The most stunning detail from the April Personal Income & Outlays release in the US was the surge of the savings rate to a record 33% of disposable income. It reflects that households are not spending the help they received…

Neutral We recently capitalized gains of 37% in our size bias and moved to neutral in the S&P 500 / S&P 600 share price ratio as our 10% rolling stop was hit. In addition, in the most recent Weekly Report we…

BCA Research's US Equity Strategy service no longer has a size bias. When the economy was shutting down, small and medium businesses were clearly the outfits that would suffer the most. Thus, investors started pricing in a…

Highlights Portfolio Strategy An easy Fed as far as the eye can see and World War-like fiscal easing packages as the Trump administration prepares to slowly reopen the economy, signal that the path of least resistance remains higher for…

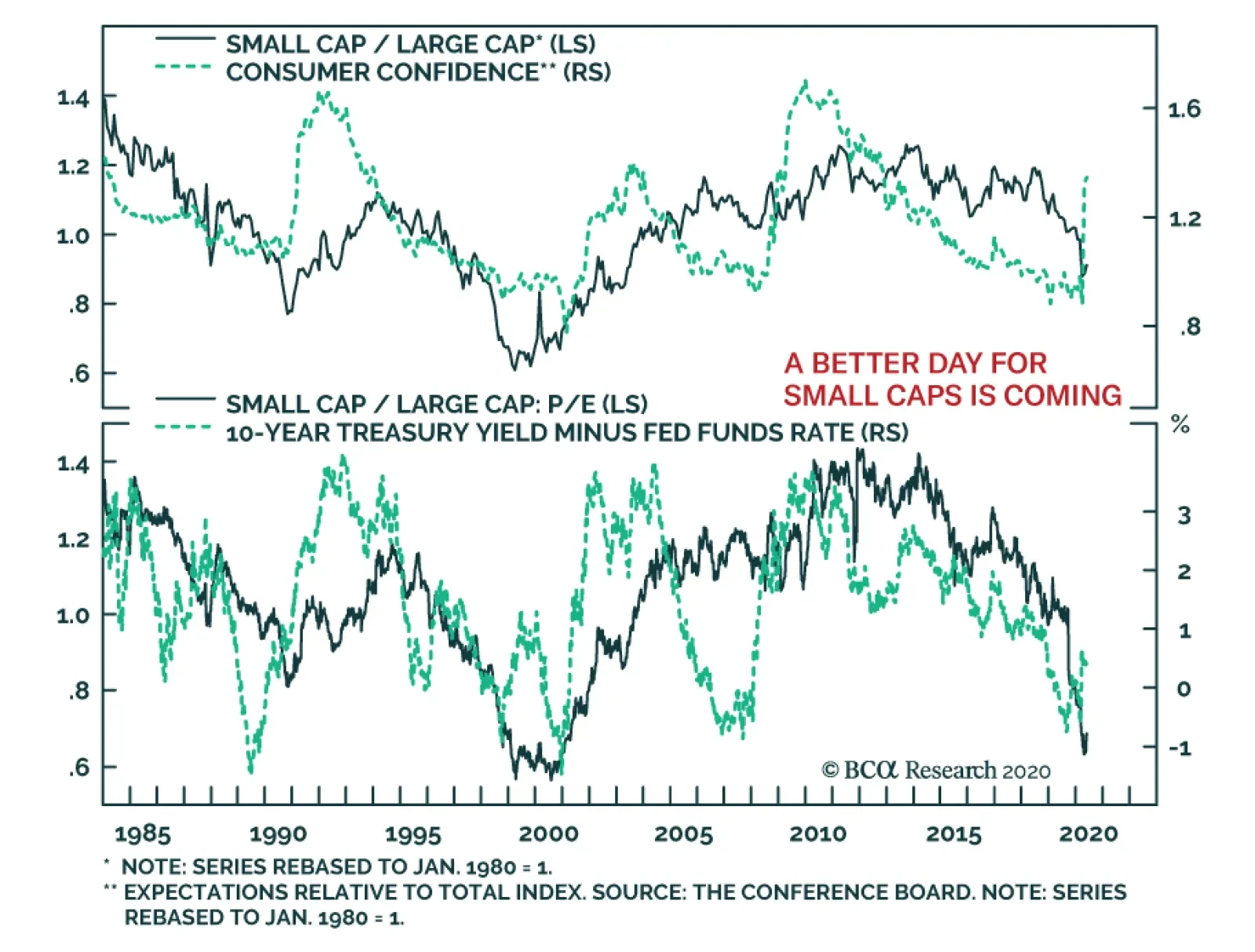

In the spring of 2018 we initiated a size preference of large caps at the expense of small caps. At the time, we went against the grain as the investment community was arguing that small caps would offer the best protection from President…

