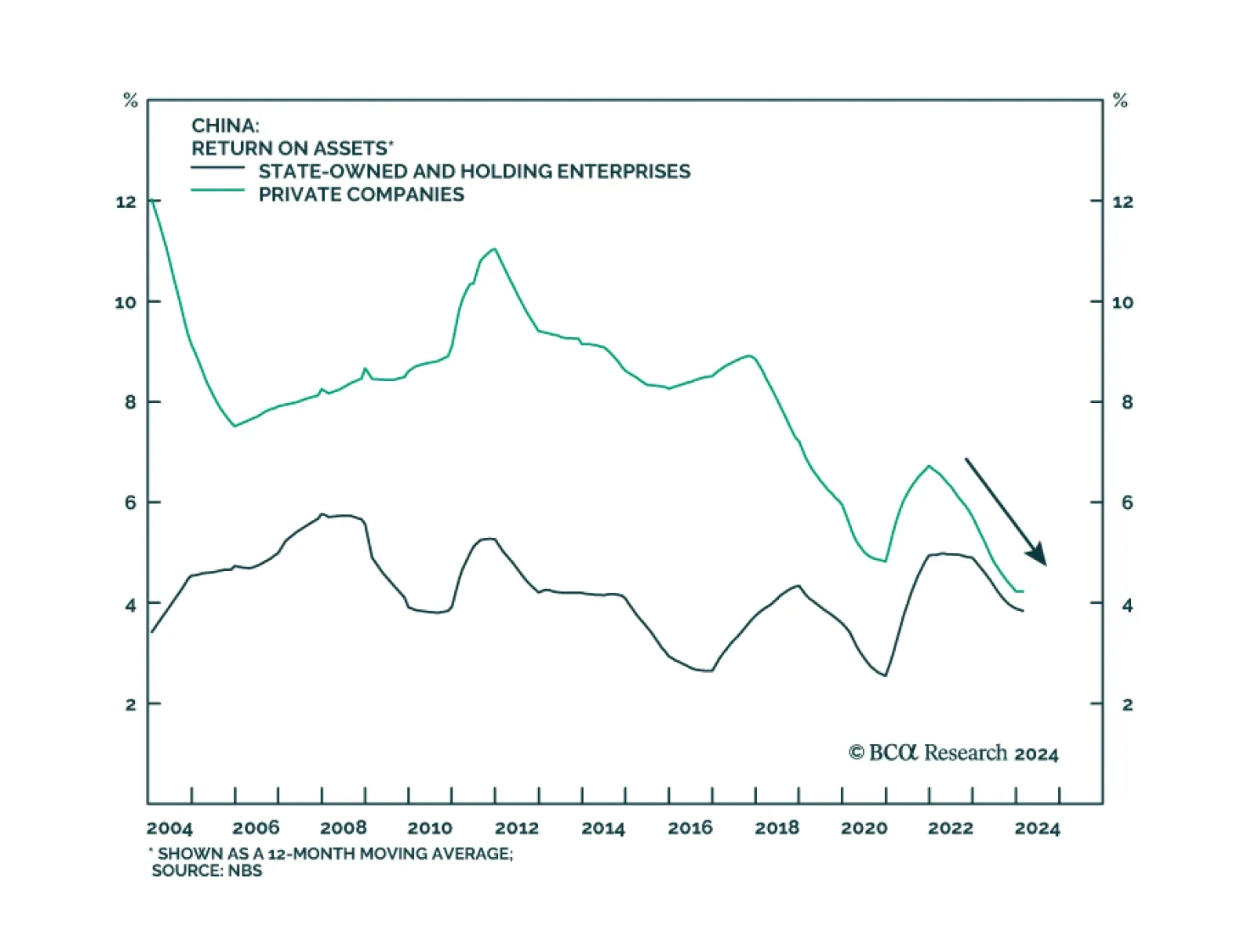

Though hope springs eternal among global investors for big-bang stimulus from Beijing, the closely watched Third Plenum adjourned without any specific prescriptions to reverse China’s economic slump. The communiqu…

