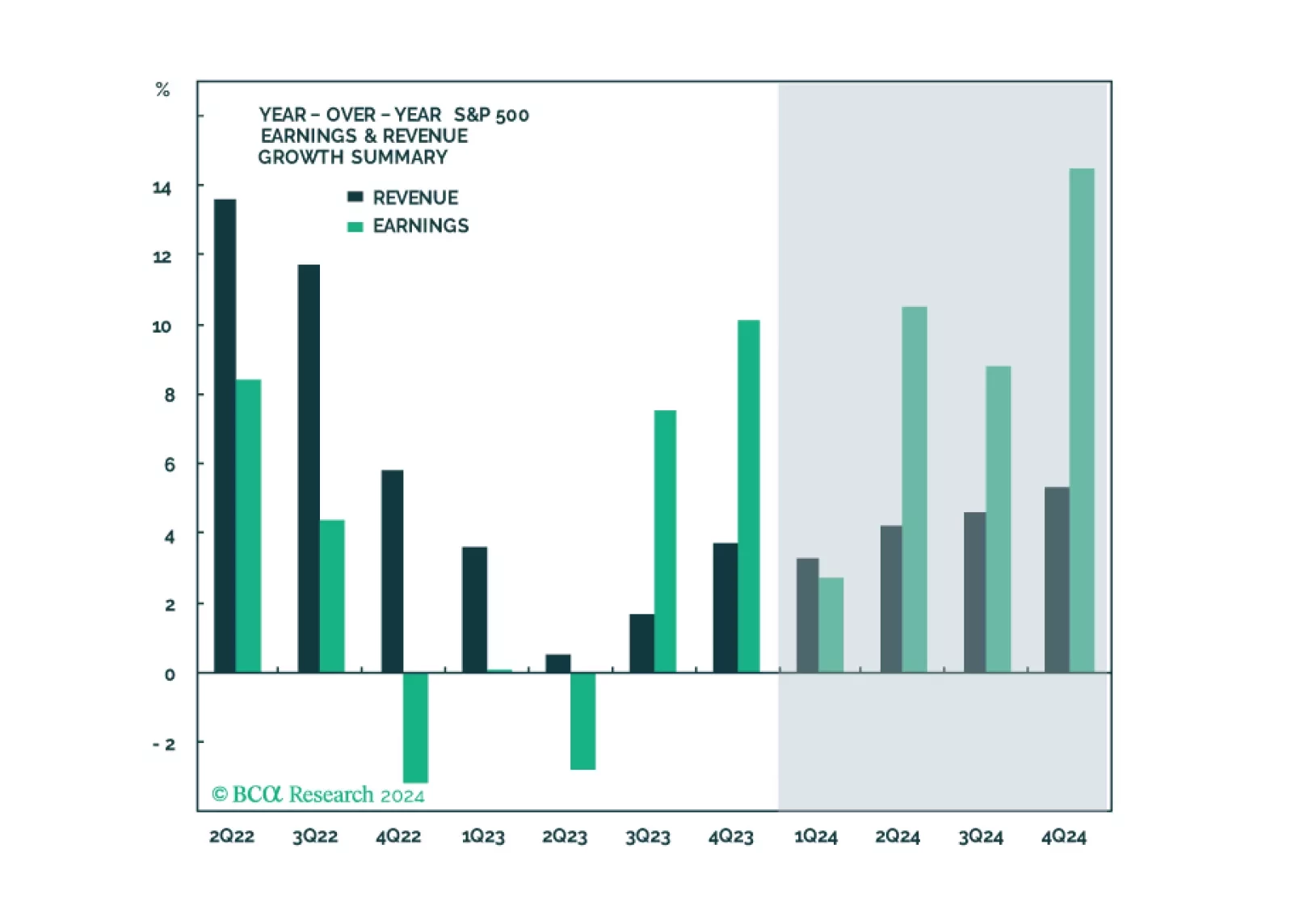

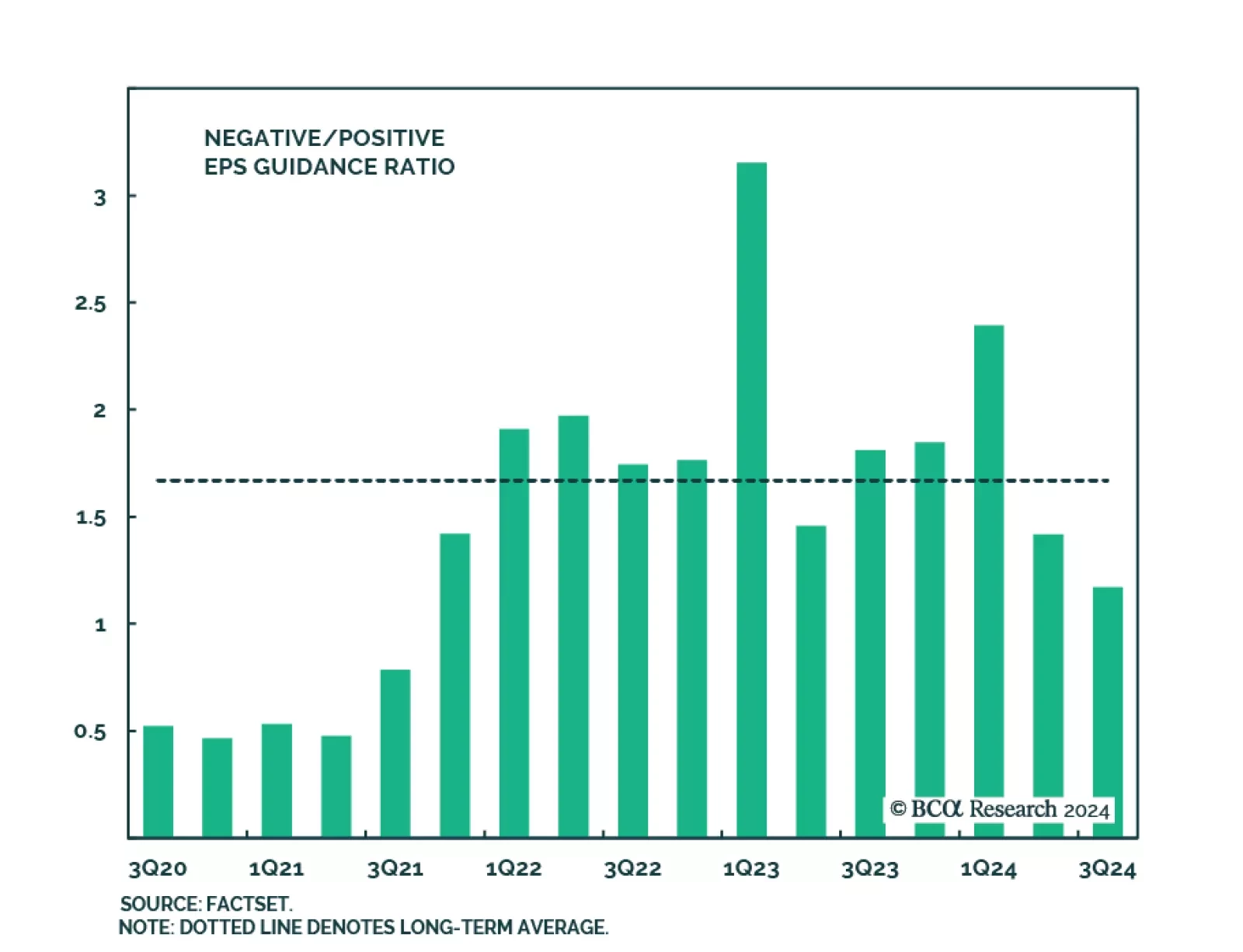

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

