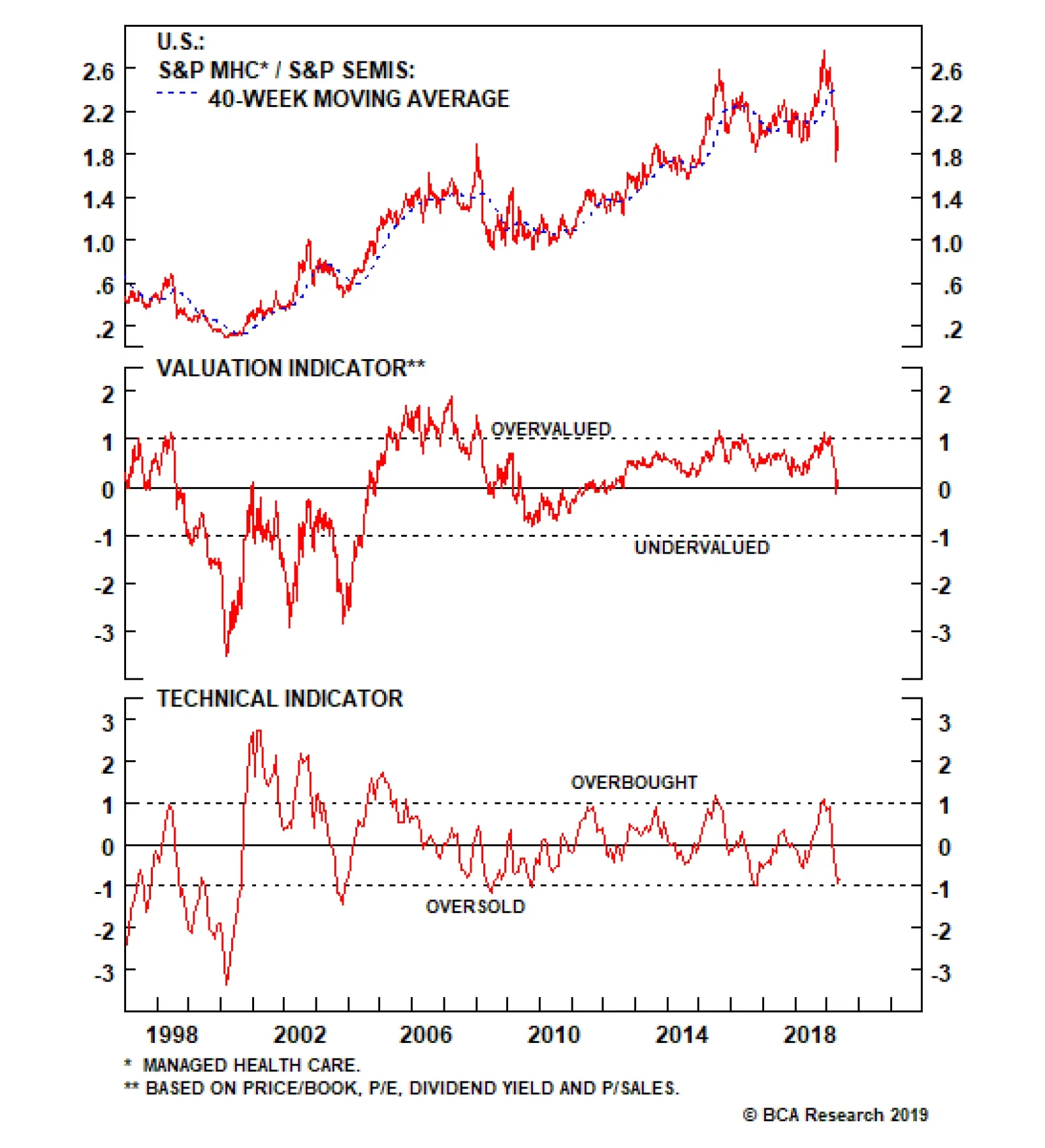

In our recent Weekly Report, we initiated a pair trade, going long S&P managed health care/short S&P semiconductors. Given the trade’s extreme volatility, we initiated this trade with a stop loss at the -7…

