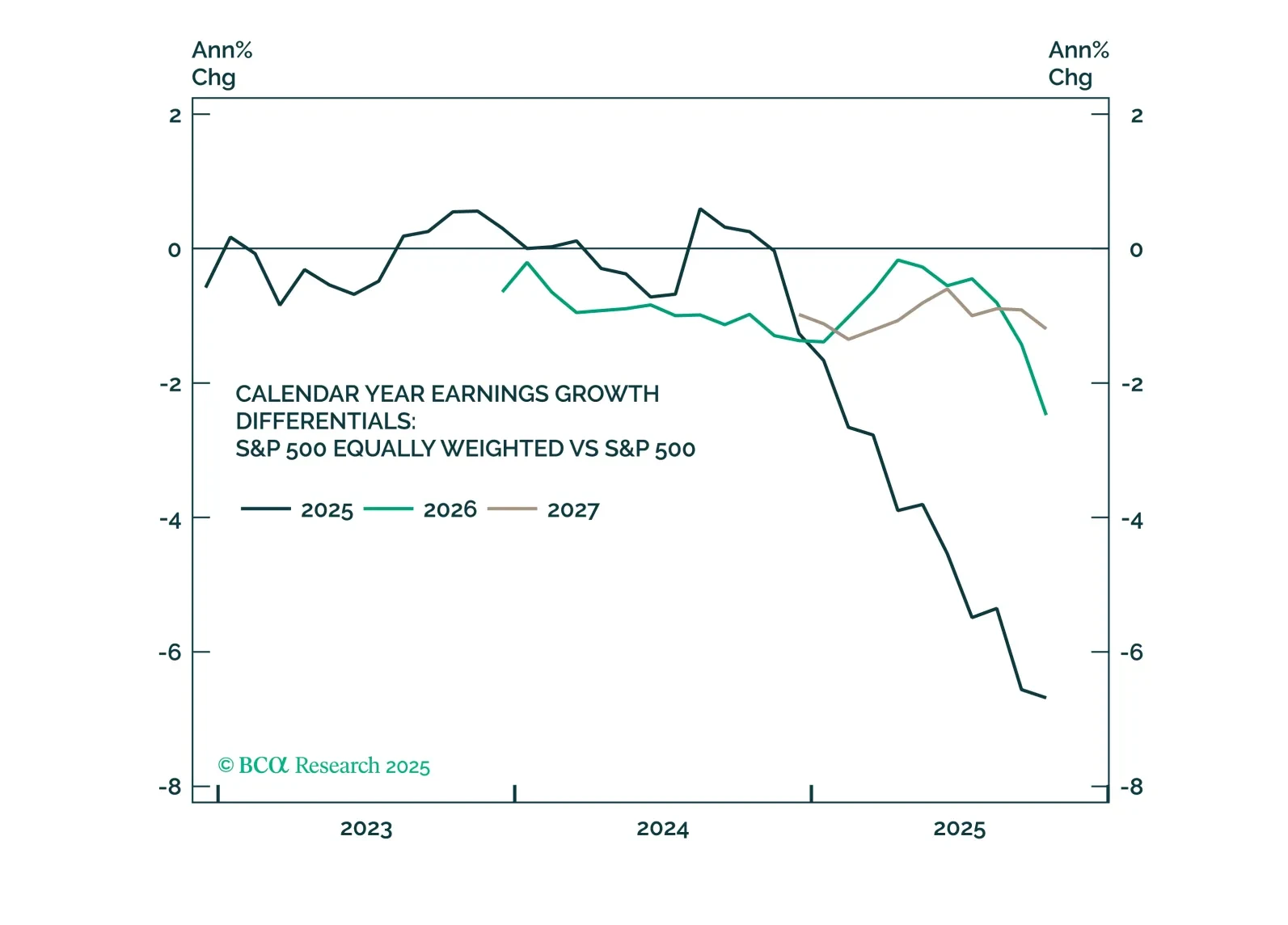

The outperformance of the S&P 500 relative to the S&P 500 EW index is likely to continue over the next year, supported by stronger earnings growth. However, extreme levels of market concentration will ultimately halt the…

