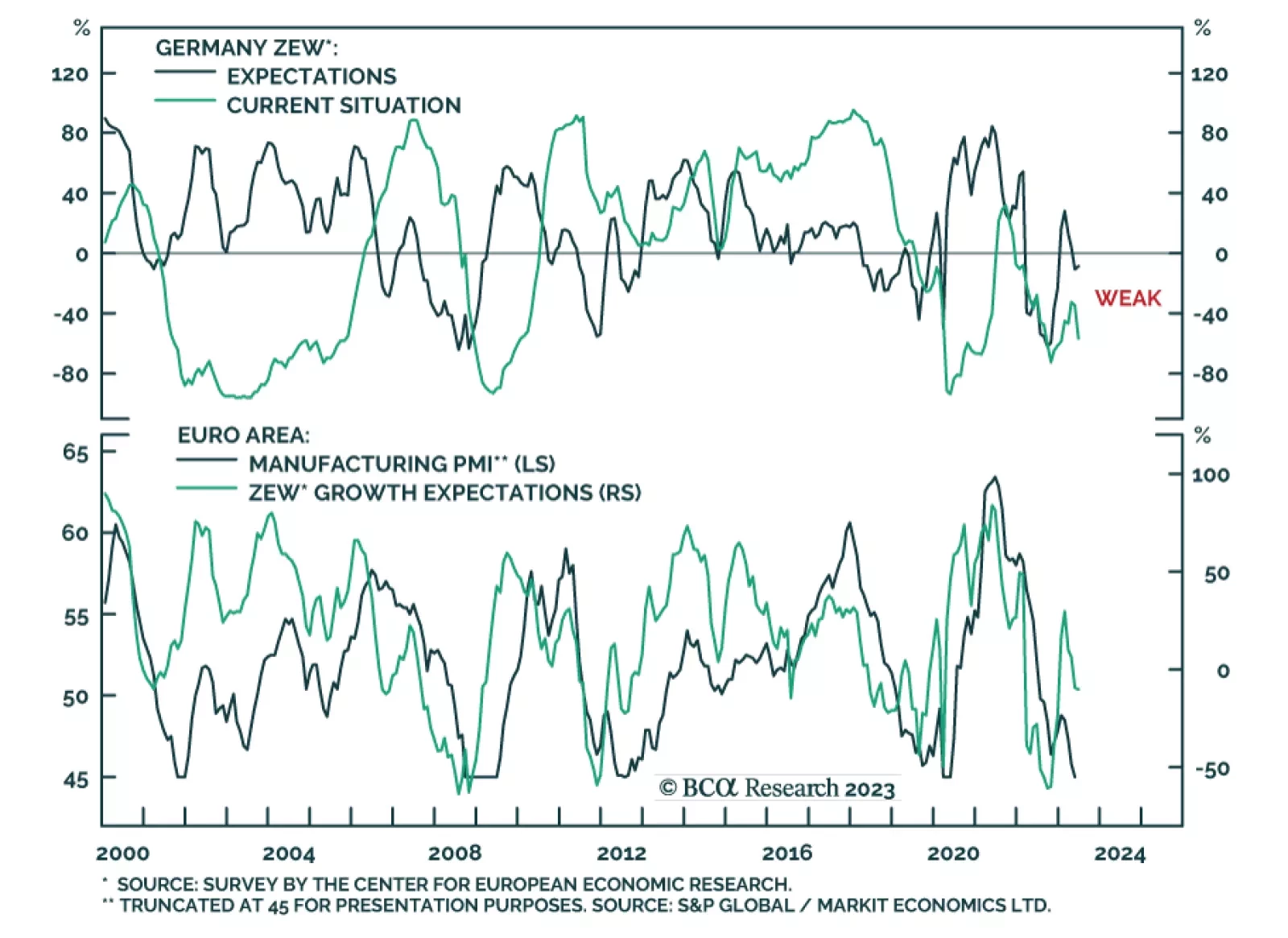

The message from the ZEW economic research institute’s June survey was mixed. On the one hand, the German Indicator of Economic Sentiment unexpectedly ticked up from -10.7 to -8.5. While the negative reading indicates that…

