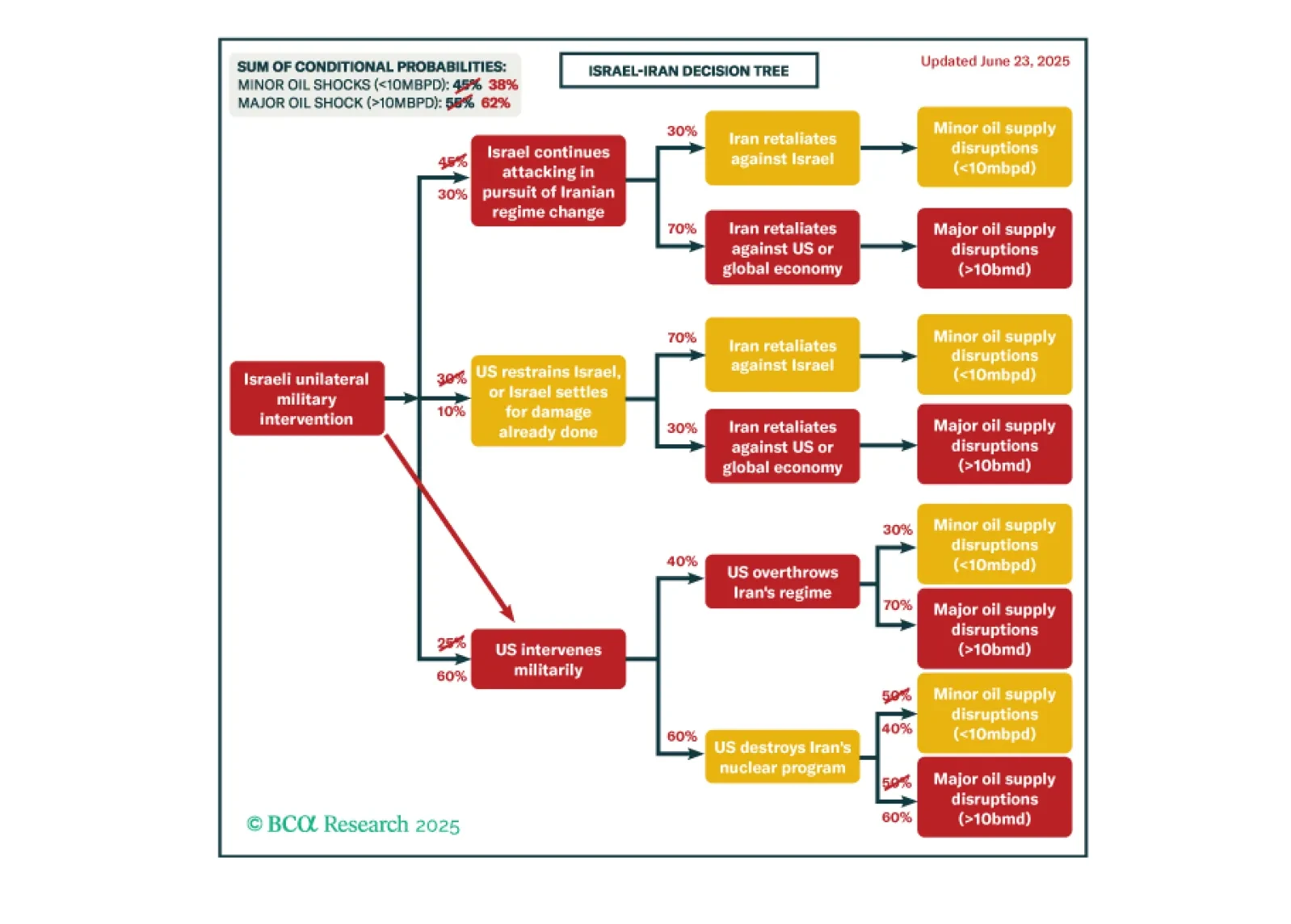

Russia’s recalcitrance will probably trigger a near-term global stock market correction by prompting larger sanctions and derailing US-China talks. But Israel’s actions do not raise our odds of a major oil shock.

