A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

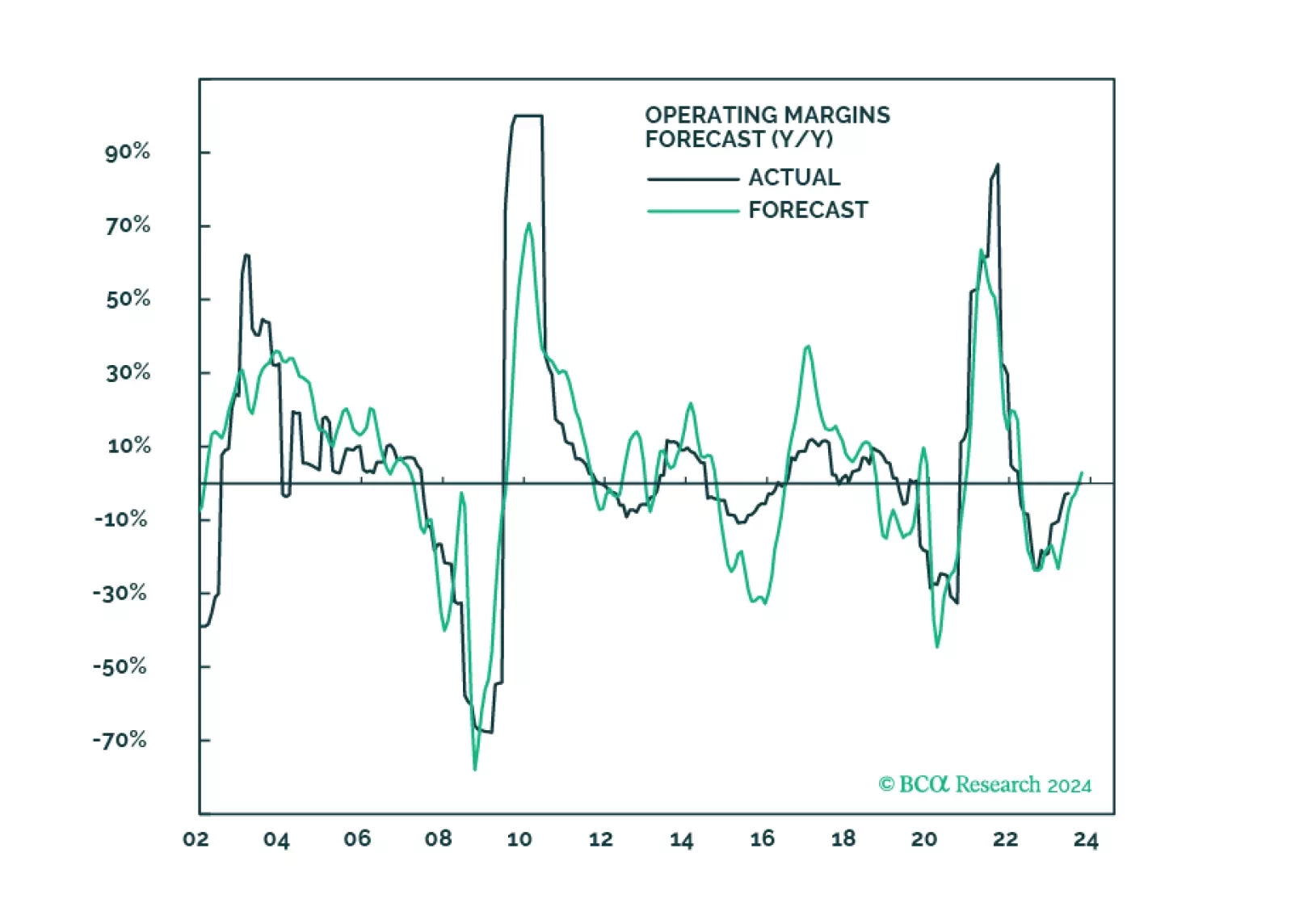

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

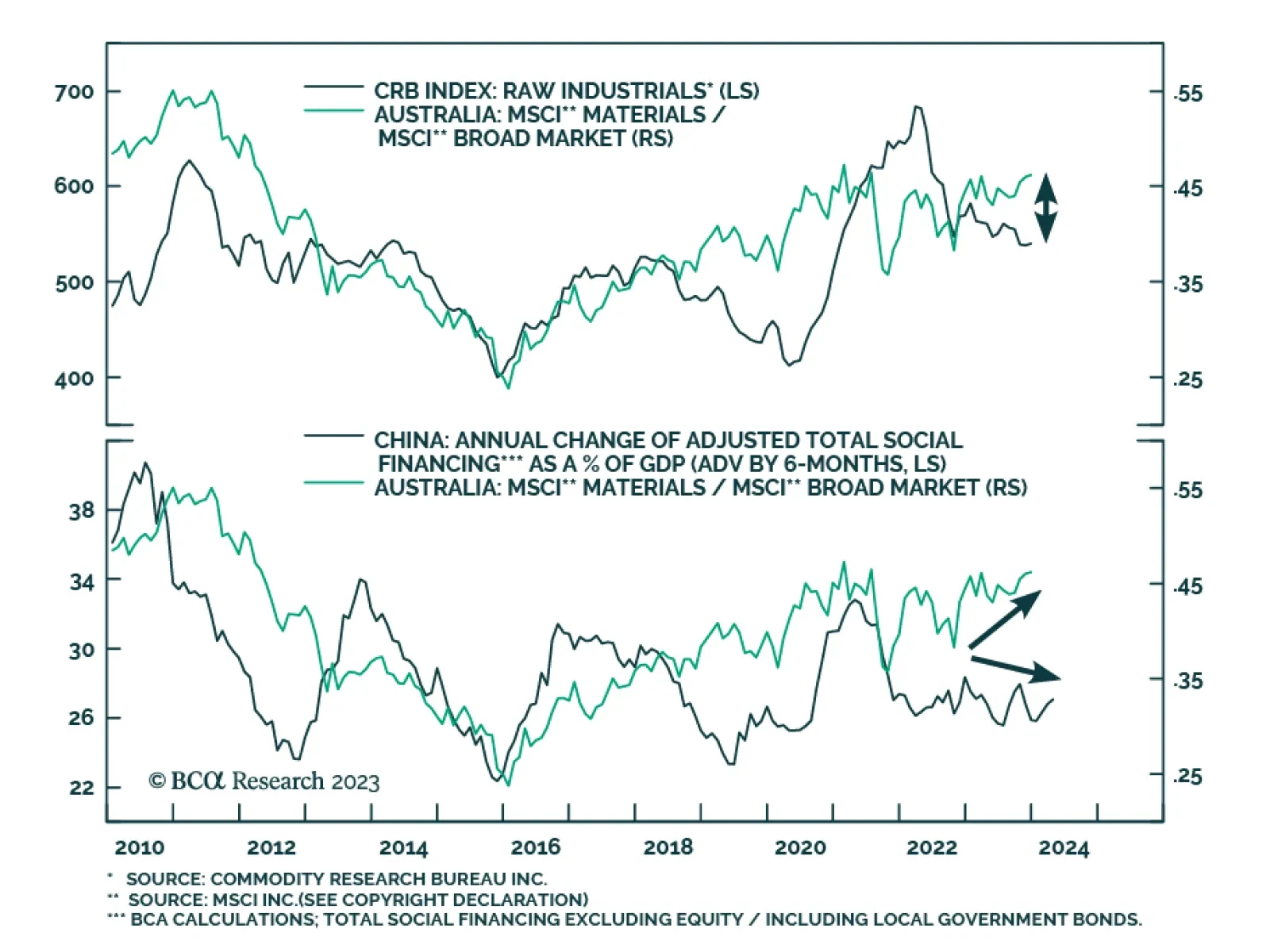

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