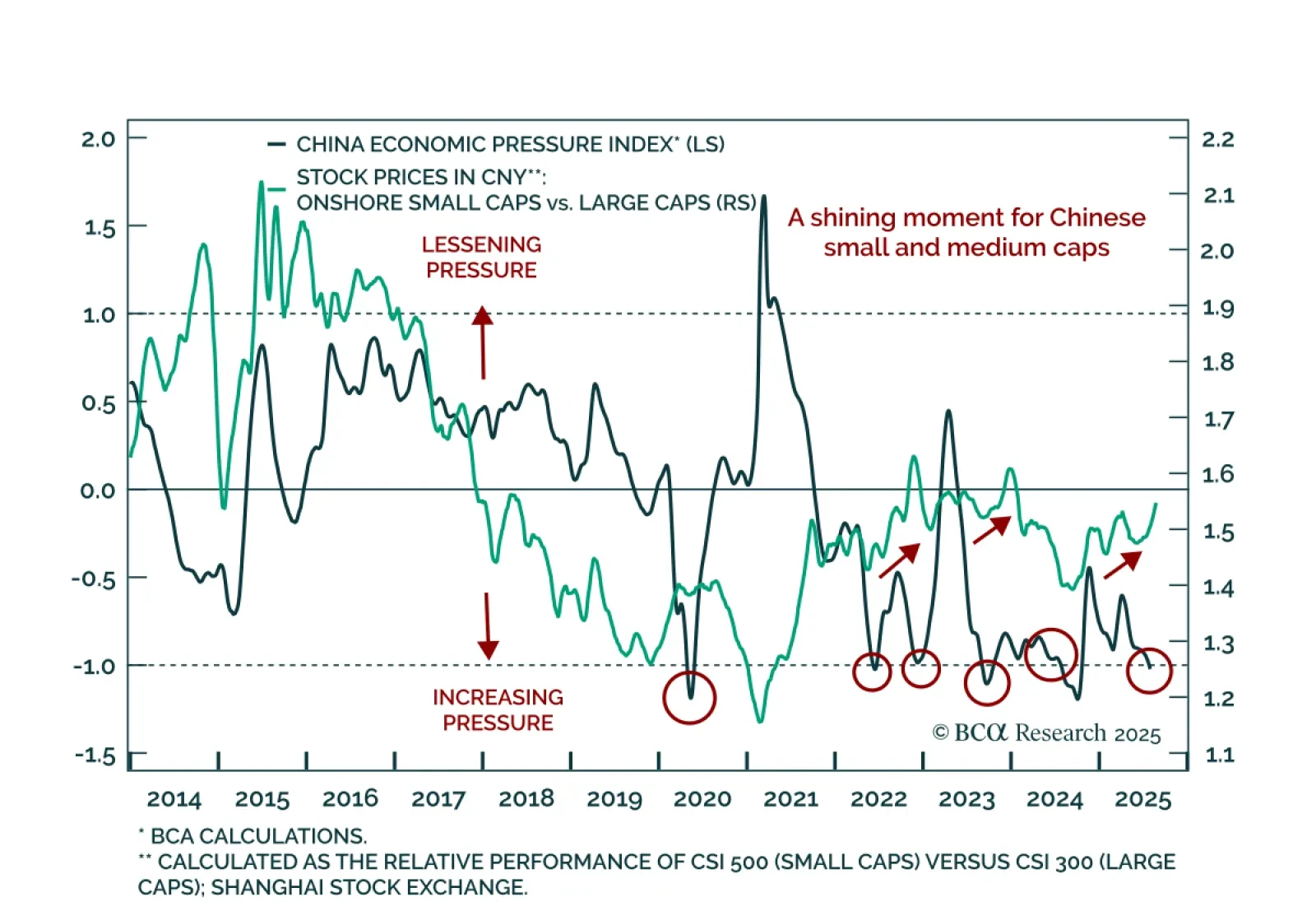

Our China Investment strategists advise against chasing the recent equity rally but recommend a tactical long on onshore small and mid caps versus large caps ahead of potential stimulus. Their new China Economic Pressure Indicator (…

