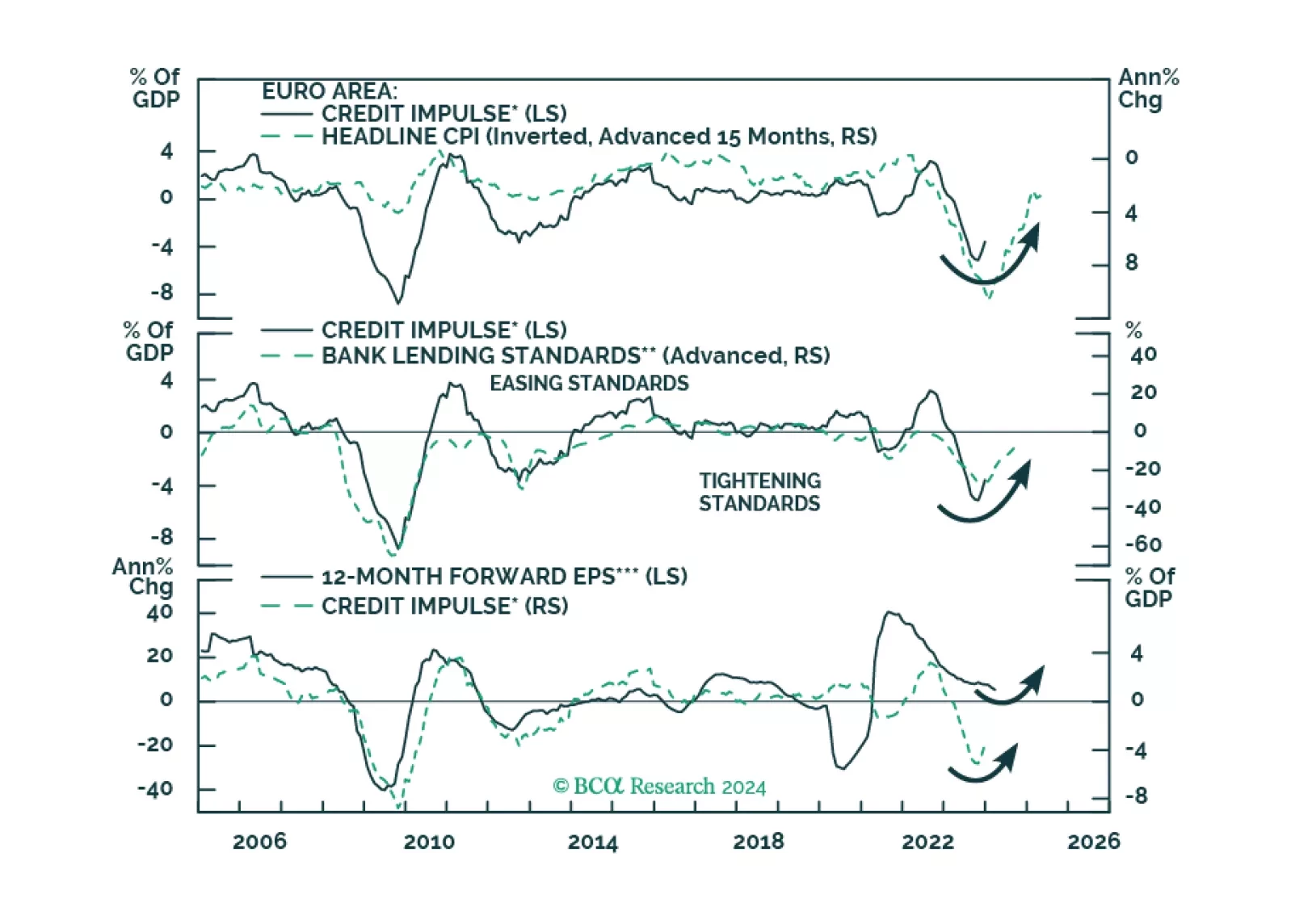

Europe credit flows are stabilizing, hence a major drag on the region’s growth will dissipate. What does this development imply for European equities?

