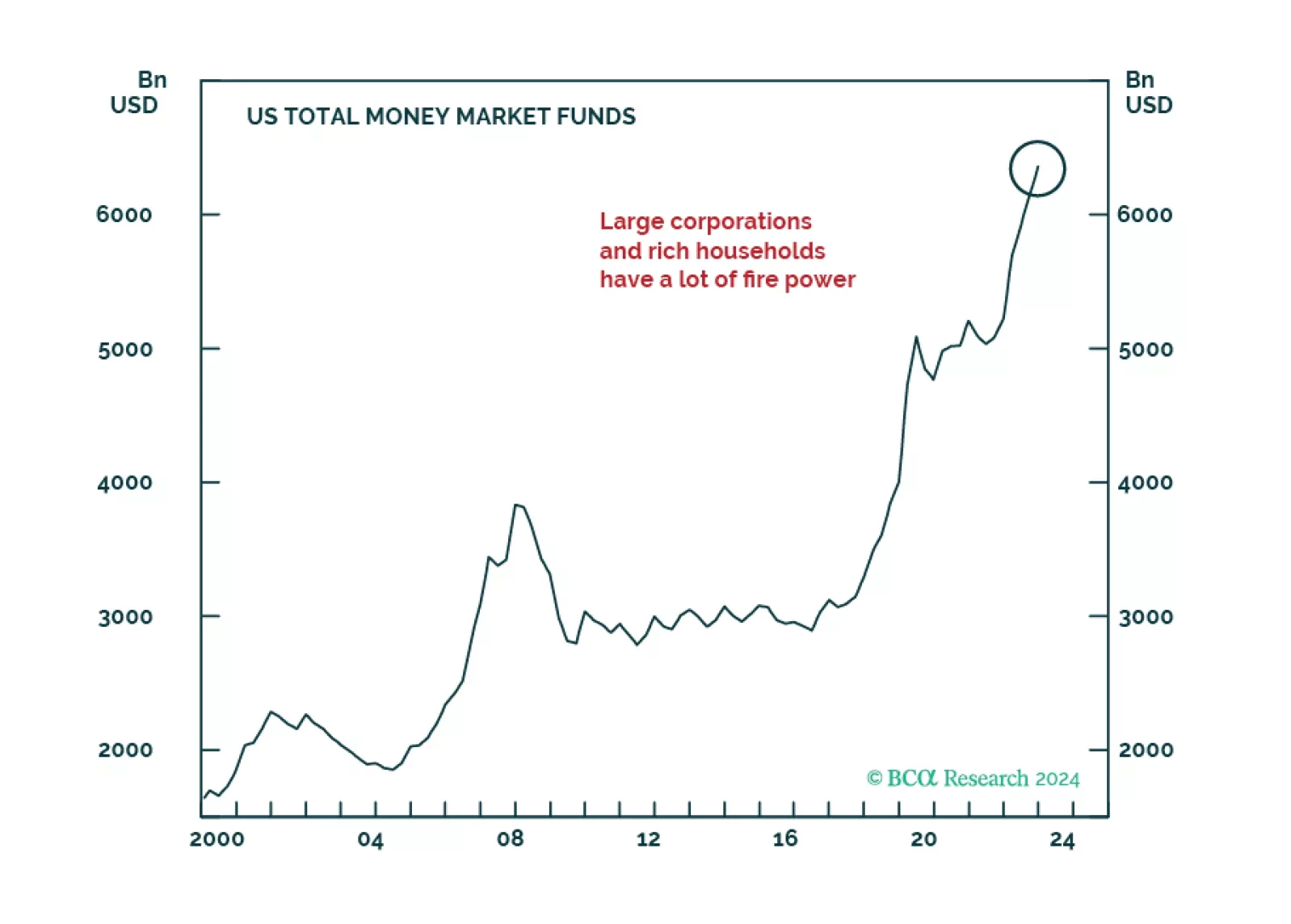

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

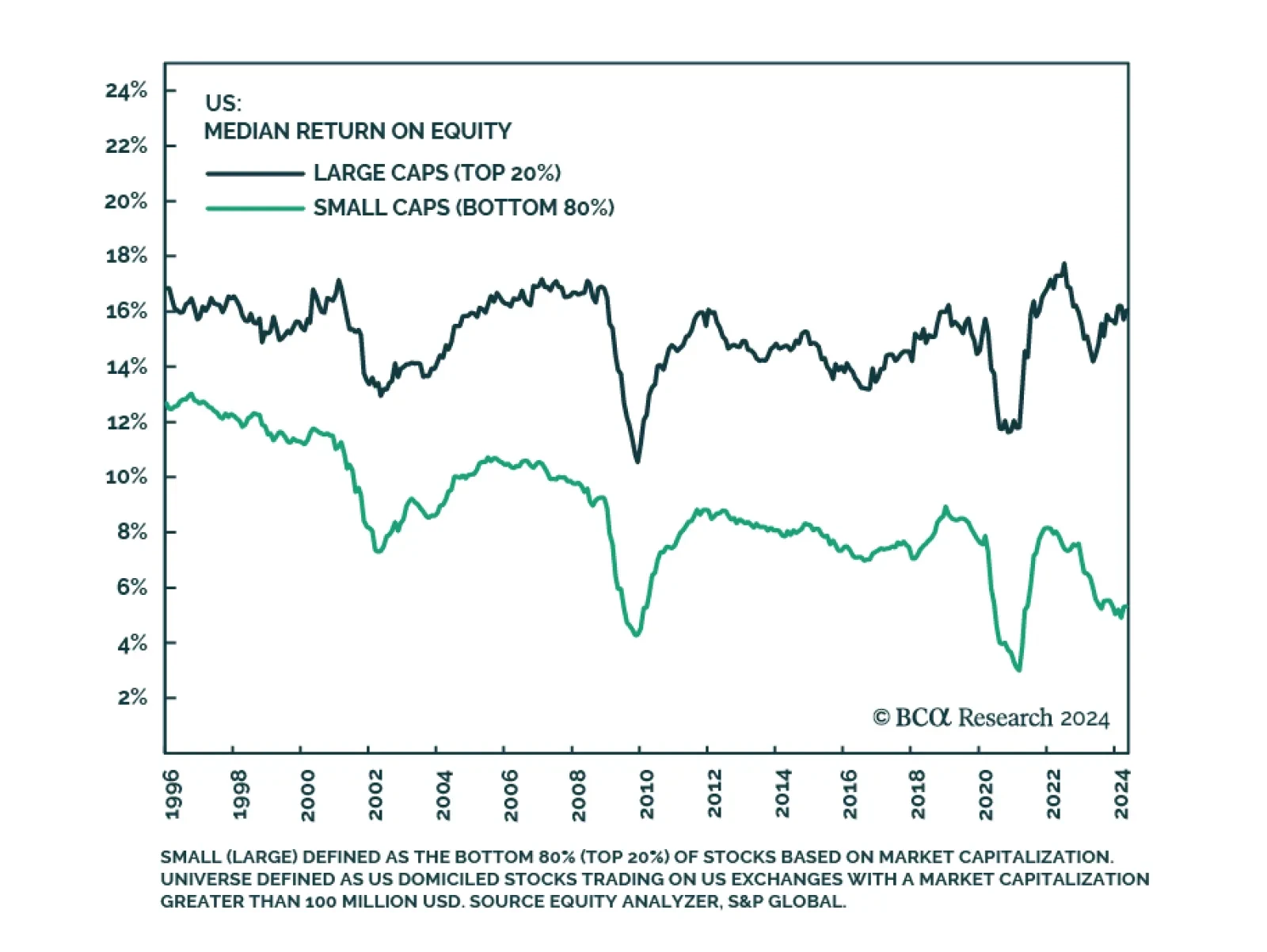

