In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

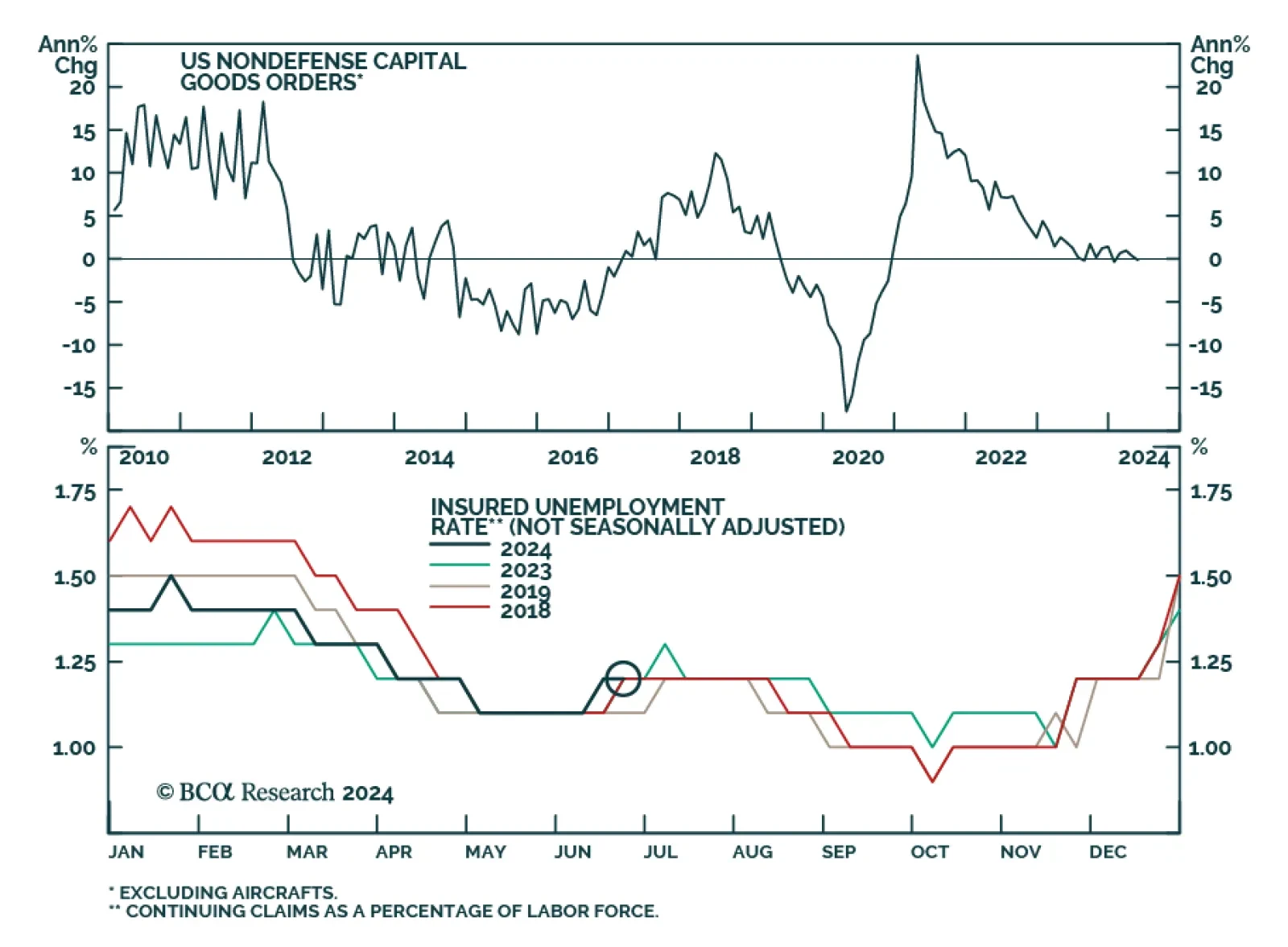

Several pieces of data were released for the US on Thursday. US durable goods orders growth slowed from 0.2% to 0.1% in May, beating expectations of a 0.5% contraction. However other components of the report disappointed…