Marko Papic, a pioneer in using geopolitics as an essential component of investment strategy, has returned to BCA, where he founded Geopolitical Strategy, the world’s first dedicated investment consultancy focused on…

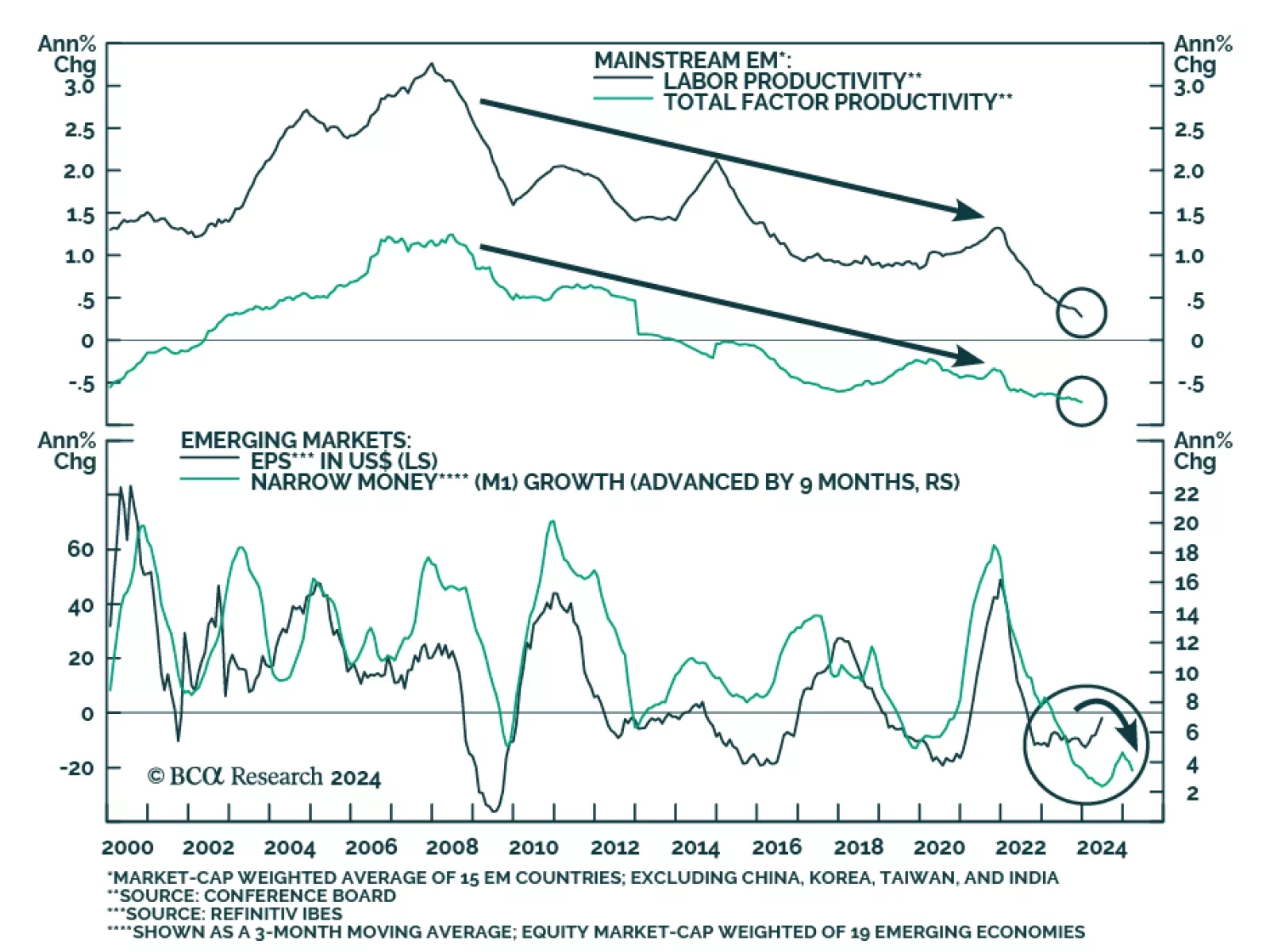

According to BCA Research’s Emerging Markets Strategy service, extremely disappointing corporate profit growth has been the main reason for EM's poor equity performance in absolute terms and massive underperformance…

