Monetary

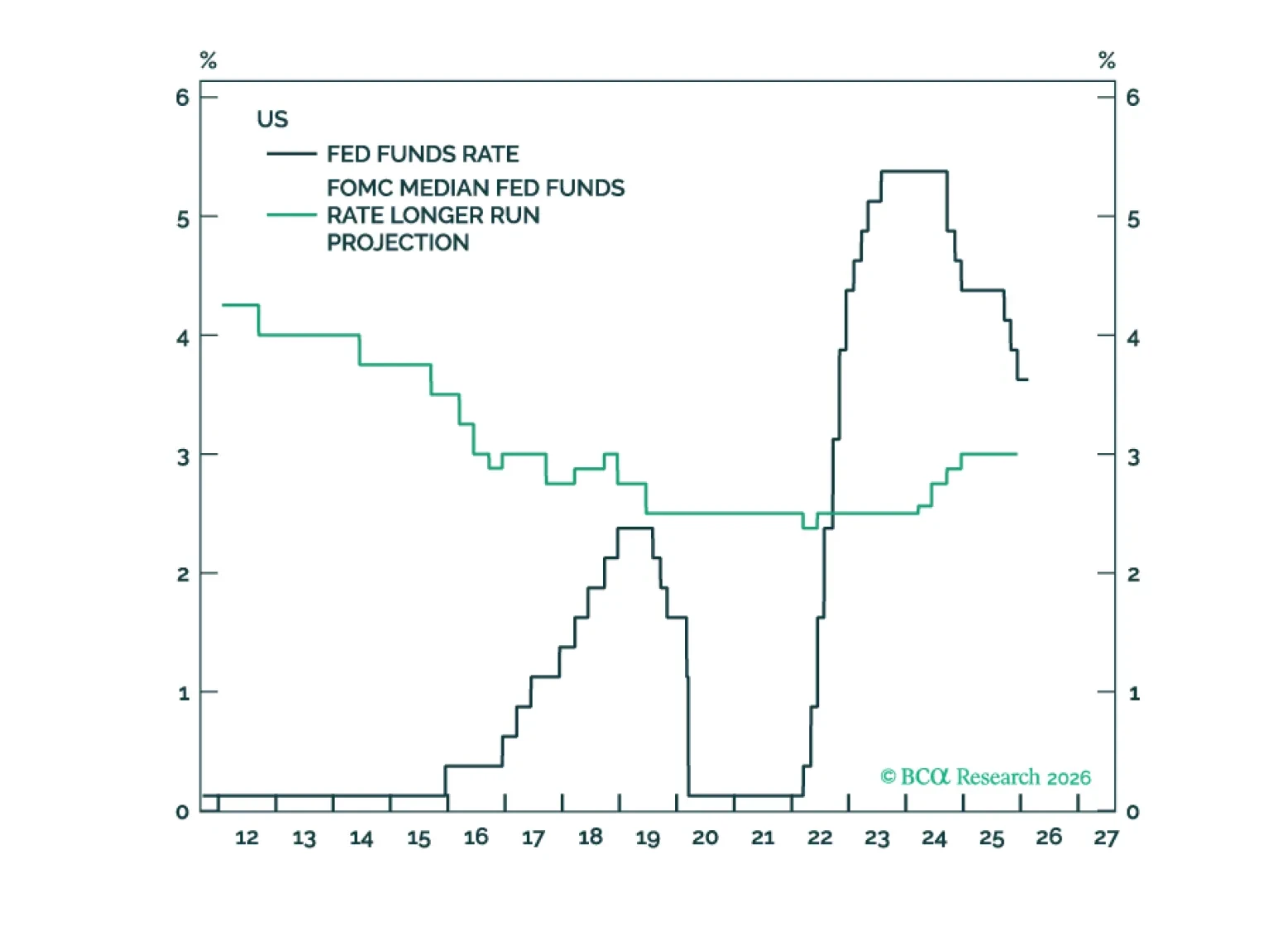

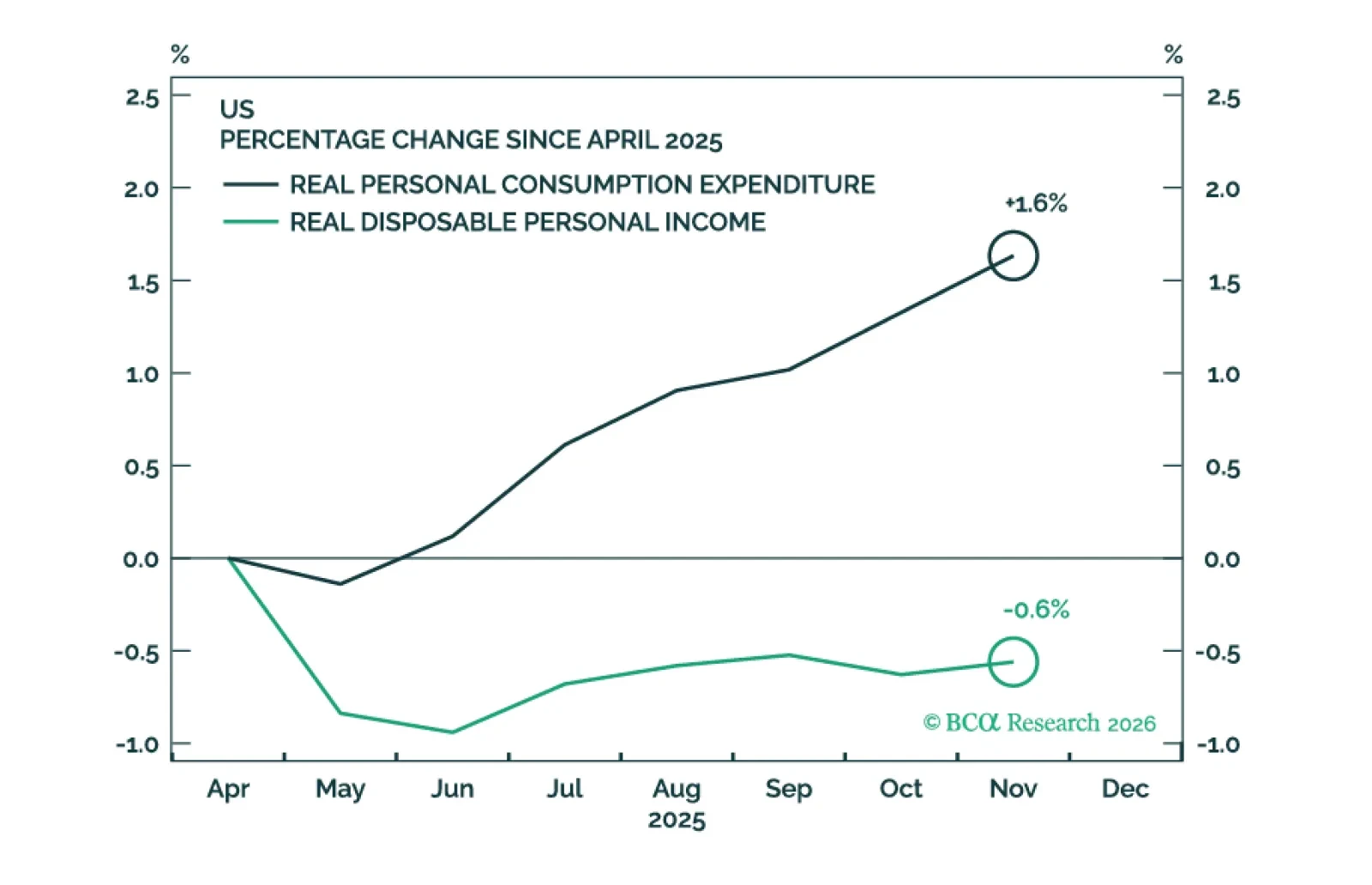

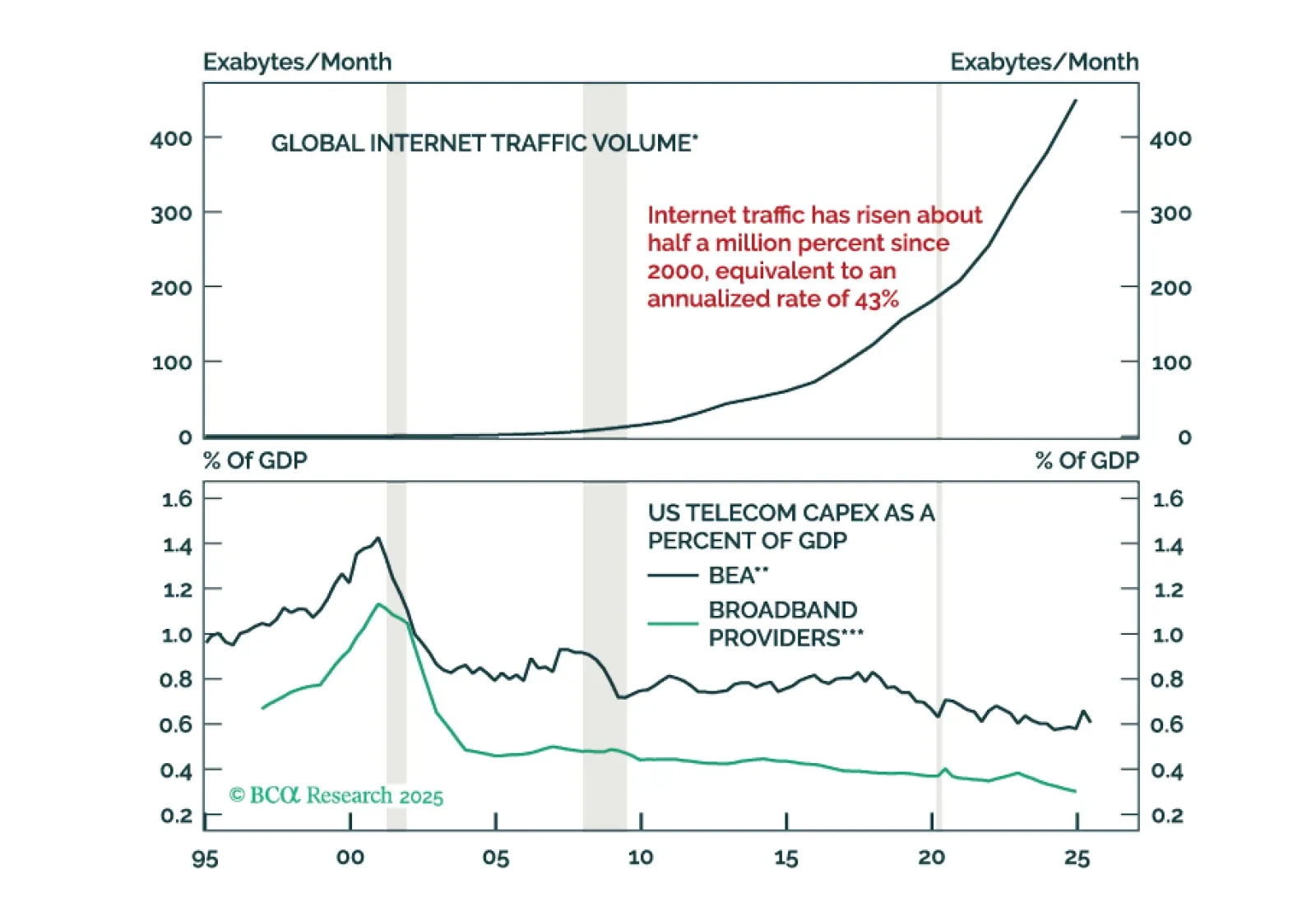

The neutral rate in the US is being propped up by a variety of forces that are at risk of reversing. These include the AI capex boom, large budget deficits, and the extraordinarily high level of household wealth. As such, interest rates are likely to surprise to the downside over the next few years.

