Please join BCA Research's Chief US Equity Strategist, Irene Tunkel, for a US Equity Intelligence session on Wednesday, April 16 at 9:00 AM HKT, 11:00 AM AEST.

We are pleased to share the replay of US Equity Market Intelligence Session, hosted by Chief US Equity Strategist Irene Tunkel.

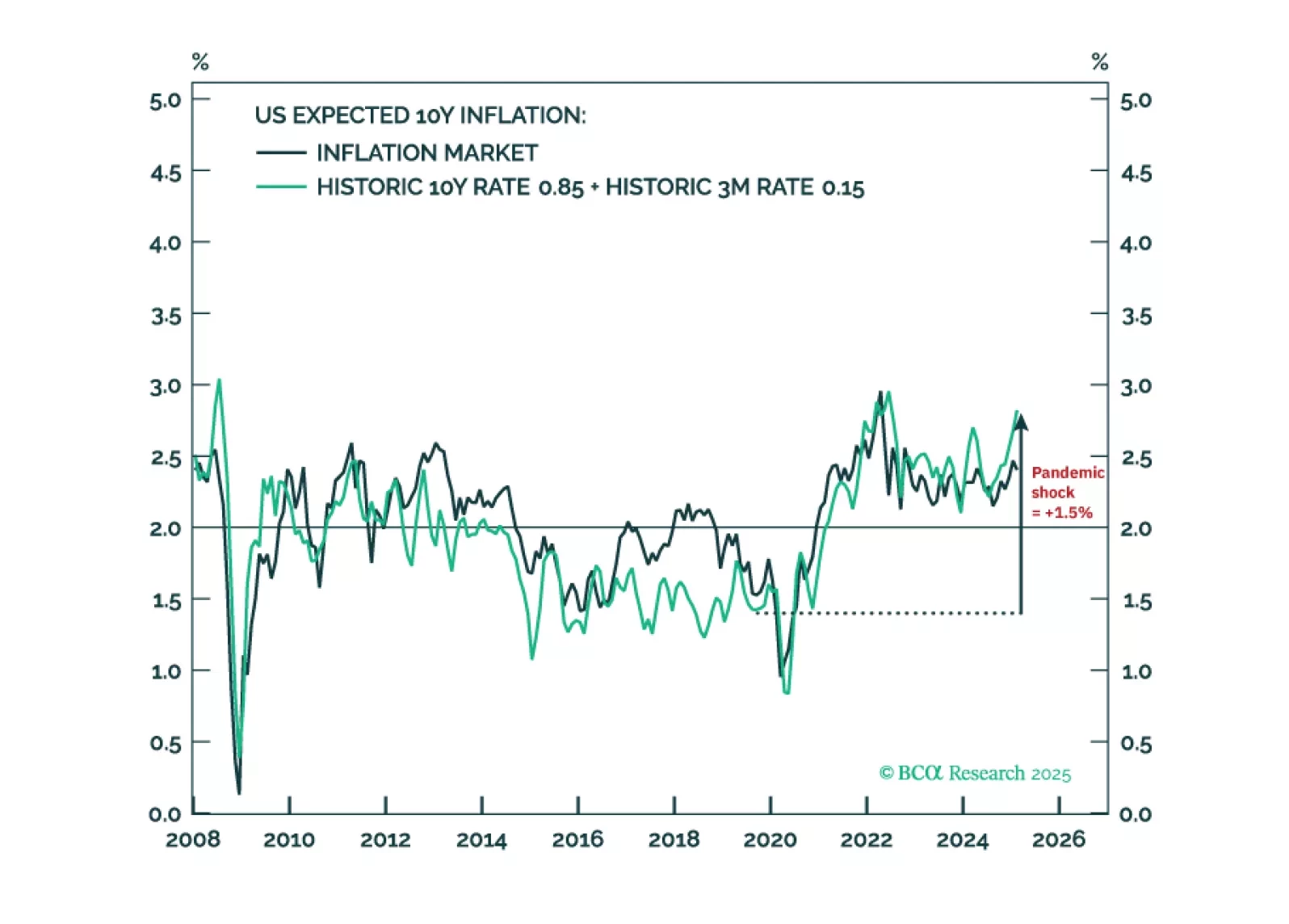

Tariffs will make a difficult job almost impossible. Hitting and sustaining a precise 2 percent inflation target is more about luck than judgement. It requires both the starting point for inflation expectations and any inflation/…

