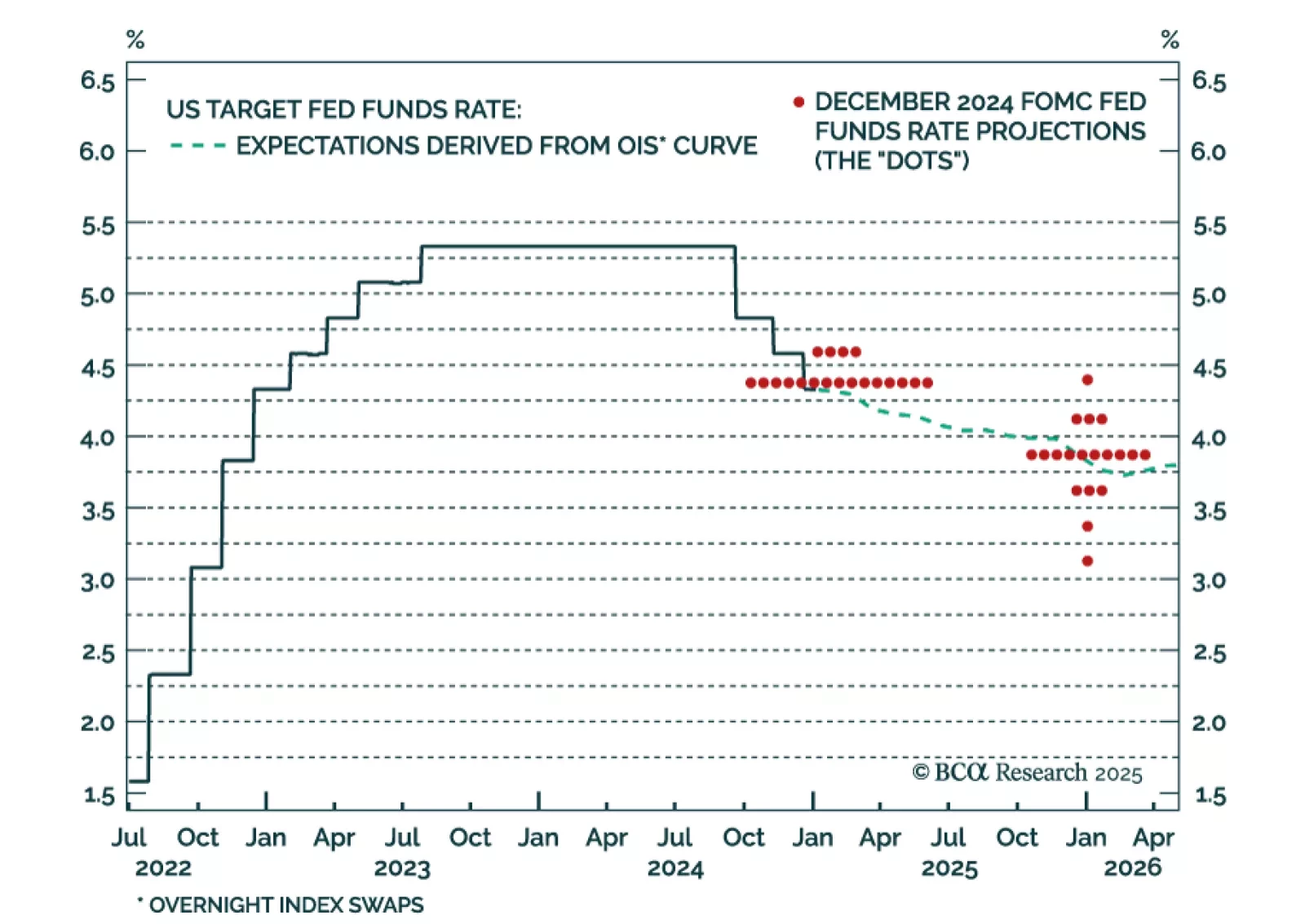

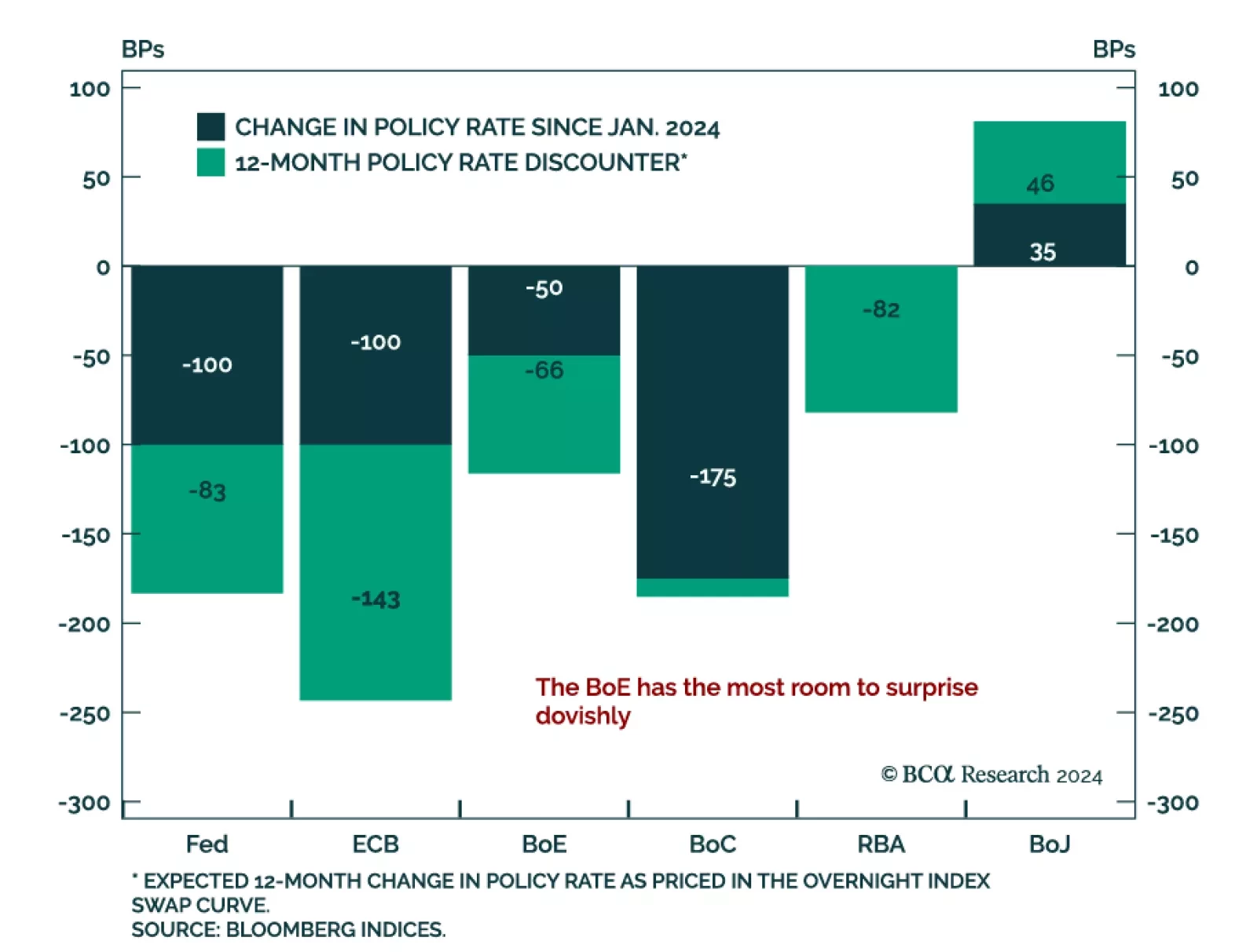

Our US Bond Strategy team published their outlook for the Fed in 2025. They expect more cuts than the 50 bps signaled by the Fed at its December meeting. Core PCE inflation is tracking well below the Fed’s 2.5% forecast, while…

