Executive Summary Wars Don’t Usually Affect Markets For Long We expect the war in Ukraine to stay within its borders, and therefore to have little impact on global growth. Markets will be volatile, but we recommend…

Executive Summary Russian Invasion Scenarios And Likely Equity Impact The Ukraine crisis is escalating as predicted. We maintain our odds: 65% limited incursion, 10% full-scale invasion, 25% diplomatic de-escalation.…

Highlights The selloff in equities since the start of the year marks a long overdue correction rather than the start of a bear market. Stocks often suffer a period of indigestion when bond yields rise suddenly, but usually bounce back…

Highlights The markets are already looking past Omicron. Now they have new worries – the Fed battling inflation. In the past, the Fed moved because of confidence that strong economic growth can withstand rates normalization.…

Highlights 2022 will be a year of economic normalization. We hope that even if we can’t leave COVID behind, we will learn to live with it. Economic growth will remain strong, but it will be trending down towards its long-term…

The S&P 500 return is becoming concentrated once again. Over the past three months, the combined return from the 257 S&P stocks that rallied was 316 index points, 62 (20%) of which came from only two tickers: MSFT and AAPL. As a…

Highlights Rate Hikes Are Coming – O/W Banks And Small Caps: Rampant inflation is changing investor expectations on the timing and speed of rate hikes. At present, the market is pricing in three rate hikes in 2022. Overweight…

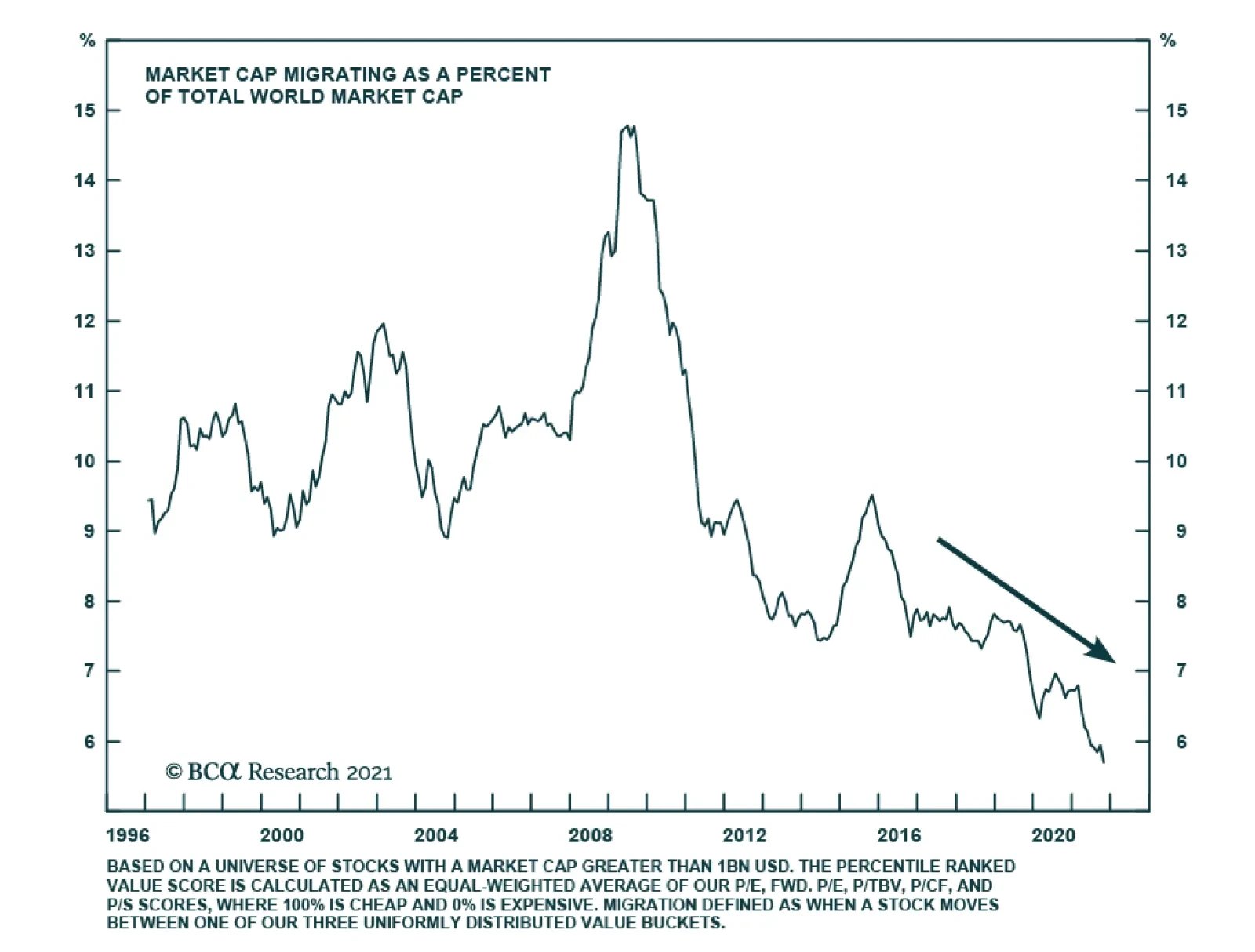

In a seminal paper, Fama and French describe the process of migration as the movement of stocks across different value buckets. An example is when stocks in the cheap bucket migrate to the neutral and expensive bucket, or when…

The past two weeks have been characterized by a rotation in US equities. Sectors and styles that are sensitive to rising interest rates such as real estate, tech, and growth stocks have been underperforming. Meanwhile, less rate…

Highlights European small-cap equities have structurally outperformed large-cap stocks. This outperformance echoes the desirable sectoral biases of small-cap stocks. It also reflects the inability of European large-cap stocks to…