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

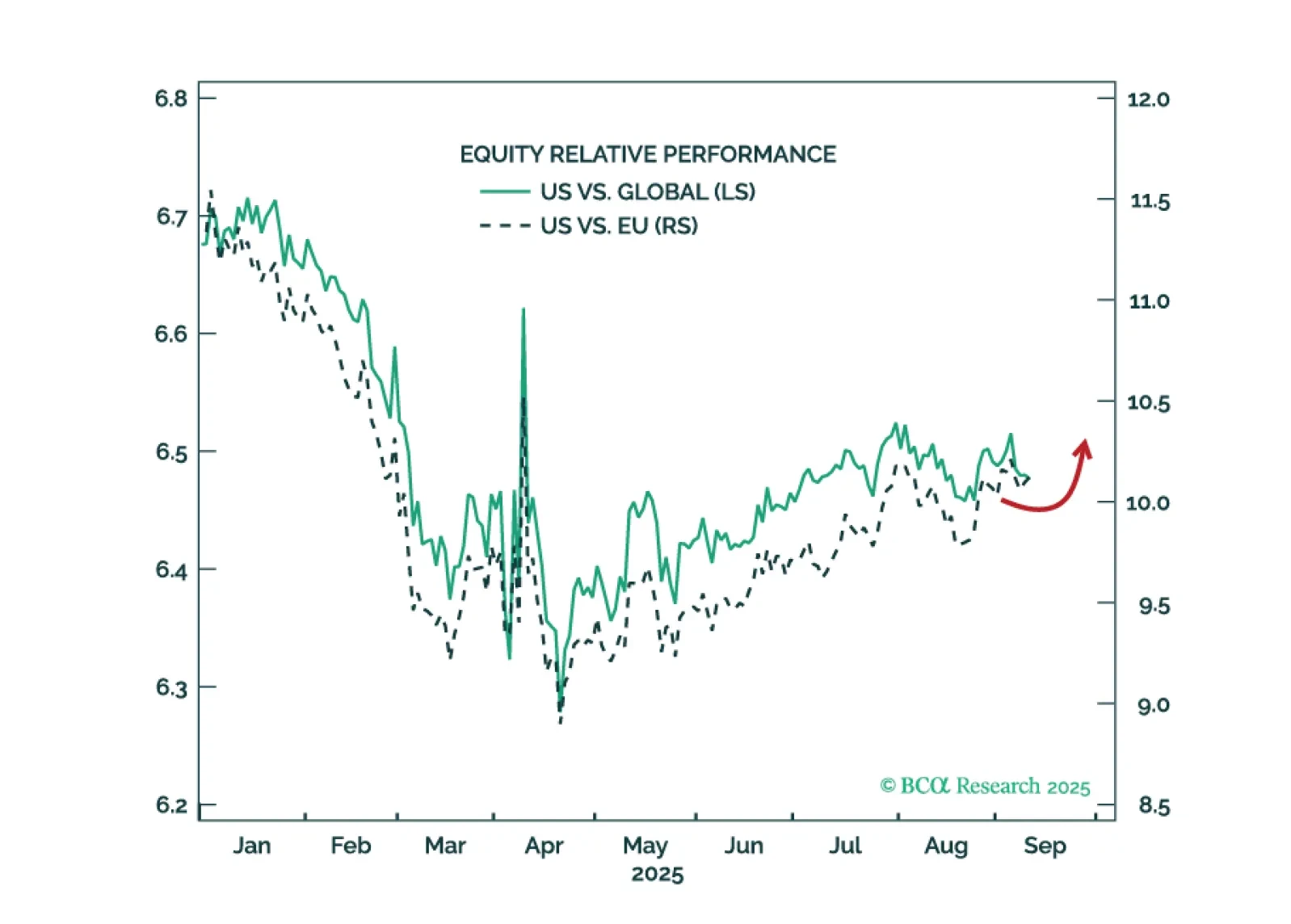

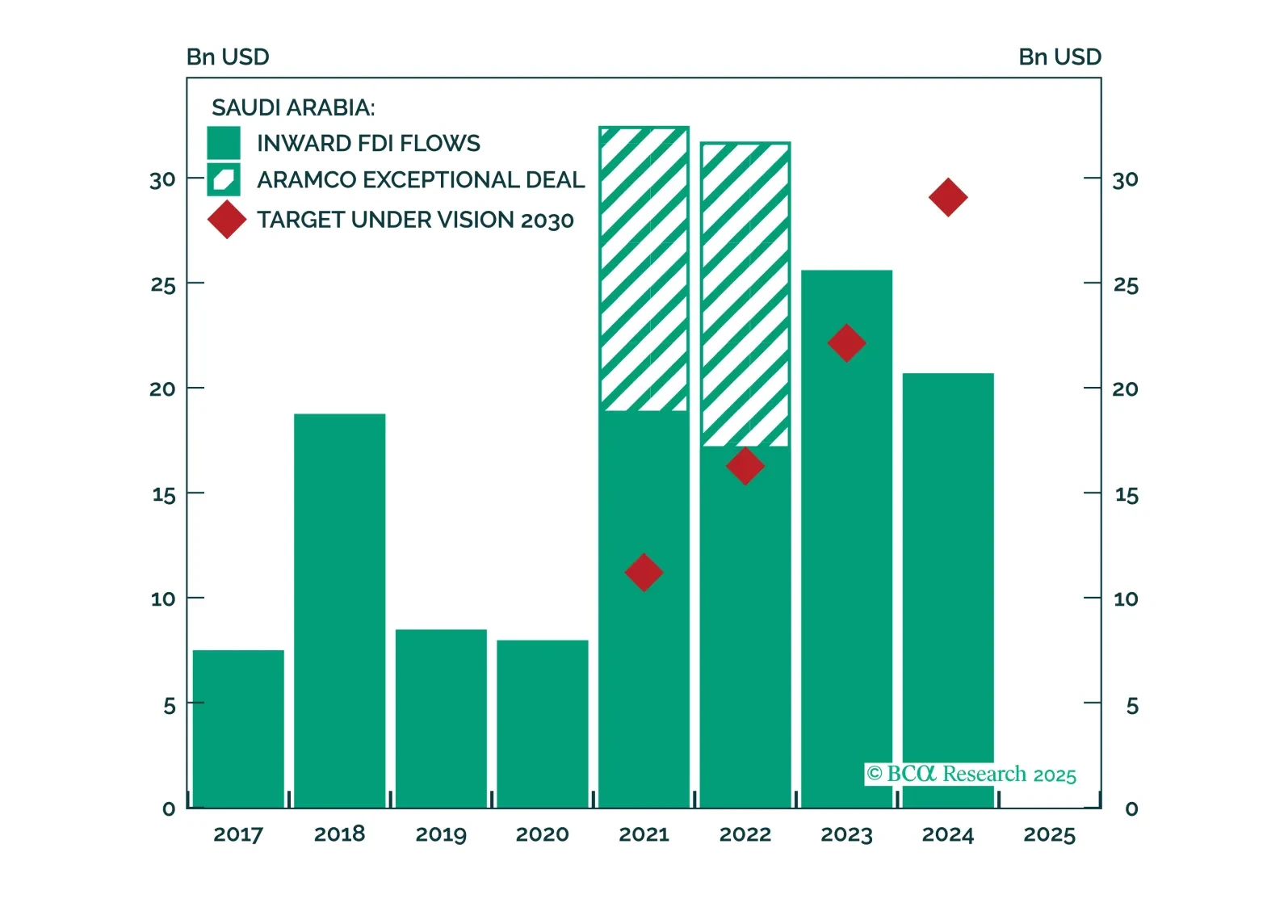

There is a thin line between geopolitical risk and Enlightenment, just ask Europe in the seventeenth century. The Middle East is exhibiting both. Investors are over-indexing on the negative – which has not impacted the investible…