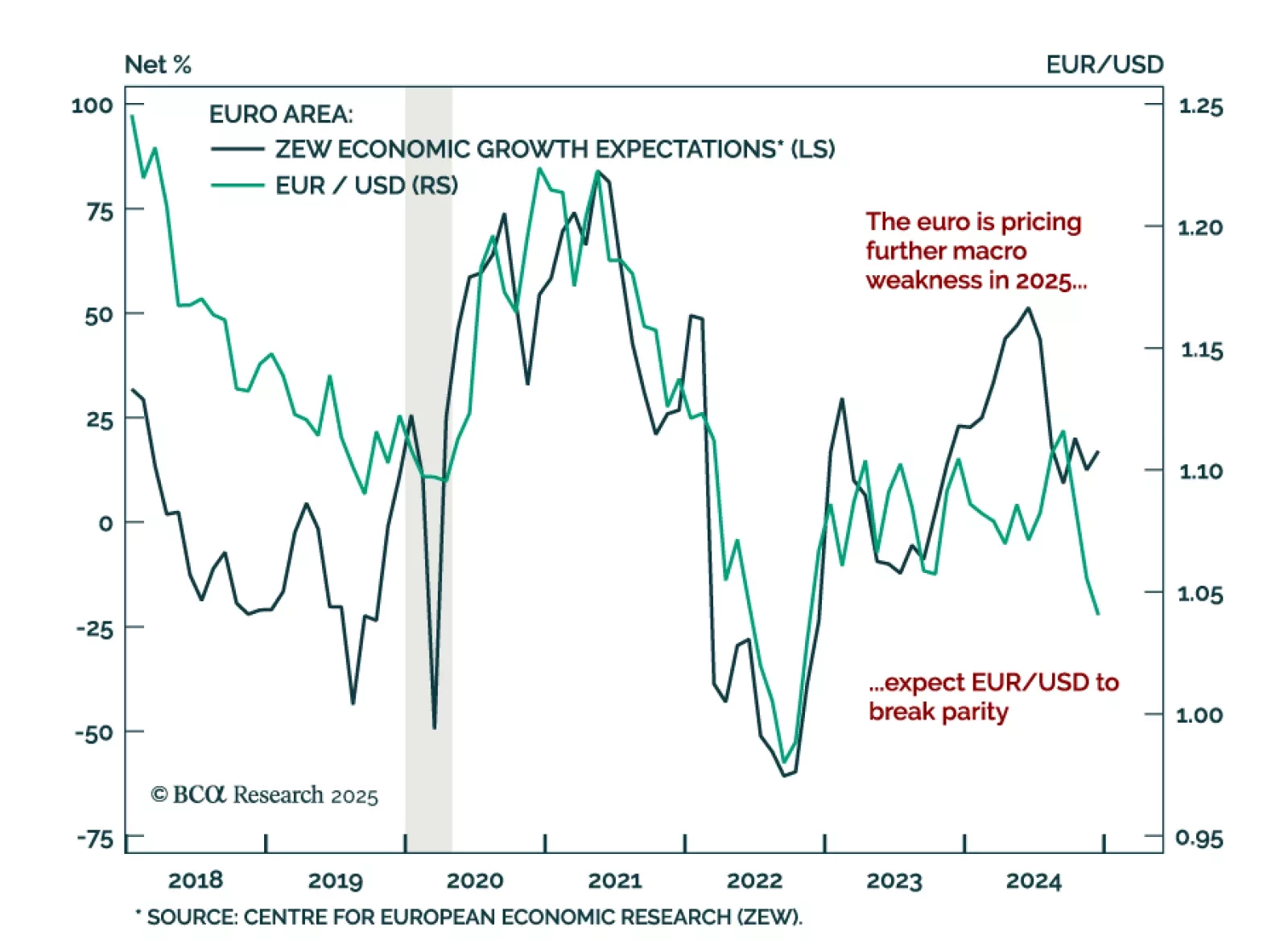

The euro broke the support level of its 2-year trading range against the USD, extending the strong dollar trend witnessed since September of last year. This trend will continue in Q1 2025. Despite global yields rallying in late…

