Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

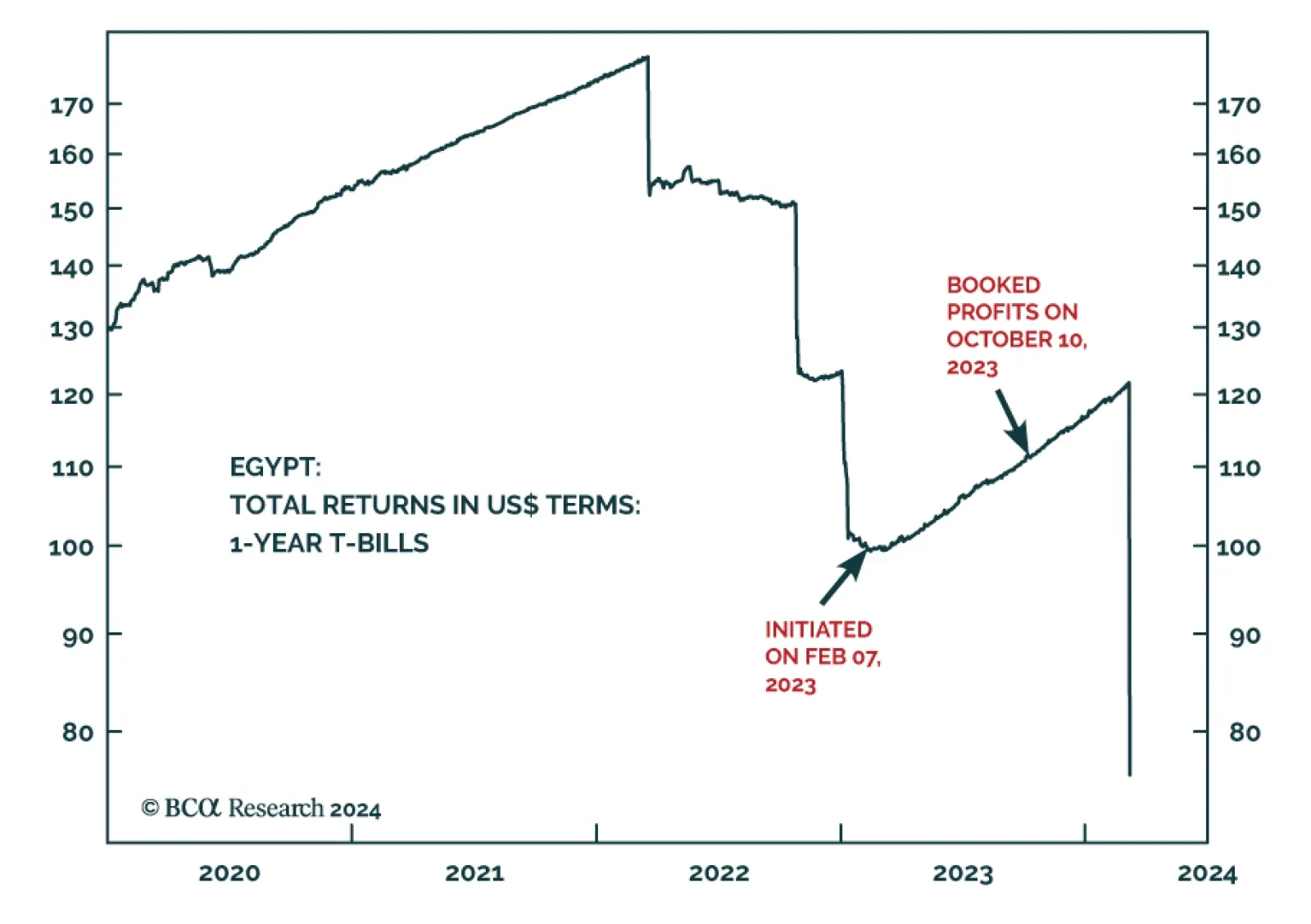

Our Emerging Market Strategy (EMS) colleagues recommended booking an 11.4% gain on their Egyptian T-bill trade initiated earlier in the year. Now that currency-devaluation risk has been removed from the picture for the…

