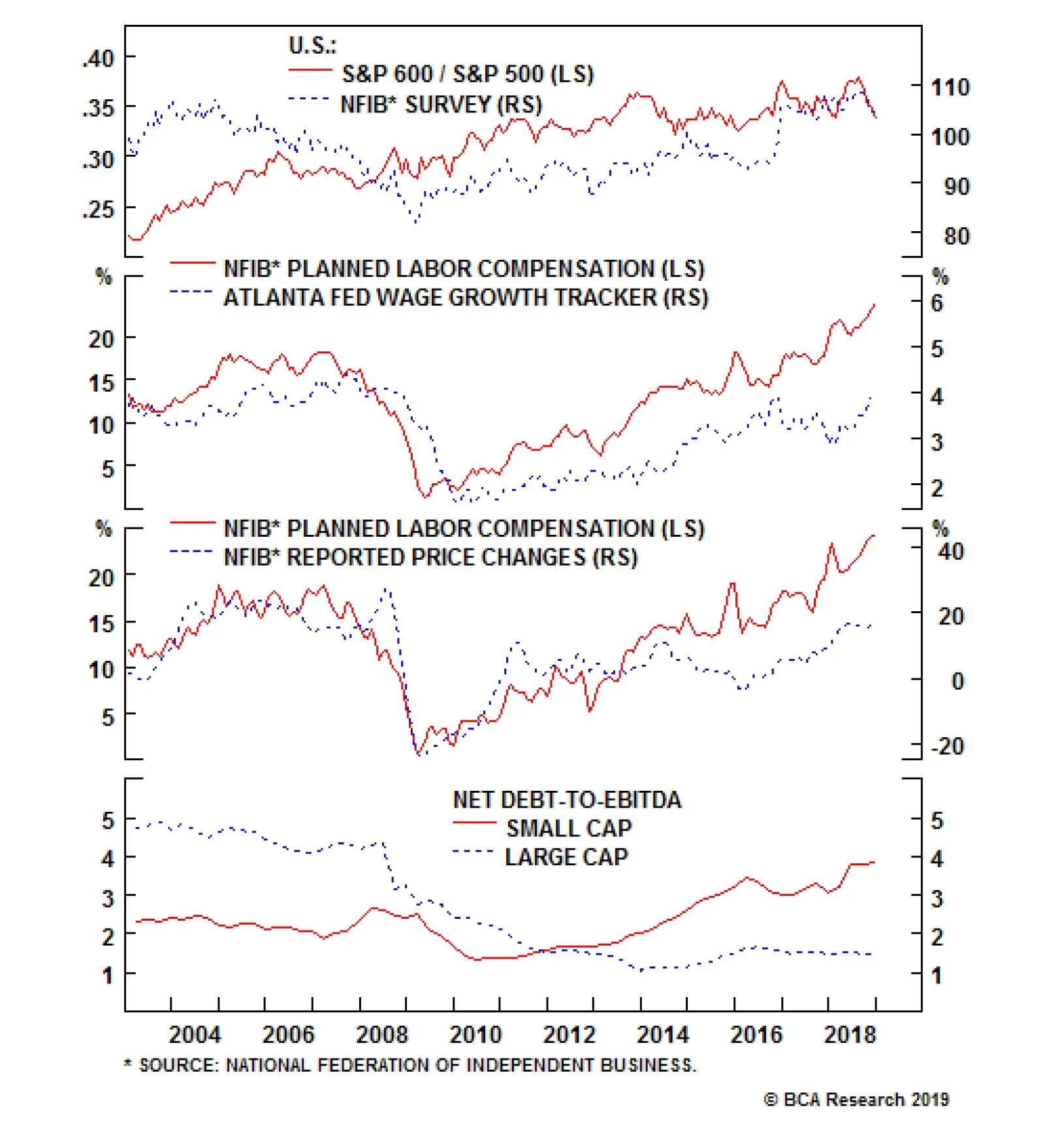

This week’s NFIB survey showed that in December, small business optimism has further declined, albeit from very high levels. This has coincided with the continued slide of small cap stocks relative to their large cap peers…

Prefer Large Caps To Small Caps (High-Conviction) This week’s NFIB survey showed that small business optimism has continued to fall through the end of the year, albeit from a very high level (top panel). This has coincided with…

The most recent National Federation of Independent Business (NFIB) small-business optimism index marked a notable shift in small business sentiment, coming in at its lowest level in seven months. Considering its correlation with…

Underweight Small Caps/Large Caps (High-Conviction) Small caps are severely debt saddled. Sustained small cap balance sheet degradation is worrying, with S&P 600 net debt-to-EBITDA close to 4 compared with less than 2 for…

Highlights Portfolio Strategy Higher interest rates, with the Federal Reserve tightening monetary policy three more times in the next seven months, will be the dominant theme next year. All four of our high-conviction underweight…

Despite a stellar Q3 earnings print, the S&P 500 had a terrible October as EPS continues to do the hard work in lifting the market (Chart 1). Chart 1EPS Doing The Heavy Lifting We bought the dip,1 consistent with our view…

Overweight Large Caps Over Small Caps The days in the sun are over for small cap stocks. Similar to the double top formation in the early 1980s, small cap stocks have hit a wall and are giving in to their larger brethren. There are high…

Highlights Portfolio Strategy Debt saddled small caps have to wrestle with rising interest rates at a time when they lack a valuation cushion. Tack on their high beta status and investors should continue to avoid small caps and…