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

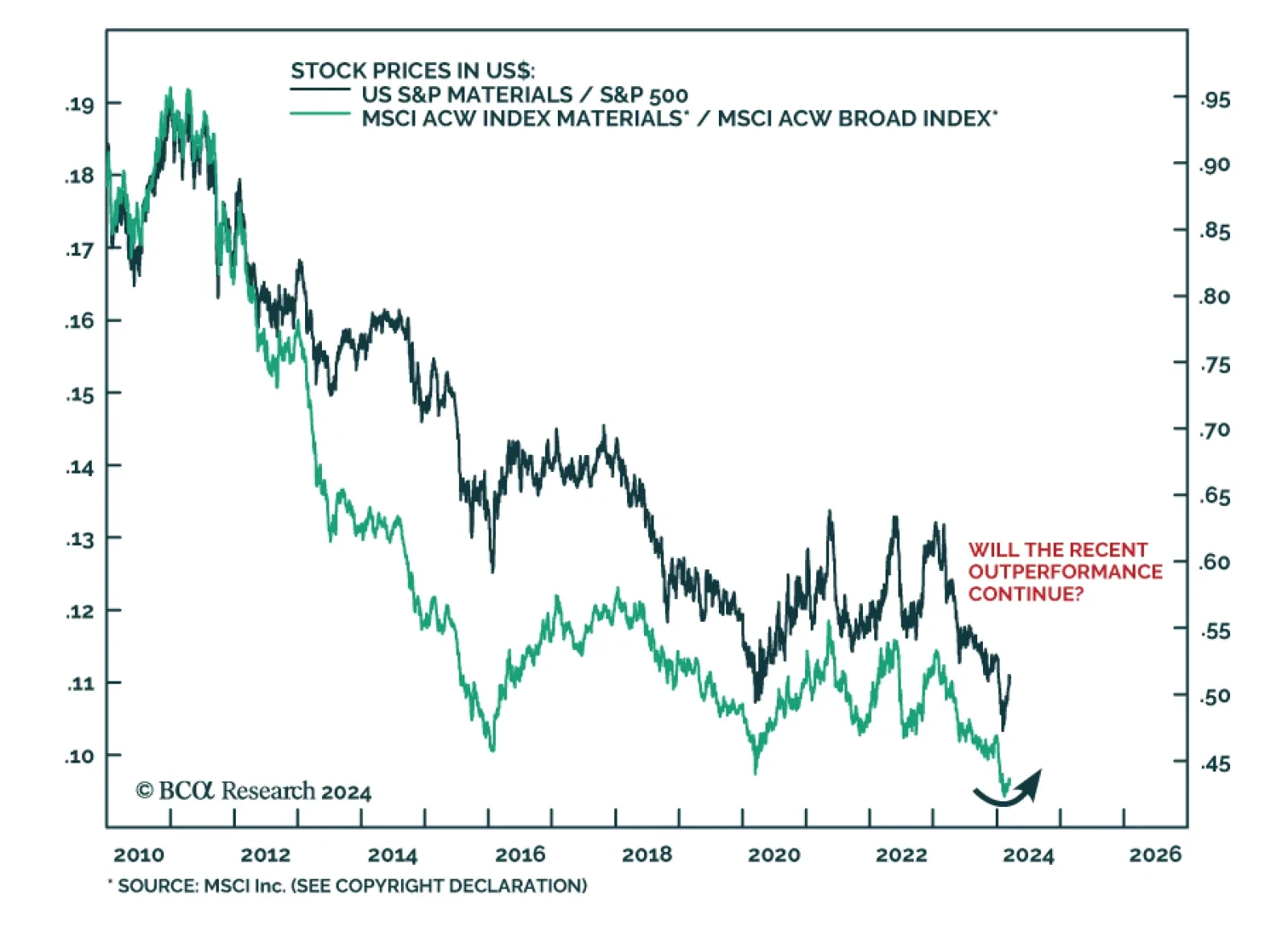

As we highlighted in a recent Insight, dynamics have shifted beneath the surface of the S&P 500. The Materials sector has been rallying sharply since the end of January, gaining 9.9% over this period and taking the top spot…