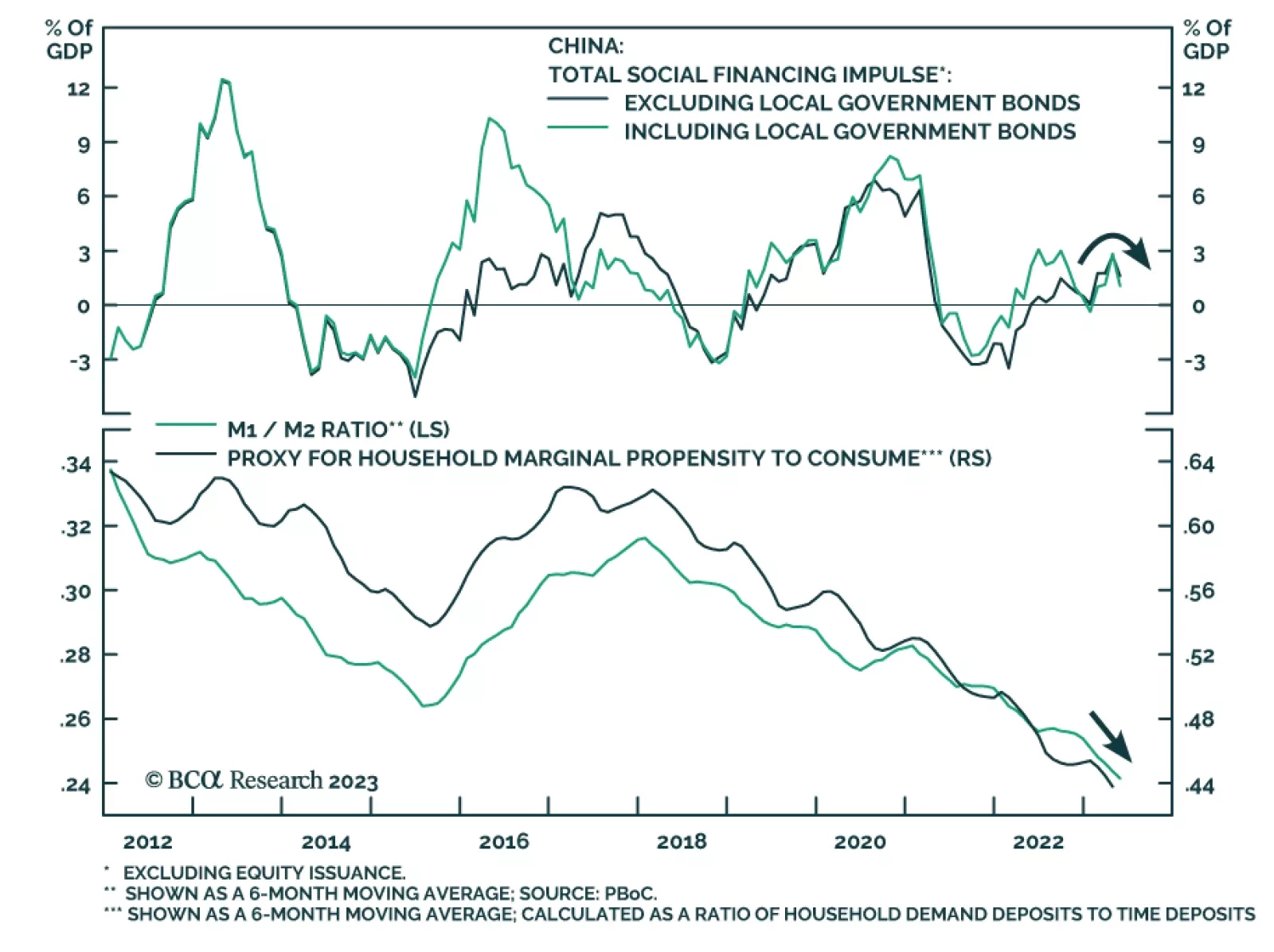

China’s money and credit update for May continues a string of disappointing Chinese data releases. The CNY 1.56 trillion increase in total social financing fell below expectations of a CNY 1.90 trillion rise. Similarly, the…