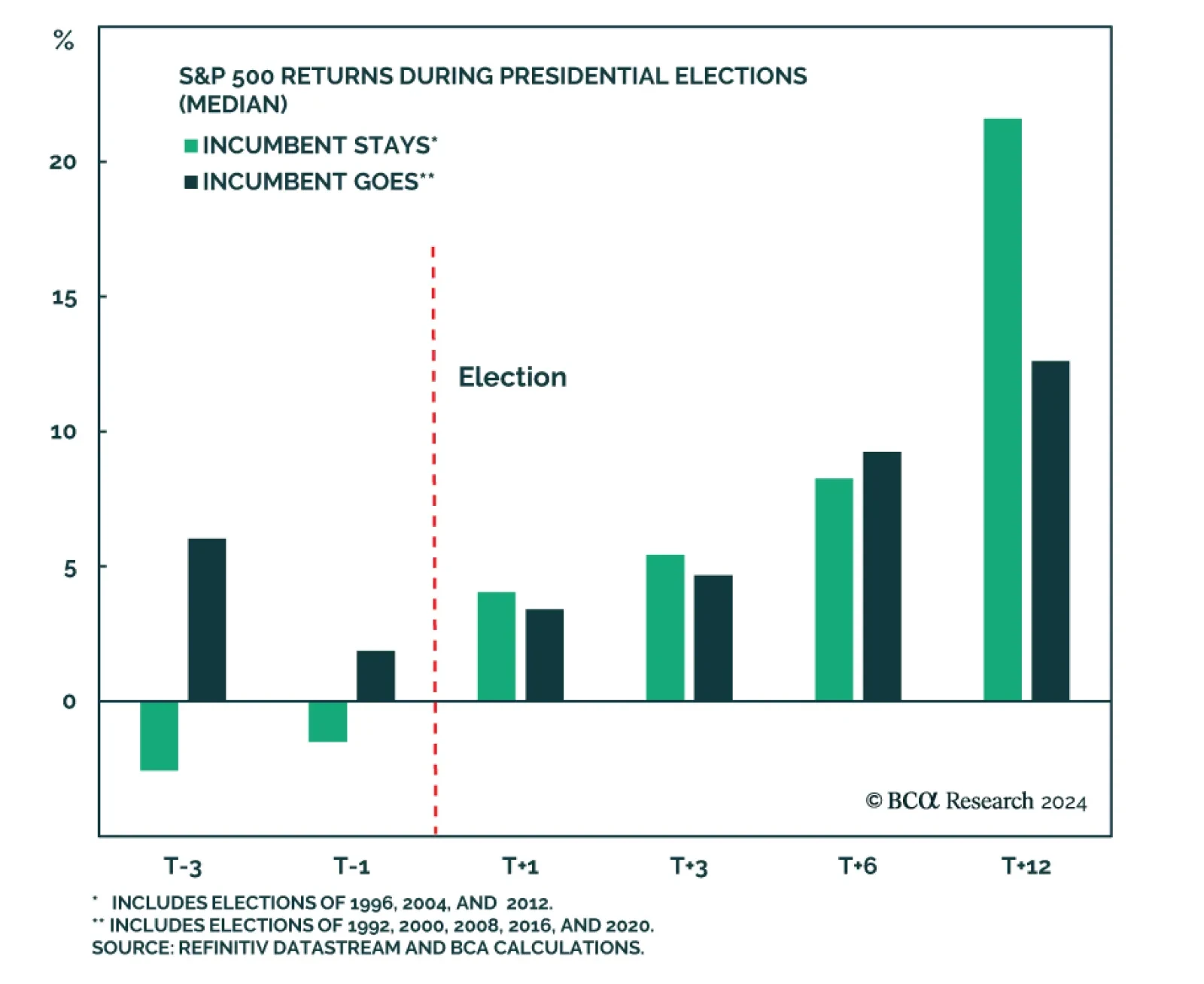

According to BCA Research’s US Political Strategy service, in the final months of an election cycle, equities underperform relative to non-election years. This extends further into Q1 of the following year due to…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

