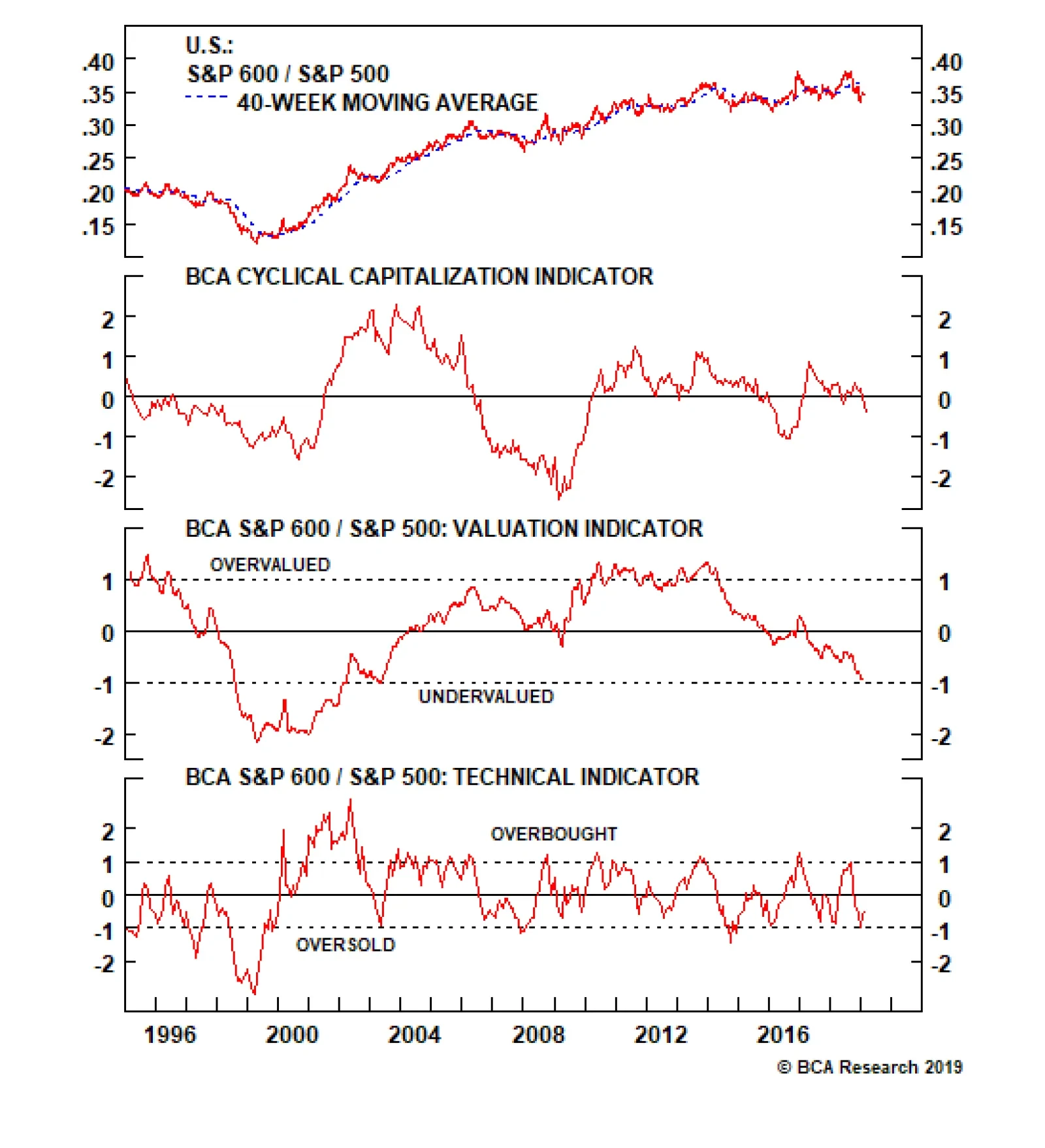

We are removing the large cap bias we have had on a tactical basis since our December 2018 High-Conviction Call report and booking gains of 9% (top panel). We are also setting a stop near the 10% return mark to protect cyclical profits…

Bearishness toward small vs. large caps has been pervasive over the past year, raising the question: Does it still pay to prefer large caps to small caps? The short answer is yes. Five key reasons underpin our large/mega…