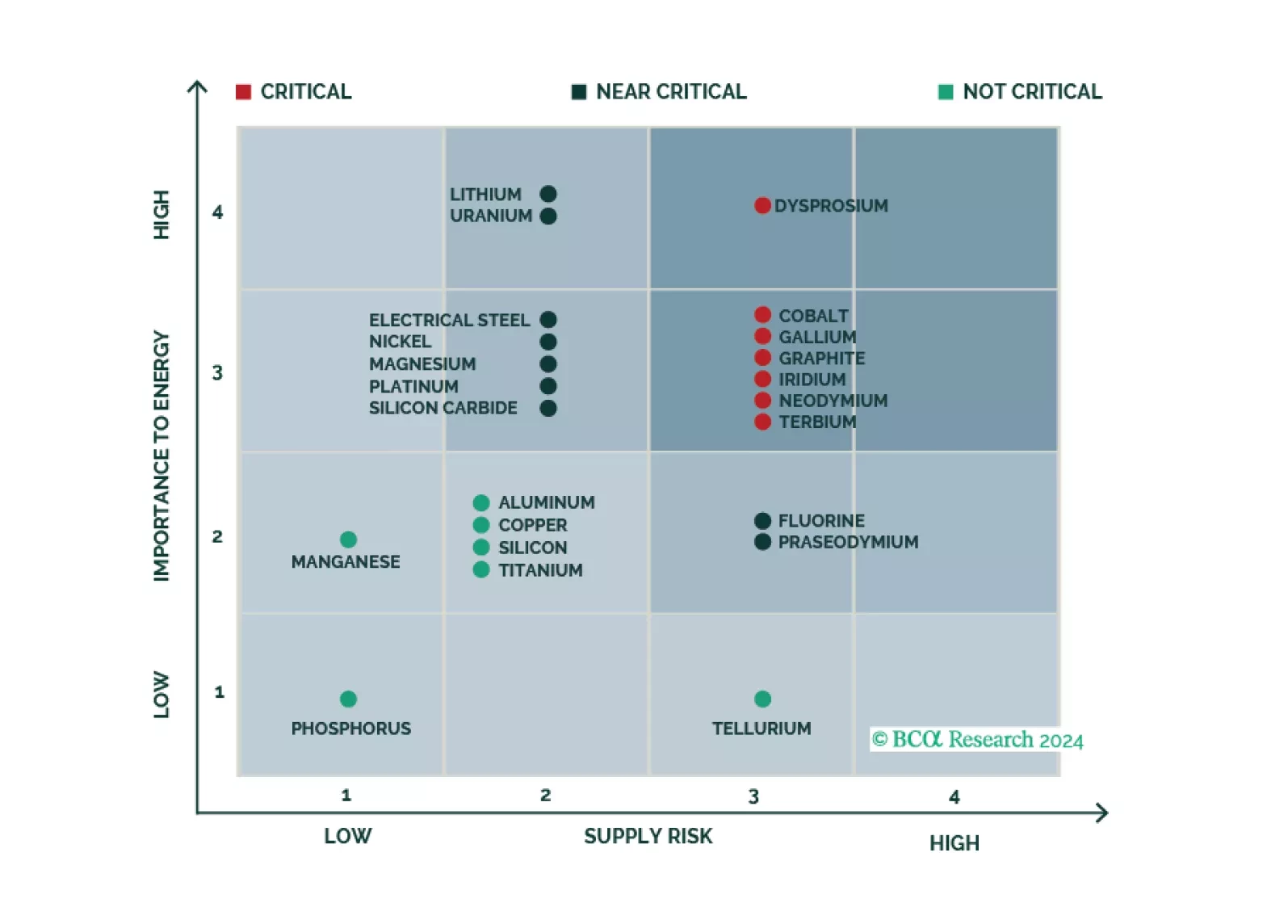

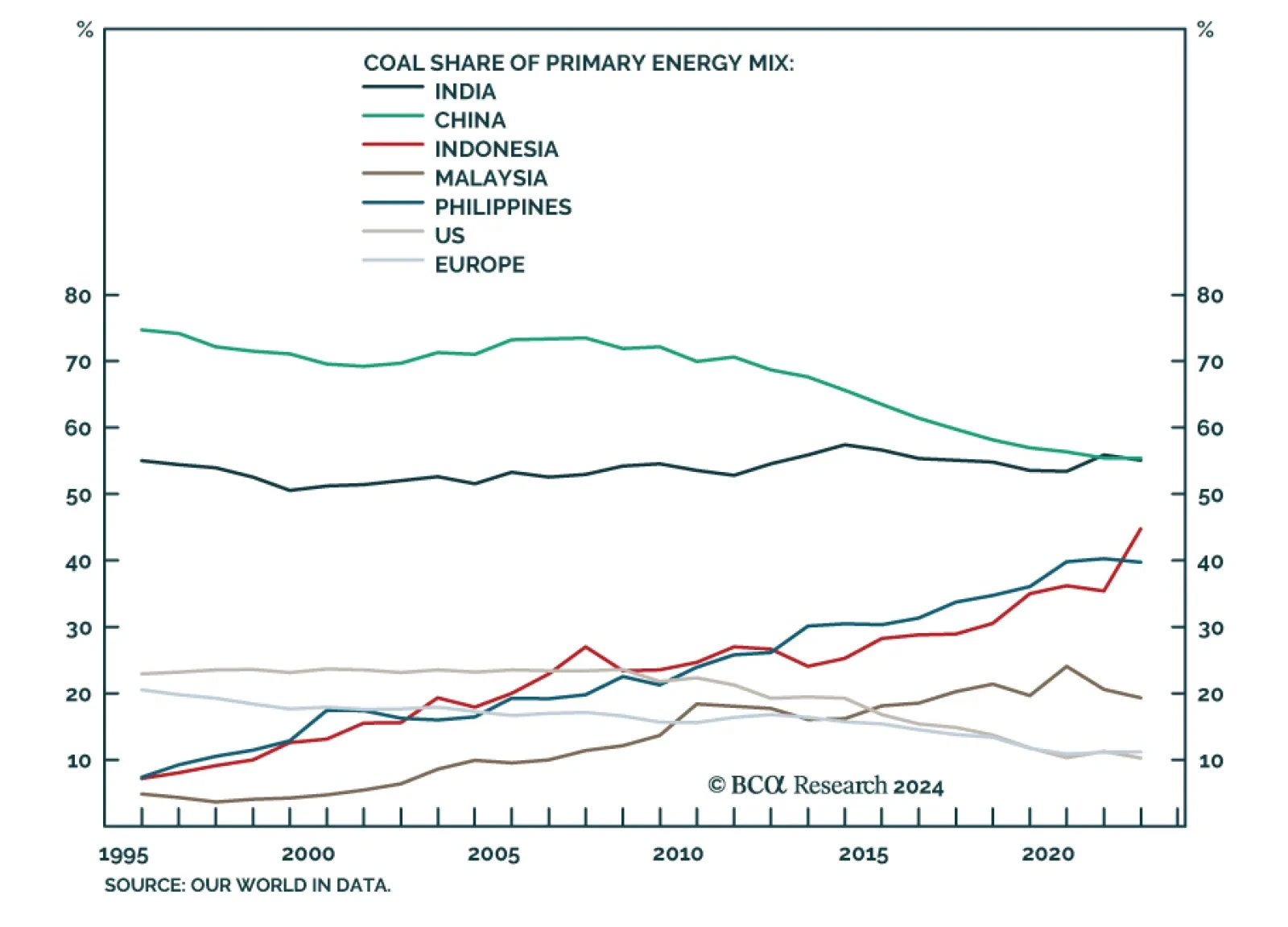

According to BCA Research's Commodity & Energy Strategy service, Qatar will be the winner as it takes advantage of the global energy transition towards renewables and the world fragments under economic and…