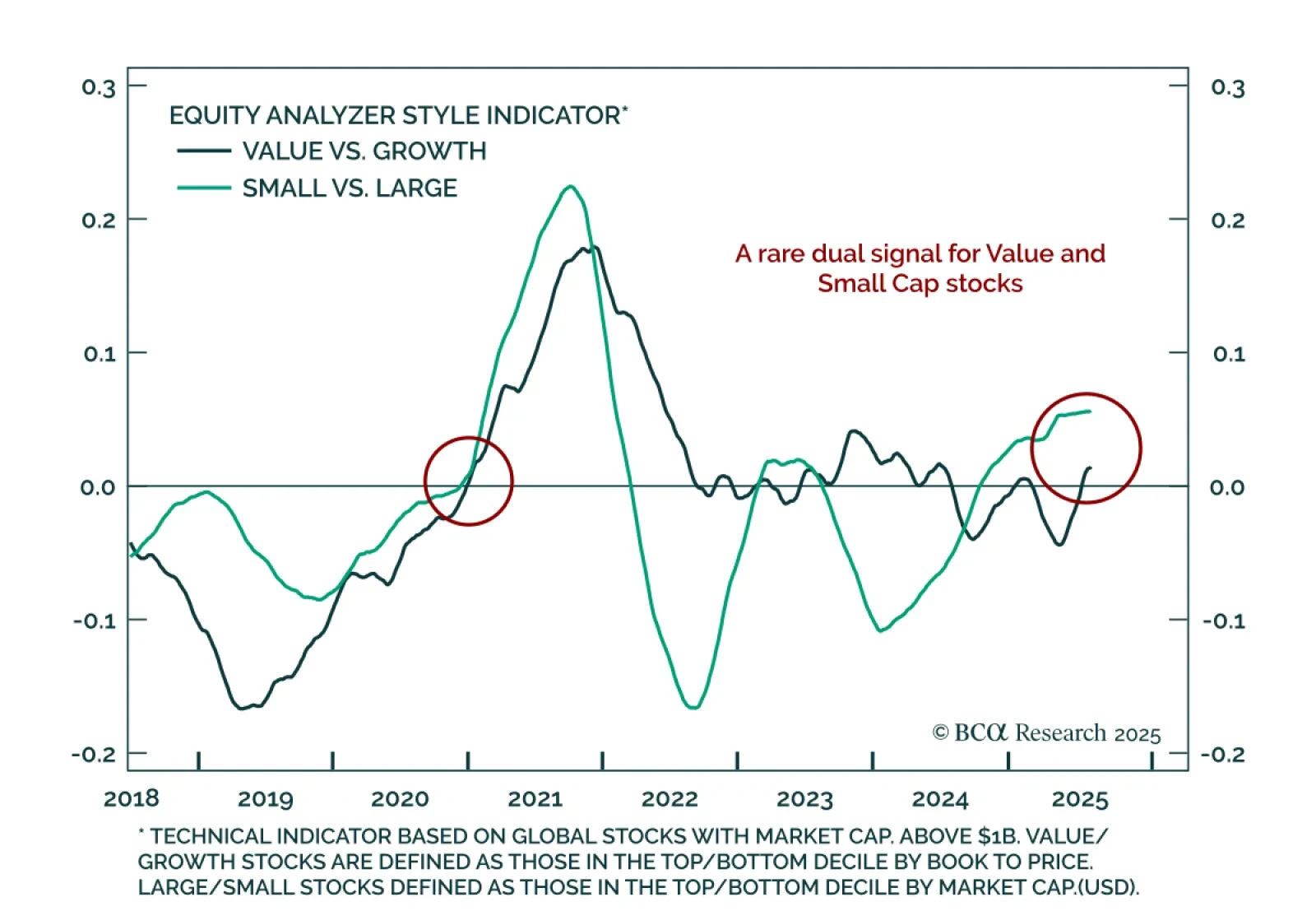

Momentum is building behind small-cap and value stocks, signaling a rare dual tailwind for cyclical styles. Our Chart Of The Week comes from Guy Russell, strategist for Equity Analyzer.While market attention remains focused on the…

