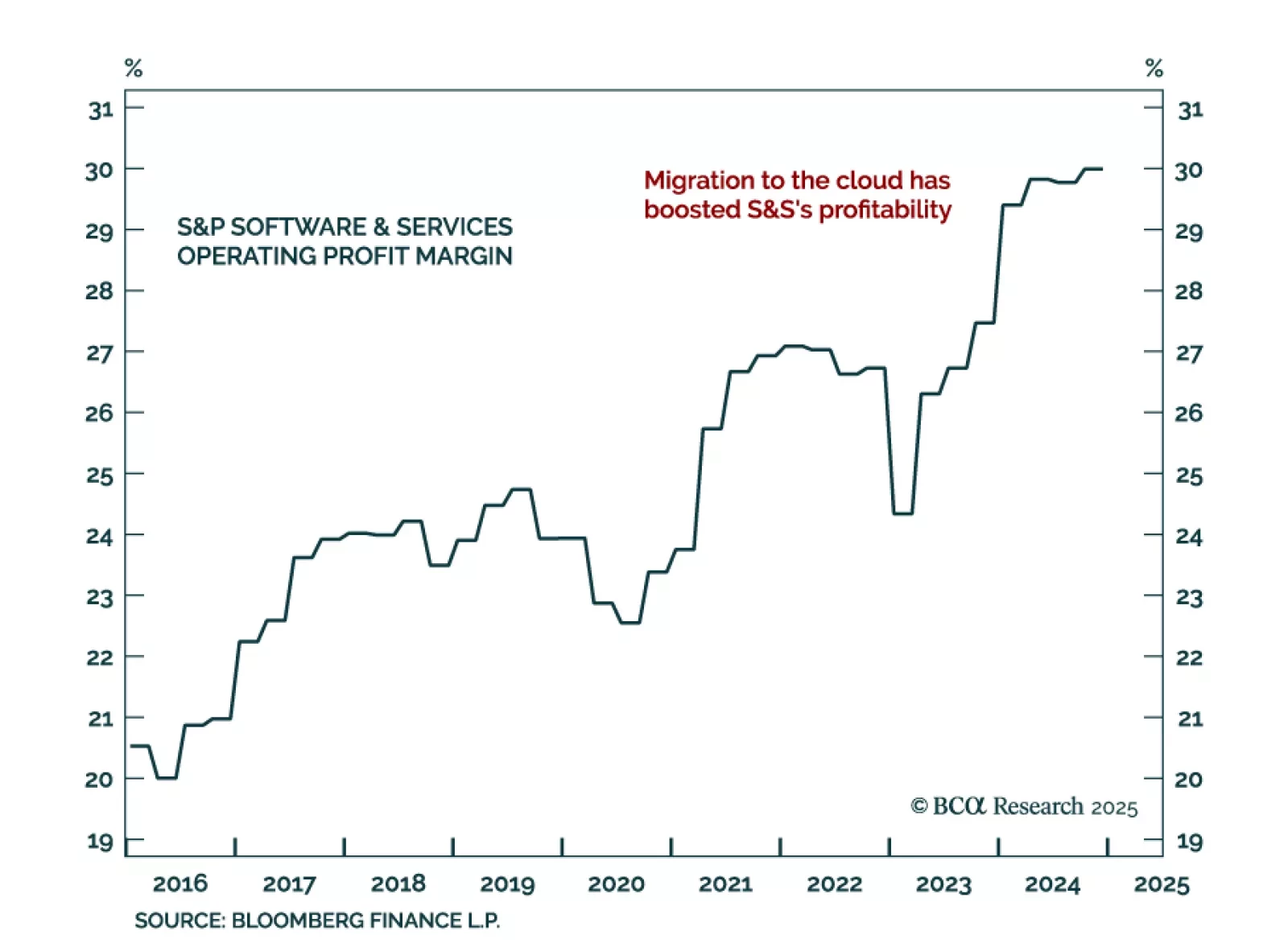

In the aftermath of Monday’s tech selloff, our US Equity strategists took a deep dive into the Software and Service (S&S) industry group. The S&S industry underperformed in 2024 as post-pandemic spending slowed, but…

