Monetary

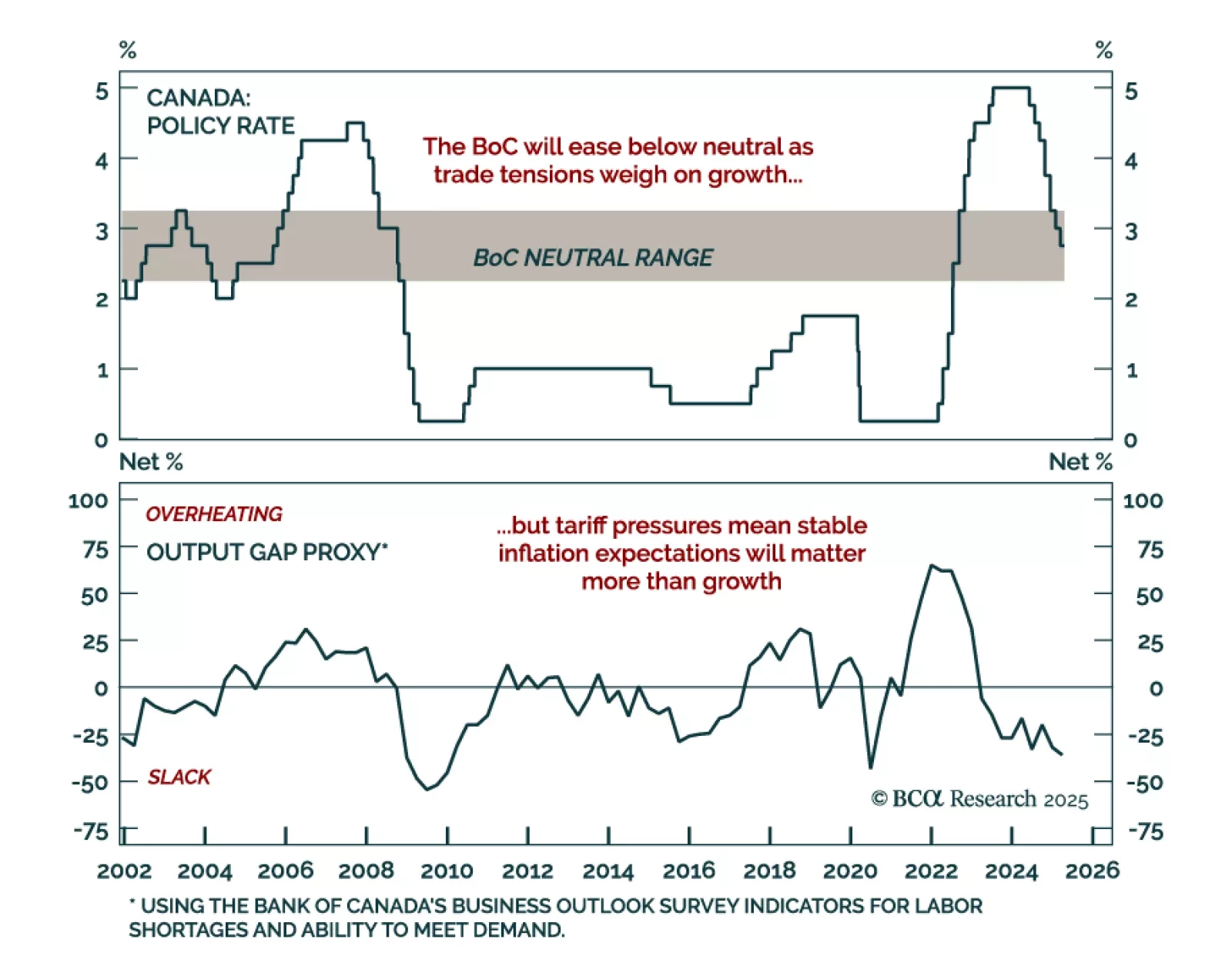

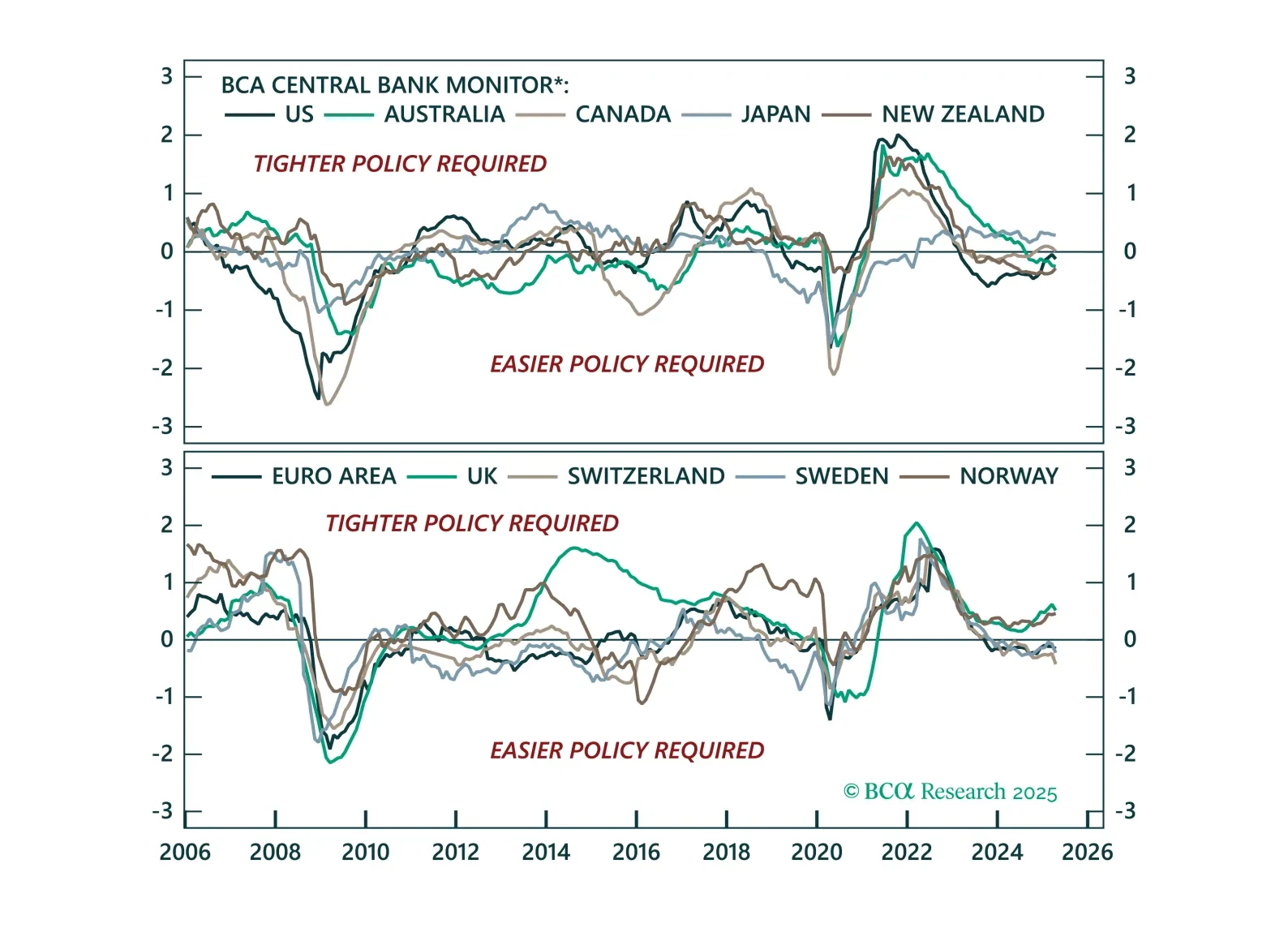

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

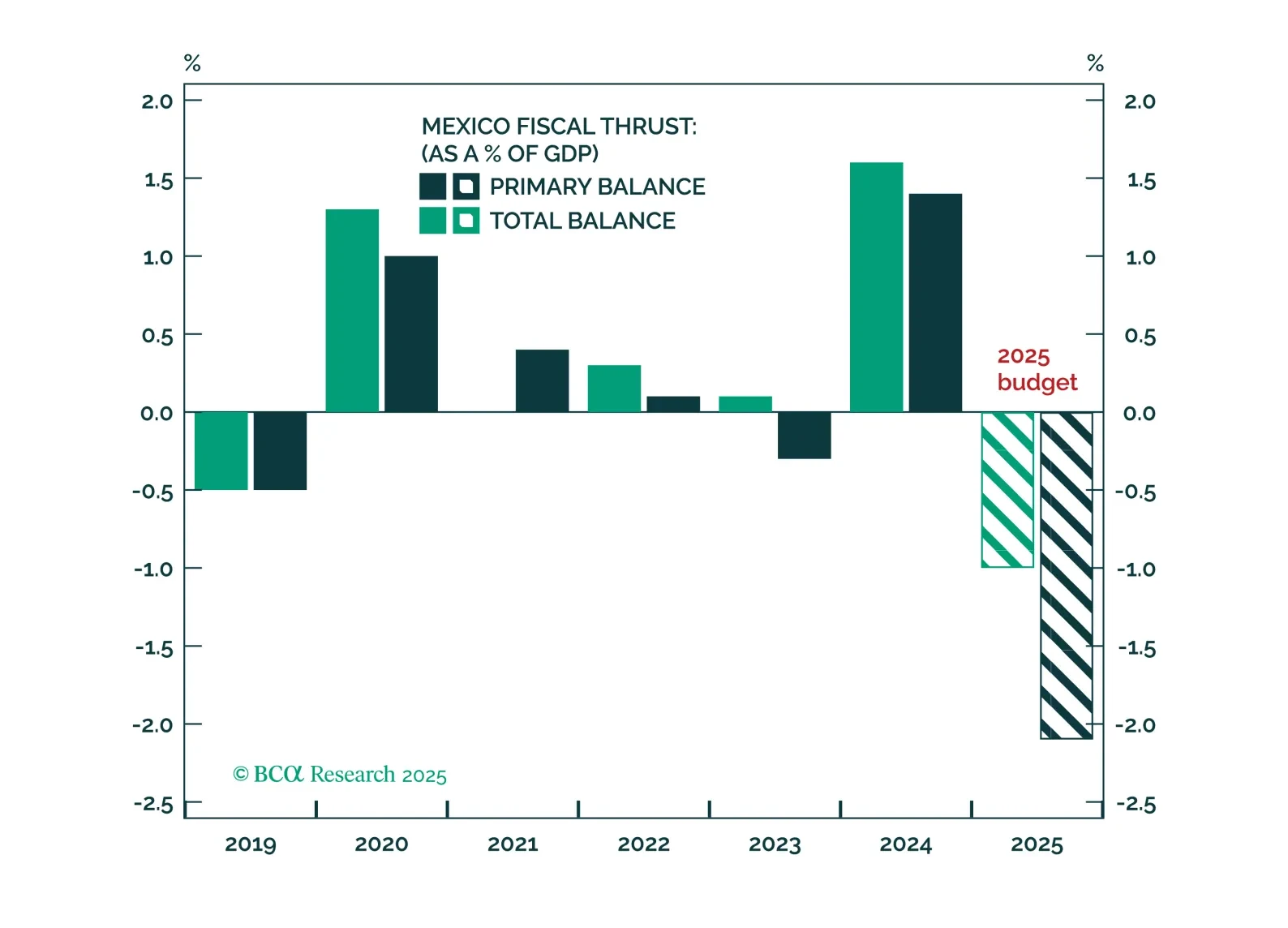

Short-term pain from Trump-related concessions, fiscal tightening amid a US and Mexican slowdown, and rising labor slack will weigh further on Mexican assets. But long-run, policy direction will capitalize on the nearshoring trend and resume the trend of Mexican asset outperformance relative to other emerging markets.

