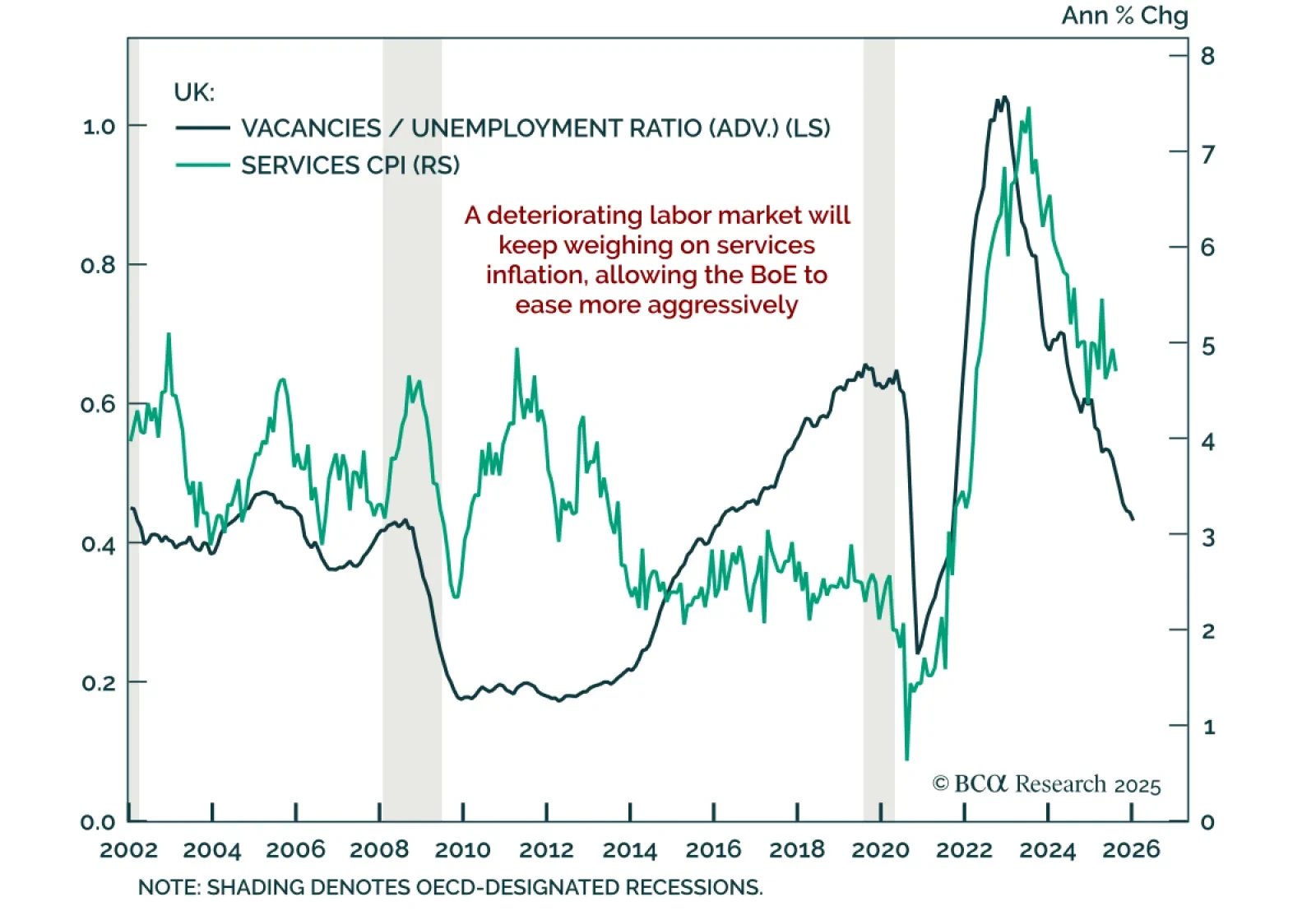

The Bank of England will resume rate cuts in December after the autumn budget is passed. Today’s Strategy Insight discusses what this means for UK gilts and the pound.

