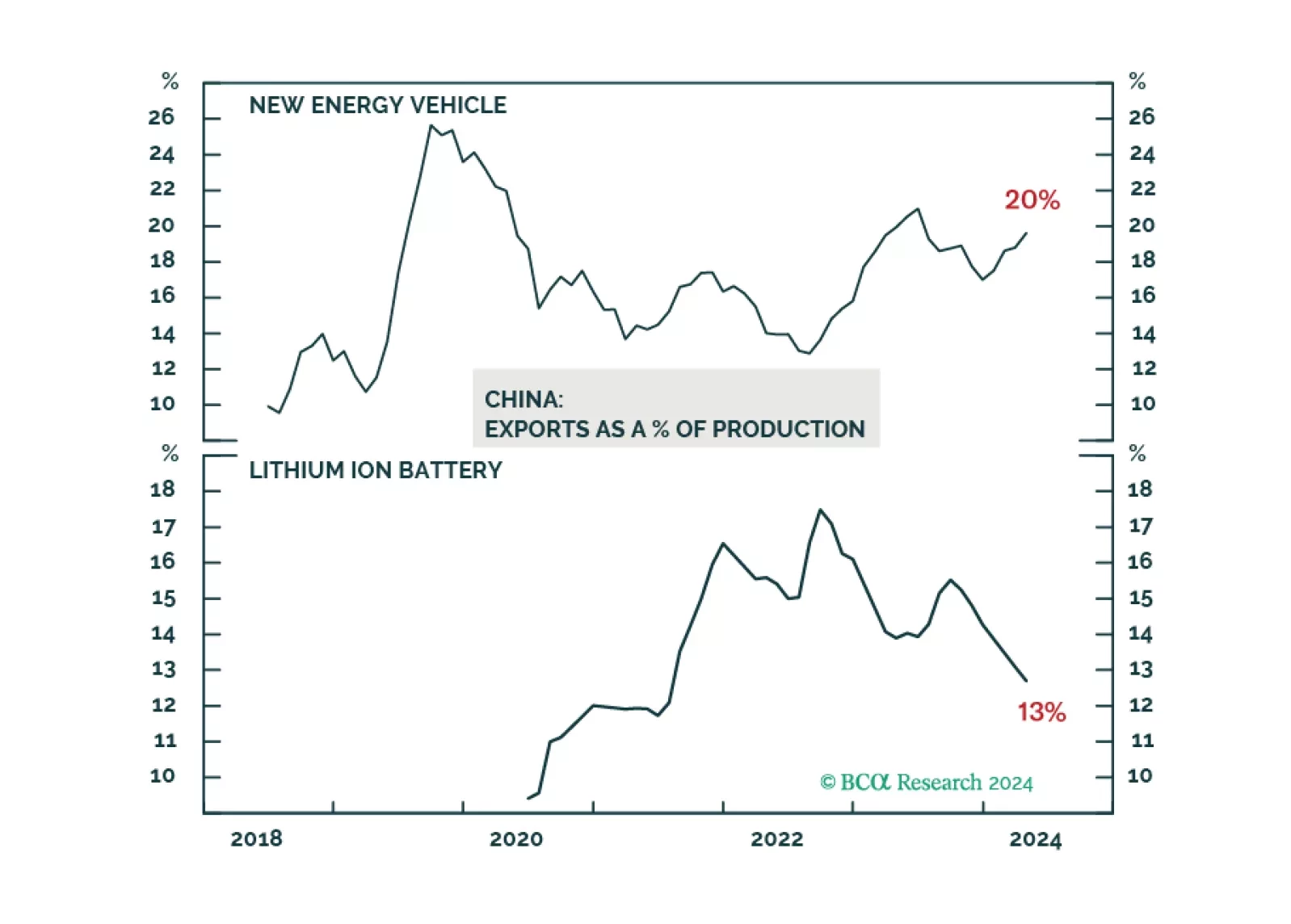

On Wednesday, the European Commission announced it would impose tariffs ranging between 17% and 38% on imports of Chinese EVs starting next month. These duties will be applied on top of existing 10% across-the-board tariffs on…