Equity market bloodletting likely reached a climax last Thursday as indiscriminate selling pushed correlations to the extremes of +/-1. Since then however, hypersensitive stocks have made an attempt for a comeback. These…

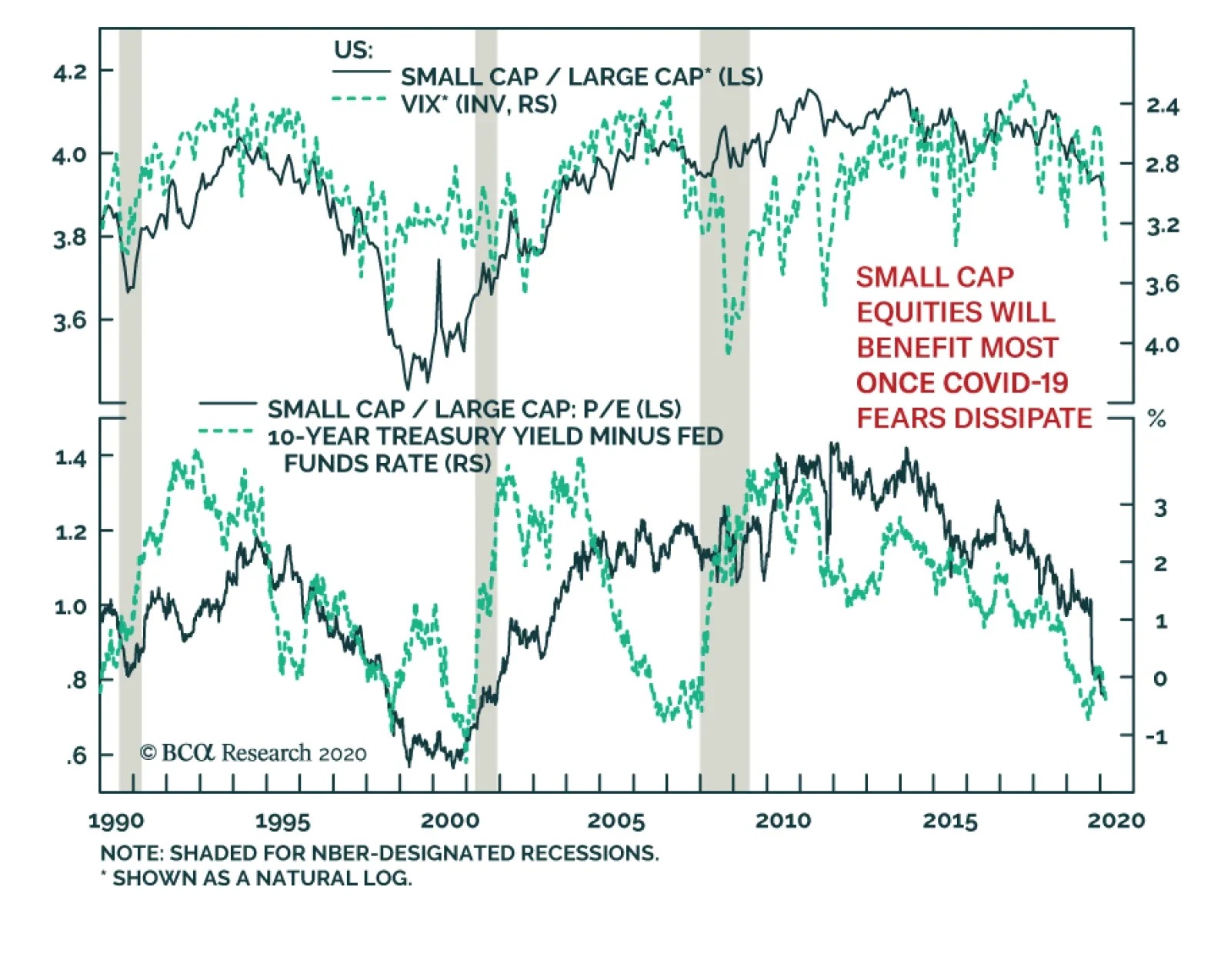

There is a lot of uncertainty that reverberates through the equity markets and the dust has yet to settle down from Monday’s big crack. Small caps (similar to weak balance sheet stocks, middle panel) have cratered for…

While the collapse in the S&P 500 grabbed financial headlines this week, small caps suffered a much worse fate. Such a move was in line with historical drivers. Small cap stocks underperform their larger brethren when the VIX…

Cyclical & High-Conviction Overweights Both our cyclical and 2020 high-conviction large caps overweights versus small caps are in the black by 20% and 5%, respectively, since inception. Debt-saddled small caps have been left behind…

Feature The purpose of this Special Report is to identify and provoke a healthy debate on the prevailing investment themes for the 2020s and to speculate on what the key US sector beneficiaries and likely losers may be. Every decade a…