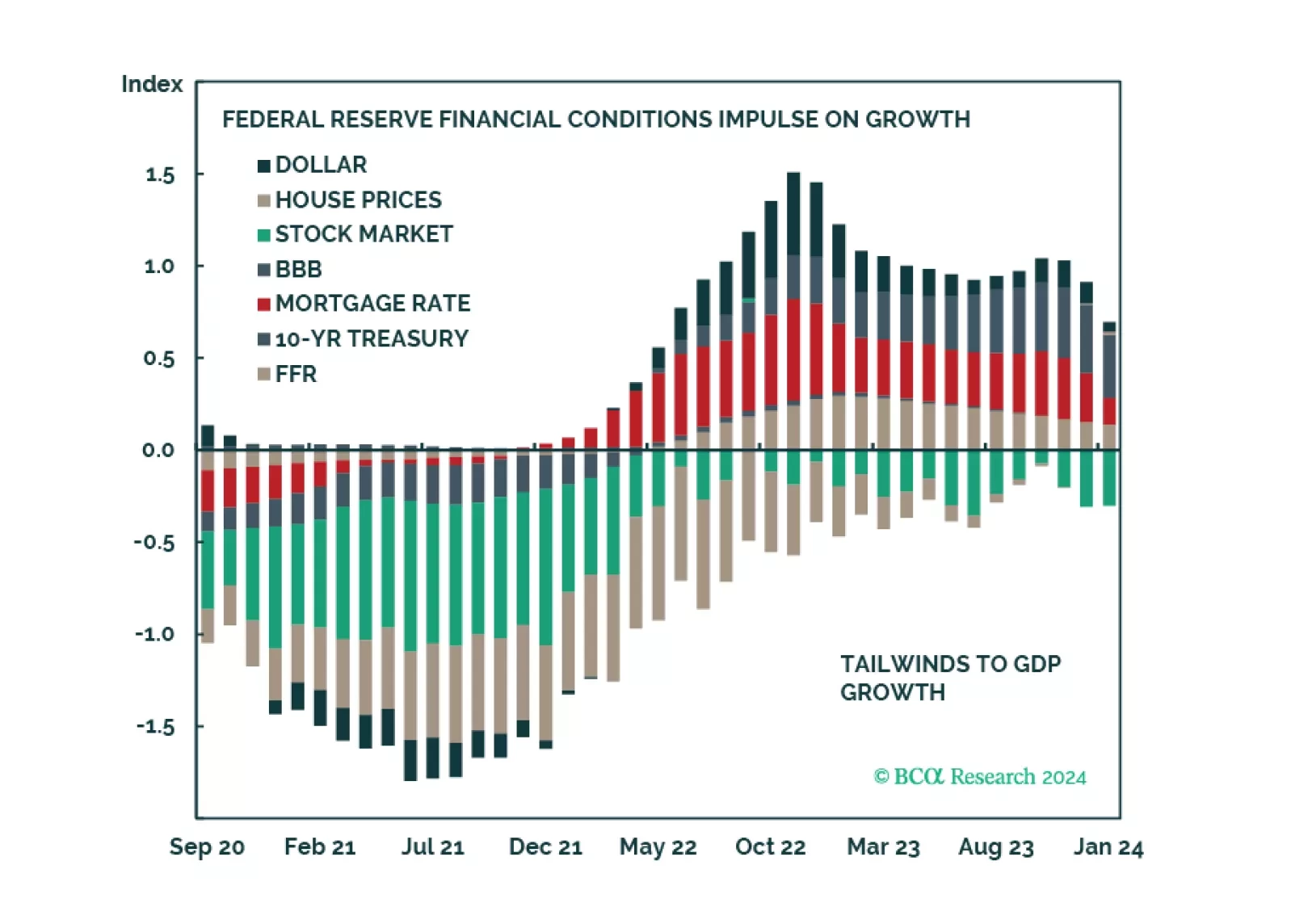

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

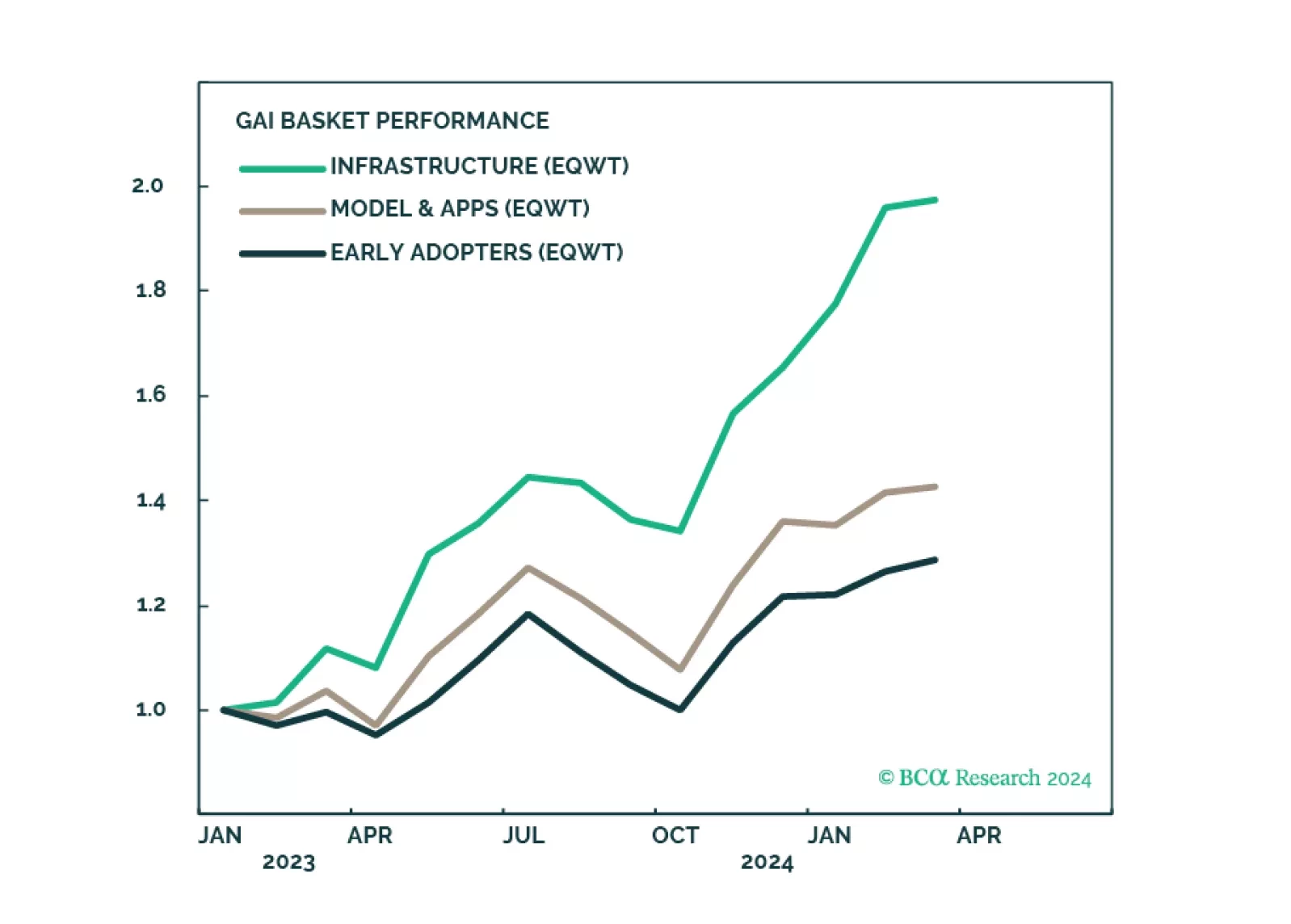