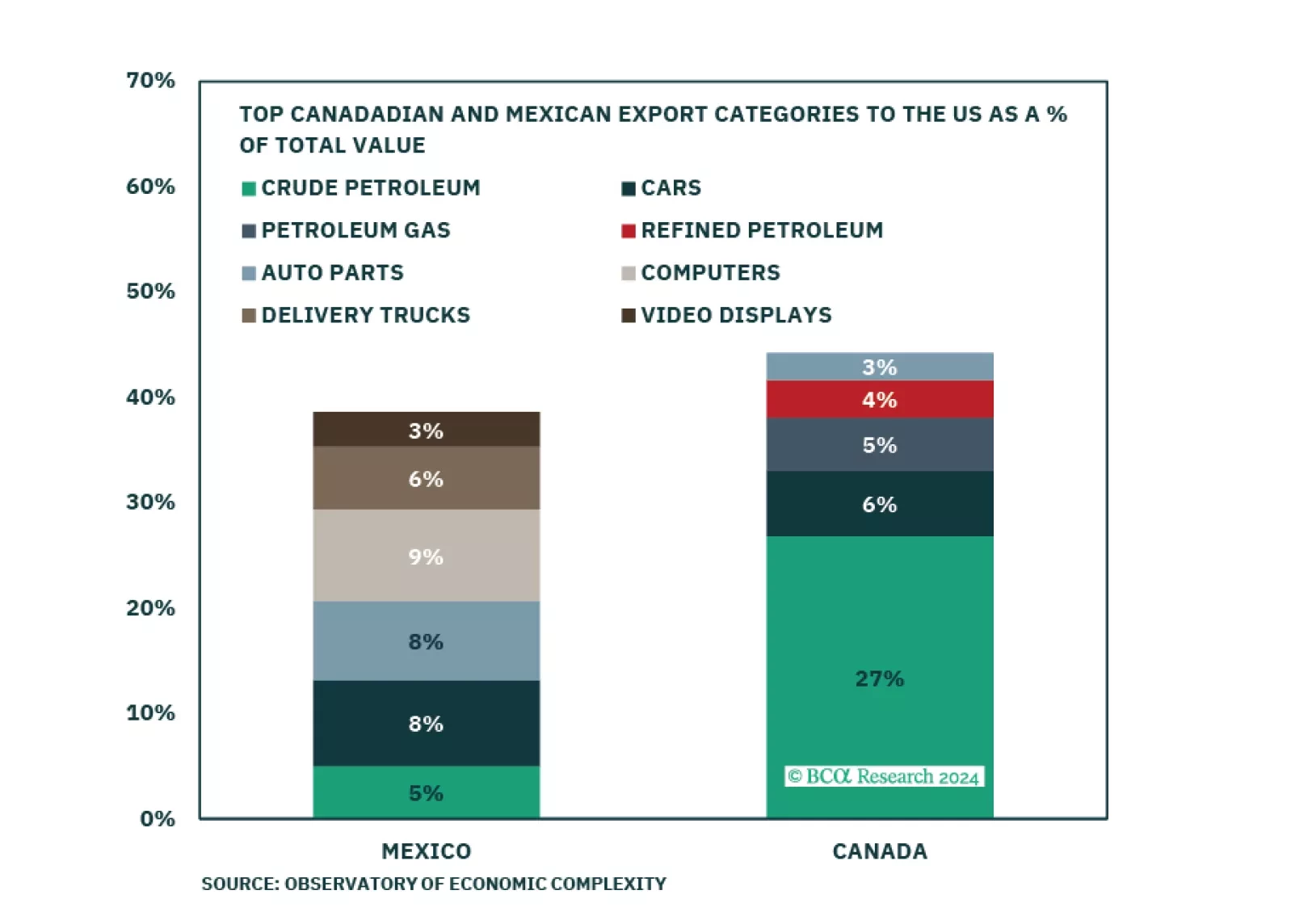

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

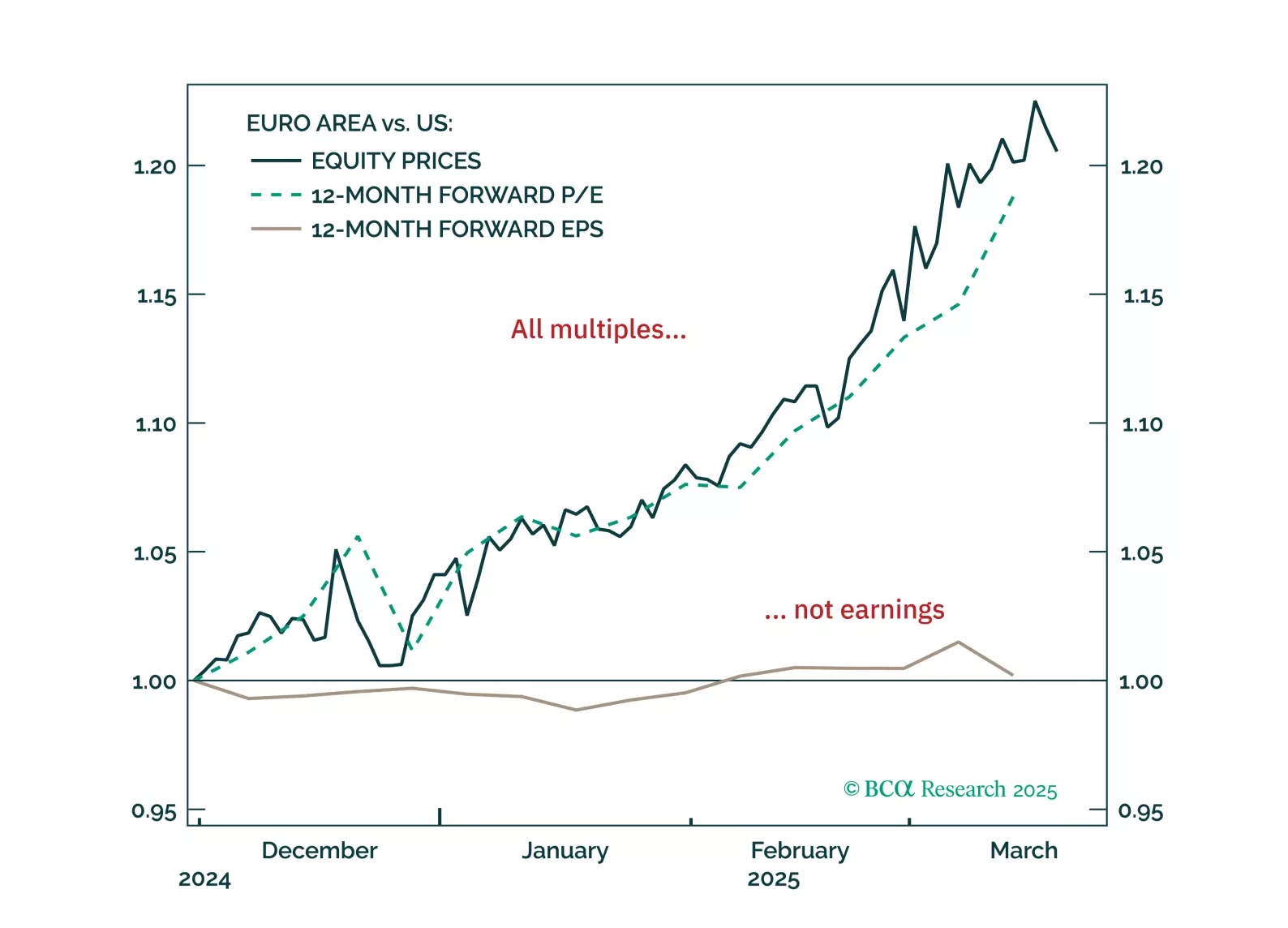