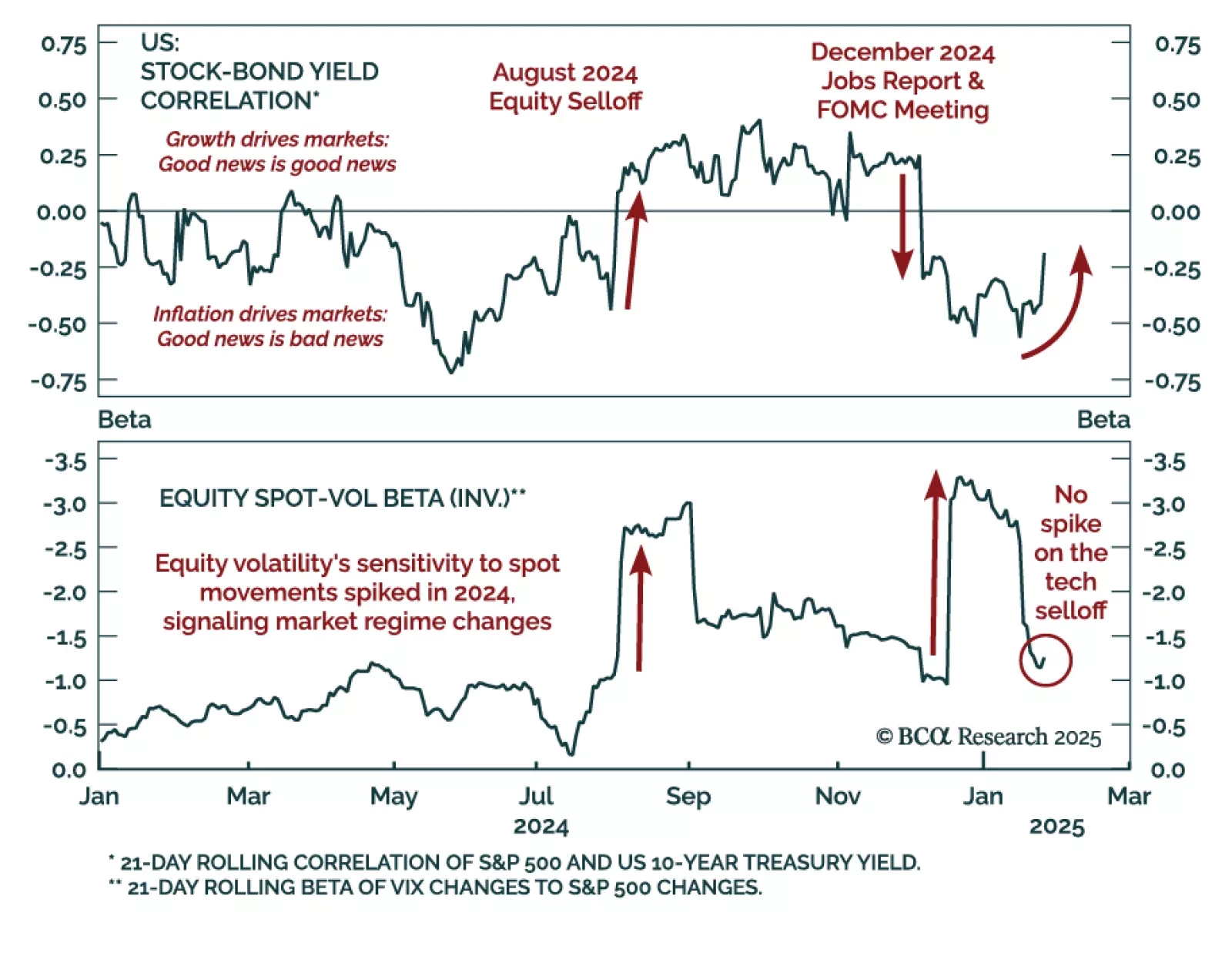

Monday’s selloff was orderly and concentrated in the tech sector. The price action was a classic risk-off response, where both stock prices and bond yields decreased. While the VIX increased, the equity spot-vol beta, volatility’s…