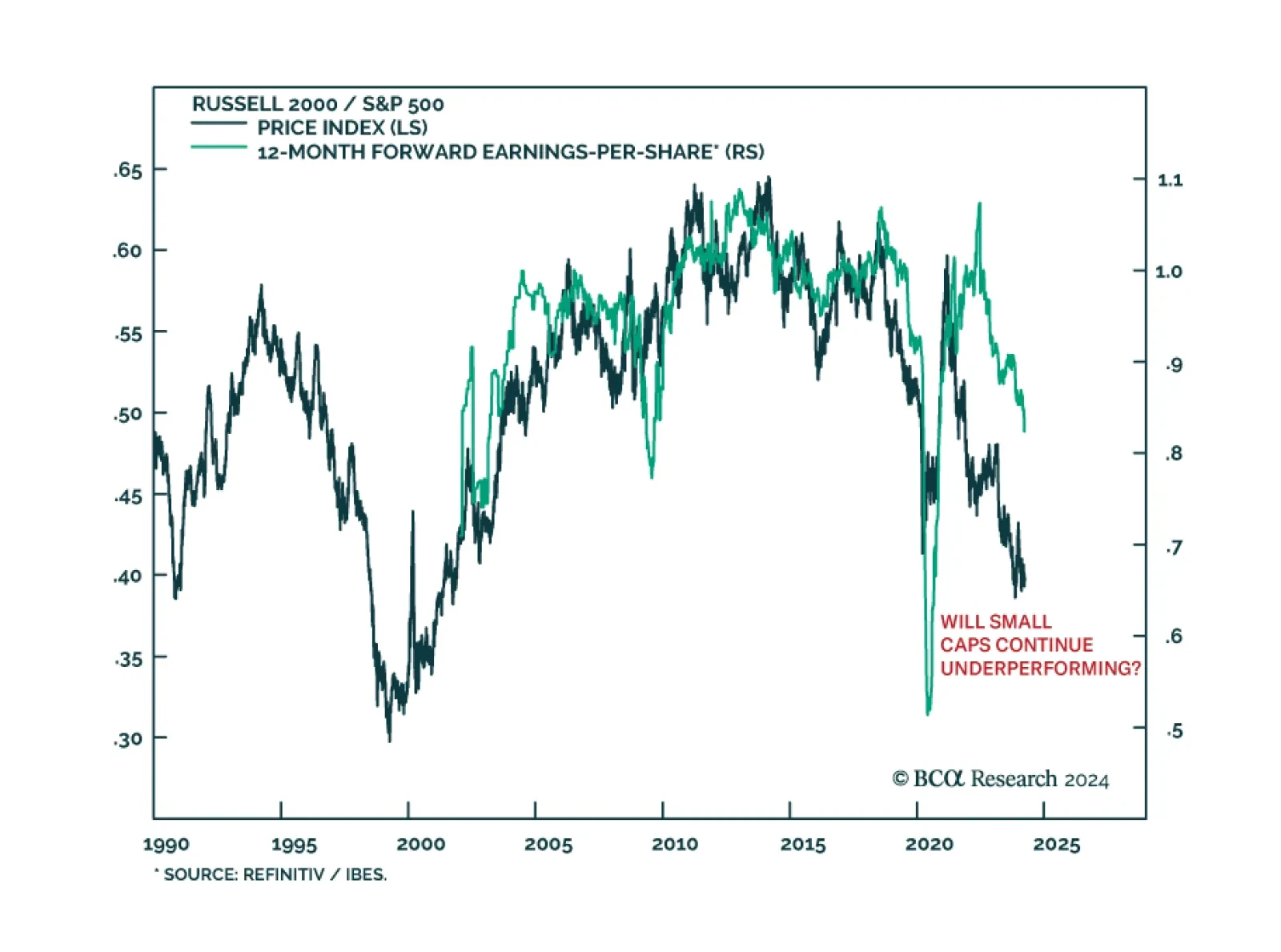

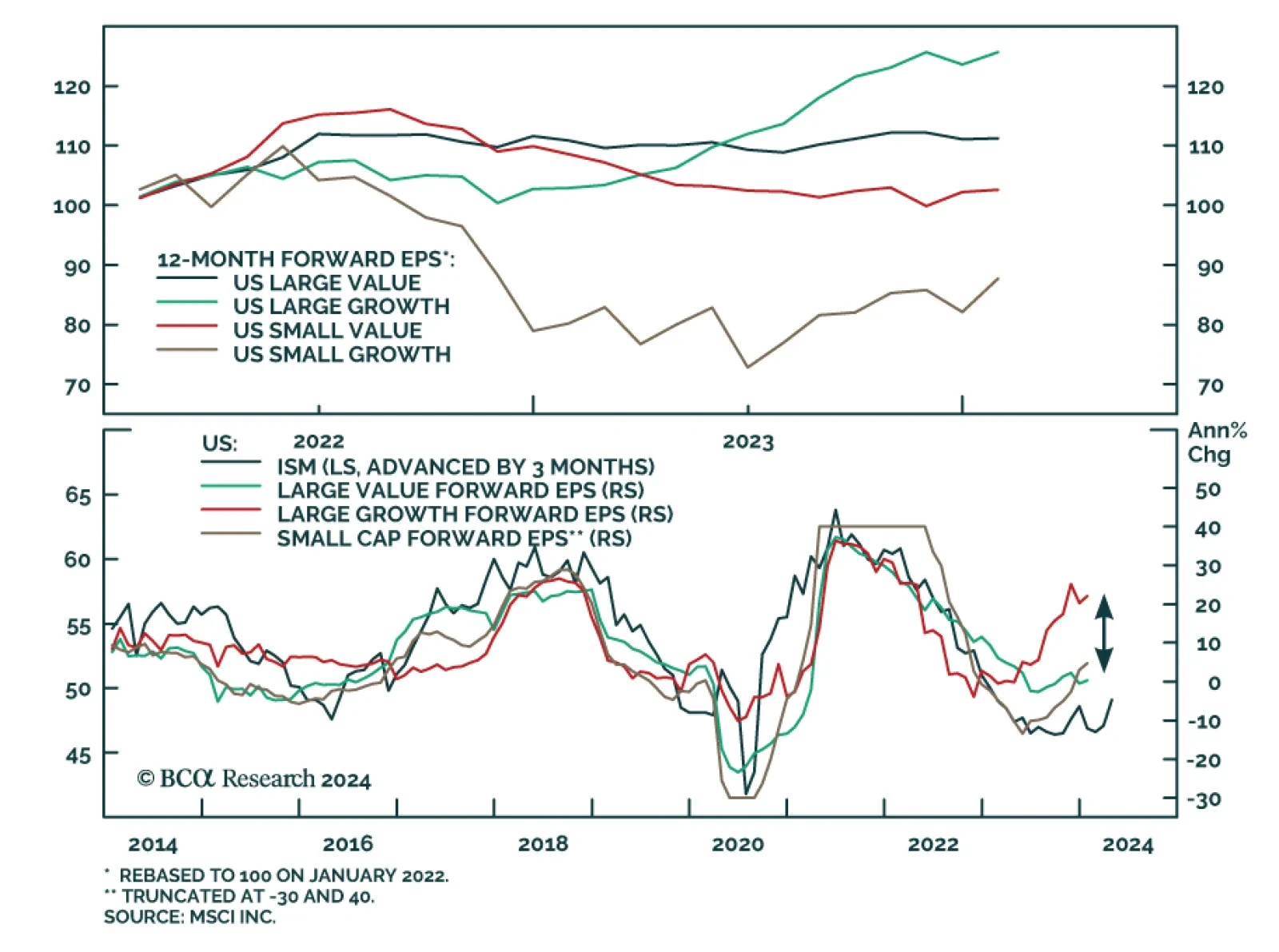

Our Global Asset Allocation strategists caution that US small-cap stocks’ deep discount relative to the S&P 500 is not the generational buying opportunity it may appear to be on its face. While the size premium…