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

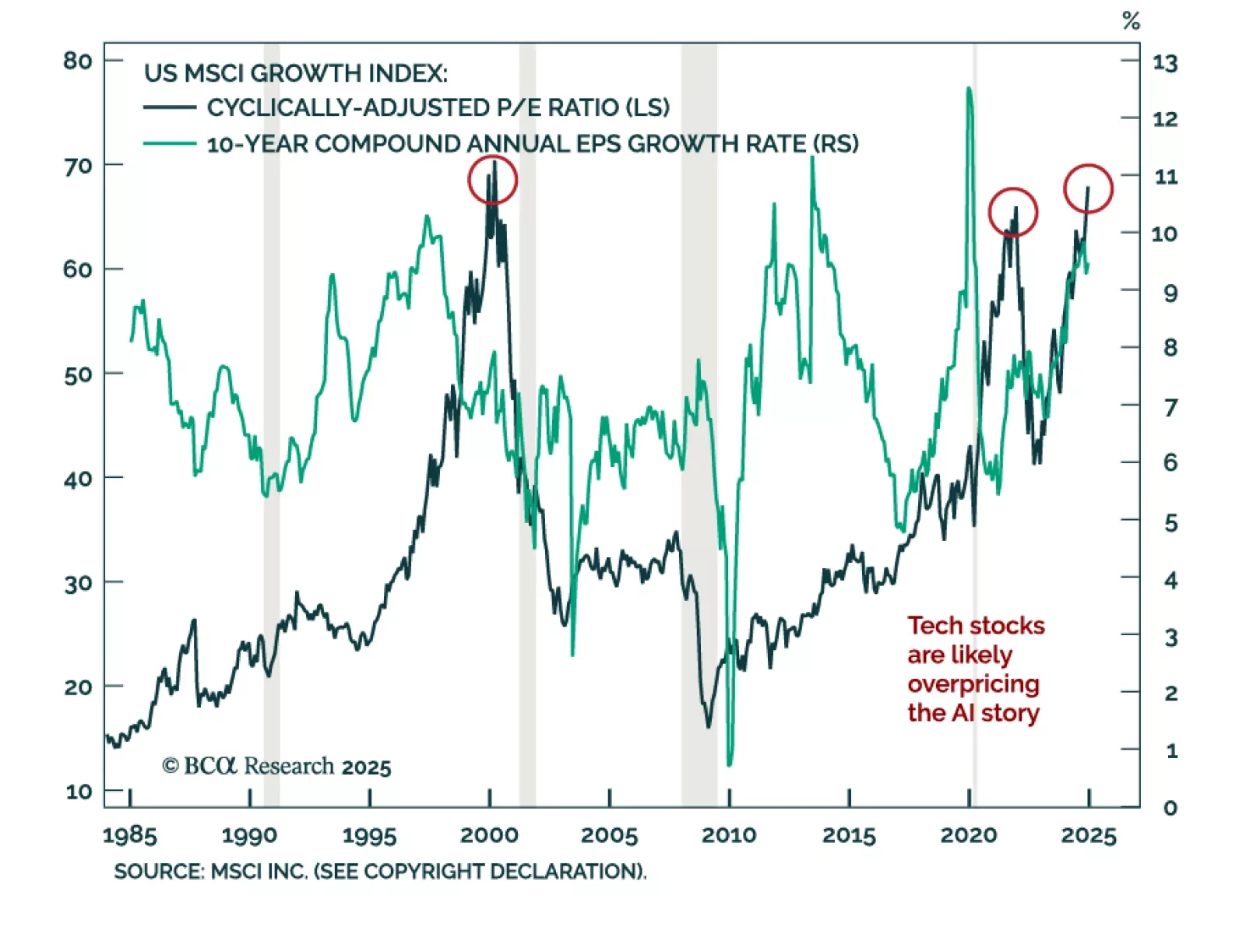

Our Equity Analyzer team used their platform to find value plays in a richly-valued US stock market. US equities remain in a bull market, but valuations are stretched, with investors heavily concentrated in large, trending…