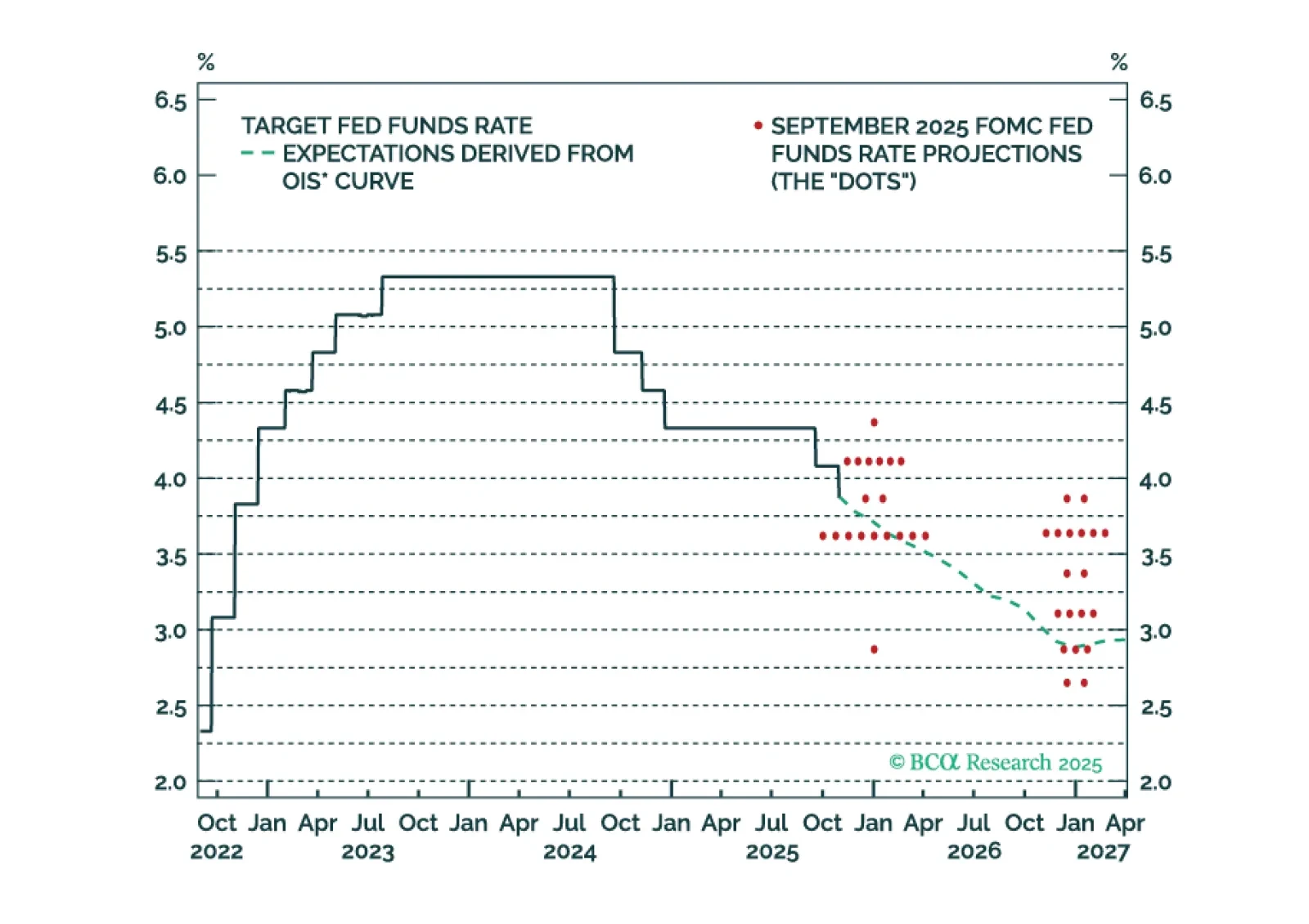

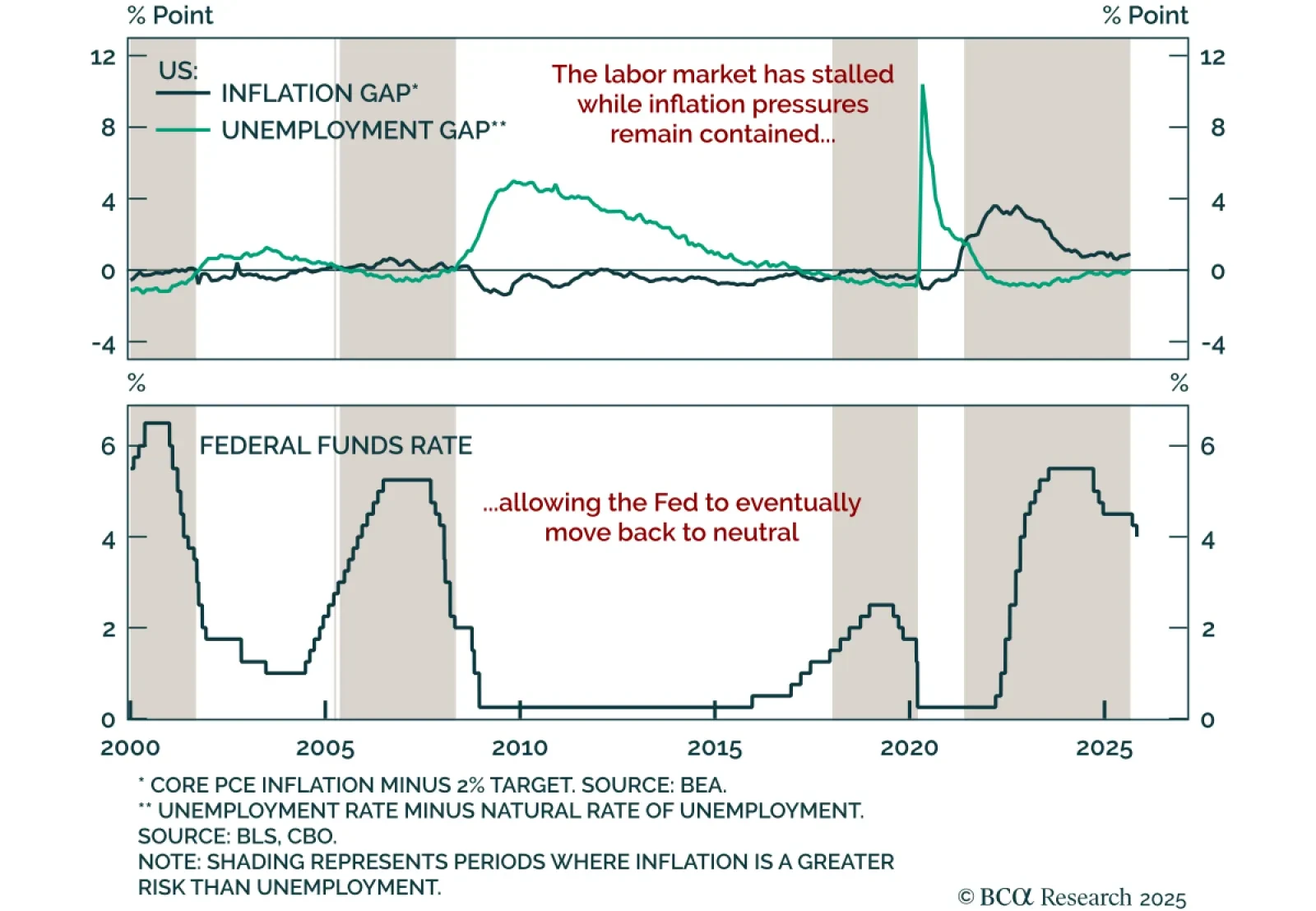

The Fed cut rates today, but a follow-up rate cut in December is uncertain. It will depend, in large part, on who wins a debate about the neutral rate of interest.