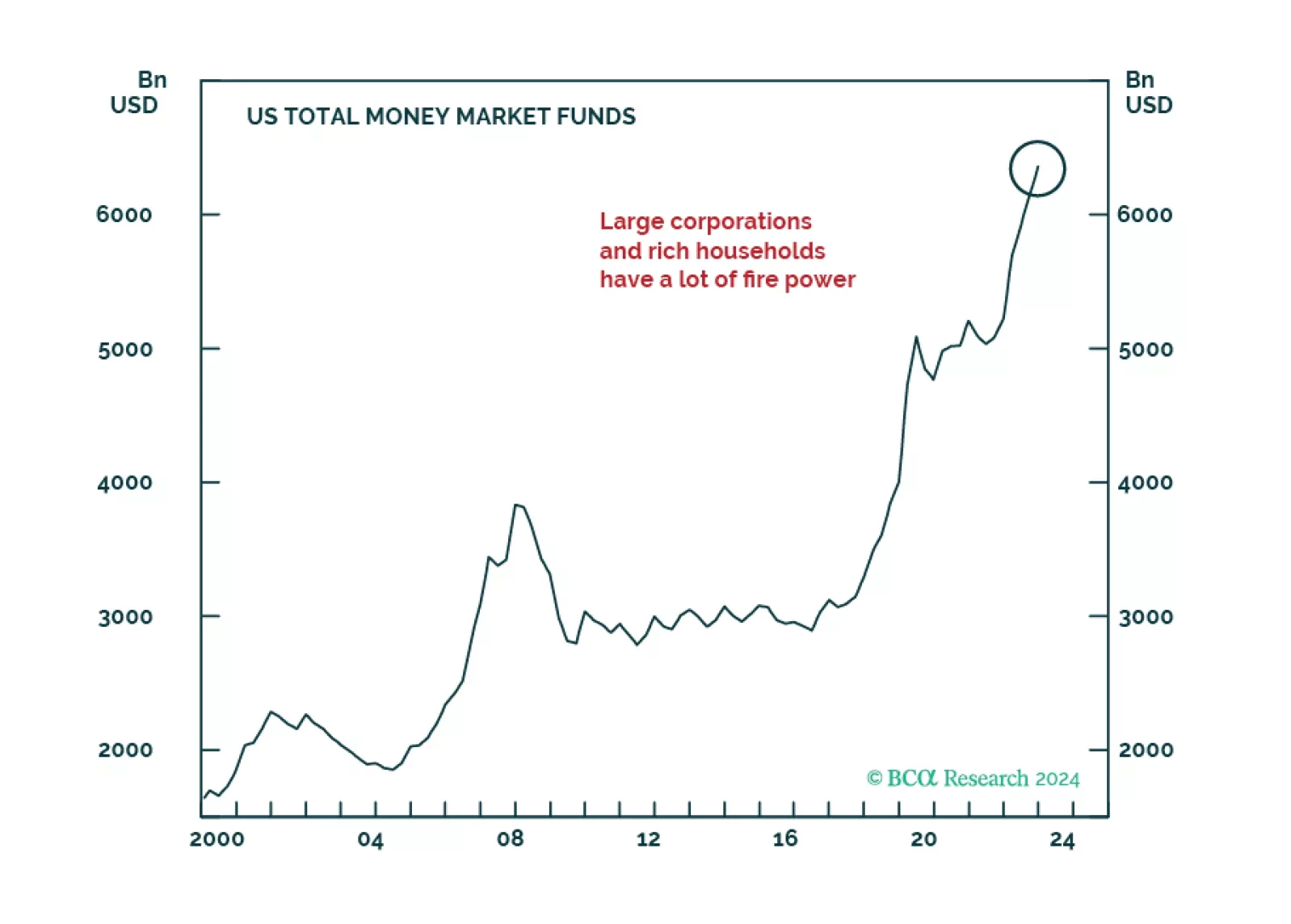

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

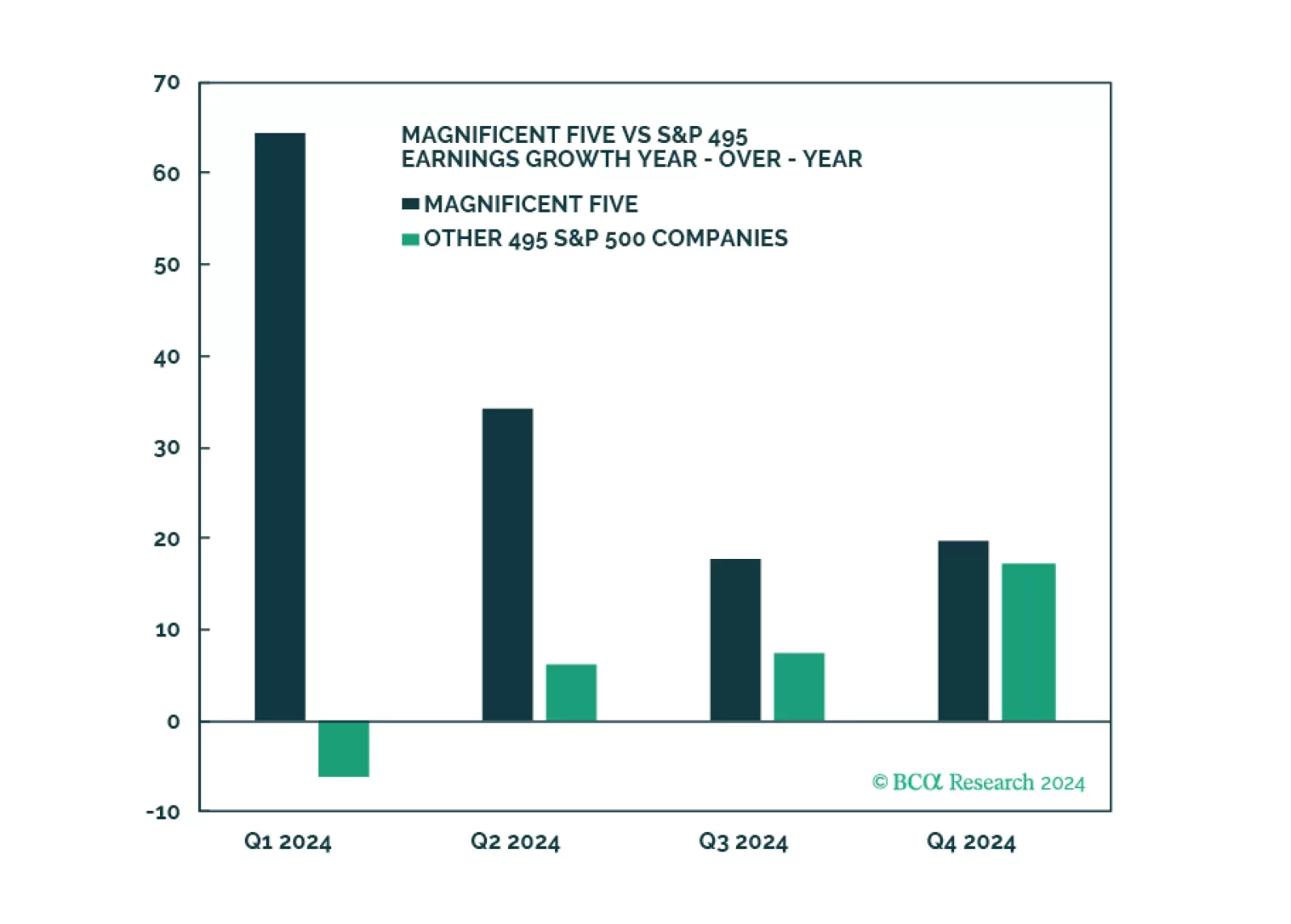

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

The broad market took a significant step backward in April, as market jitters gripped investors, stoking fears of higher for longer monetary policy. However, our roundtable investor poll has demonstrated that the majority remain…

In this note, we preview the Q1-2024 earnings season, give our take on expectations and share what we will be watching.

