The Fed is still on track for a June pause, even after May’s strong nonfarm payroll print.

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…

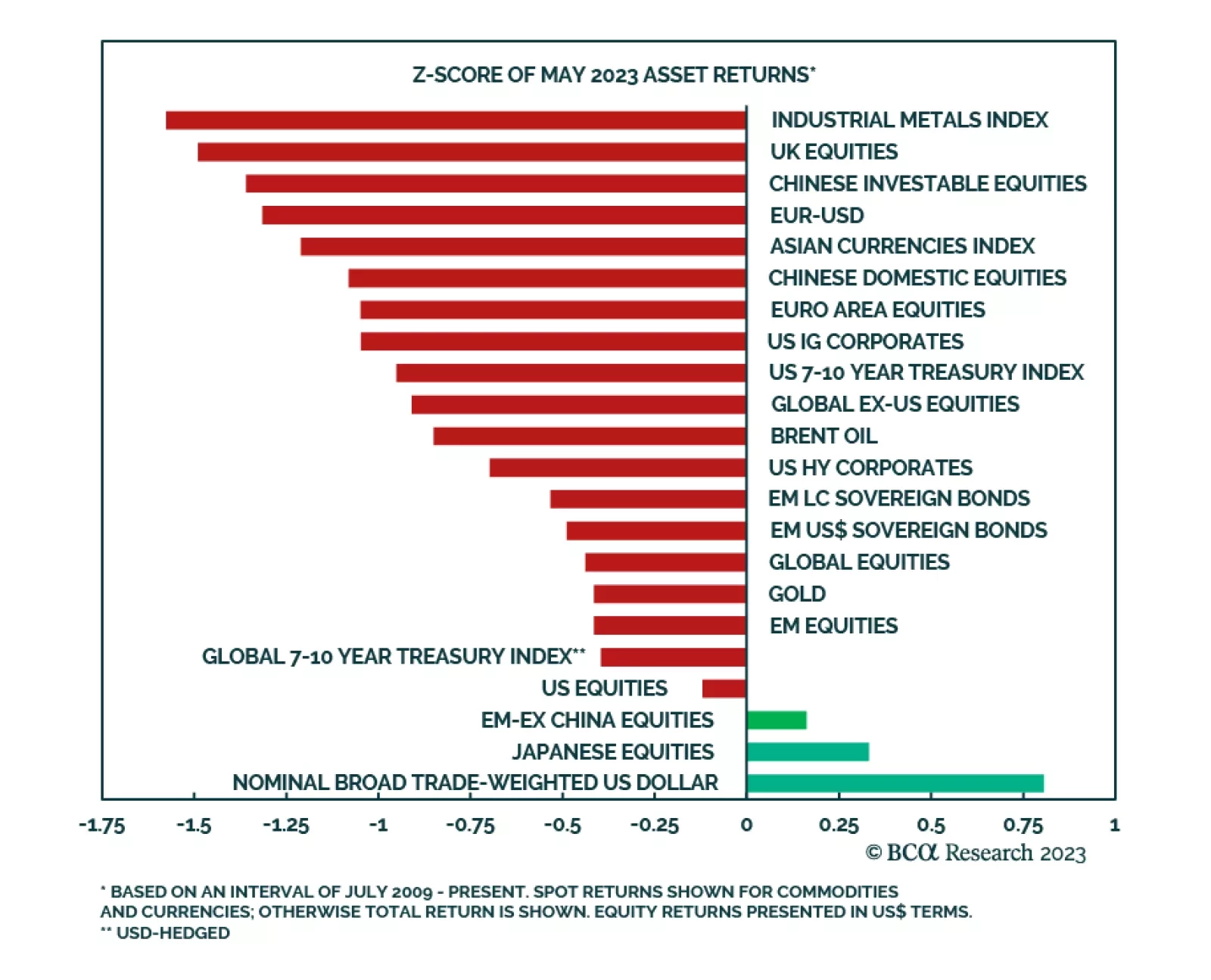

Global financial markets relapsed in May. After a relatively strong start to Q2, most of the major financial assets we track generated below average returns last month. A shift in investor expectations for the path of the Fed…

