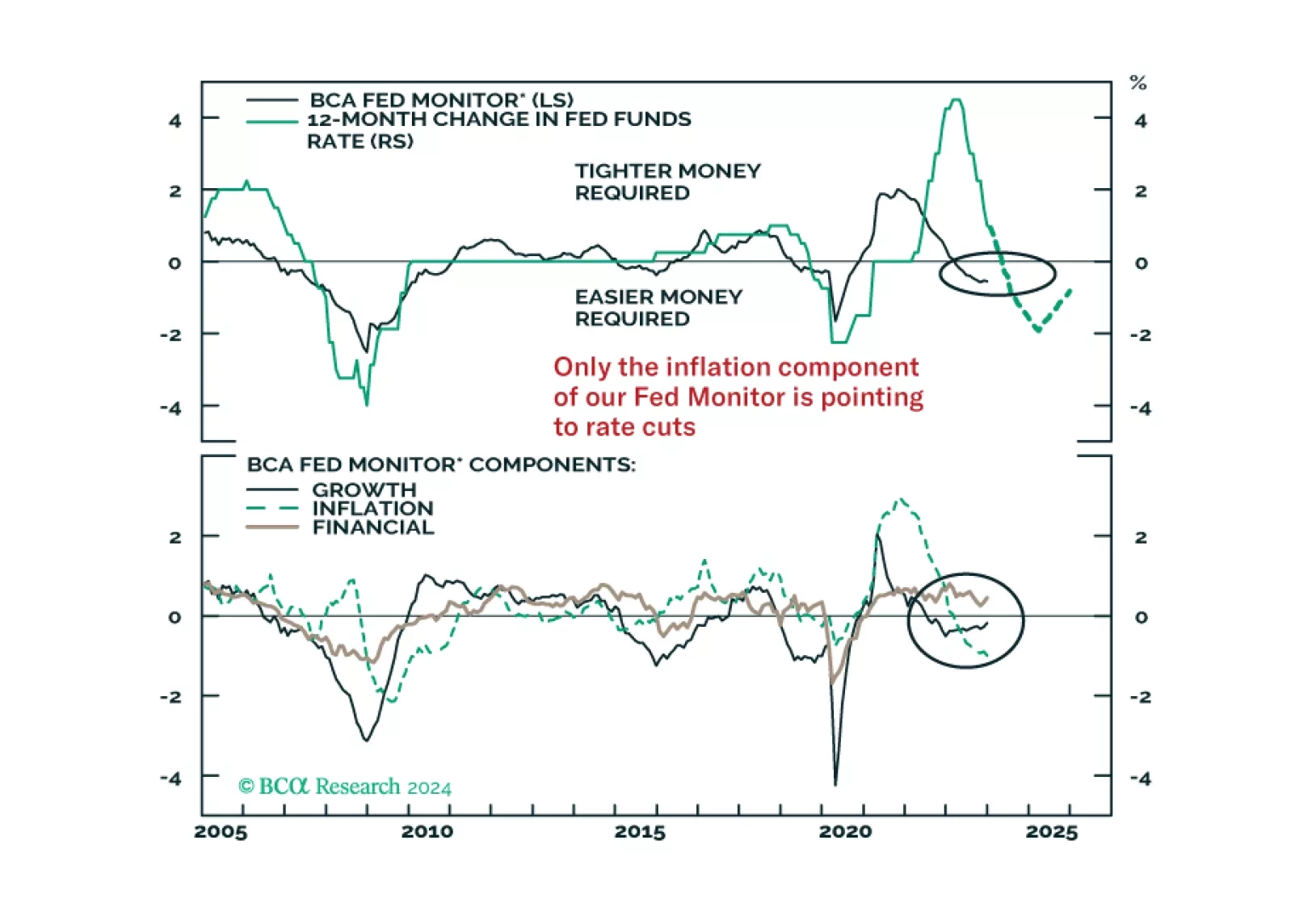

In this Insight, we share our thoughts on yesterday’s FOMC meeting and the Fed’s likely next moves, with implications for US bond strategy.