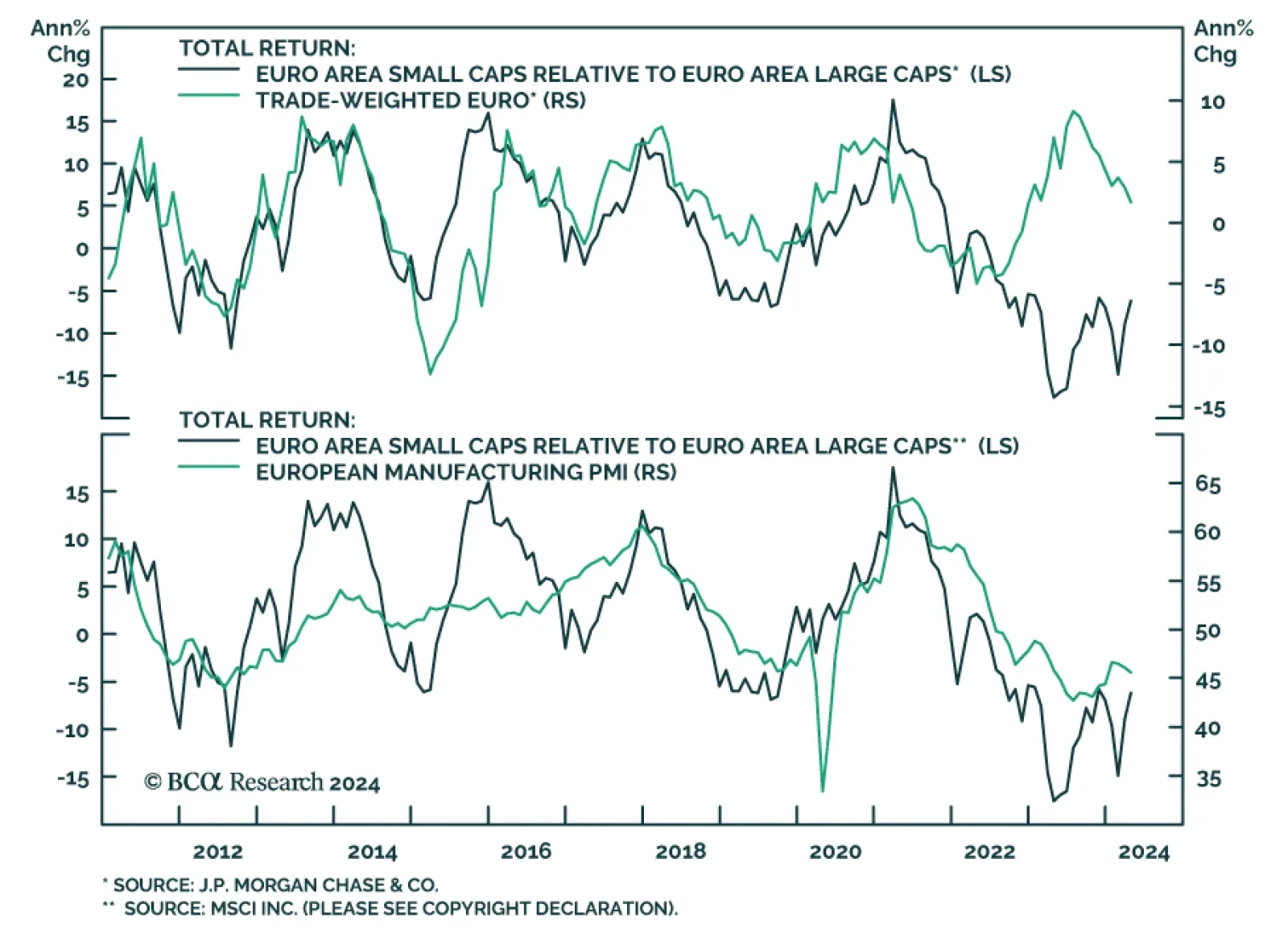

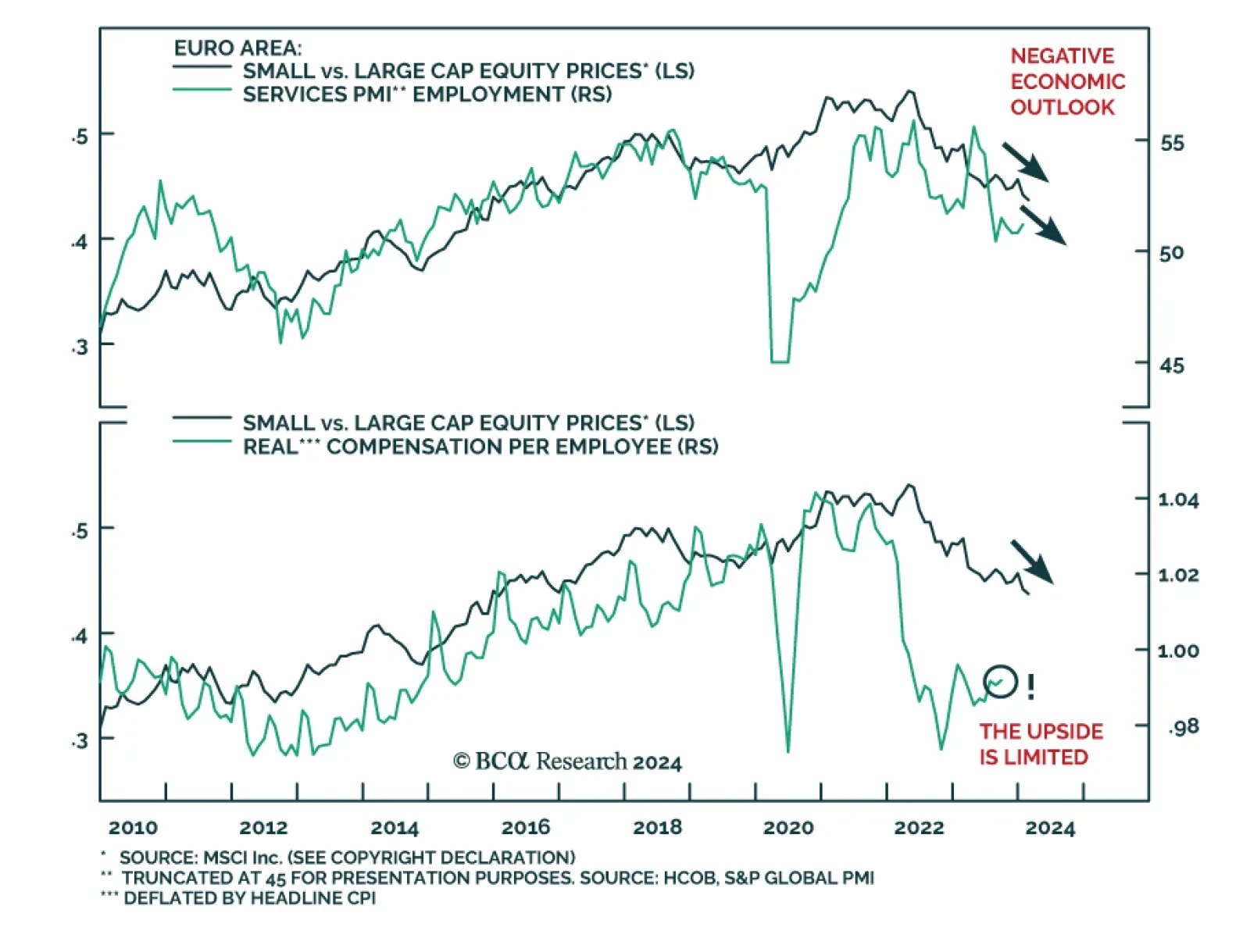

Euro Area small caps typically outperform large caps whenever the trade weighted euro appreciates and underperform whenever it depreciates. The rationale is simple. Most European large cap companies are large multinationals that…

