Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

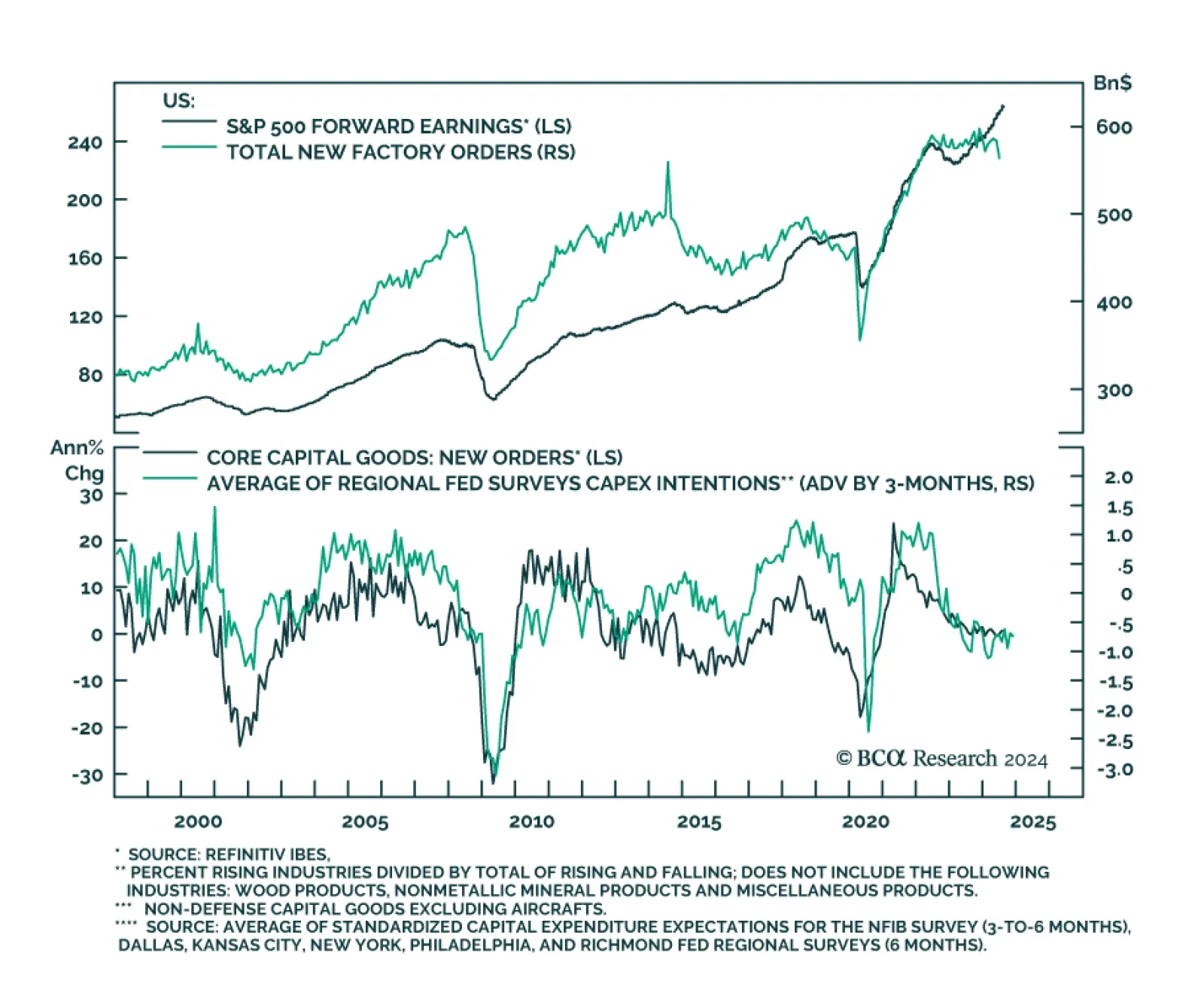

Preliminary estimates suggest that US durable goods orders growth rebounded sharply from a 6.9% m/m contraction to 9.9% growth in July, upending expectations of a more muted 5.0% monthly increase. However, a 34.8% m/m rise in…