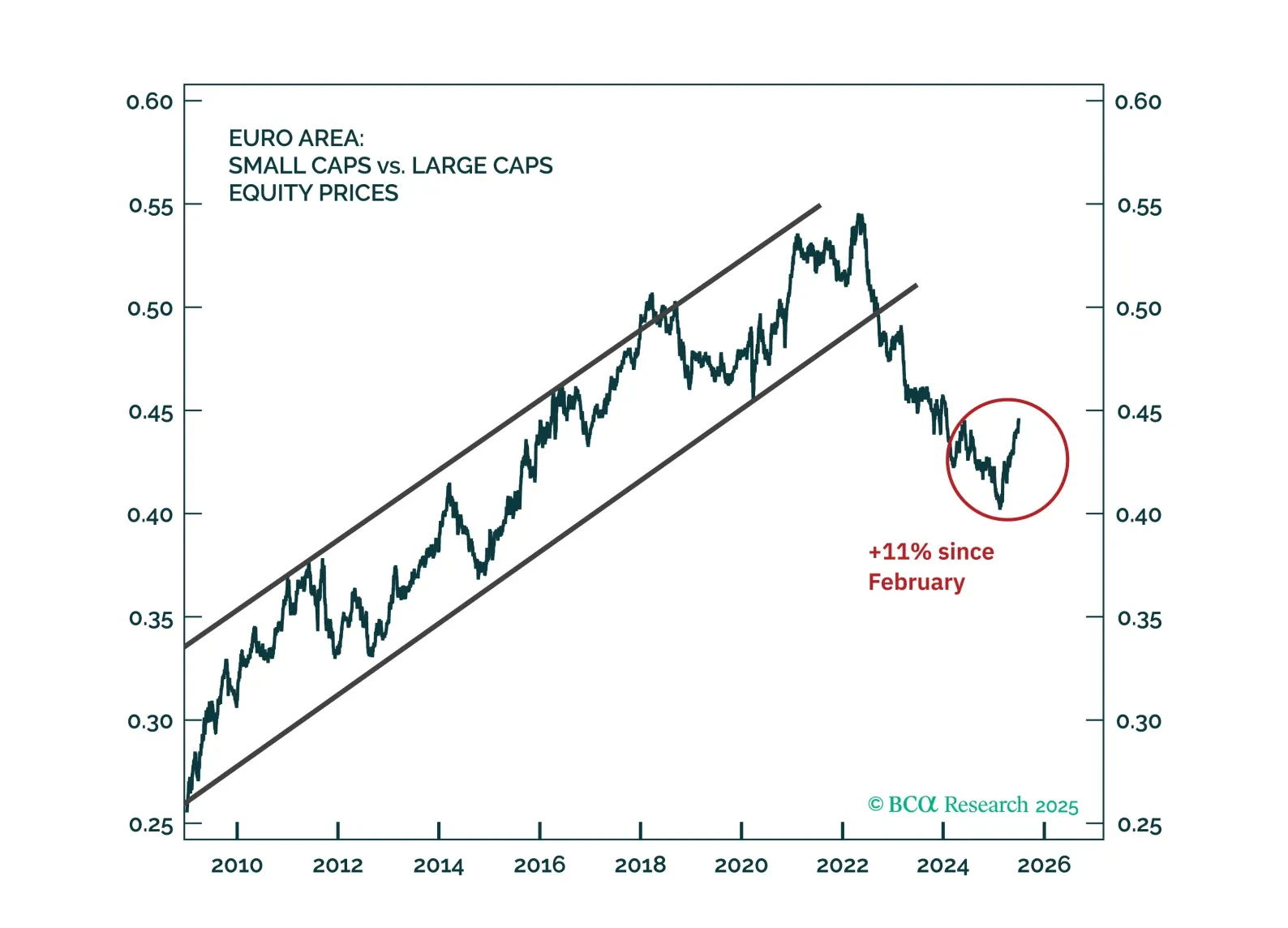

We upgrade European small caps to maximum overweight and double down on our existing recommendation to go long European small caps relative to US ones.