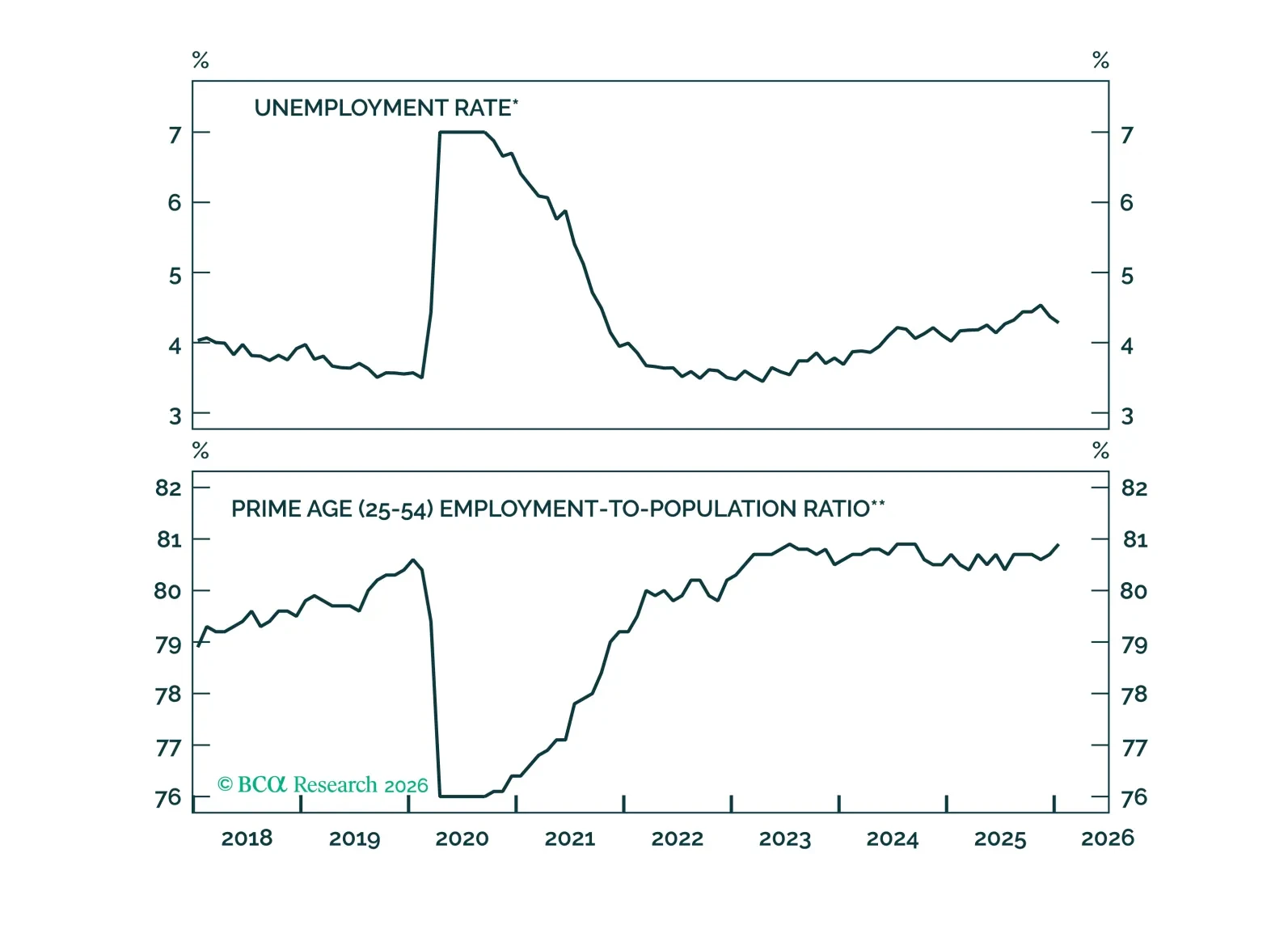

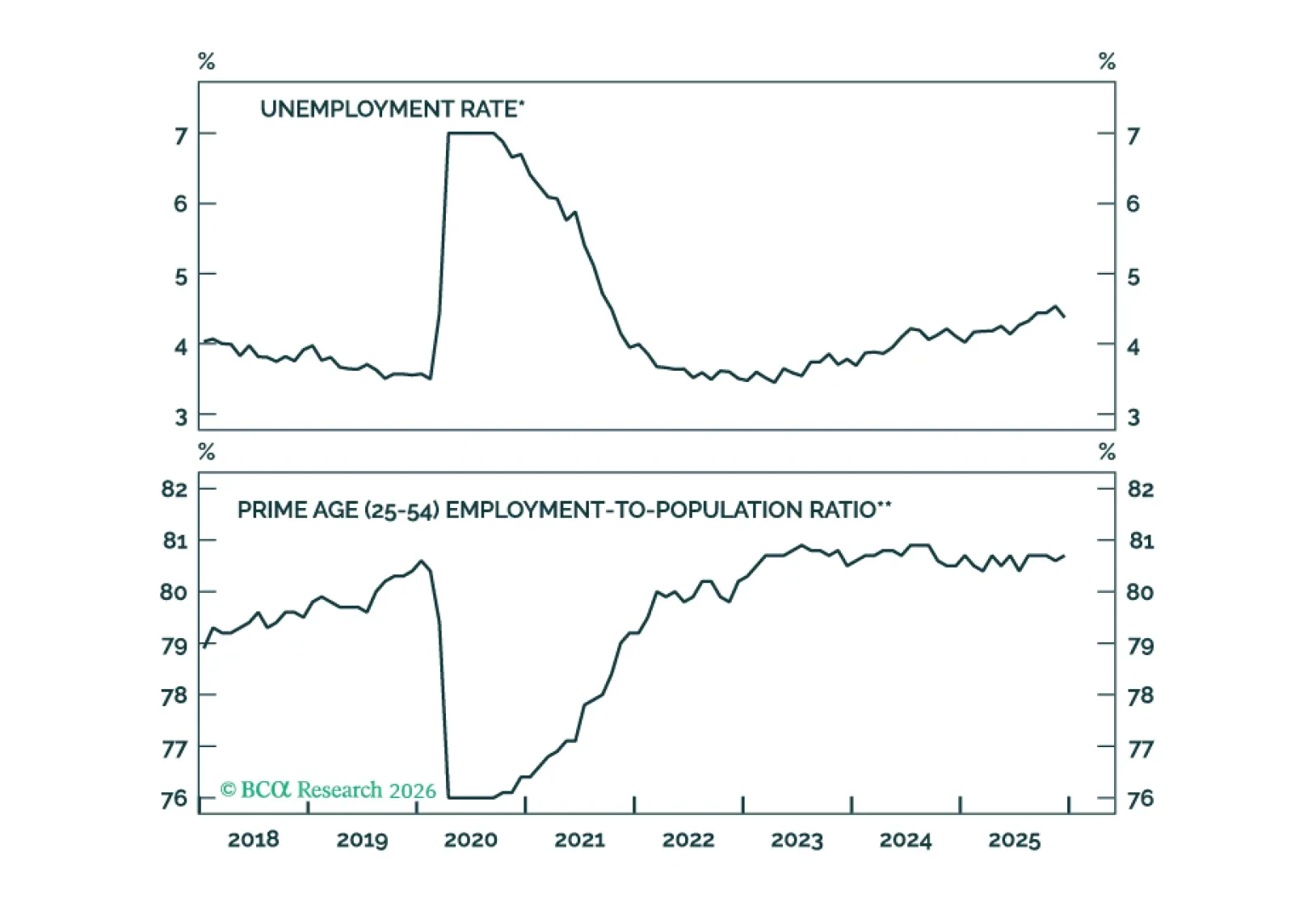

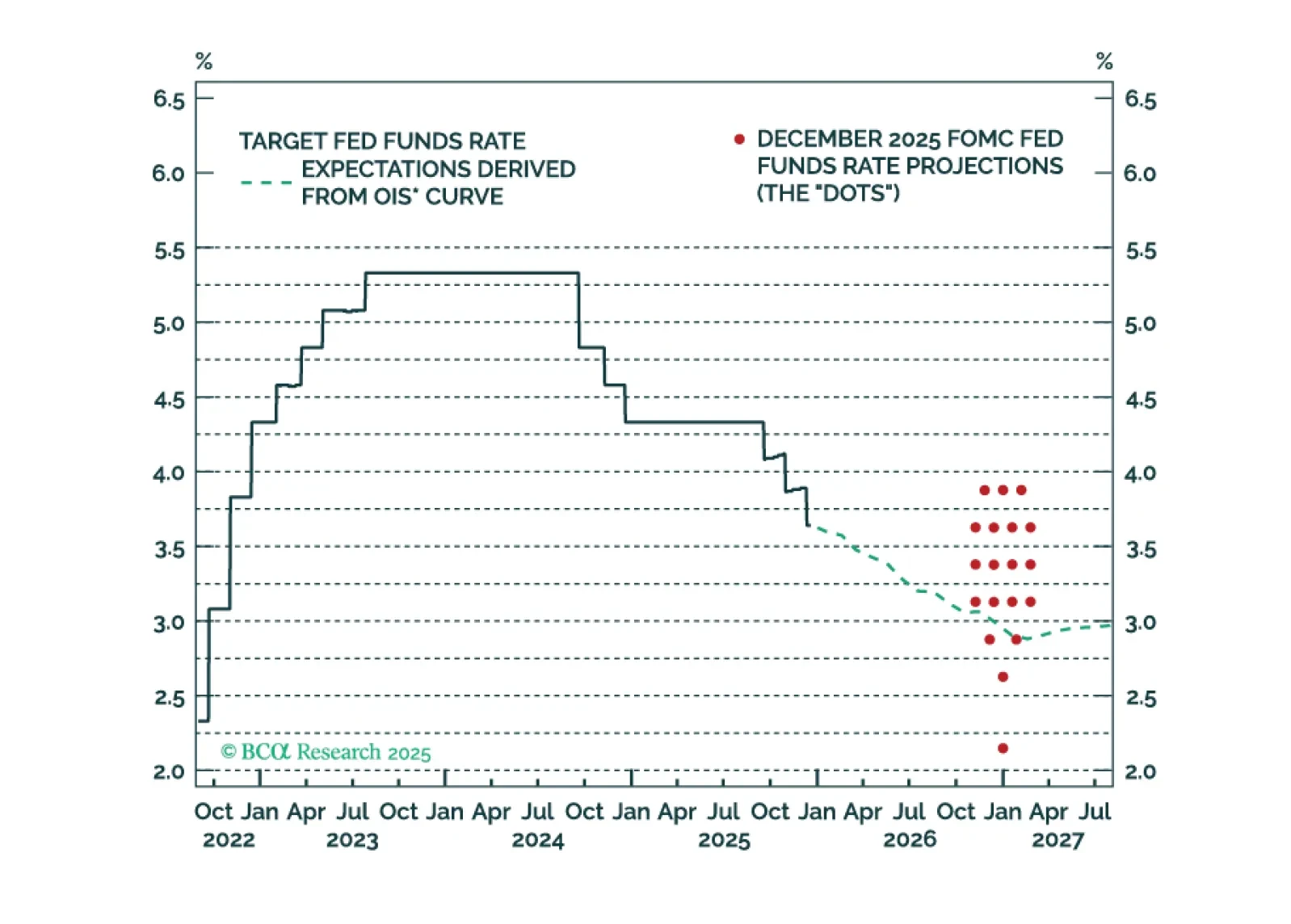