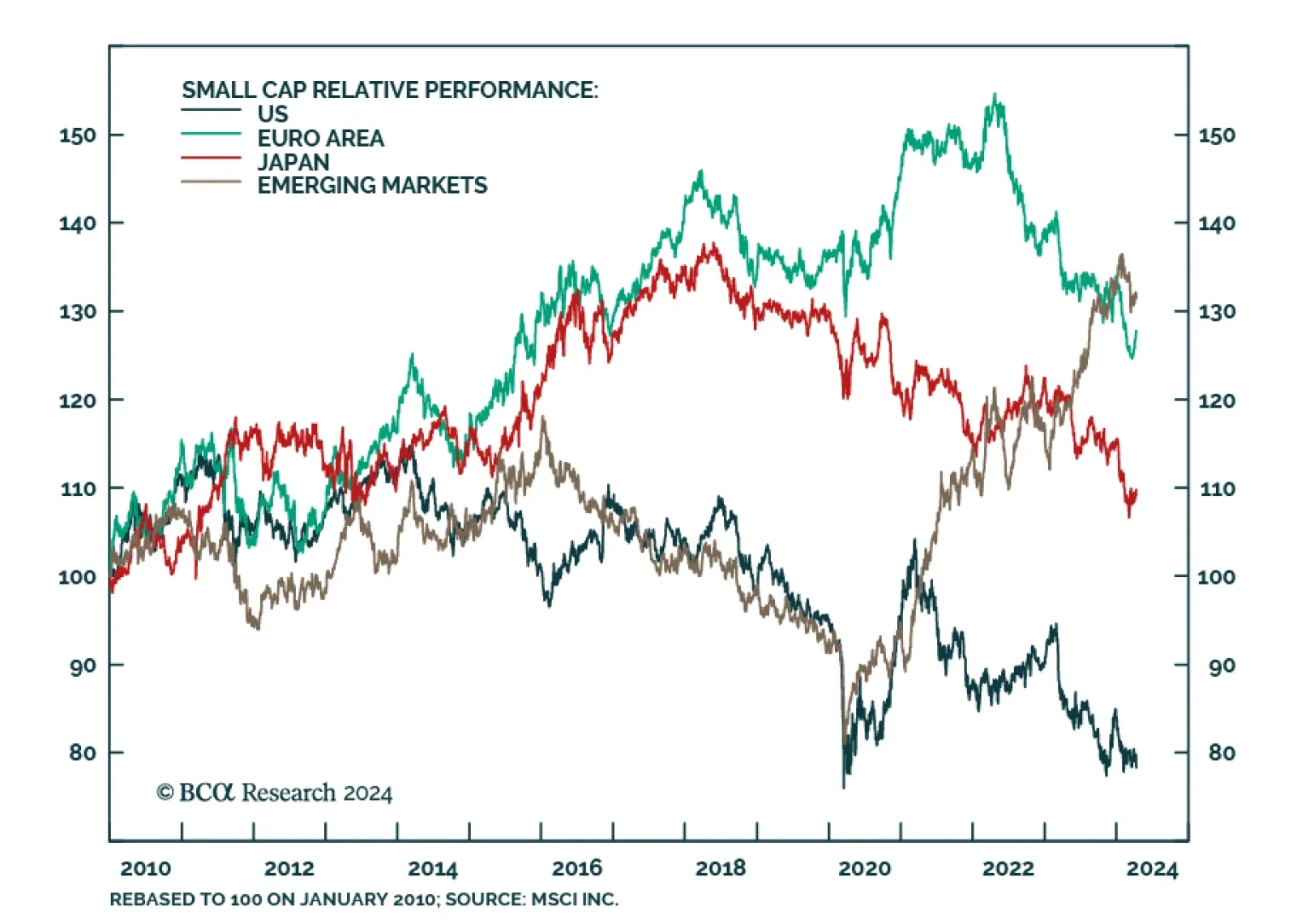

US, European and Japanese small caps have underperformed their large cap counterparts by 22.6%, 15.3% and 10.1% respectively since 2021. They now face conflicting forces. On the one hand, they are extremely beaten down and cheap…

