As 2019 draws to a close, we thank you for your ongoing readership and support. We wish you and your loved ones a happy holiday season and all the best for a healthy and prosperous 2020. Highlights We explore the principal risks to…

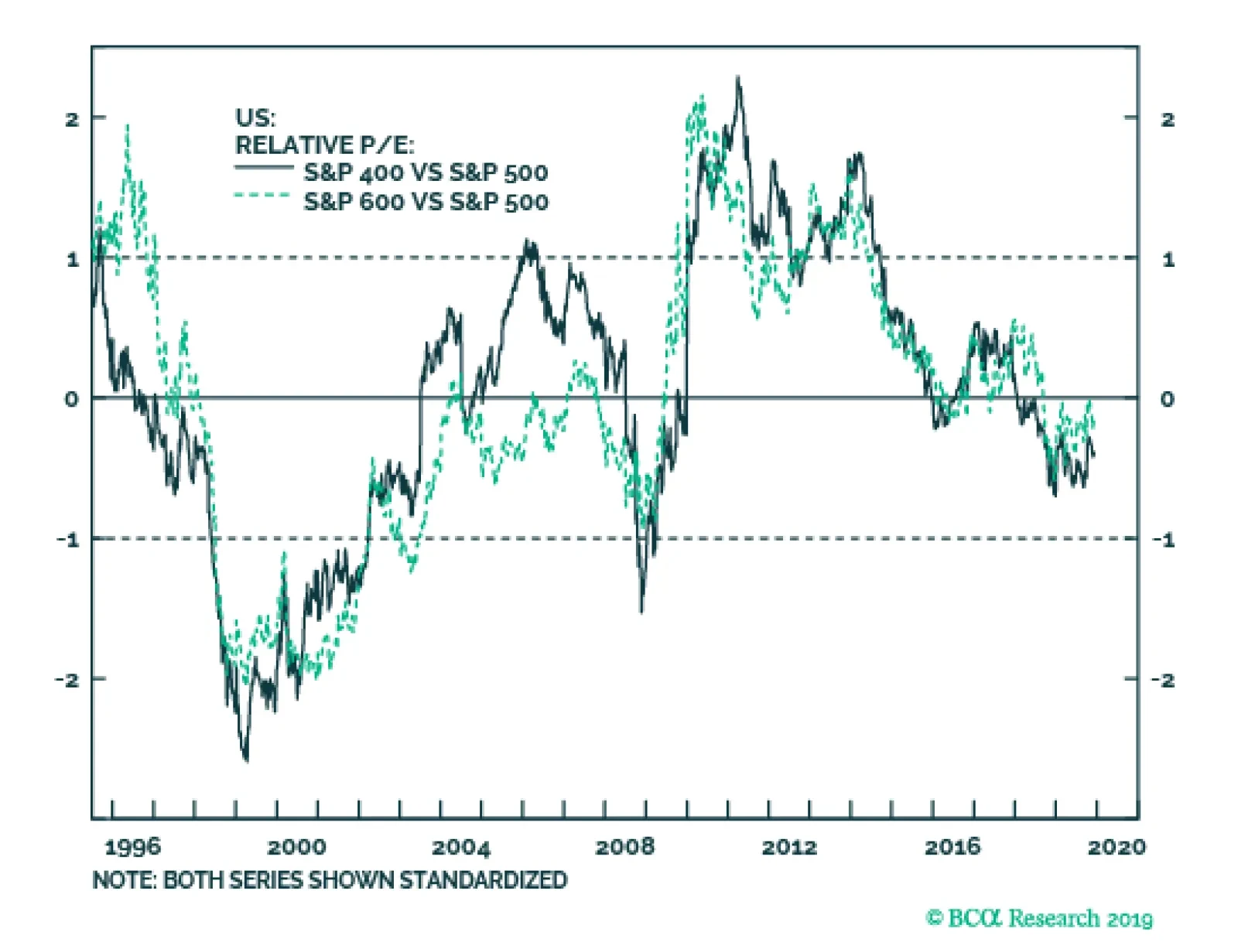

Overweight The large cap size bias is our sole hold out from last year’s high-conviction list despite getting stopped out and booking a handsome 9% profit. We recommend reinstating a large cap size bias. This…