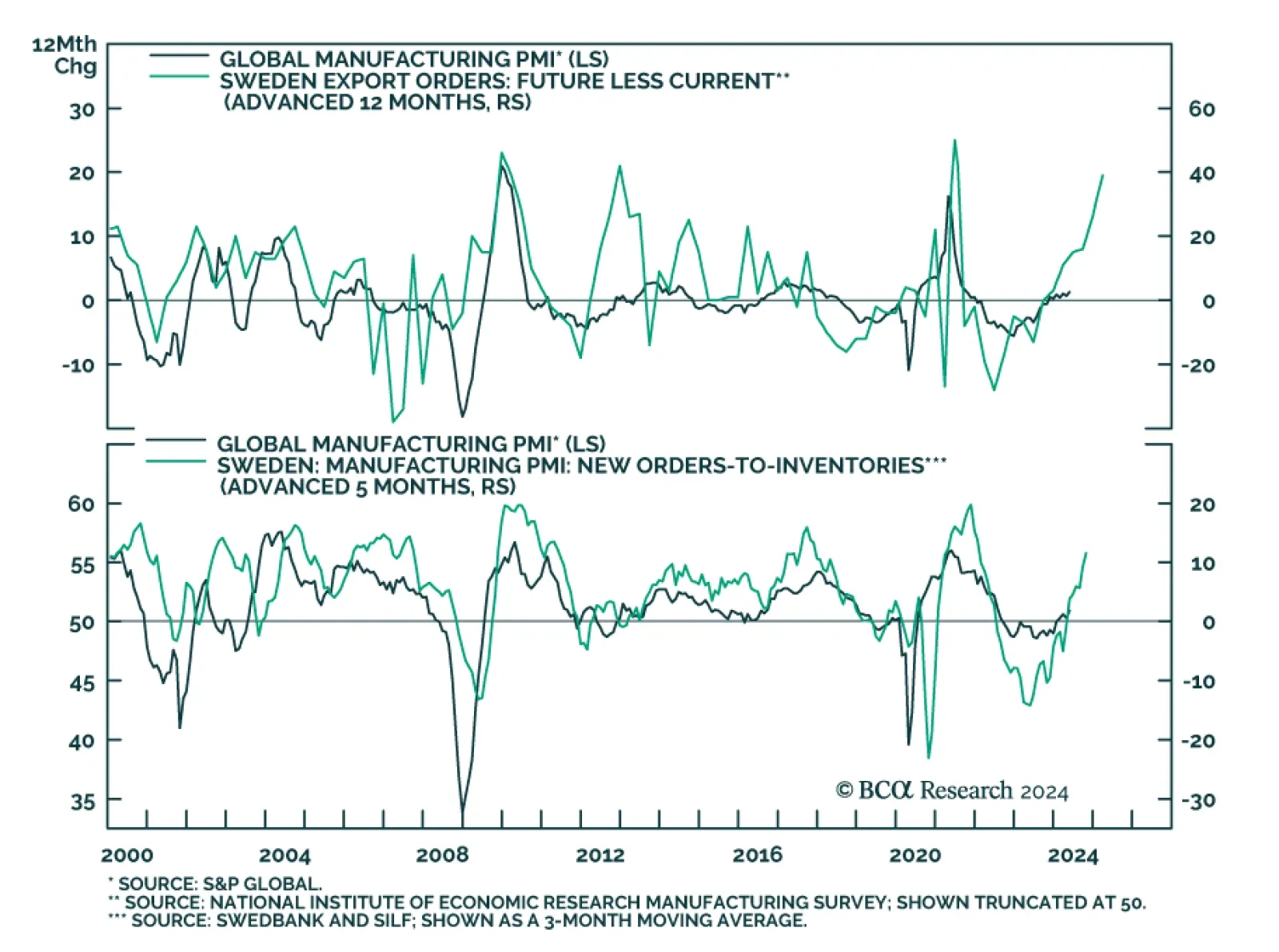

Sweden is a small export-oriented economy and its high sensitivity to global trade makes it a good bellwether of global growth developments. The headwinds from high borrowing costs are relatively more pronounced in Sweden…