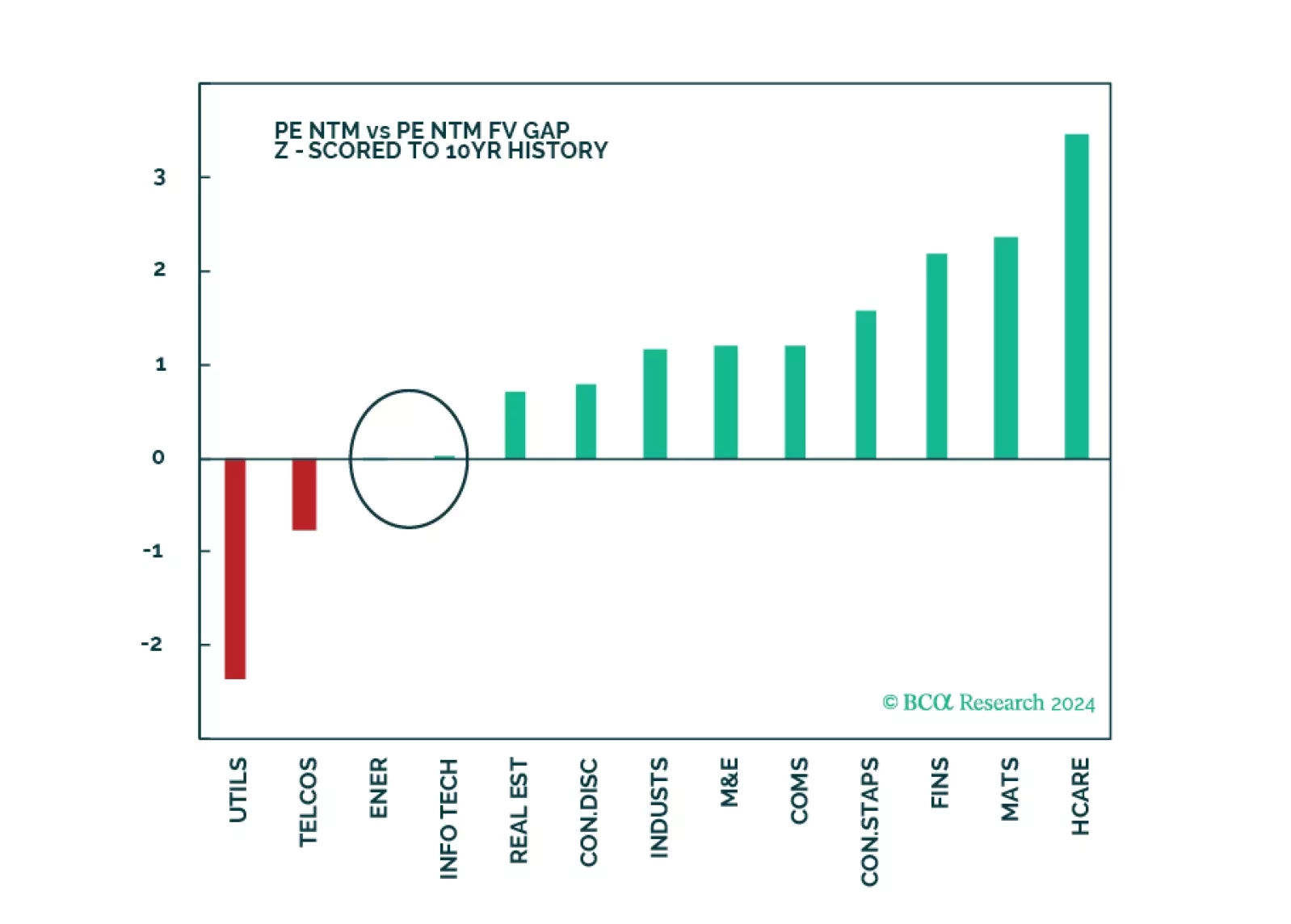

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

In an Insight we published yesterday, we highlighted that the S&P 500 rally has recently stopped narrowing with the gap between the market cap-weighted and equal-weighted indices stabilizing over the past month. This has also…