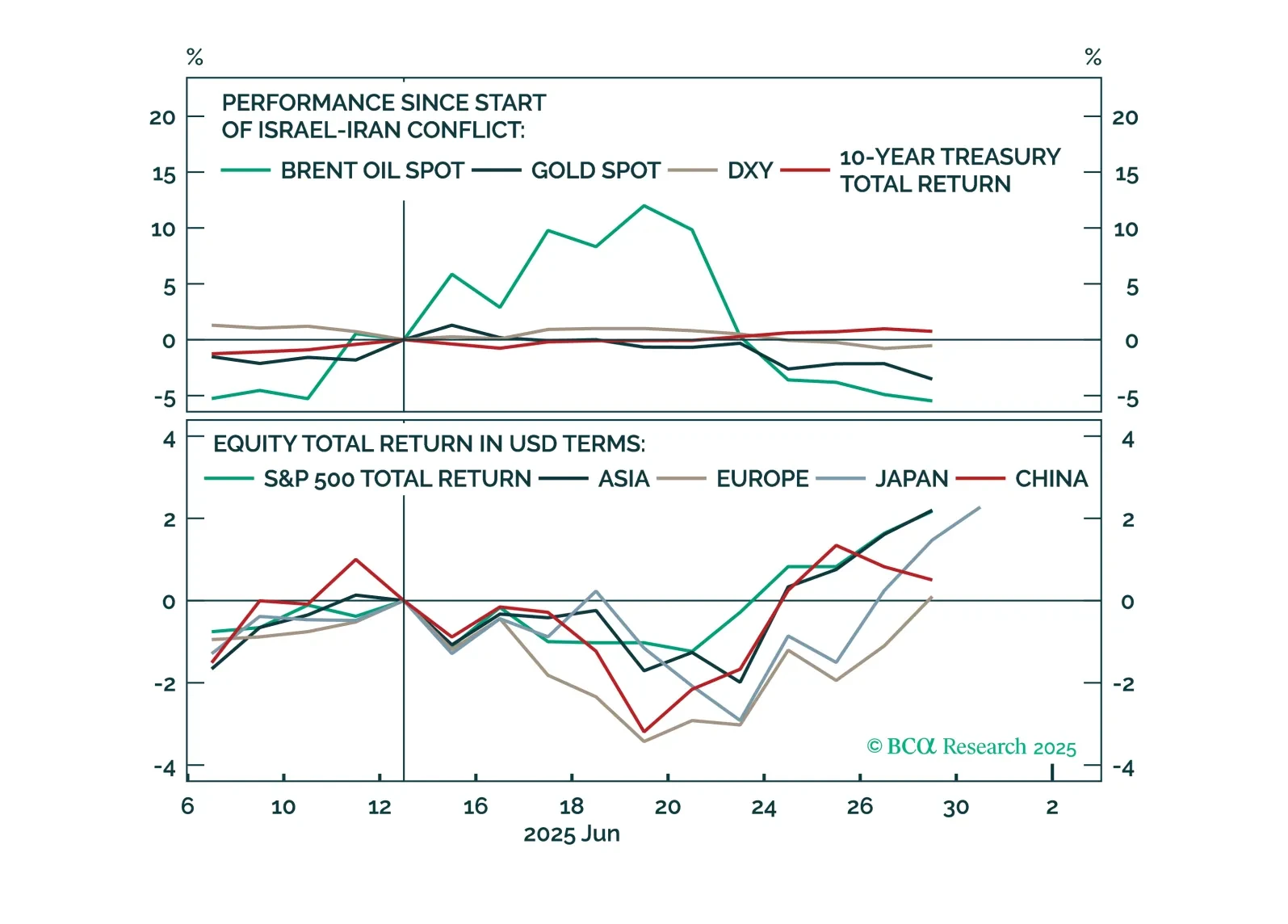

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

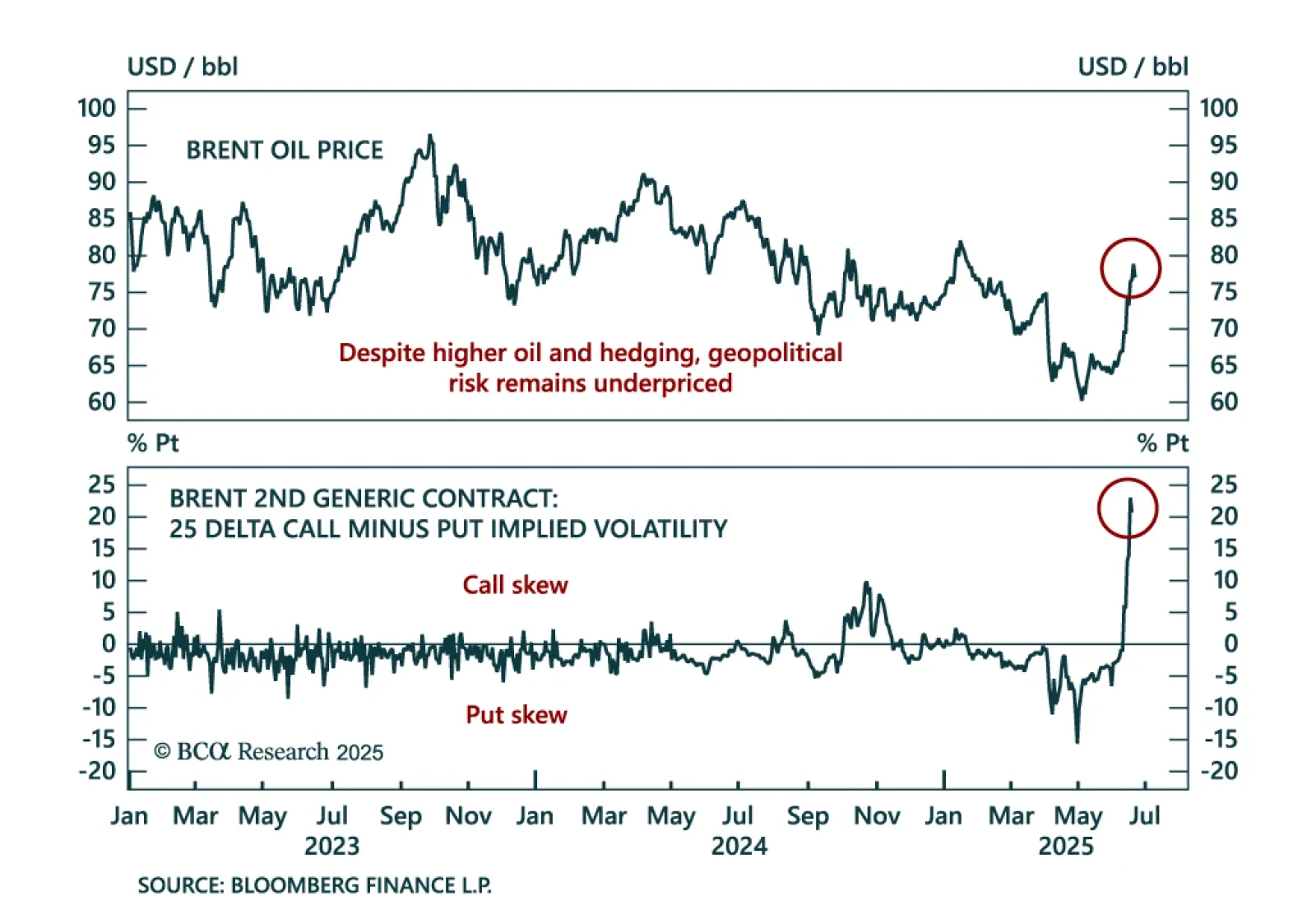

Elevated market complacency contrasts with high geopolitical risk as oil disruption remains a key threat. Middle East tensions escalated over the weekend after the US struck Iran’s nuclear capabilities, yet markets have reacted…