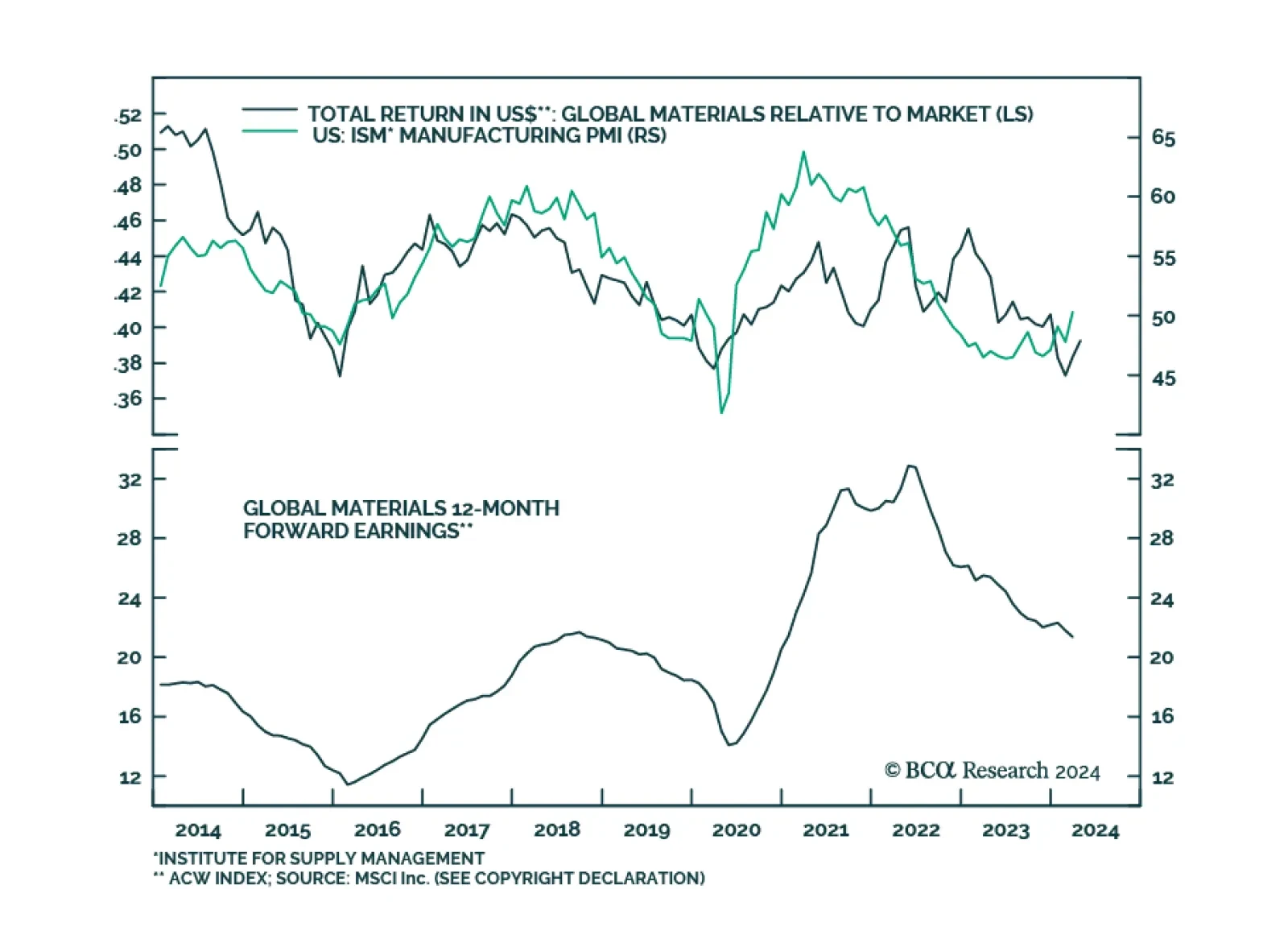

Global material stocks have underperformed over the past 12 months, returning only 11.3% vs 21.4% for the overall market. But could they be a buy now? There are several arguments to argue that they will: The ISM has…