Qatar’s strategy to raise LNG output 84% by 2030 is a bold bet DM demand for energy security – and EM demand for affordable electricity to support economic and population growth – will remain a higher priority than eliminating fossil…

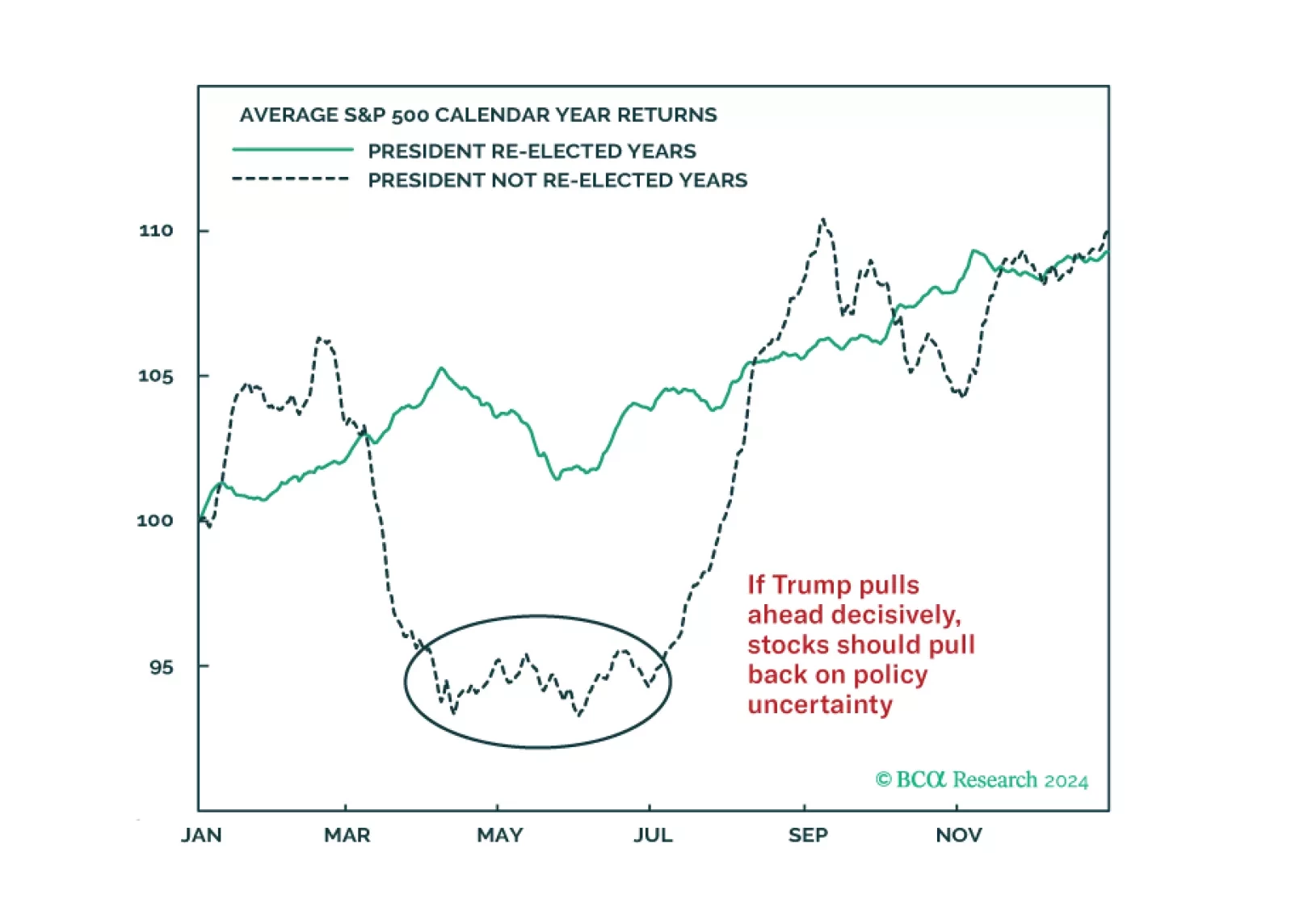

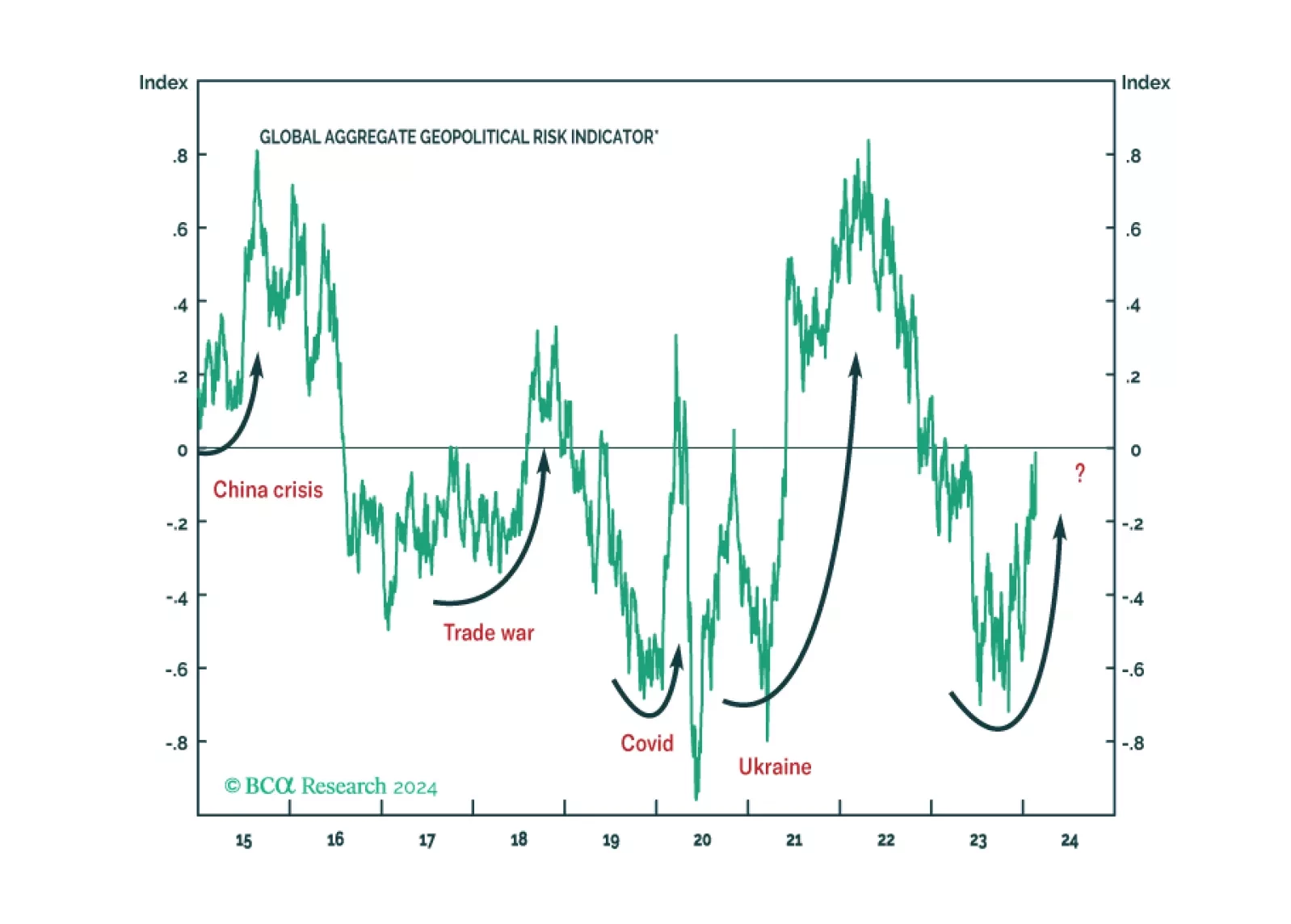

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

Since the pursuit of a nuclear deterrent makes it inevitable that the US and Israel will oppose Iran in the coming years, Iran must seize the initiative today. It cannot afford to assume that the Democratic Party will stay in…