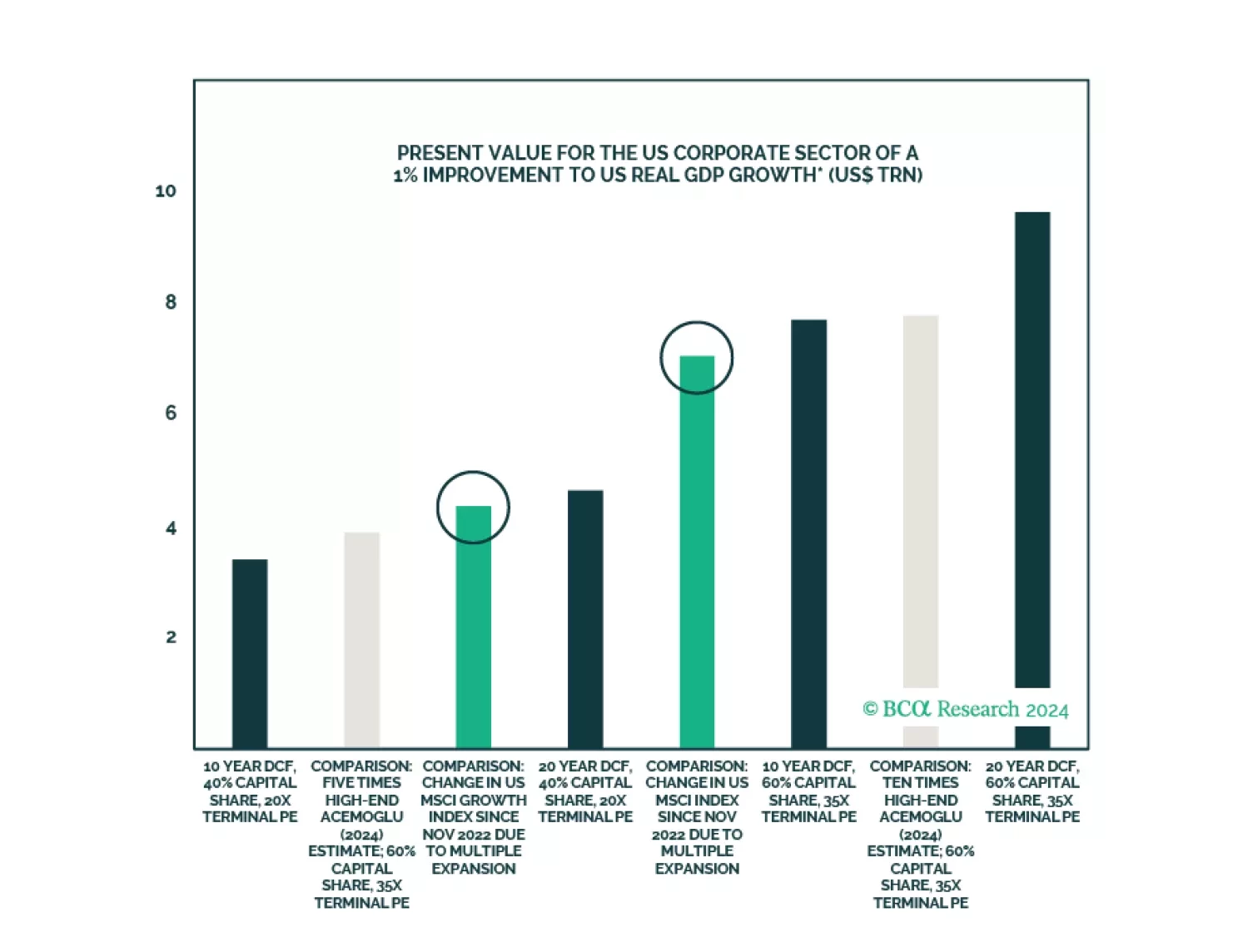

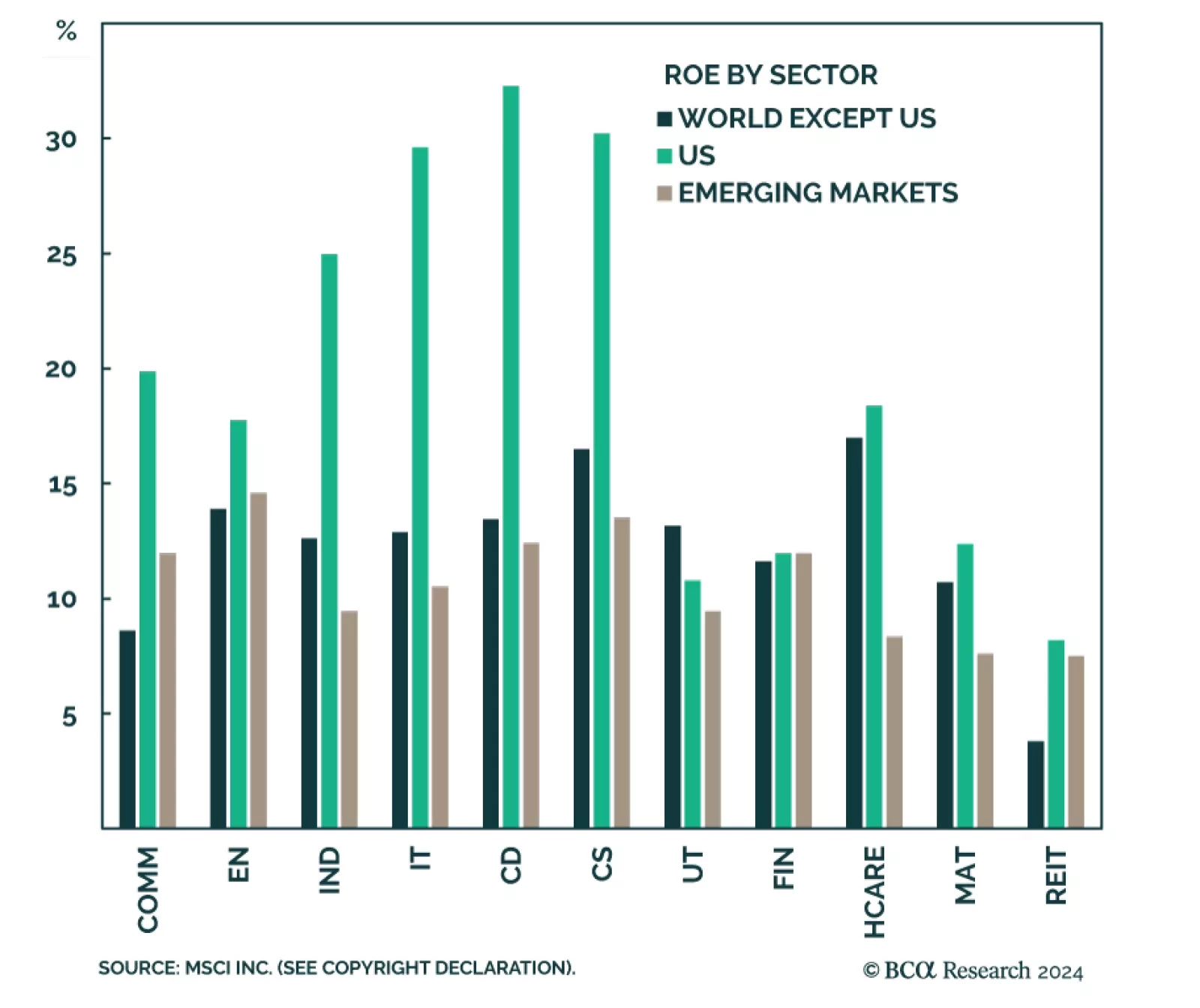

According to BCA Research’s US Equity Strategy service, post-GFC US equity outperformance can be attributed to a perfect storm of advantageous policies and a human capital edge. The topic of American exceptionalism is…