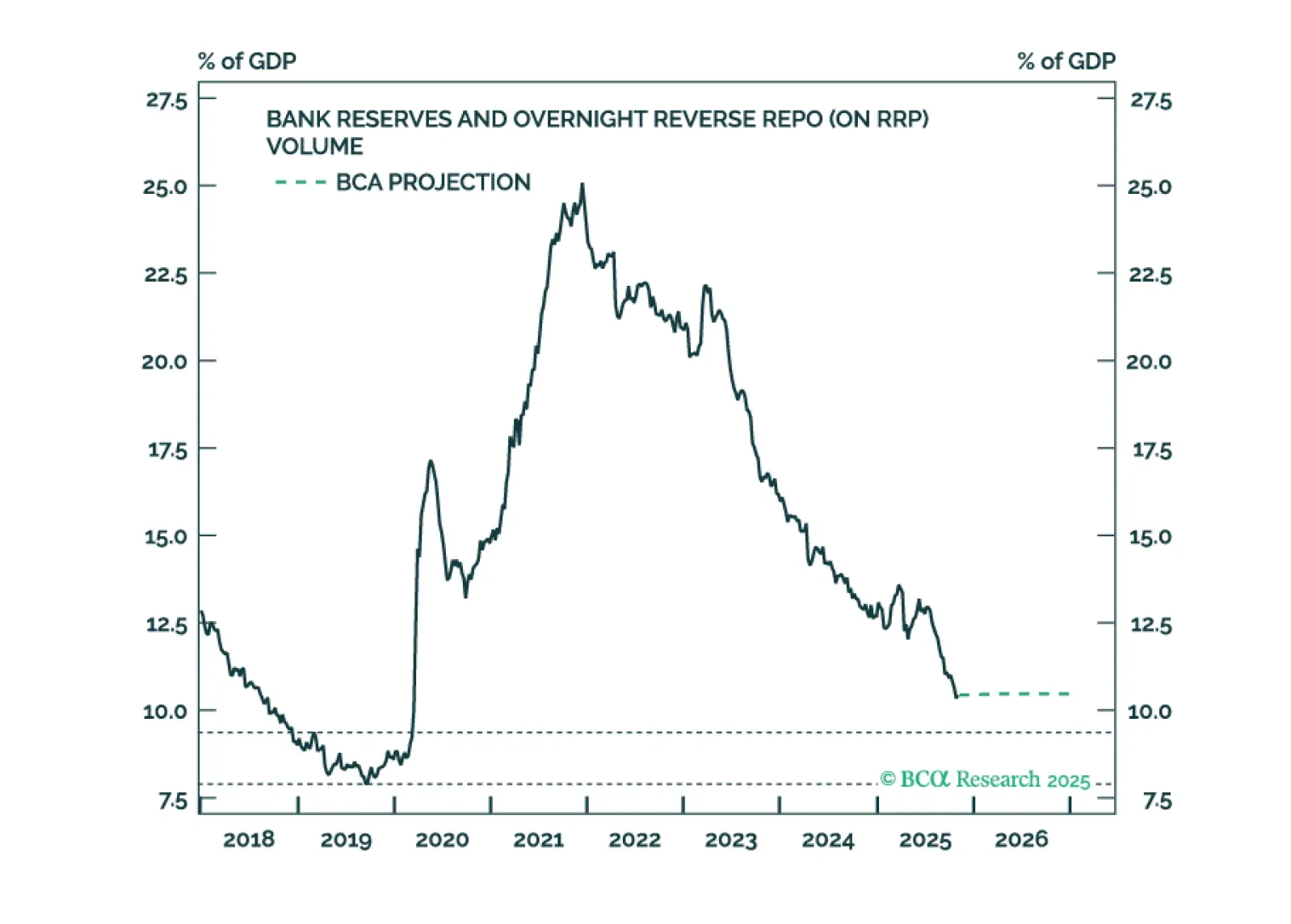

The Fed cut rates by 25 bps to 3.75%–4.00% and announced QT will end December 1, signaling modest easing but no December cut commitment. The decision matched expectations, with dovish (Gov. Miran, for a 50 bps cut) and hawkish (Pres…