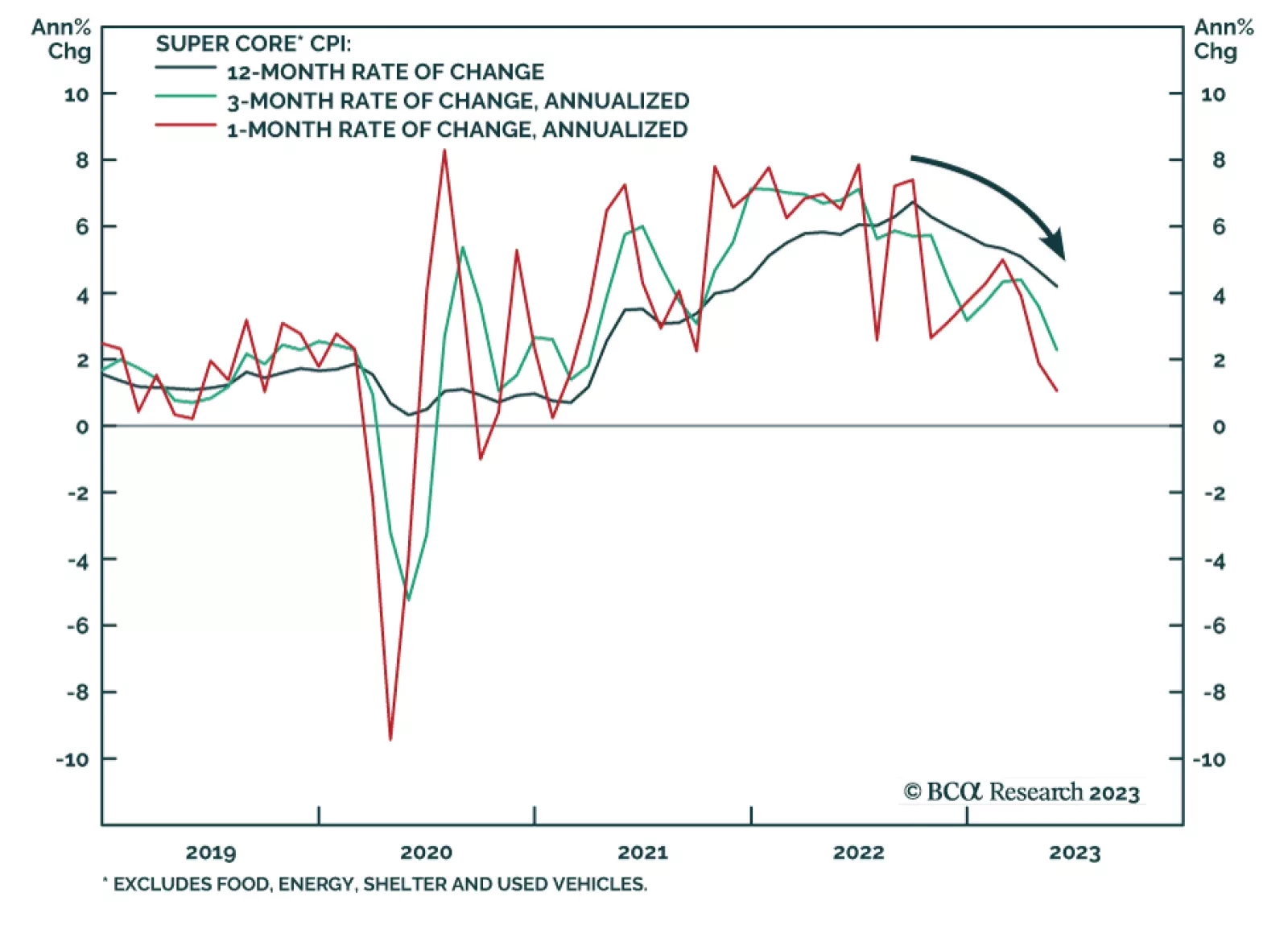

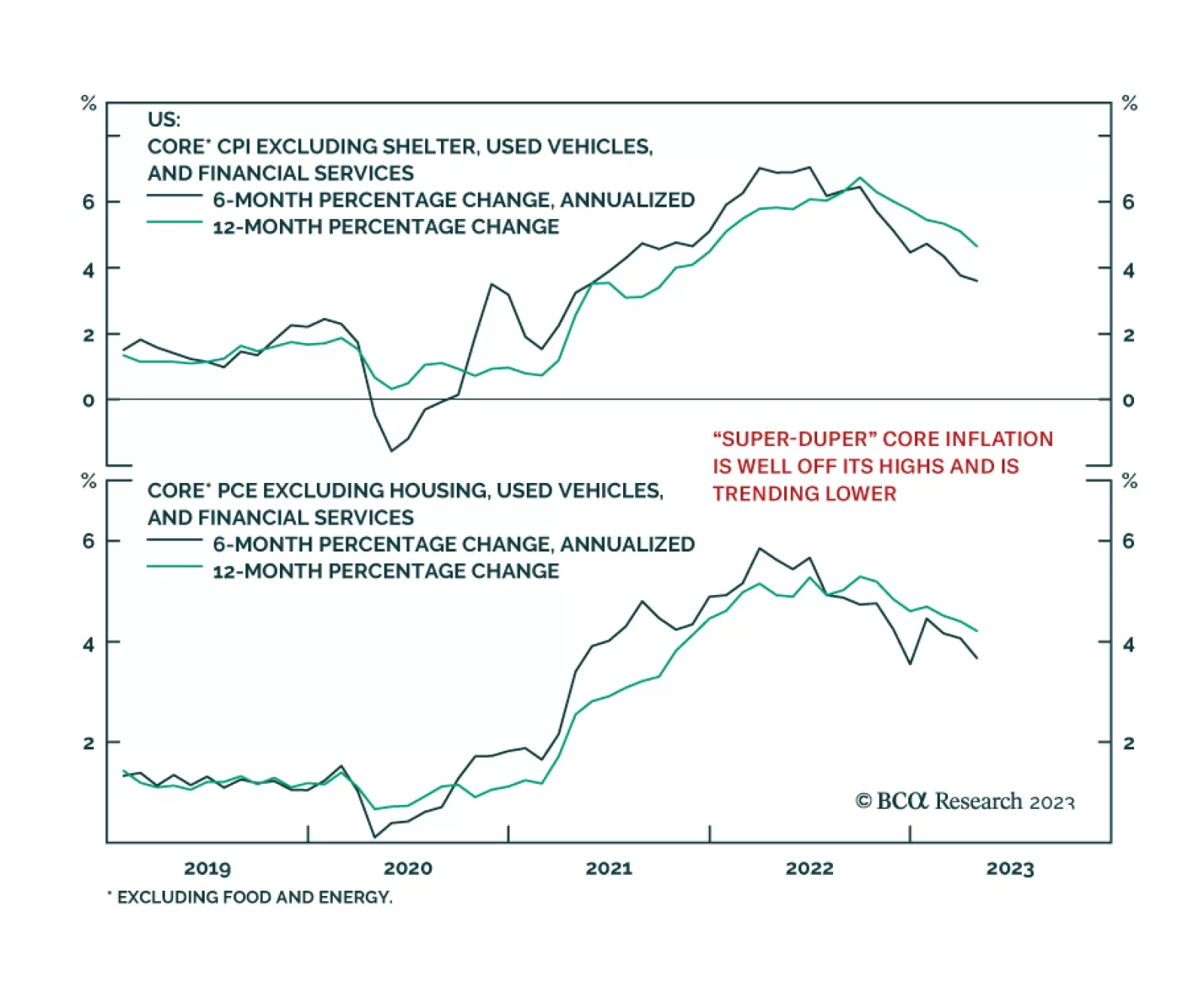

With the 1-year CPI swap rate trading at 2.3%, the market was already priced for a significant drop in inflation heading into yesterday’s May CPI release. The results of the report should only reinforce those expectations…

