The attacks on Red Sea commercial tankers by Iran’s Yemeni proxies, the Houthi movement, are an inflation risk inasmuch as they lengthen voyage times for any shipping forced to avoid the Bab el-Mandeb Strait. The risk of an expansion…

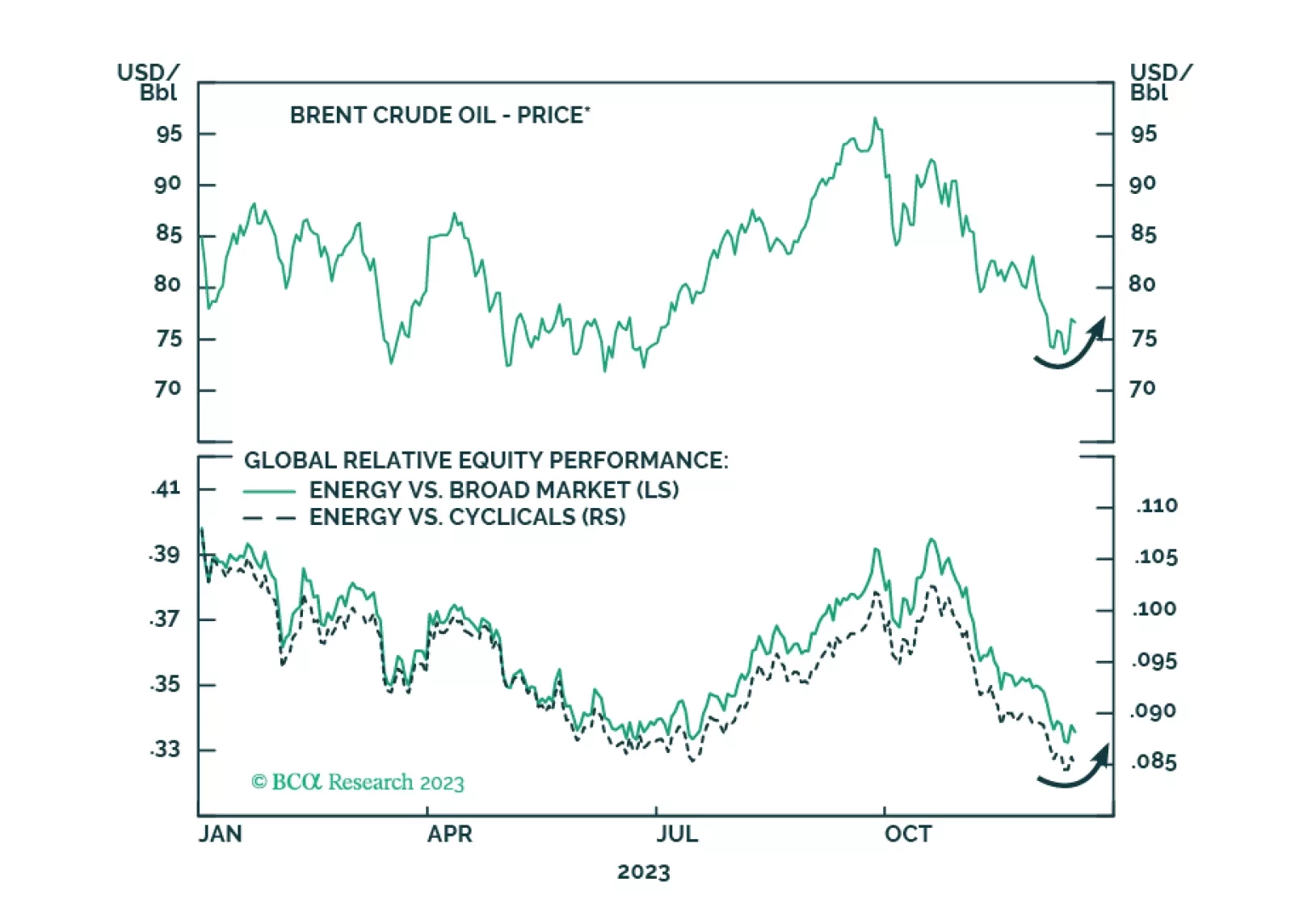

