Highlights The bipartisan Infrastructure Investment and Jobs Act will increase US government non-defense spending to around 3% of GDP, a level comparable to the 1980s-90s and larger than the 2010s. Democrats are…

Nearly two-thirds of the S&P 500 companies reported their Q3 earnings, and the earnings season is drawing to a close. 83% of companies have beaten the street expectations with an average earnings surprise standing at 11% (40%…

With 119 S&P 500 companies having reported Q3-2021 earnings, it’s time to take a pulse of the interim results. So far, the blended earnings growth rate is 34.8% while actual reported growth rate is 49.9%. The blended sales…

In a recent daily report, we analyzed relative performance of the S&P 500 sectors and styles under different US 10-year Treasury yield (UST10Y) regimes. Today we expand our analysis and map relative performance of the S…

Foreword Today we are publishing a charts-only report focused on the S&P 500, and GICS 1 sectors. Many of the charts are self-explanatory; to some, we have added a short commentary. The charts cover macro, valuations,…

Chart 1Cyclicals Styels and Sectors Outperform In The Rising Rates Environment In a recent daily report, we analyzed performance of the S&P 500 sectors before and after the 2013 tapering announcement. Today we expand our…

August PPI reading came in at 8.3%. Naturally, many investors are wondering whether the companies will be able to pass their soaring input costs to the customers. An in-depth analysis of margins and pricing power requires a significant…

Highlights The Evergrande crisis is not China’s Lehman moment. Nonetheless, Chinese construction activity will decelerate further in response to this shock. Global equities are frothy enough that a weaker-than-expected Chinese…

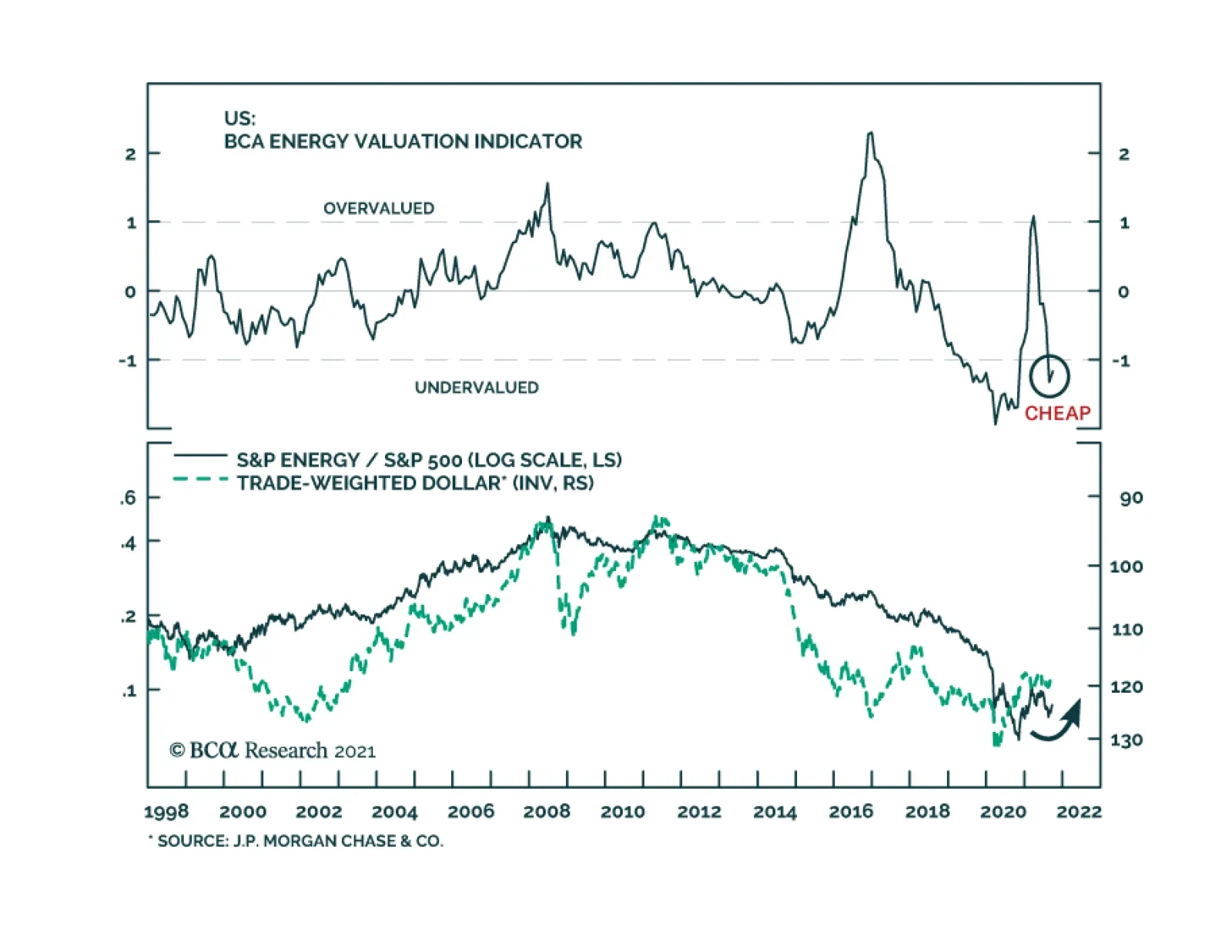

US energy stocks performed poorly earlier this year. They fell 14tween early March and late August. However, the tide seems to be turning in their favor. The energy sector is now leading the benchmark. It is up 12% since August…

Today we take a close look at the historical GICS1 level performance following the taper event in 2013. Chart 1 provides an overview of a price action of the 10-year US Treasury yield, the US dollar, and gold to provide context,…