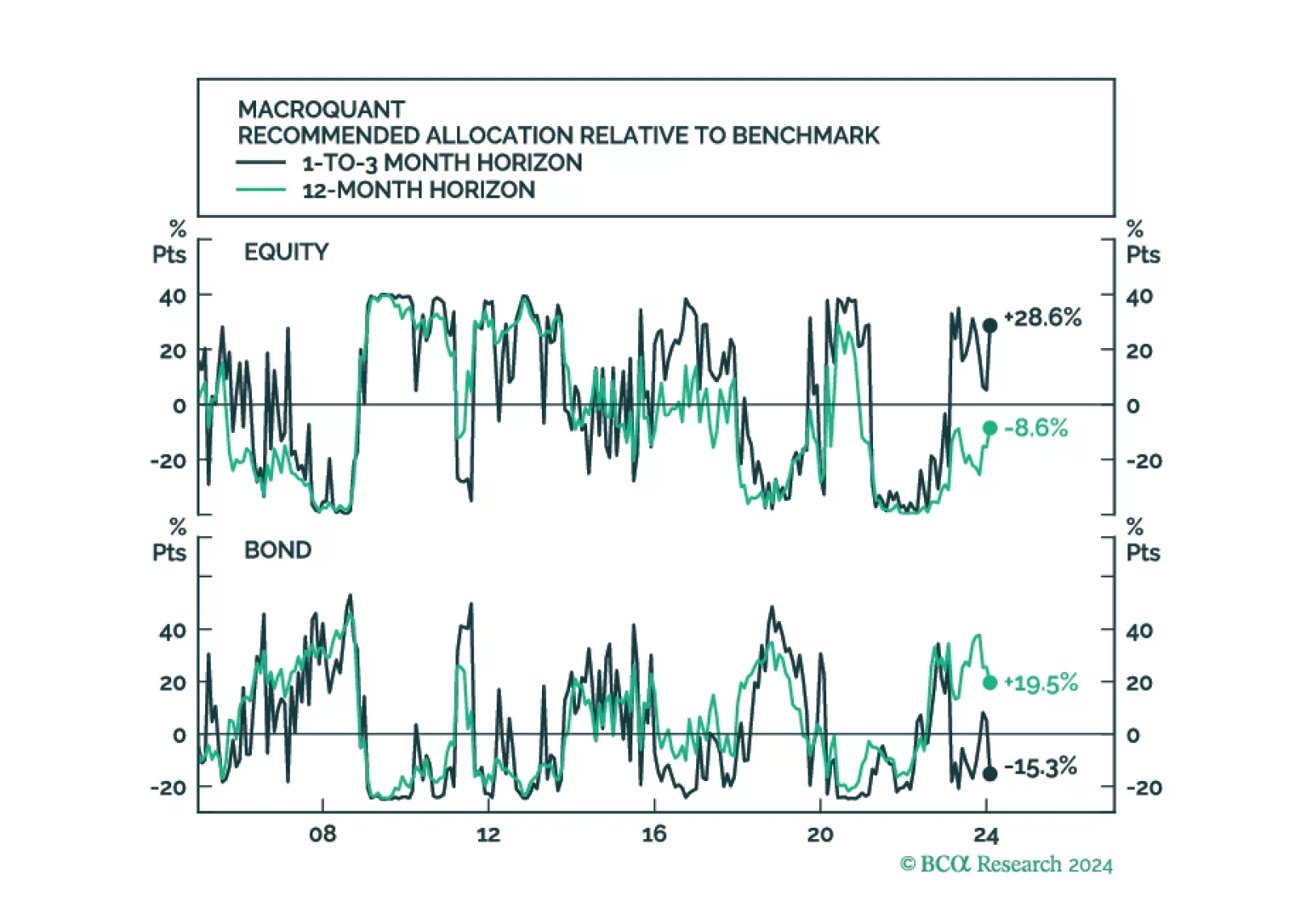

MacroQuant upgraded equities to overweight in February on a tactical short-term (1-to-3 month) horizon, but it continues to see downside risks to stocks on a medium-term (12-month) horizon. Consistent with the model’s relatively…

