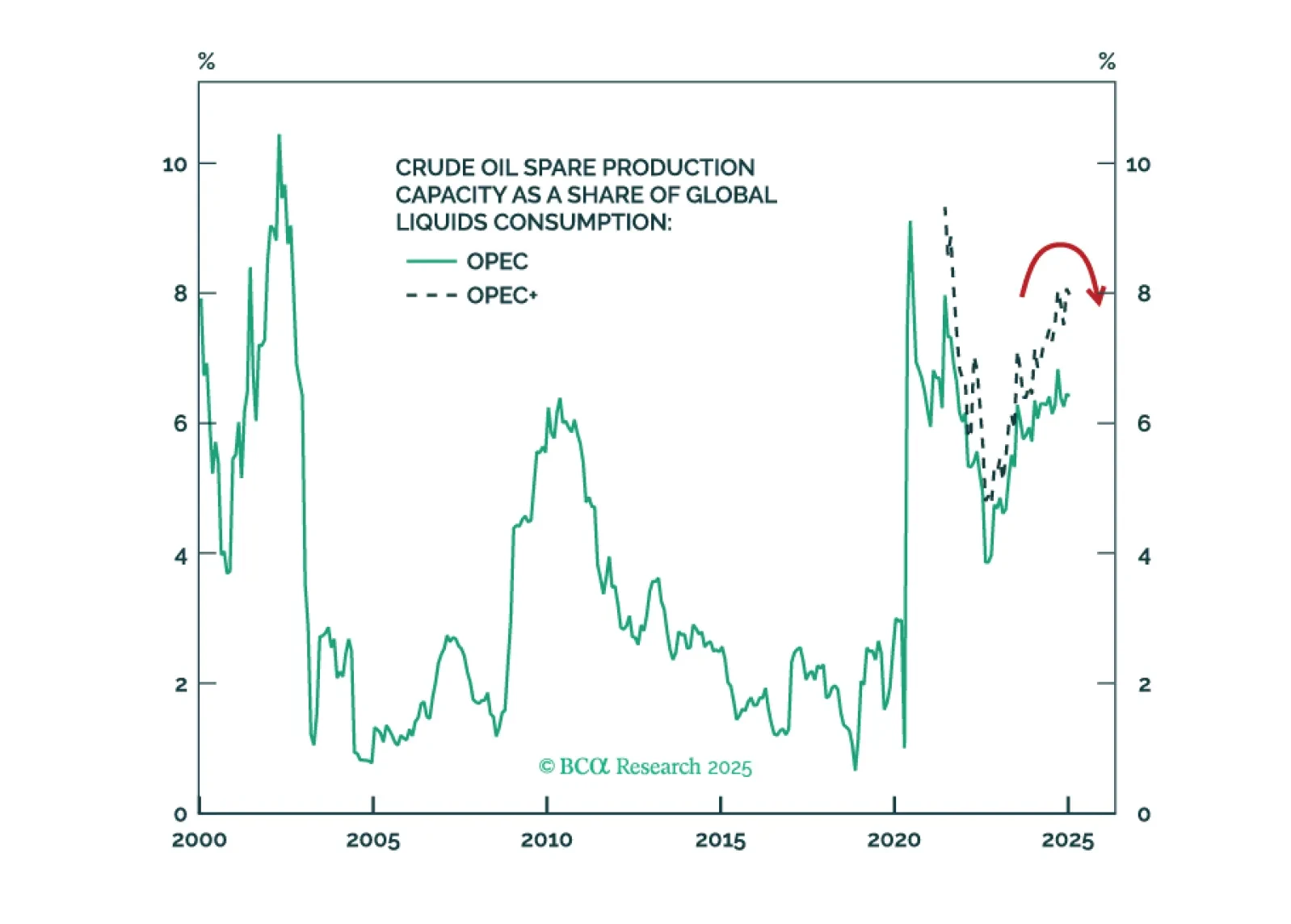

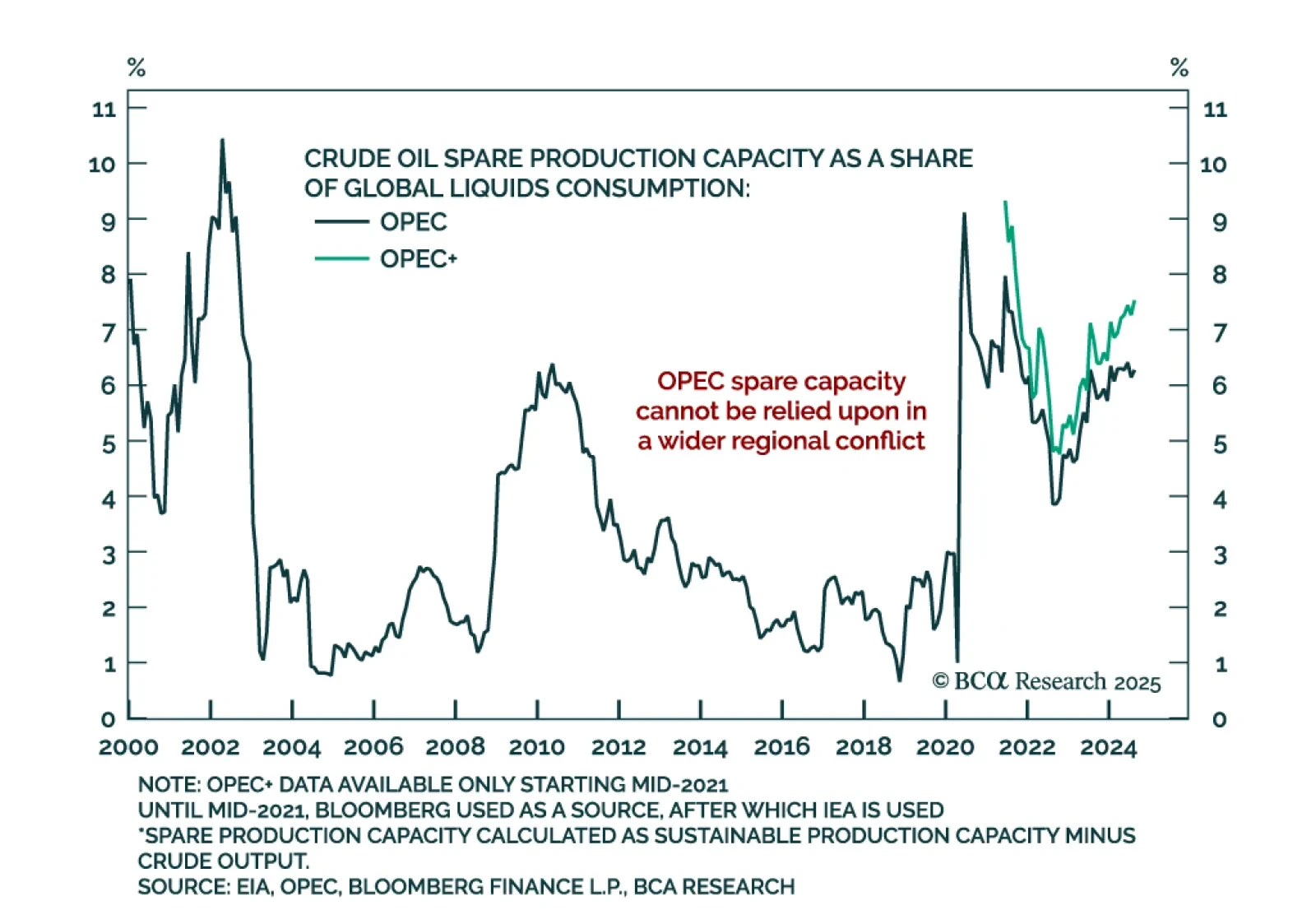

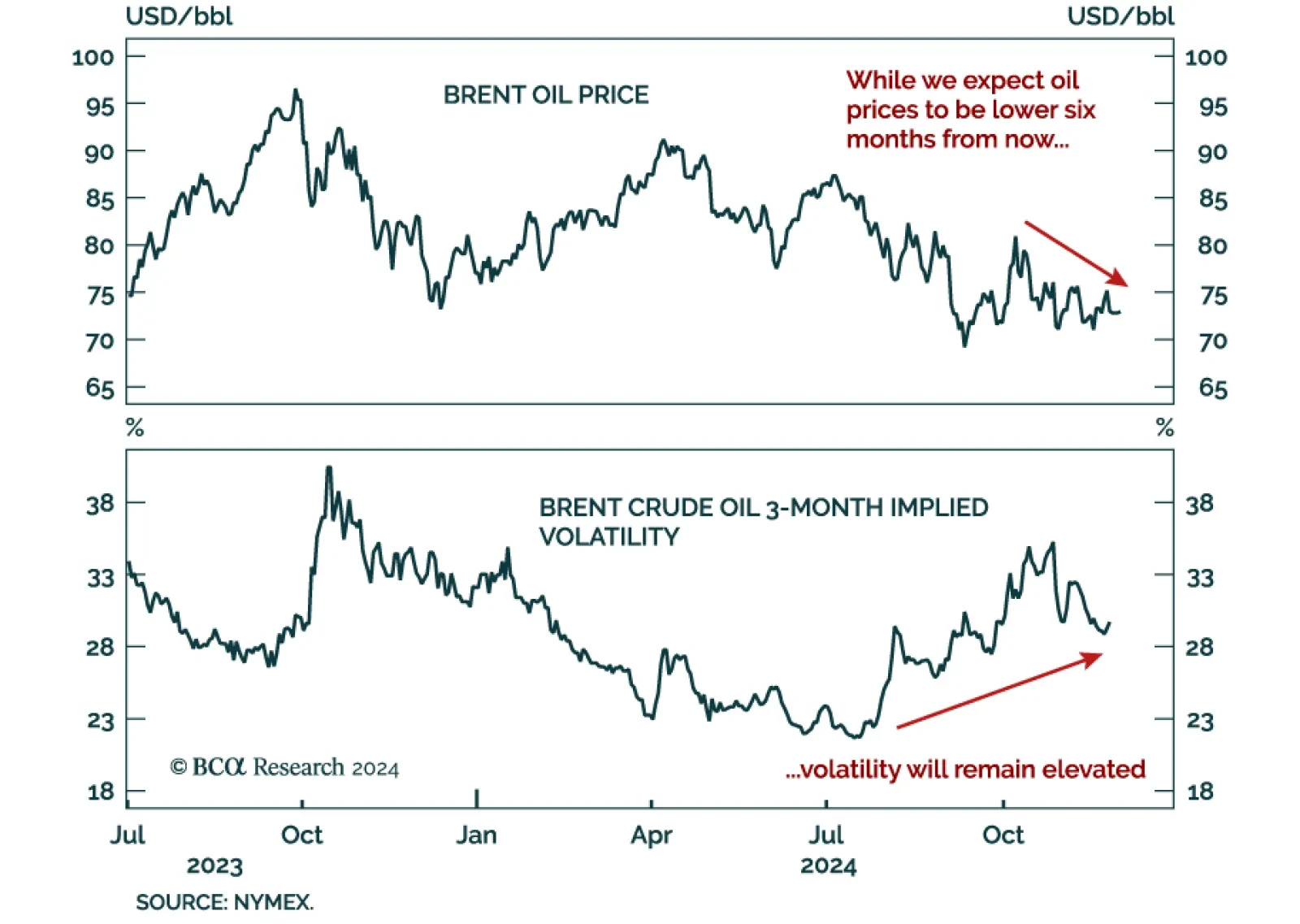