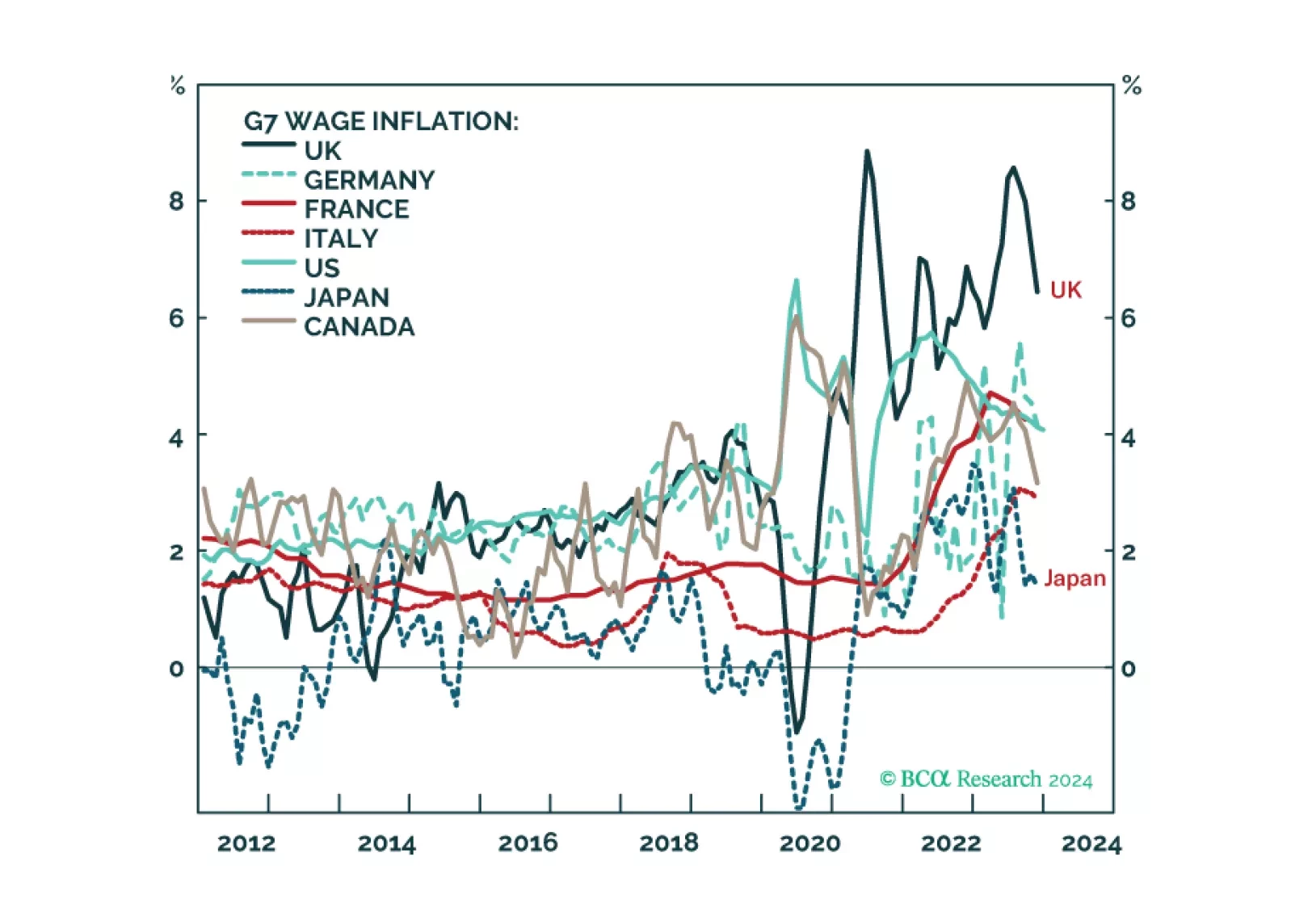

We describe and explain the wide disparity of wage inflation across G7 economies, and discuss what it means for the Fed, ECB, BoE, and BoJ policy moves in the coming year. Plus: we highlight two investments ripe for reversal, and two…