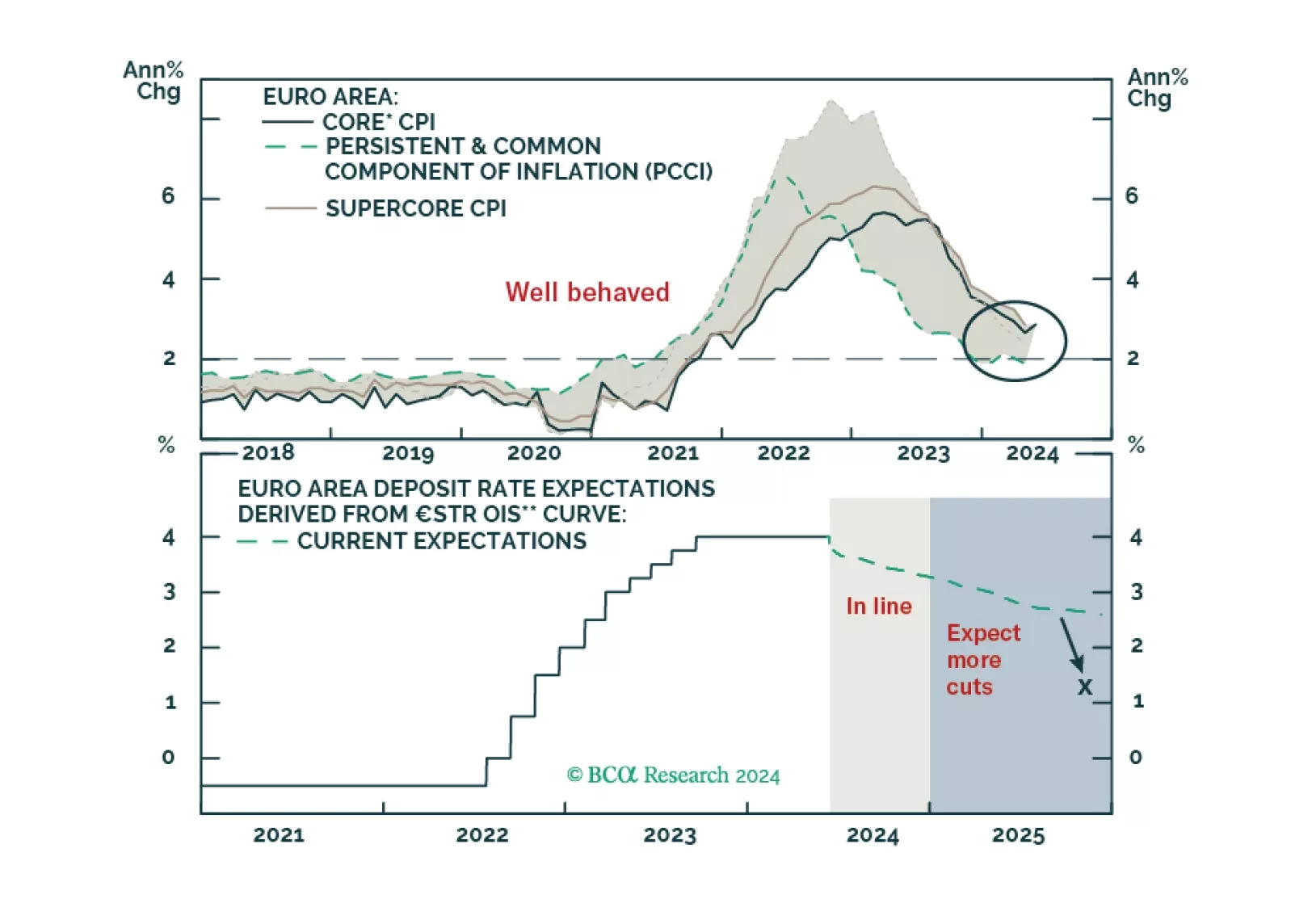

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

Although the comprehensive economic surprise indexes continued weakening in May, the metrics in our equity downgrade checklist haven’t softened enough to check more boxes now. While we continue to expect the US economy will enter a…

