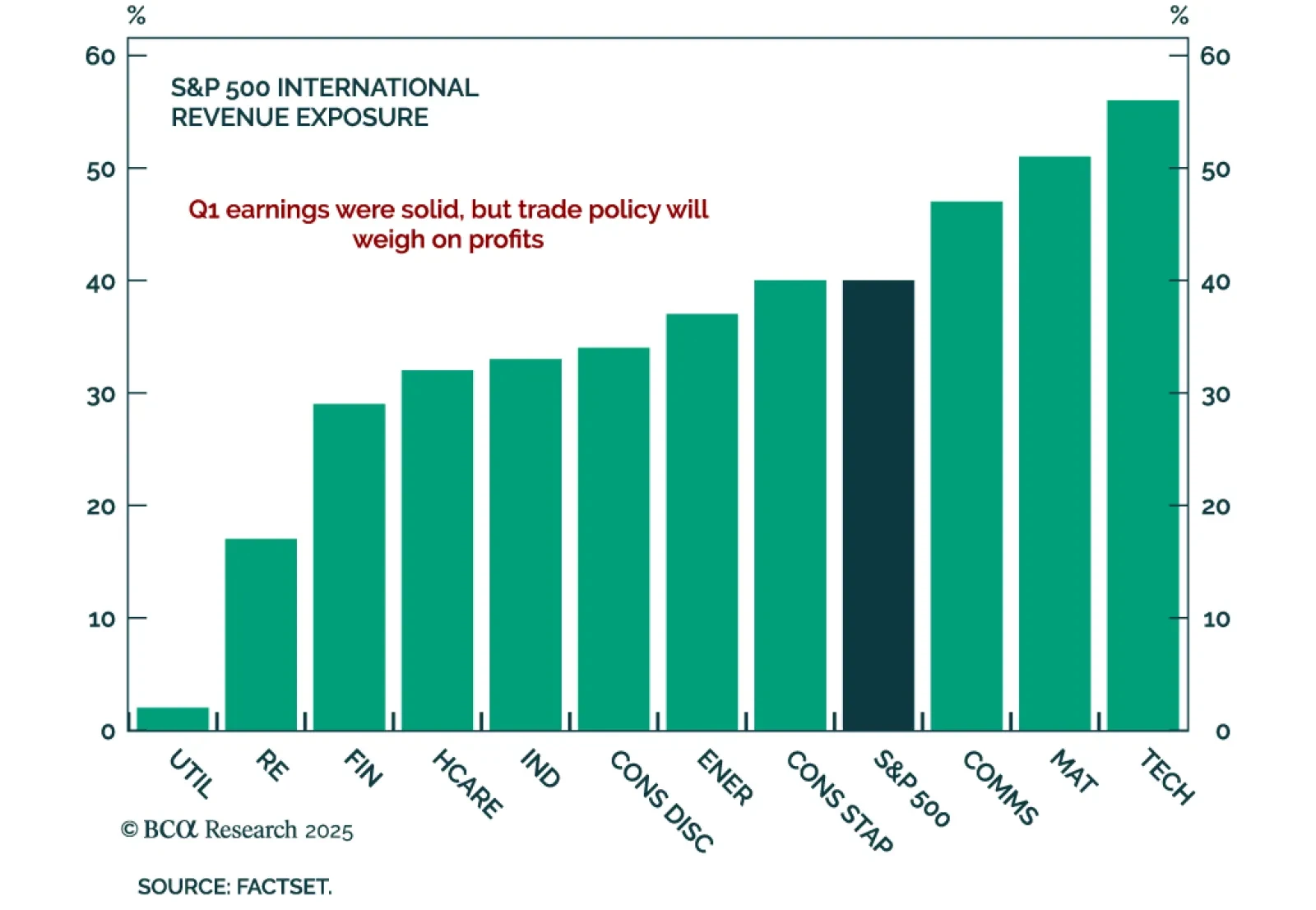

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

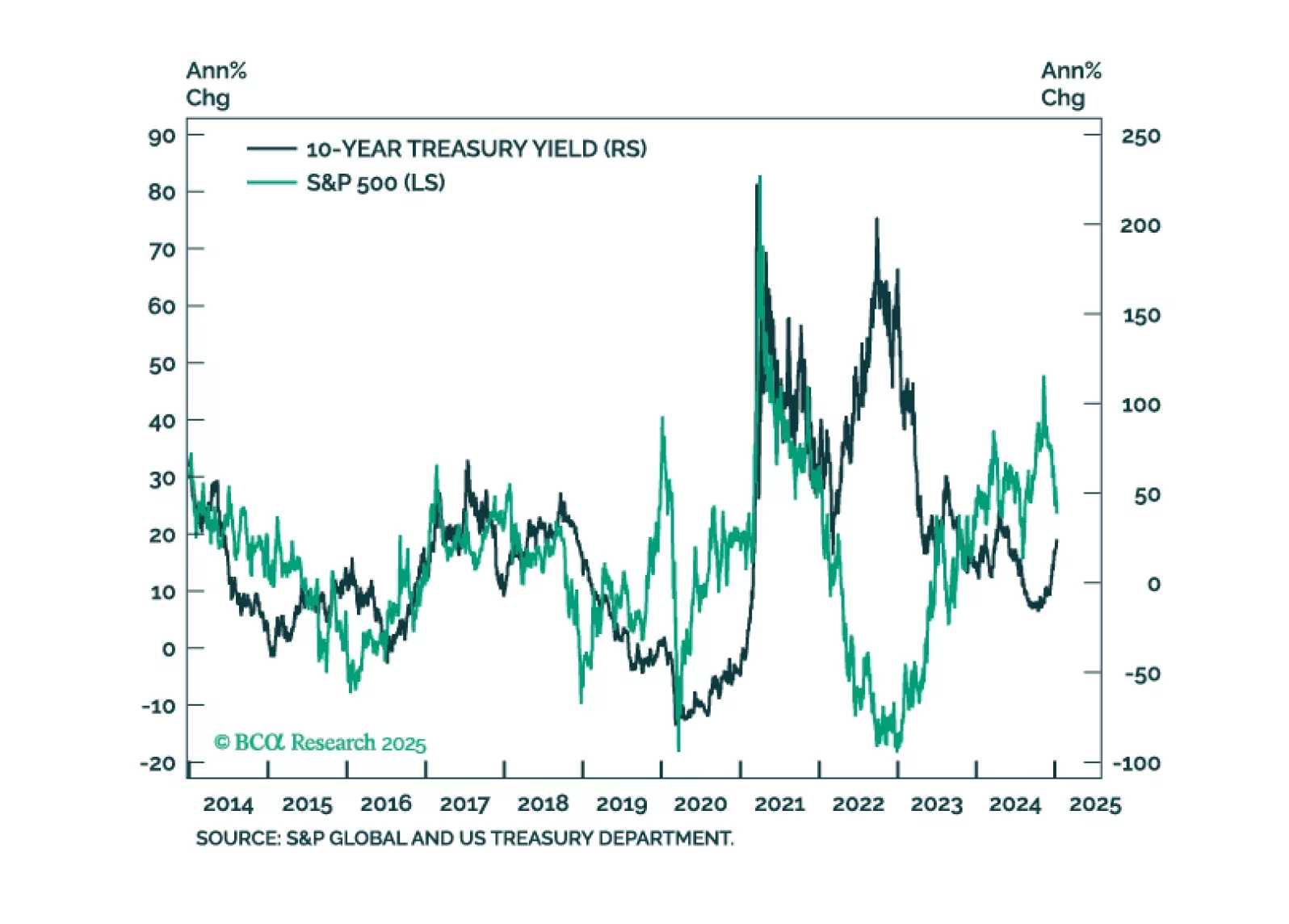