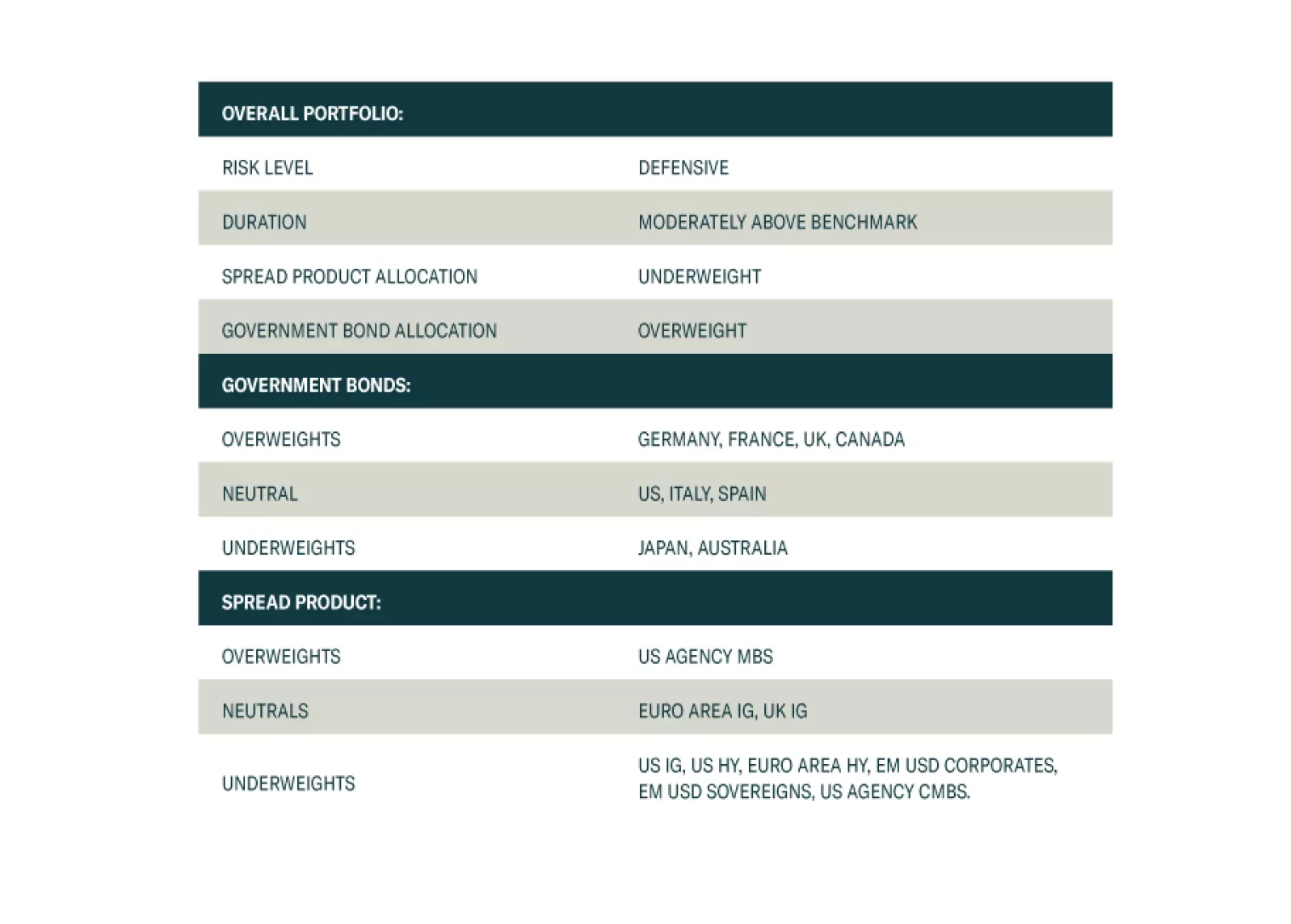

We present the performance review of the Global Fixed Income Strategy Model Bond Portfolio for 2023. We also discuss the outlook for 2024 performance based on our Key Views for the year. The portfolio is positioned to benefit from a…