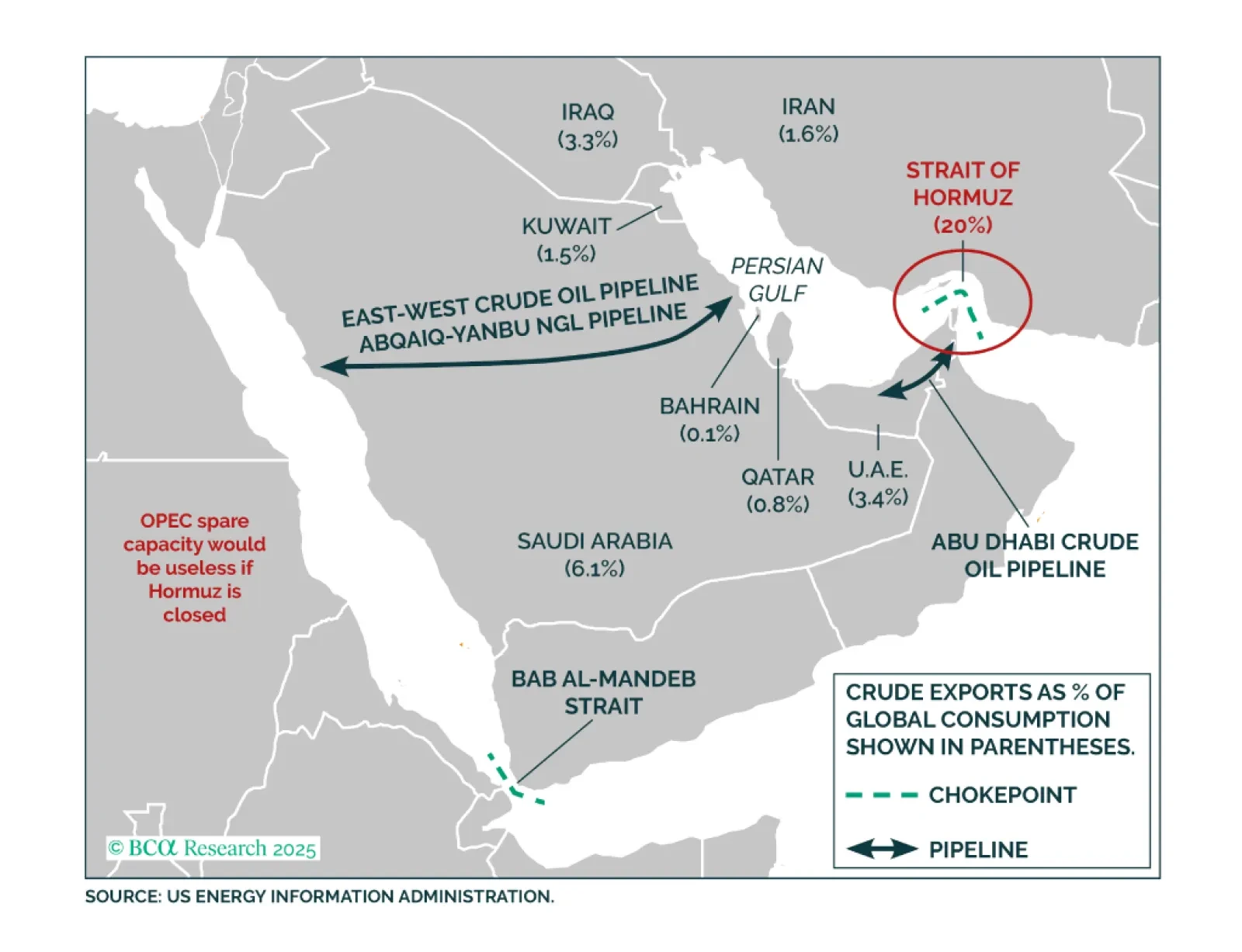

Our Commodity strategists see rising geopolitical risks as a catalyst for gold outperformance and caution that oil markets are underpricing the threat of a supply shock. The intensifying conflict between Israel and Iran has raised…