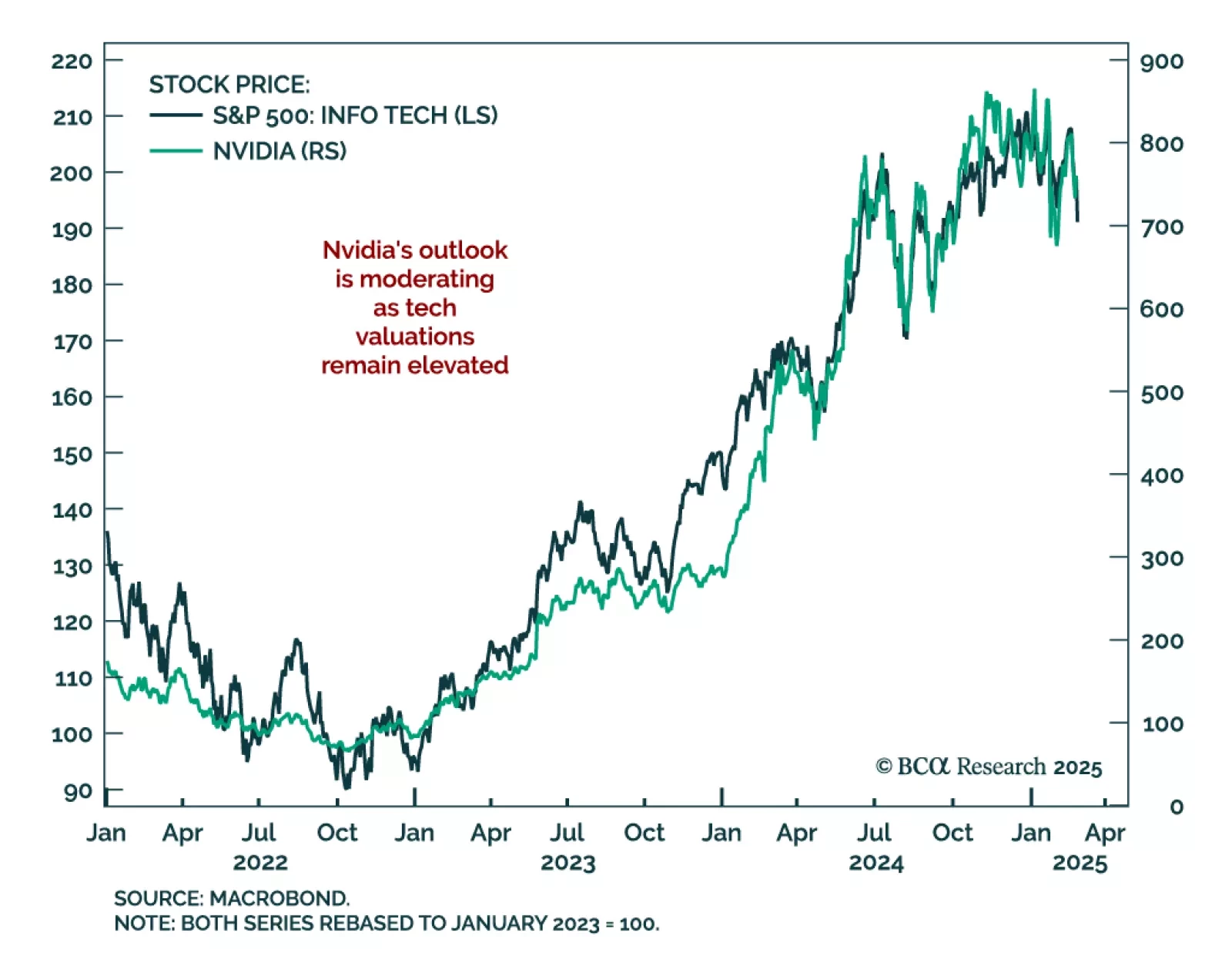

Nvidia announced good results, but Q1 sales guidance fell short of expectations. The numbers point to growth normalization as investors have been accustomed to blowout numbers. Nvidia’s meteoric rise means investors think about…