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

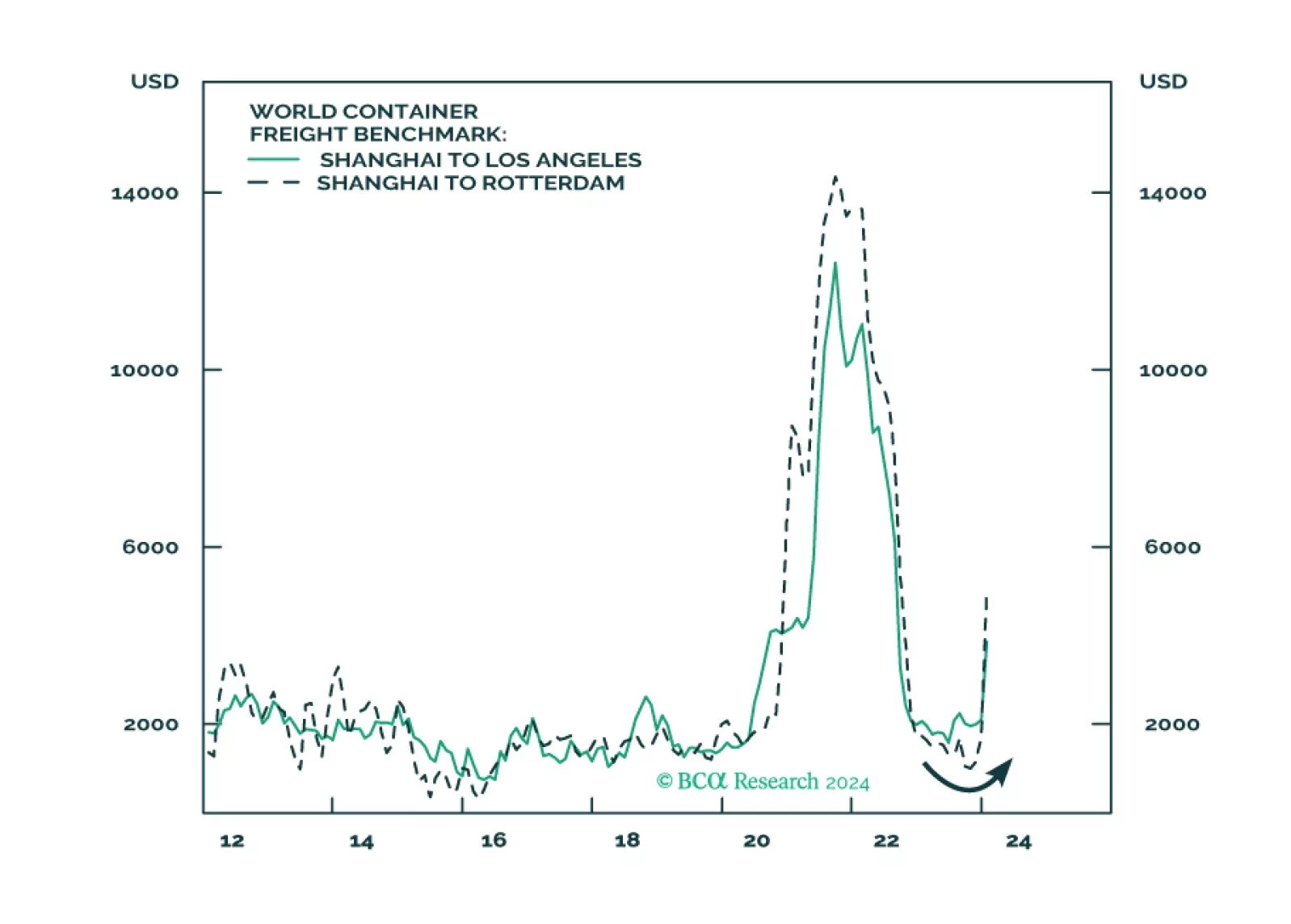

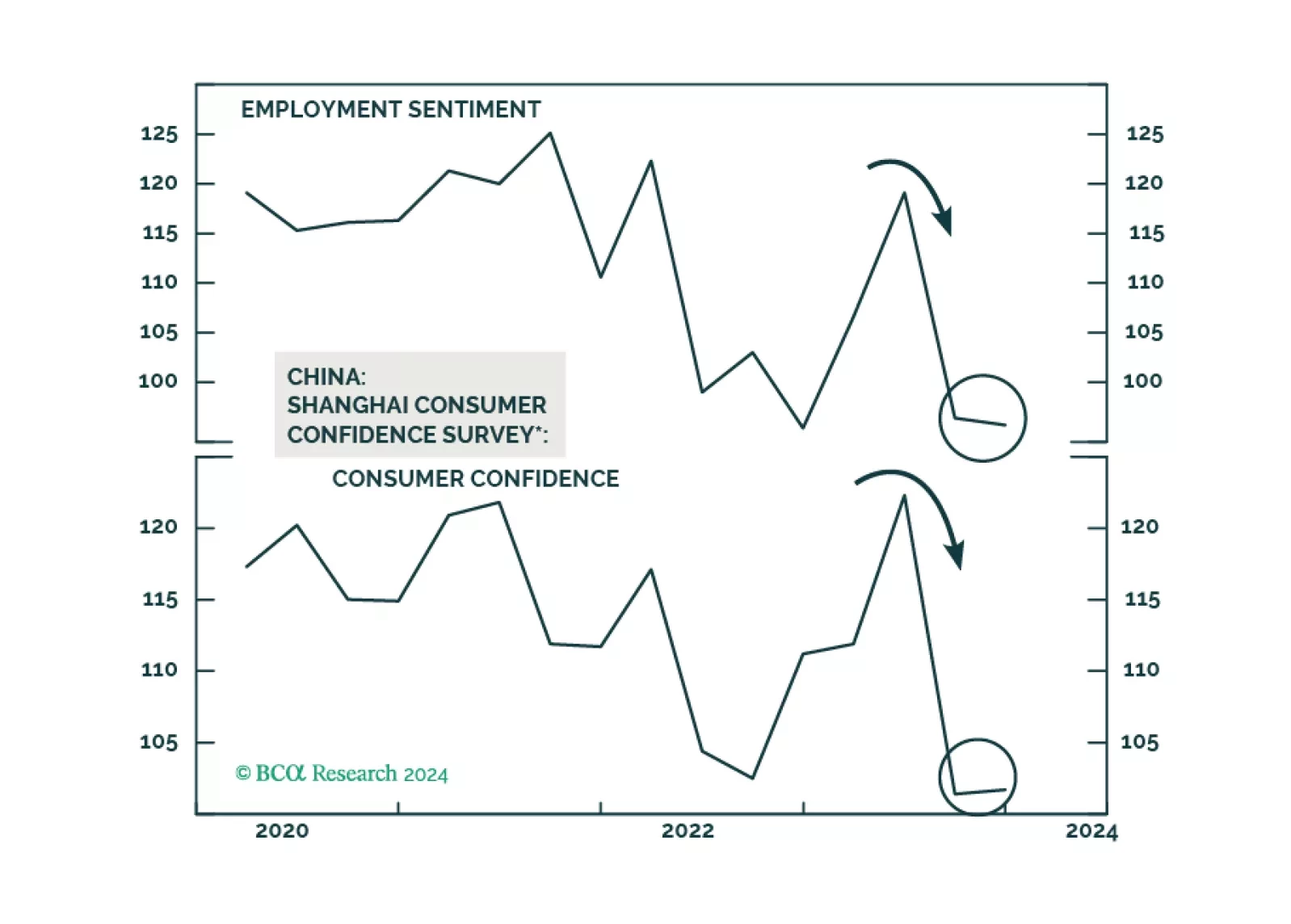

There is no easy way for China to forestall deflation. Provided policymakers are still reluctant to unleash large-size stimulus, more economic disappointments are likely in the coming months, and Chinese stocks will continue to sell…