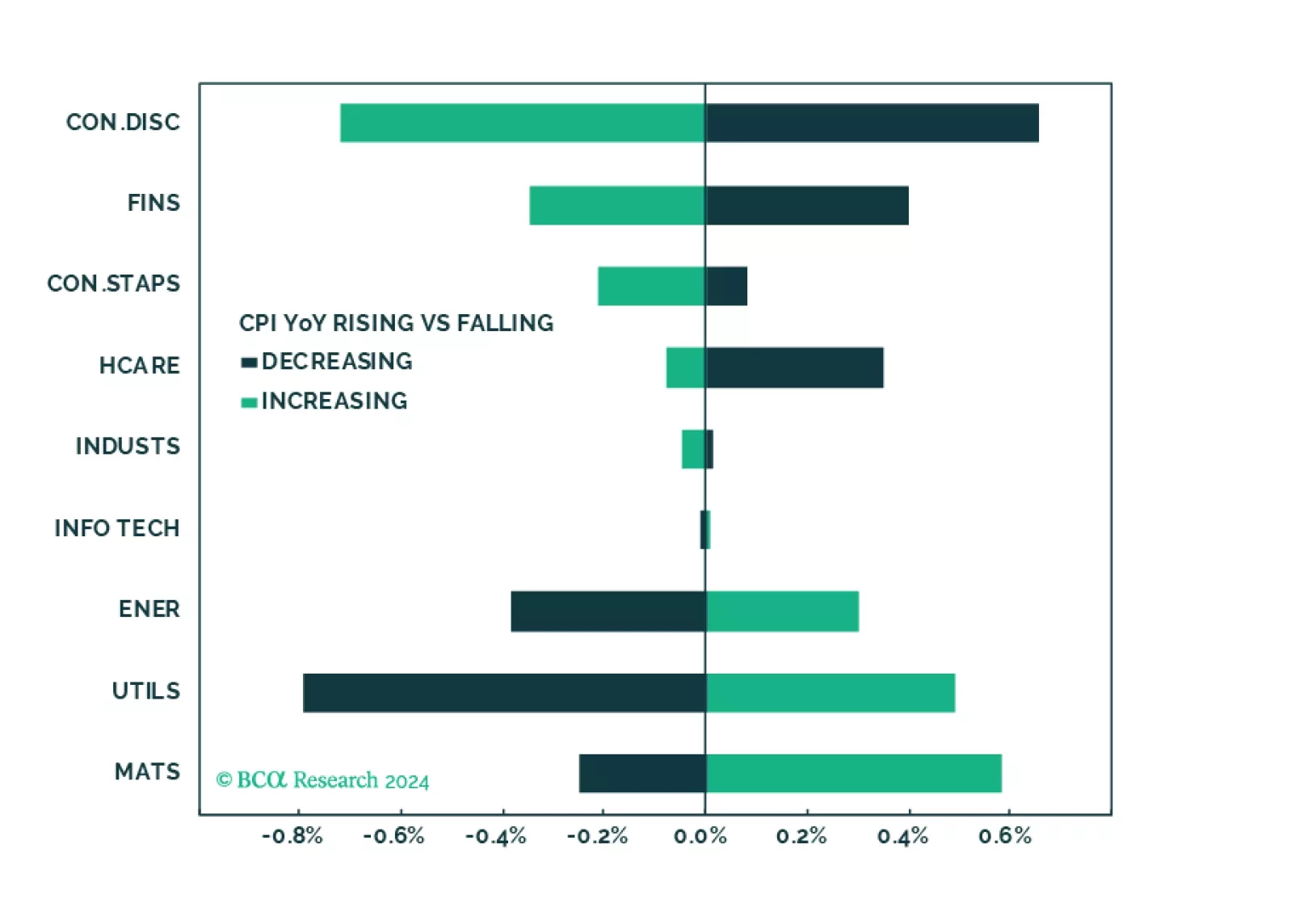

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…