Highlights Remain short the DXY index. The key risk to this view is a US-led rebound in global growth, or a pickup in US inflation that tilts the Federal Reserve to a relatively more hawkish bias. Stay long a petrocurrency basket. The…

Highlights Global Investment Strategy View Matrix Receding trade tensions; diminished risks of a hard Brexit; reduced odds of a victory for Elizabeth Warren in the US presidential elections; liquidity injections by most…

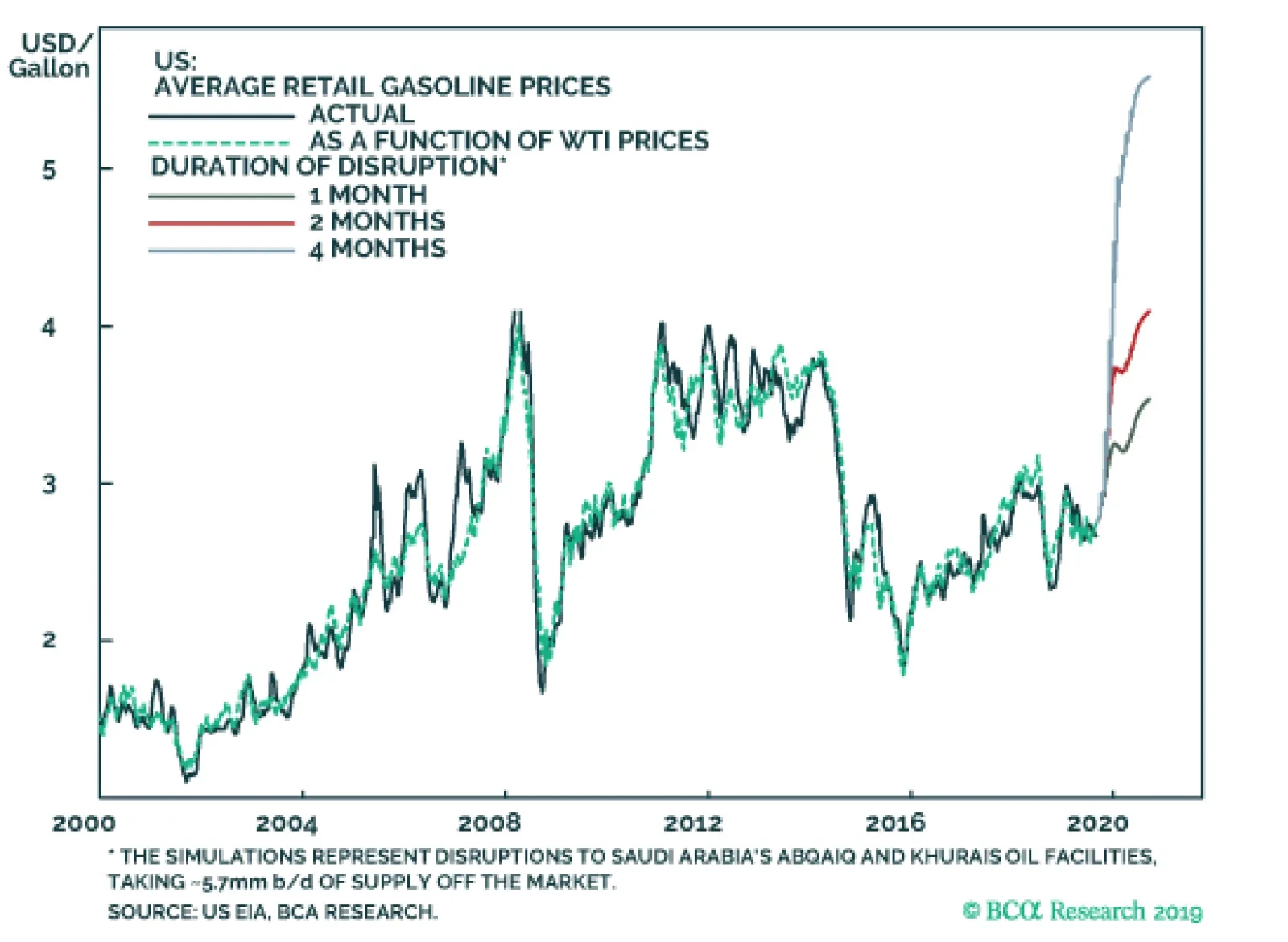

We doubt any serious US-Iran negotiations will take shape until 2021 at the earliest – and any negotiations could fail and lead to another, more serious round of military exchanges. This means that today’s reprieve…

Highlights Iran responded with missile attacks on Iraqi military bases hosting US troops in retaliation for the assassination of Gen. Qassem Soleimani, the commander of the Quds Force. The post-attack messaging from Iran and the US…