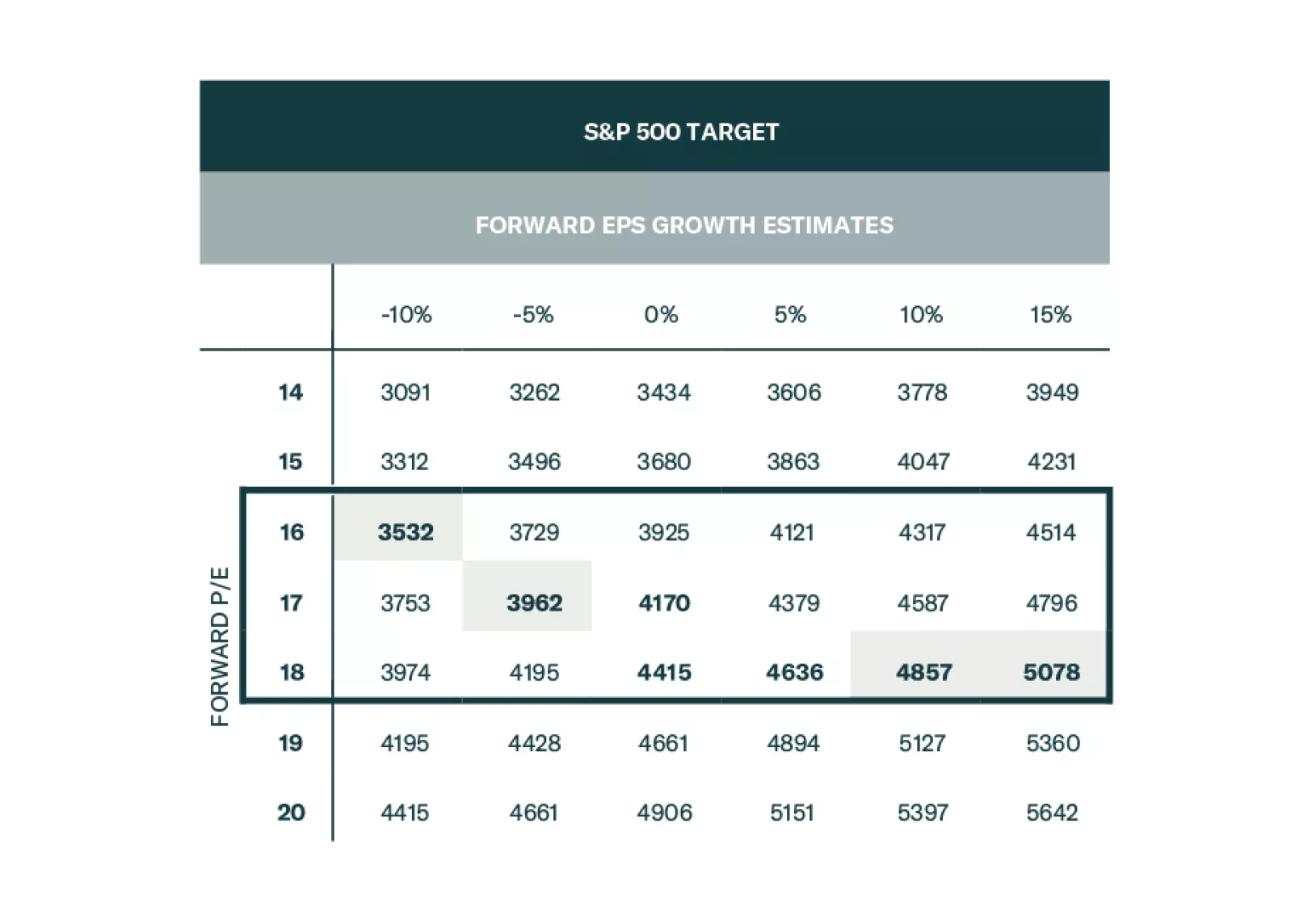

Q3-2023 is expected to mark the end of the earnings recession for the past three quarters, opening the door to positive earnings growth. Whether that would be sustainable or will sputter once the recession settles in as expected in…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

European stocks and the euro continue to weaken; soon, they will test the bottom of their recent trading range. Which sectors can protect investors against this downdraft?