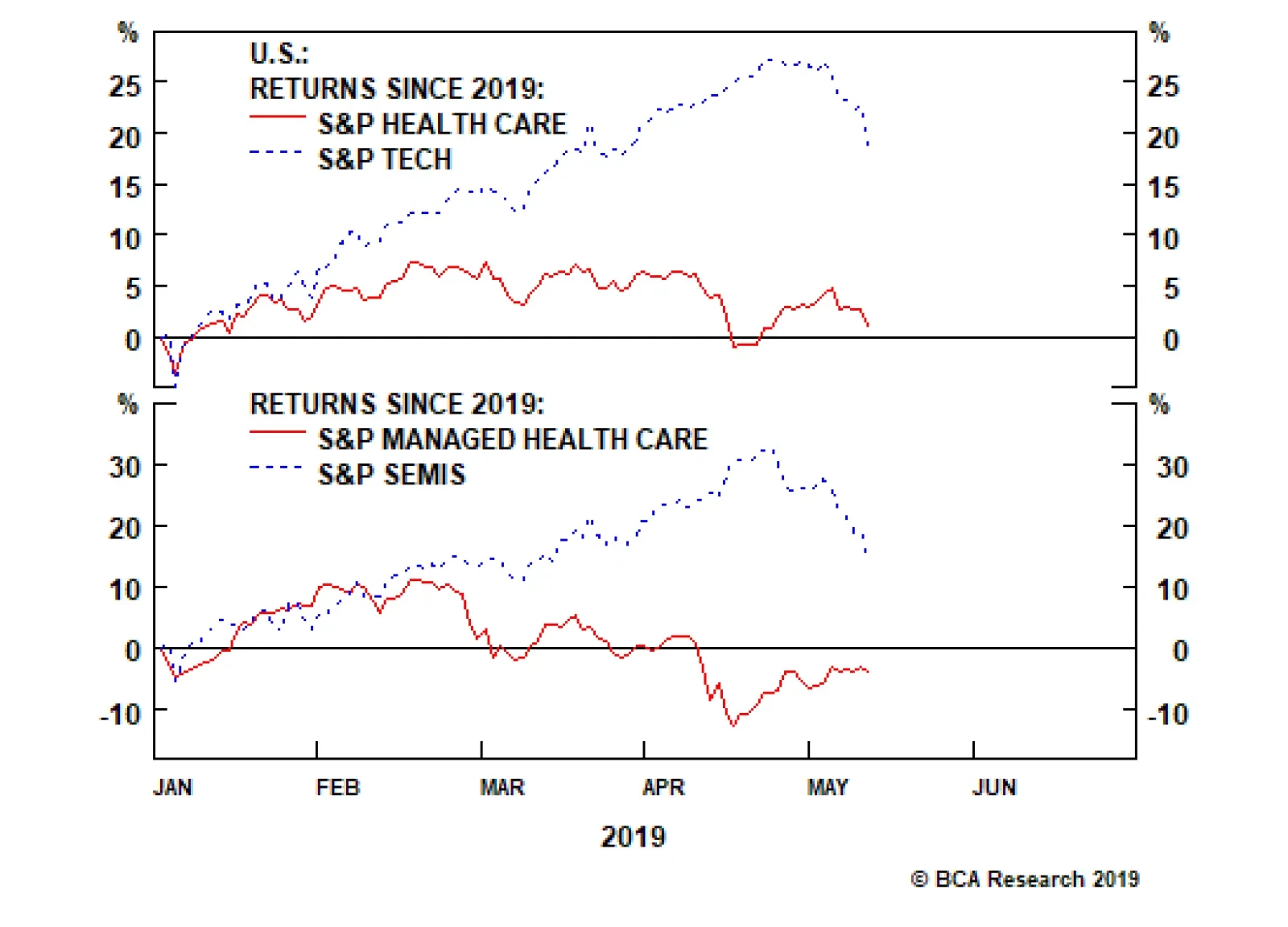

While health care and tech stocks started the year on a similar footing, a wide gulf has opened that is likely to, at least partially, reverse in the back half of the year. This dichotomy is most evident at the subsector…

With regard to relative macro drivers, managed health care has the upper hand. Relative demand dynamics clearly favor HMOs and are working against chip stocks. Non-farm payroll growth, which drives HMOs revenues, is trouncing…

While health care and tech stocks started the year on a similar footing, a wide gulf has opened that is likely to reverse in the back half of the year. This dichotomy is most evident at the subsector level where managed health…

Highlights Portfolio Strategy Firming relative demand and input cost dynamics, the Medicare For All (MFA)-induced panic selling in HMOs coupled with 5G euphoria buying in semis have set the stage for an exploitable pair trade…

