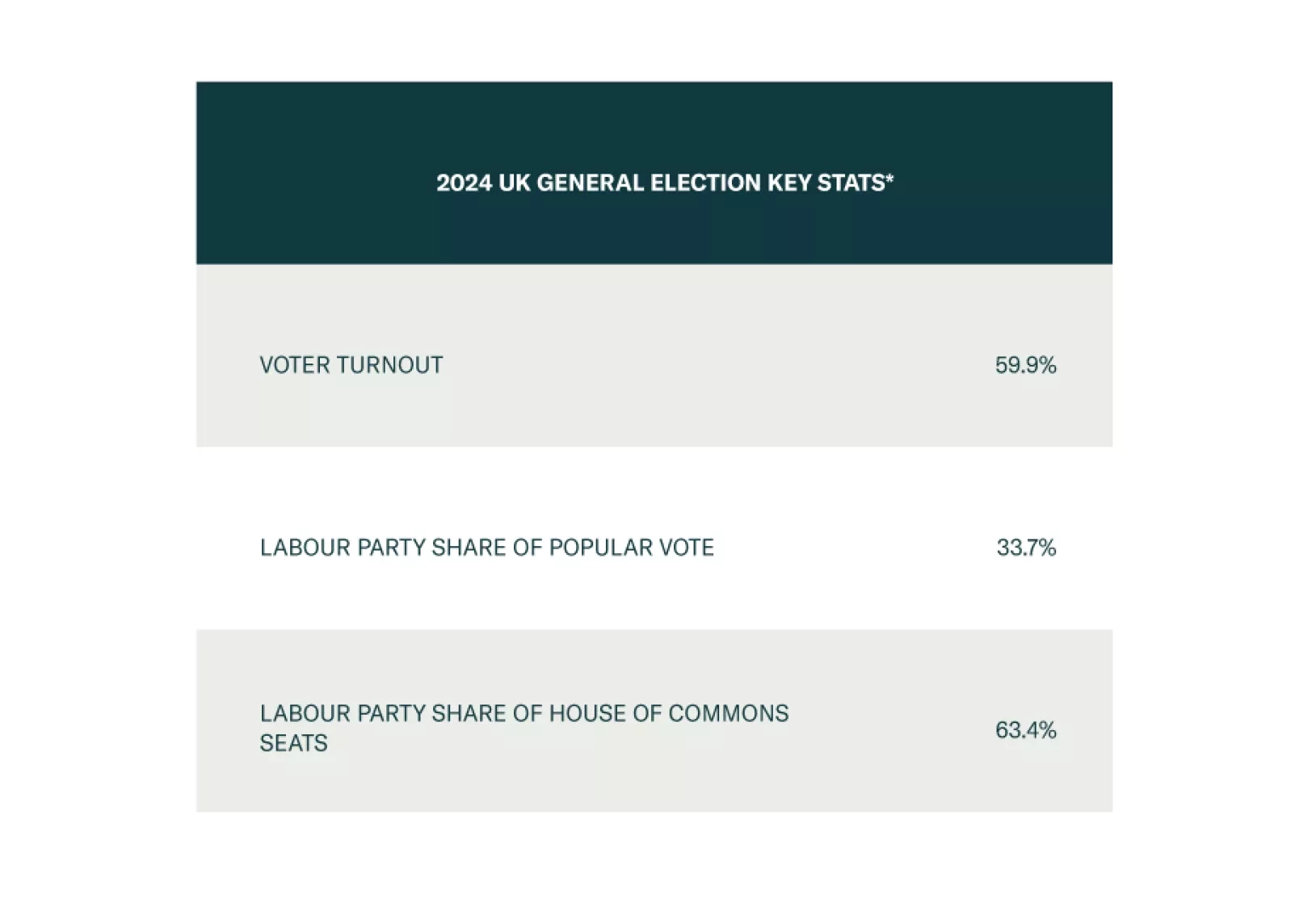

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…

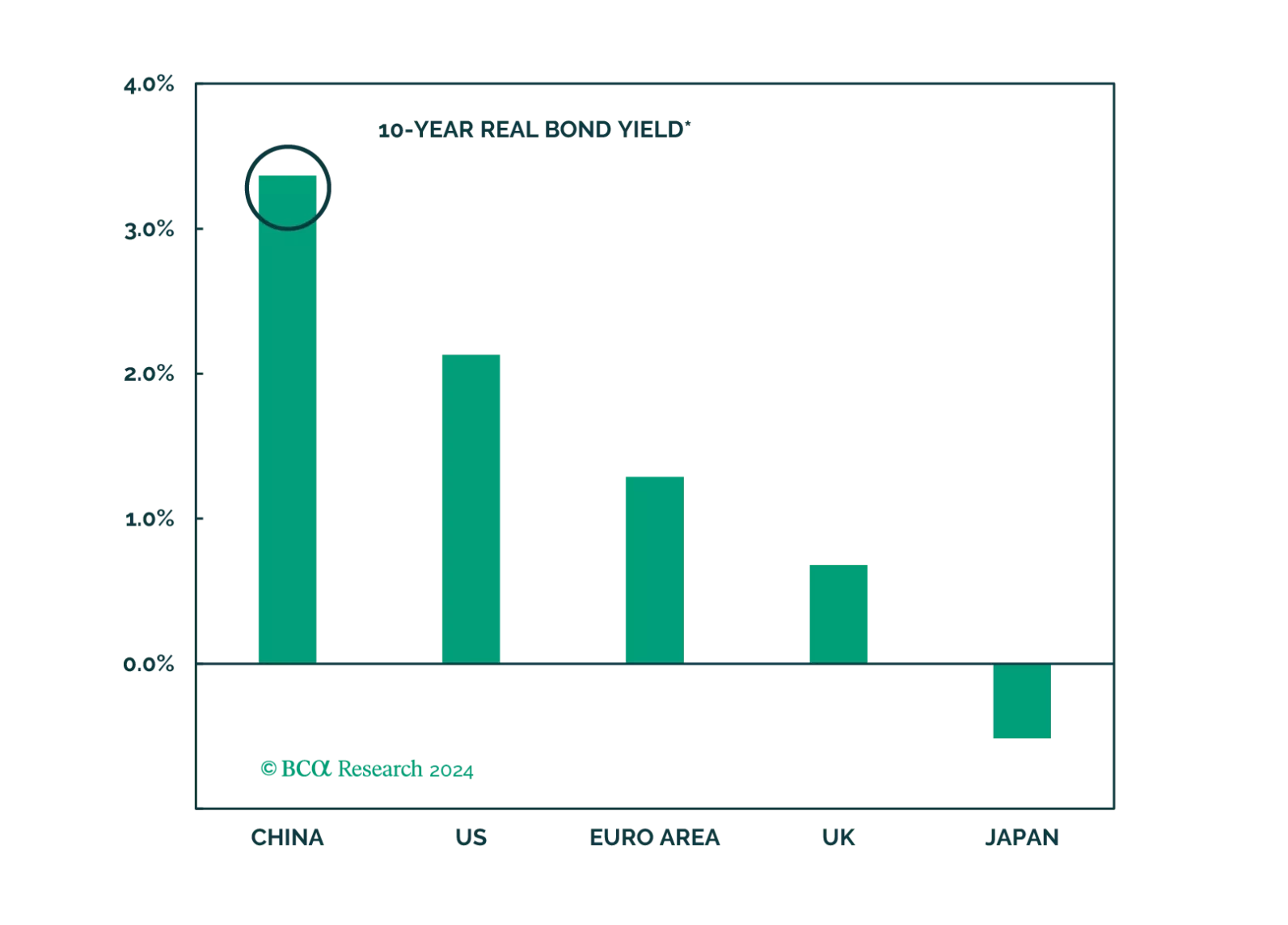

The PBoC appears increasingly uncomfortable with the rapid decline in the Chinese government bond yields. While the PBoC will succeed in temporarily curbing investors’ enthusiasm for bonds, the central bank will be unwilling to raise…

