The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

Investors have become increasingly more optimistic about the economic outlook. BoA’s Global Fund Manager Survey shows the share of investors surveyed expecting the global economy to experience a soft landing over the next…

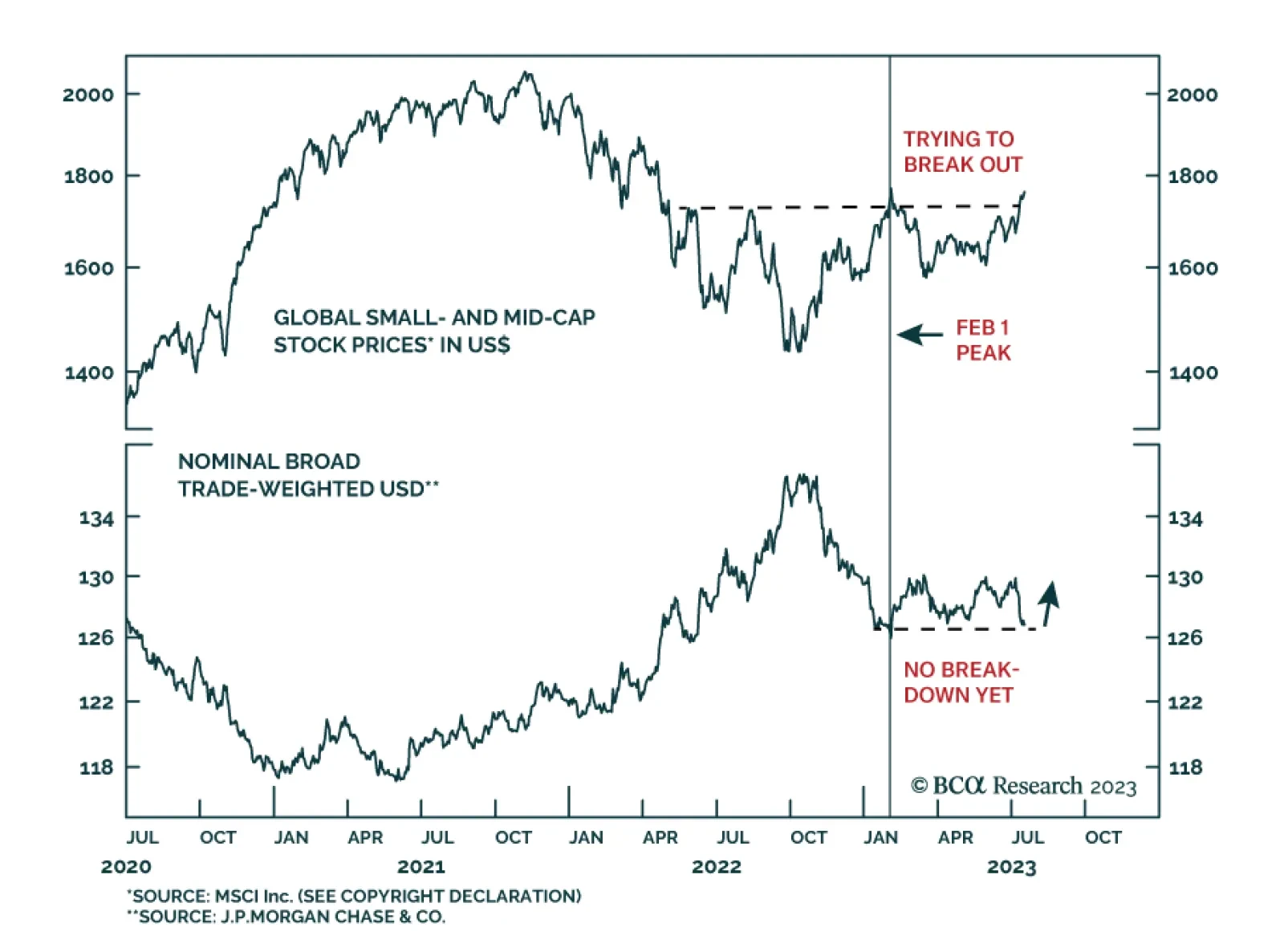

BCA Research’s Emerging Markets Strategy service concludes that the failure of EM stocks, Asian currencies and commodities to stage a broad-based outperformance is consistent with their macro thesis that global trade/…