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

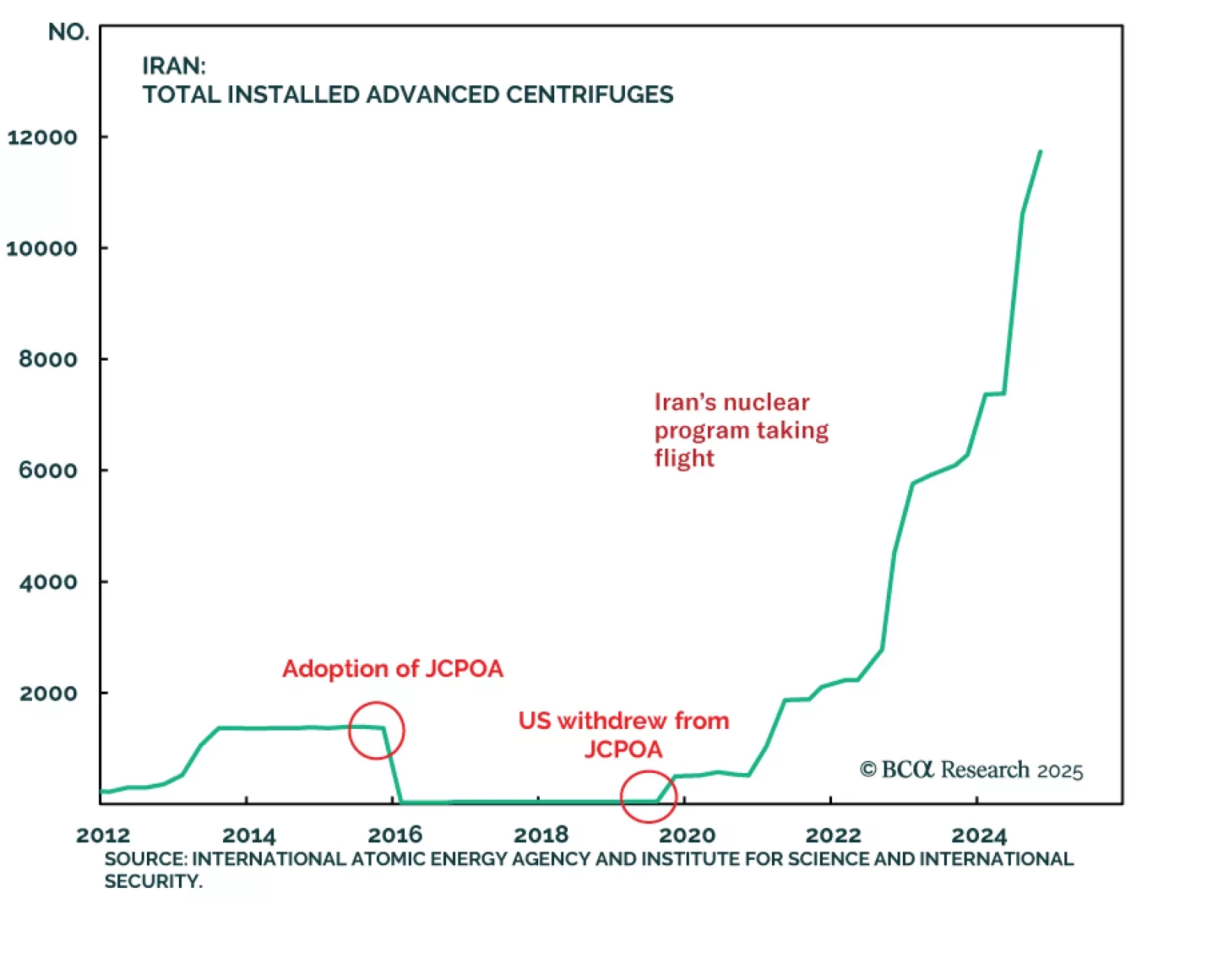

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