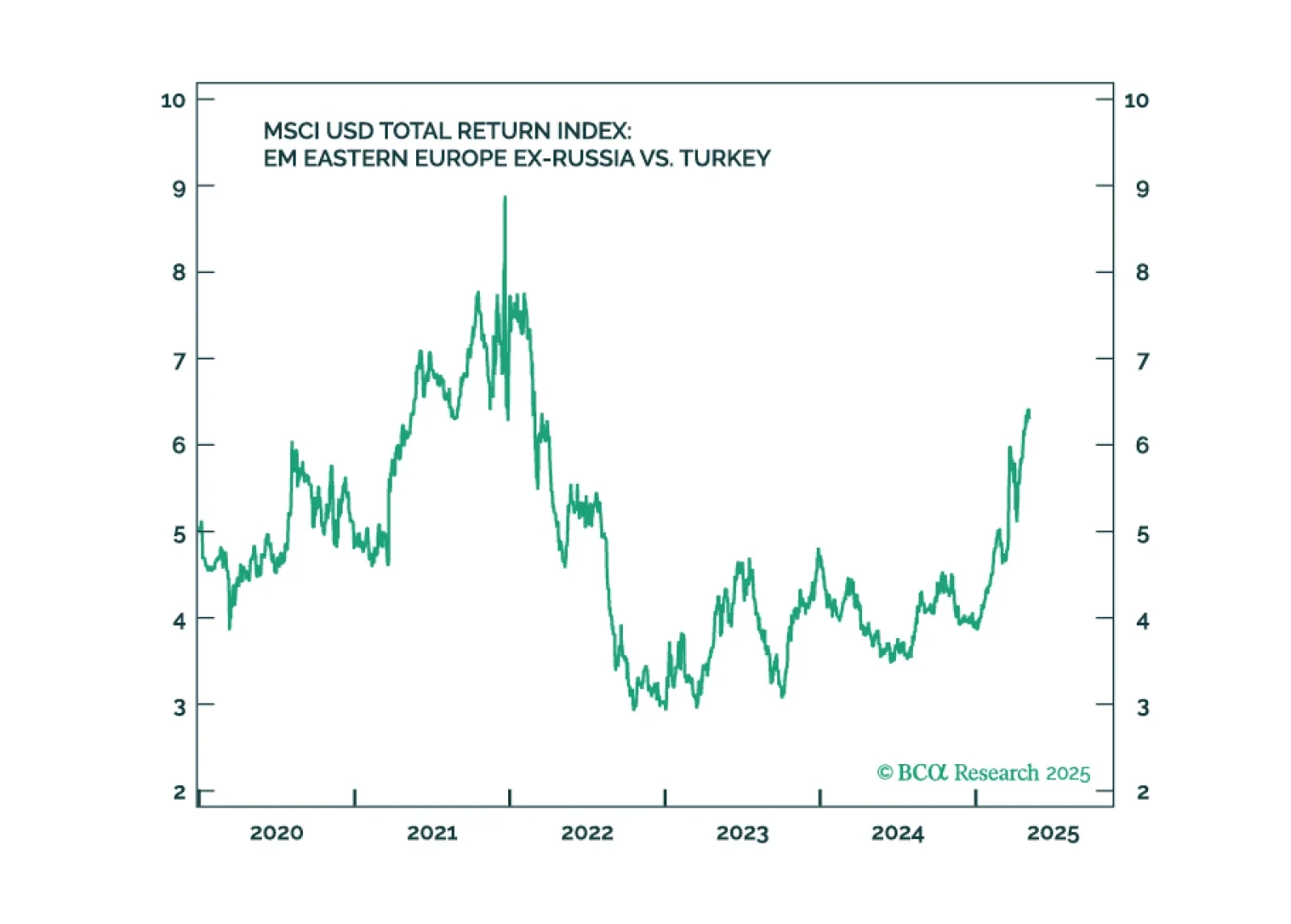

Erdogan's rule continues to decline. Social unrest will persist, governance will erode, and the macro backdrop will deteriorate further. We recommend underweighting Turkish assets.