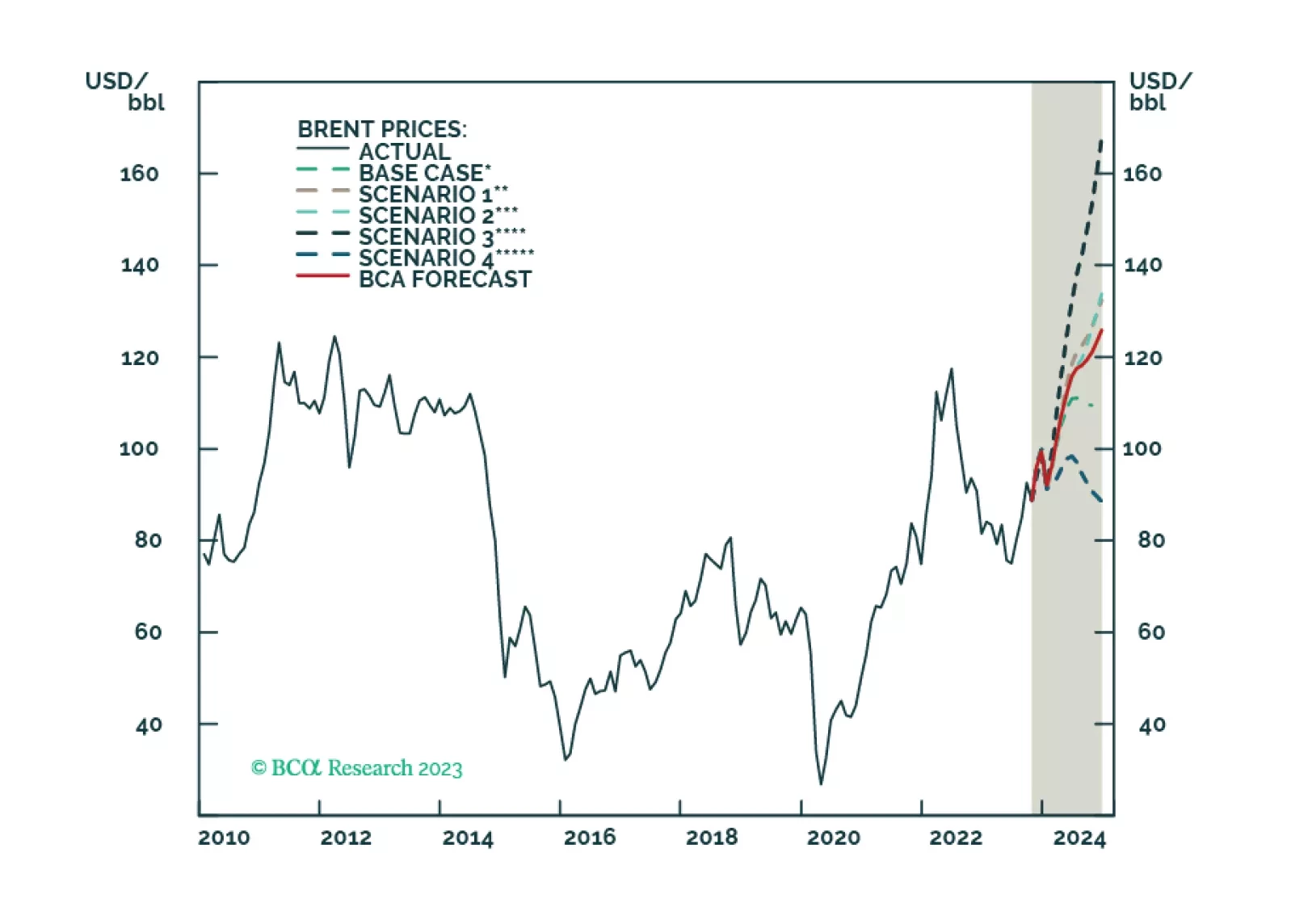

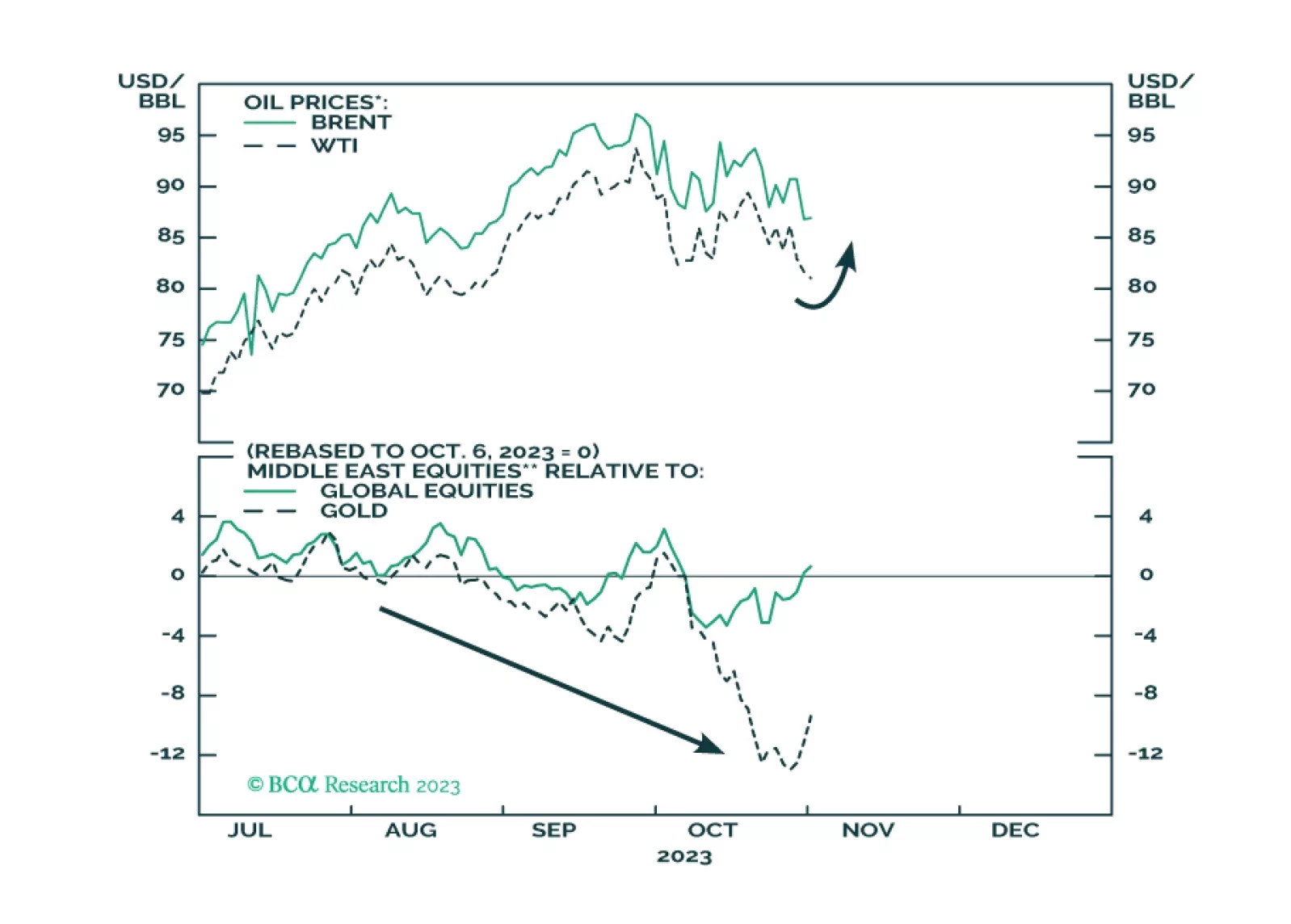

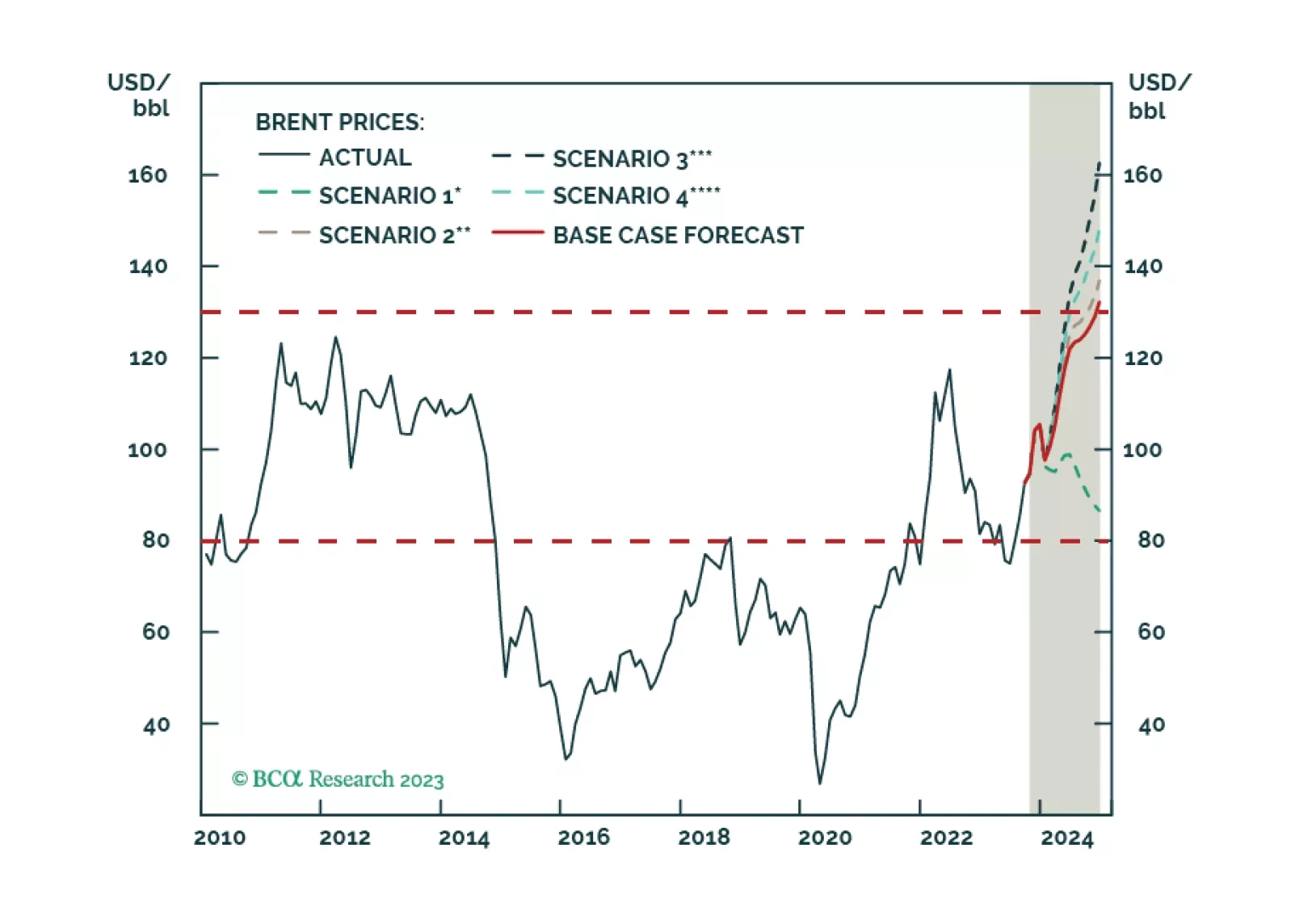

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