Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

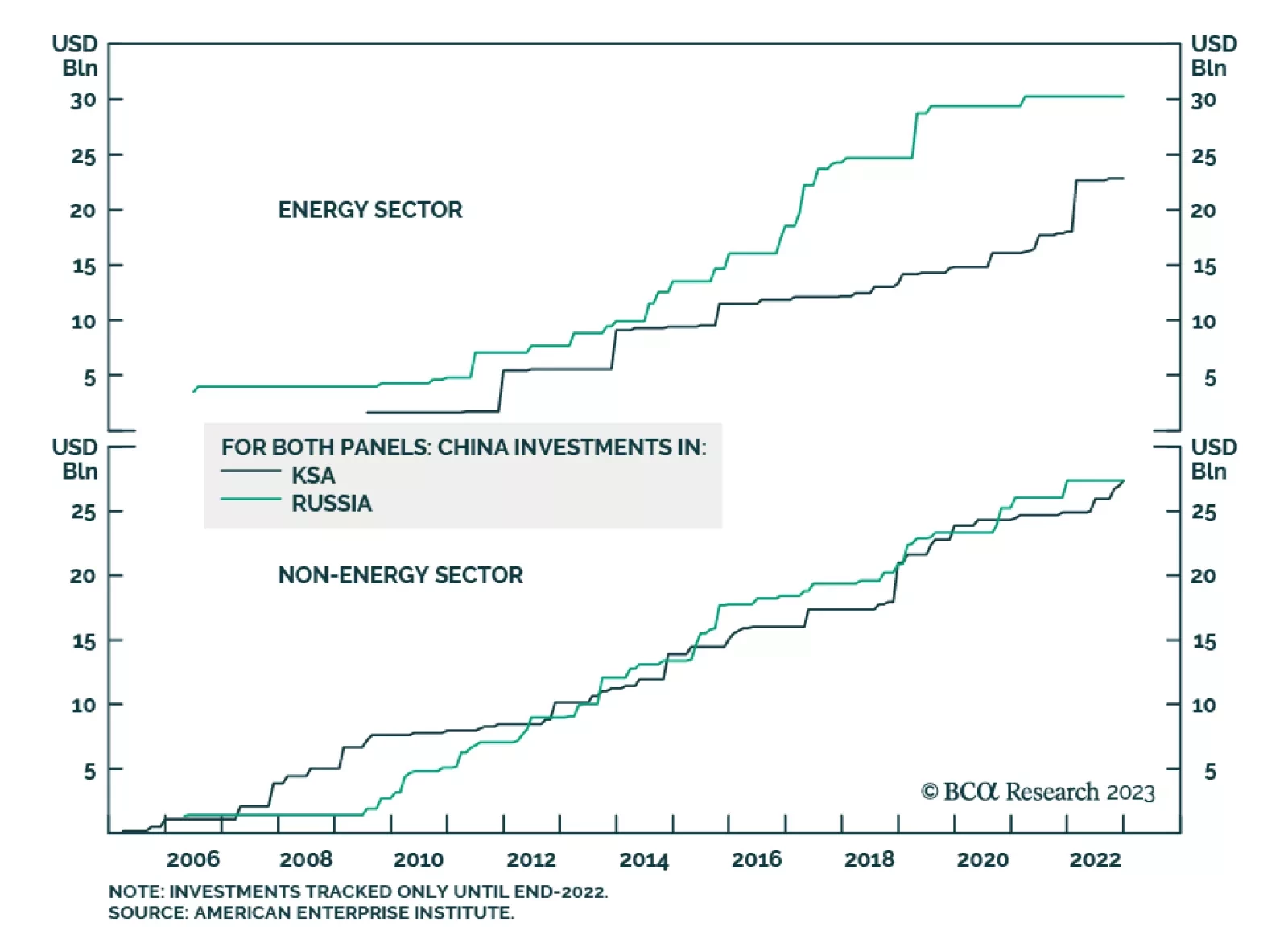

Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

The Turkish presidential election will go to a runoff in two weeks, but President Erdogan outperformed his opinion polls. His party, the incumbent AKP, won a majority in parliament. This outcome rewards Turkey’s inflationary policies…

Erdogan will most likely lose the Turkish election but it could go onto a second round. A strong opposition majority in the assembly would justify a tactical overweight in Turkish equities on a relative basis. For now, go long…

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…