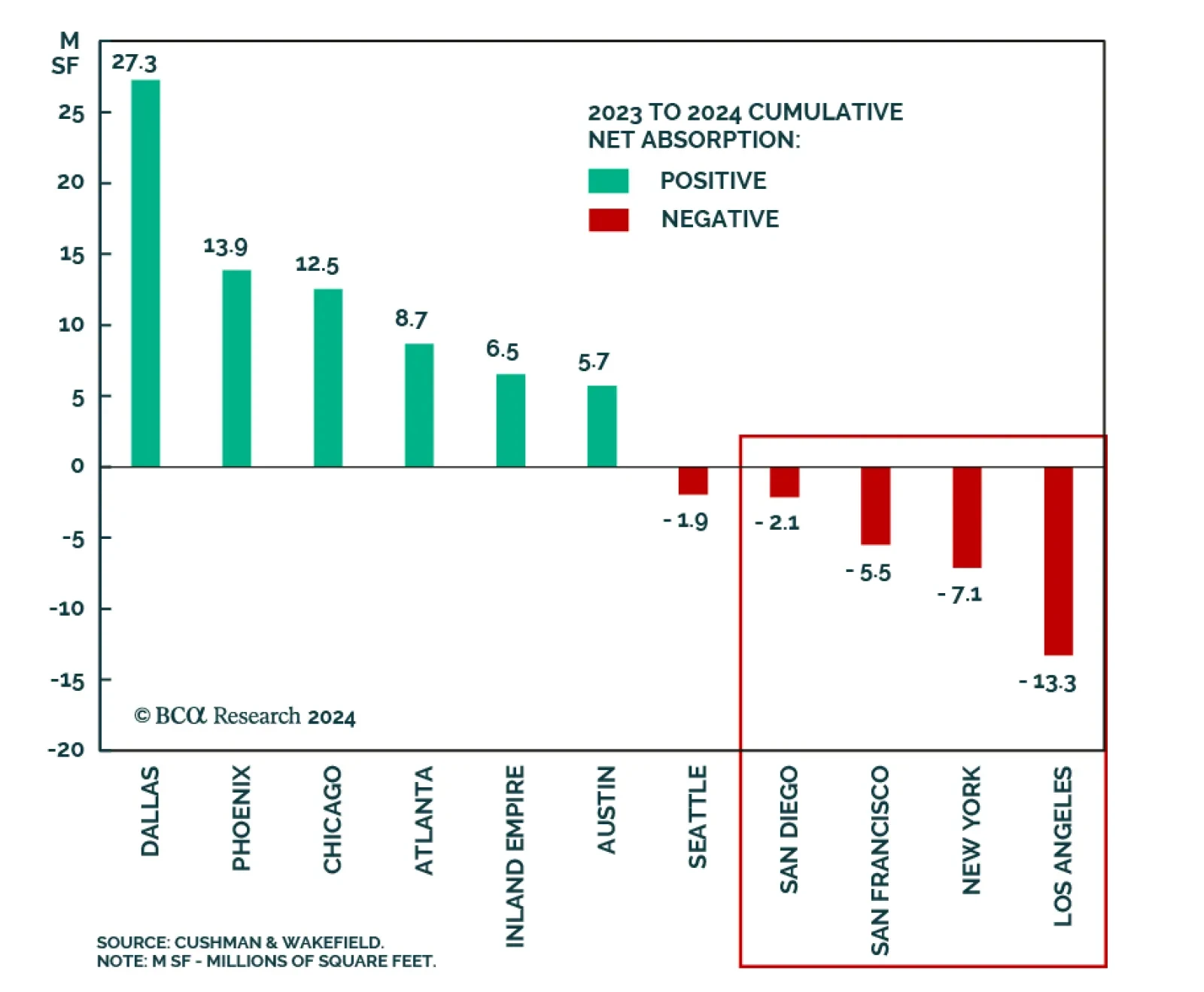

According to BCA Research’s Private Markets & Alternatives service, intra-market repricing will offer investors a unique opportunity to enter the industrial real estate space in the next two years. In the short…