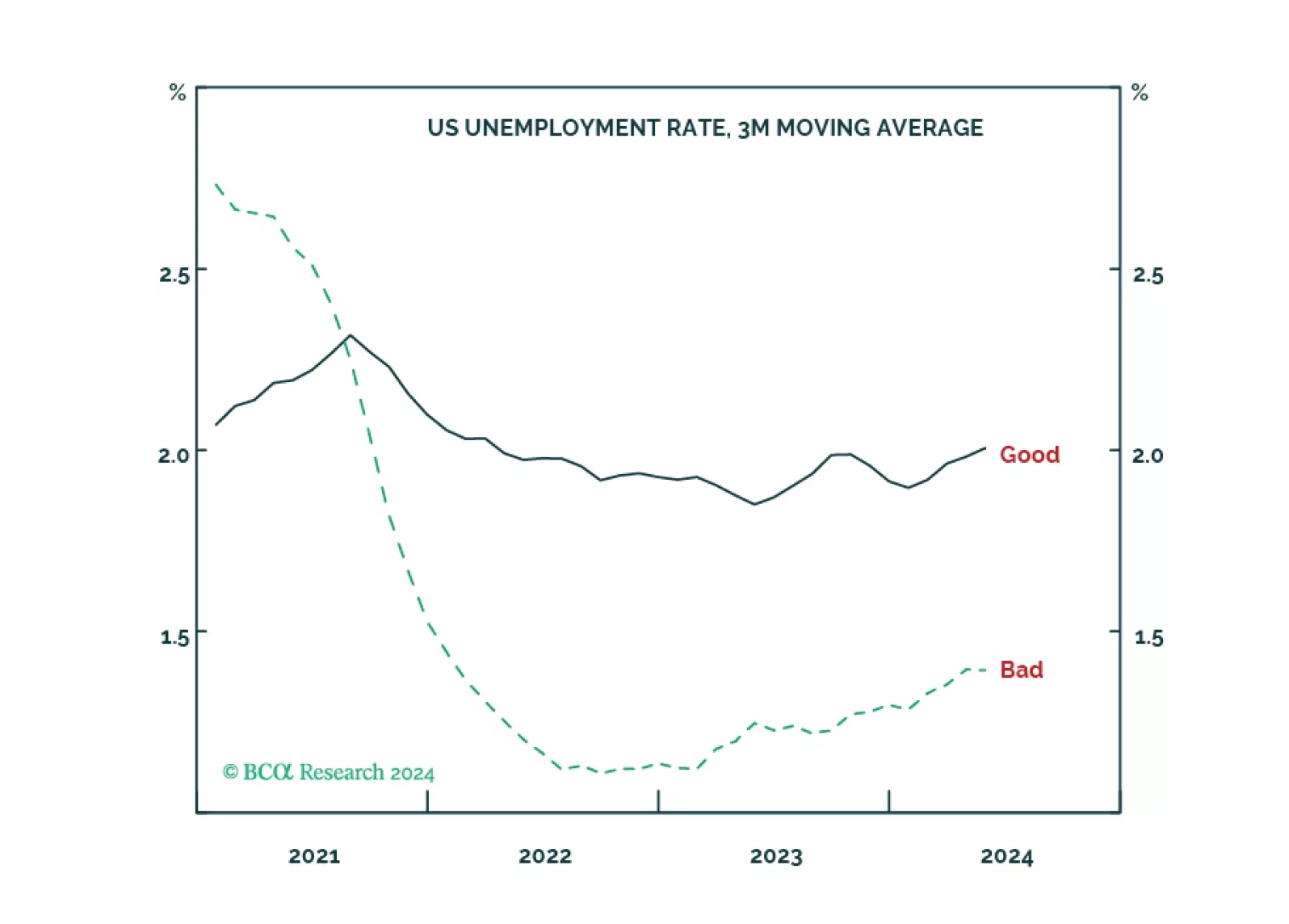

We explain how to distinguish between ‘good’, ‘bad’ and ‘ugly’ unemployment, why bad unemployment is a much better gauge of the jobs market than headline unemployment, and what this means for the tactical positioning in bonds and…