Highlights The US and Iran are not rushing into a full-scale war for the moment – and yet the bull market in US-Iran tensions will continue for at least the next 2-3 years (Chart 1). This means that while global risk assets can…

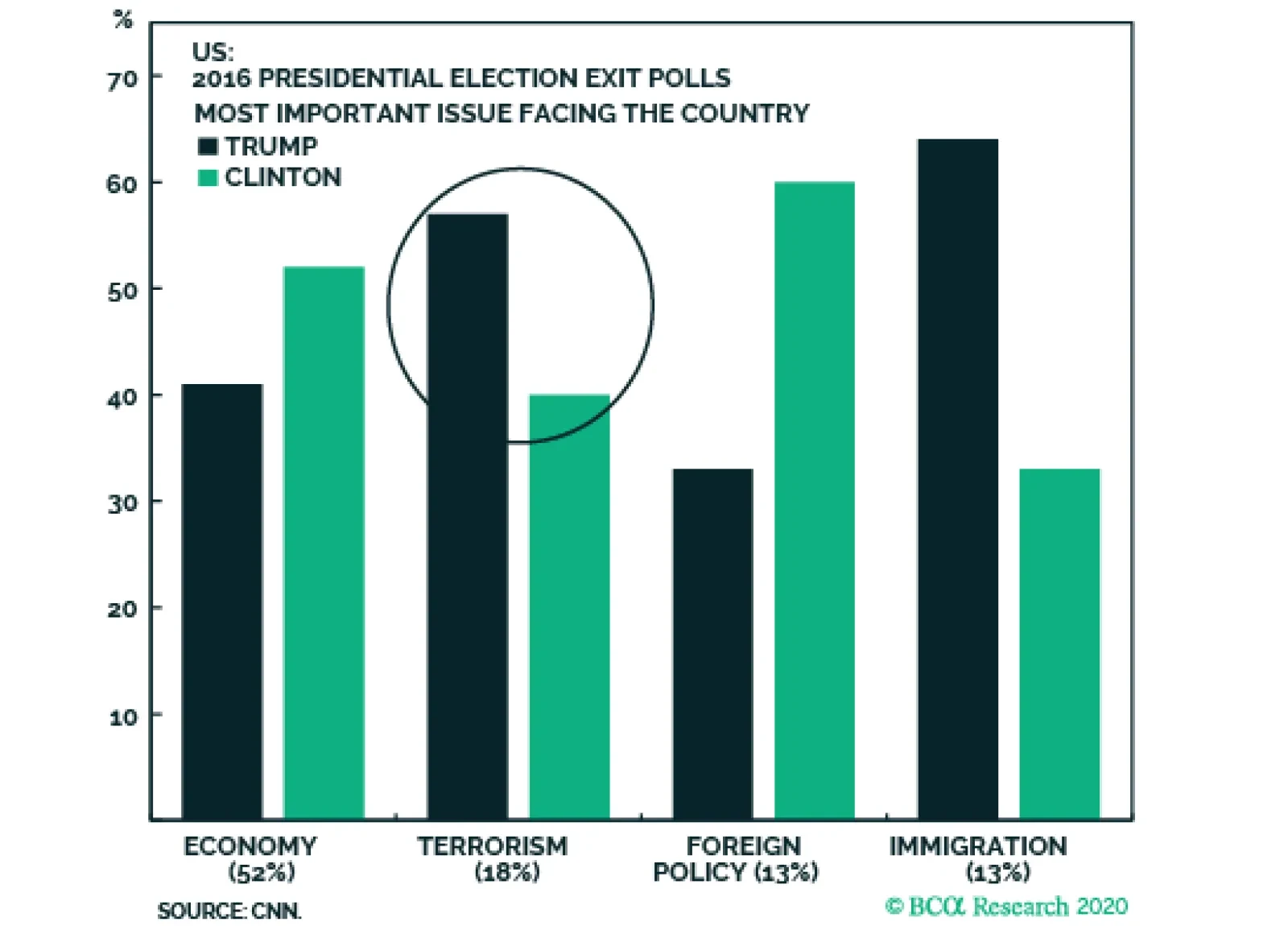

With the killing of General Soleimani, Middle Eastern tensions are once again surging. In the US, the House of Representatives may try to wrestle the power to wage war away from President Trump, but the Senate will not…

Feature One of BCA Research’s key geopolitical views since May 2019, outlined recently in our 2020 Outlook, is rapidly materializing: a dramatic escalation in the US-Iran conflict. On January 3 the United States successfully…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

Opinion polls show that the Iranian public primarily blames the government for the collapsing economy, and yet that American sanctions are siphoning off some of this anger. This could tempt Iran’s leaders to stage…