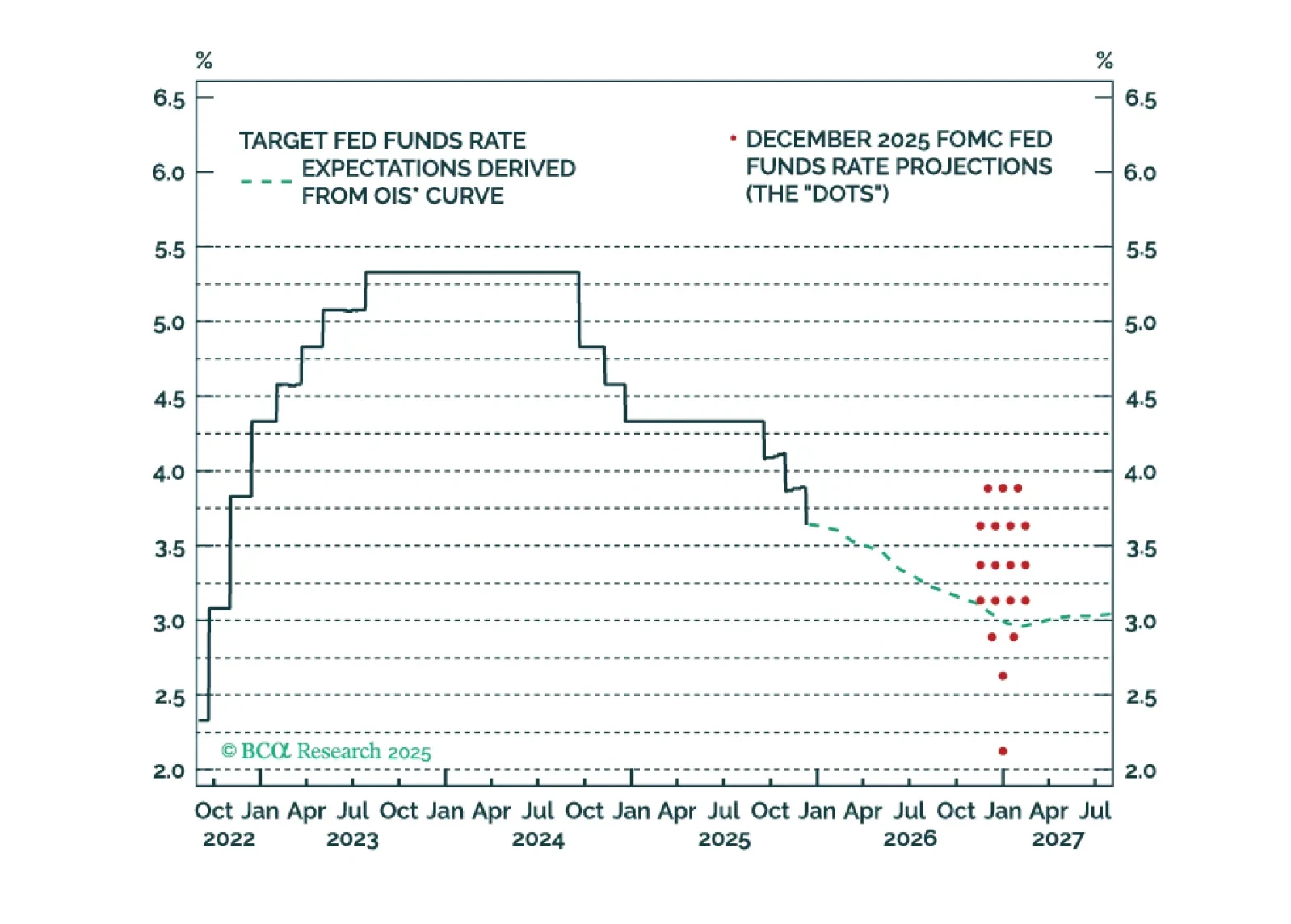

The labor market tightened in January, significantly lowering the odds of a H1 2026 rate cut. Rate cuts driven by lower inflation are still likely in H2 2026.