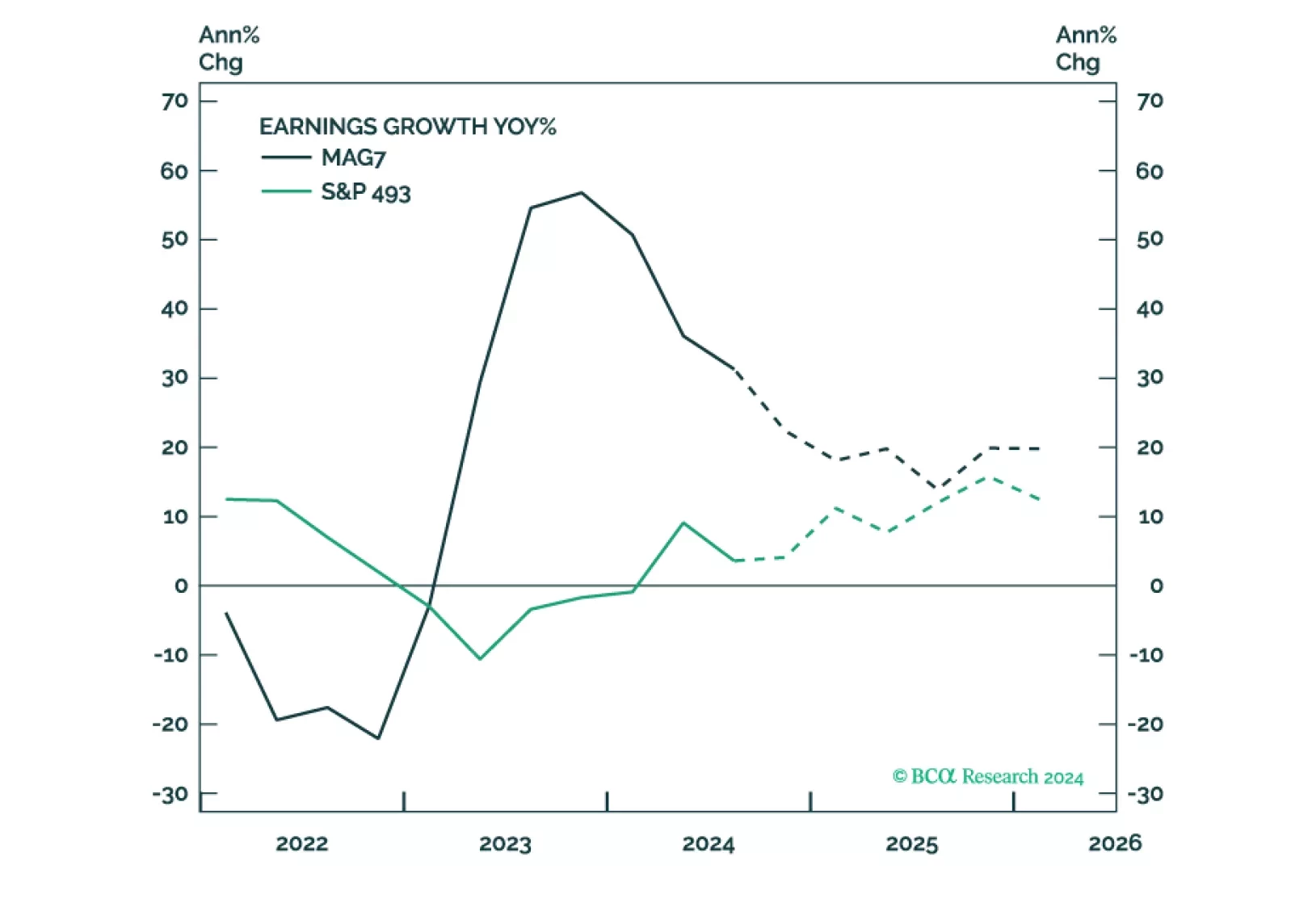

Our US Equity strategists preview the 2024 Q4 earnings season, and look at the results from banks. Q4 earnings growth is set to impress, with small and mid-cap earnings surging and S&P 493 growth turning positive, though…