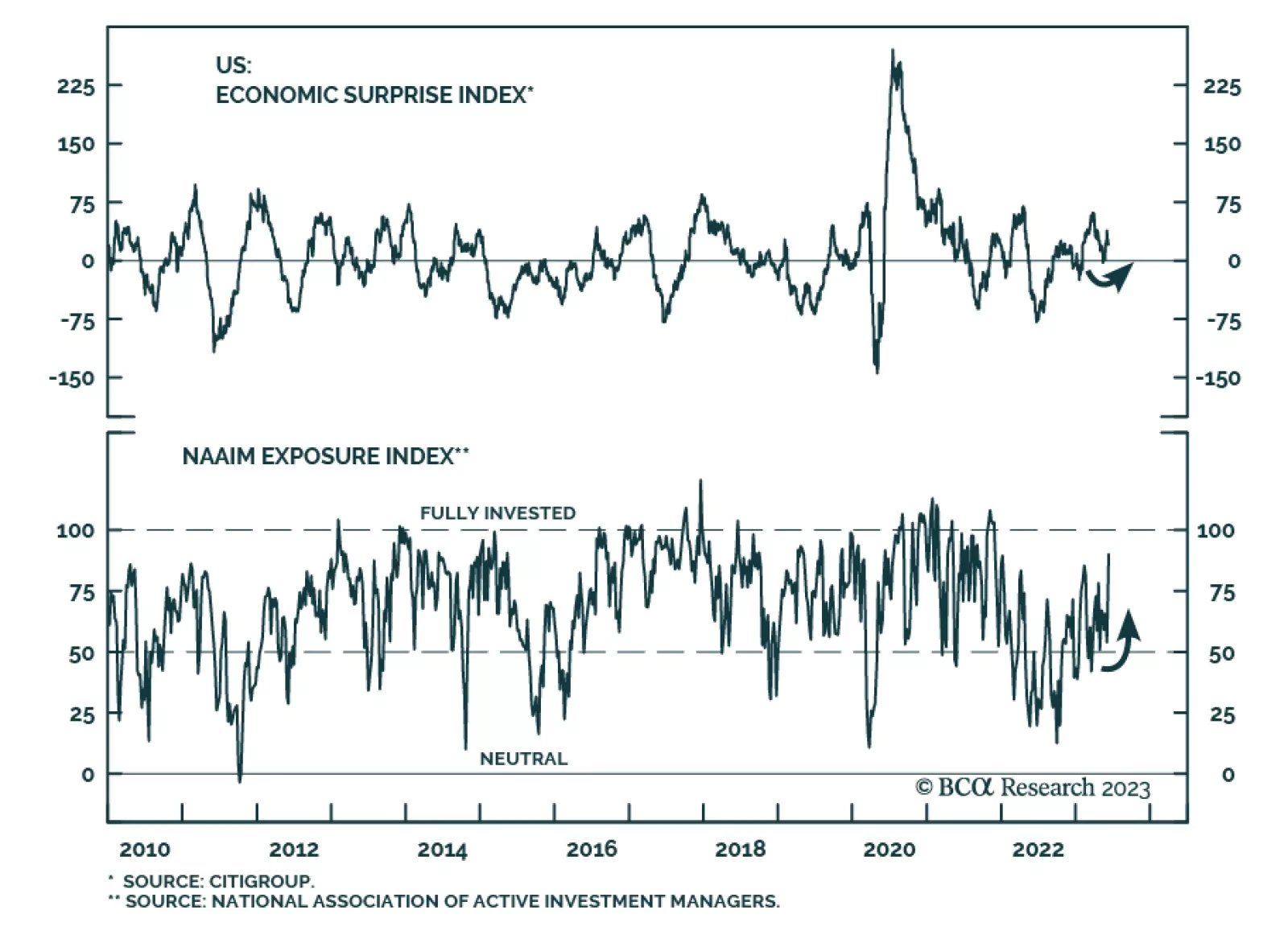

According to the Exposure Index compiled by the National Association of Active Investment Managers (NAAIM), active risk managers are increasing their net exposure to equities. The range of responses to the weekly survey…