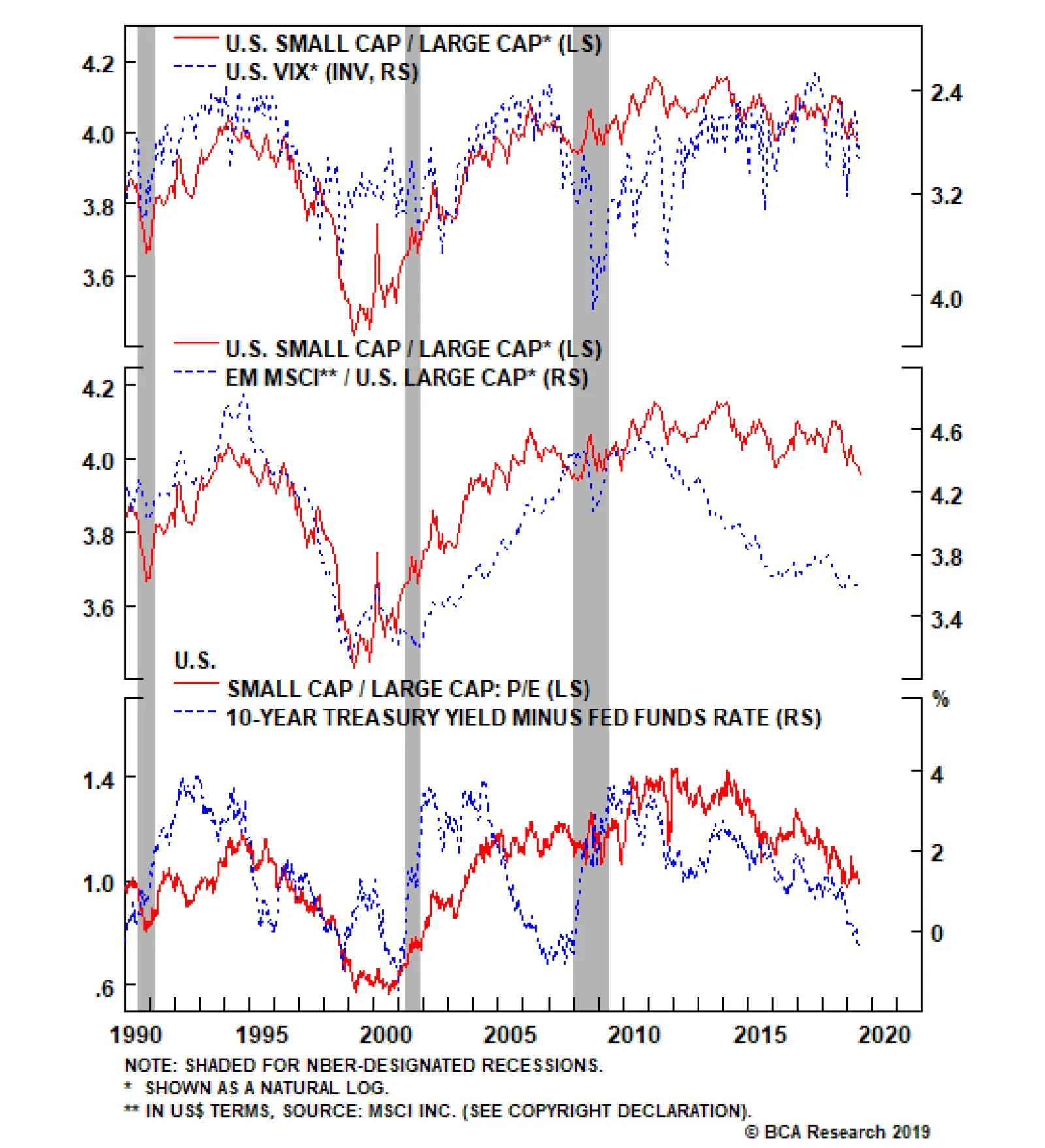

The relative small cap/large cap share price ratio sits at multi-year lows, having given back all the gains realized since the 2016 U.S. election (see Chart). Our U.S. Equity Strategy service provides five key reasons to maintain…