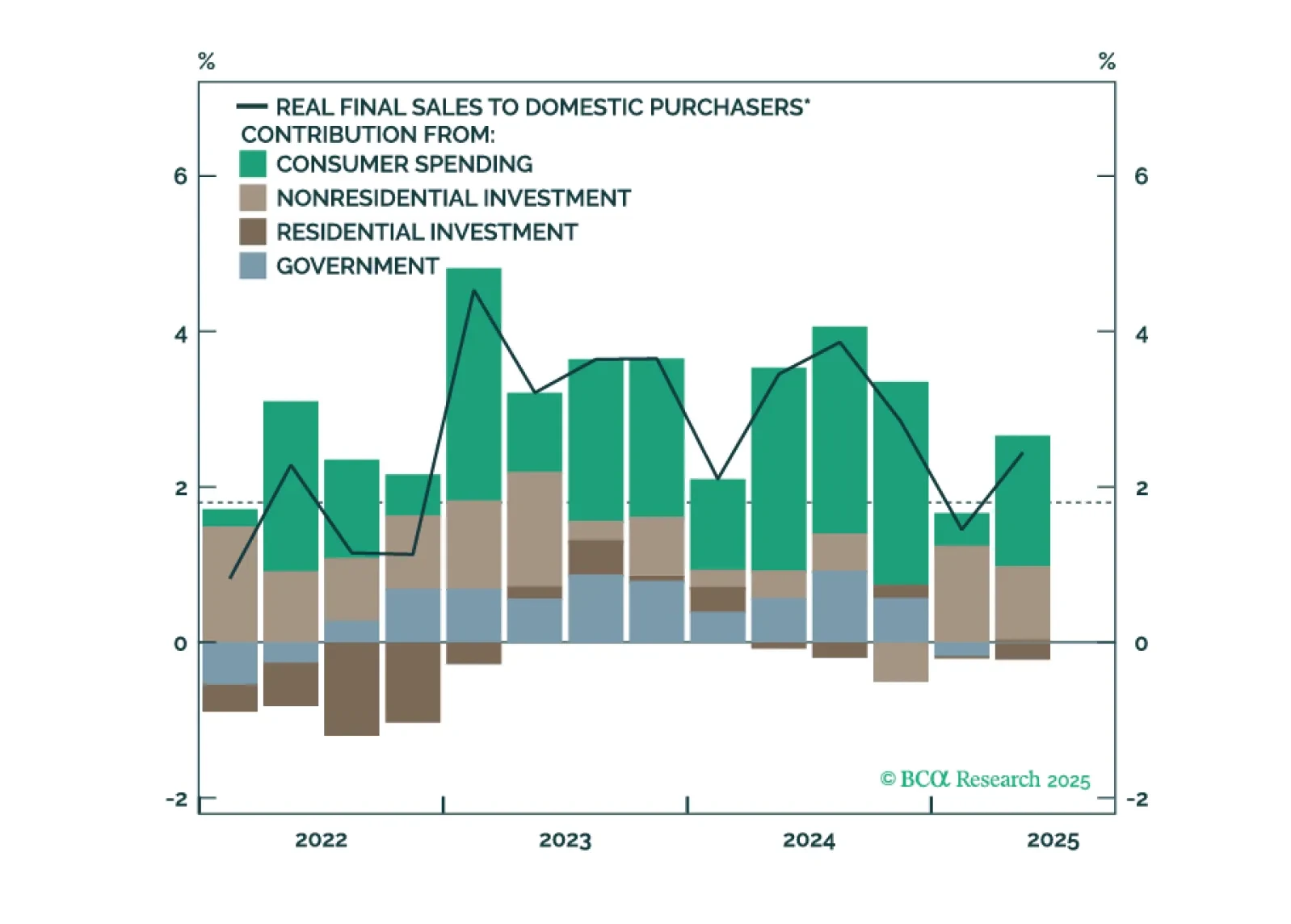

The Fed is poised to deliver a 25-basis-point rate cut this month, but a follow-up rate cut in December will depend on how the divergence between strong consumer spending and weak employment growth is resolved.