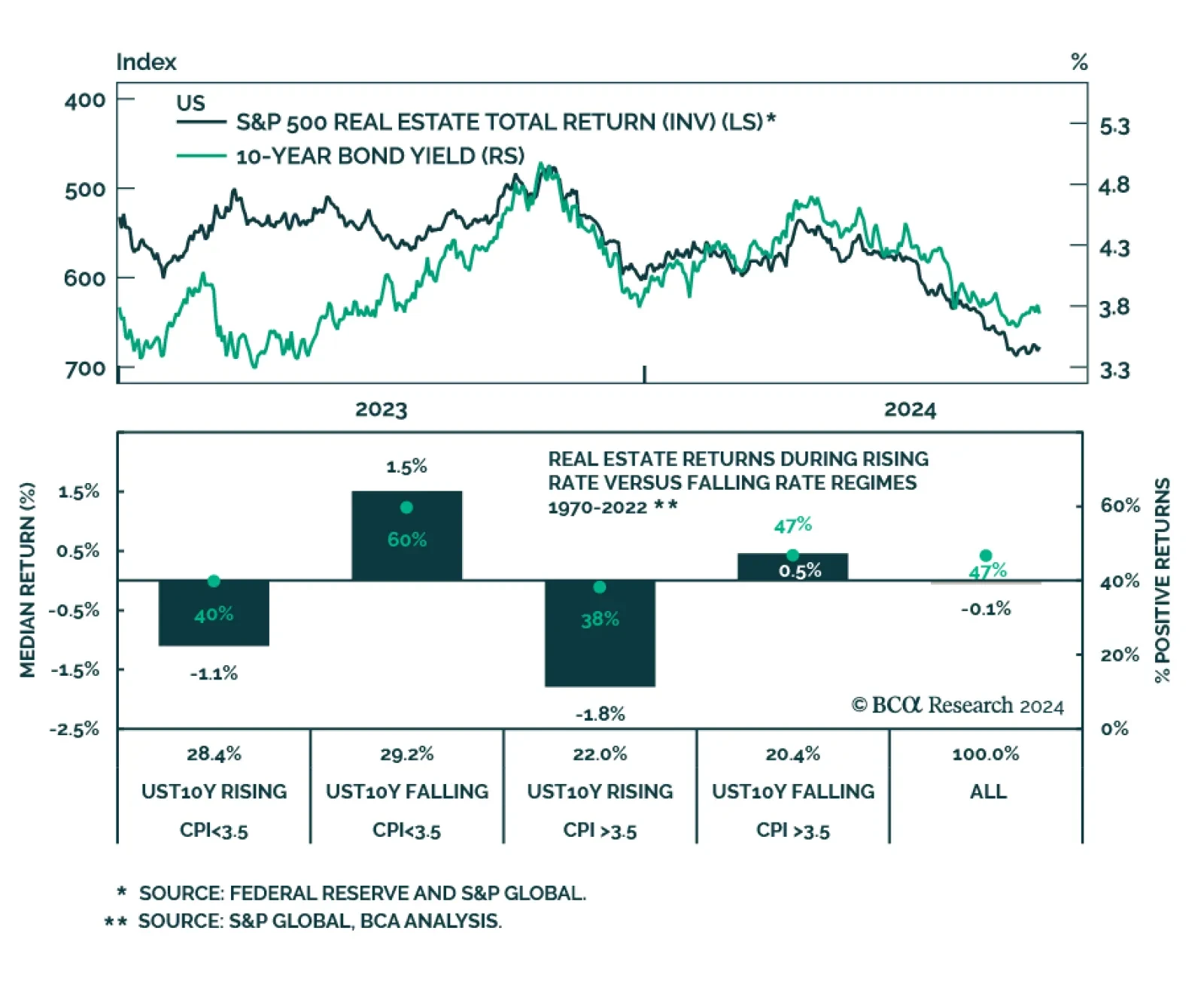

The prospects of Fed rate cuts powered the S&P 500 Real Estate index’s rally. Real estate was the best-performing sector in Q3, outperforming the S&P 500 by nearly 12%. Can this sector pursue its lead now that…