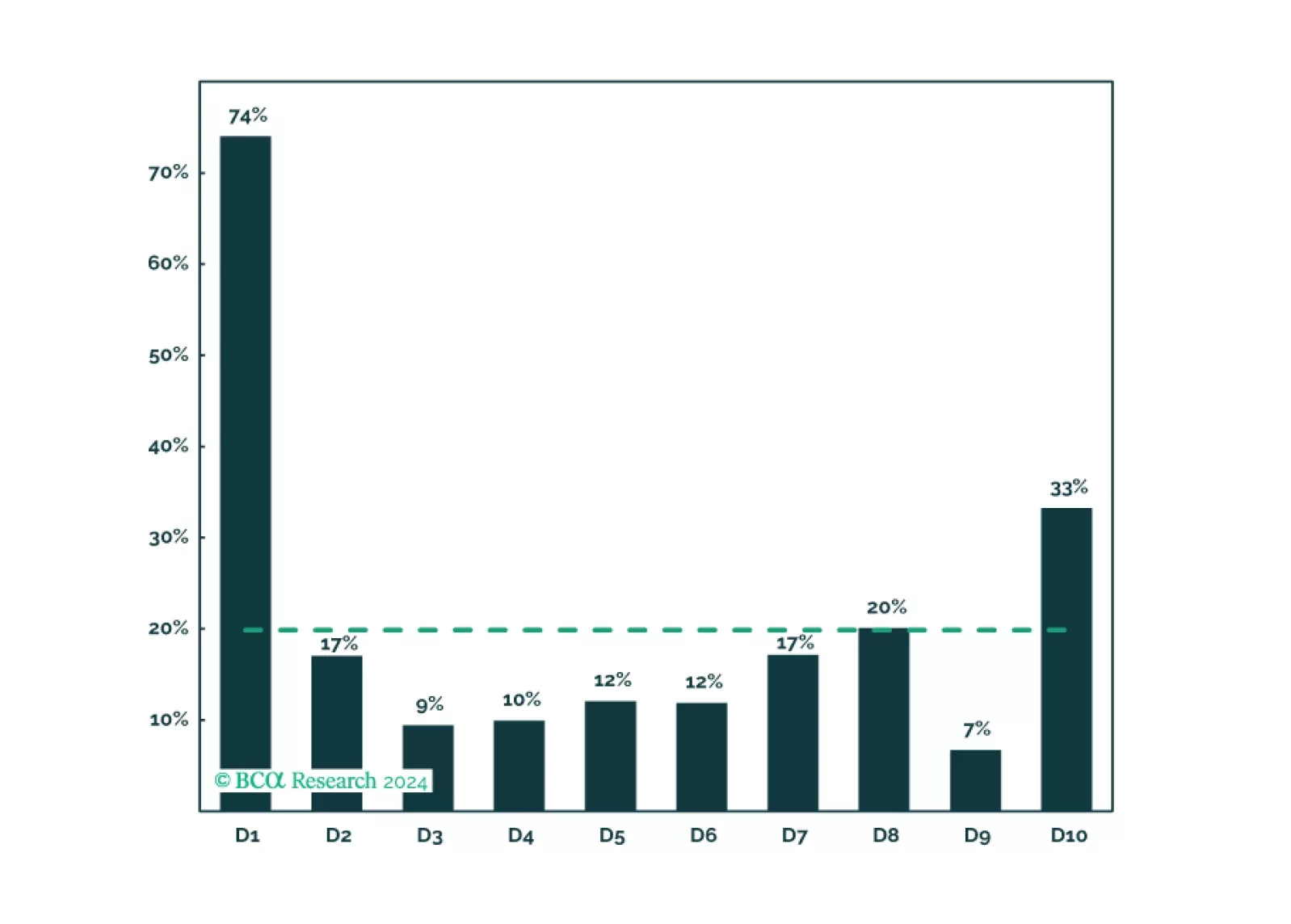

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

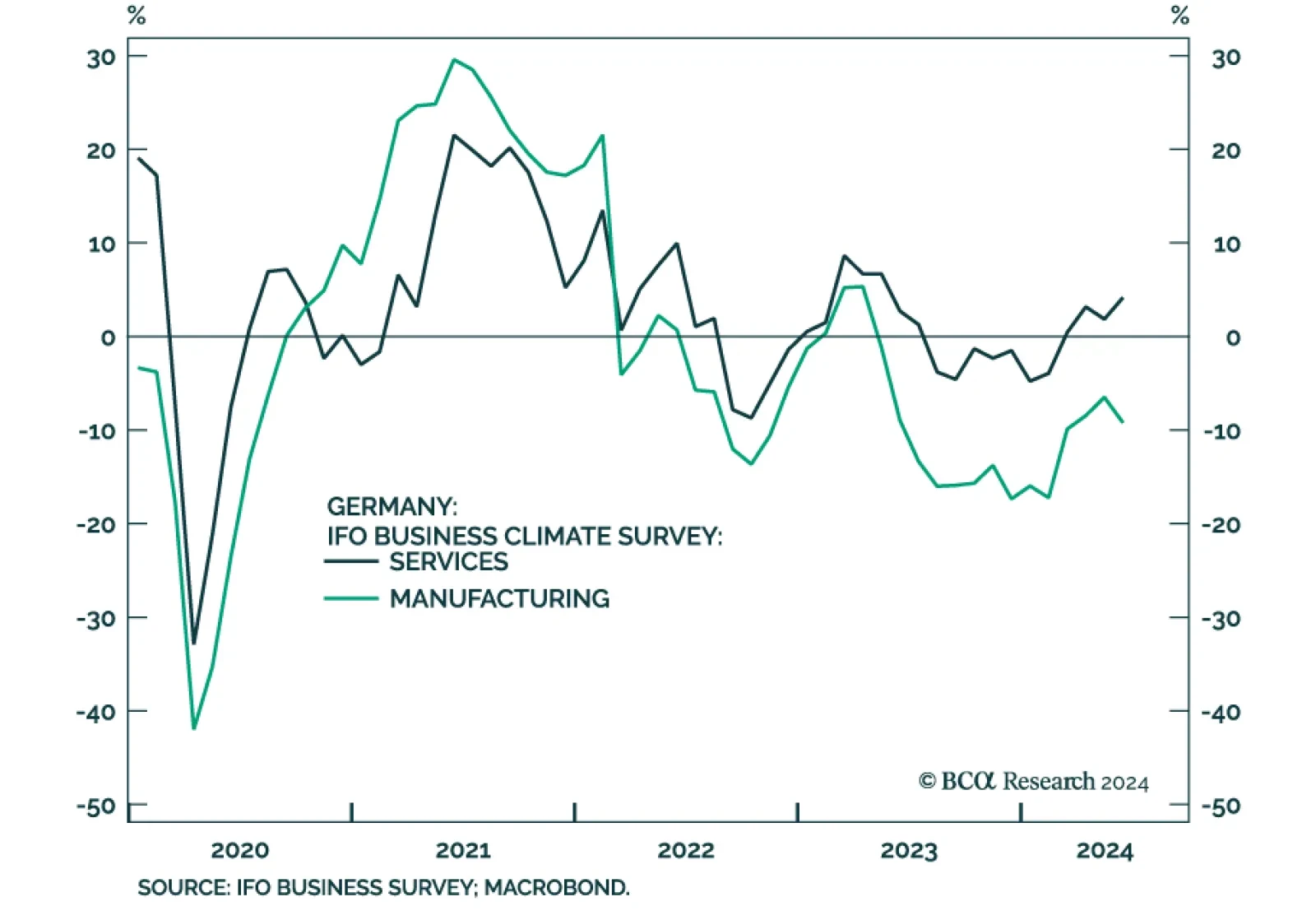

According to the results of the latest German IFO survey, overall sentiment deteriorated slightly in June. The IFO Business Climate index declined from 89.3 in May to 88.6 in June, disappointing expectations of a modest…