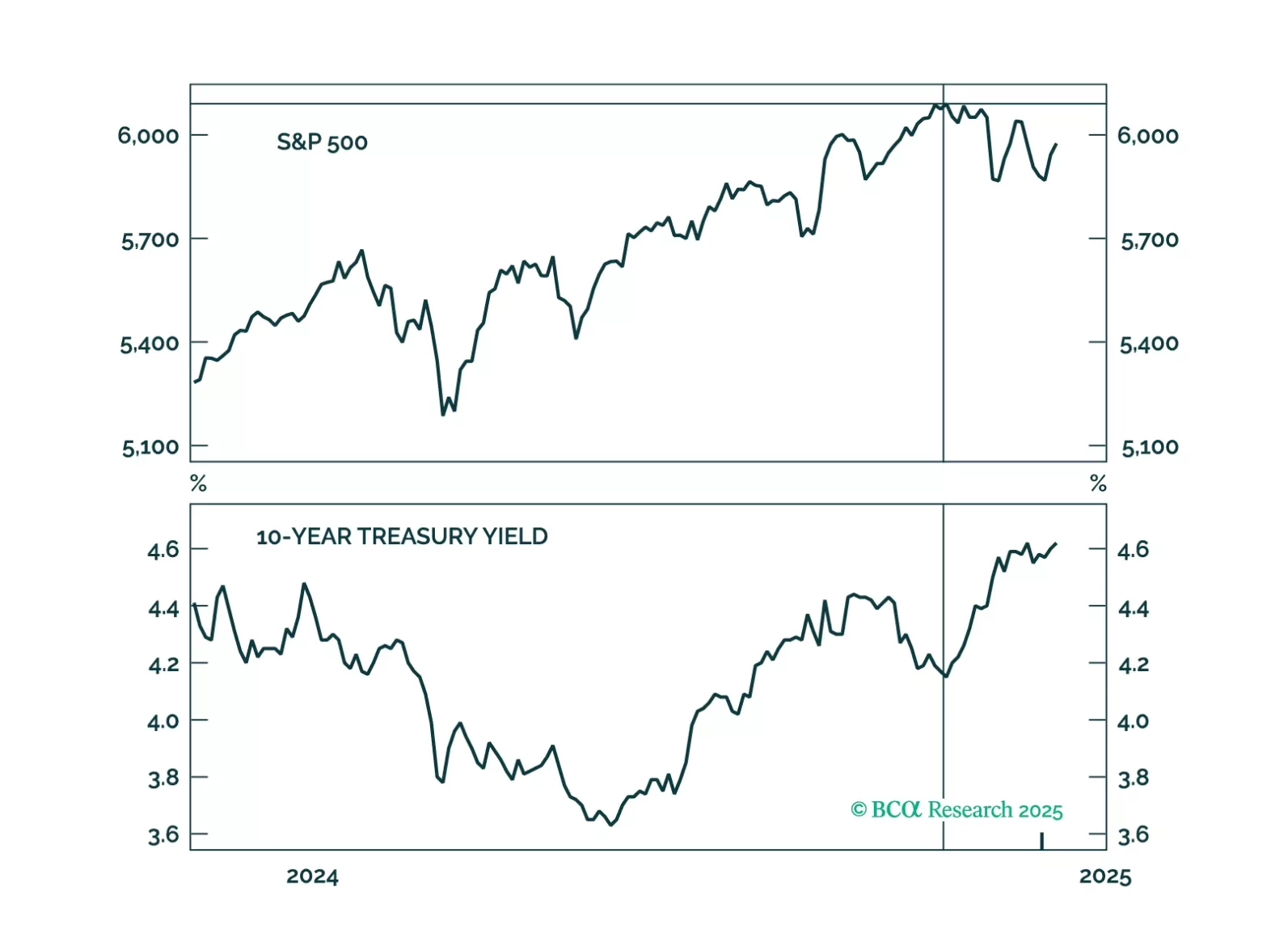

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…

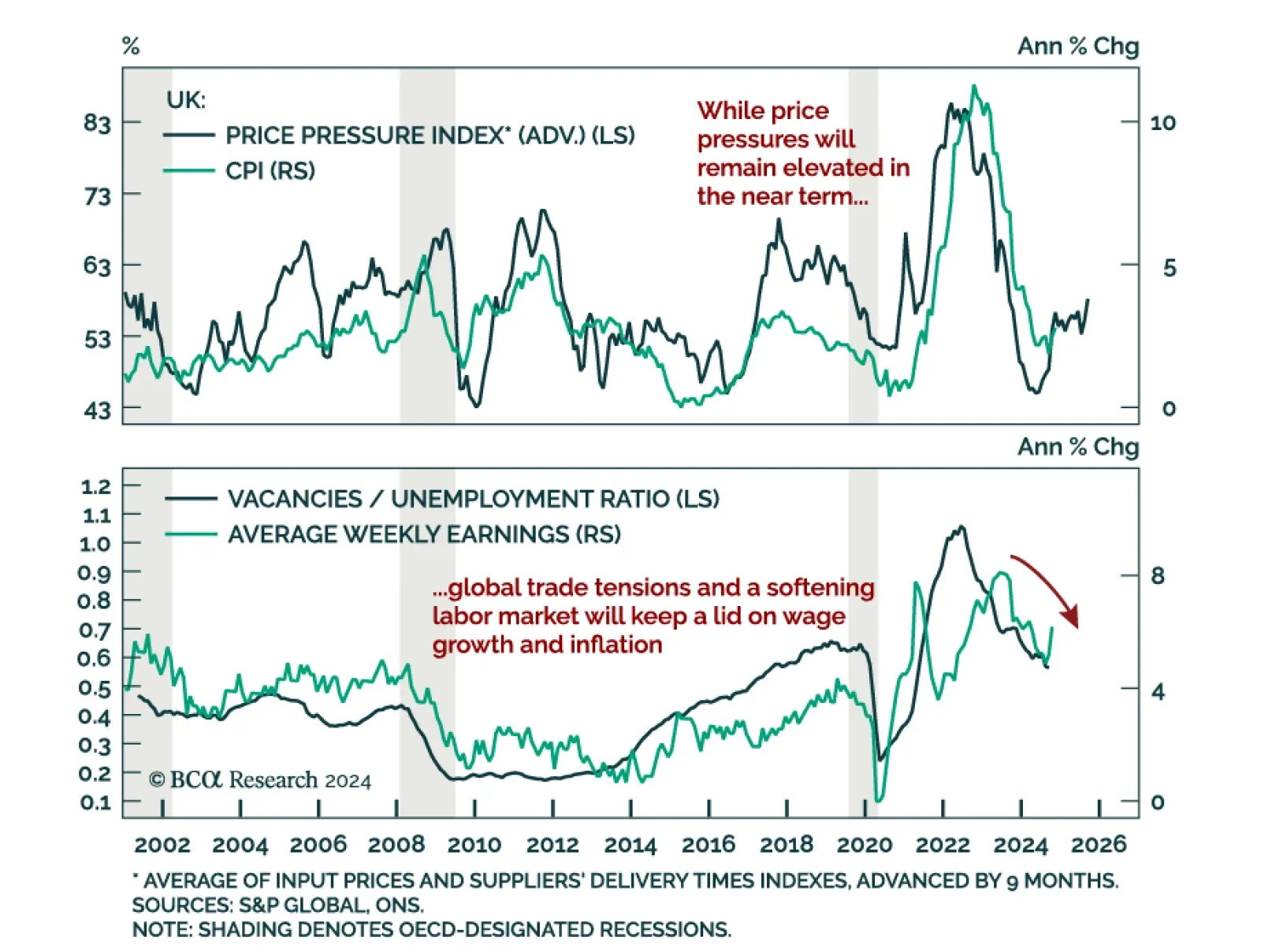

The November UK CPI, in line with estimates, hit an eight-month high, accelerating from 2.3% y/y to 2.6%. Core and services inflation were also strong at 3.5% (vs. 3.3% in October) and 5.0% (flat from October), respectively.…

Our Global Fixed Income and FX strategists published their 2025 outlook, and provide five key views for the year ahead. Duration revival: After three years of underperformance versus cash, government bonds will…

Our thoughts on this afternoon’s Fed decision and the bond market reaction.