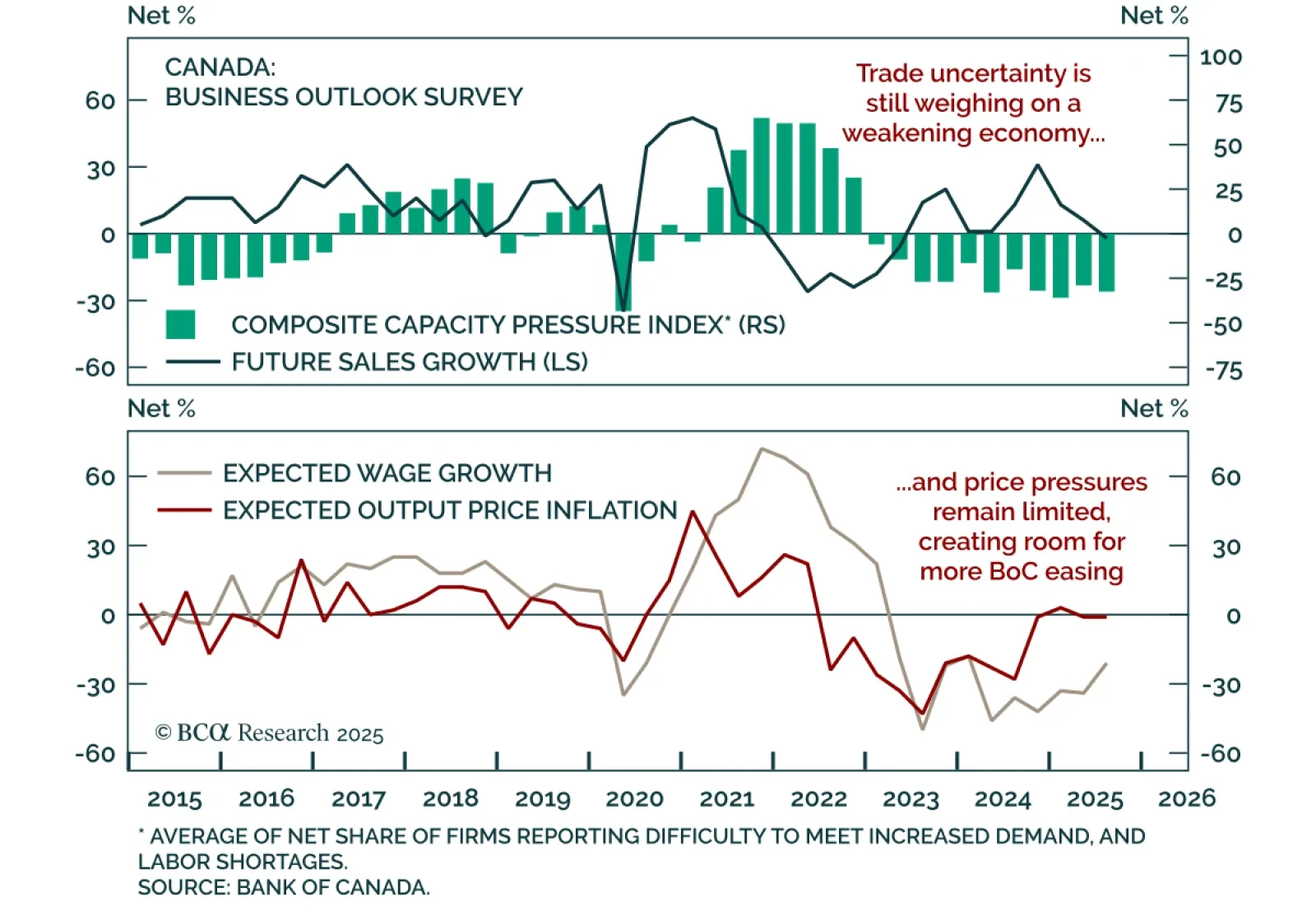

Canada’s Q3 Business Outlook Survey paints a weak macro picture with limited price pressures, supporting an overweight on CGBs and CAD 5s10s steepeners. The BOS Indicator ticked up marginally to -2.3 from -2.4, as low capacity…