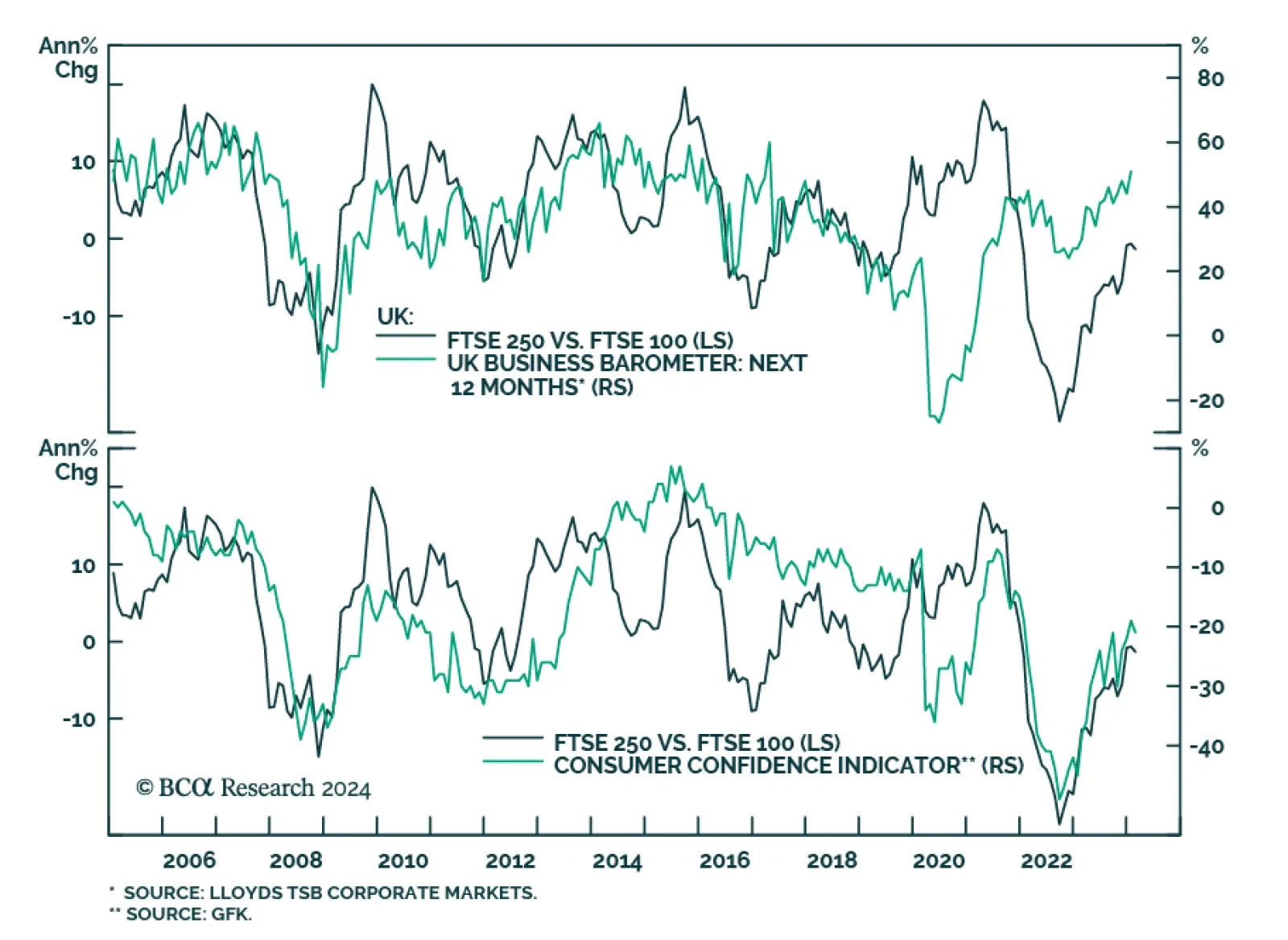

The FTSE 250 has been outperforming the FTSE 100 since late October 2023, with the former gaining 13.7% versus 3.9% in the case of the latter over this period. To the extent that UK small cap stocks are more exposed to…

The dominance of large tech companies in the S&P 500 has caused concern amongst investors. The Magnificent Seven now represent 30% of the index. These companies have more than doubled in value over the past year, in contrast…

Euro area small-cap stocks are attractively valued compared to their large-cap counterparts. They have underperformed by 20% since April 2022, but small caps’ earnings have kept pace with those of large-cap firms. Hence,…