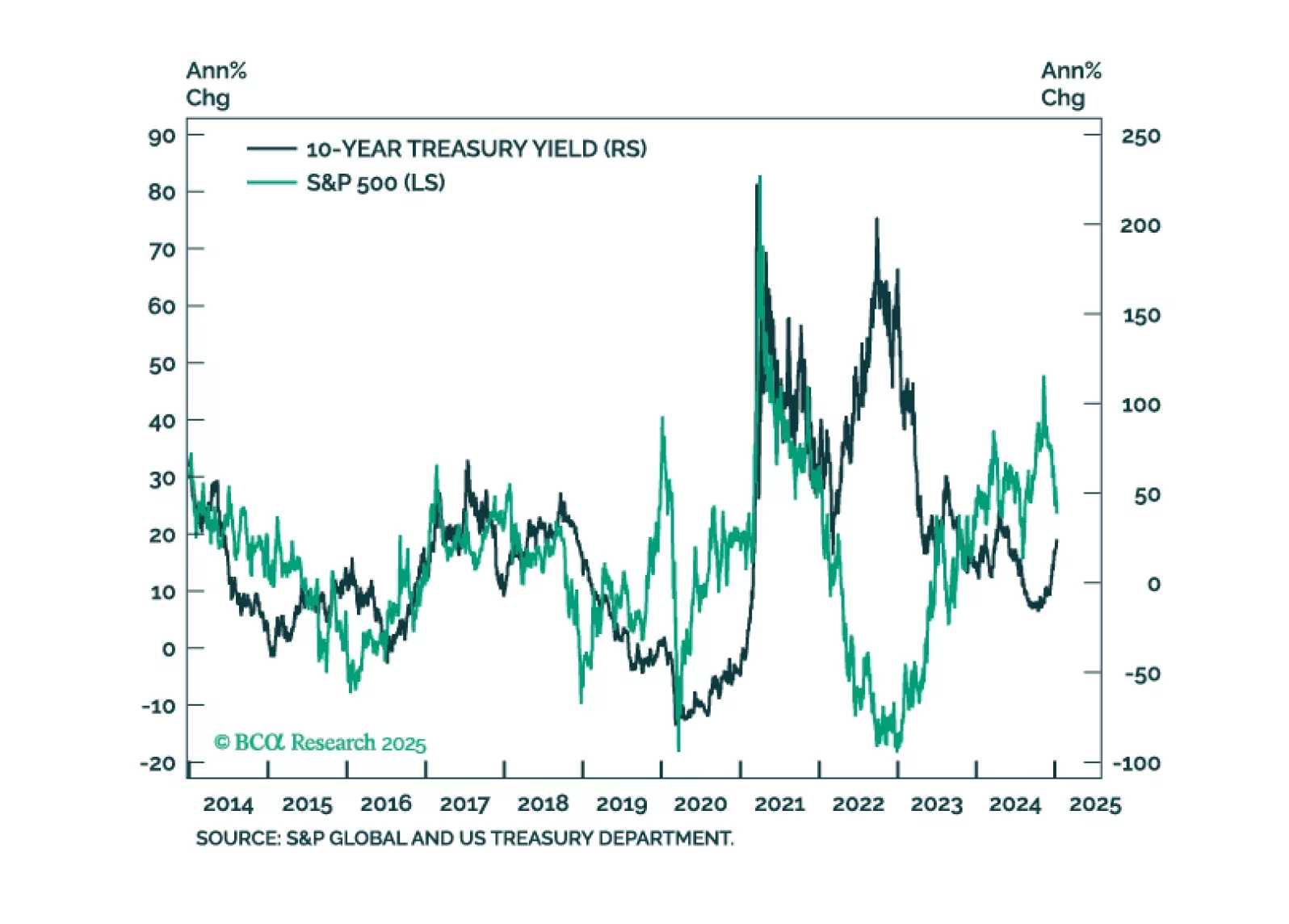

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…

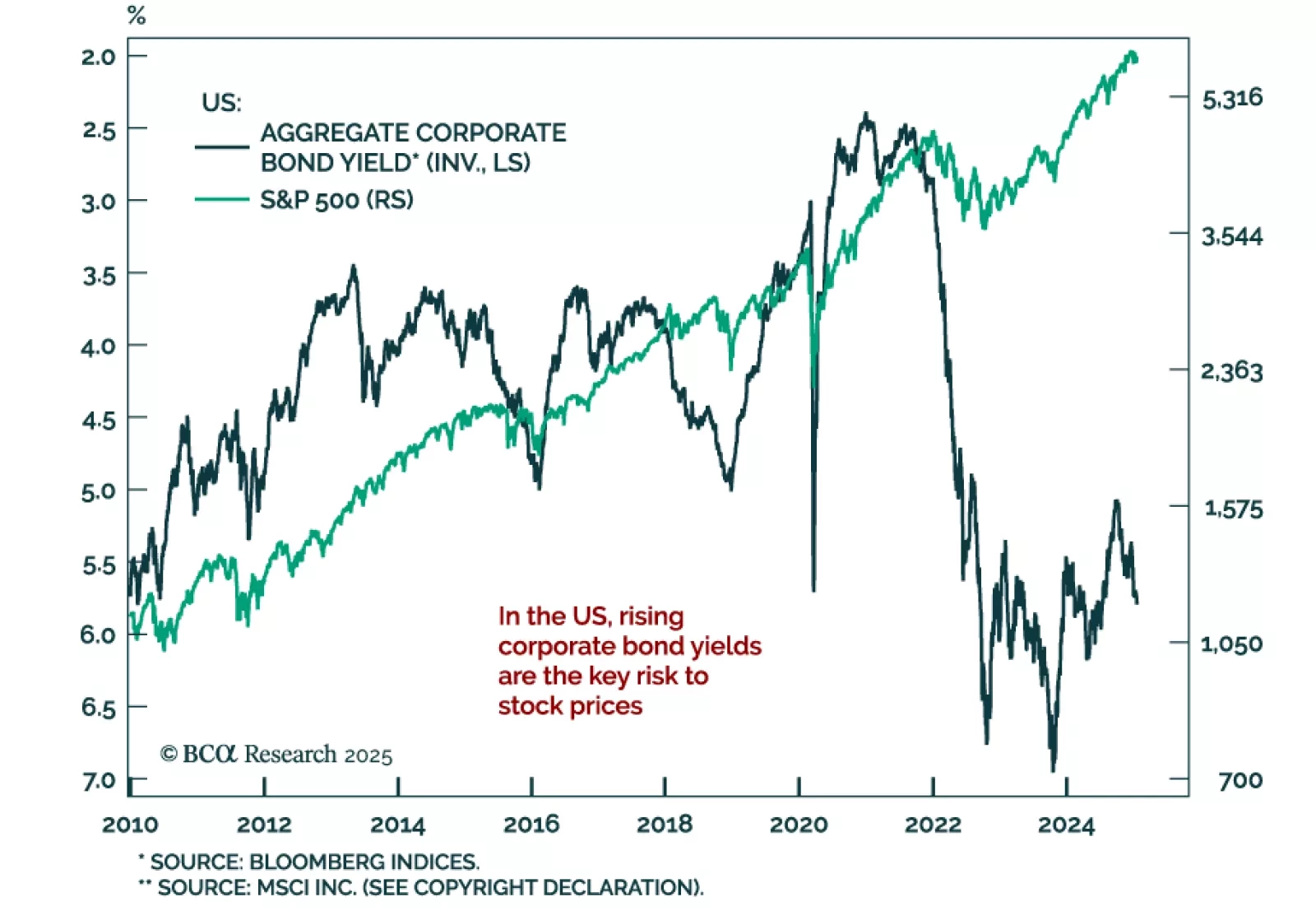

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist for our Emerging Markets Strategy service. Arthur discusses the relationship between corporate bond yields and stock prices. Historically, US stocks suffer when…