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…

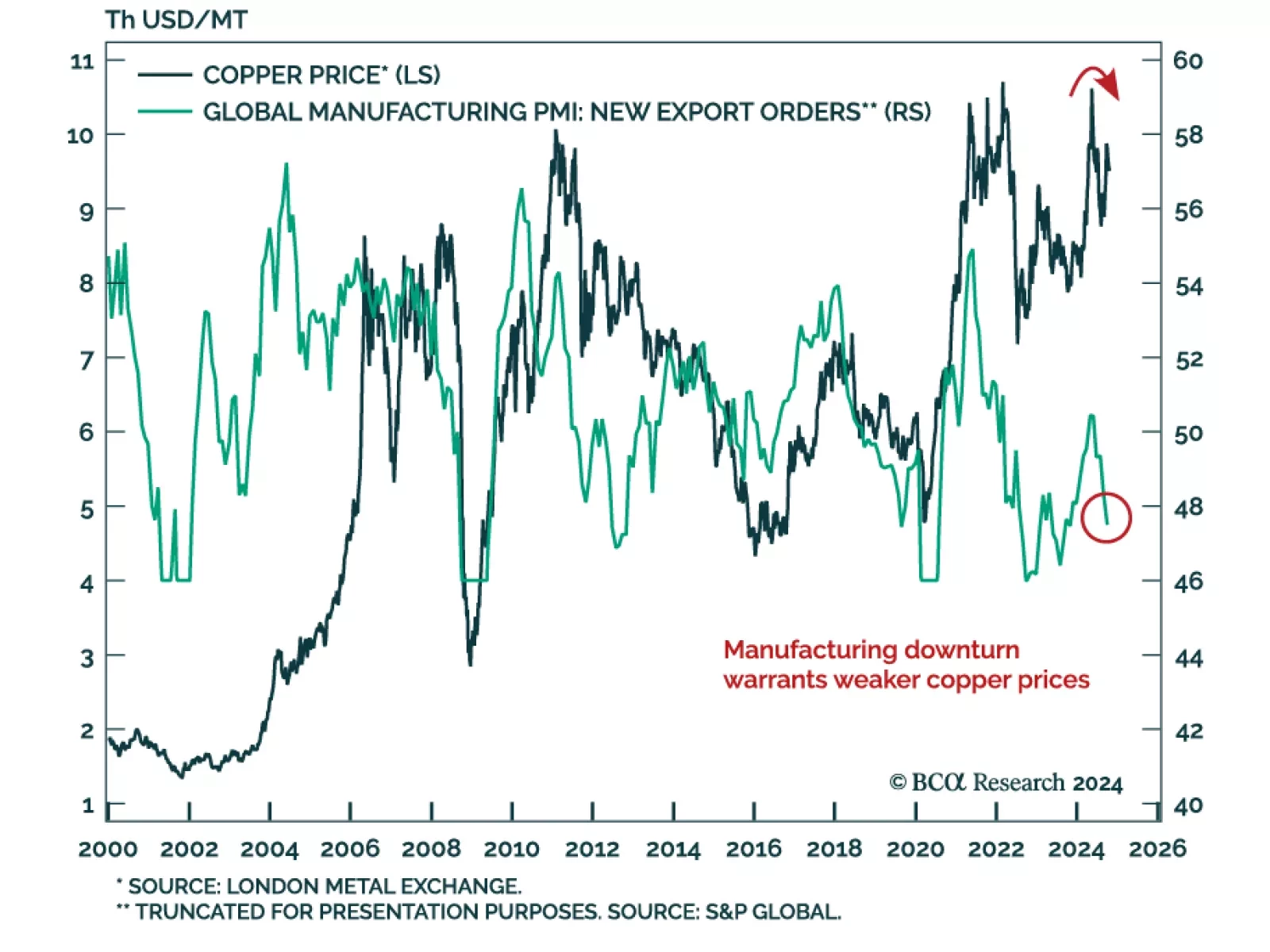

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…