The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

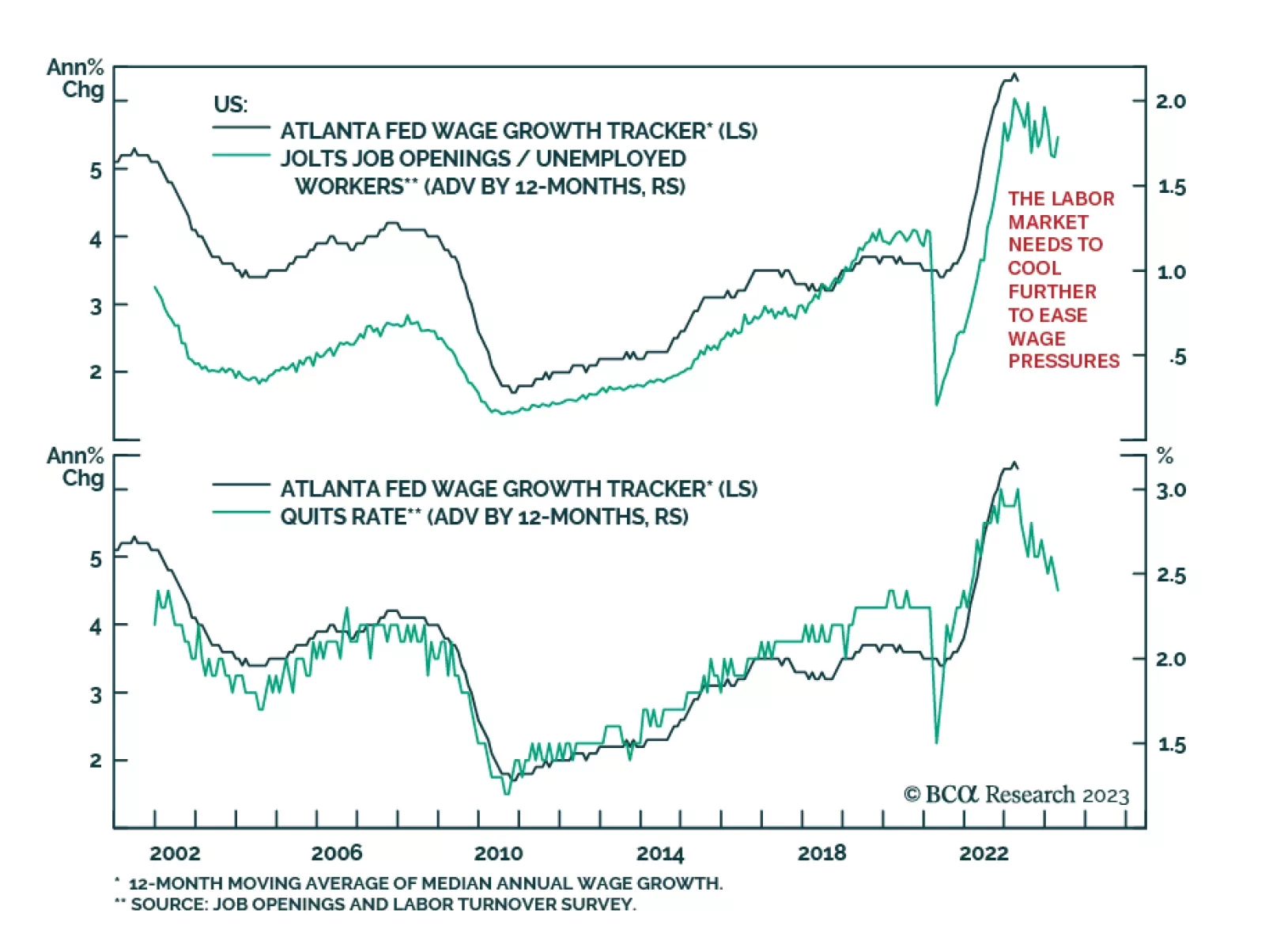

The JOLTS survey for April shows job openings unexpectedly rising from an upwardly revised 9.7 million to 10.1 million – above expectations of a decline to 9.4 million. The job openings rate inched up to 6.1% from 5.9%…