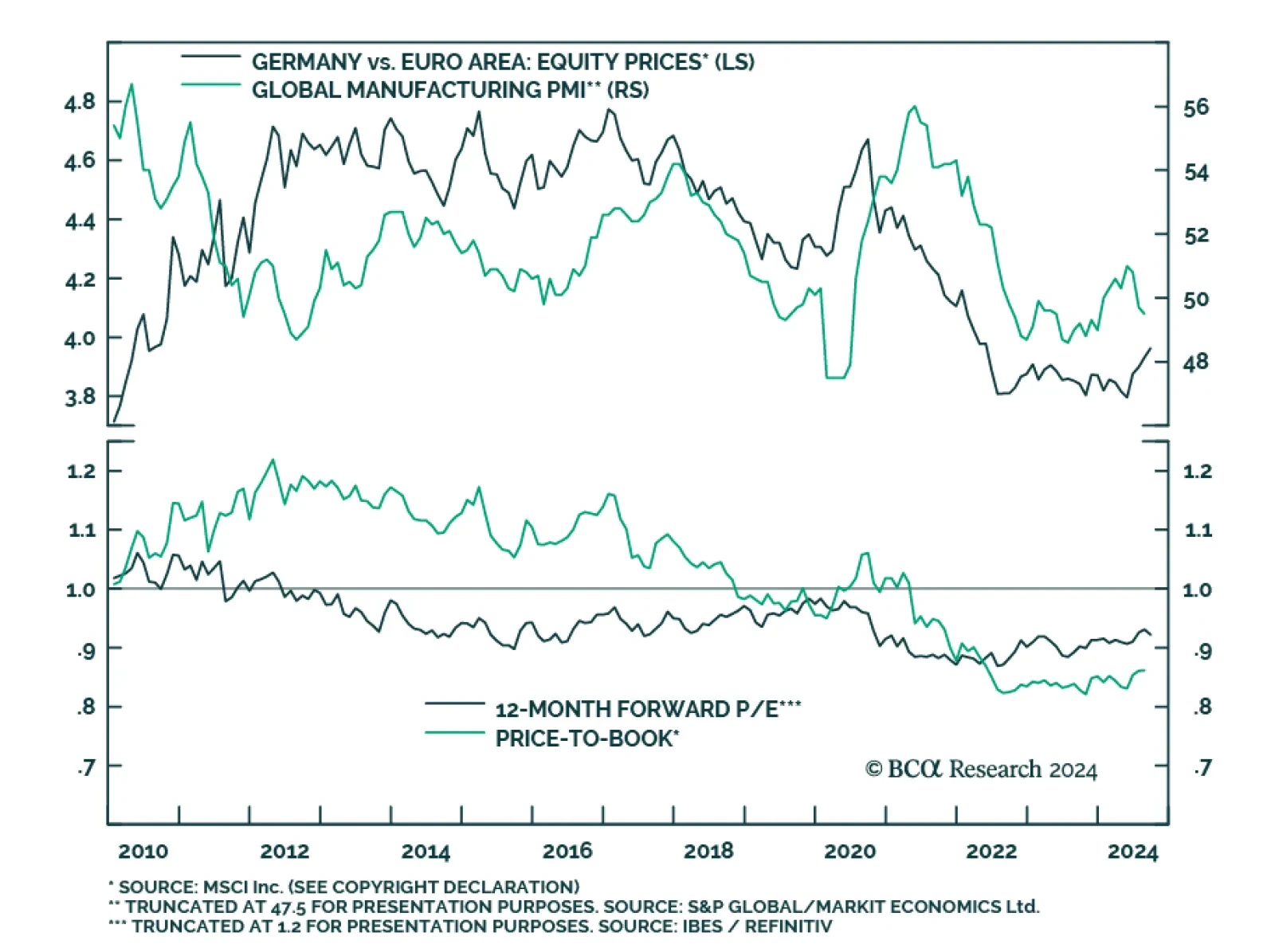

German equities have outperformed their Euro Area peers on a year-to-date basis, with the gap widening since May. The MSCI Germany Index returned nearly 4.5 percentage points more than the MSCI Eurozone index over the latter…