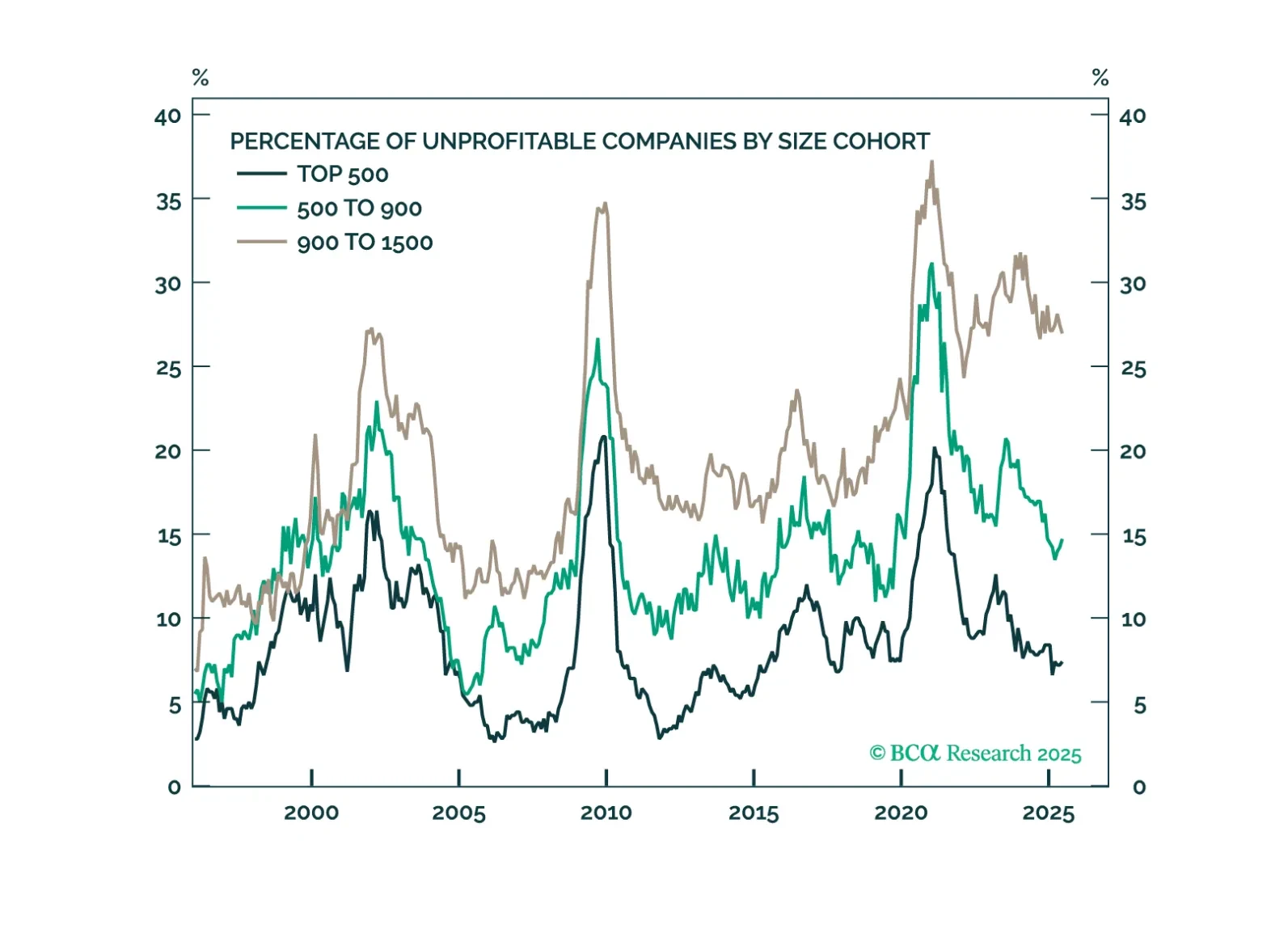

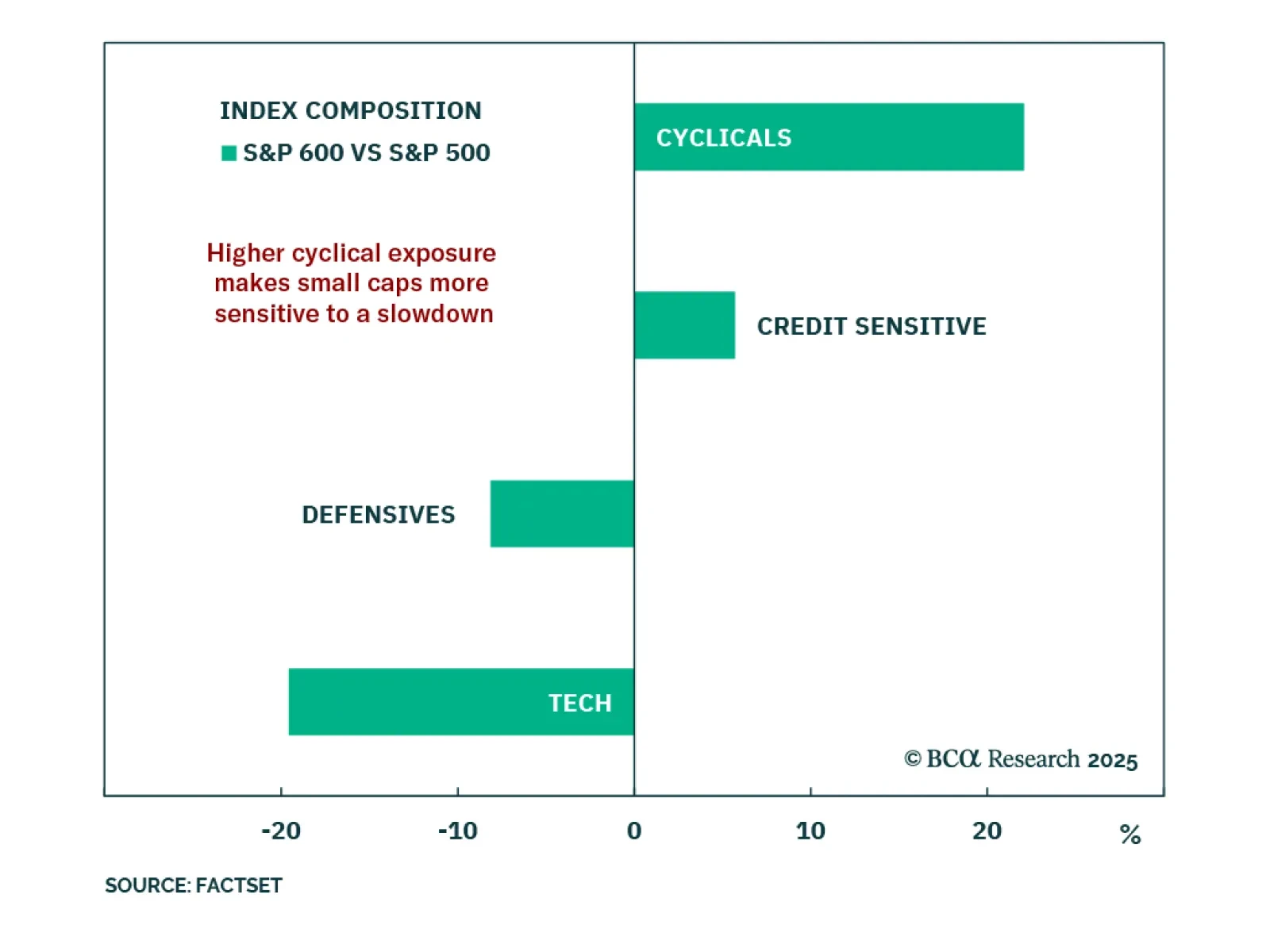

Our US Equity strategists remain cautious on small caps, as tariff exposure and slowing growth continue to weigh on this equity style. With the S&P 500 nearing its recent peak, some investors are rotating into riskier segments…

Recently, small-cap stocks have shown signs of outperformance. In this report, we examine whether the rebound is sustainable by analyzing long-term structural trends, the macroeconomic backdrop, the impact of tariffs, and other key…