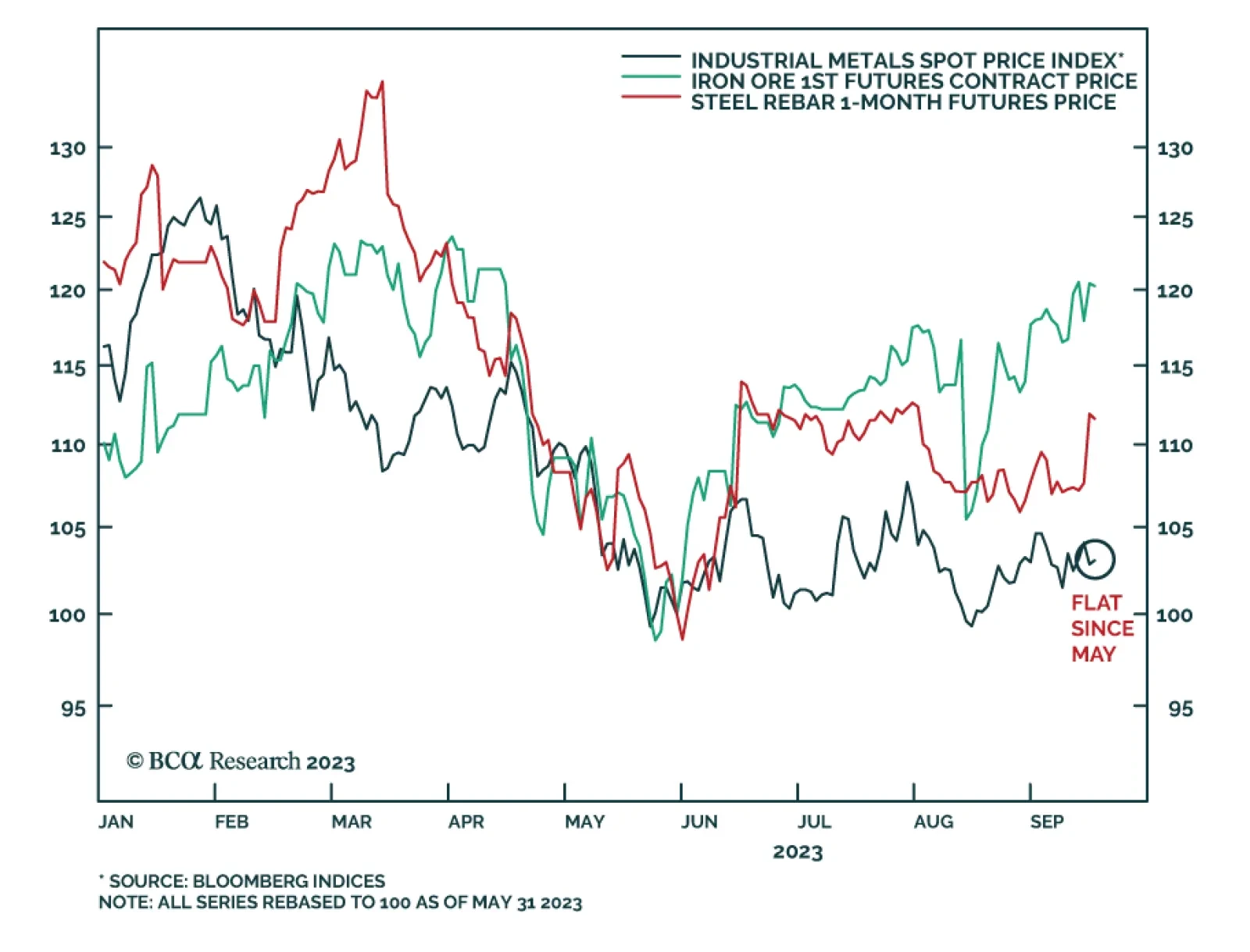

Over the past few months a schism has emerged in the industrial metals complex. On the one hand, the Bloomberg Industrial Metals Index – which is composed of futures contracts on copper, aluminum, zinc, nickel, and lead…