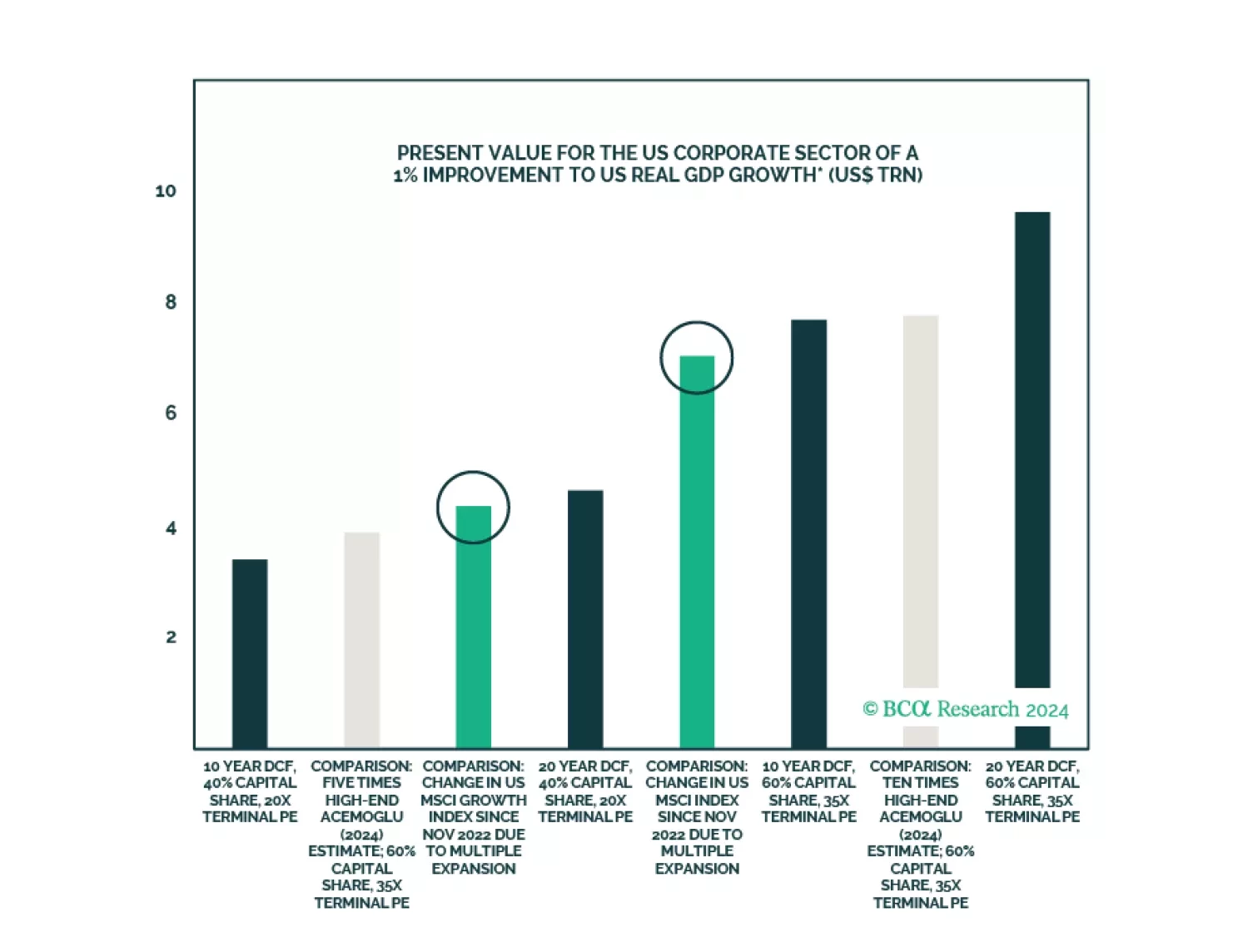

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