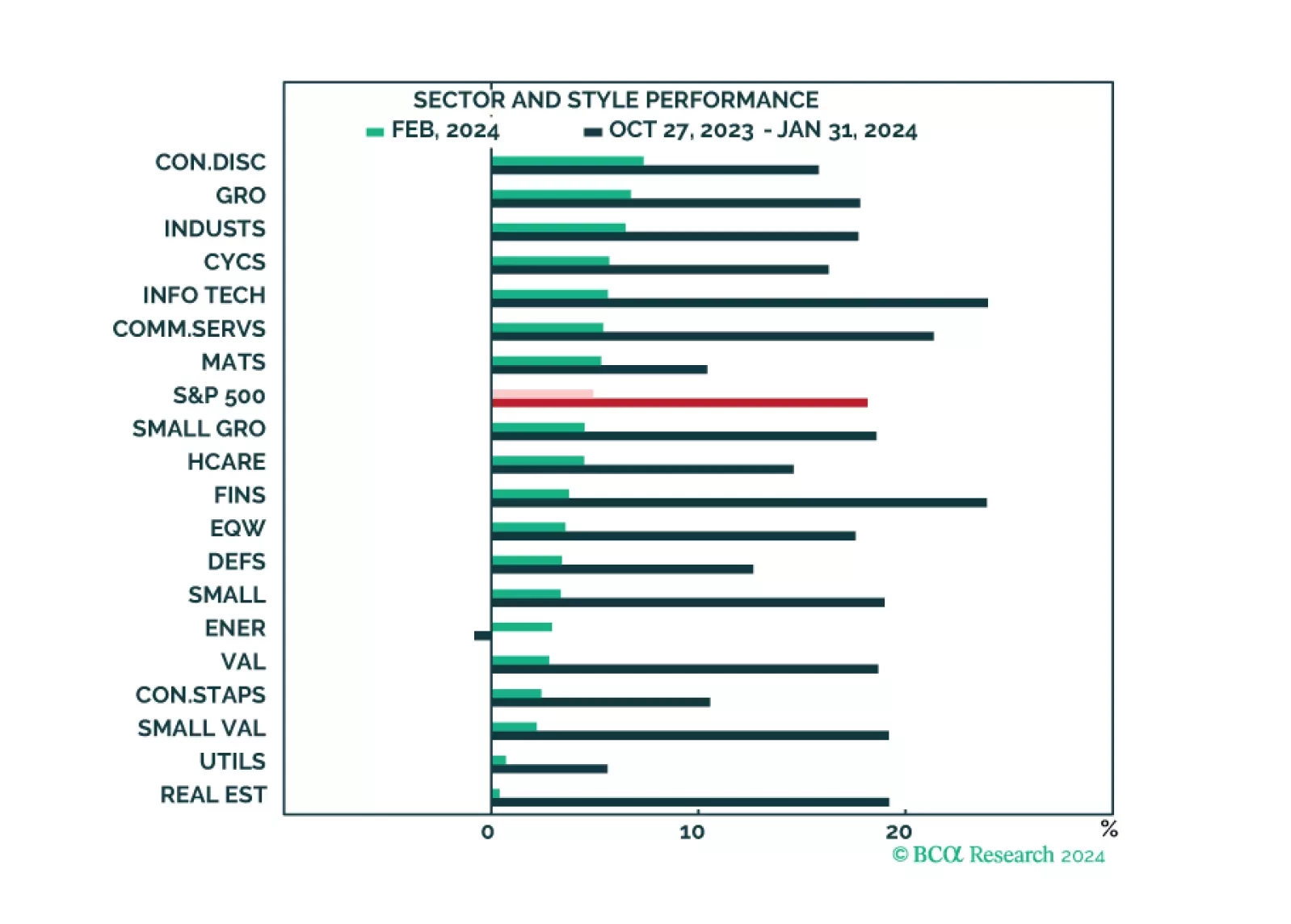

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