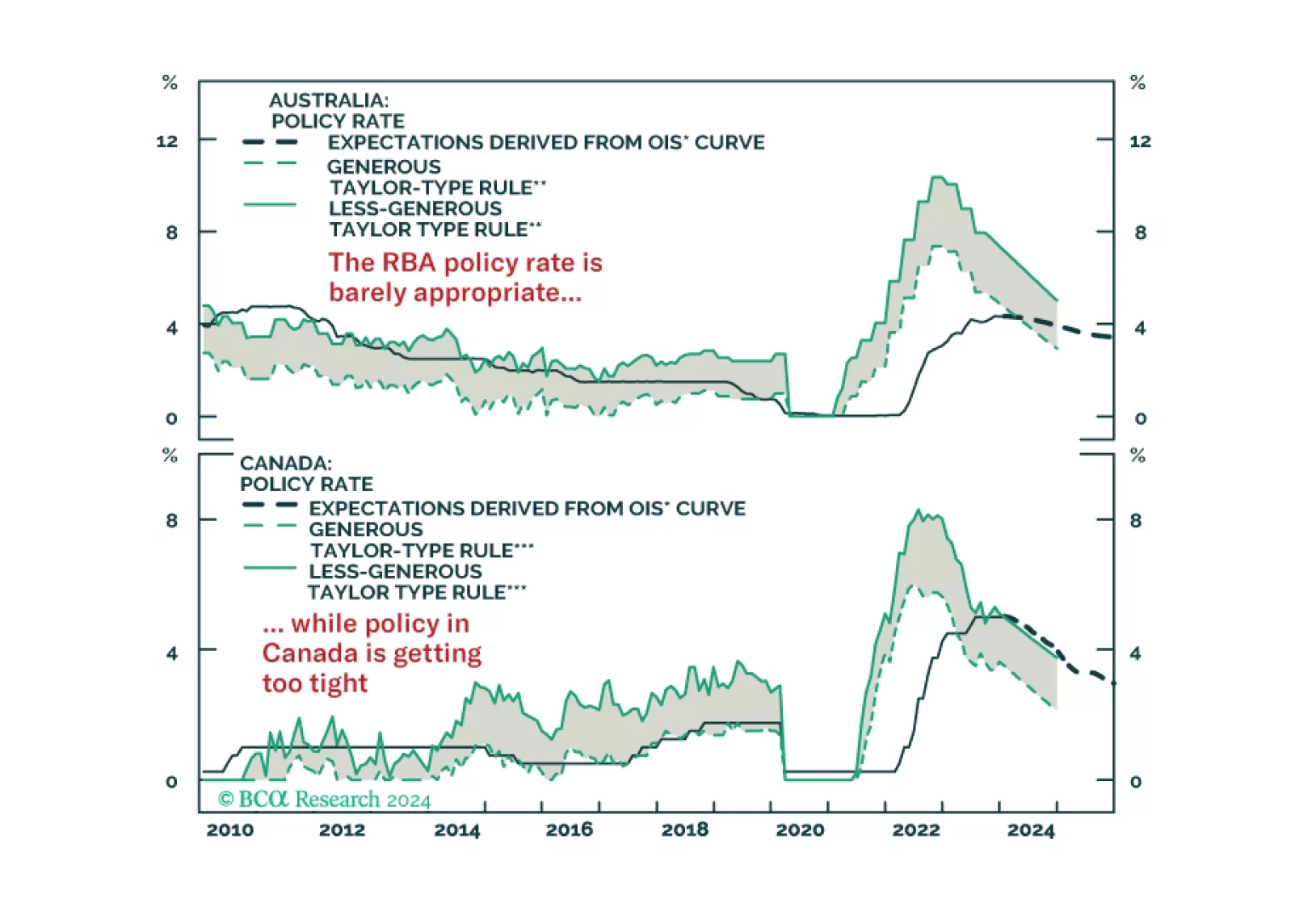

In this Strategy Insight, we assess the monetary policy path for Australia and Canada in 2024 and we discuss how to profit from a growing divergence between the two economies.