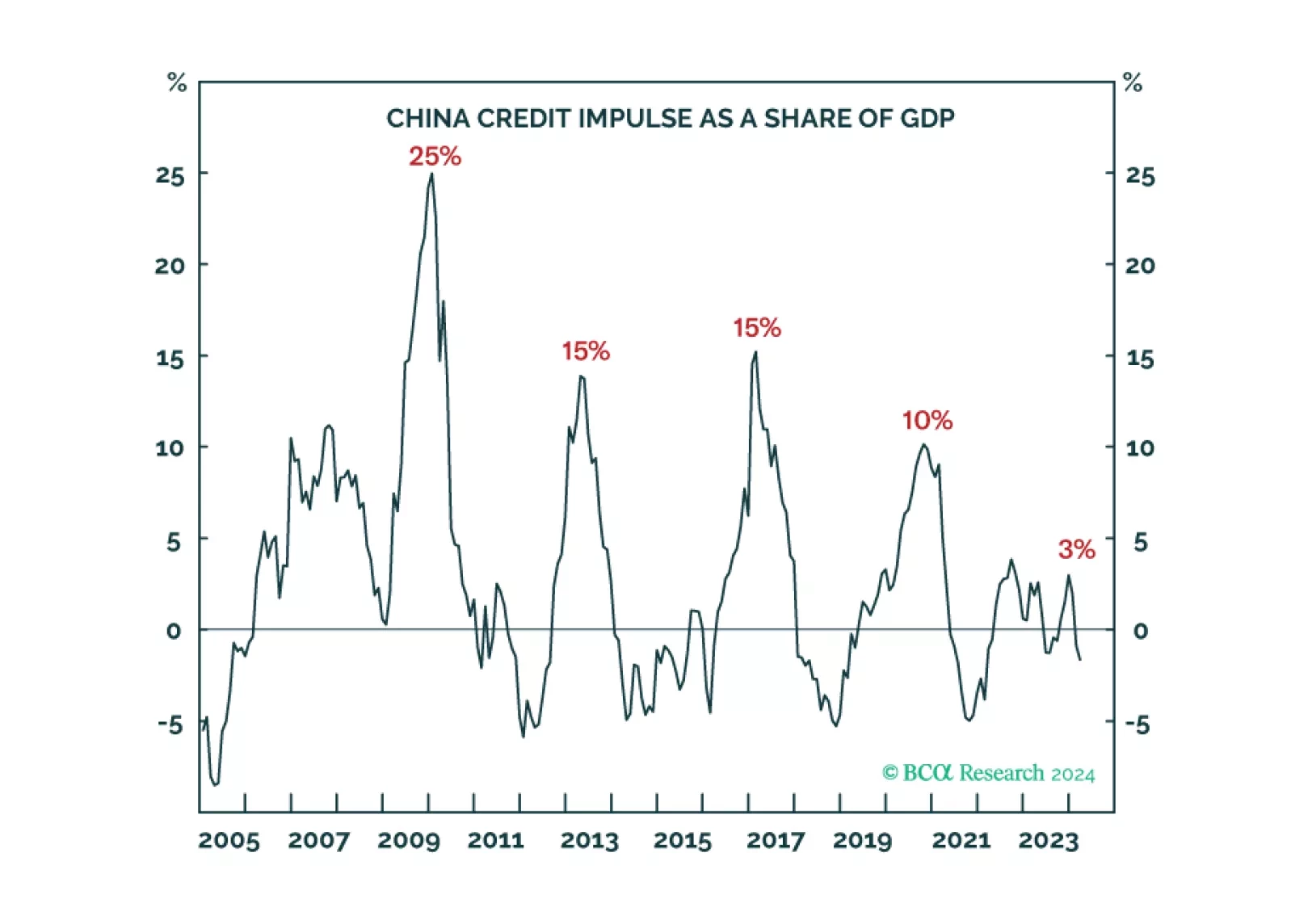

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…

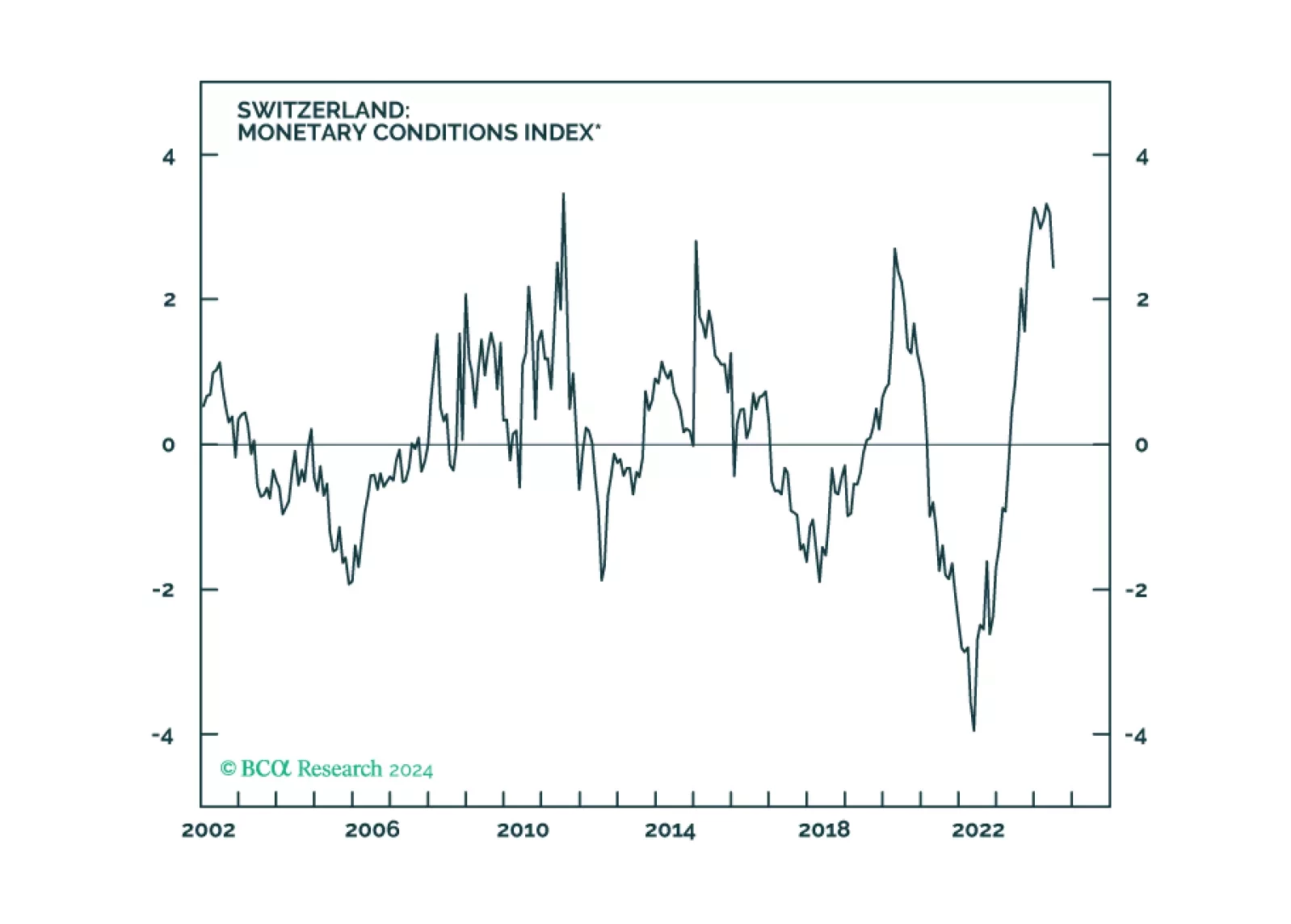

We look at the implications a various European central bank meetings this week, for currency strategy.