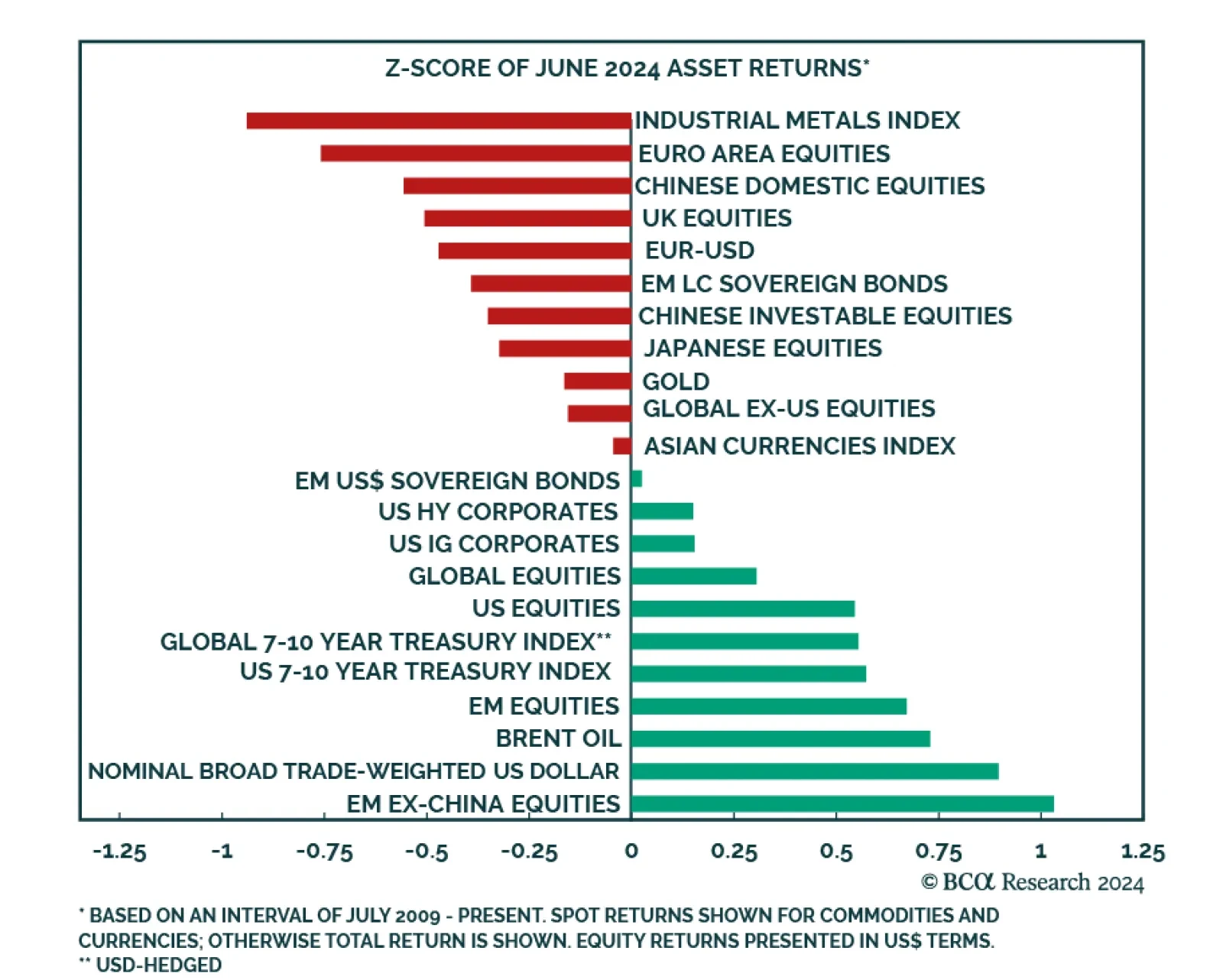

The risk-on soft-landing narrative dominated US markets in June. US equities continued their tech-led gains while lower yields sent Treasuries higher. US spread product also ended the month in the green. Outside the US,…

