Your feedback is important to us. Please take our client survey today. Highlights Portfolio Strategy Today we recommend investors shift to a small versus large cap size bias on the back of rising inflation expectations, a steepening…

Is the long-period of underperformance of small-cap stocks ending? From March to June, it seemed to be the case, with the Russell 2000 outperforming the S&P 500 by nearly 15%. Yet, ever since, small-cap stocks have traded…

Rotation out of the tech titans is a high probability scenario given that the easy money has already been made as AAPL, MSFT and AMZN each commanded an almost $2tn market capitalization near the peak on September 2. Thus,…

Highlights A weak dollar and low bond yields have pushed up the S&P 500 more than anticipated. Cyclical forces favor loftier stock prices in 12 months. Froth creates short-term vulnerabilities that higher yields could catalyze.…

Dear Client, In lieu of our regular report next week, we will be sending you a Special Report from my colleague Garry Evans, Chief Global Asset Allocation Strategist. Garry will be discussing the social and industrial changes that will…

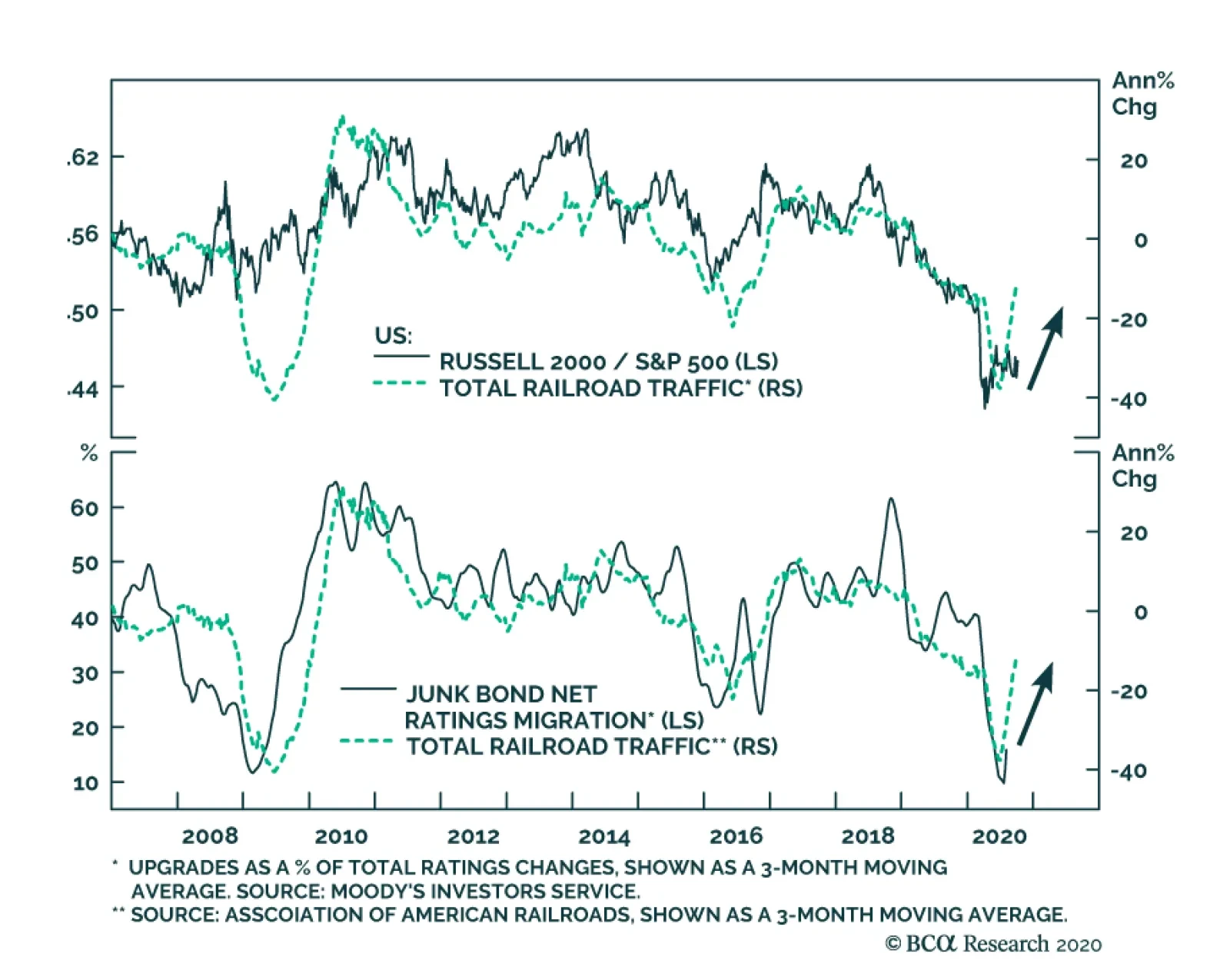

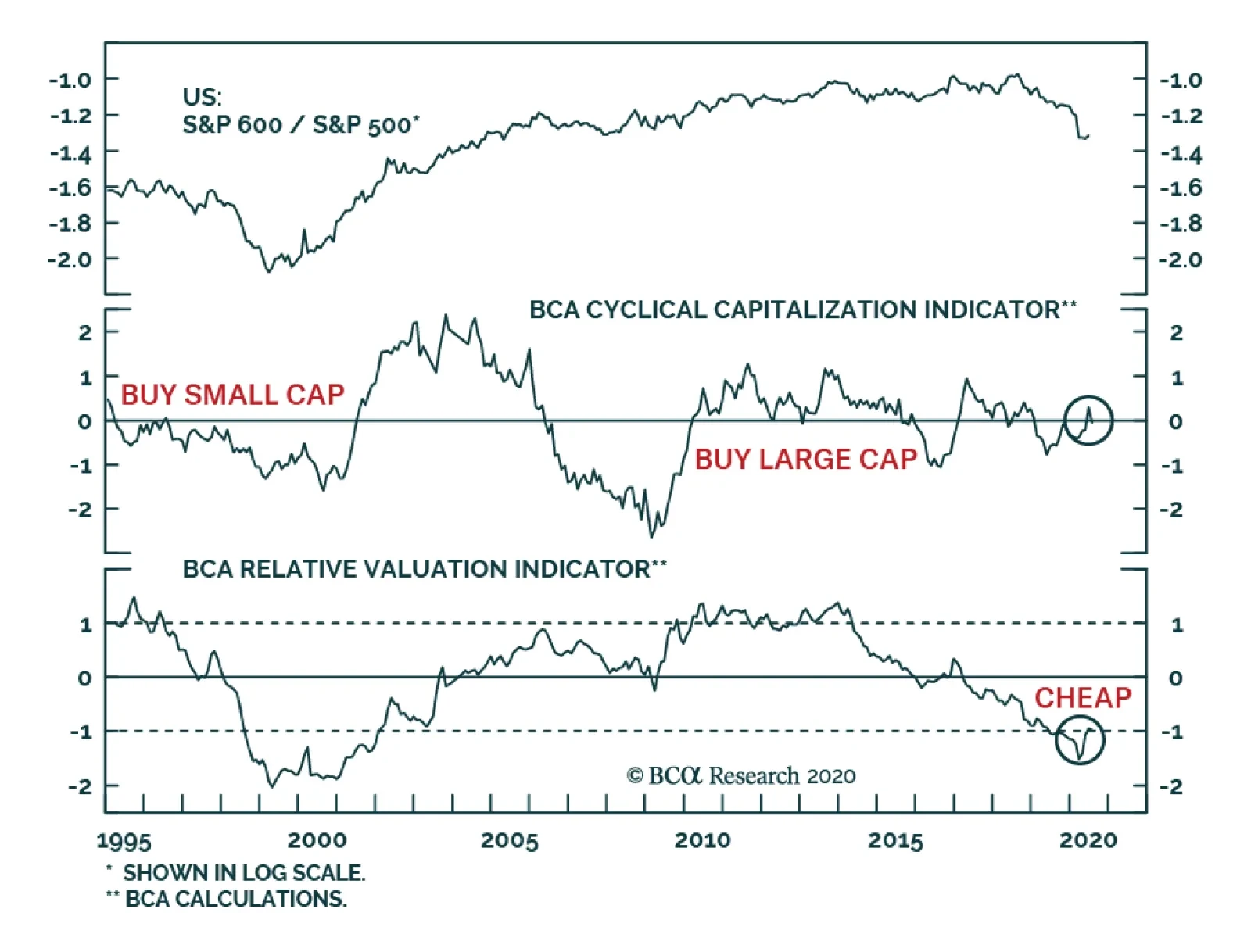

Small-cap stocks have outperformed the S&P 500 since mid-March, albeit choppily. This trend can continue as our BCA US Cyclical Capitalization Indicator is flashing a buy signal for small firms relative to their larger…

Highlights Policymakers vs. the virus remains the story at the macro level: Fiscal support is the wild card, but we expect Senate hawks, caught between the House and the White House, will roll over in the end. The economy is perking…

Despite the strong rally in stocks since mid-March and a looming second wave of the pandemic, we continue to recommend that investors overweight equities on a 12-month horizon. Needless to say, this view has raised some eyebrows. With…