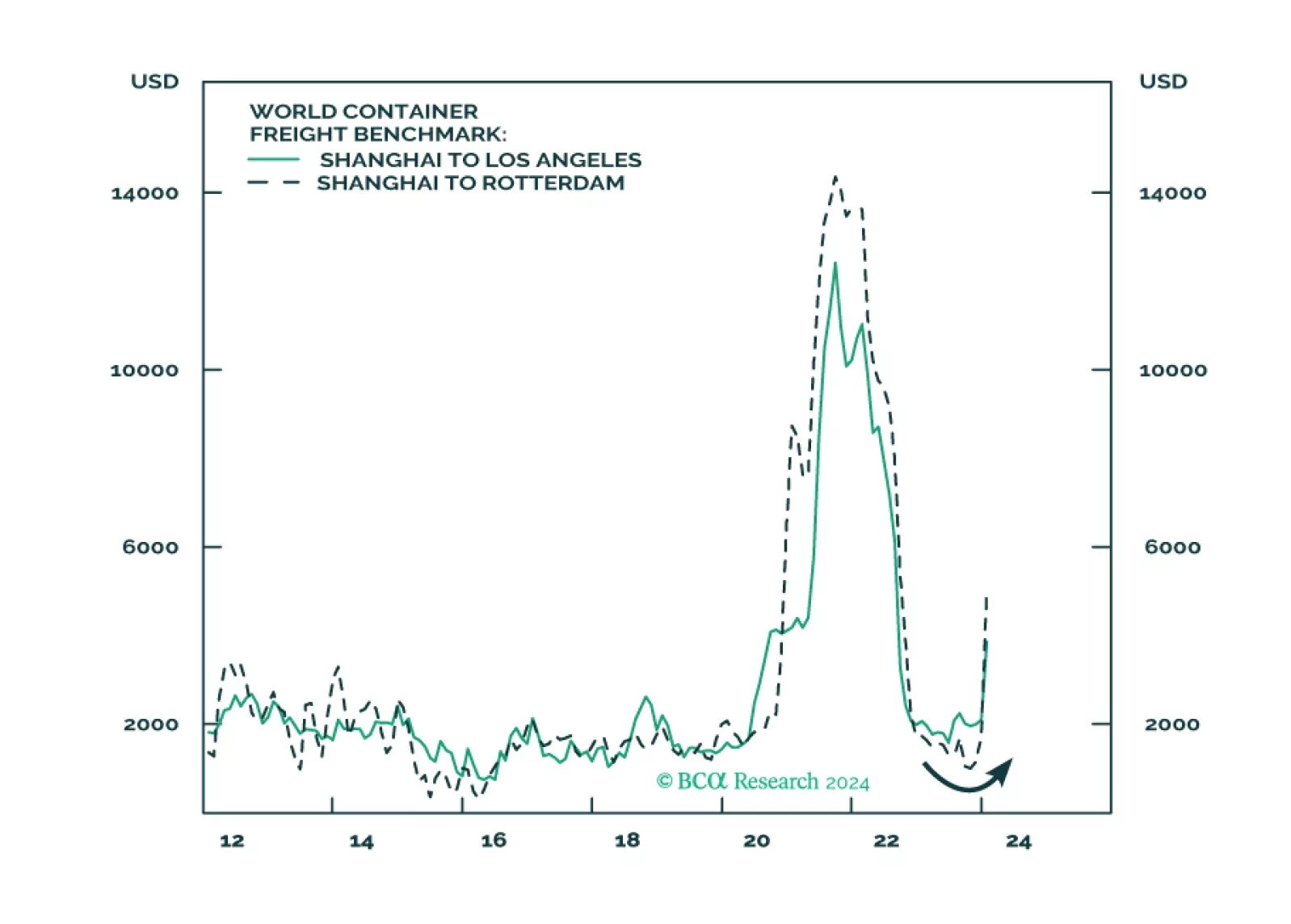

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

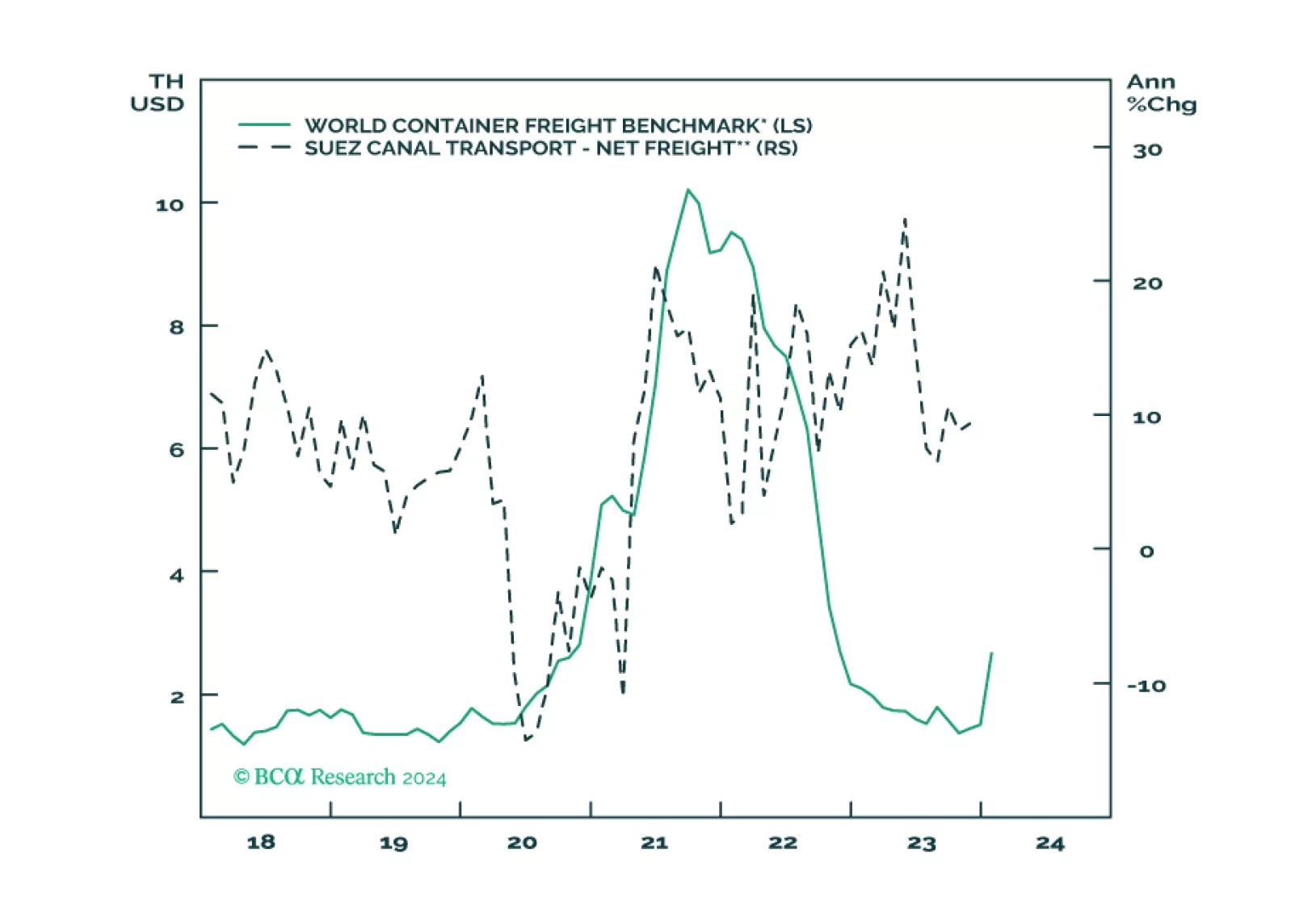