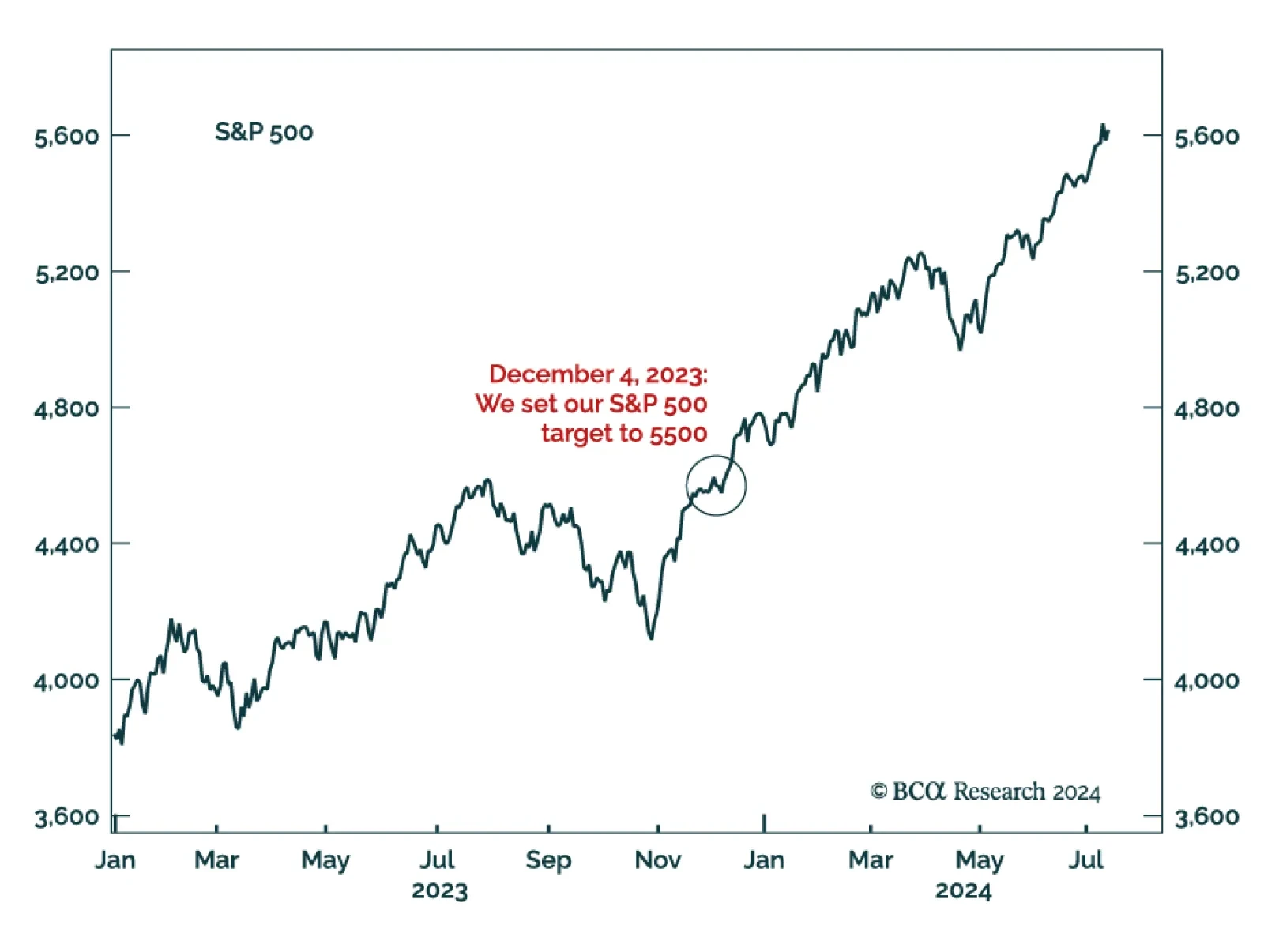

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

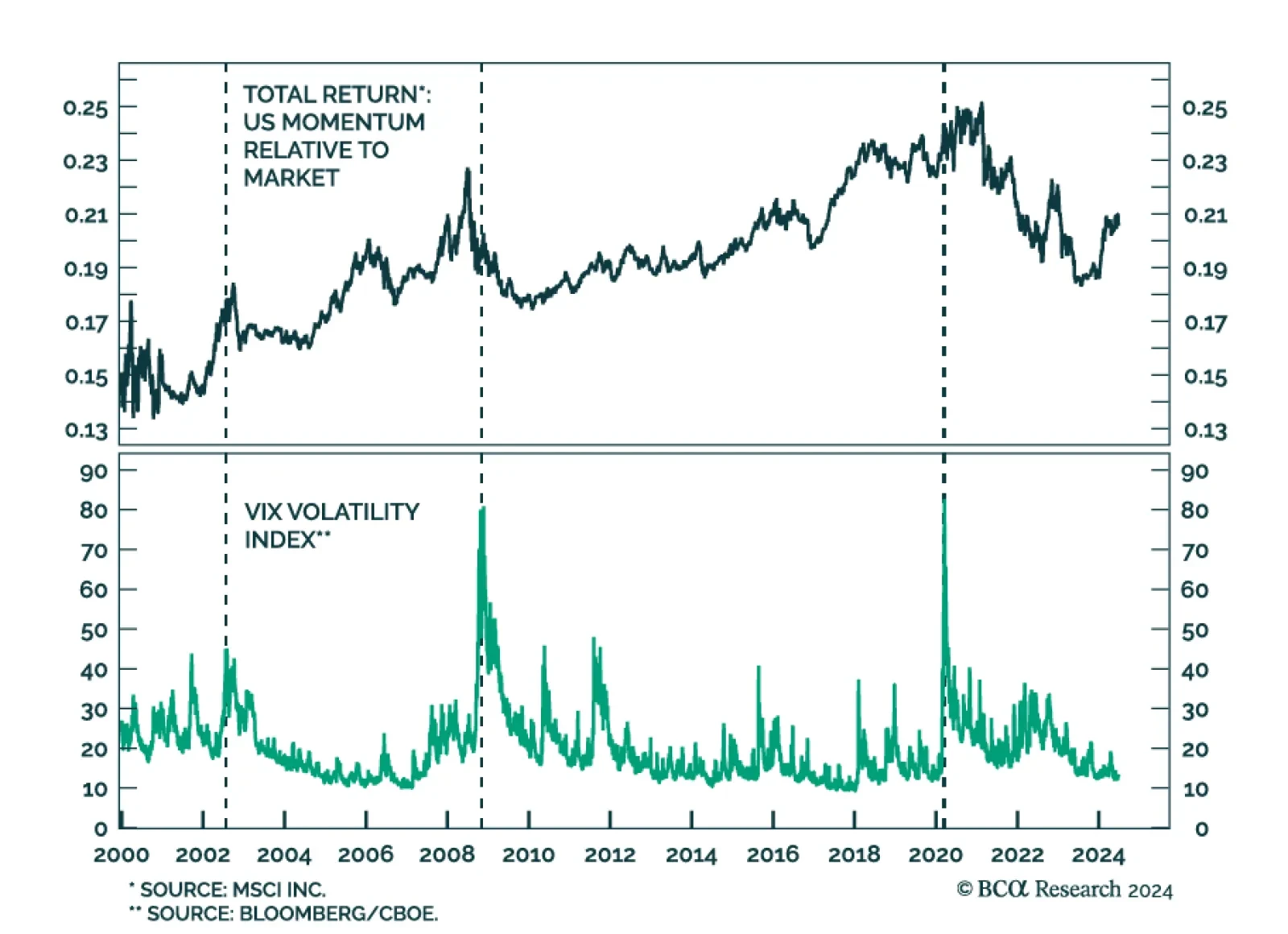

Volatility is usually a poor predictor of stock returns. It has no leading properties on the overall equity market. High volatility is contemporaneous with big drawdowns, while low volatility is contemporaneous with bull markets…