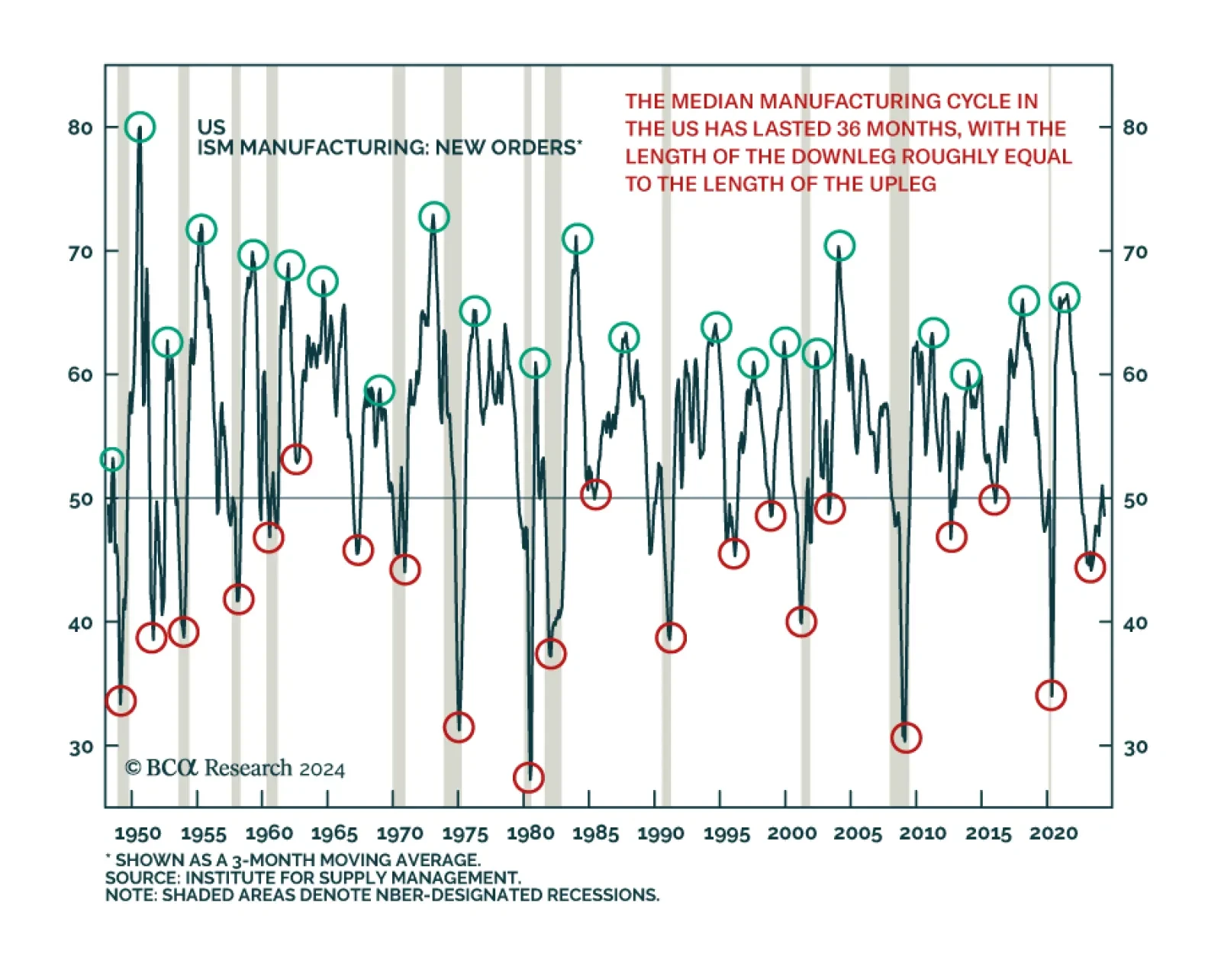

Our colleagues at Global Investment Strategy have shown that postwar US (and global) manufacturing cycles have tended to last 3 years, divided equally between an 18-month up leg and an 18-month down leg. This framework has been a…