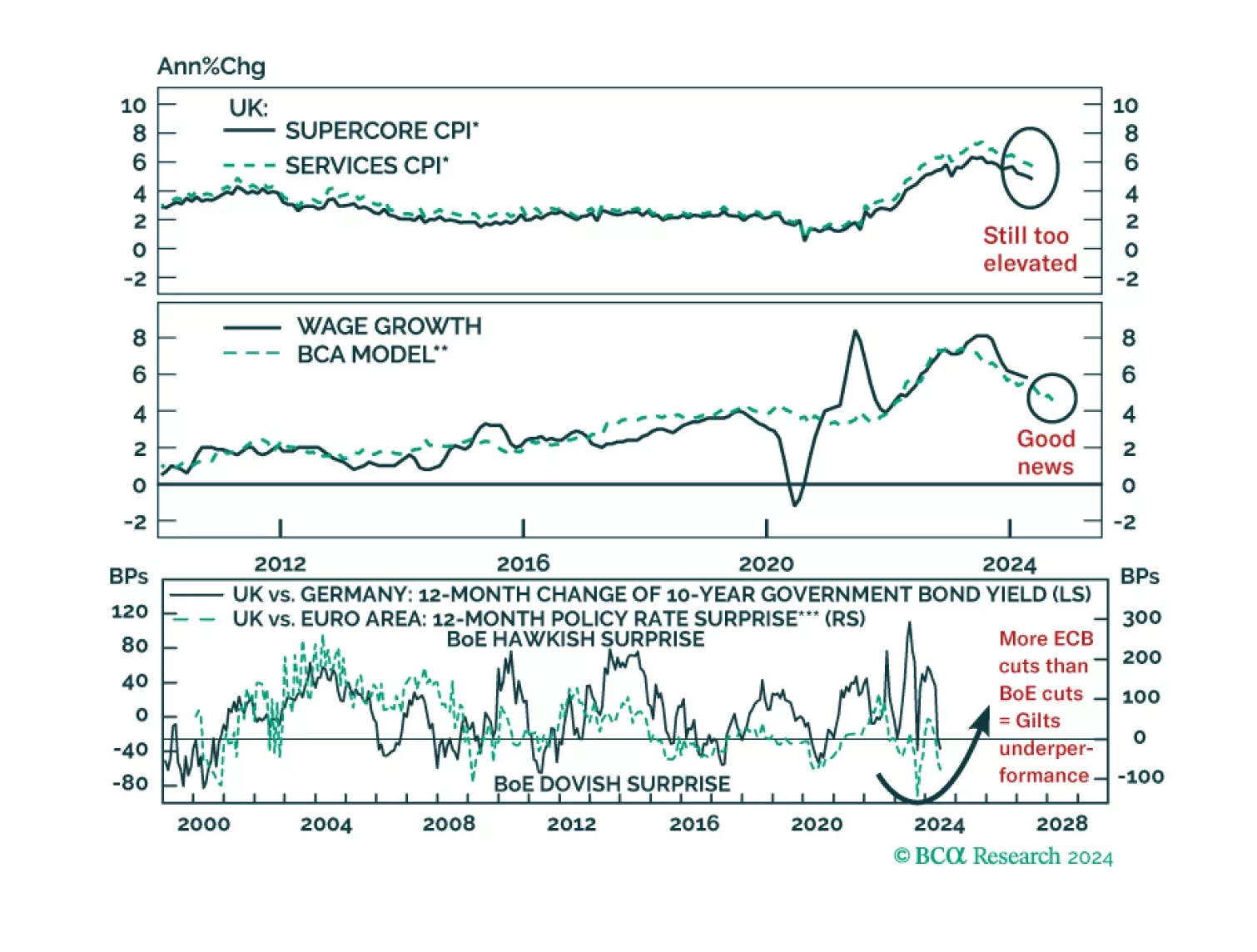

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

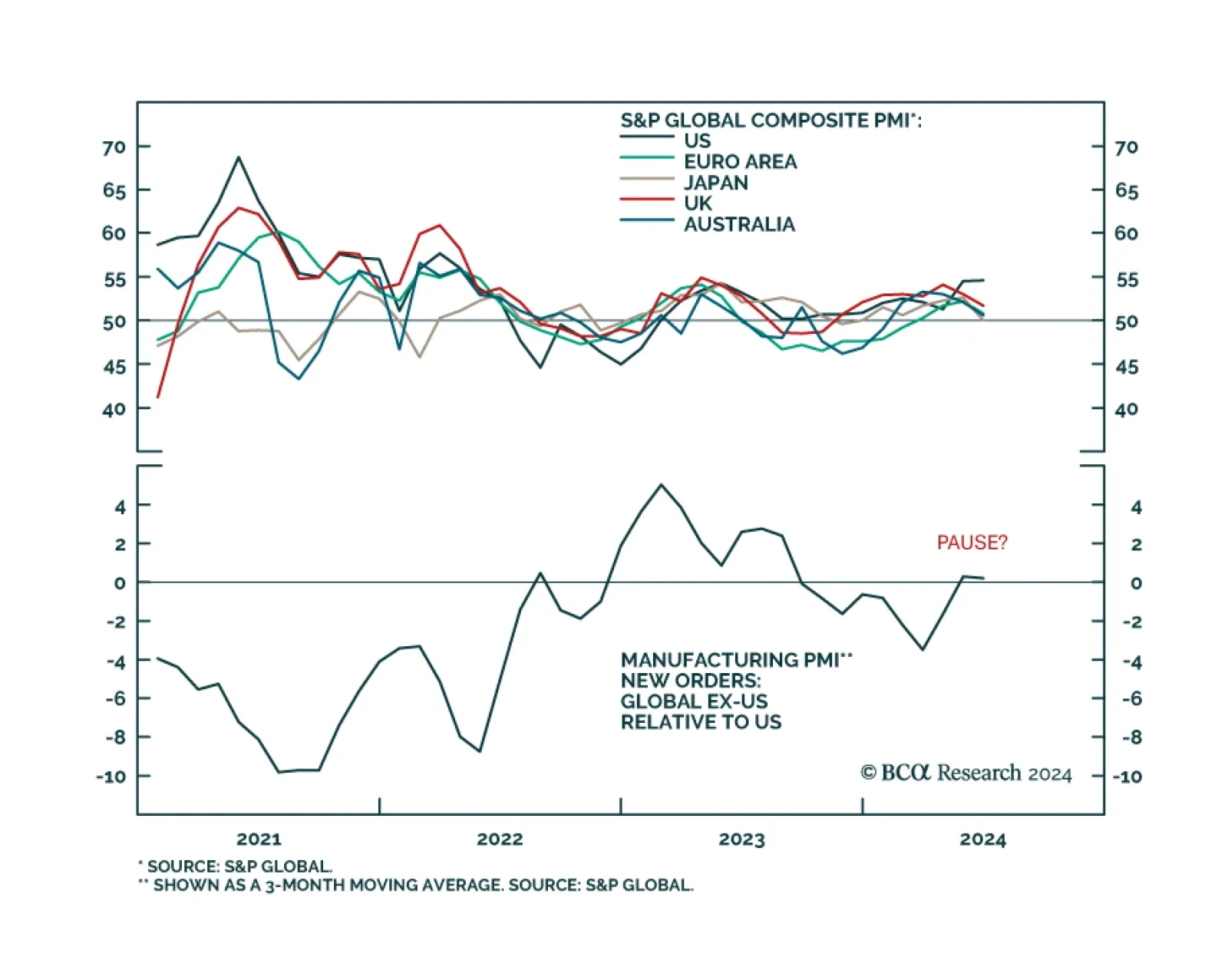

Preliminary PMI estimates suggest that US economic leadership remained intact in June, despite previous signs that it was passing the global growth baton to the rest of the world. US manufacturing, services and composite PMIs…