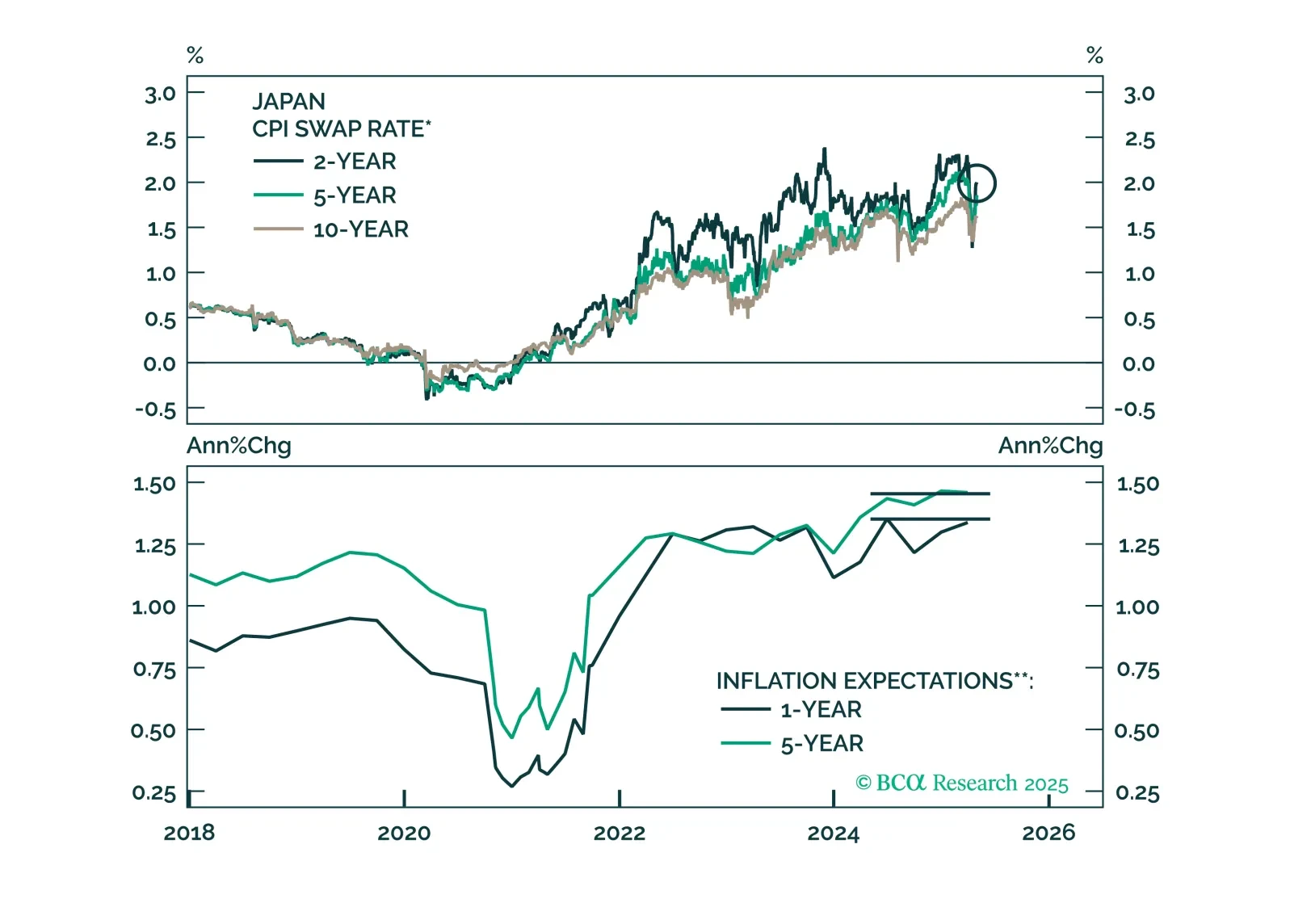

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen will ultimately rally. That said, JPY is due for a tactical pullback.