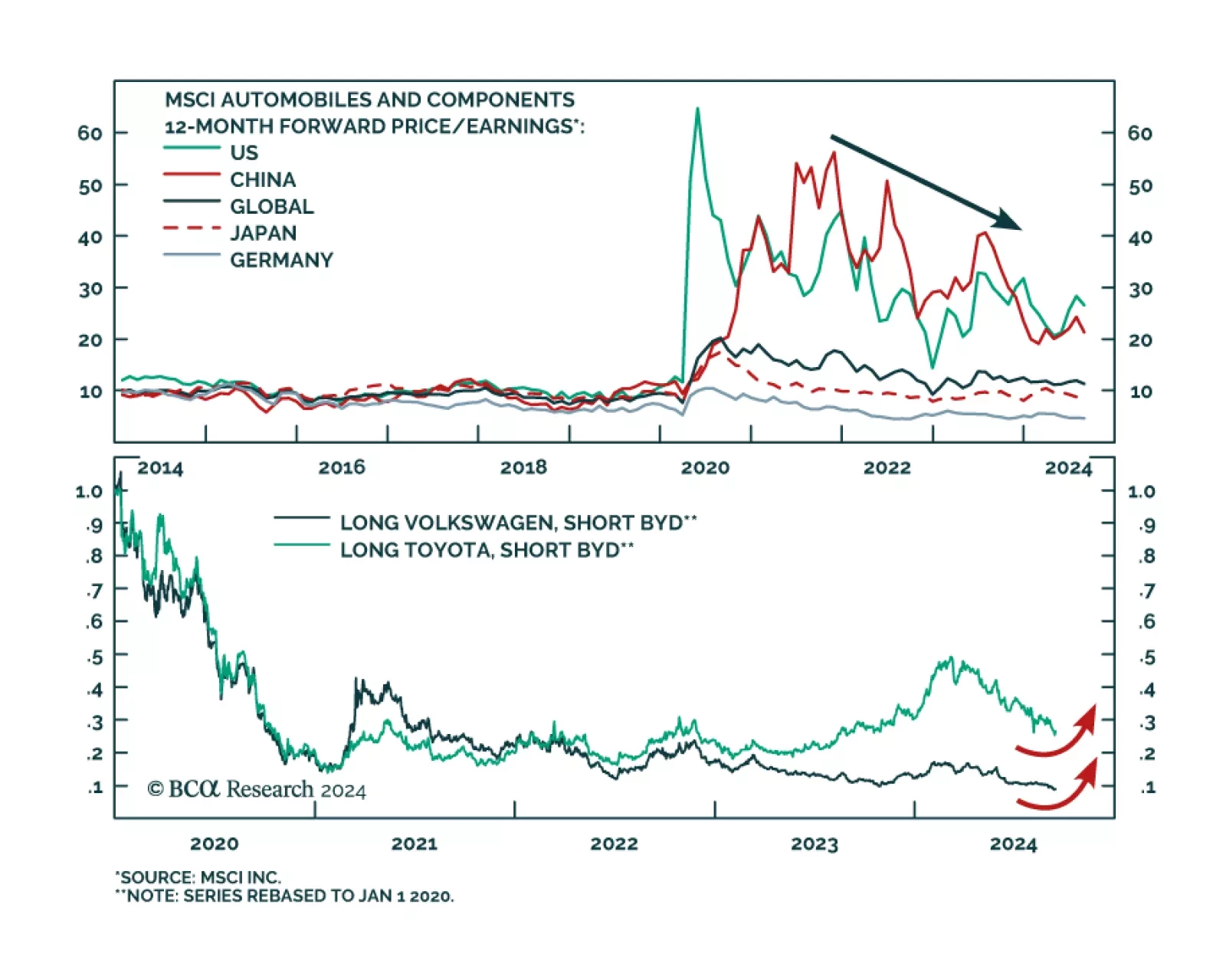

Volkswagen’s CEO has been making the point that the market for European carmakers has been deteriorating. Earlier last week, he went on to make a rather pointed reference at Chinese EV manufacturers. He was quoted…