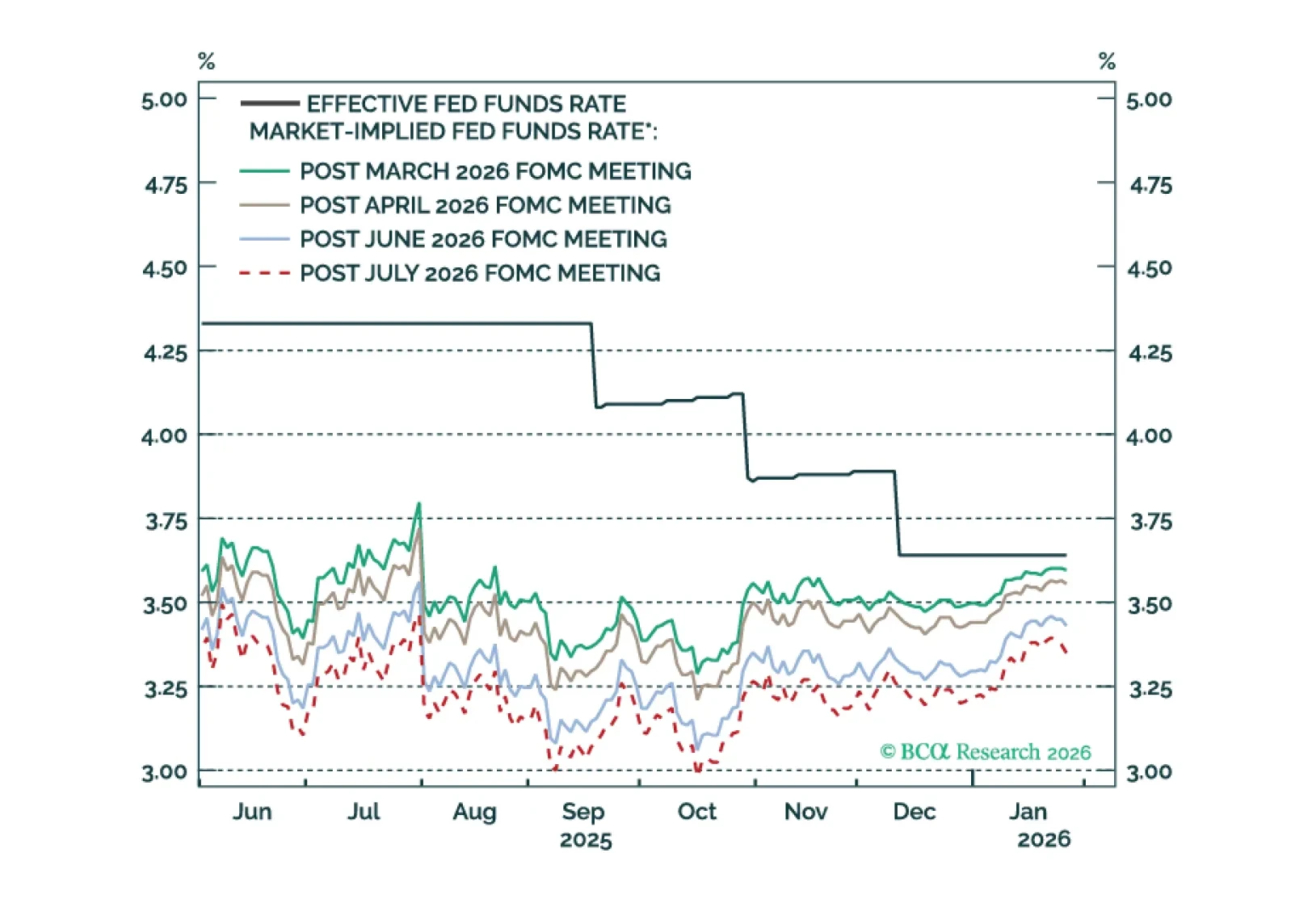

The Fed will keep rates on hold in H1 2026, but dovish policy surprises are likely in the second half of the year.

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026 price target for the S&P 500 to 6375 from 6200.