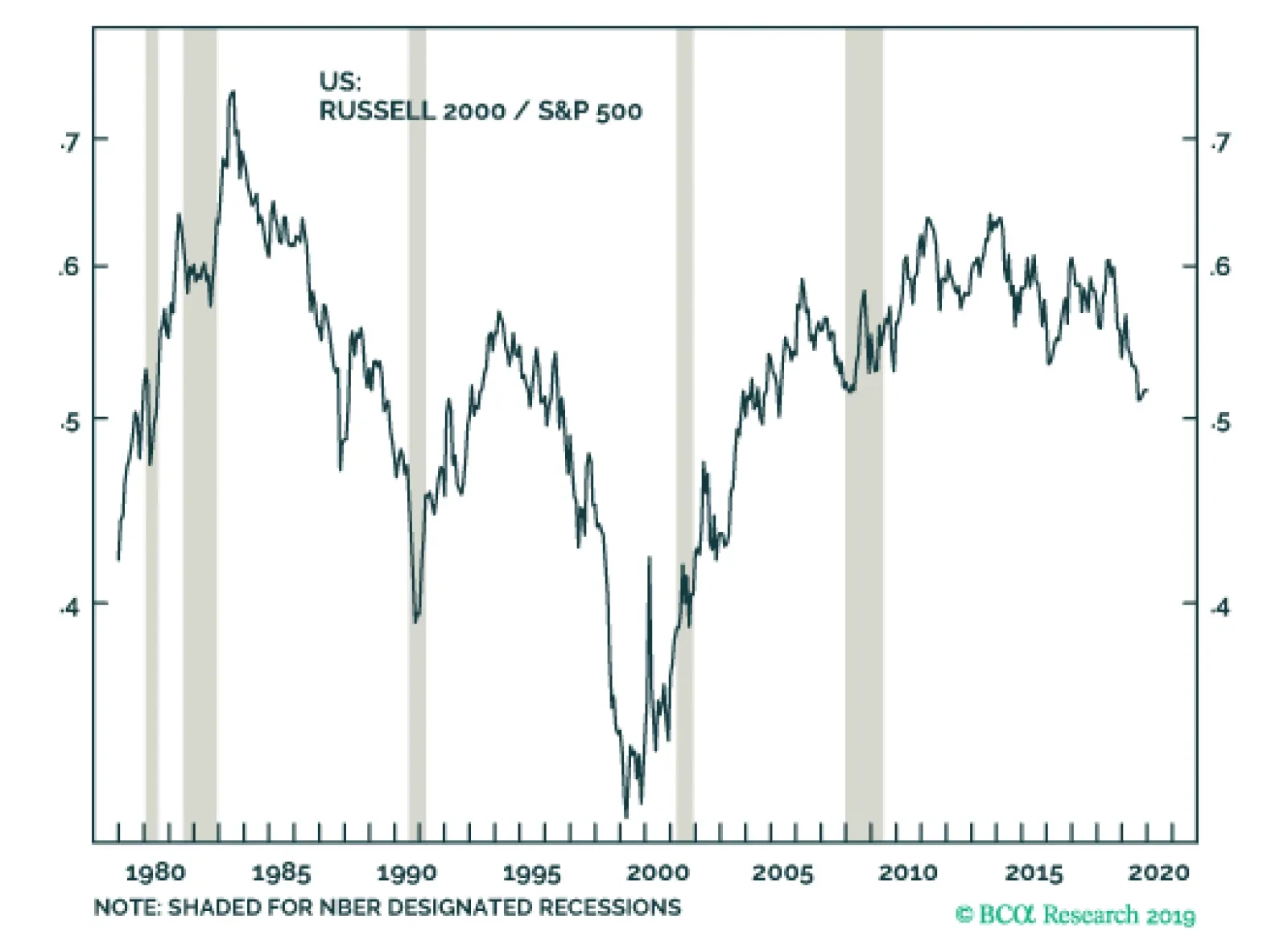

The preference for small cap stocks is a secular view that spans the next decade, not a recommendation for the next 12 months. The small versus large cap share price ratio ebbs and flows over long cycles. Small caps…

The S&P 500 has made thirteen new all-time highs, or about one every other day, since the last week of October. The S&P SmallCap 600, on the other hand, just narrowly topped its year-to-date high, and remains more than 9…

Highlights Portfolio Strategy Interest rates are one of the most important macro drivers of overall equity returns via valuations. BCA’s view of a selloff in the bond market is a key factor underpinning most of our 2020 high-…

Highlights BCA still sees green shoots: Our latest view meeting reinforced BCA strategists’ optimistic global outlook, and we are methodically adding international and cyclical exposures to reflect it. Relatively modest M&A…

The latest NFIB job openings data nosedived, warning that small cap troubles are even deeper than previously assumed. Worrisomely, when compared with non-farm payrolls (gauging the large cap labor market) our proxy is sending…

The latest NFIB survey made for grim reading. Following up from this Monday’s profit margin report, the forward margin relevant survey subcomponents signal that small business profit margins will suffer a squeeze.…