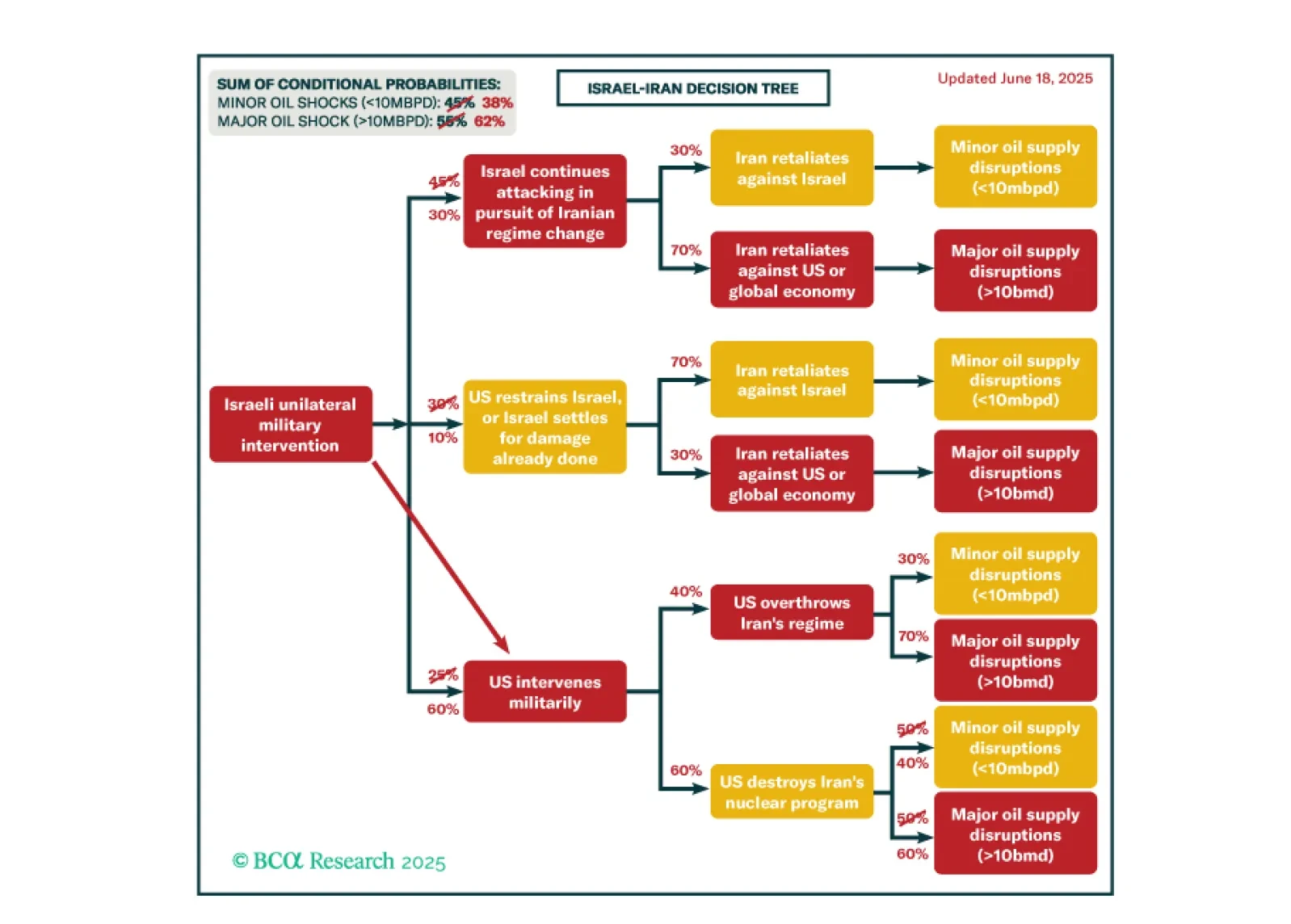

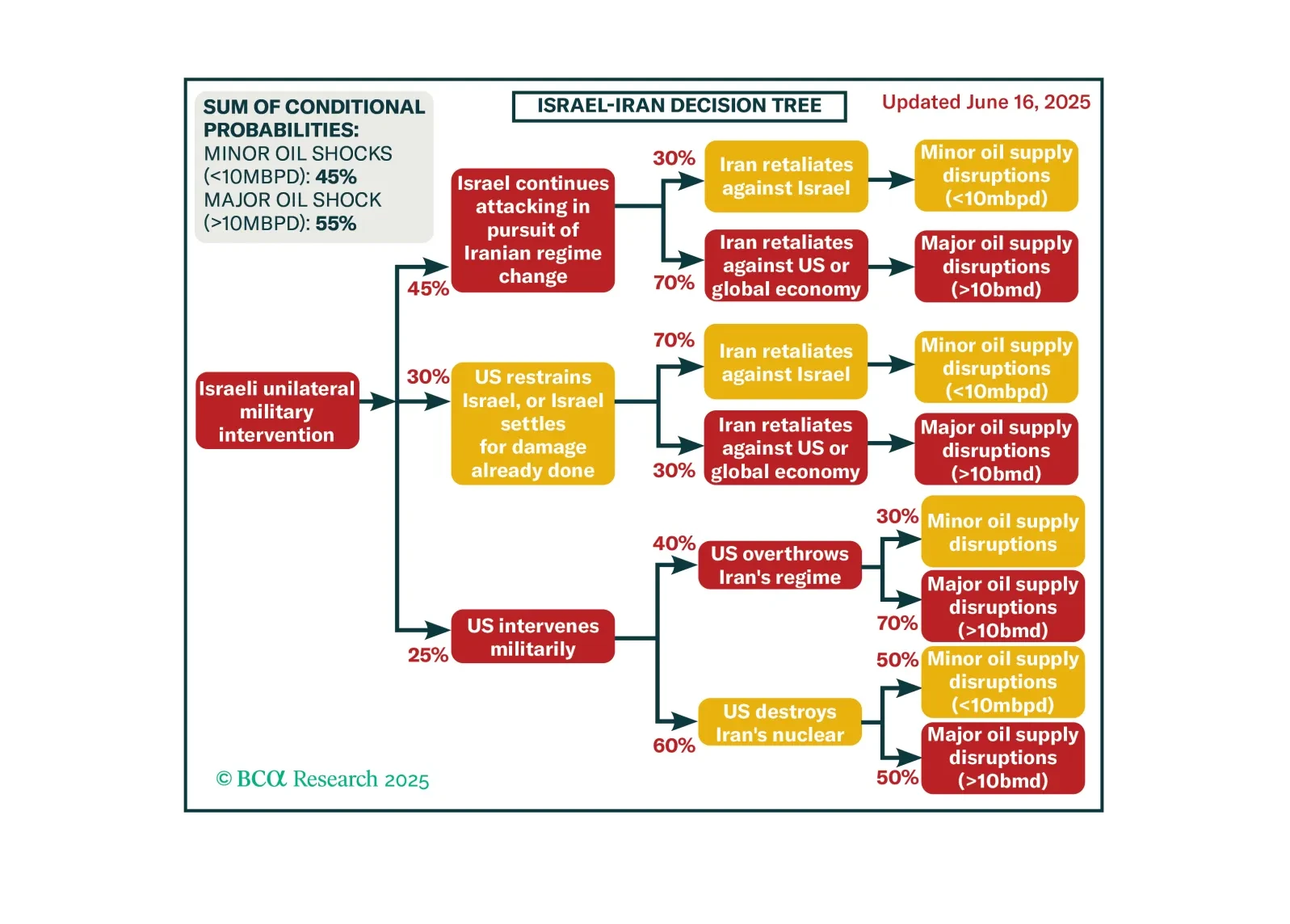

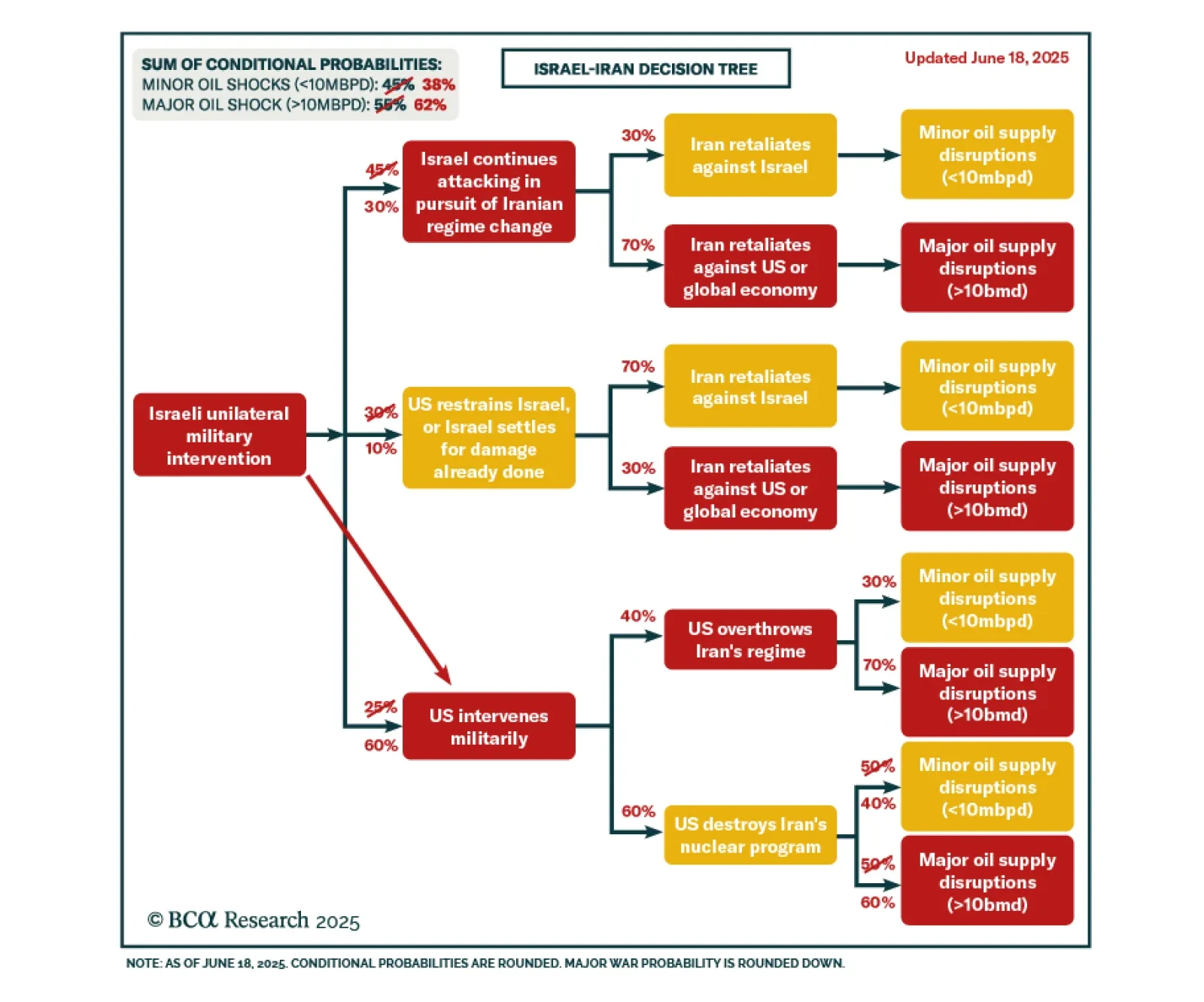

Our Geopolitical strategists expect US involvement in Israel’s military campaign against Iran, raising near-term risks to oil supply and market stability. Iran is likely to retaliate by targeting regional oil production and transport…

Even if Iran tries to revive talks, the US has an irresistible opportunity to dismantle its nuclear program. Tactically, investors should favor Treasuries over the S&P, defensive sectors over cyclicals, energy stocks over…

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.