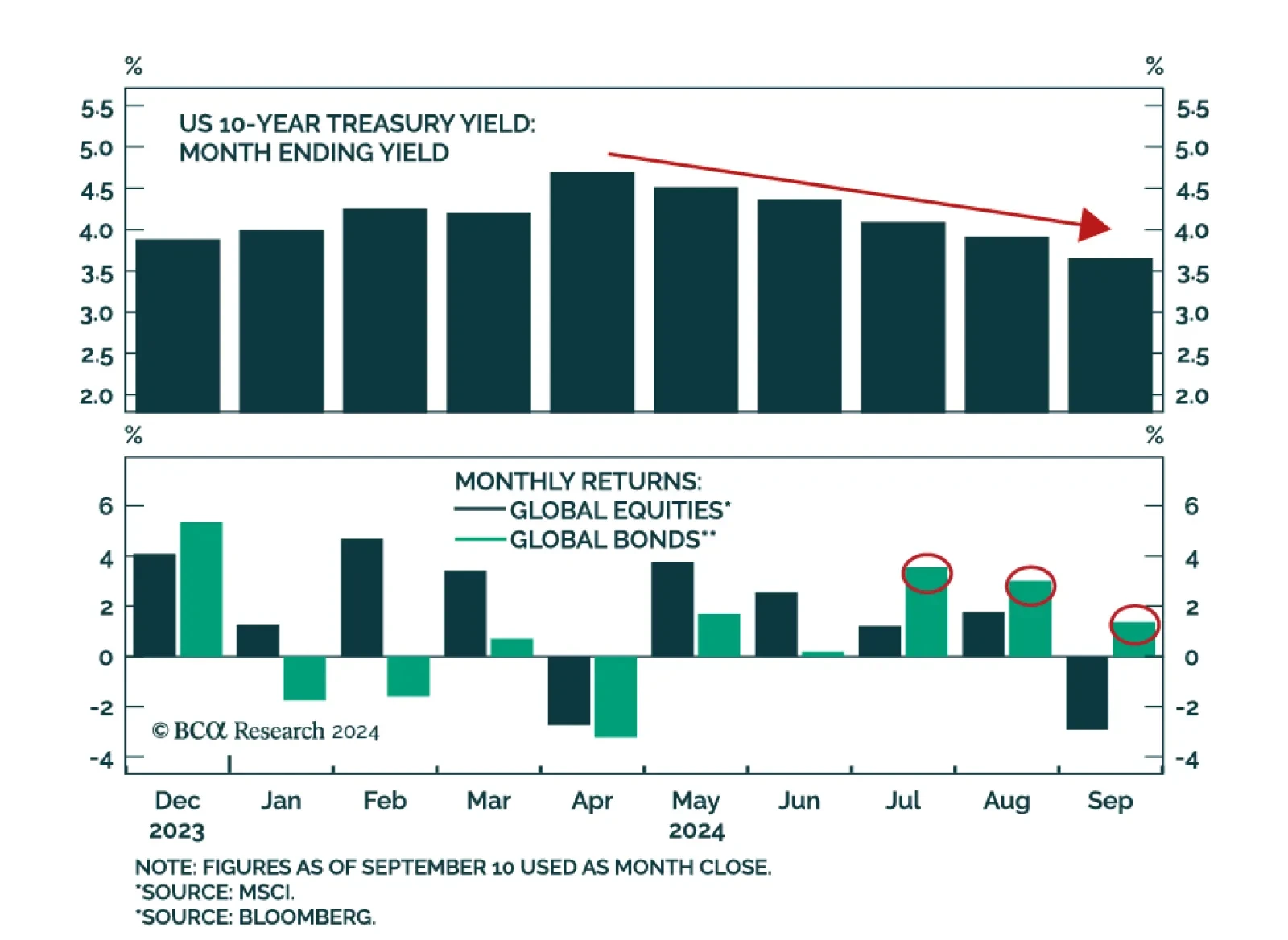

Despite global bond yields having trended lower since April, bonds have only started outperforming equities since July in US dollar terms. We expect this outperformance to persist going forward. Sentiment has largely driven…