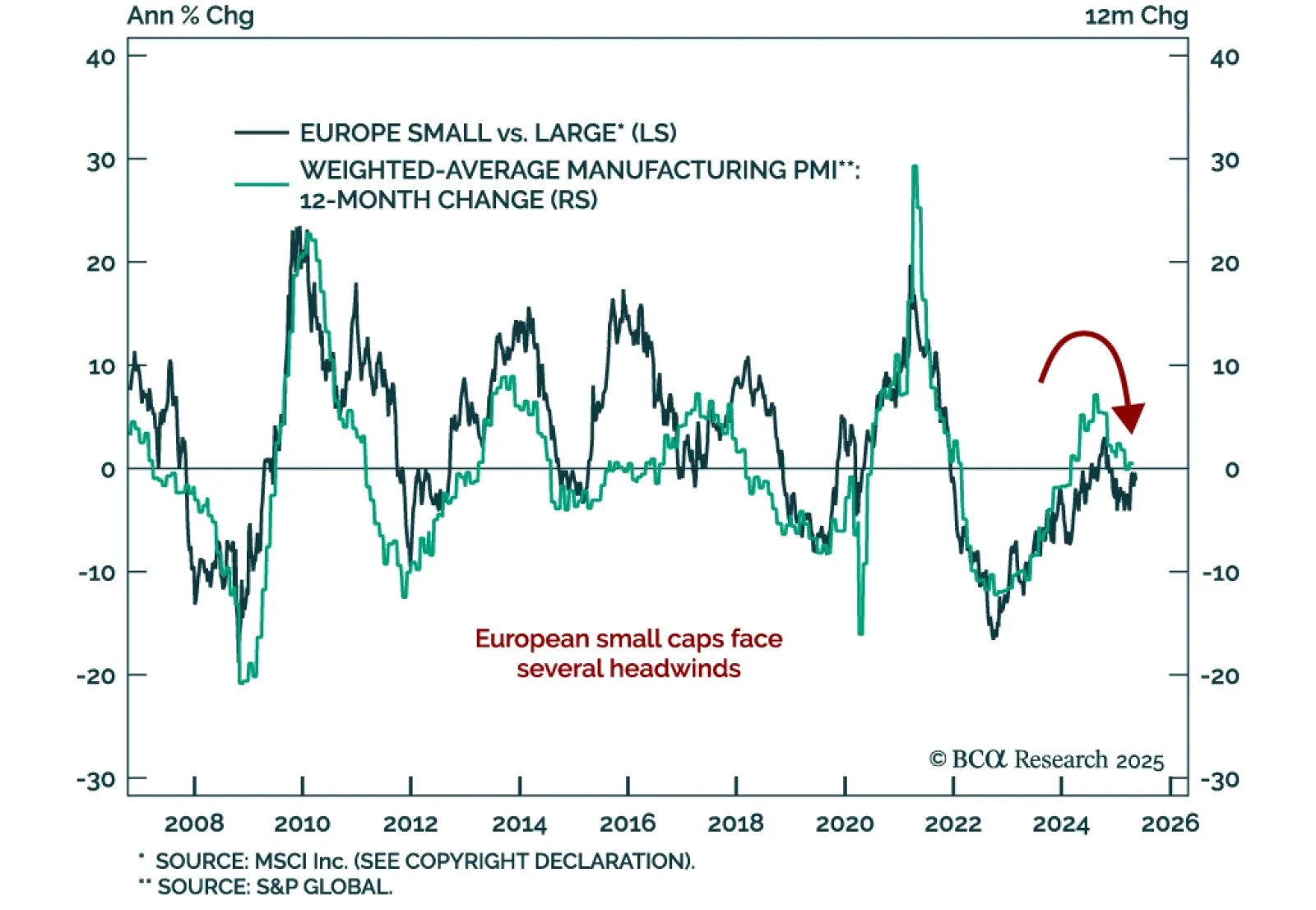

The outperformance of European small caps is coming to an end. Our Chart Of The Week comes from our European Investment Strategy team.The team identifies several headwinds for small caps in Europe in the near term. Small caps’…

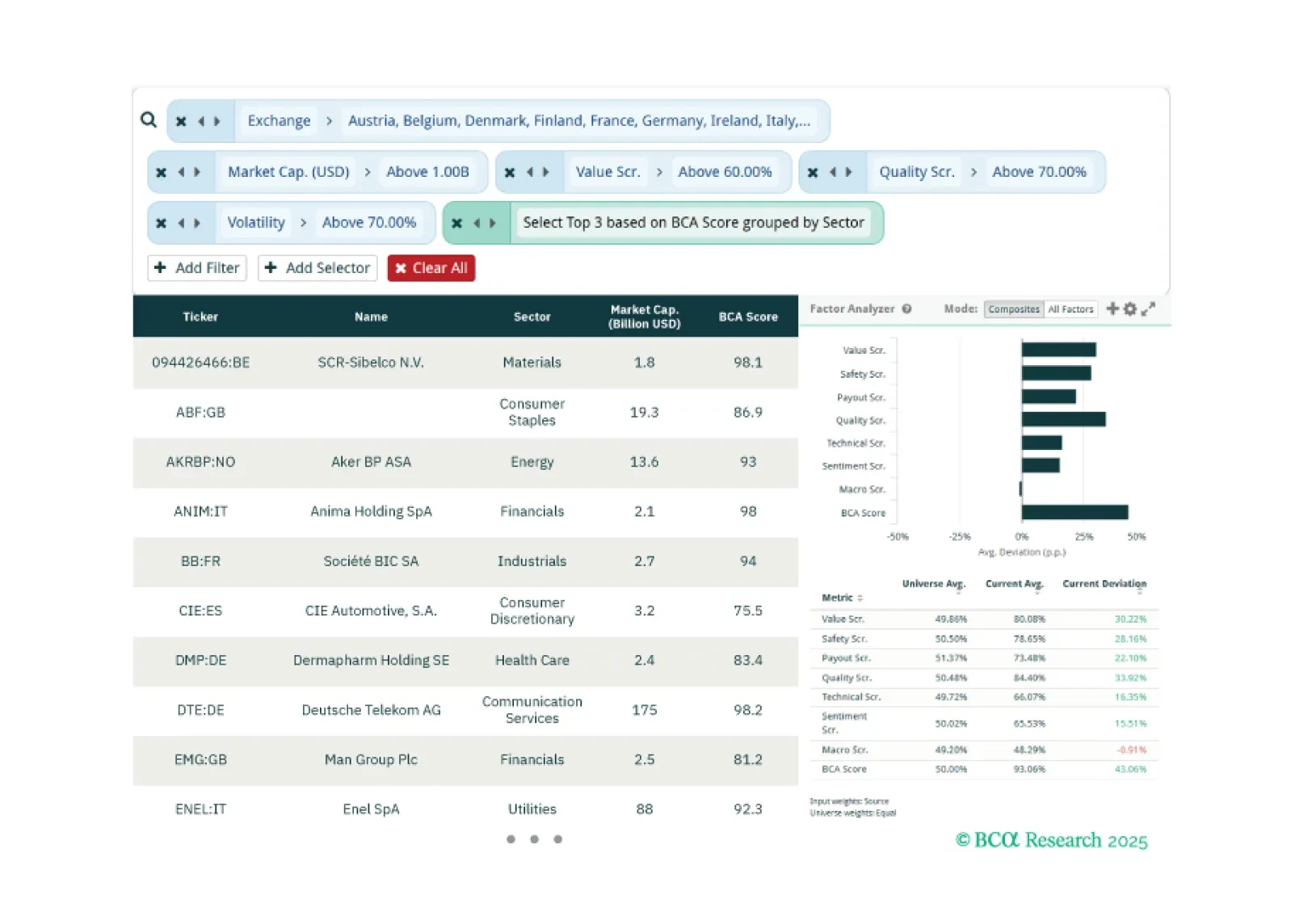

This week, our three screeners cover: Favoring European equities over US equities, cybersecurity stocks, and large caps with large moves in their BCA Score.