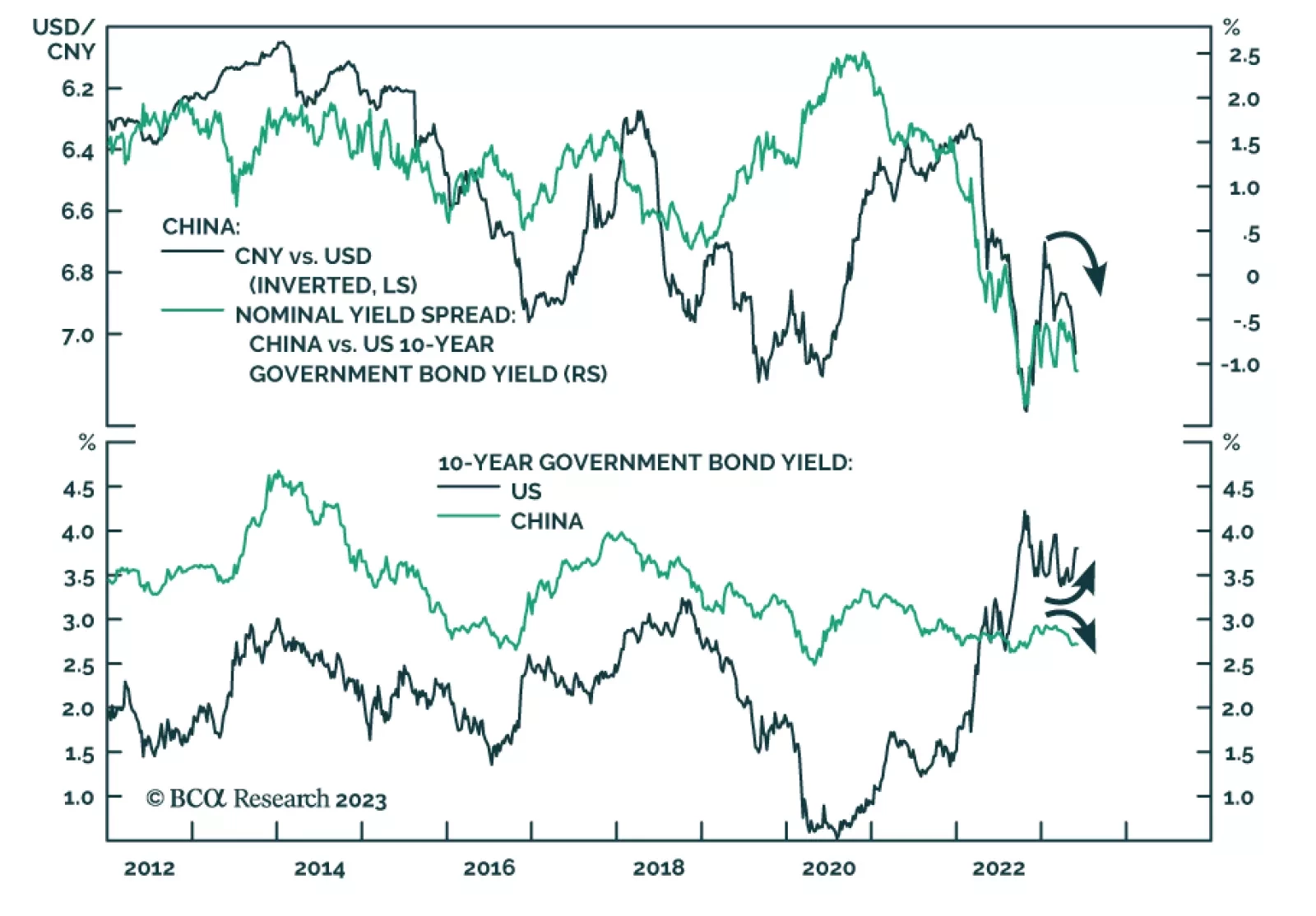

The Chinese currency has underperformed most of its emerging market peers so far this year, depreciating by 2.5% vis-à-vis the US dollar. RMB weakness is consistent with the signal from other Chinese risk assets including…