Our Geopolitical Strategy colleagues published their annual “Black Swan” report, where they outline low-odds scenarios that could have a major impact on financial markets. Here is the 2025 edition: China’s Policy Reversal: A…

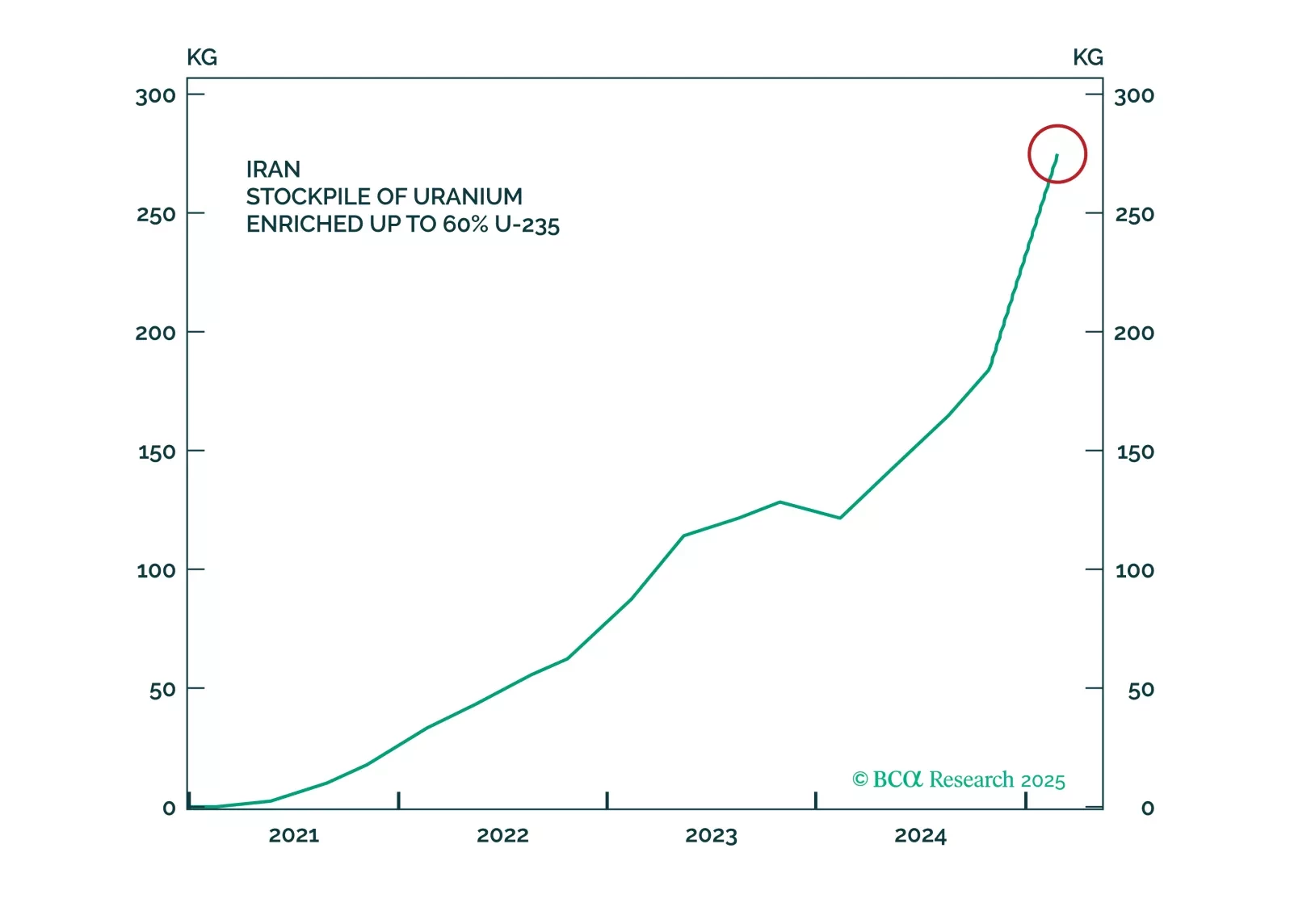

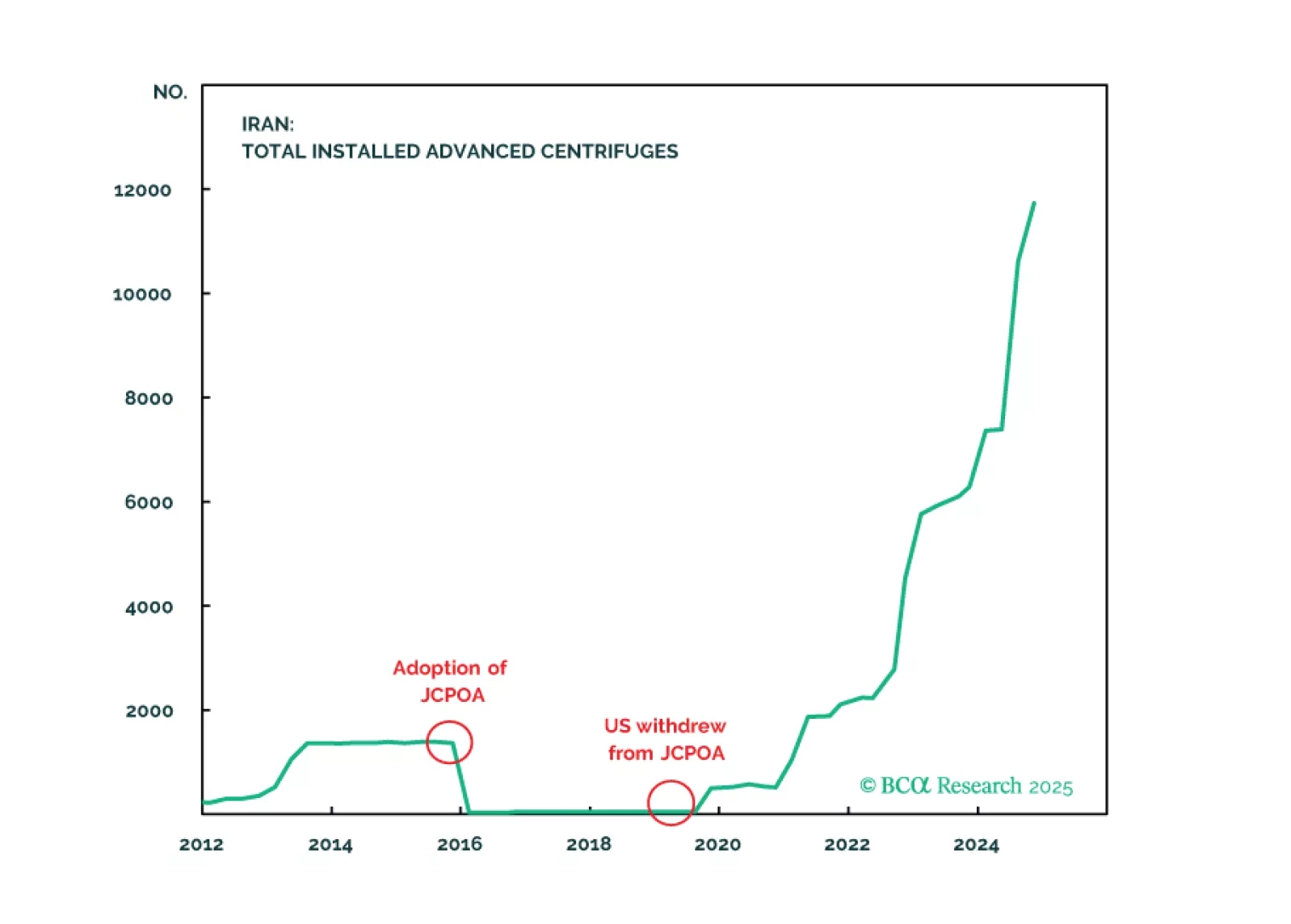

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

After more than 10 years of civil war, Bashar Al-Assad’s rule came to an abrupt end when rebels captured Damascus. Syria might not be a significant country in economic or financial terms, but it is part of the Middle…