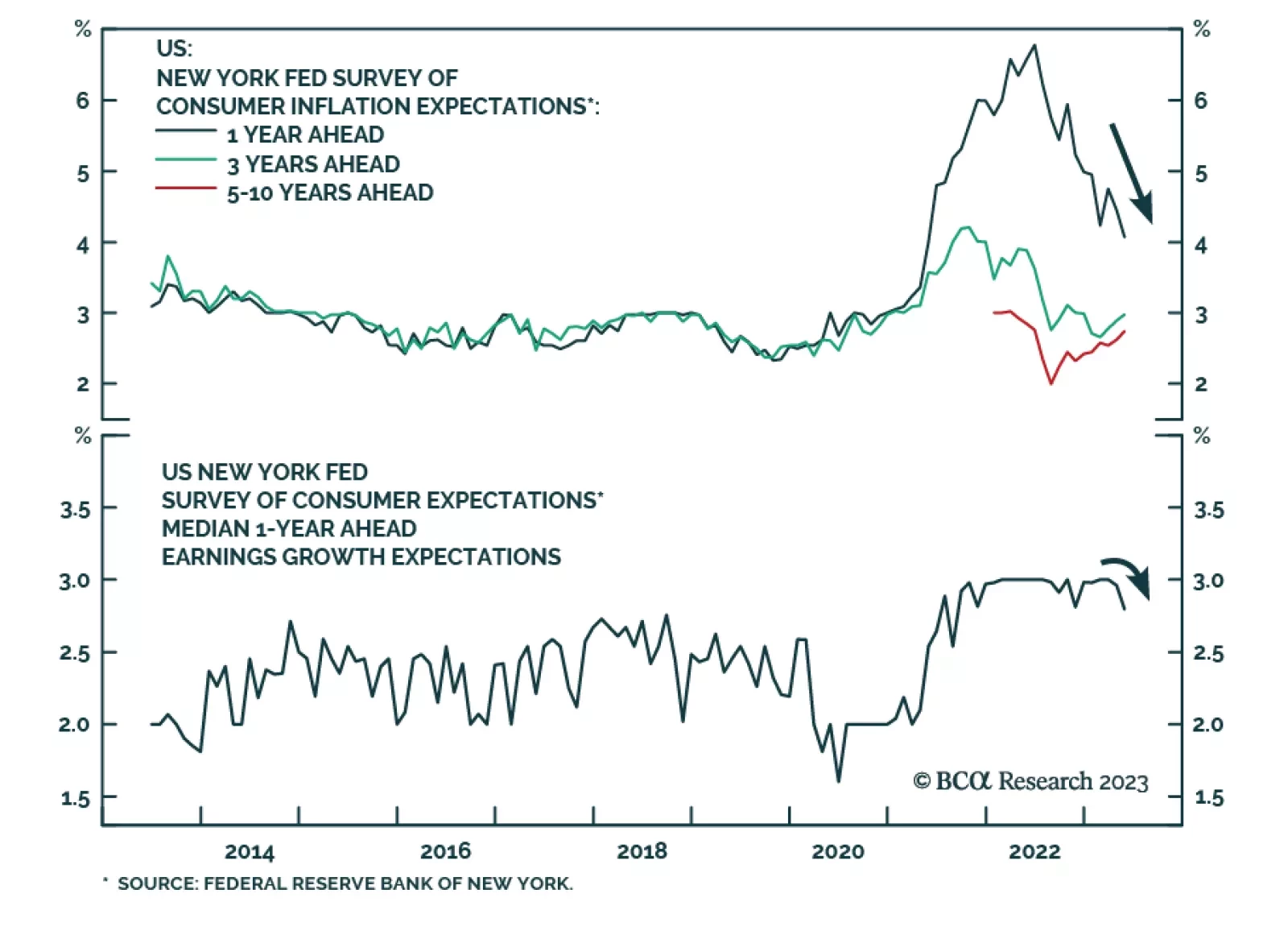

Results of the New York Fed’s Survey of Consumer Expectations sent a positive signal about short-term inflation expectations. Median one-year-ahead inflation expectations dropped by 0.3 percentage point to a two-year low of…

According to BCA Research’s Global Investment Strategy service, the leading indicators of inflation continue to point down, suggesting that the Fed may be able to finally go on hold after hiking one last time in July.…

