Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

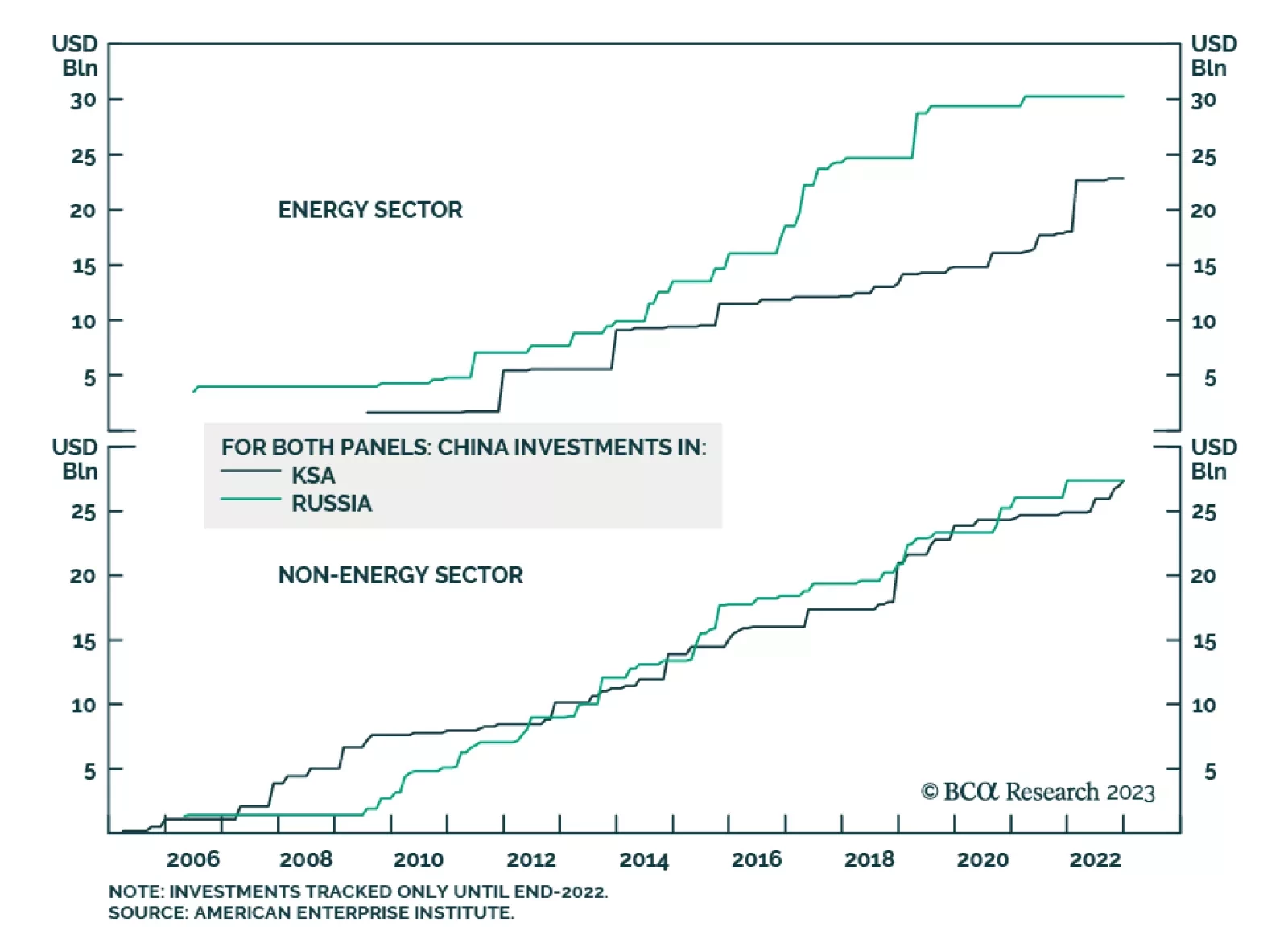

China’s economic and diplomatic interests in the GCC region will expand, as will its military presence. Whether or not this stabilizes the region is yet to be determined, particularly if tensions in the South China Sea and other…

The normalization of oil storage markets in the Northern Hemisphere; strong demand, aided by China stimulus this year; and continued production discipline supports our view Brent prices likely have bottomed, and will move higher from…

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

Following this weekend’s OPEC 2.0 meeting, KSA announced a 1mm b/d crude output cut, slated for this July or August, as it attempts to support weak oil prices. The new output quotas, reduced to reflect members’ weak crude oil…

The Gulf’s political economy – particularly that of KSA – drives the supply side of oil-price discovery. This has been evolving since 2017, when OPEC 2.0 was formed. It is now fundamental to the market. We expect Brent to average $95…

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…