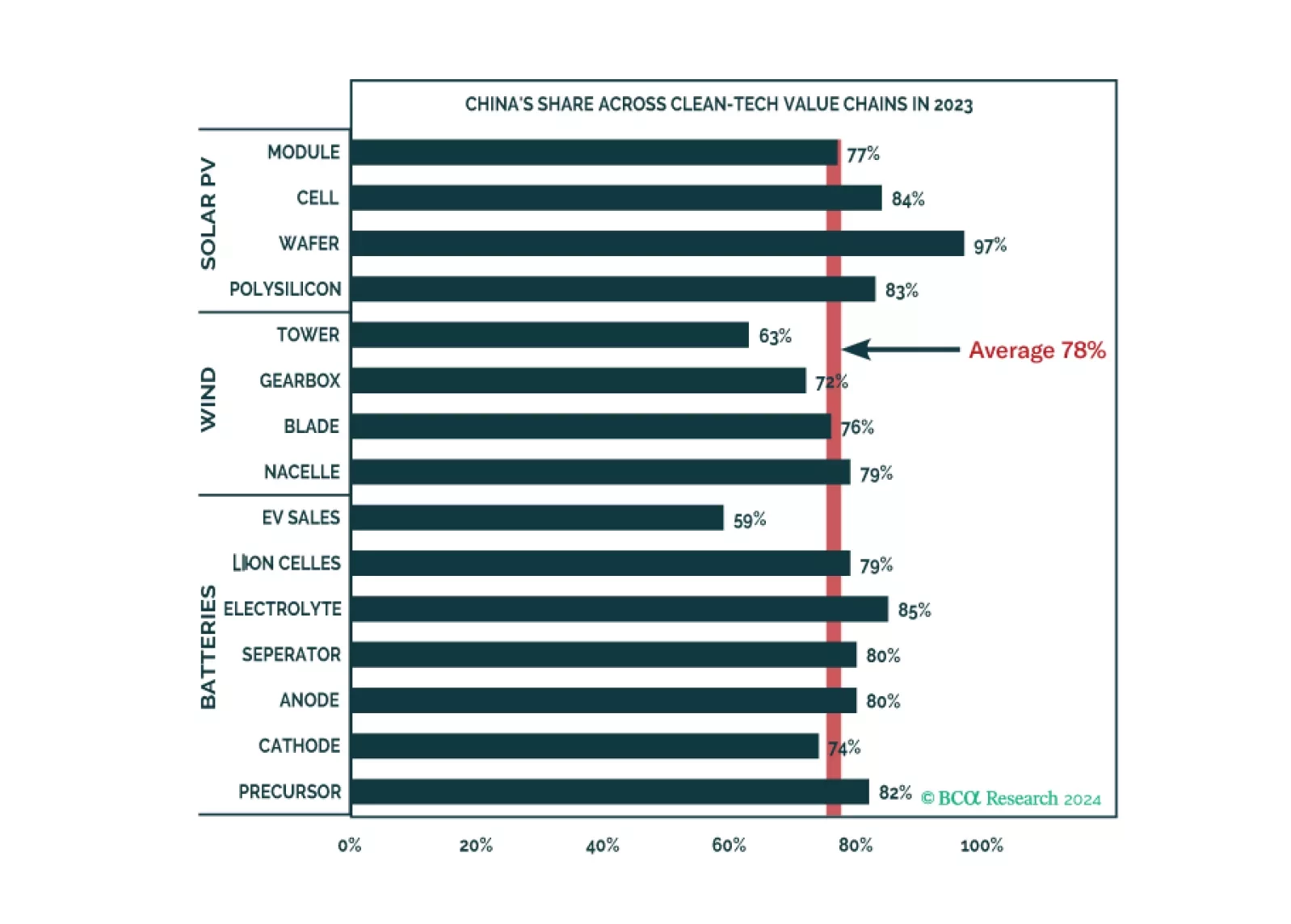

The EU's import tariff increases on Chinese EVs are expected to have a minimal impact on China's overall exports. We anticipate that most Western-brand EV shipments from China will be less affected by the EU import tax hike. Beijing…