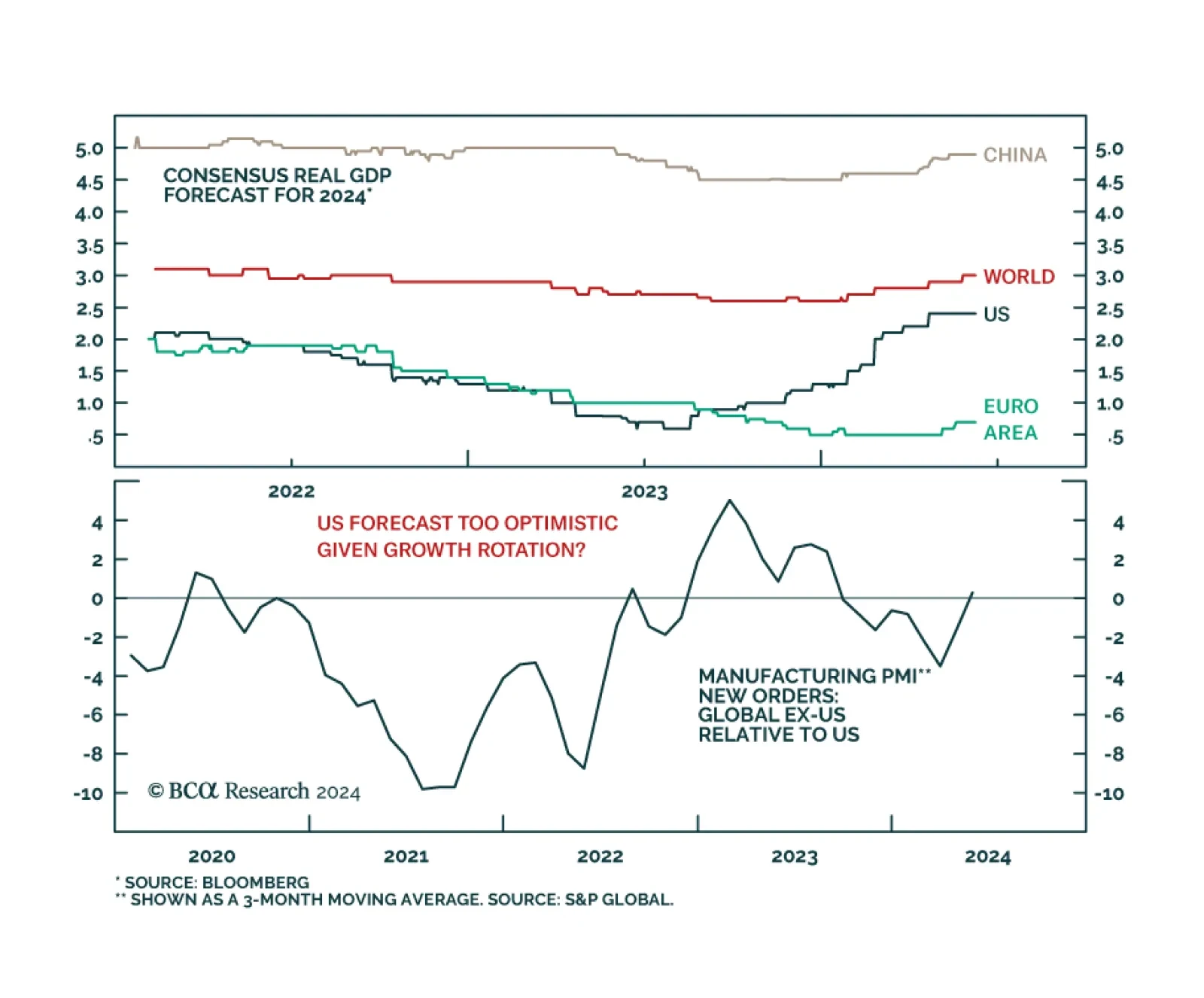

Global growth expectations for 2024 have been revised higher. Investors now forecasts 2024 GDP growth to clock in at 3%, up from 2.6% at the beginning of this year. A 1.1% upward revision in US growth expectations since January…