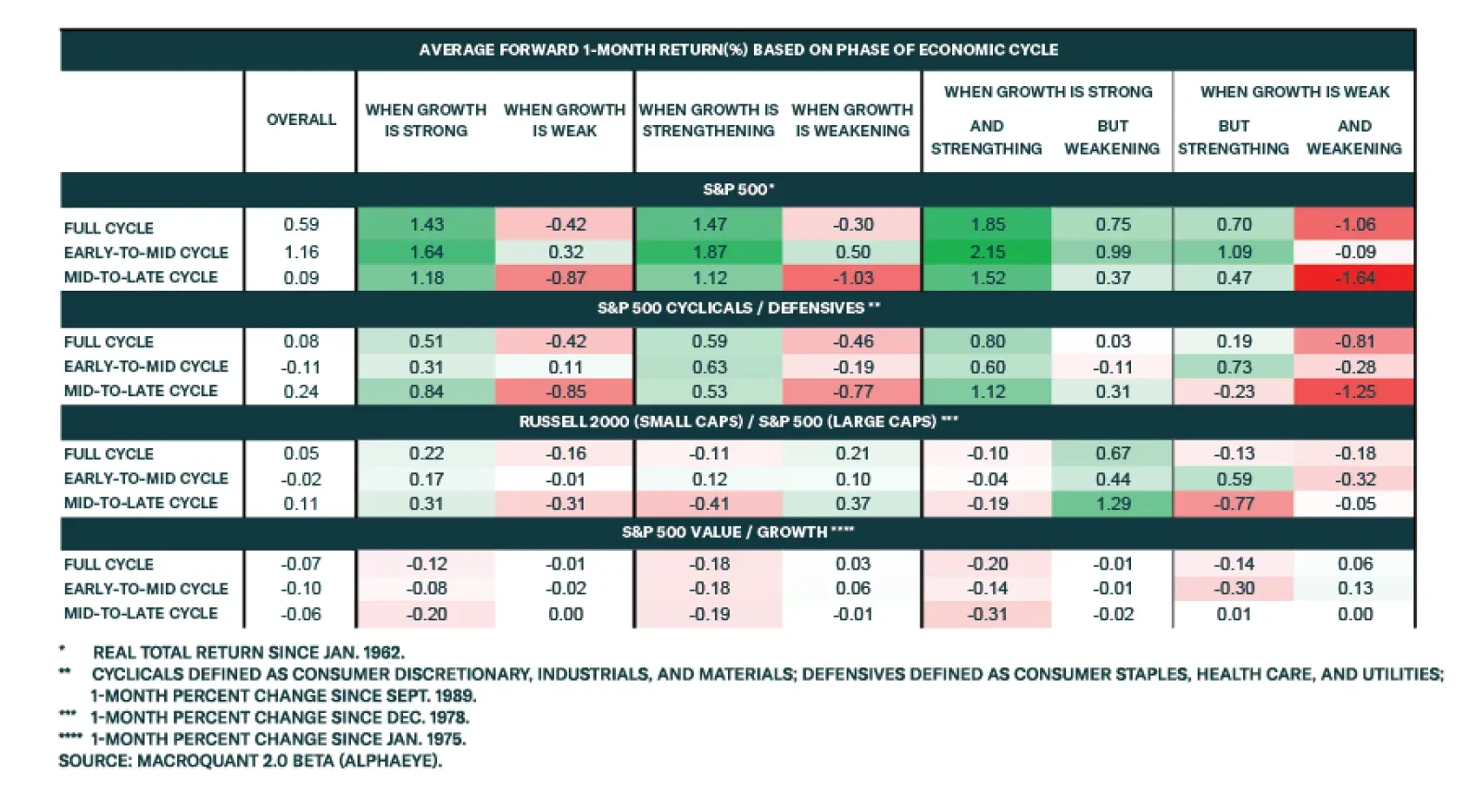

According to BCA Research’s Global Investment Strategy service, stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. In classical physics, the trajectory of an object…