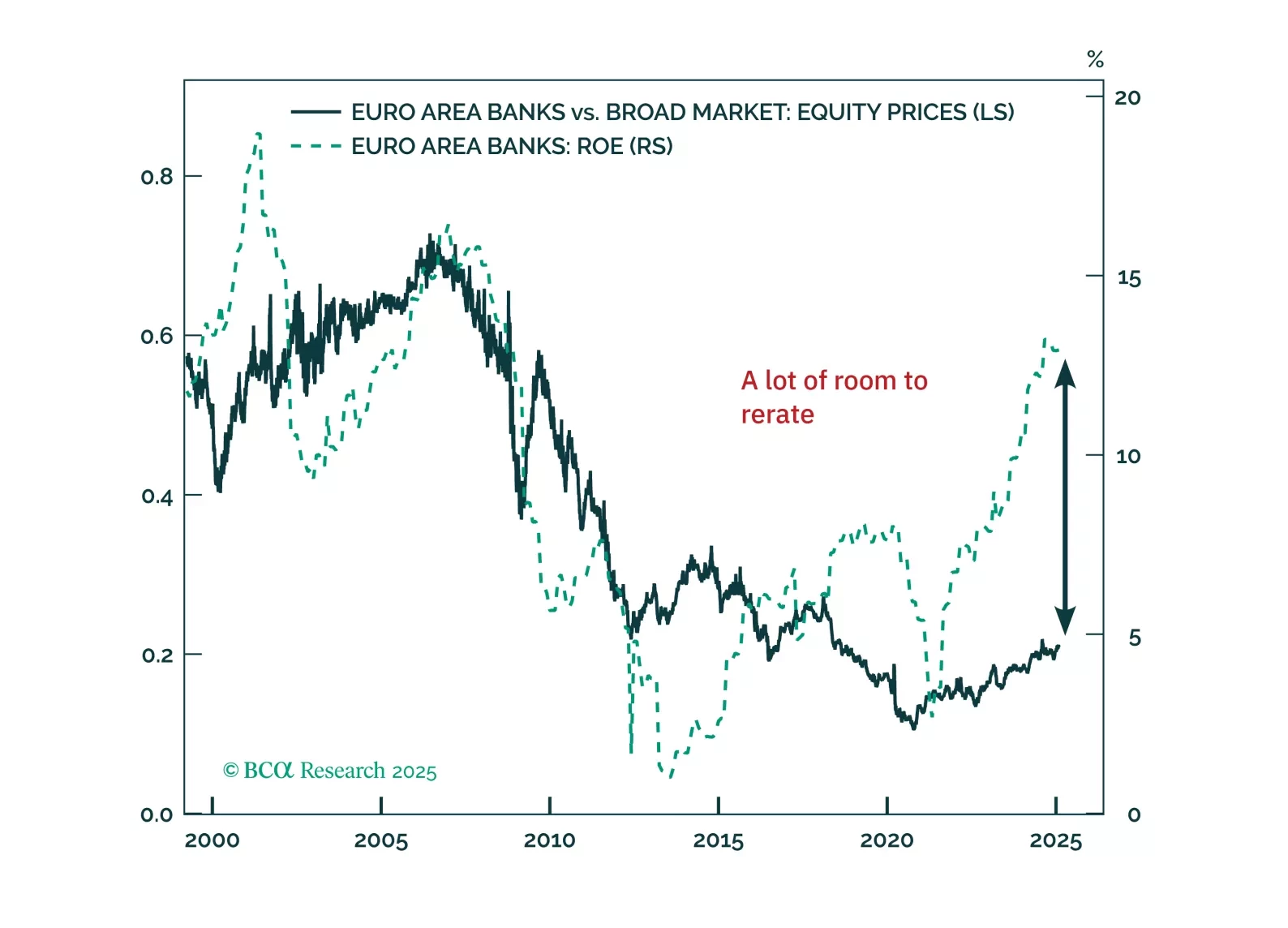

Eurozone banks have quietly outpaced the Magnificent 7—can they keep winning? With strong balance sheets, rising profitability, and structural tailwinds, European lenders still offer value despite short-term risks. Meanwhile, German…