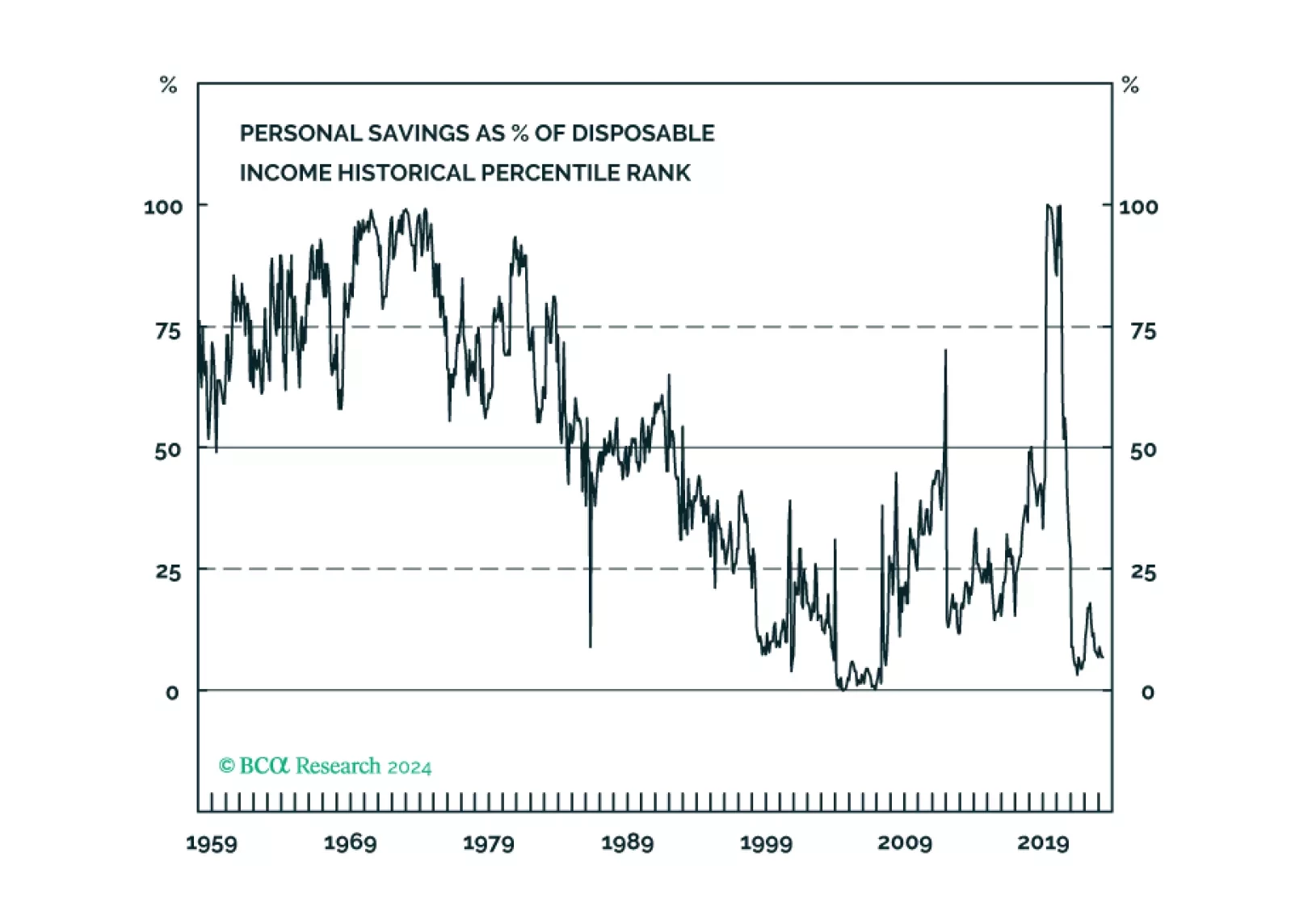

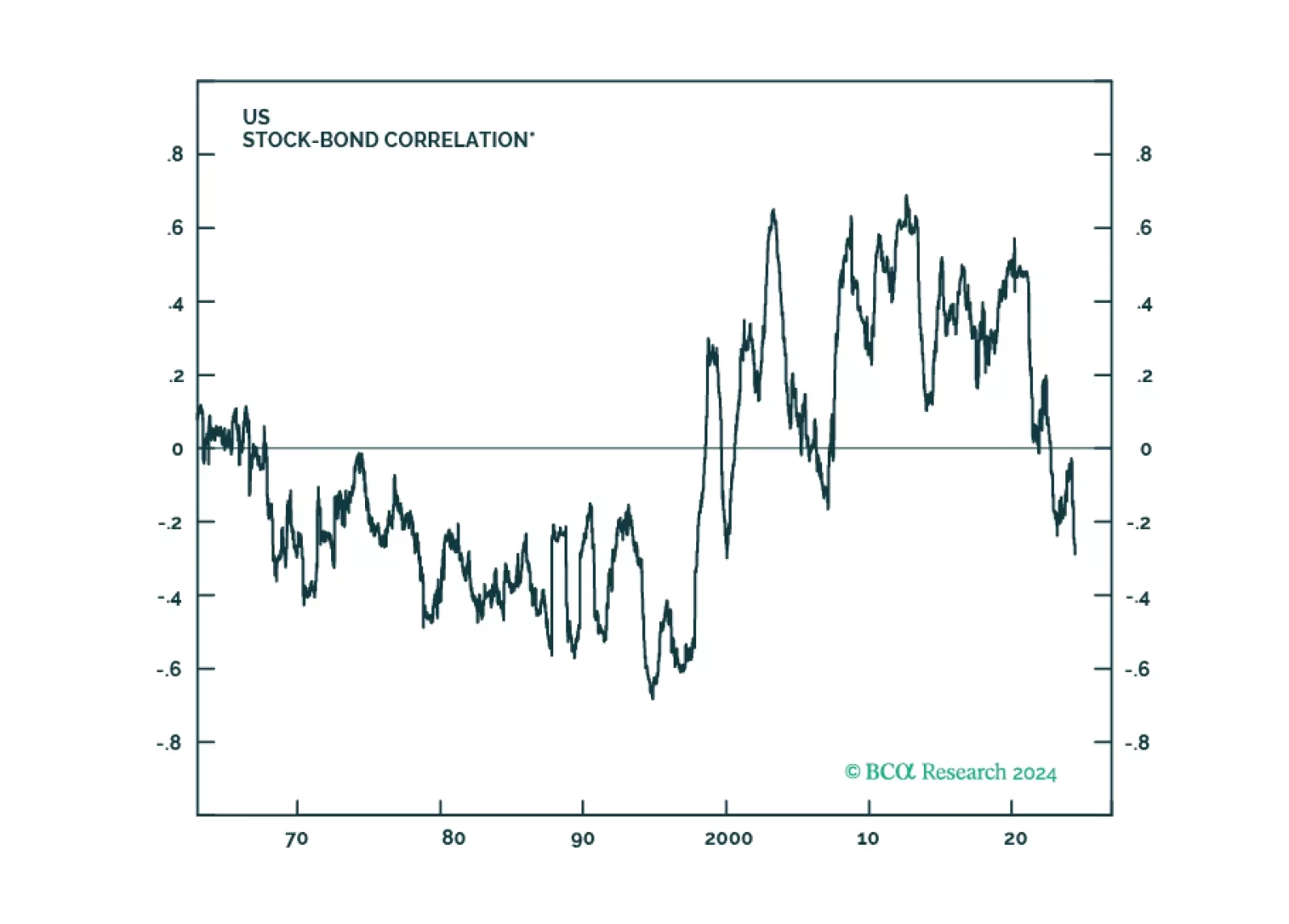

The US economy remains on a path towards a recession, most likely starting in late 2024 or early 2025. For now, investors should maintain a benchmark allocation to equities, but employ a barbell strategy of overweighting defensives…