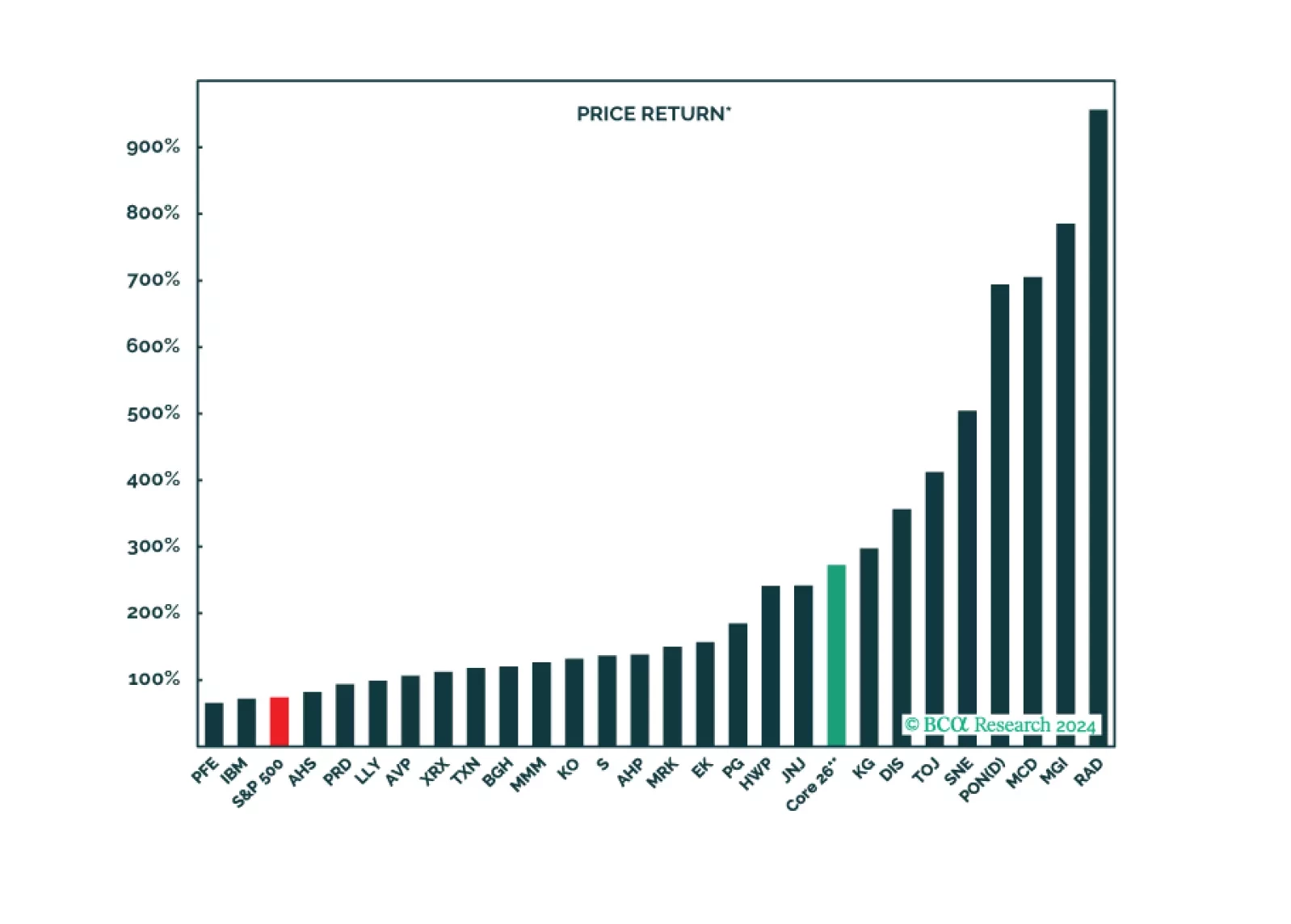

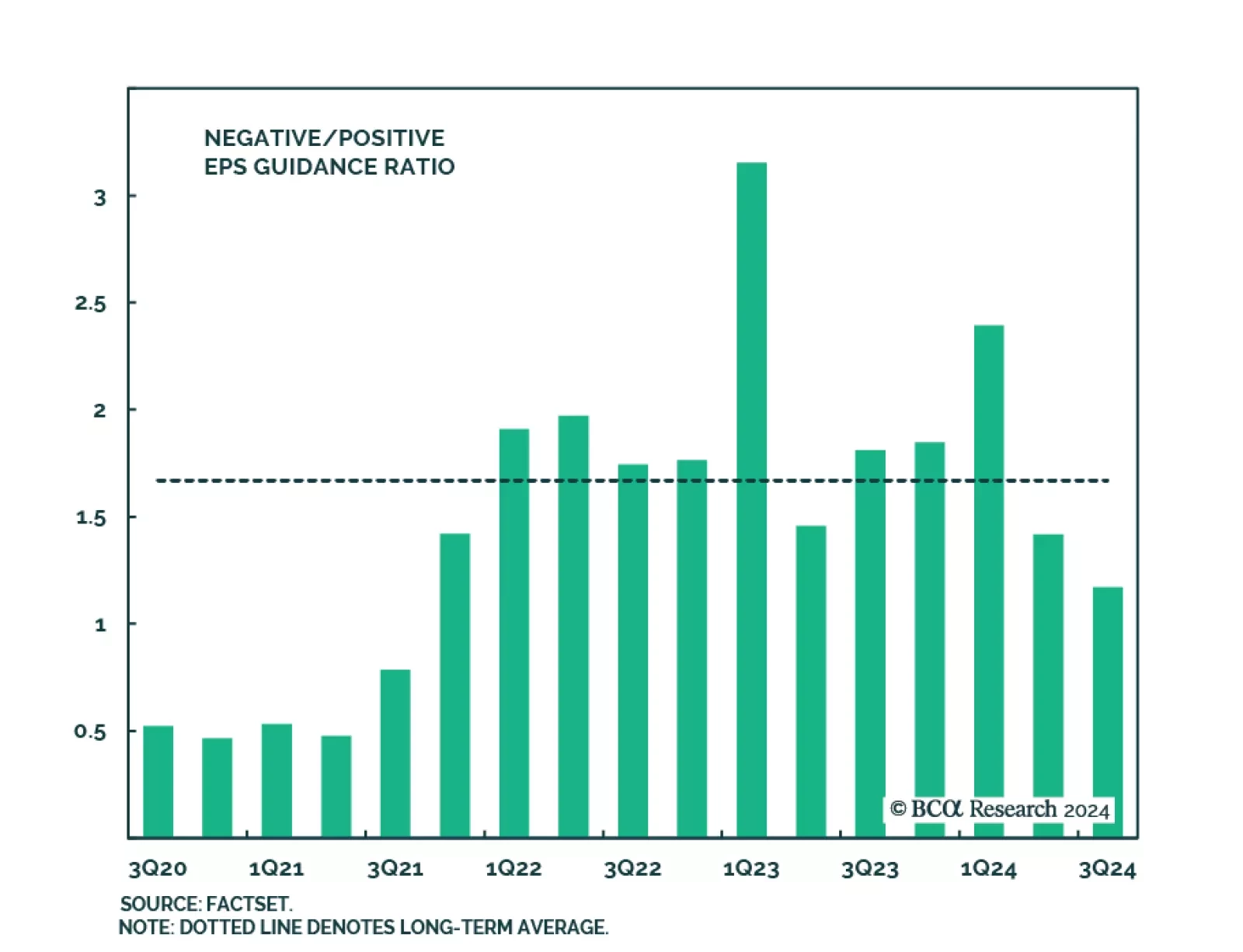

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

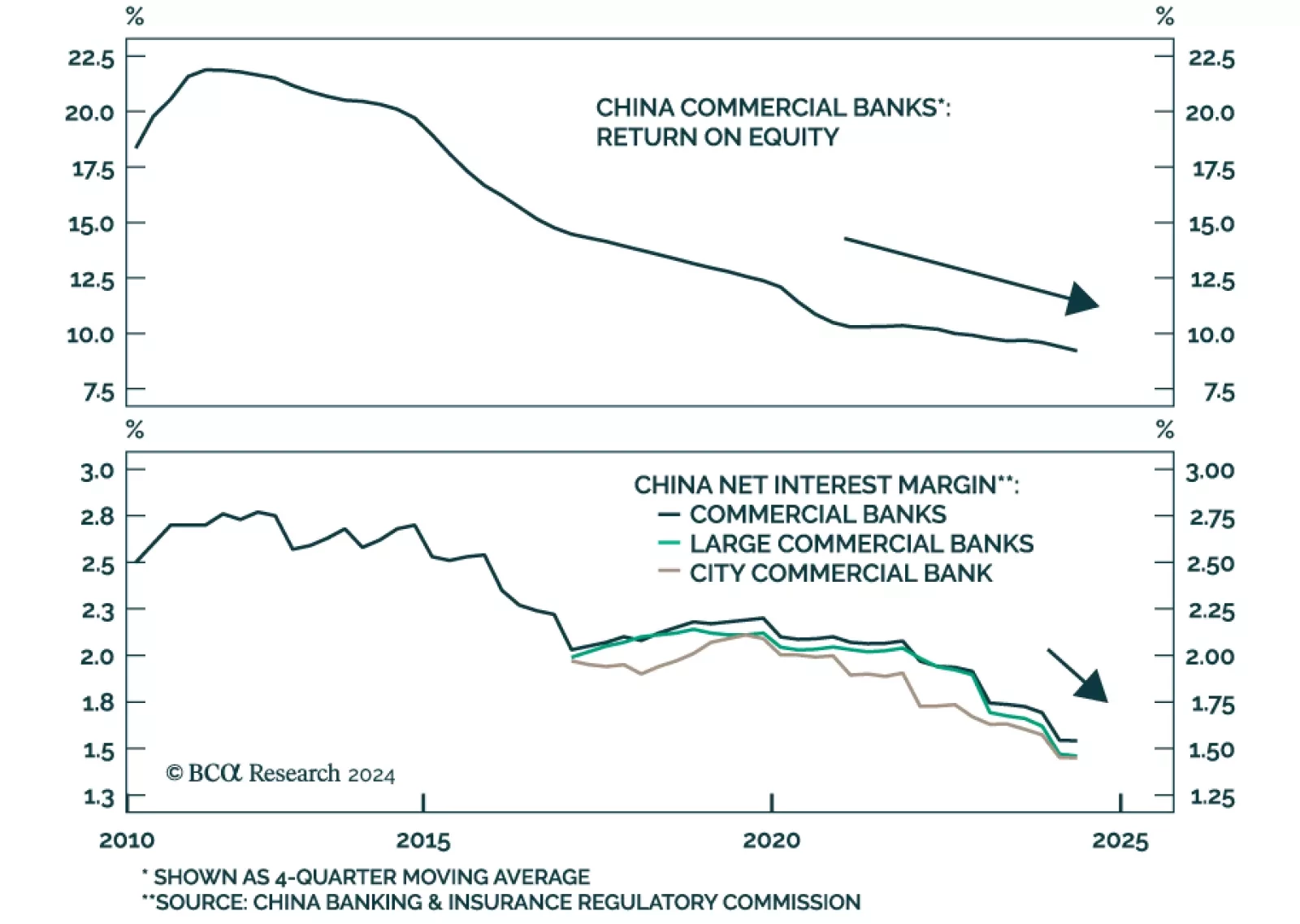

Chinese onshore and offshore bank stocks have outperformed their respective broad markets by 26% and 24% since October. Despite deteriorating return on assets, return on equity and net interest margins, investors have sought out…