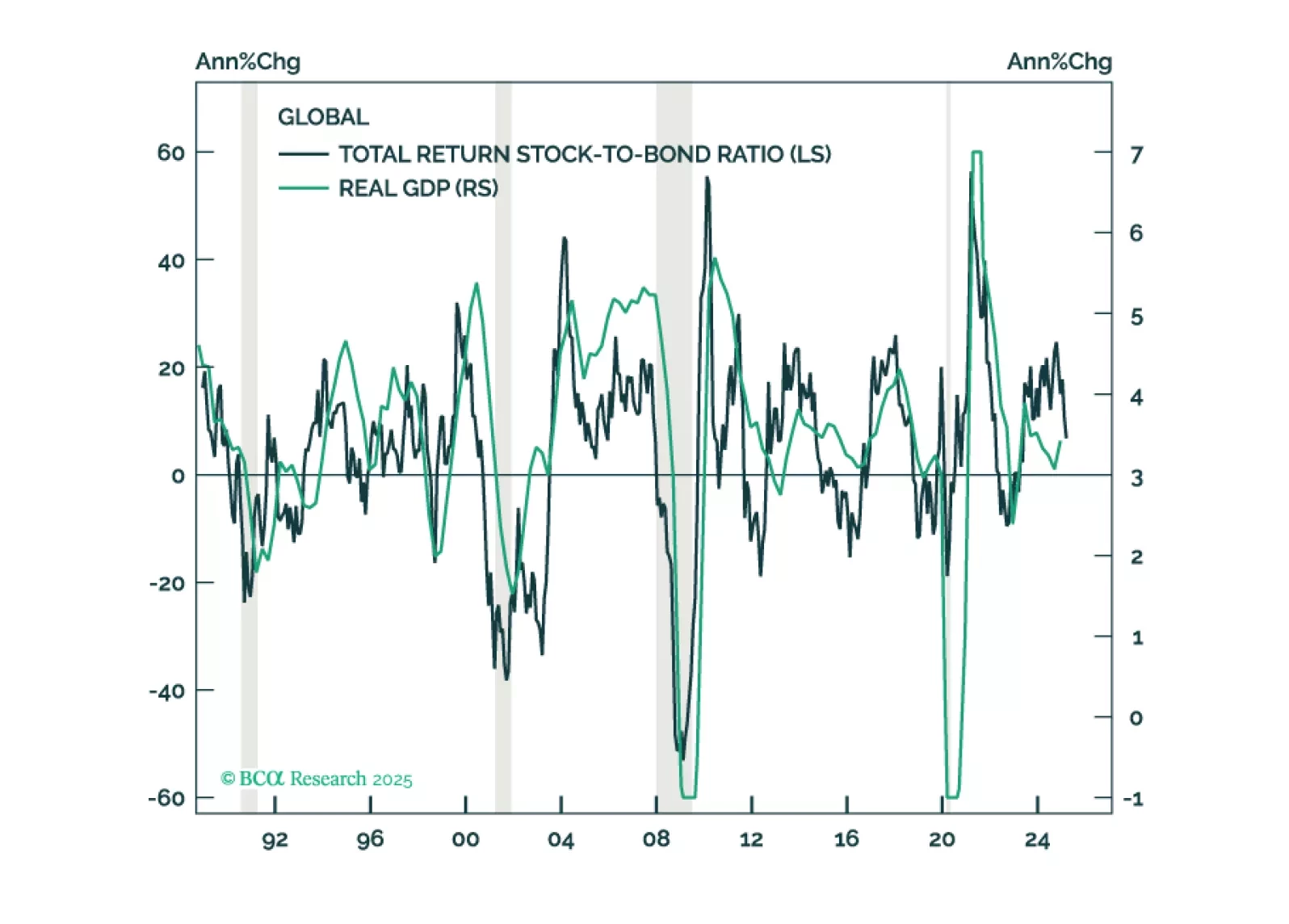

We expect market volatility to remain elevated due to uncertain economic, monetary, and trade policies. Barbell is the best portfolio strategy at this time. We recommend boosting defensive allocations to lower portfolio beta. …

The Magnificent 7 have a leg up on AI investments over the rest of the market. Although the future impact of AI on productivity and profits is still debated, current tech stocks valuations reflect great optimism that AI indeed will…