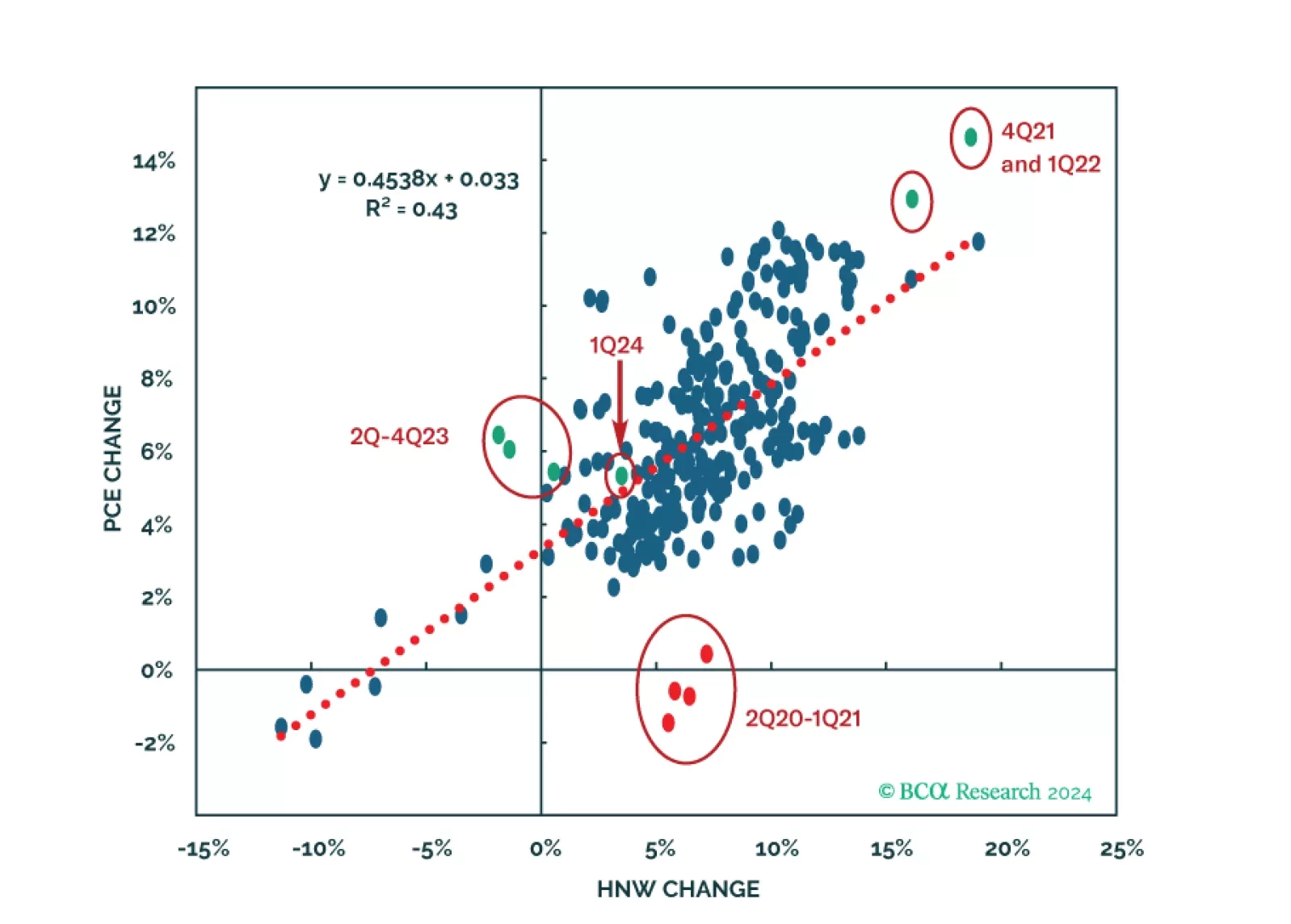

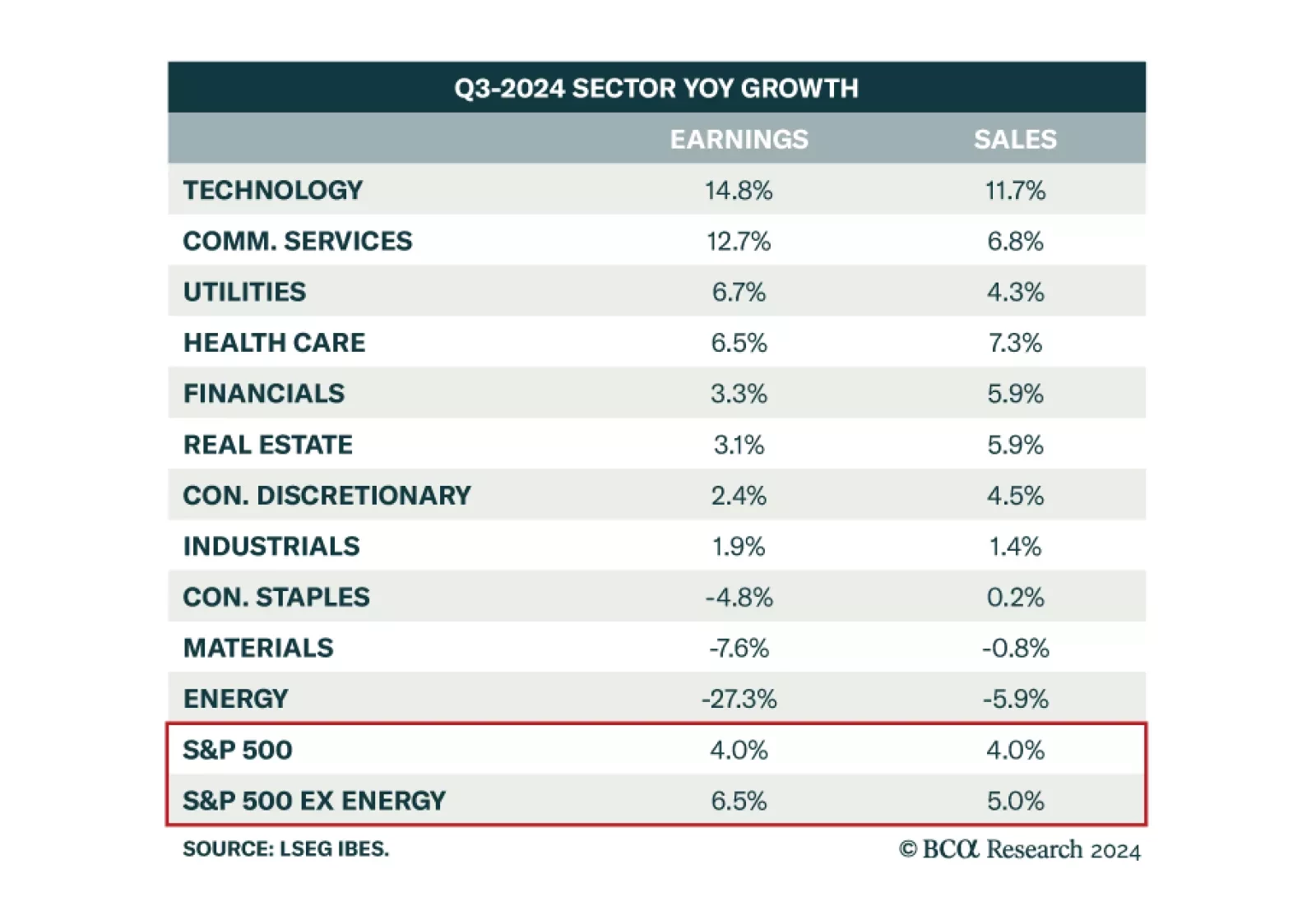

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…

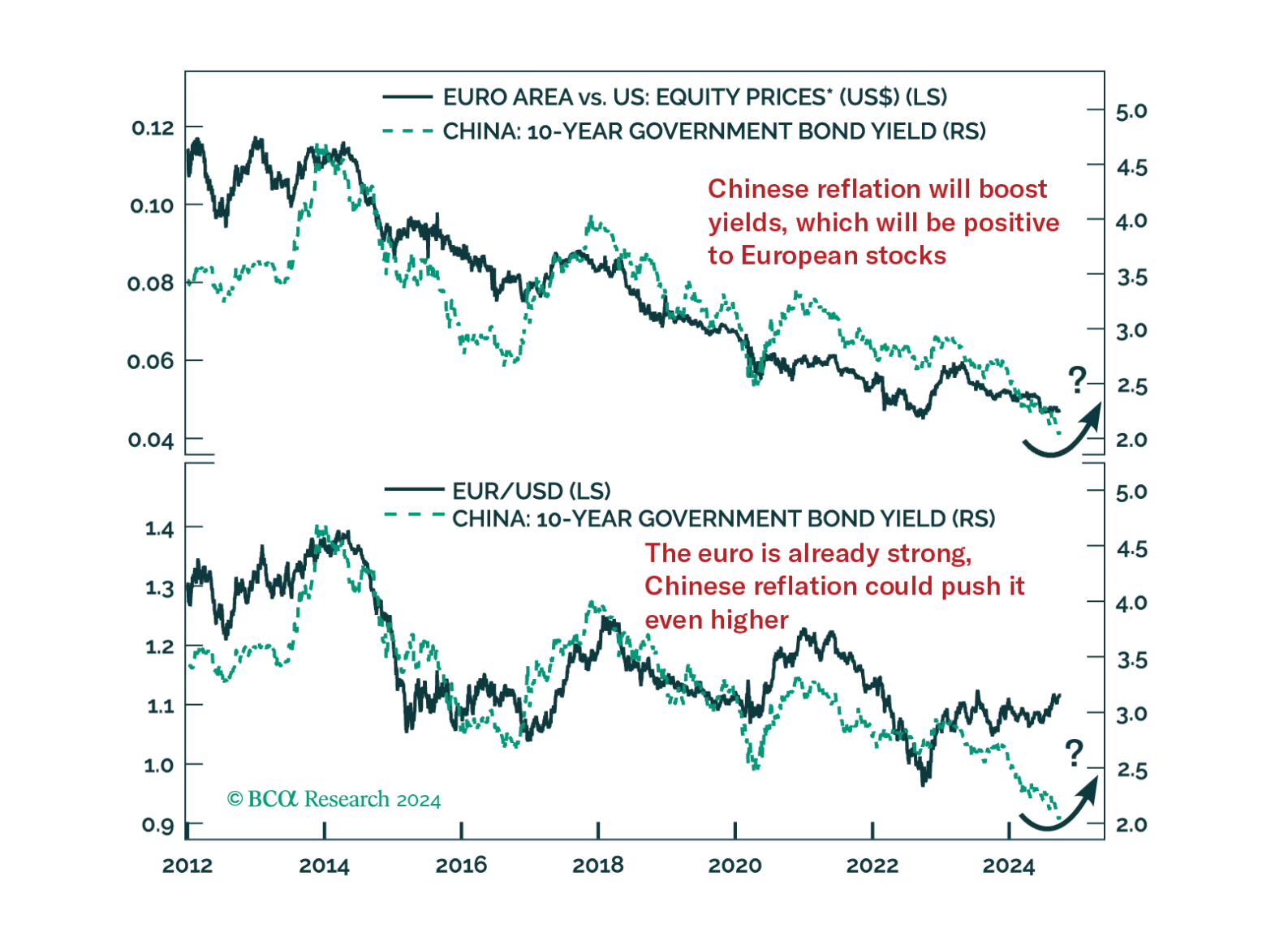