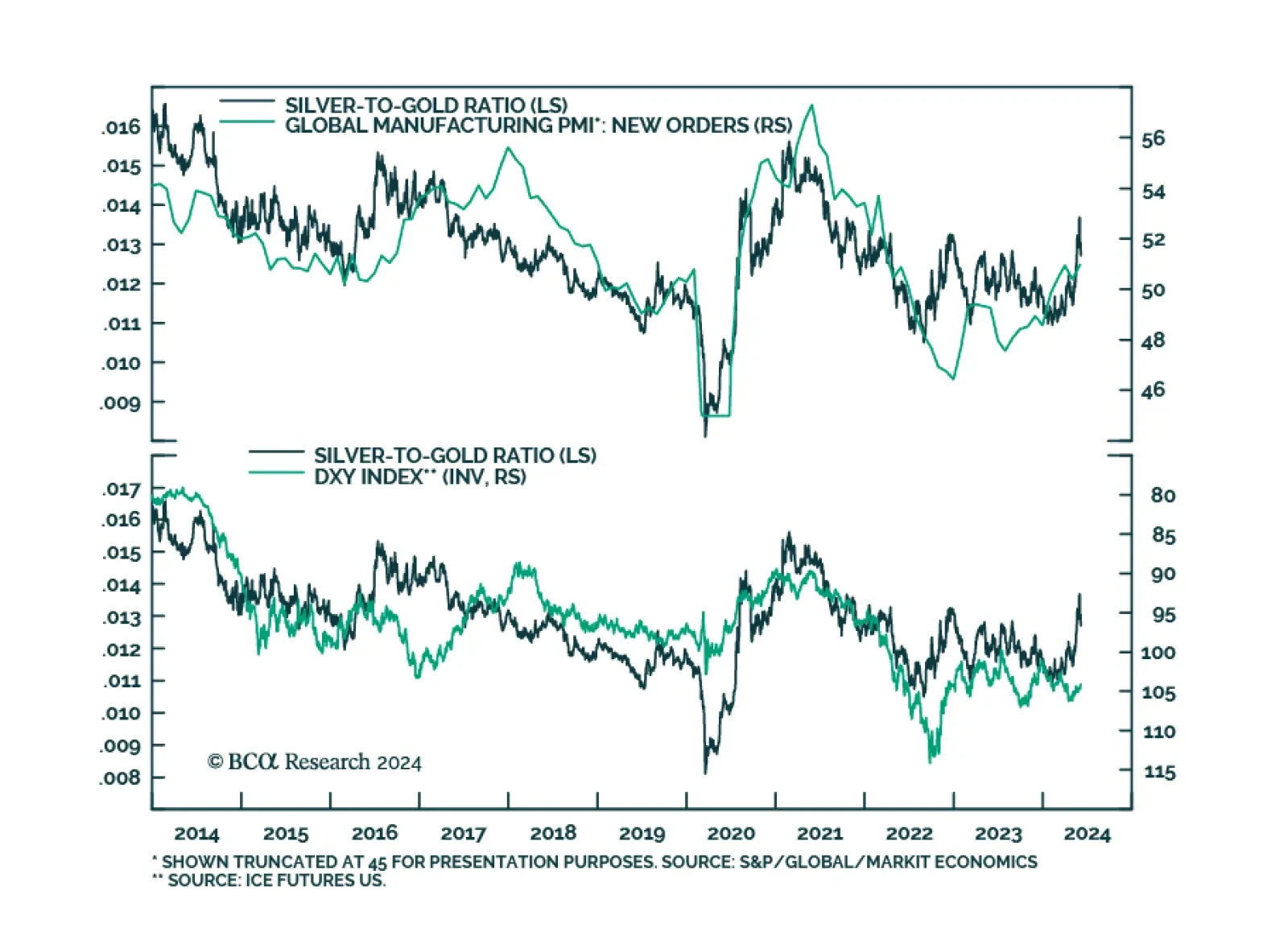

The silver-to-gold ratio has surged close to 10% this year on the back of silver prices catching up to gold. Silver has returned 22% on a YTD basis, against 12% for gold, 13% for industrial metals and 5% for the broad commodity…