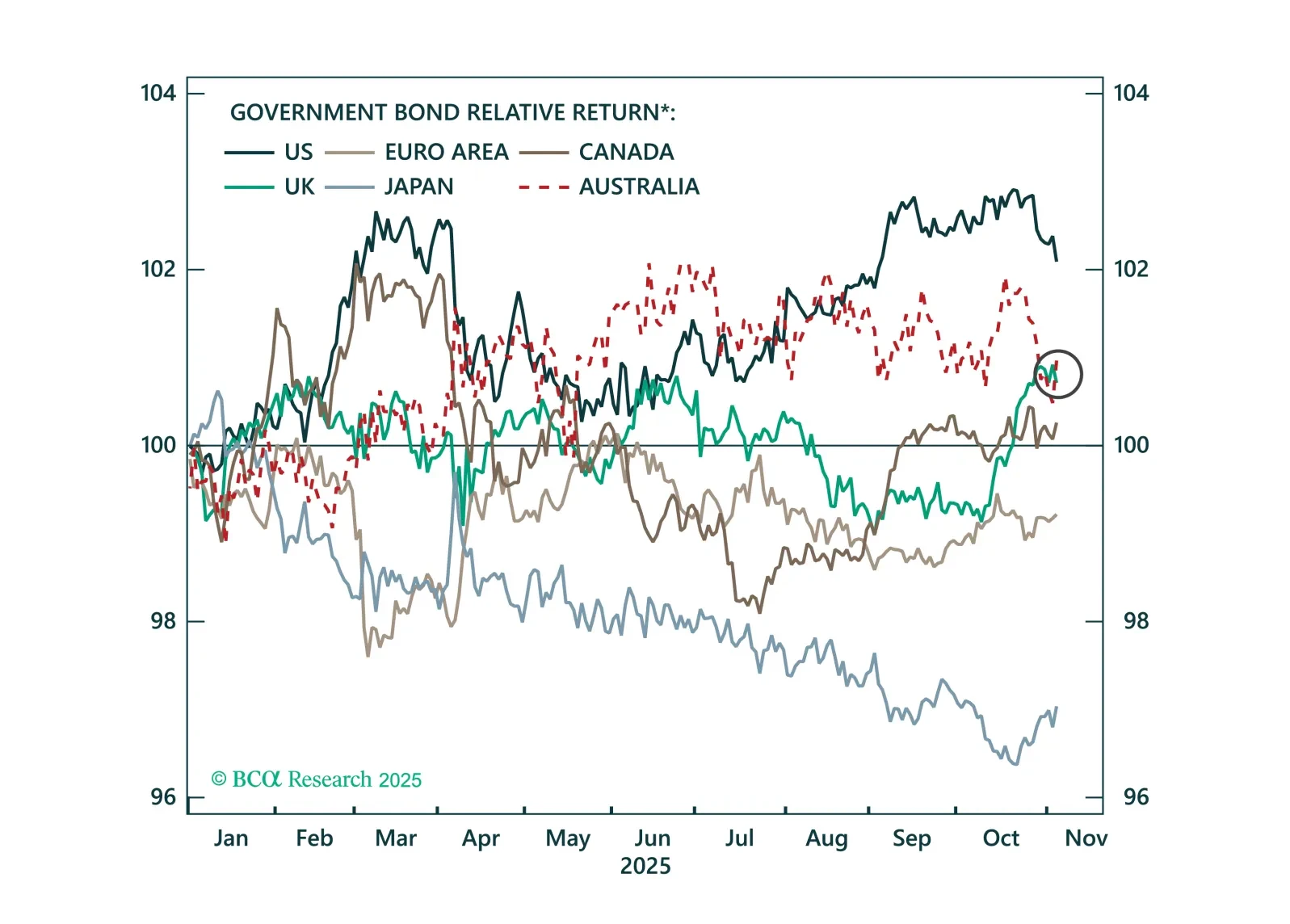

UK labor data weakened in August and September, reinforcing downside inflation risks and supporting overweight Gilts with 2s10s steepeners. Payrolls fell by 10k in September, while job vacancies continued to slide to cyclical lows as…