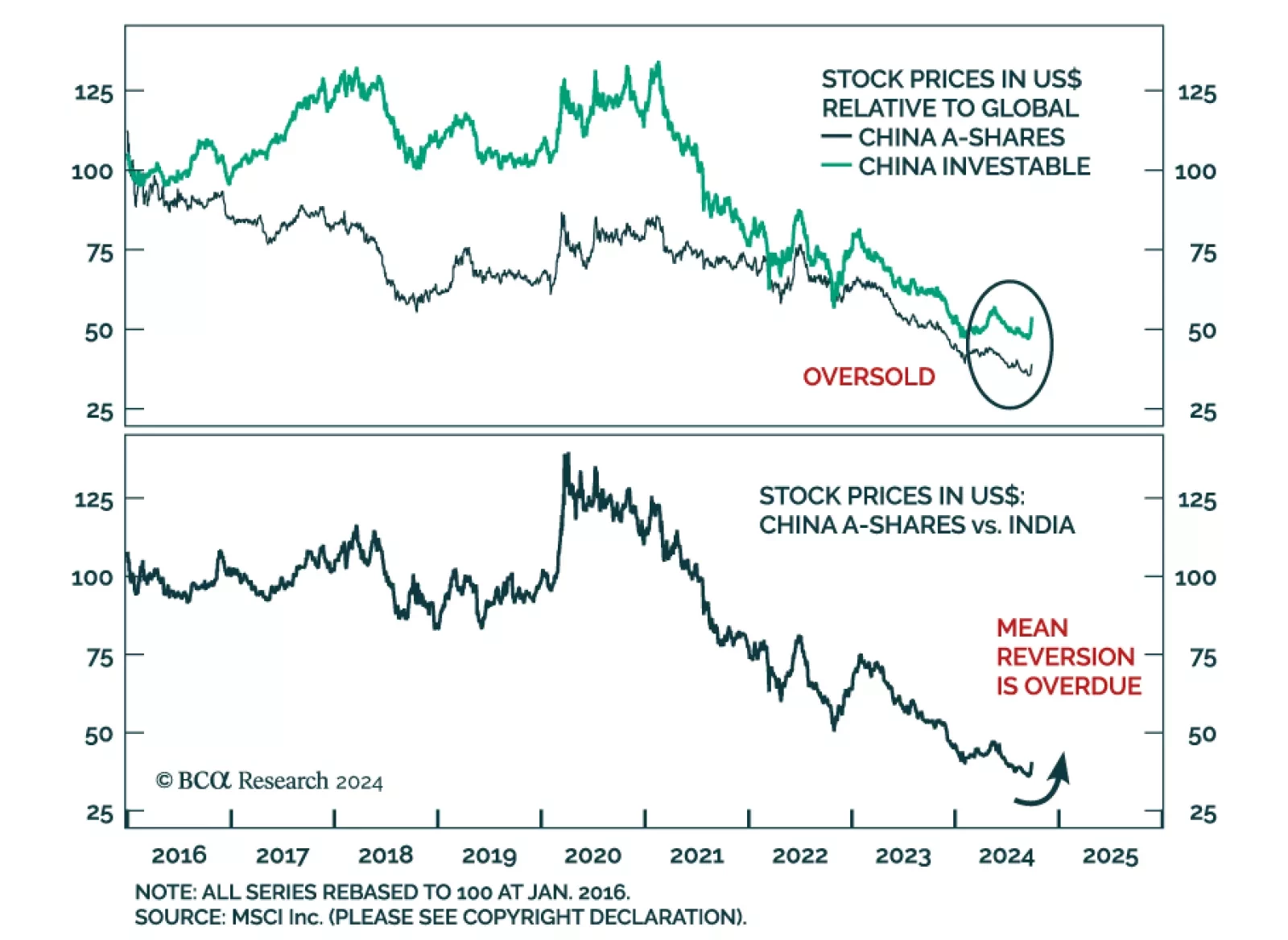

We highlighted last week that while the Politburo policy announcements are unlikely to produce a meaningful business cycle recovery in China, they nevertheless administered a shot of adrenaline to investor sentiment. Chinese…

China’s Politburo announcement is likely to lead to a repricing of China’s growth in the near-term. Read how investors can hedge against this potent threat to our defensive investment stance.