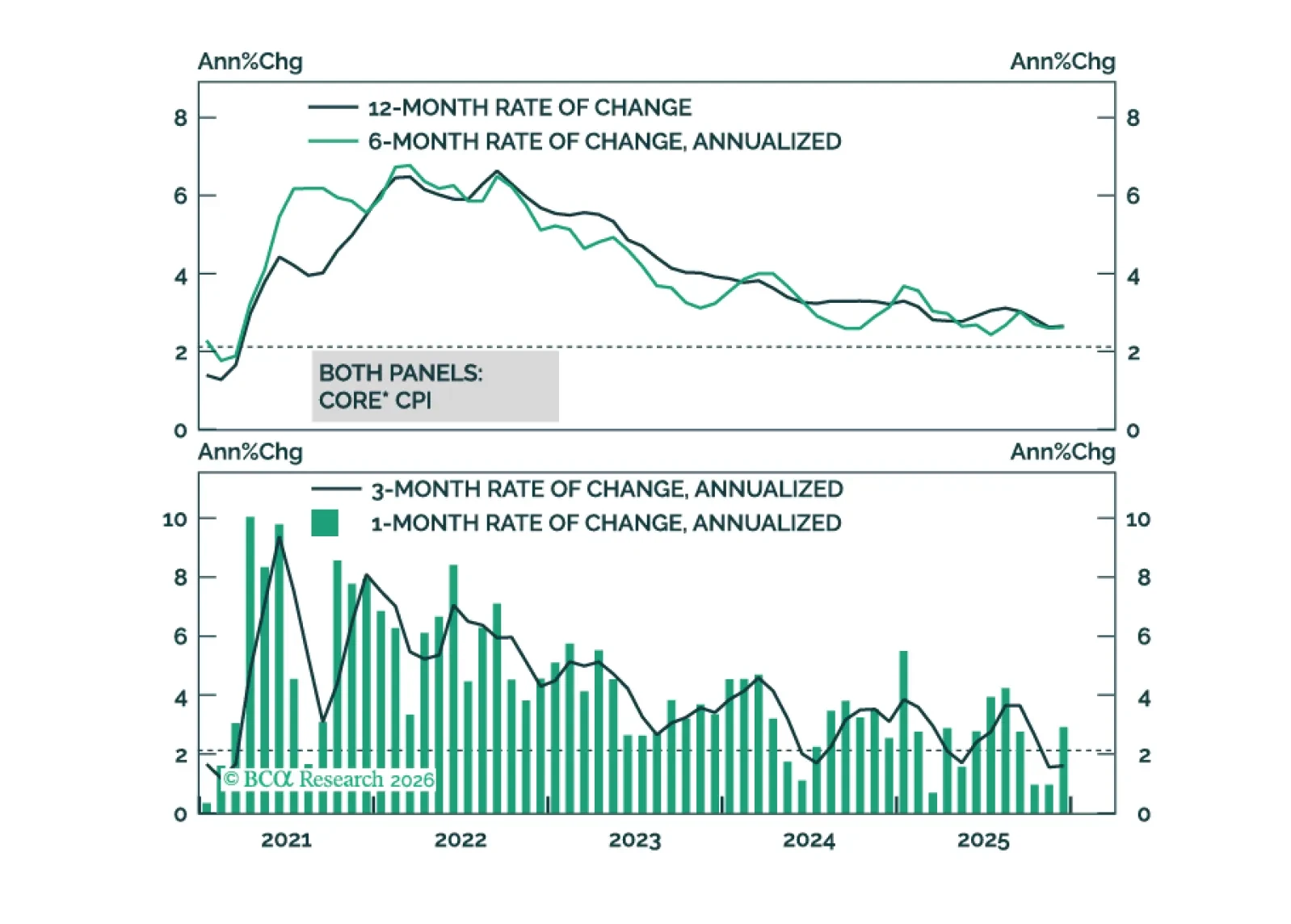

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

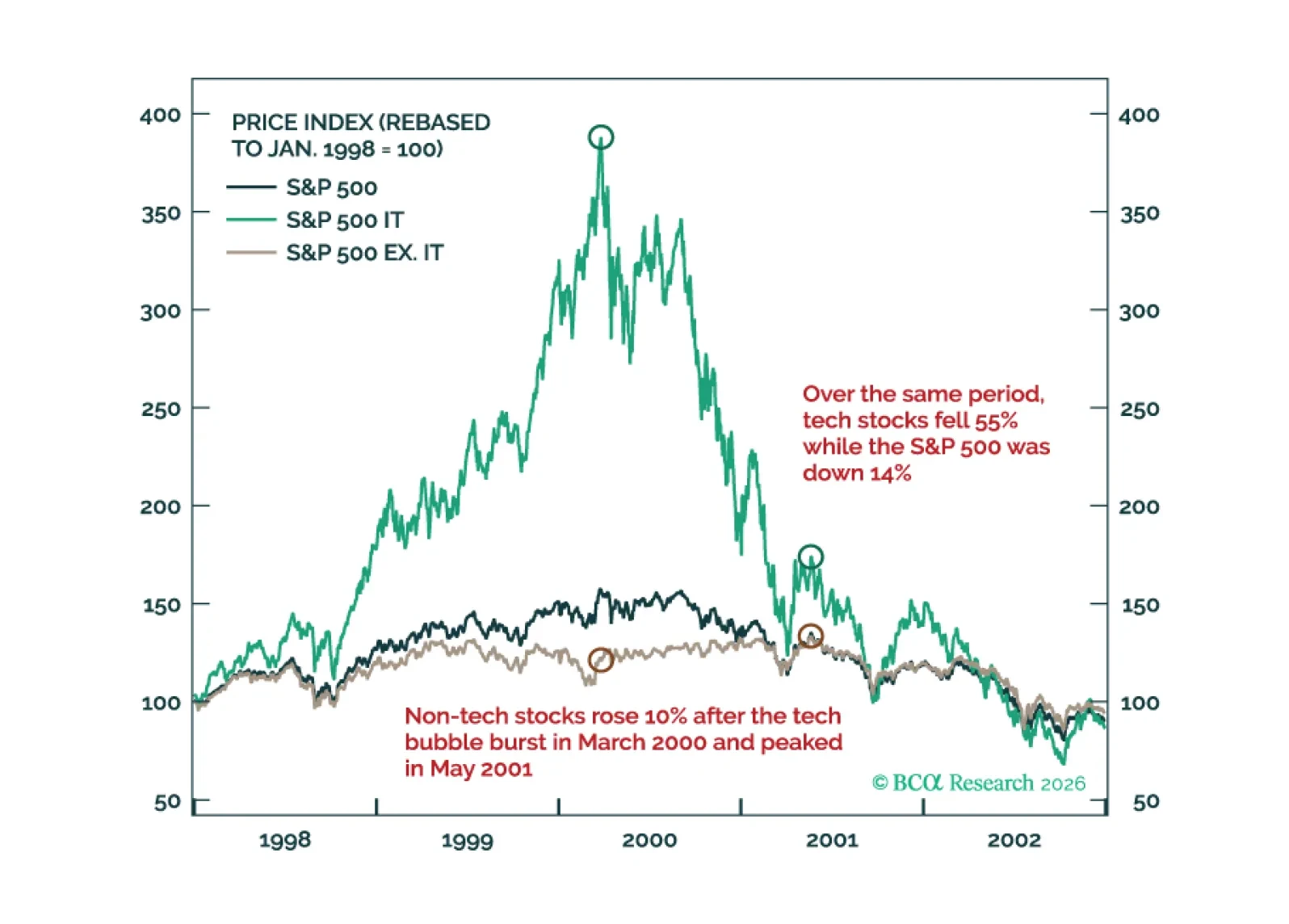

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a weakening US economy.

Our outlook for Fed policy in 2026.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.

Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET) to discuss the economy and financial markets. We will also host a Webcast for APAC on Tuesday, December 16 at 8:00 PM EST (9:00 AM HKT+1 day).

And with that, I will sign off for the year. I wish you and your loved ones a very happy and healthy 2026. We will be back on Friday, January 2 with our MacroQuant Model Update.

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.