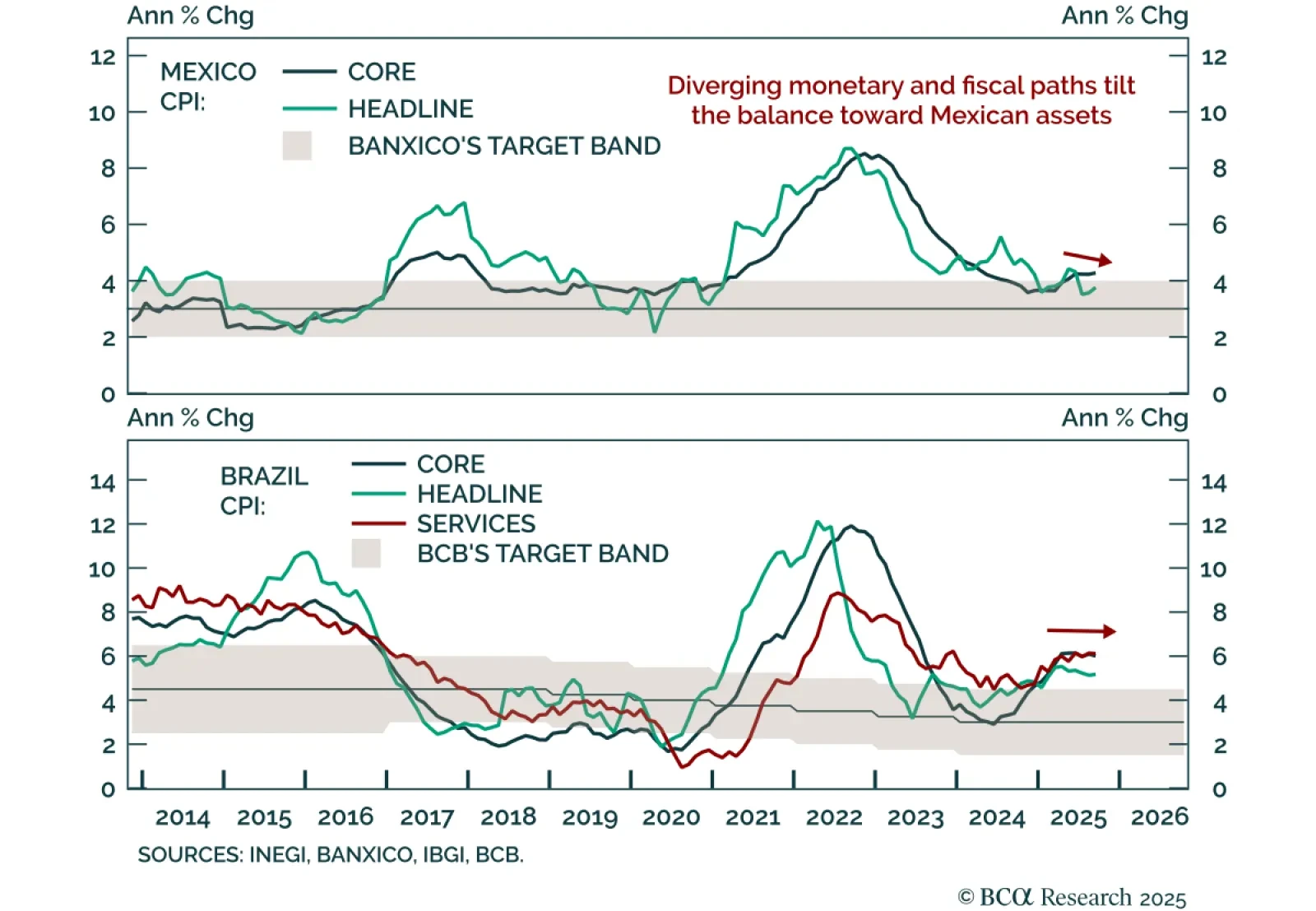

September CPI releases in Brazil and Mexico reinforce a divergent inflation and policy outlook that supports an overweight stance in Mexican local bonds and currency relative to Brazilian assets. Brazil’s headline CPI at 5.2% was…