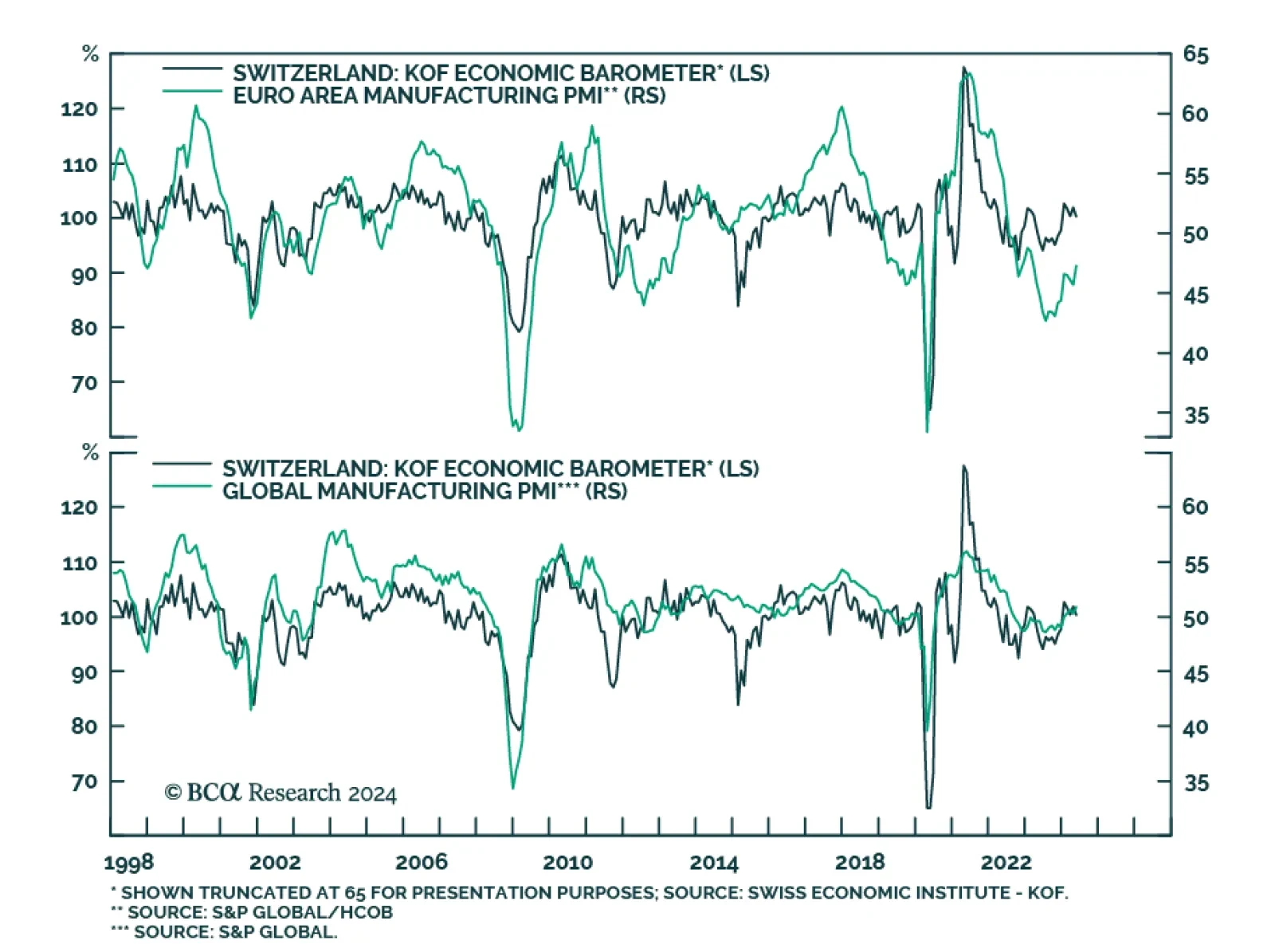

The Swiss KOF Barometer is a composite leading indicator of the Swiss economy. It surprised to the downside in May, coming in at 100.3 from 101.9, below expectation of an acceleration to 102.1. Switzerland’s economy is…