…

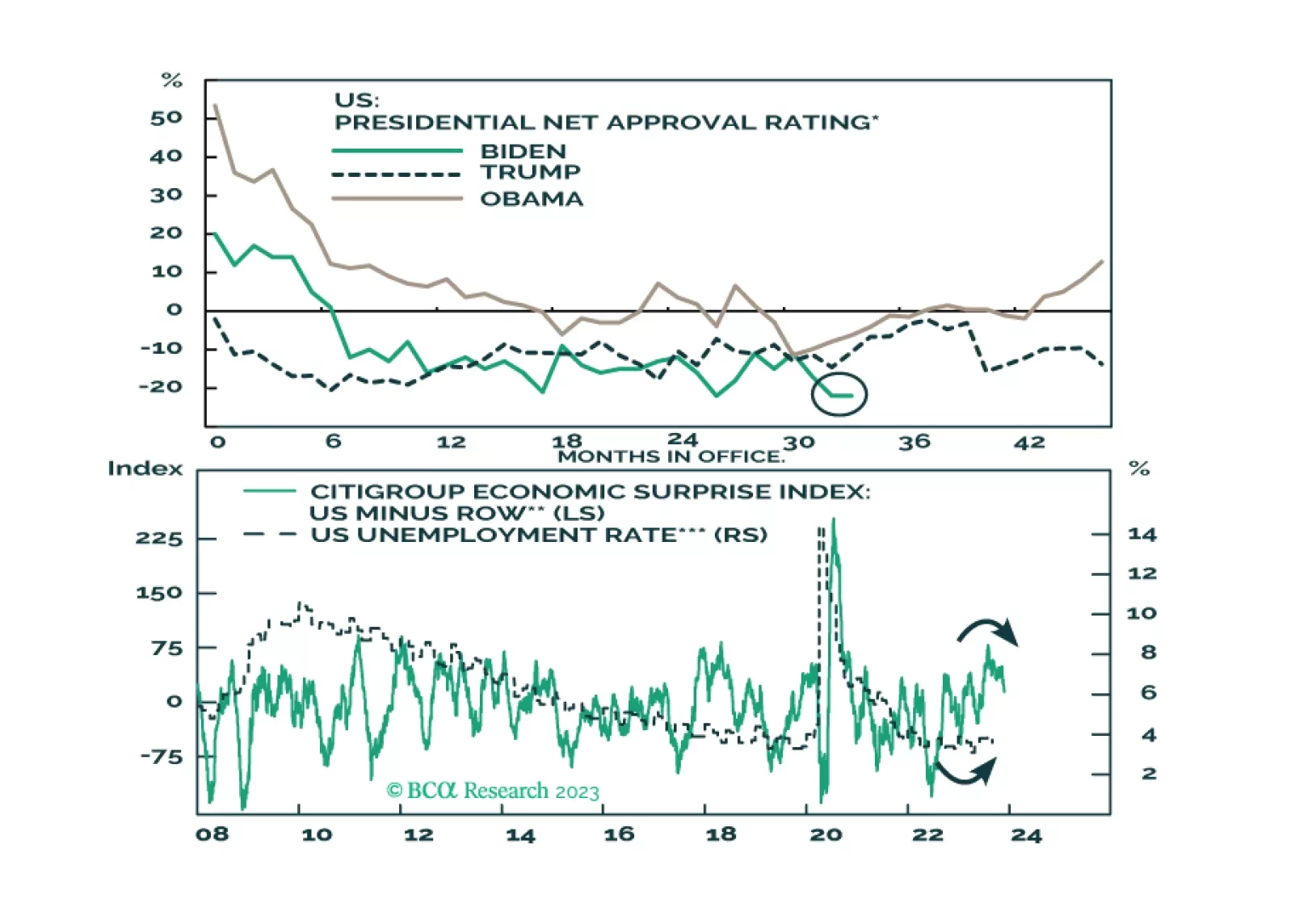

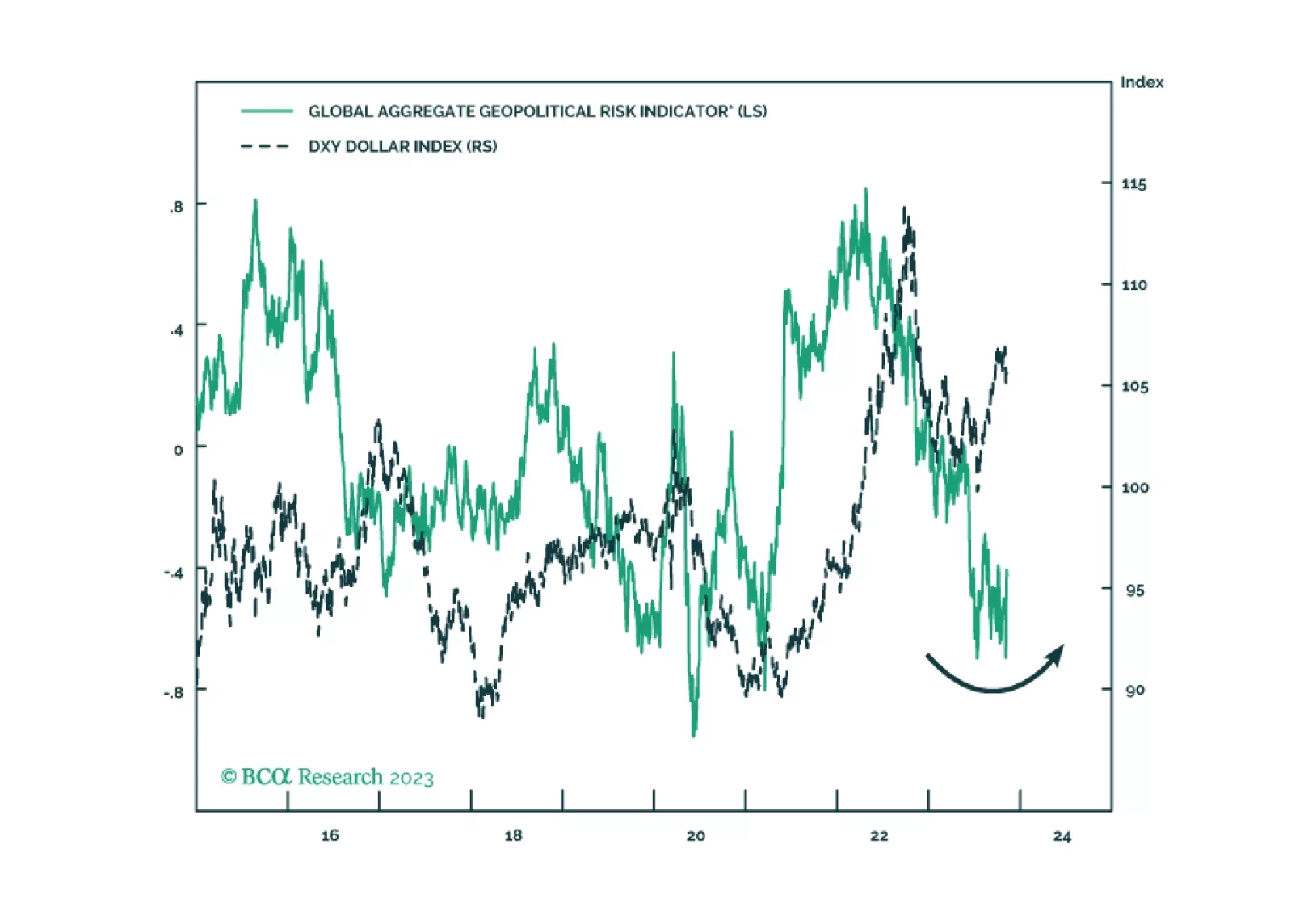

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