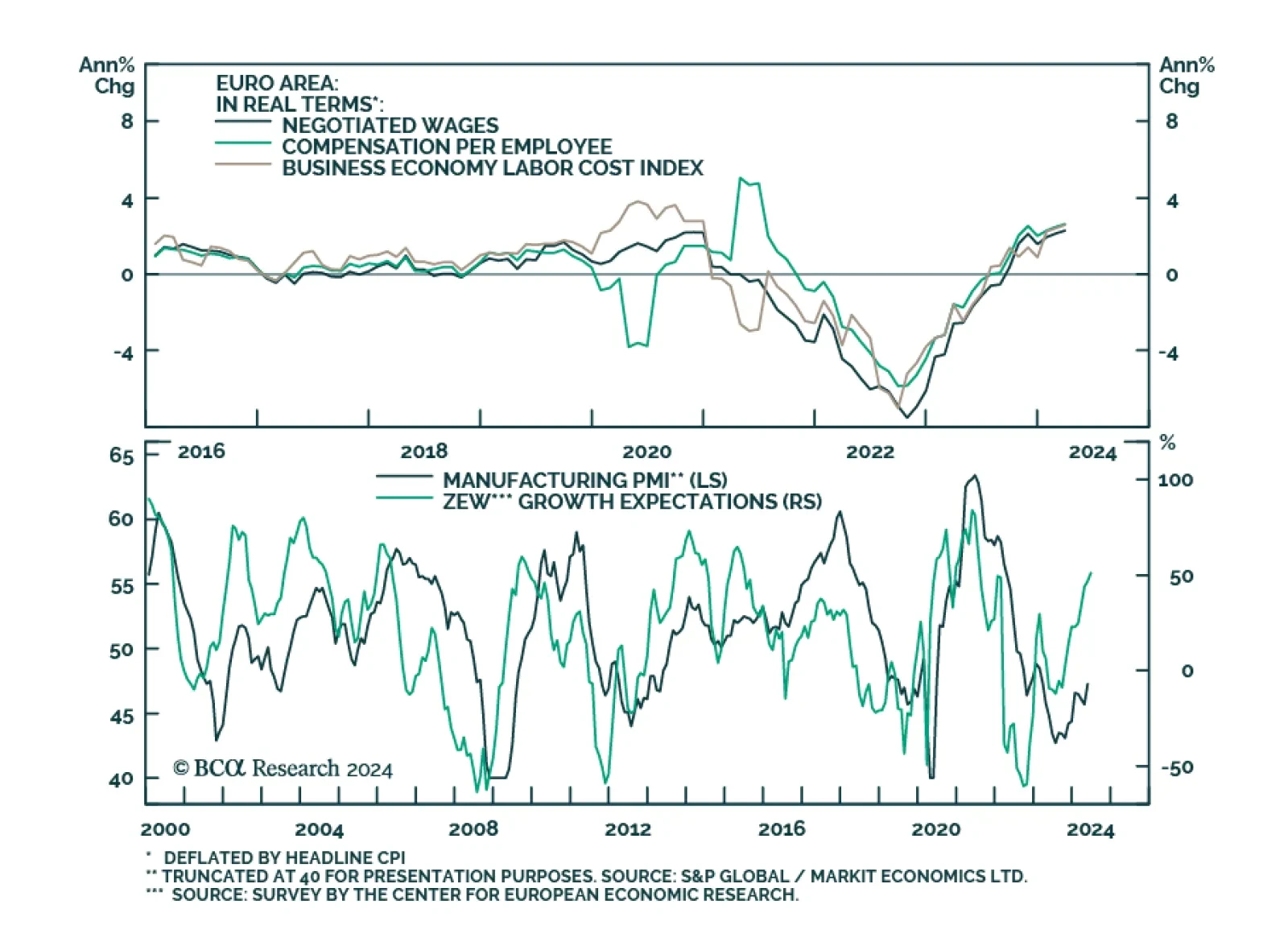

The ECB delivered its first rate cut in June, moderating the degree of restriction rather than pivoting outright to easy monetary policy settings. Indeed, the rate cut was accompanied by an upward revision of inflation and growth…