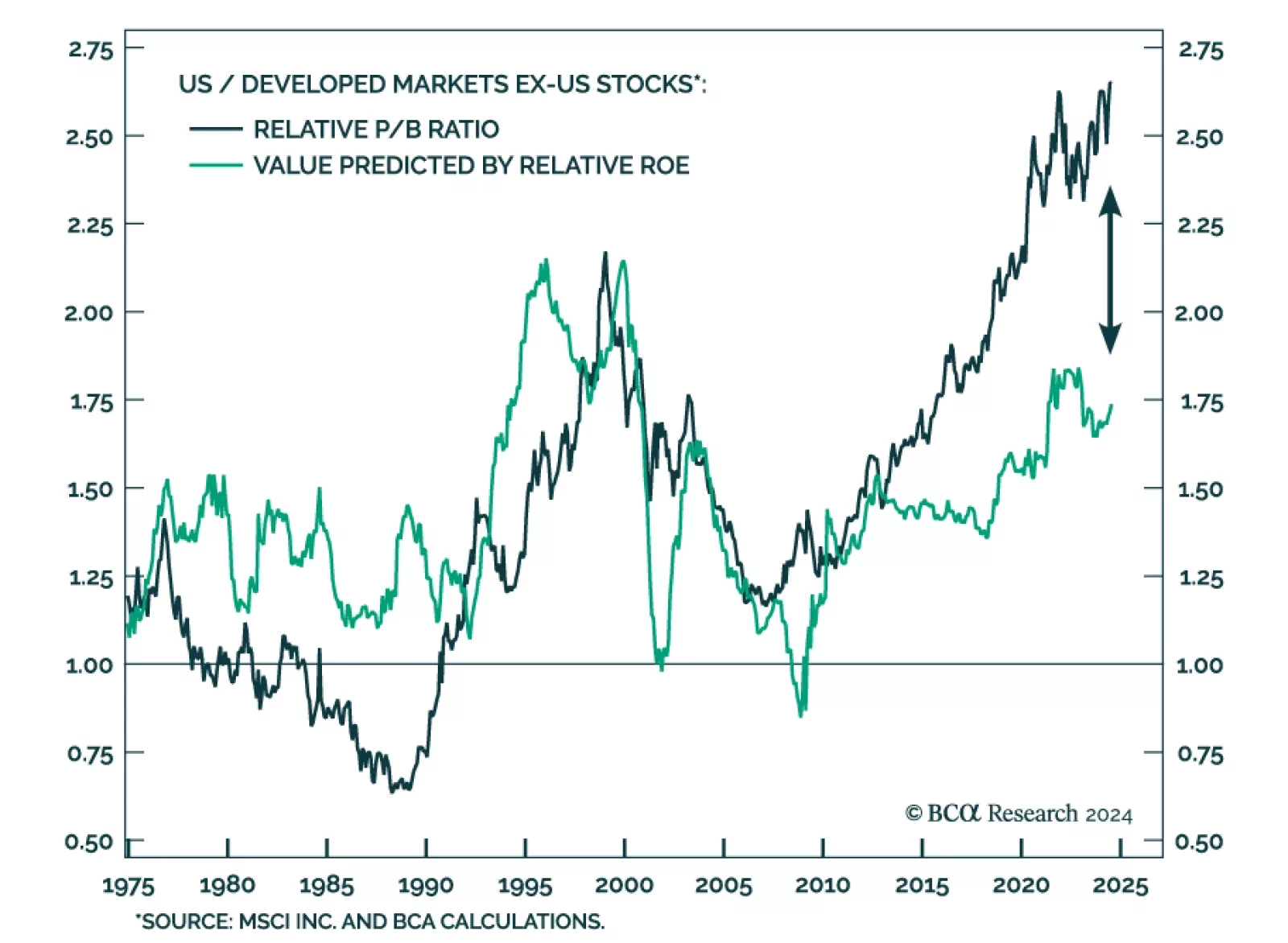

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring…

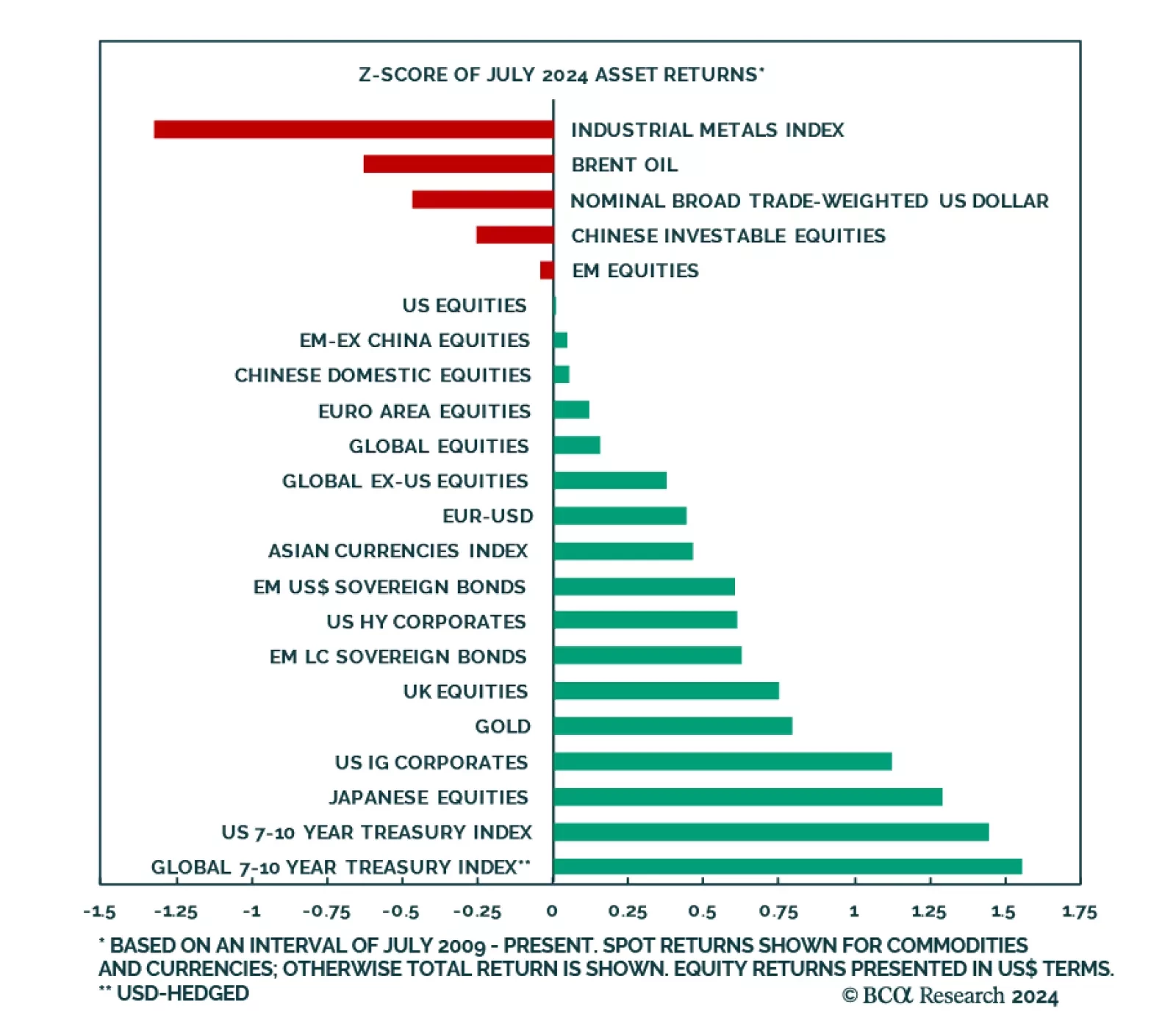

No clear risk-on/risk-off pattern emerged from July’s market performance data. On the one hand, consistent with a risk-off environment, US bonds ranked highest in the monthly return distribution, while pro-cyclical…