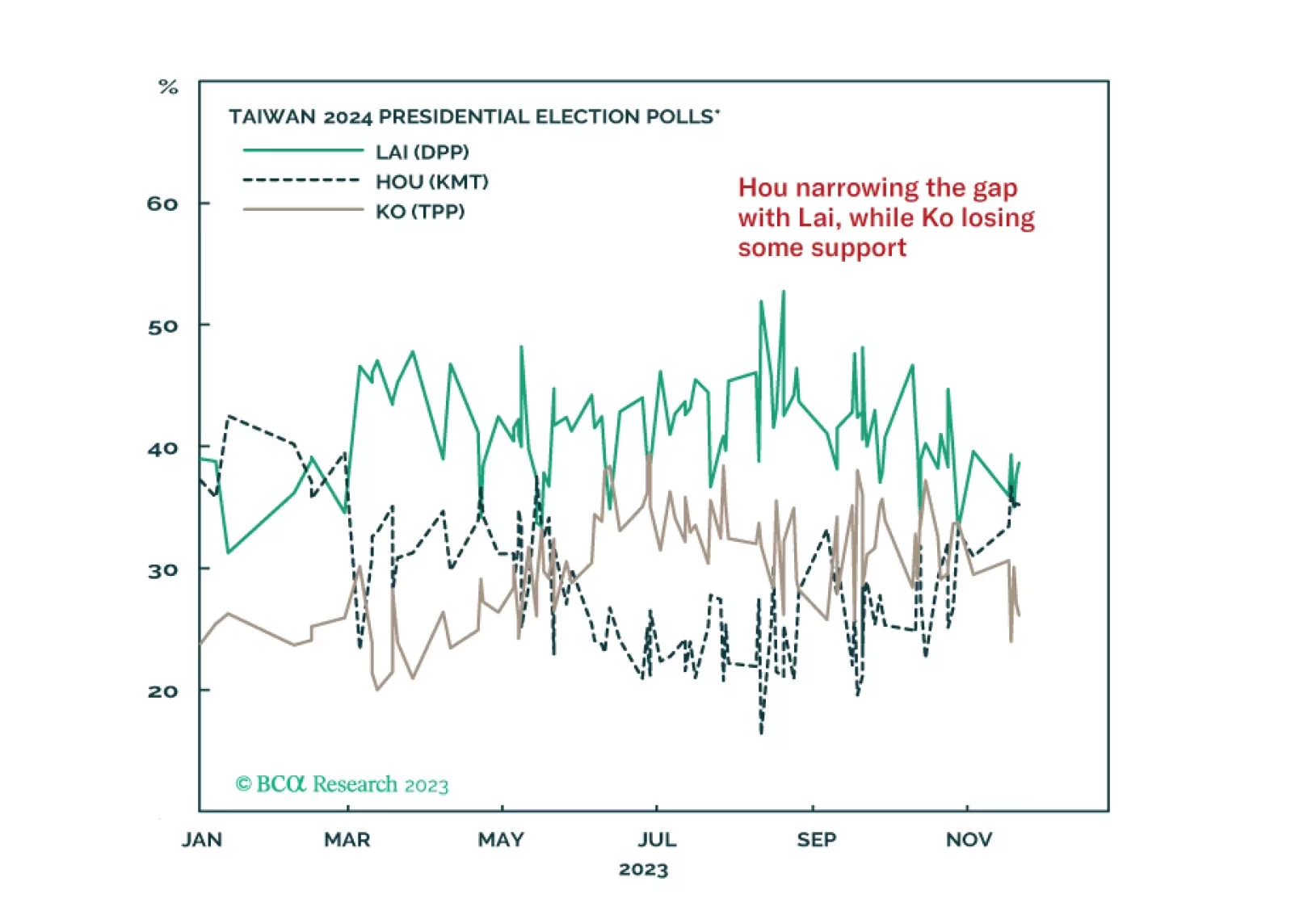

A series of notable events took place over the Thanksgiving holiday but none of them force us to change our fundamental assessments. The conflict in the Middle East is likely to escalate rather than de-escalate, while the Taiwan…