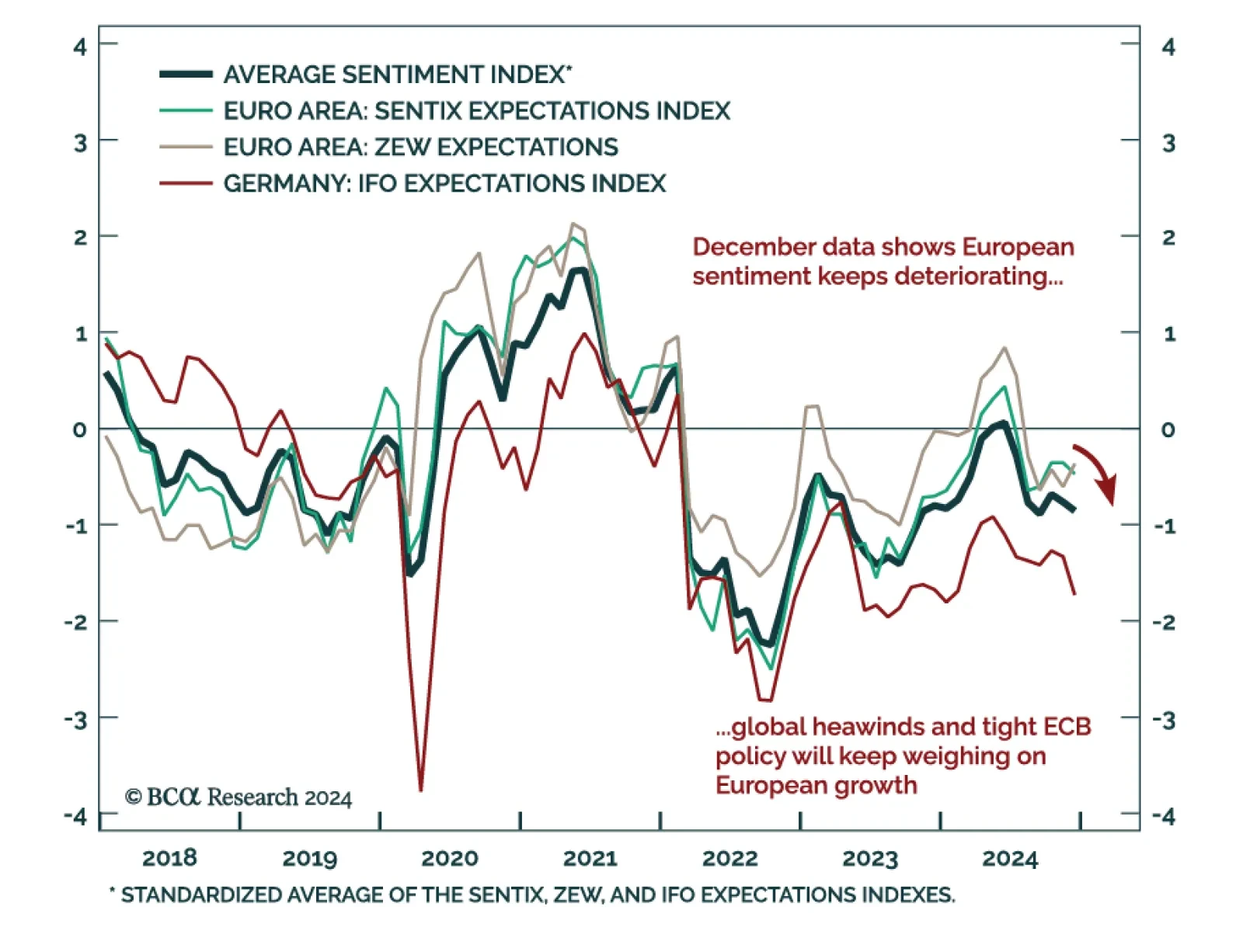

European sentiment data was mixed. The December Ifo Business Climate index for Germany missed estimates and was down 1 point to 84.7 from November. The decrease came from its expectations component, which fell to 84.4 from 87.2.…