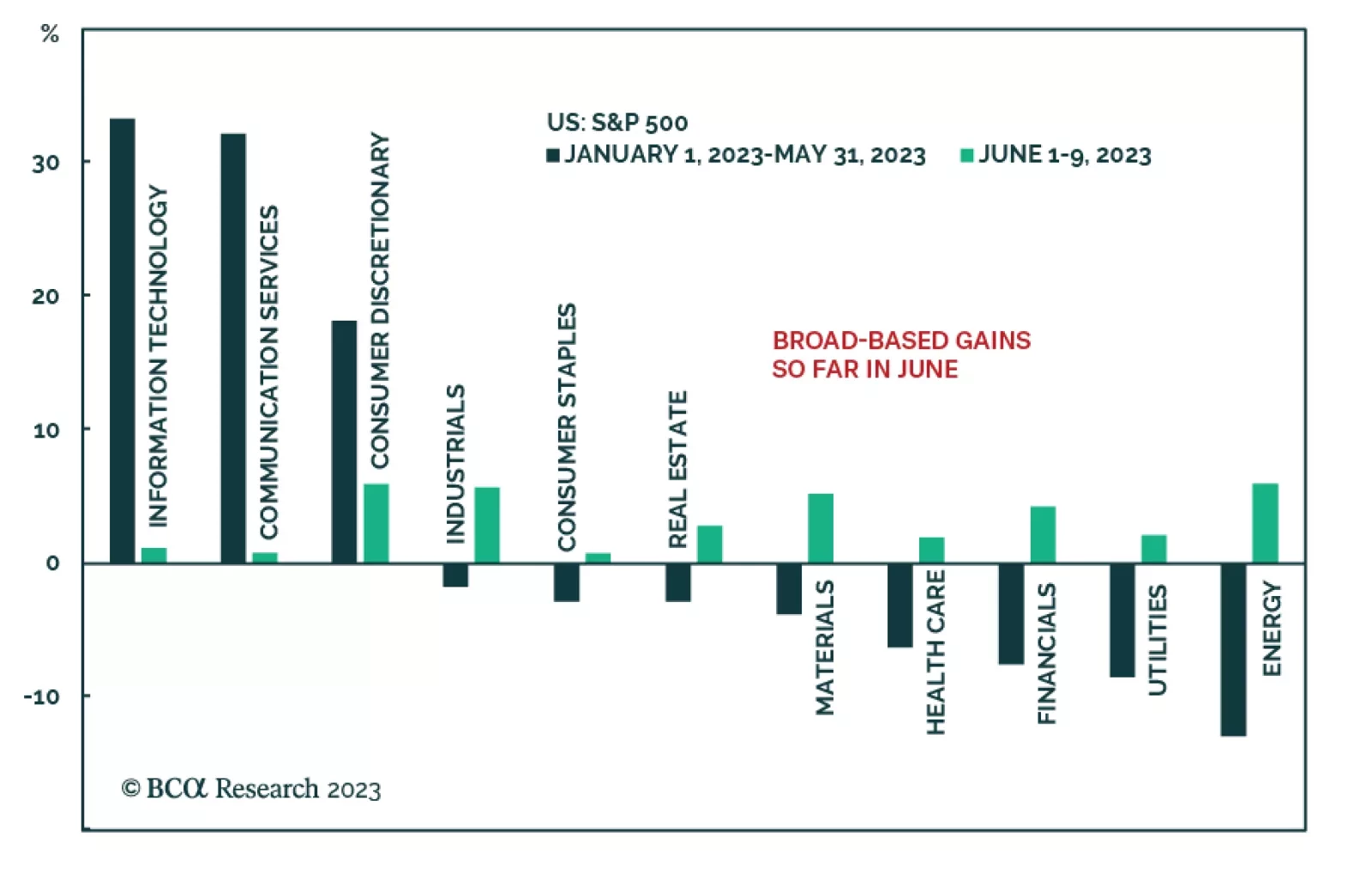

As we’ve highlighted in recent Insights, the S&P 500’s year-to-date rally has been concentrated among a few mega cap stocks. In particular, companies that benefit from the AI craze have driven the gains. This…

A preview of what to expect from next week’s FOMC meeting.