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

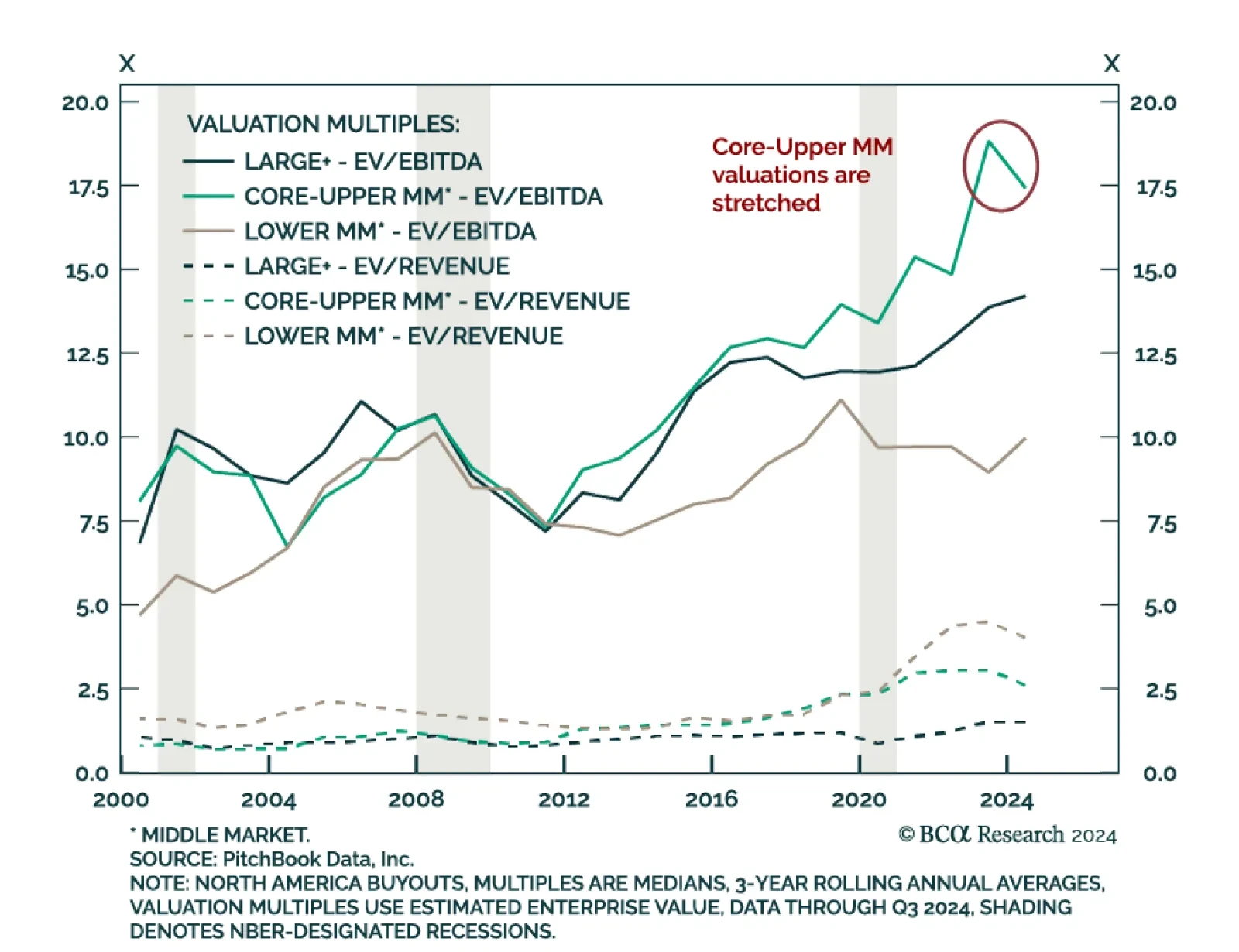

Our Private Markets & Alternatives strategists have delved into the North American Buyouts market, concluding that the investment playbook needs rewriting. The performance of Middle Market Buyouts has been exceptional,…