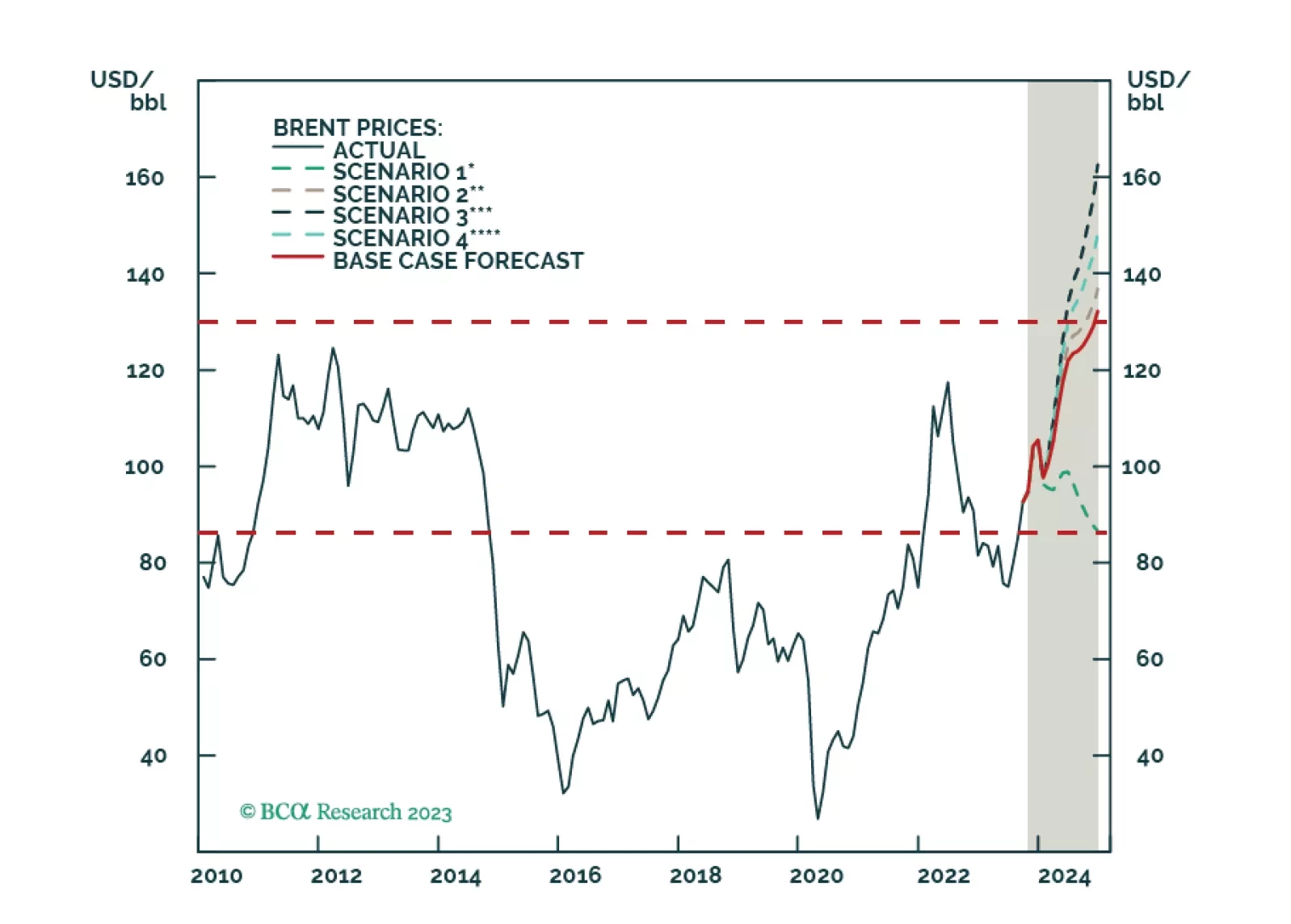

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

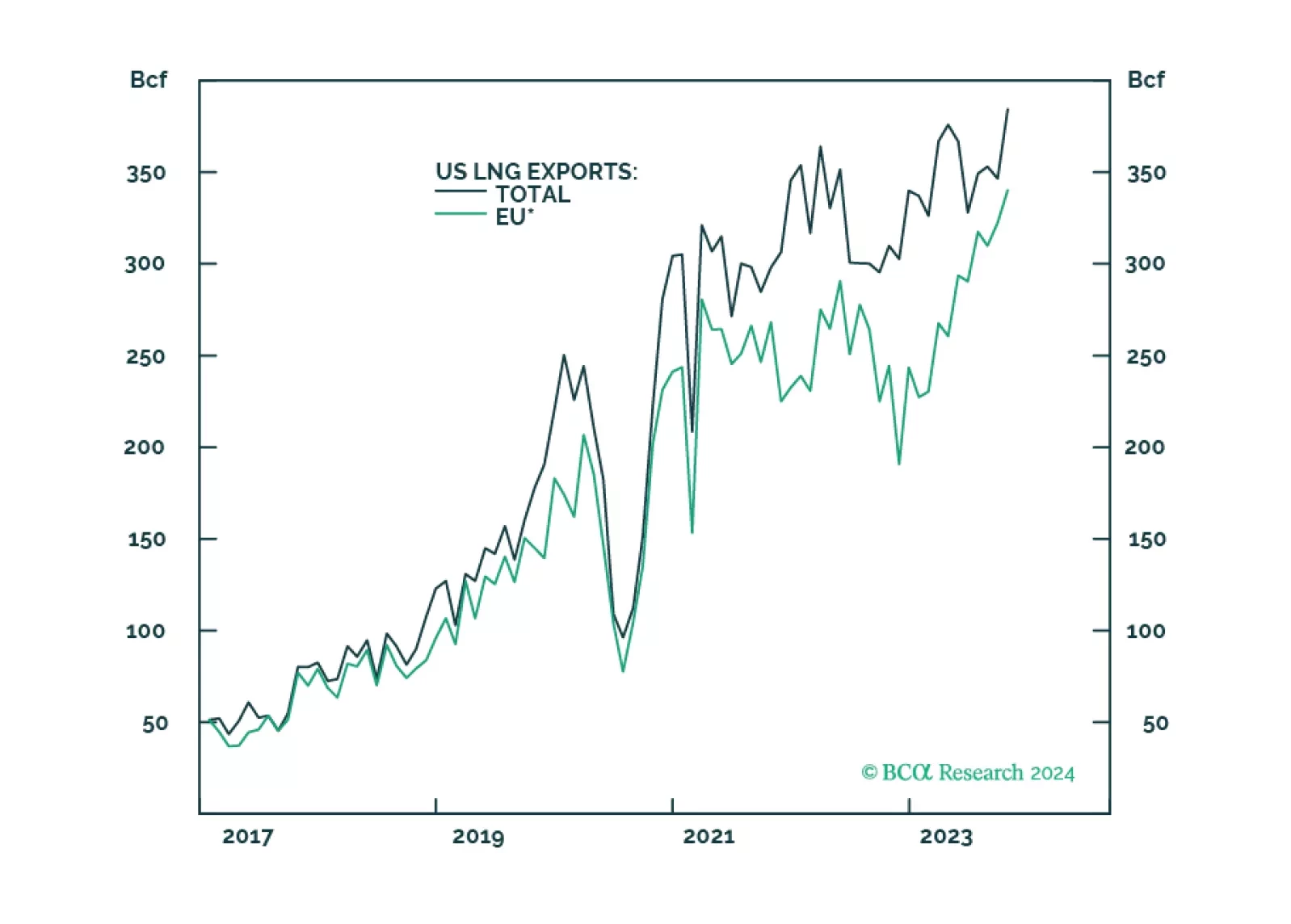

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

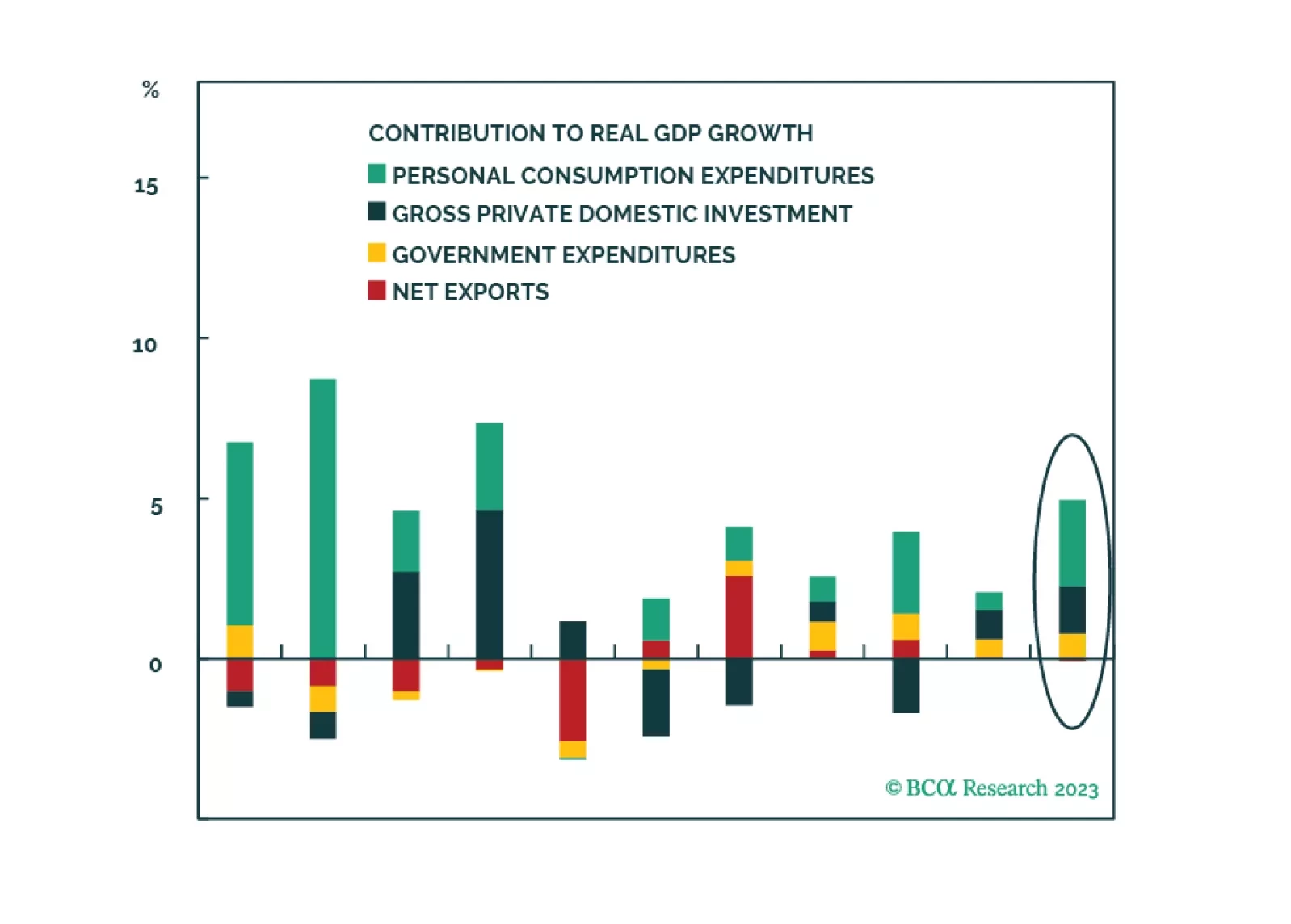

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

The US and core OPEC 2.0 are – wittingly or not – laying the groundwork for a price band with a floor and cap on oil prices – at $79/bbl and $130/bbl, respectively – “at least” to May 2024. This accommodates multiple goals for both…