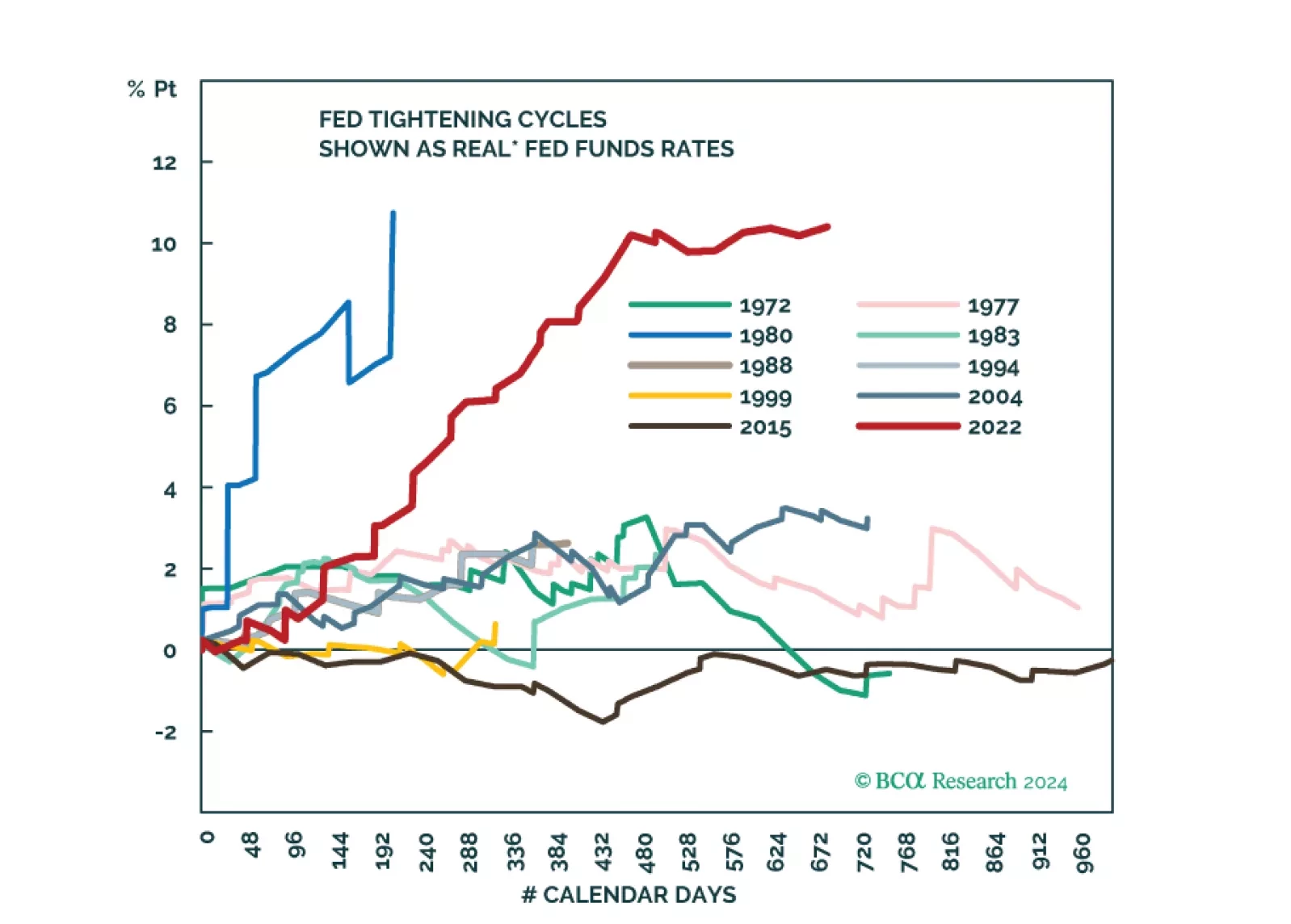

Amid patchy global growth, the US economy remains resilient. However, tight monetary policy will eventually trigger a recession in the US too. The stock market rally has been very narrow. Stay underweight risk assets.