In this Insight, we answer a few crucial questions: Do the BoC and RBA decisions have any impact on what we can expect from other major central banks next week? Are there any profitable trades that can be put on, given the recent…

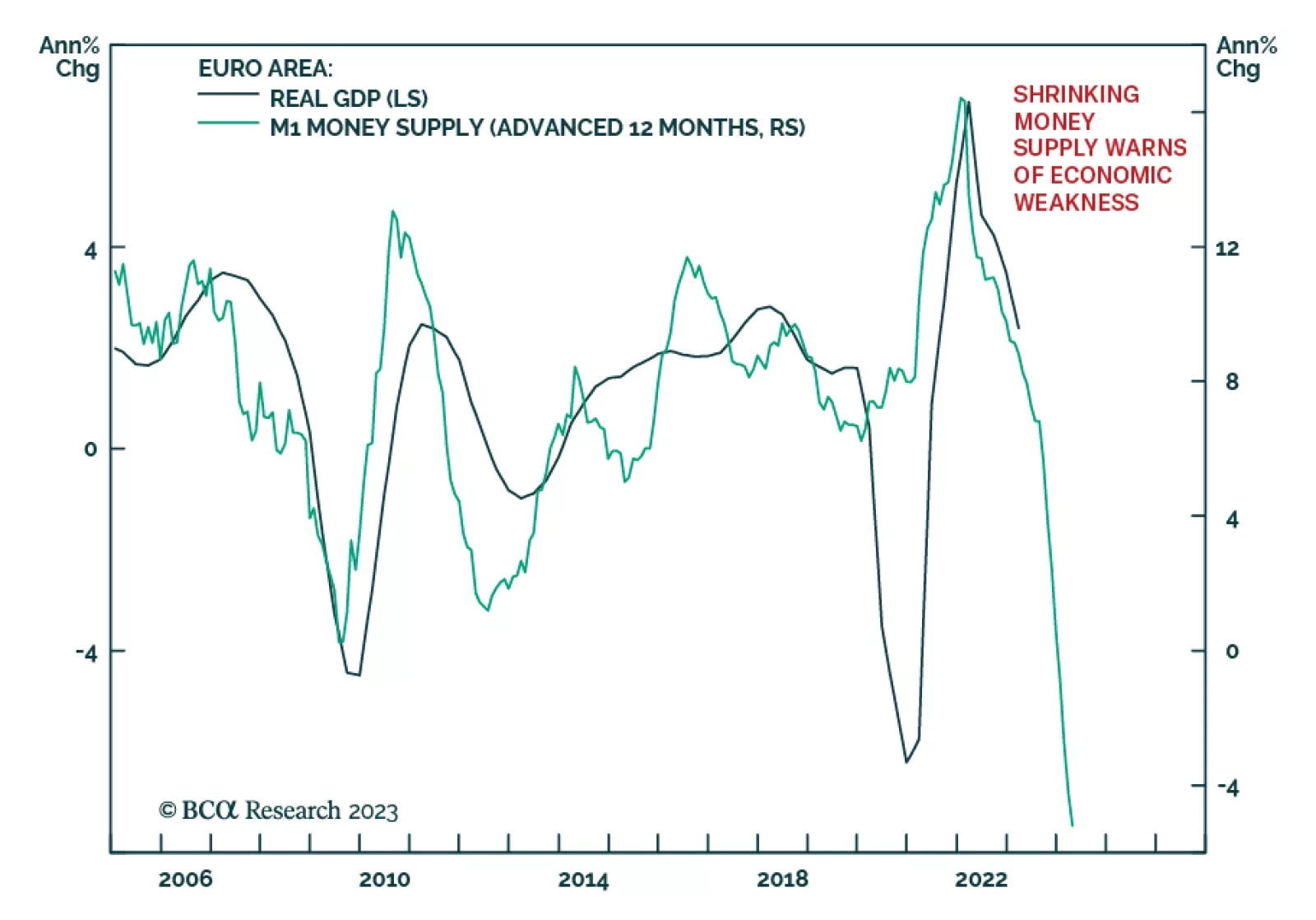

The final Q1 GDP release shows the Euro Area economy contracted by 0.1% q/q last quarter, a downwards revision from estimates of a 0.1% expansion. To the extent that this follows a 0.1% q/q decline in Q4 2022, the revised numbers…