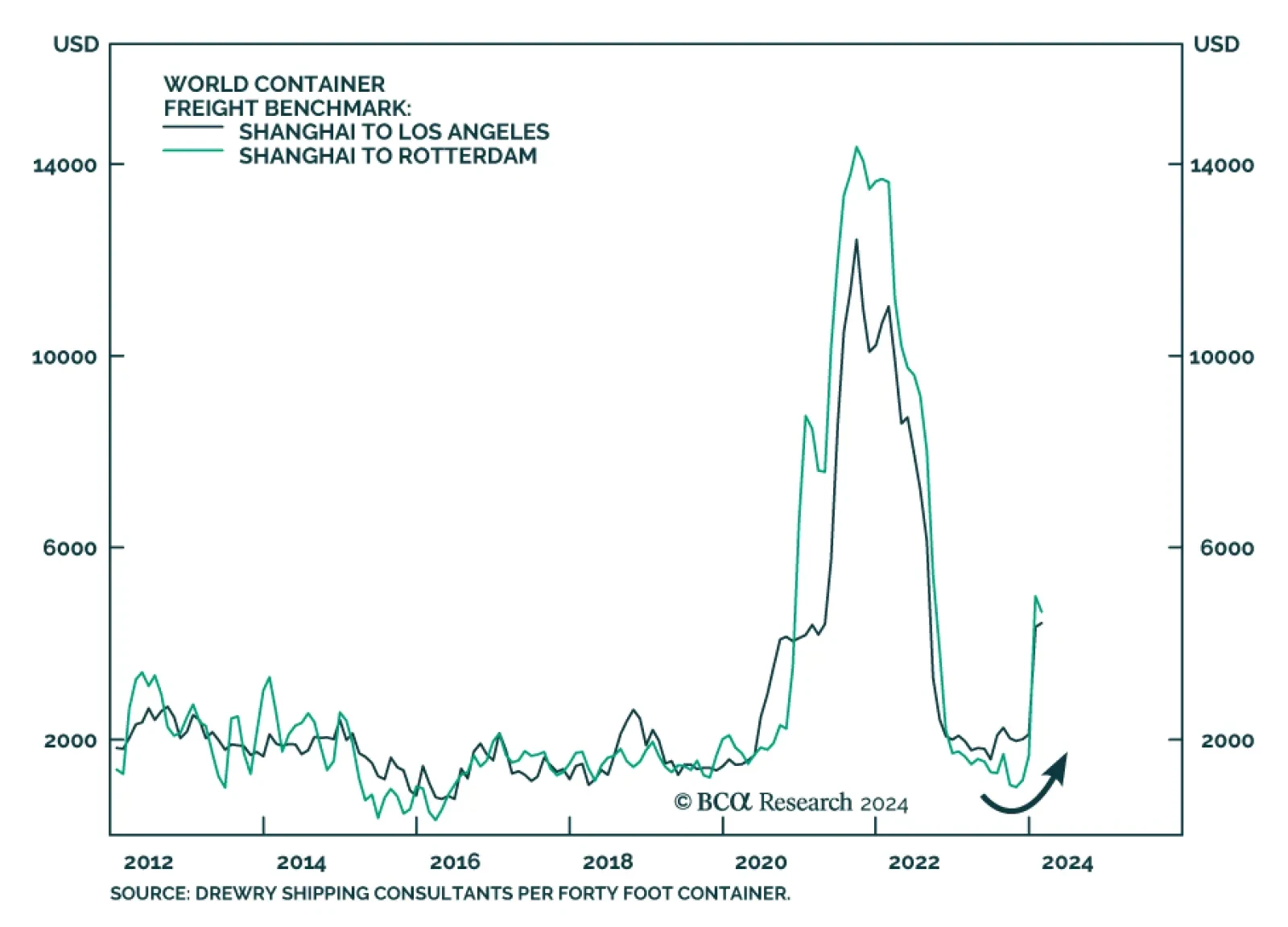

In this brief Insight we examine the expanding Middle East conflict and update the situation in the Taiwan Strait on the eve of elections. The Houthis are a distraction and China is not likely to invade Taiwan in the near term, but…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…