China’s victory in getting KSA and Iran to restore diplomatic relations is of far greater consequence to commodity markets than the past weeks’ bank failures in the US. For China, further success in sorting long-standing security…

The tempo of China’s and the US’s military operations is picking up sharply. The risk of a sudden, perhaps unintended, escalation of military conflict, therefore, is rising in the South China Sea. So is the risk of another shooting…

The risk-on rally is challenging our annual forecast so we are cutting some losses. But we still think central banks and geopolitics will combine to reverse the rally later this year.

China’s re-opening – powered by the fiscal and monetary stimulus required to achieve at least 5% real GDP growth after flattish 2022 growth – and a weaker USD will catalyze demand growth this year and next, lifting global oil…

Investors should bet against the global rally in risk assets and maintain a defensive positioning until recession risks verifiably abate.

Prefer government bonds over stocks, defensive sectors over cyclicals, and large caps over small caps. Favor North America over other markets. Favor emerging markets like Southeast Asia and Latin America over Greater China, Turkey,…

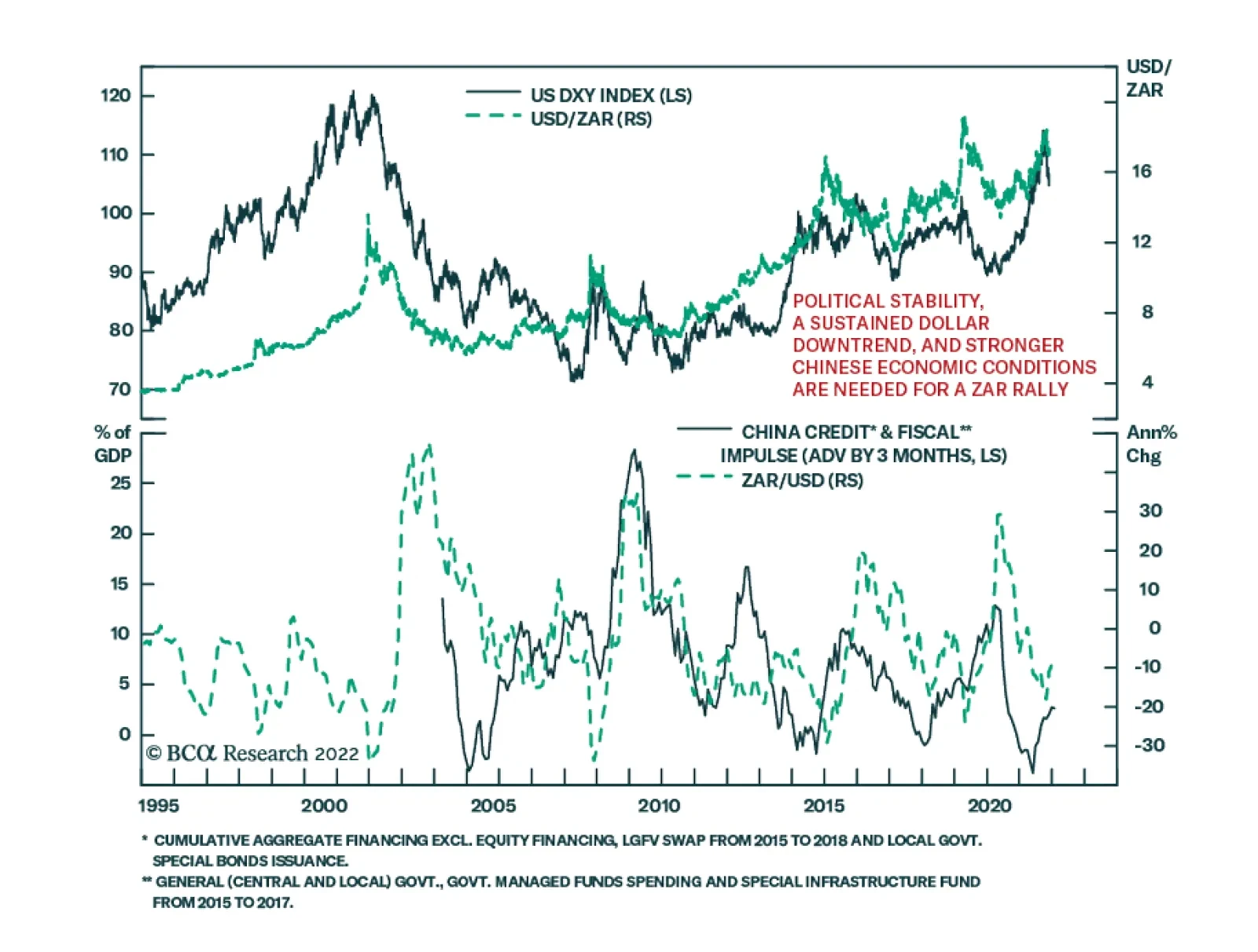

Over the past week, the South African rand was a key underperformer in the currency space. Despite broad-based dollar weakness, USD/ZAR ended the weak 2.4% higher. Heightened domestic political uncertainty triggered the South…