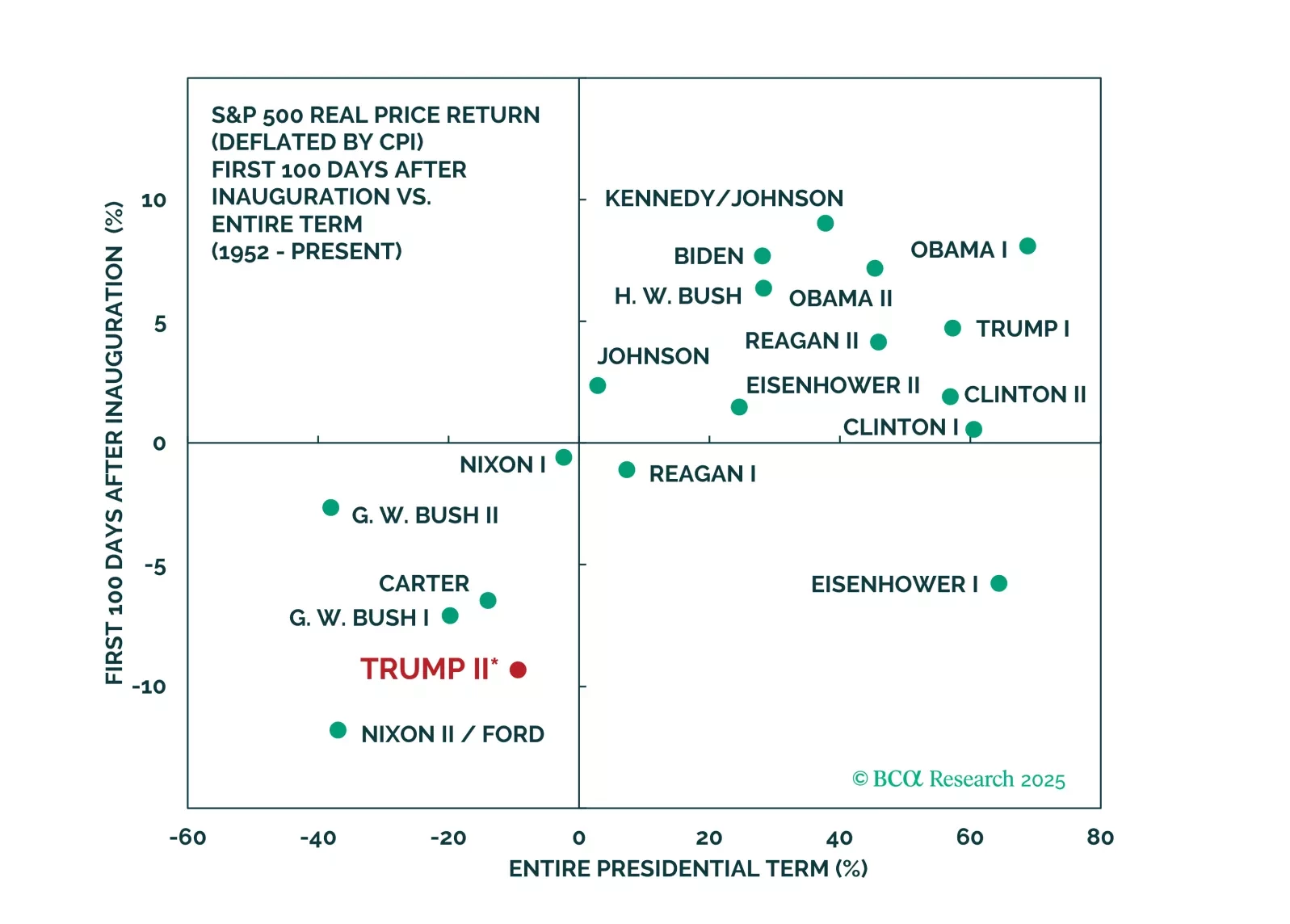

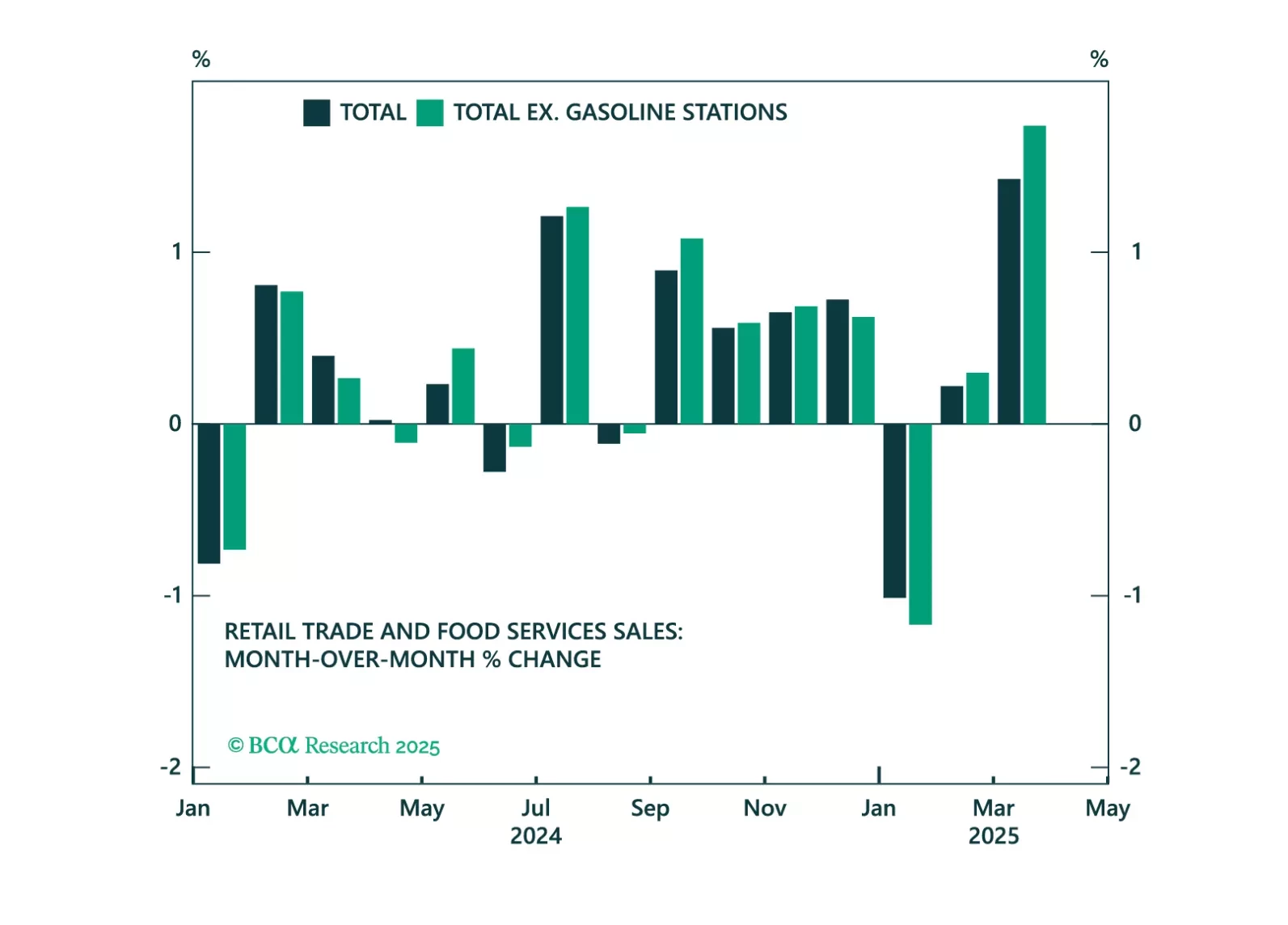

Do not play the bounce in US and global cyclical assets as Trump backpedals from the trade war. China will talk, but the pace will be slow and the outcome disappointing. Fiscal stimulus will surprise marginally in the EU, China, and even the US, but still may not rescue the business cycle.