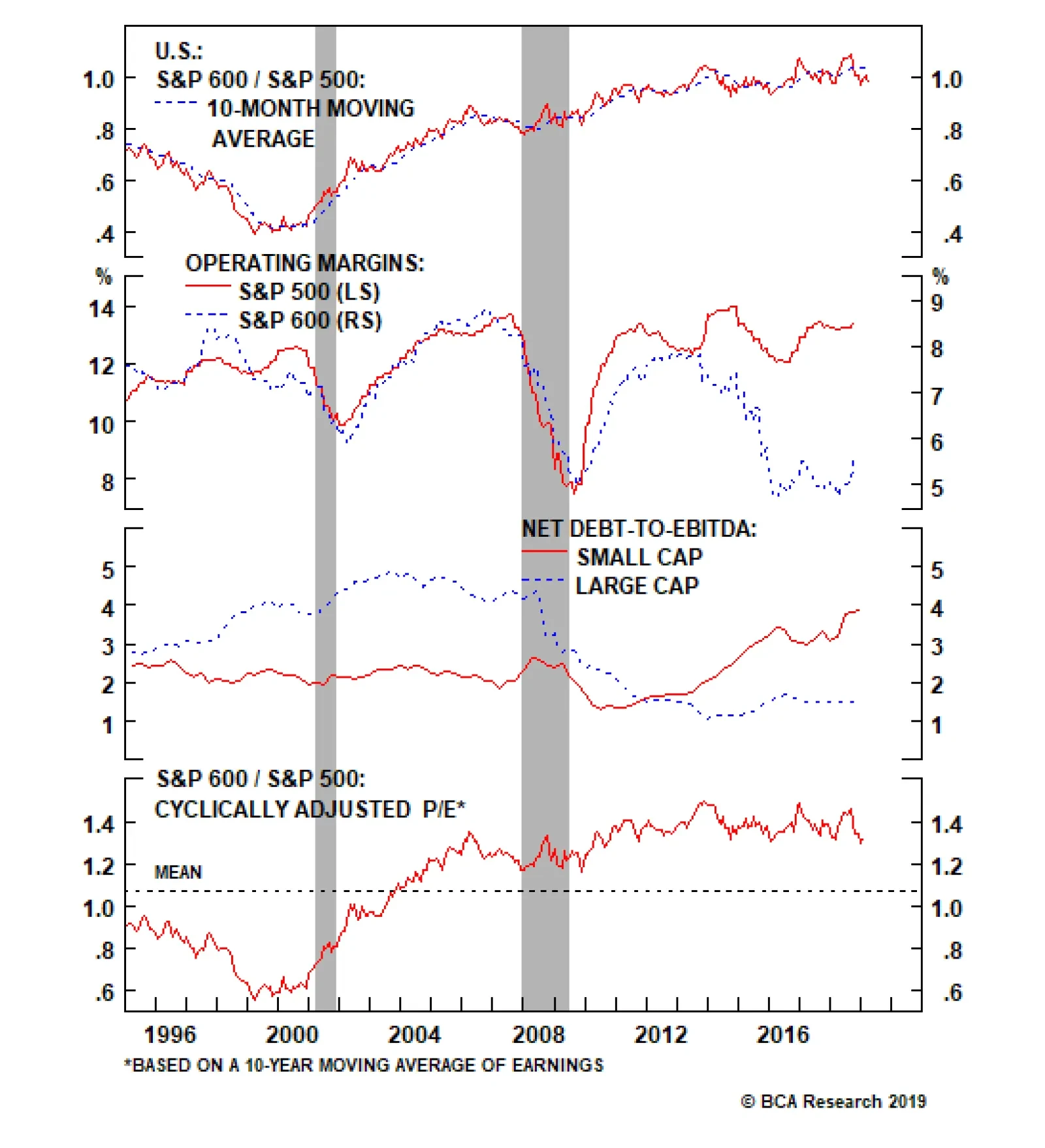

Highlights Portfolio Strategy Melting inflation expectations, widening relative indebtedness, expensive adjusted relative valuations, high odds of a further drop in relative profit margins and the high-octane small cap status all…

Small caps have been underperforming their large cap brethren this month, as the latter internationally-exposed group has benefitted disproportionally from news of a potential trade deal ending the U.S. - China dispute. While…

Prefer Large Caps To Small Caps (High-Conviction) Small caps have been underperforming their large cap brethren this month as the latter internationally-exposed group has been benefitting disproportionally from news of a…

Our size CMI has been hovering near the boom/bust line, as it has for most of the last two years. Despite the neutral CMI reading, in response to the diverging (and unsustainable) debt levels of small caps vs. their large cap…

Key Portfolio Highlights The S&P 500 has started 2019 with a bang as dovish cooing from the Fed has proven a tonic for equities. While we have not entirely retraced the path to the early-autumn highs, our strategy of staying…