Highlights Upgrade The Health Care Sector To An Overweight: Expressed through an overweight position in Health Care Equipment and Services, and an equal weight position in Pharmaceuticals and Biotech The Sector Faces A Few Tailwinds…

Highlights The Biden Administration's $2.25 trillion infrastructure plan rolled out yesterday will, at the margin, boost global demand for energy and base metals more than expected later this year and next. Global GDP growth…

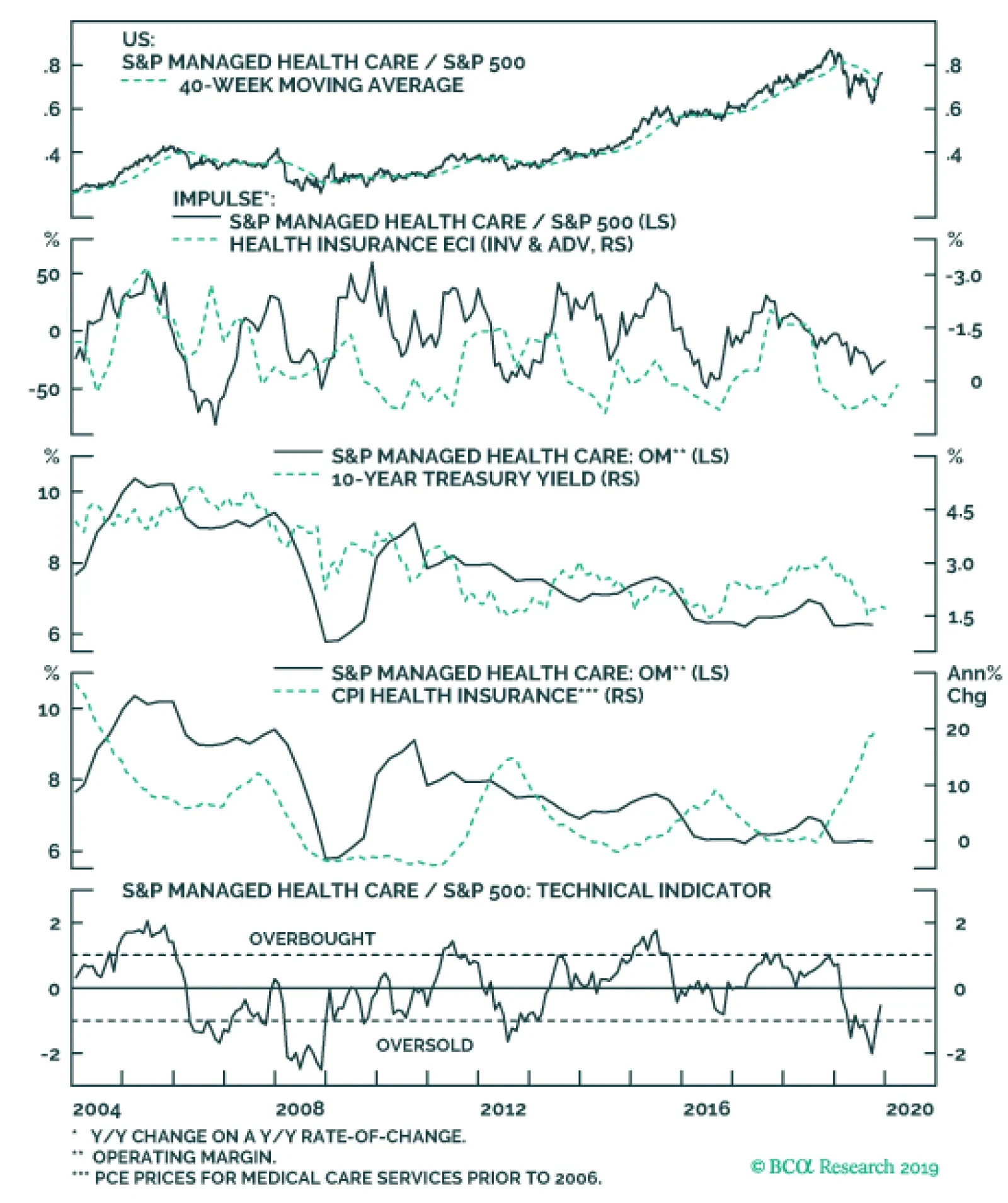

Neutral On Monday’s Weekly Report we put the S&P managed health care index on downgrade alert and instituted a 5% rolling stop on the position in order to protect gains for our portfolio. This downgrade alert reflected the…

Overweight (Downgrade Alert) In this Monday’s Weekly Report we put the S&P managed health care index on downgrade alert to reflect, at the margin, recent negative news. Over the past five weeks unemployment…

Highlights Portfolio Strategy We remain comfortable with a 3,000 SPX fair value estimate backed up by our DDM, forward ERP and sensitivity analyses. The path of least resistance remains higher for the SPX on a 9-12 month cyclical time…

Despite the recent explosive run up in relative share prices – partly owing to the drop in Elizabeth Warren’s odds of winning the Democratic candidacy and partly given her watering down of her “Medicare For All…

Overweight We upgraded the S&P managed health care group to overweight in April shortly after Bernie Sanders re-introduced his revamped “Medicare For All” bill. Despite the recent explosive run up in…

Overweight Managed health care stocks cheered UnitedHealth Group’s better than expected earnings and higher guidance. The news is offsetting recent HMO uncertainty courtesy of Elizabeth Warren’s slingshot rise in…

Highlights Portfolio Strategy Despite the Fed’s supra natural powers, the deep rooted global growth slowdown will likely win the tug of war versus flush liquidity, especially if the trade war spat stays unresolved and the U.S.…

Yesterday we were stopped out on our long S&P managed health care/short S&P semis market neutral pair trade initiated on May 13, 2019 for a gain of 10%. Our thesis remains intact that a lot of negative news has been priced into…