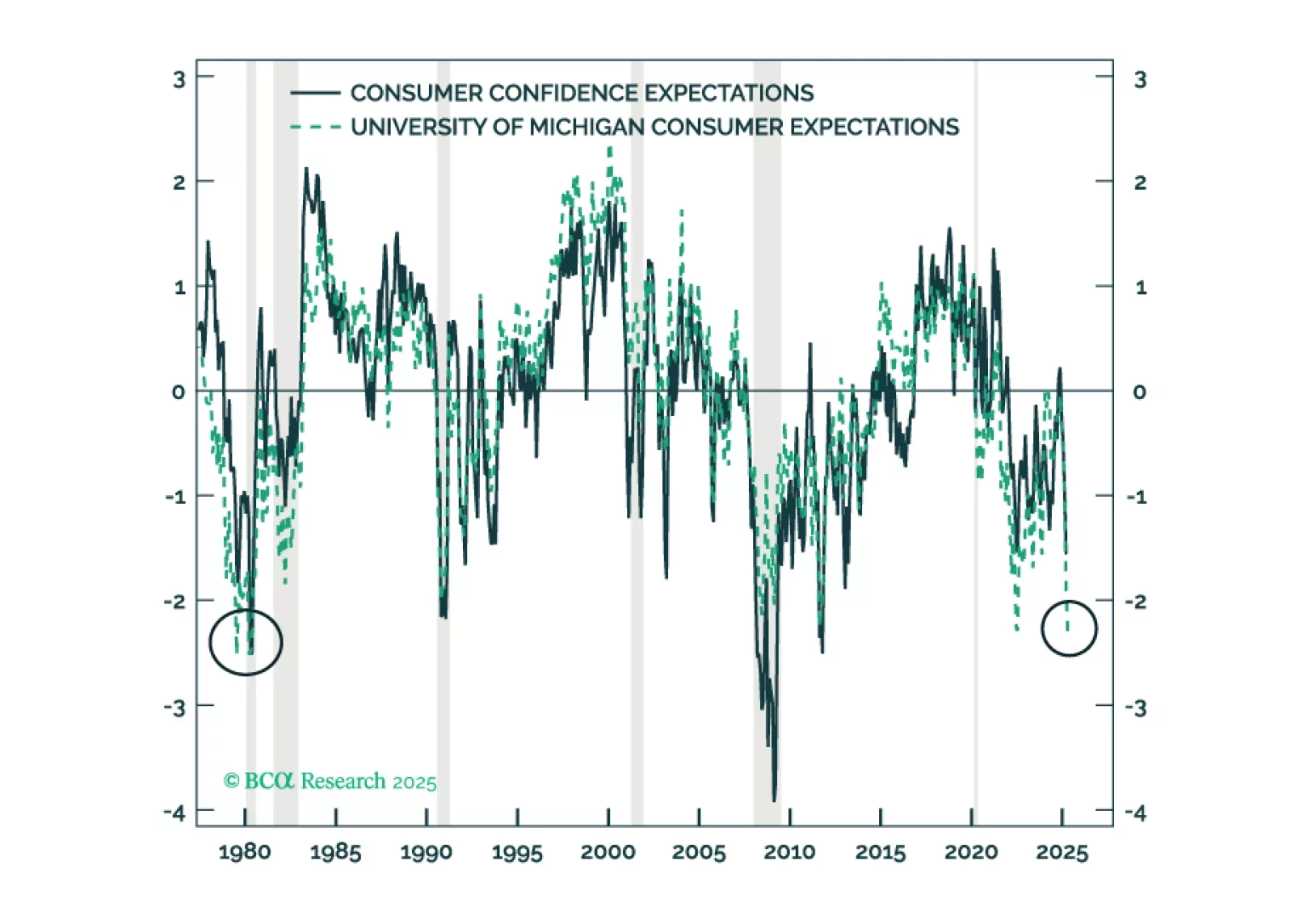

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our defensive asset allocation recommendations.

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.