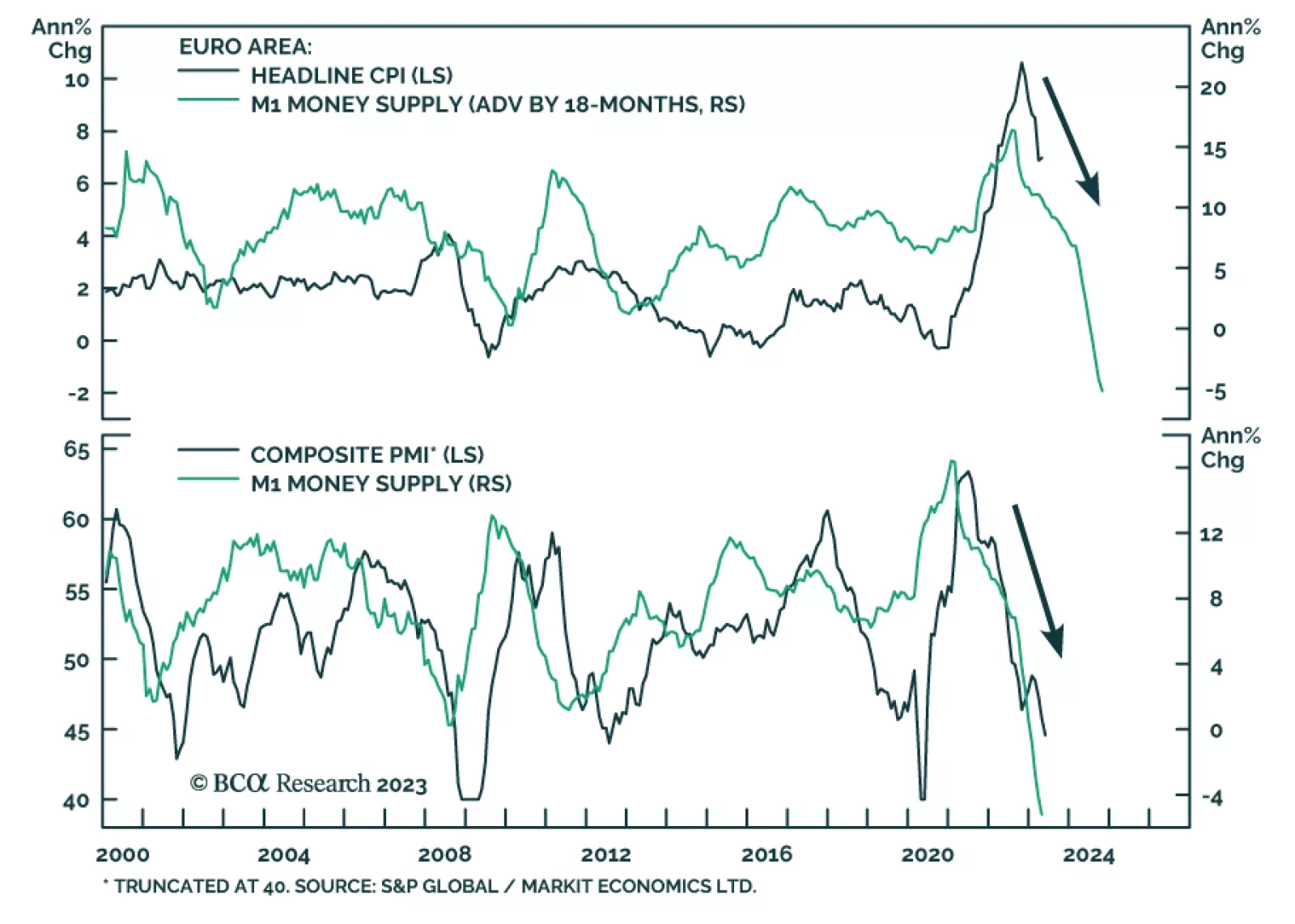

The latest Eurozone data releases show the impact of the ECB’s aggressive monetary tightening cycle. The contraction in M1 money supply – which includes currency in circulation and overnight deposits –…

The Reserve Bank of New Zealand hiked rates this week to 5.5%. There are many reasons to expect that to be the last rate hike for this cycle – a development that is positive for New Zealand bonds but bearish for the New Zealand…

US bond investors should increase portfolio duration from “at benchmark” to “above benchmark” on a cyclical (6-12 month) investment horizon. We also recommend exiting Treasury curve flatteners and closing short positions in the…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…