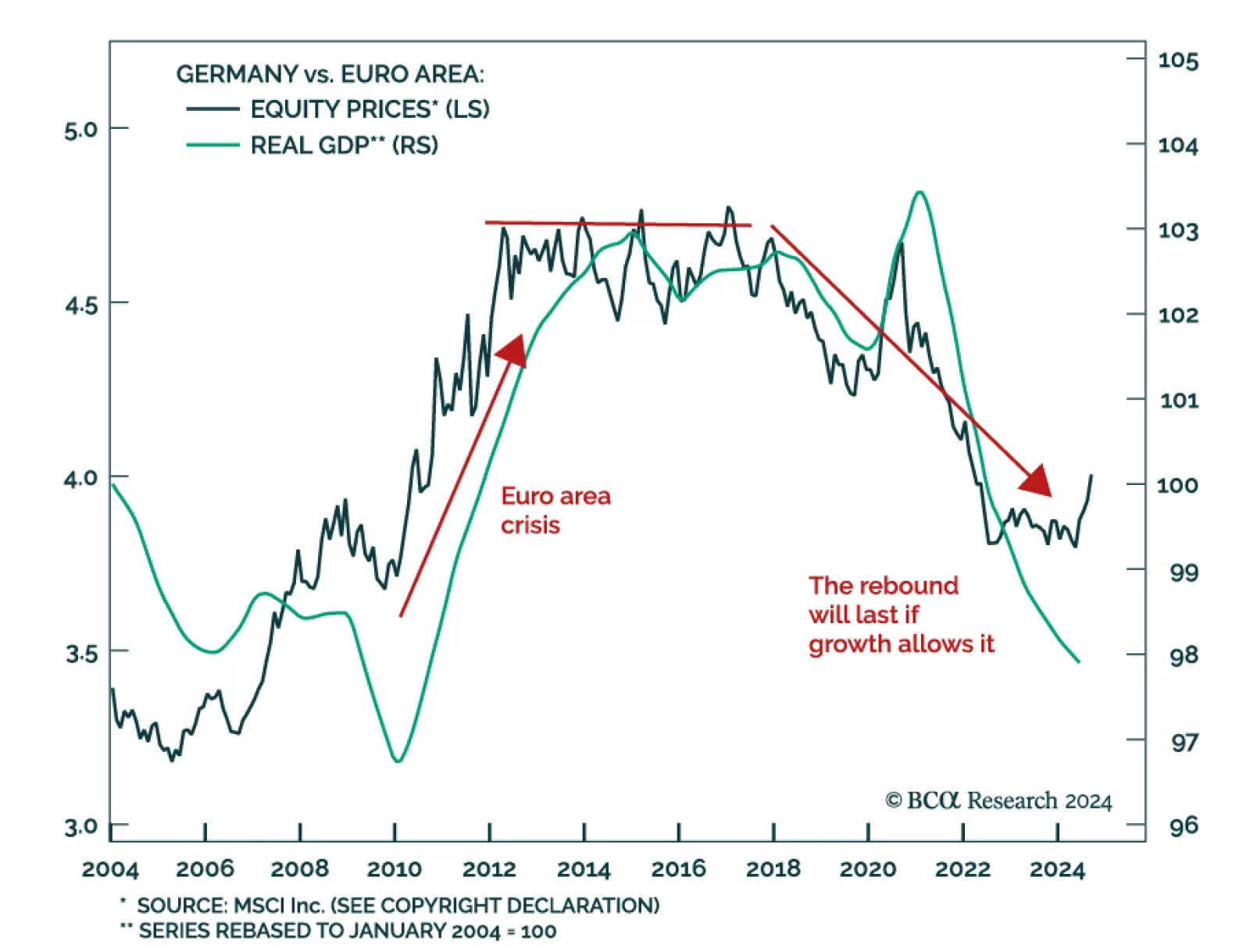

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

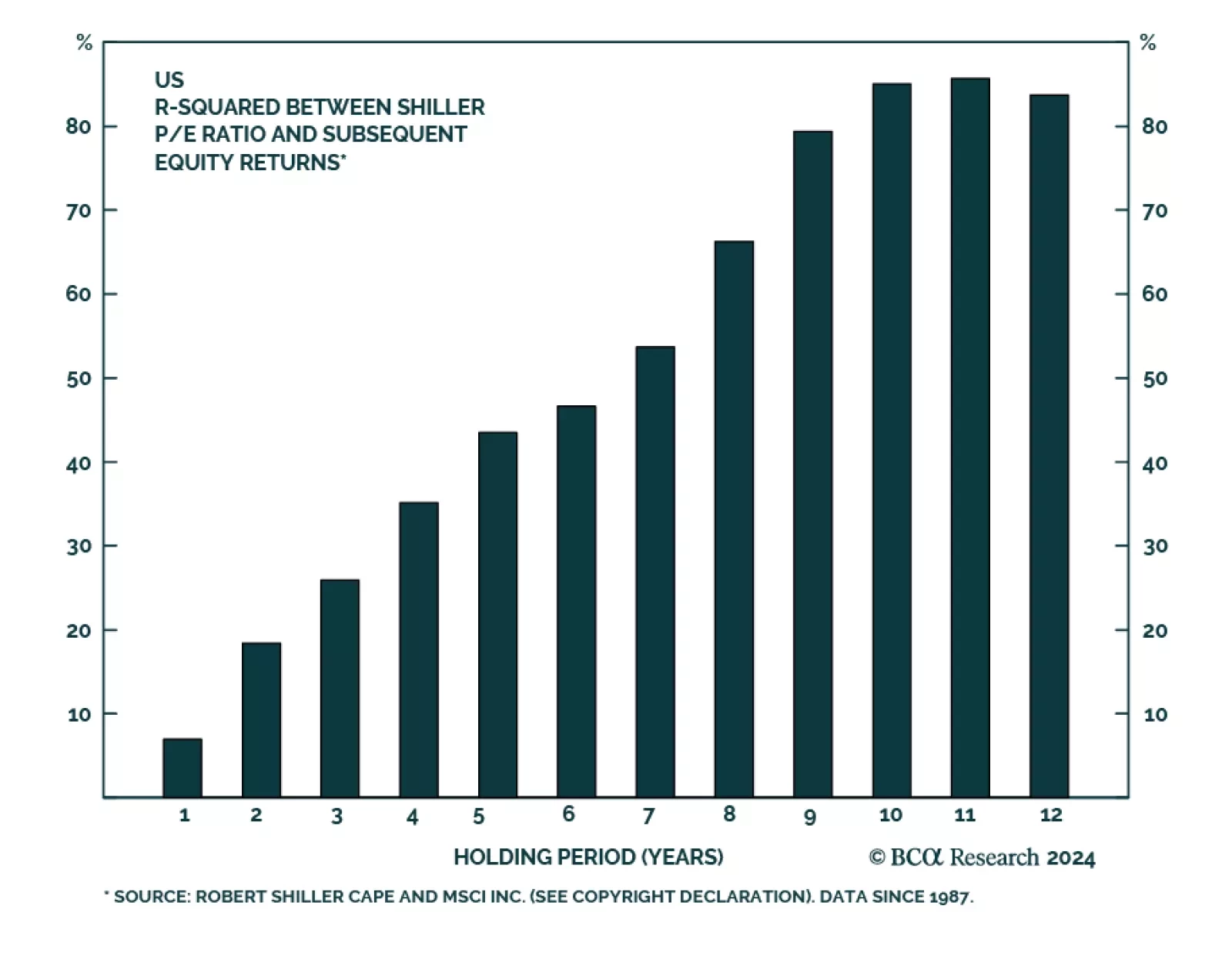

Elevated US equities valuations and their impact on returns are a hot topic right now. Valuations are not a tactical or cyclical timing tool, but they help predict long-term returns. Our Global Asset Allocation Strategy team…