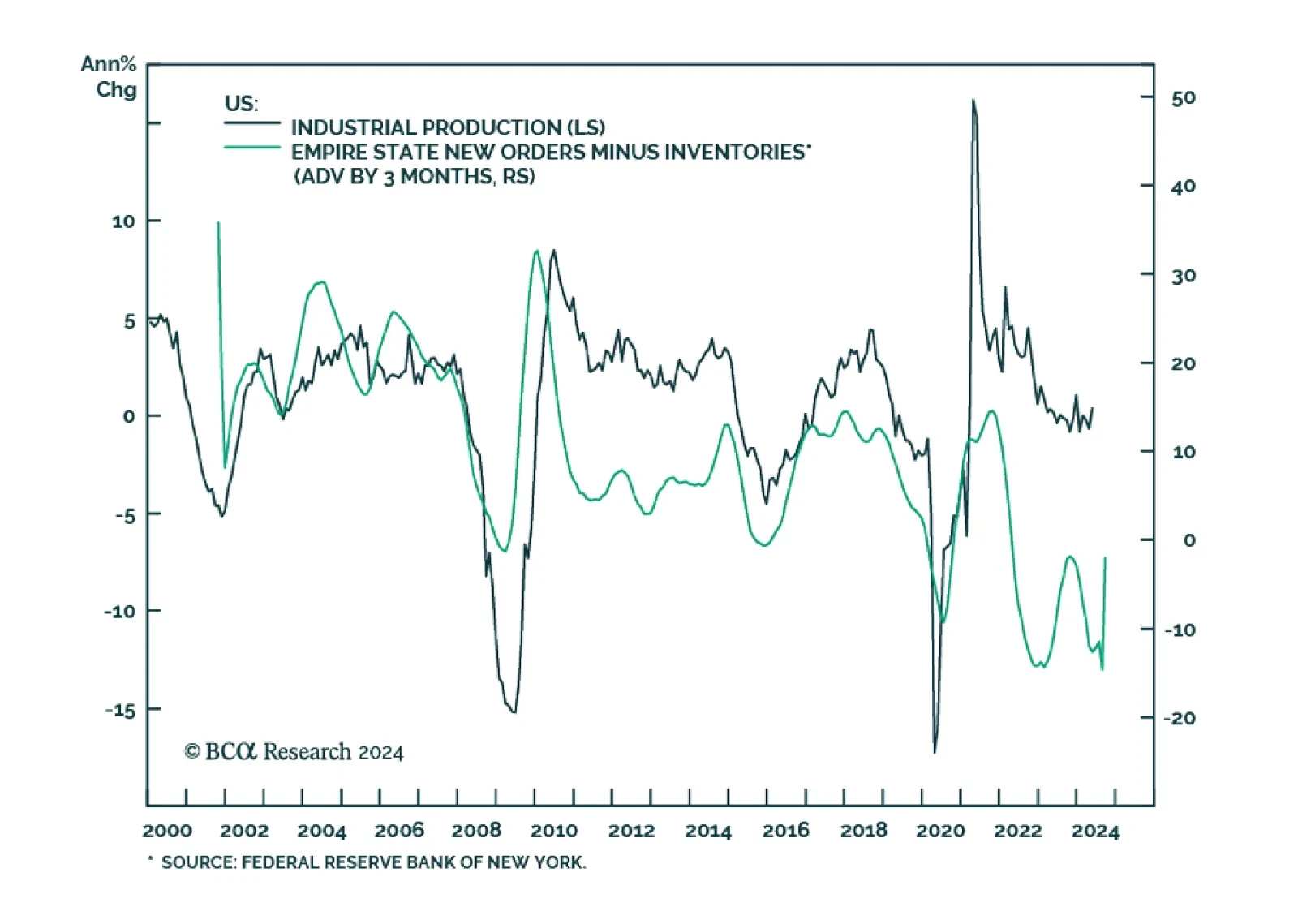

The heart of the US manufacturing sector is still pulsing. Industrial production surpassed expectations in May, growing by 0.9% m/m after having stagnated in April. Notably, the pro-cyclical manufacturing production index…