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

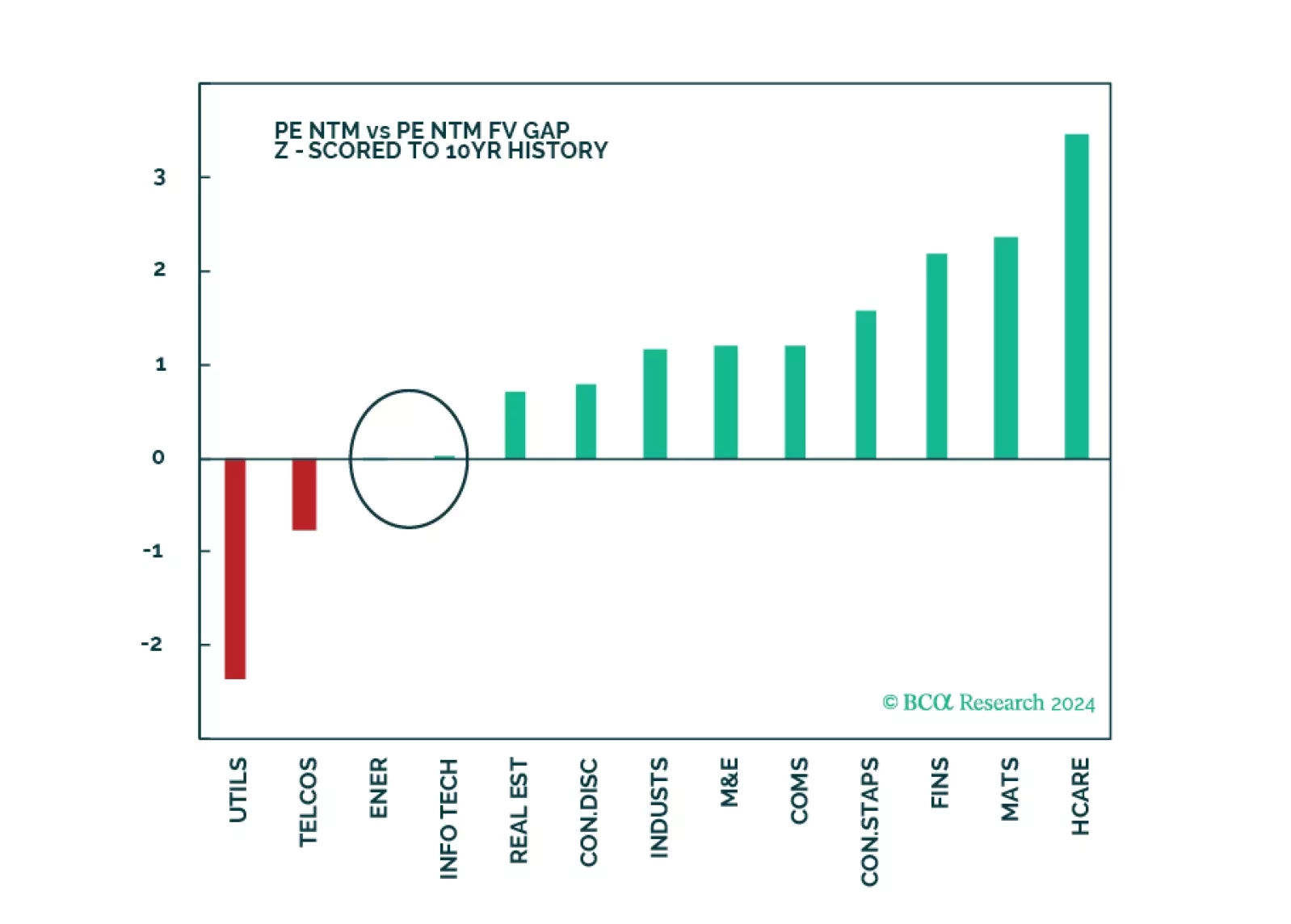