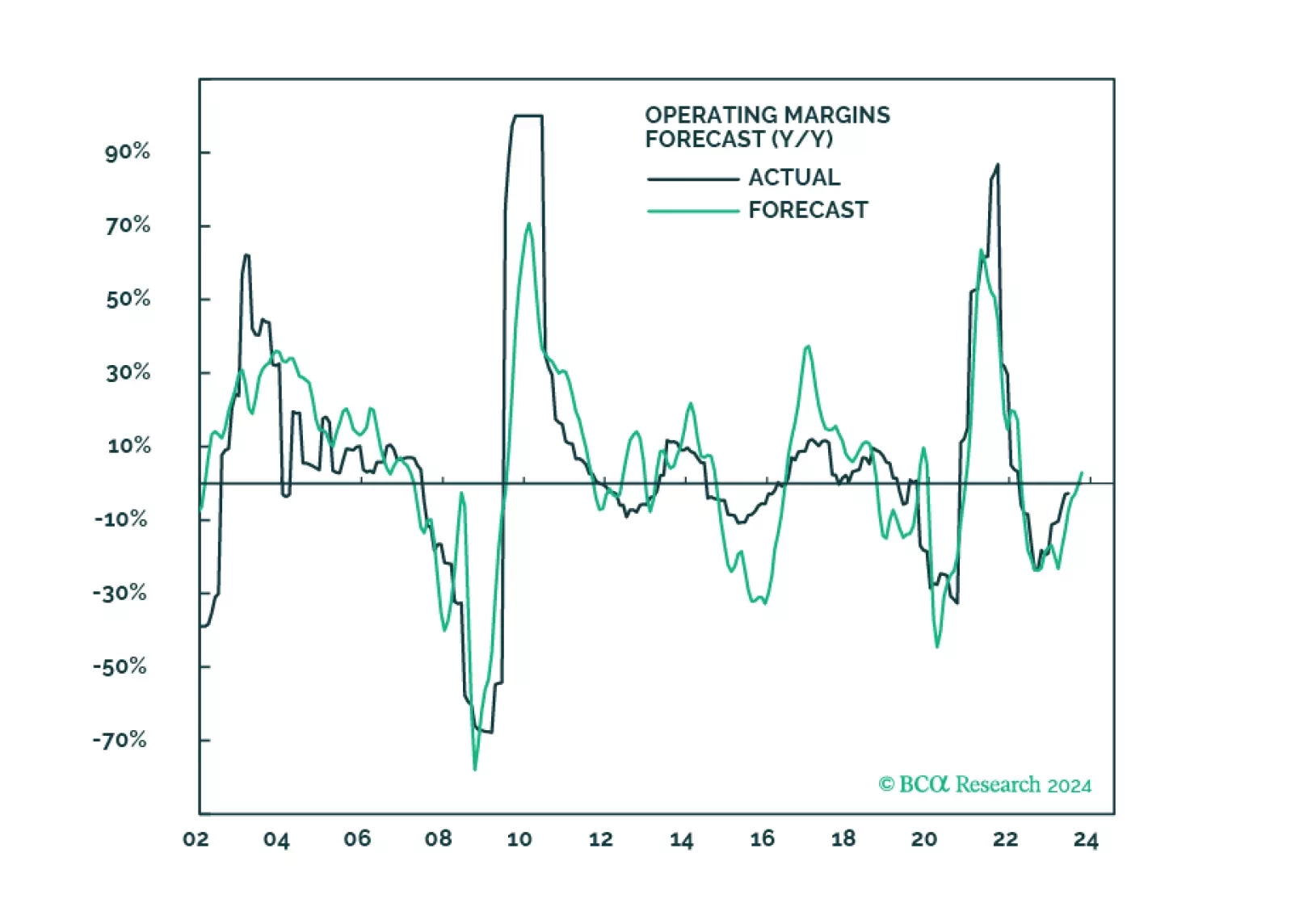

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…