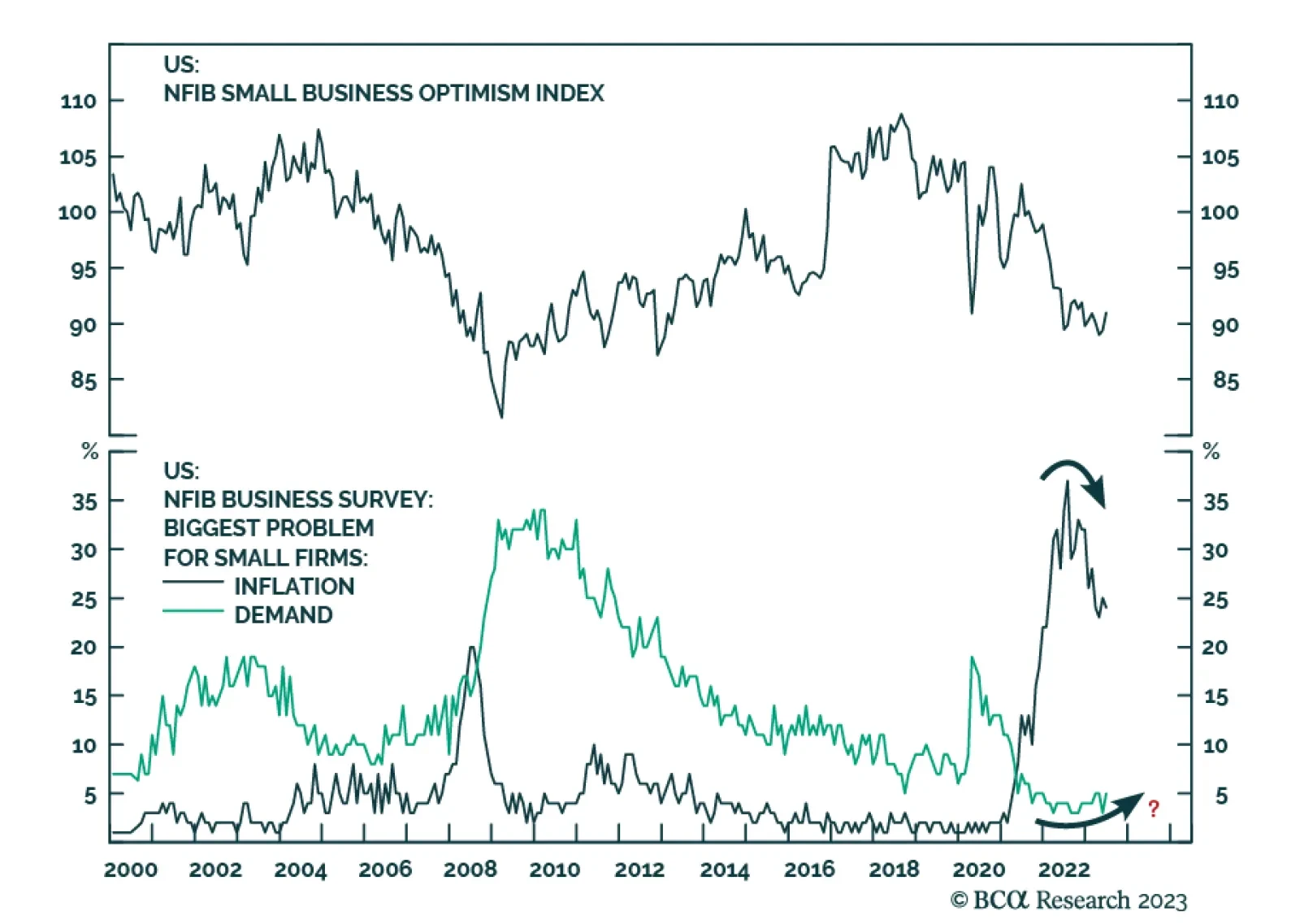

The NFIB survey provided a slightly positive signal about the US economy in June. Small business optimism improved from 89.4 to a 7-month high of 91.0 – beating expectations of a more muted increase to 89.9. Details of…