Our US investment strategists believe the Trump administration’s resolve to cut spending as well as tariff uncertainty have increased the probability of a recession.The Department of Government Efficiency’s sweeping cuts may…

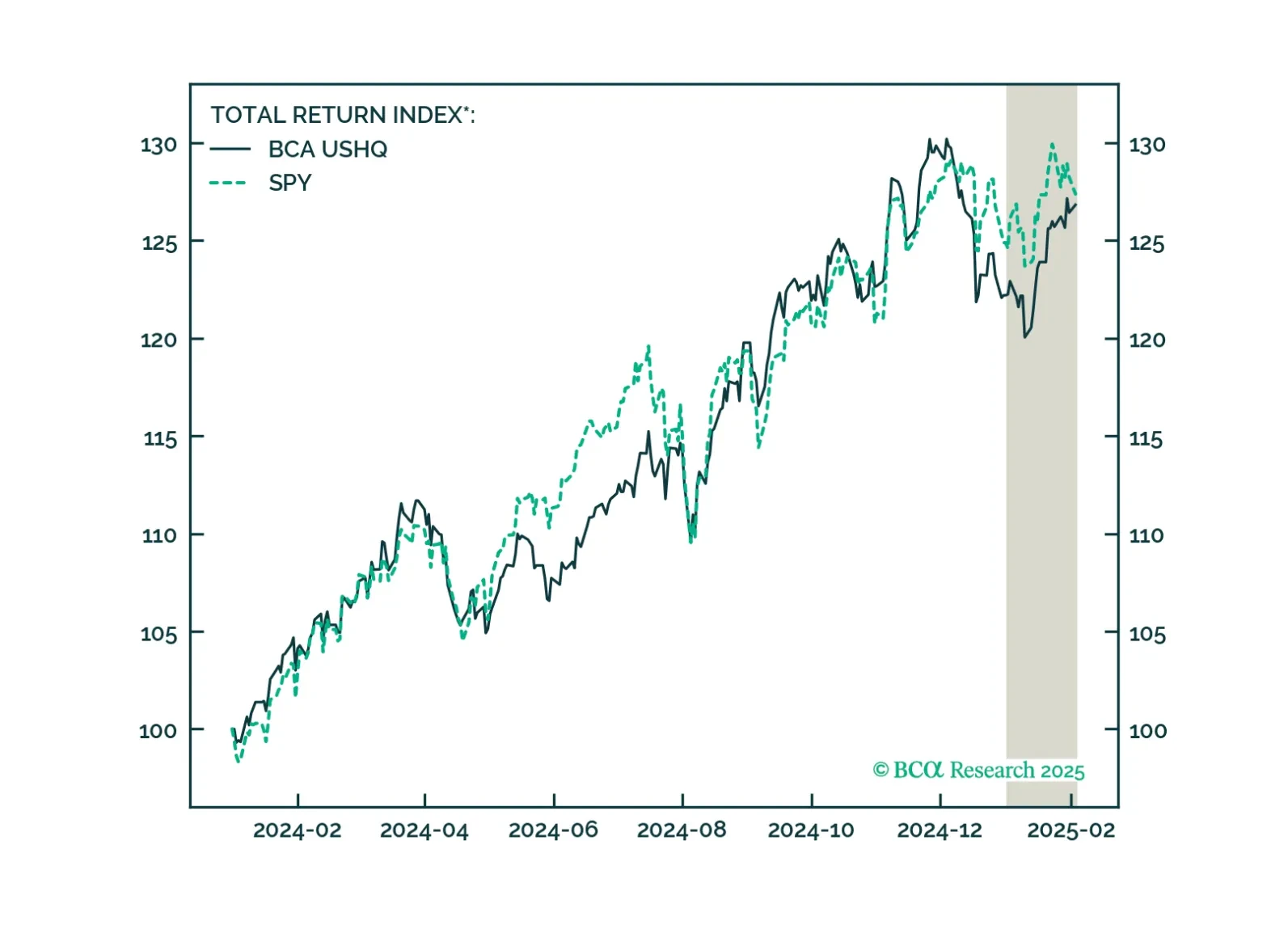

The US High-Quality (USHQ) portfolio slightly outperformed in January, returning 3.4%, whilst its SPY benchmark returned 2.9%. That said, we think the USHQ portfolio will have a solid run through the first half of 2025, benefitting…