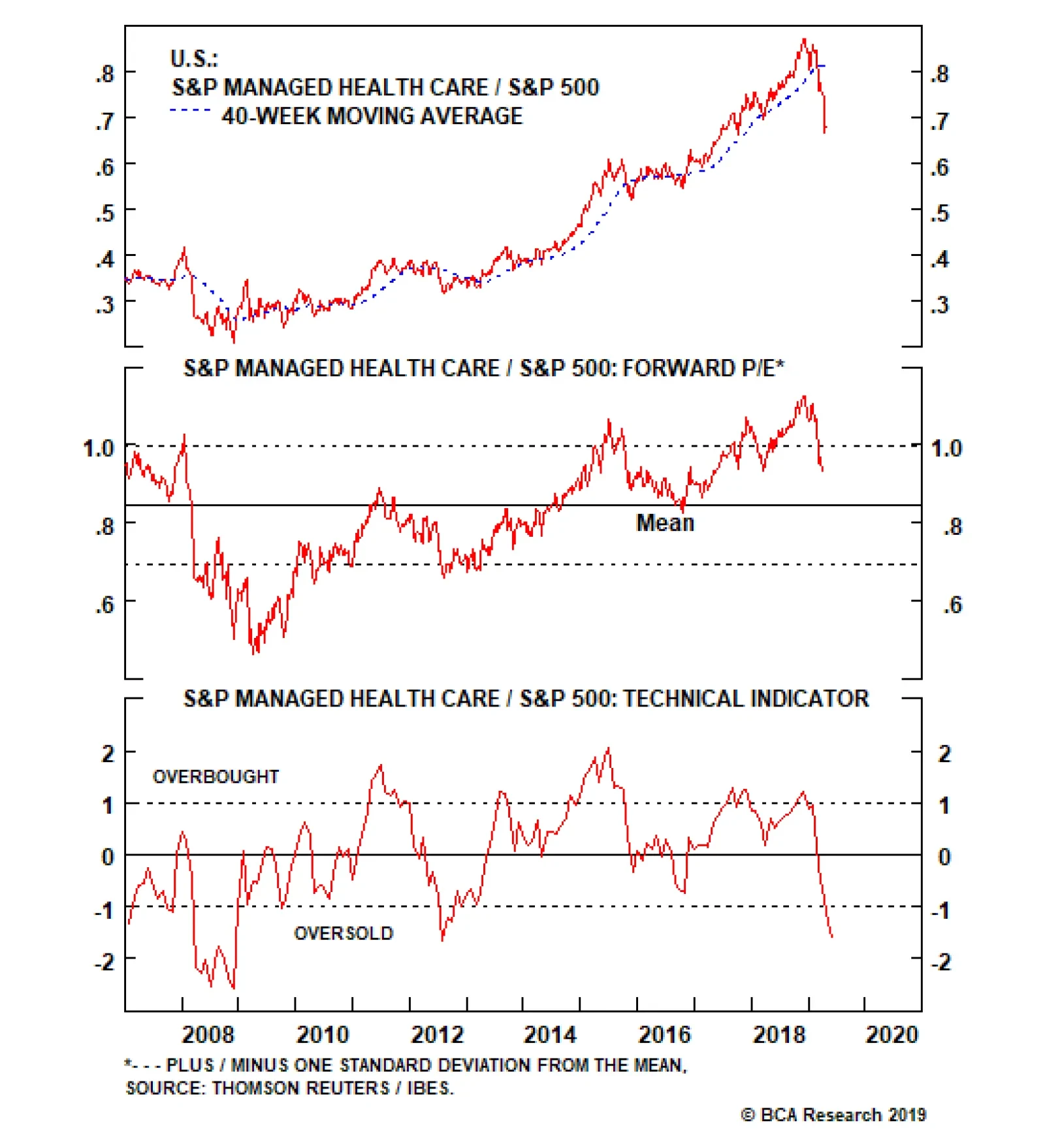

Overweight A little over a year ago we moved to the sidelines in the S&P managed health care index, crystalizing significant relative profits of 28% for our U.S. equity portfolio. Now the time has come anew to…

The inter- and intra-industry M&A fever has died down from mid-2018 and the rising momentum of a “Medicare For All” bill has weighed negatively on HMO sentiment. With regard to the latter, our geopolitical…

Highlights Portfolio Strategy Yield curve dynamics, higher oil prices, recovering balance sheets, and compelling valuations and technicals all suggest that energy stocks will burst higher in the coming months. Melting medical…

Neutral Relative share price gains for the S&P managed health care index are nearly exhausted. In Tuesday's Weekly Report, we acted on our late-March downgrade alert and took profits of 28% versus the S&P 500 since…

Highlights Portfolio Strategy A near-term pullback in U.S. Treasury yields, still robust housing fundamentals and compelling valuations that reflect most, if not all, of the bad homebuilding news and offset thorny input cost inflation…