Underweight (High-Conviction) In our initiation of coverage on the S&P interactive media & services index,1 we highlighted a renewed regulatory focus as a key risk that offset the revenue & profit growth vigor of…

Neutral The brand new S&P interactive media & services (IMS) index that we initiated coverage on last month1 has been experiencing extreme pain, being caught up in the global sell-off of former high-flying (and…

Neutral As part of this week's Special Report analyzing the rebadging of the S&P communication services index, we initiated coverage on the new S&P interactive media & services sector. Not doing so would leave a…

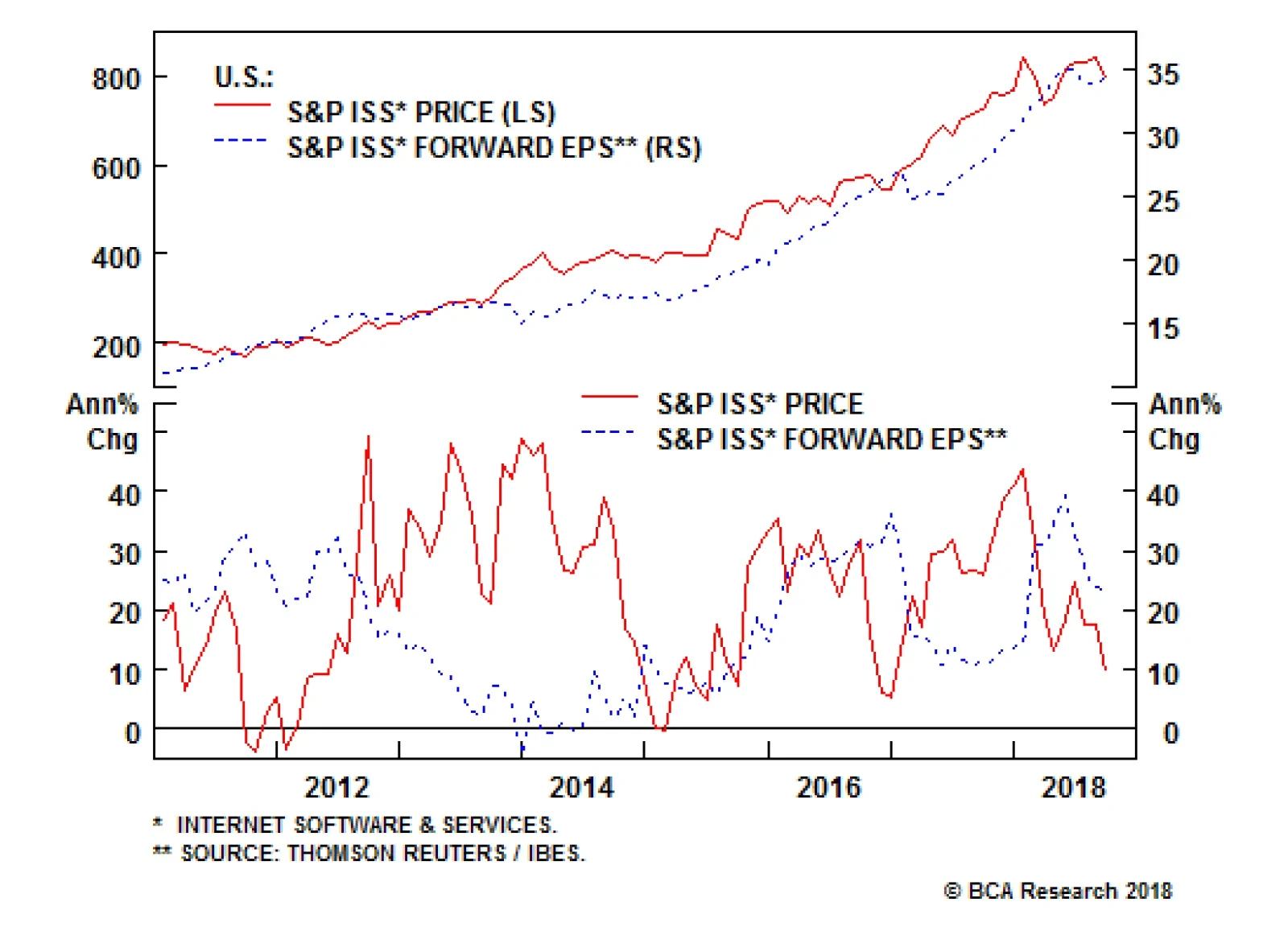

It comes as no shock to market observers that the internet services & software index has been representing a growing share of the S&P 500 as its components have been roaring ahead. The usual conclusion is that this…

Neutral The battle of the titans of the U.S. media sector for control of Sky PLC was resolved over the weekend, with Comcast emerging victorious, besting 21st Century Fox's bid for the pay-TV firm. While increasing global…