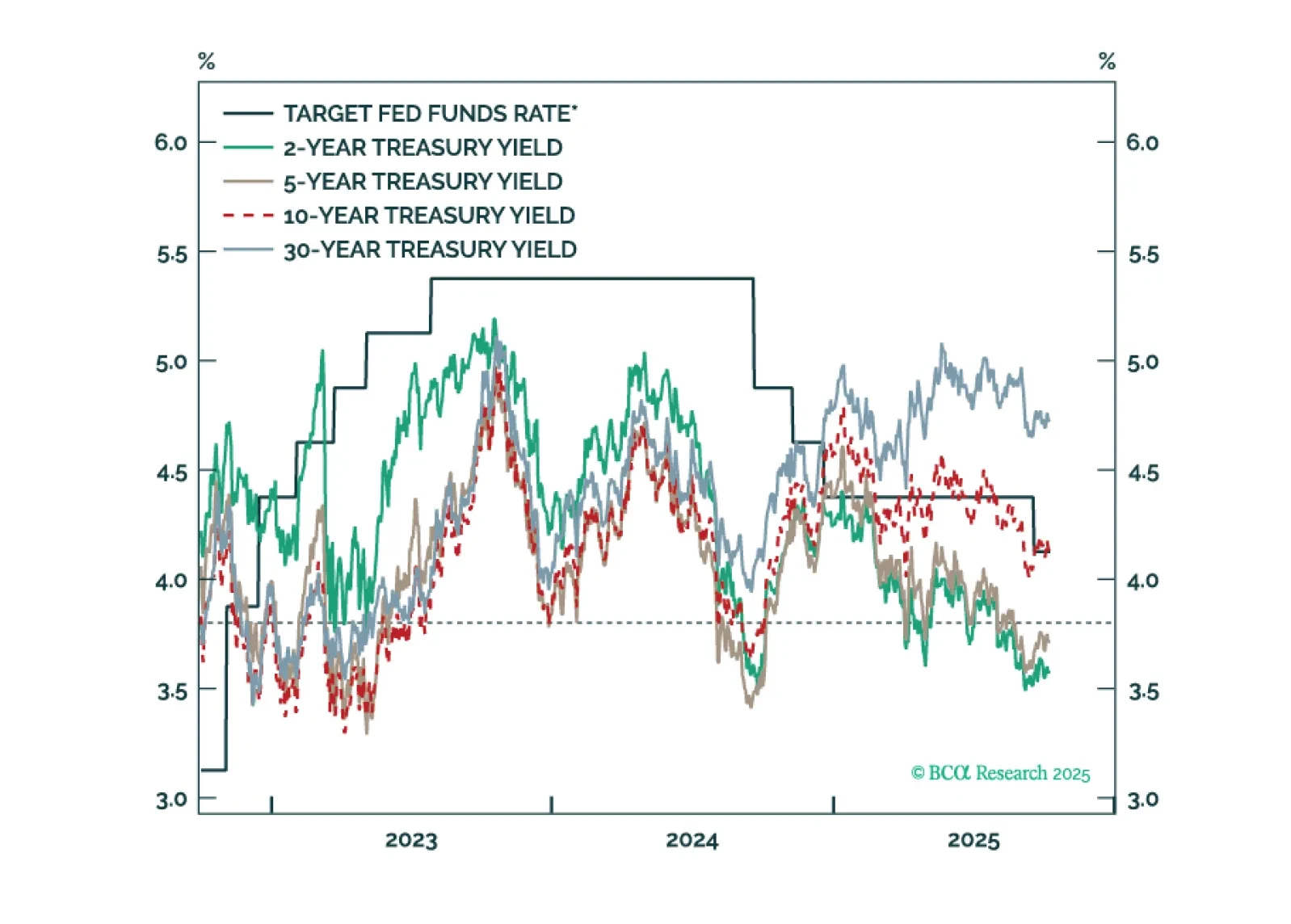

Treasury yields are generally following the pattern of past interest rate cycles, but with a larger term premium keeping the curve steeper than usual.

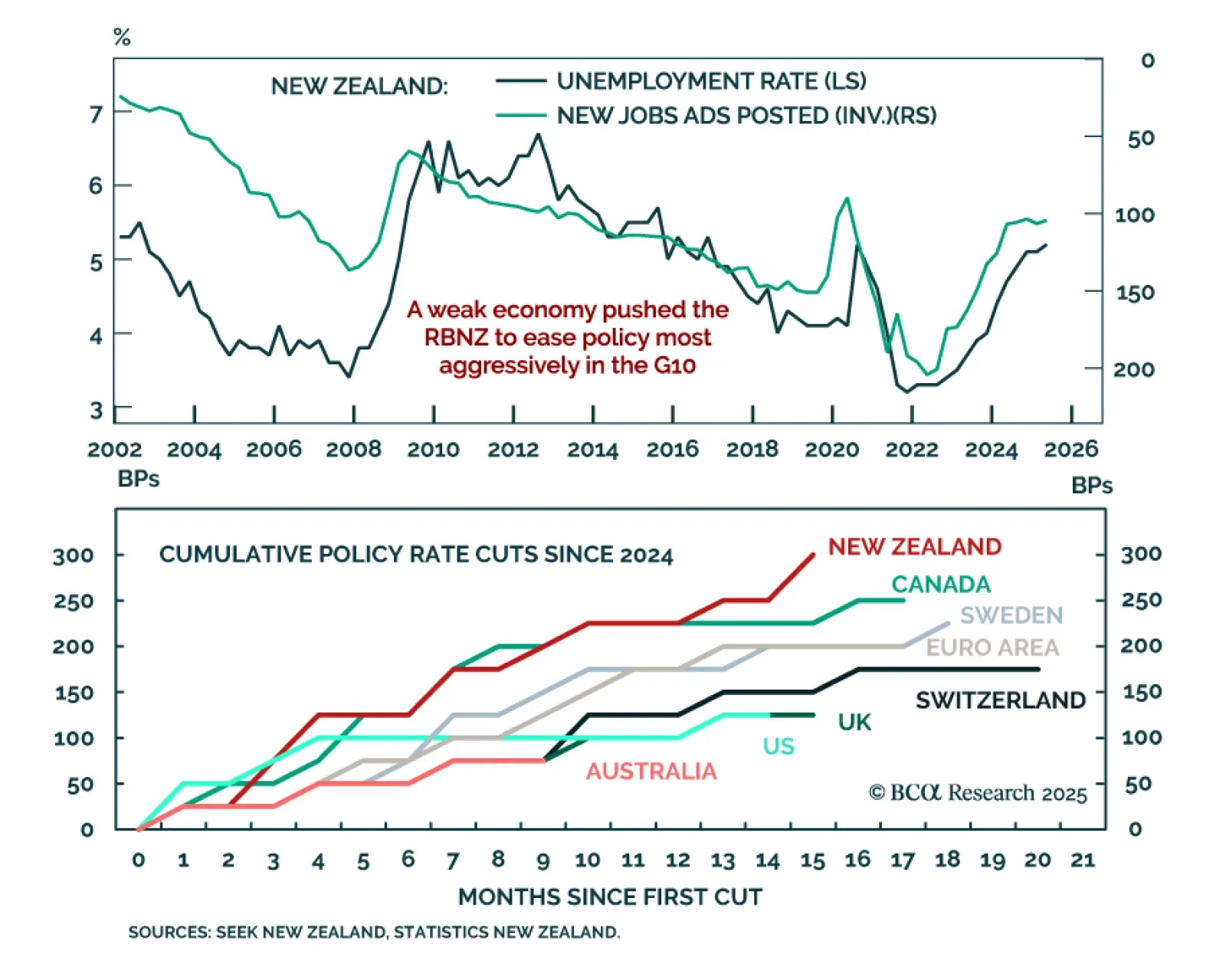

The Reserve Bank of New Zealand (RBNZ) cut the policy rate by 50 basis points to 2.5% and signaled further easing ahead, supporting an overweight stance in New Zealand government bonds and underweight in the NZD.The larger-than-…