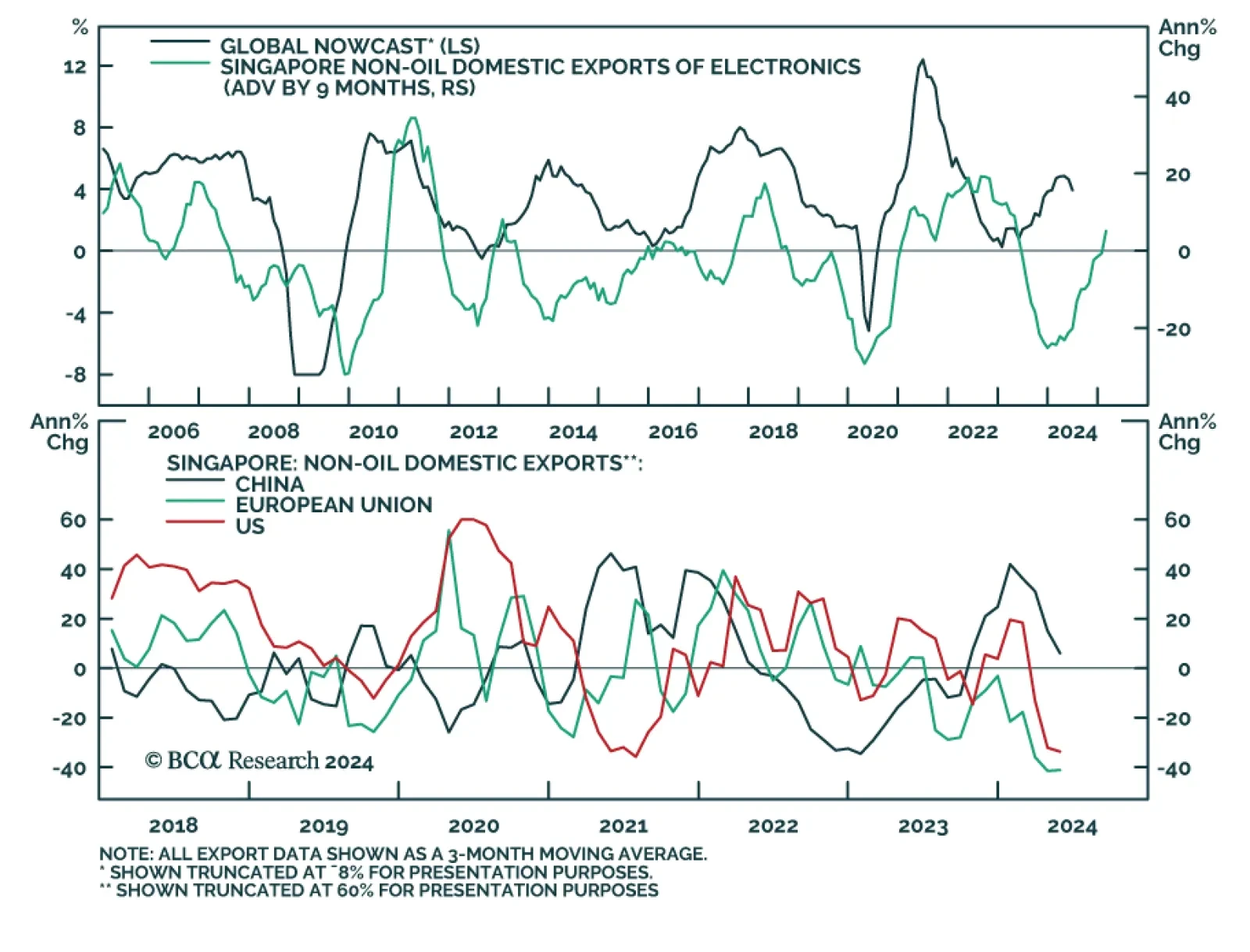

Singapore is a small open economy sensitive to global trade dynamics. Its non-oil exports (NODX) are thus a good bellwether for global growth conditions and they surprised to the upside in May. Notably, electronics exports, which…