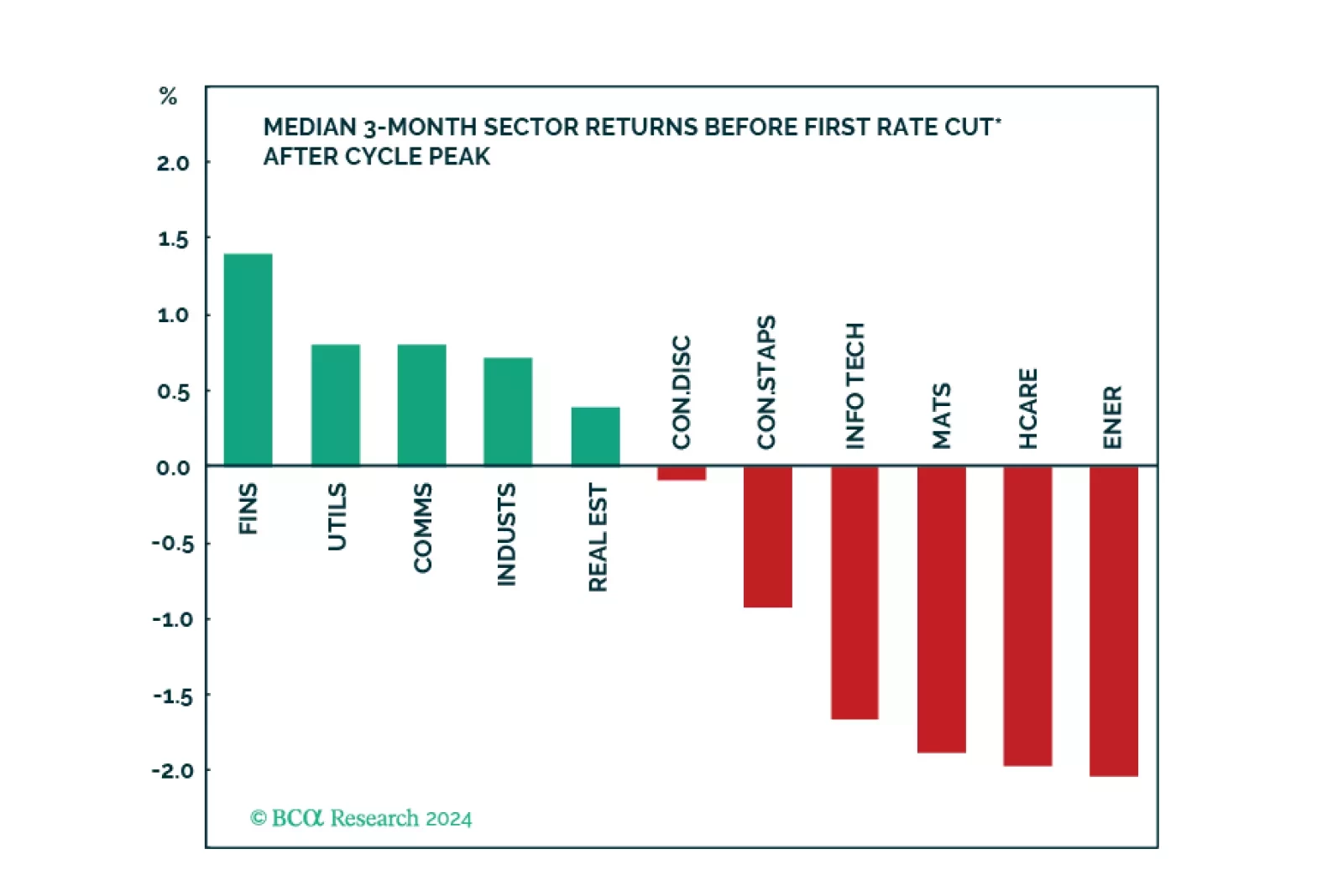

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…