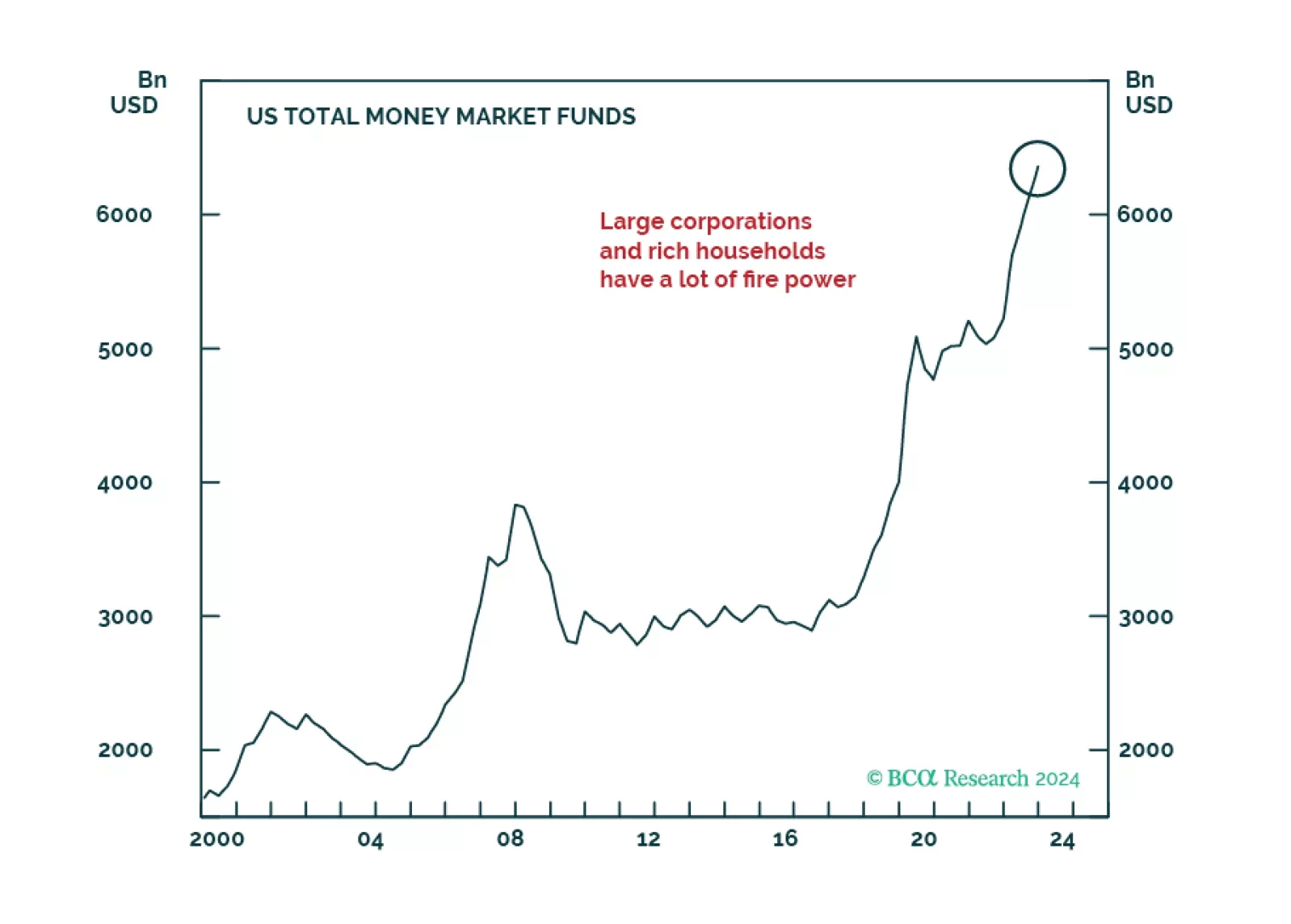

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…