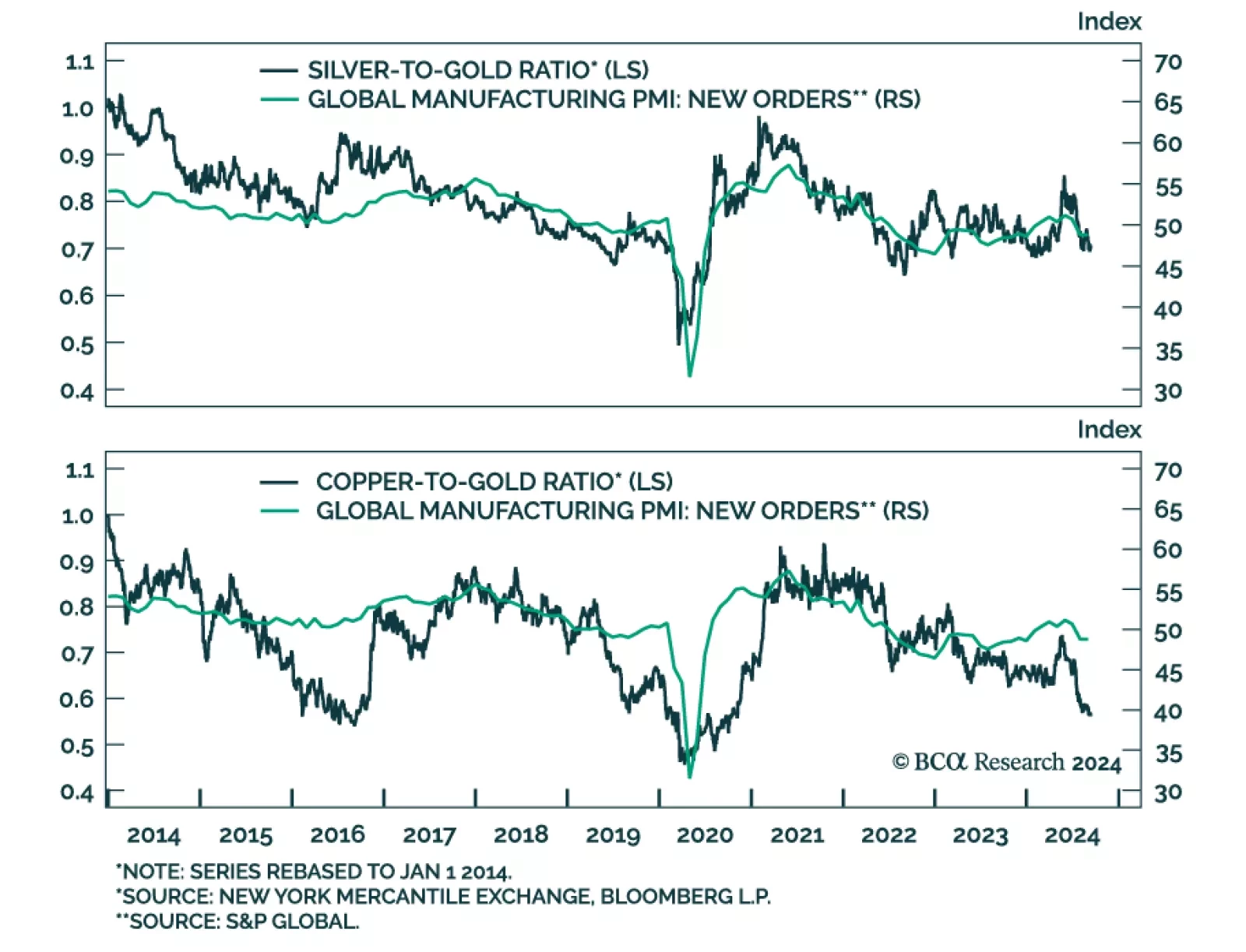

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

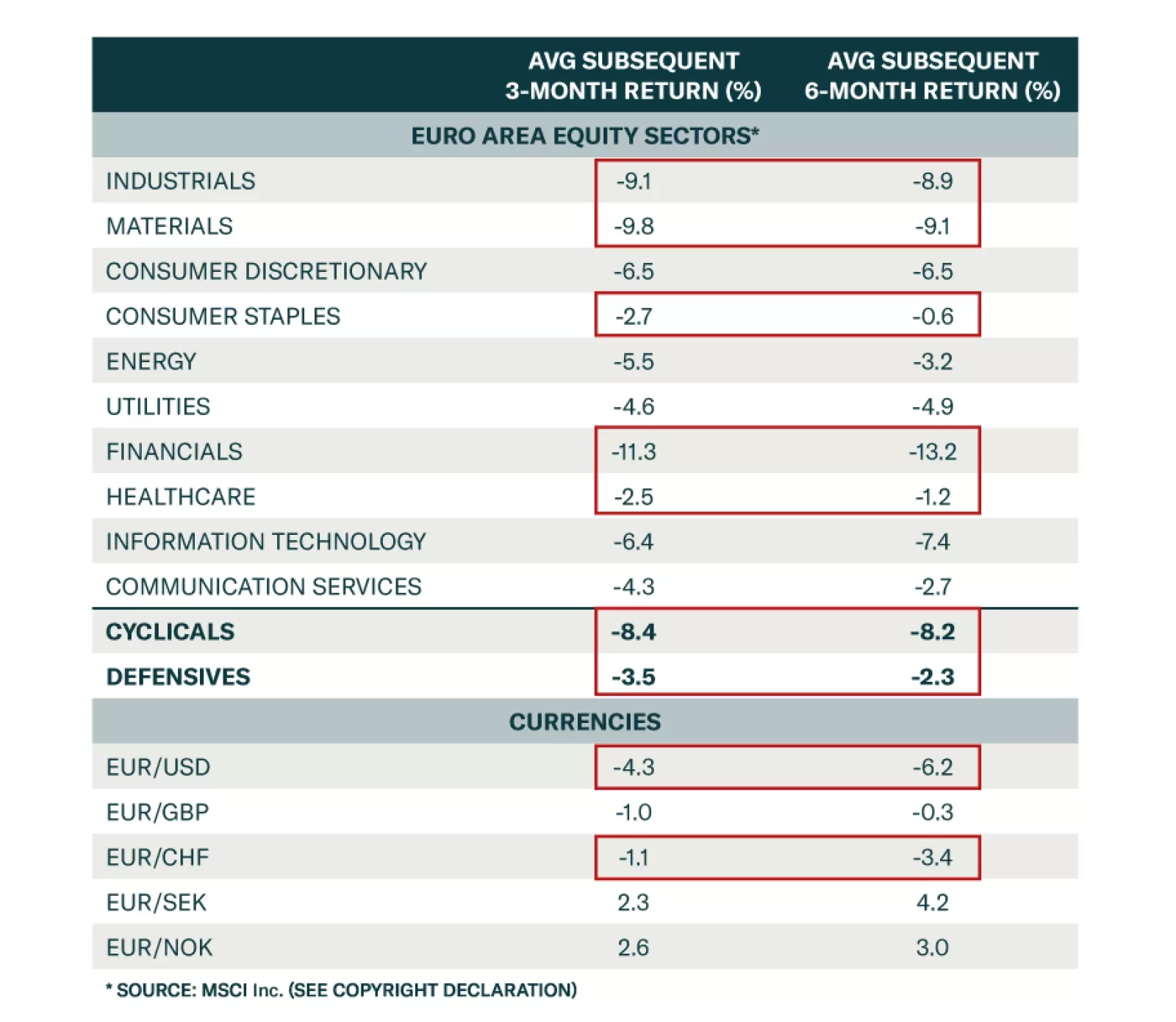

BCA Research’s European Investment strategists looked at previous episodes of carry-trade blowups and assessed the performance of the Eurozone’s key sectors, national markets, and currencies three and six months…