If Turkey is the loser, who is the winner? First, Trump, who benefits from fulfilling a campaign pledge to reduce U.S. involvement in foreign wars – a stance that will ultimately be rewarded (or at least not punished) by a…

Highlights There is a tentative decline in geopolitical risk: An orderly Brexit or no Brexit is the likely final outcome and the U.S.-China talks are coming together. The outstanding geopolitical risks still warrant caution on global…

Highlights Geopolitical risks are starting to abate as a result of material constraints influencing policymakers. China needs to ensure its economy bottoms and a debt-deflationary tendency does not take hold. President Trump needs to…

Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…

Highlights U.S. growth will soon rebound thanks to robust drivers of domestic activity, and strengthening money and credit trends. The U.S. Federal Reserve will maintain an easing bias and will expand its balance sheet again. A…

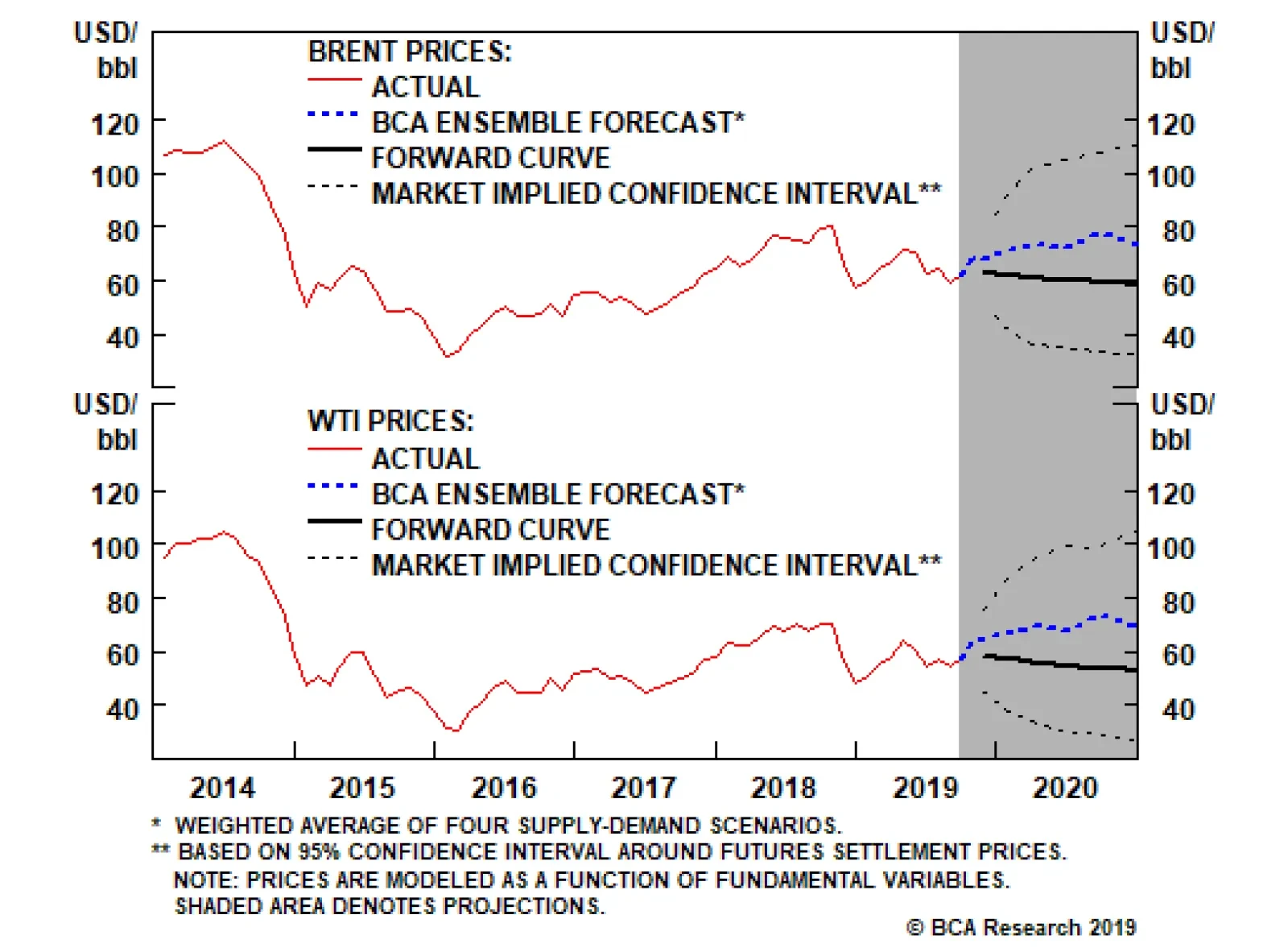

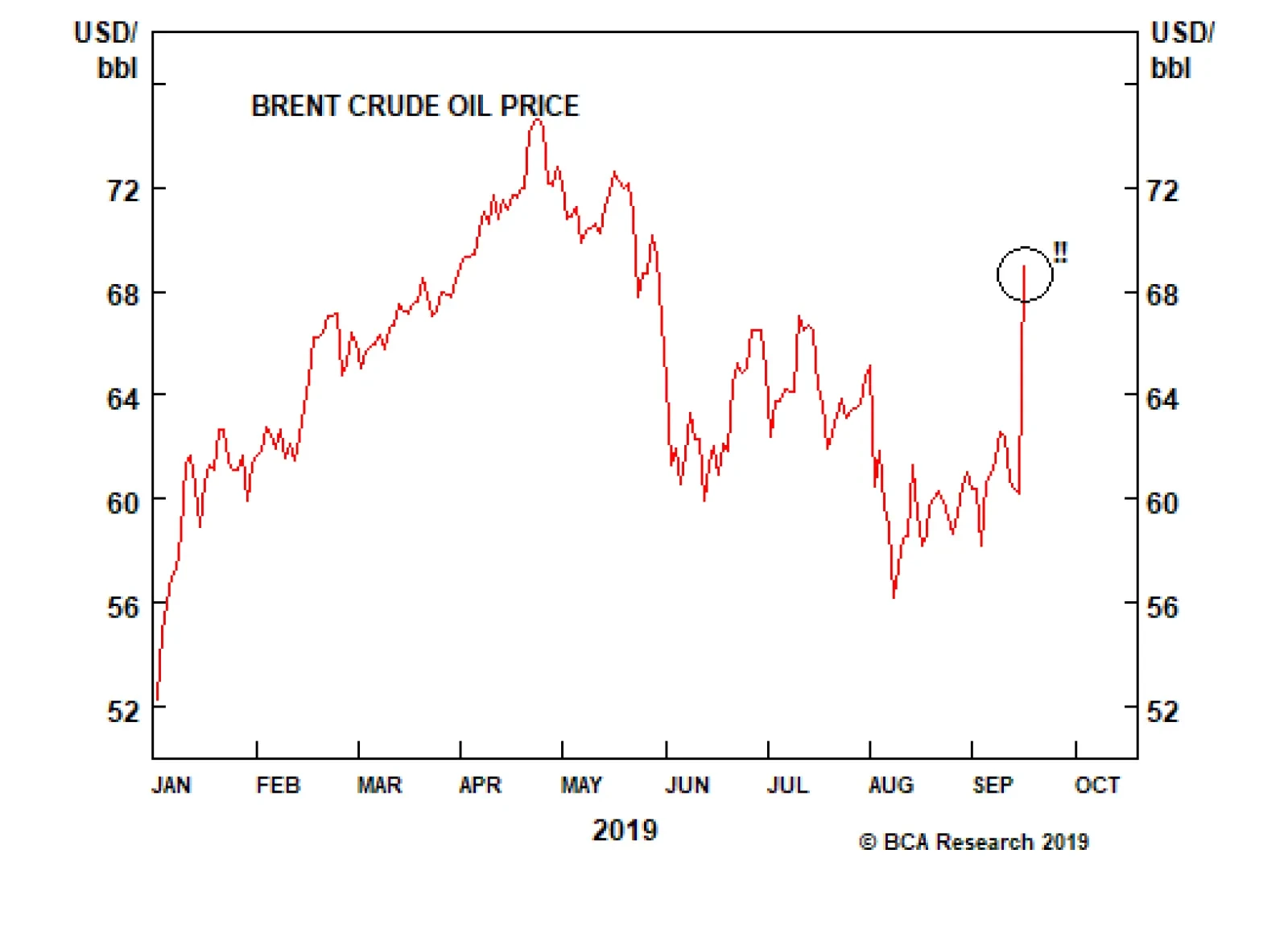

According to KSA officials, repairs to the damaged 7-million-barrel-per-day processing facility at Abqaiq will mostly be completed by month-end. Relative to last month, we are not changing our price forecasts much, with Brent…

The situation in Saudi Arabia is still unfolding following the weekend’s drone strikes that removed ~5.7 mm barrels per day from the global oil market. The price of Brent crude oil spiked yesterday, from $61 to $68, and…

Following drone attacks on critical oil infrastructure in the Kingdom of Saudi Arabia (KSA) over the weekend, which removed ~ 5.7mm b/d of output, the U.S. is likely to conduct a limited retaliatory strike. In addition, the U.S. will…