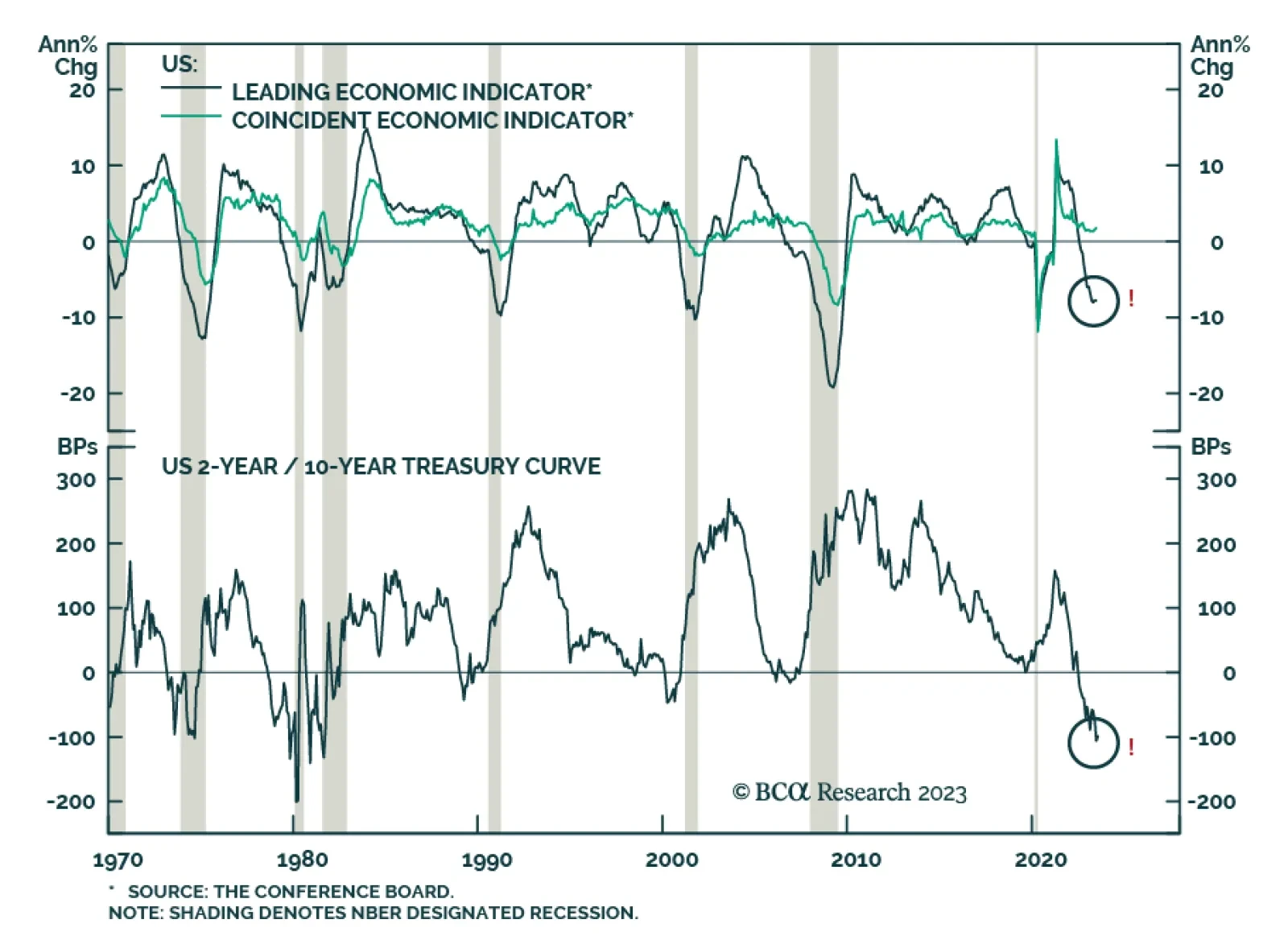

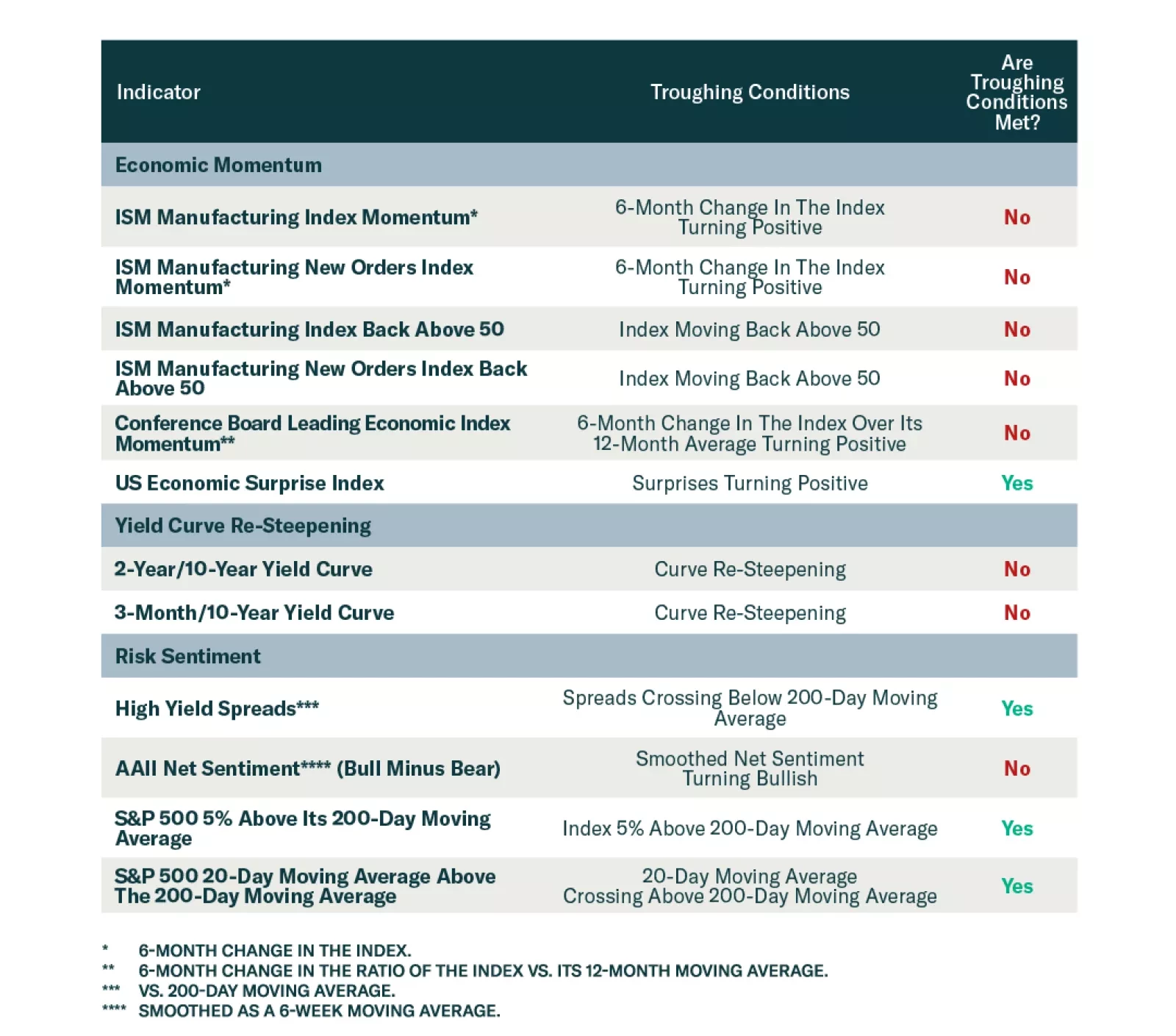

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

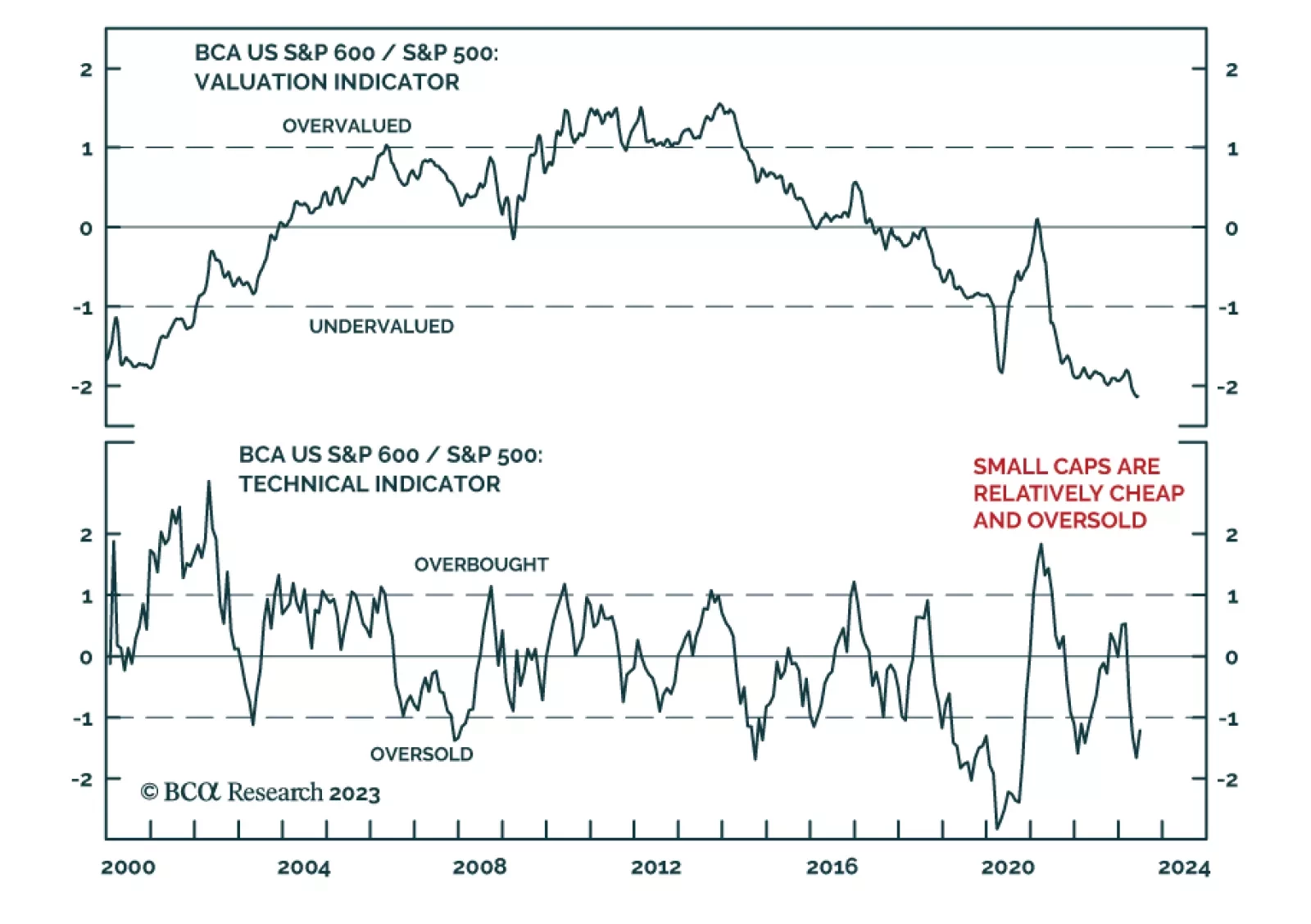

US equity market moves have recently shifted in favor of small caps. After underperforming the S&P 500 by 16% between the start of March and beginning of June, the S&P 600’s recent 6% gain is greater than its large-…

The S&P 500 performance was flat in May if not for the strong performance of a small cohort of mega-caps, aided by exposure to AI. Earnings and sales growth are contracting but analysts expect a rebound into a yearend, which is…

BCA Research’s Global Asset Allocation service continues to recommend an overweight on government bonds, neutral on cash, and underweight on equities and credit. Market technicals do not suggest this is a robust…