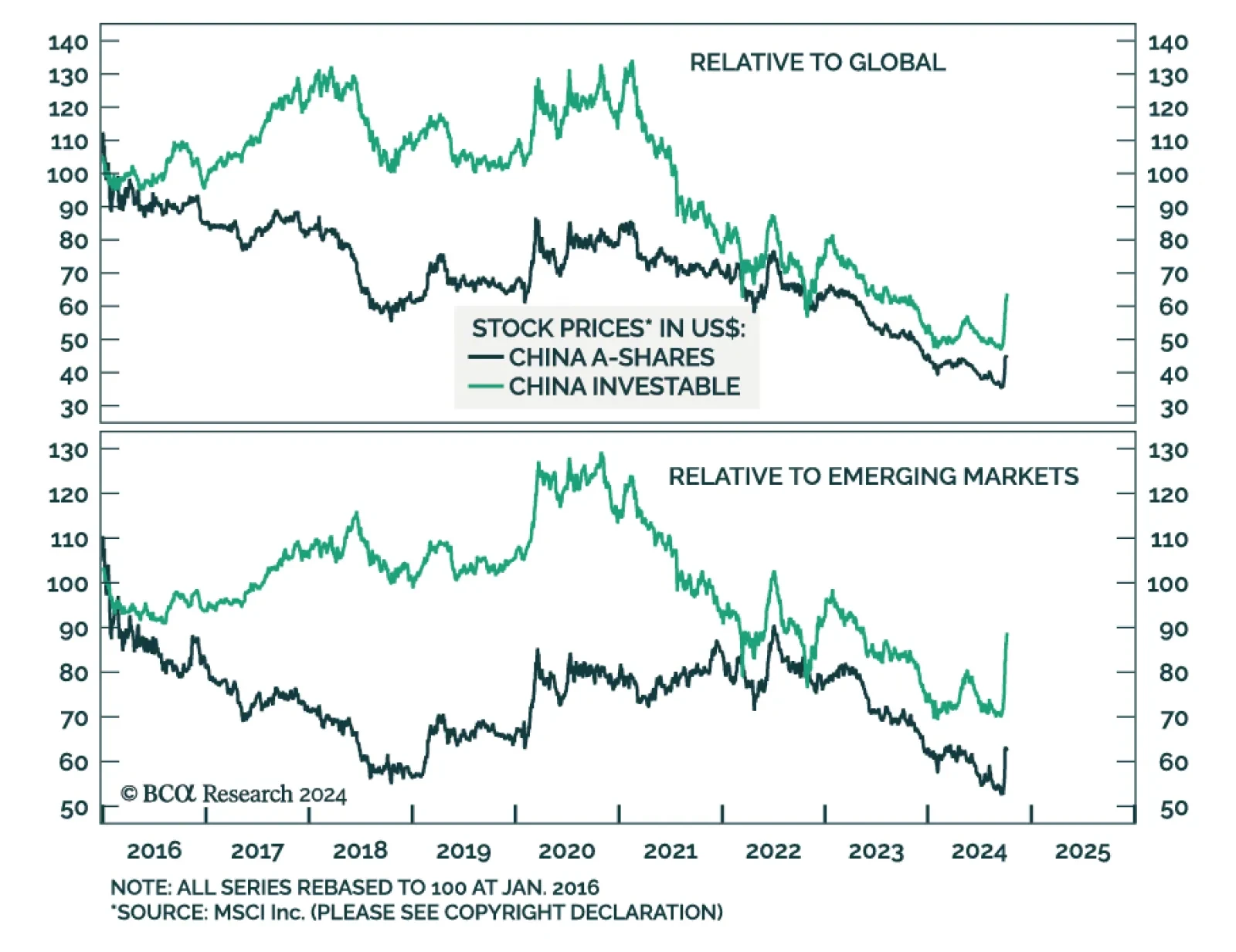

China’s National Development and Reform Commission (NDRC) provided no insights Tuesday on the size or nature of the fiscal stimulus Beijing promised in late September. The key takeaway of the authorities' first briefing…