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

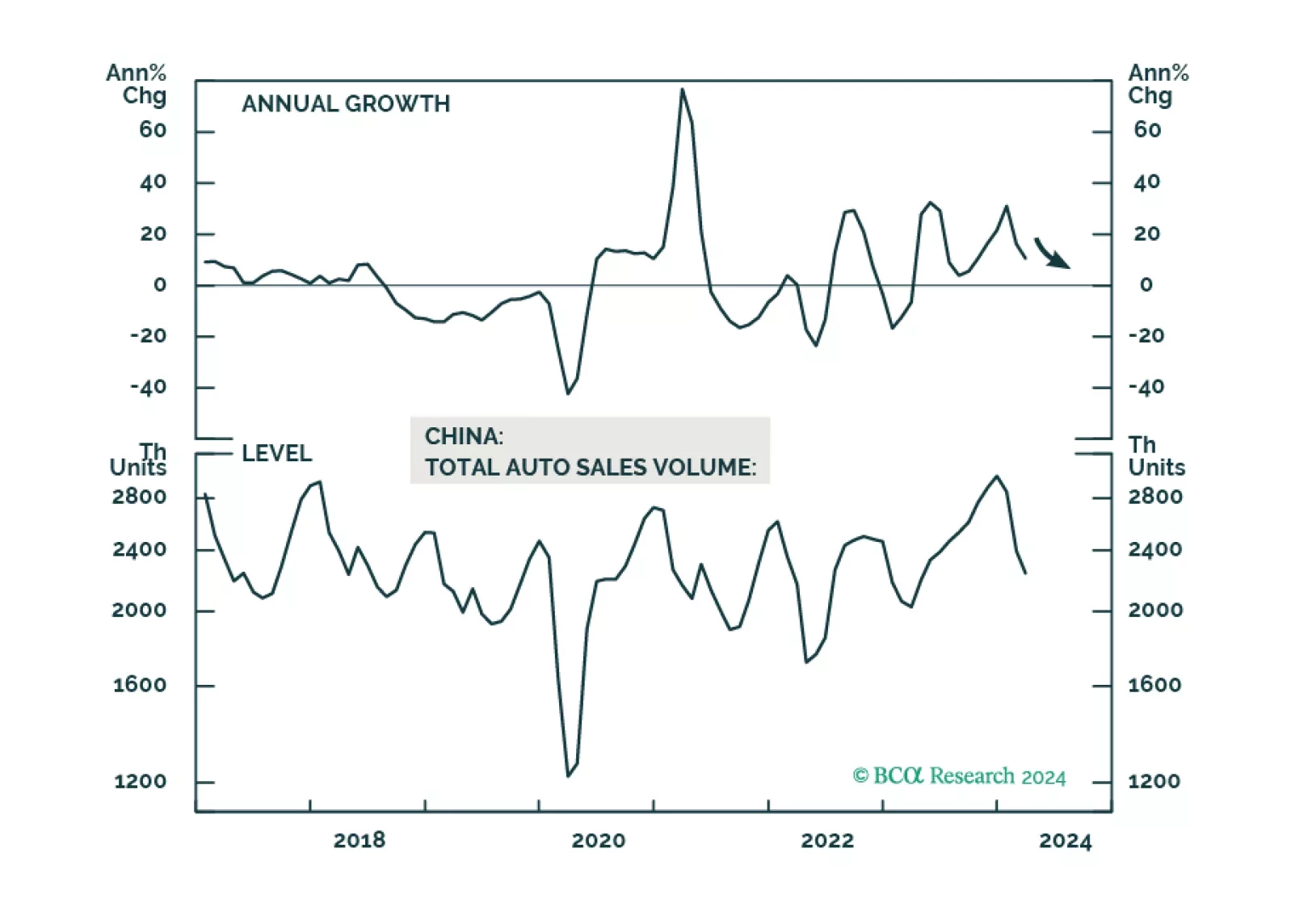

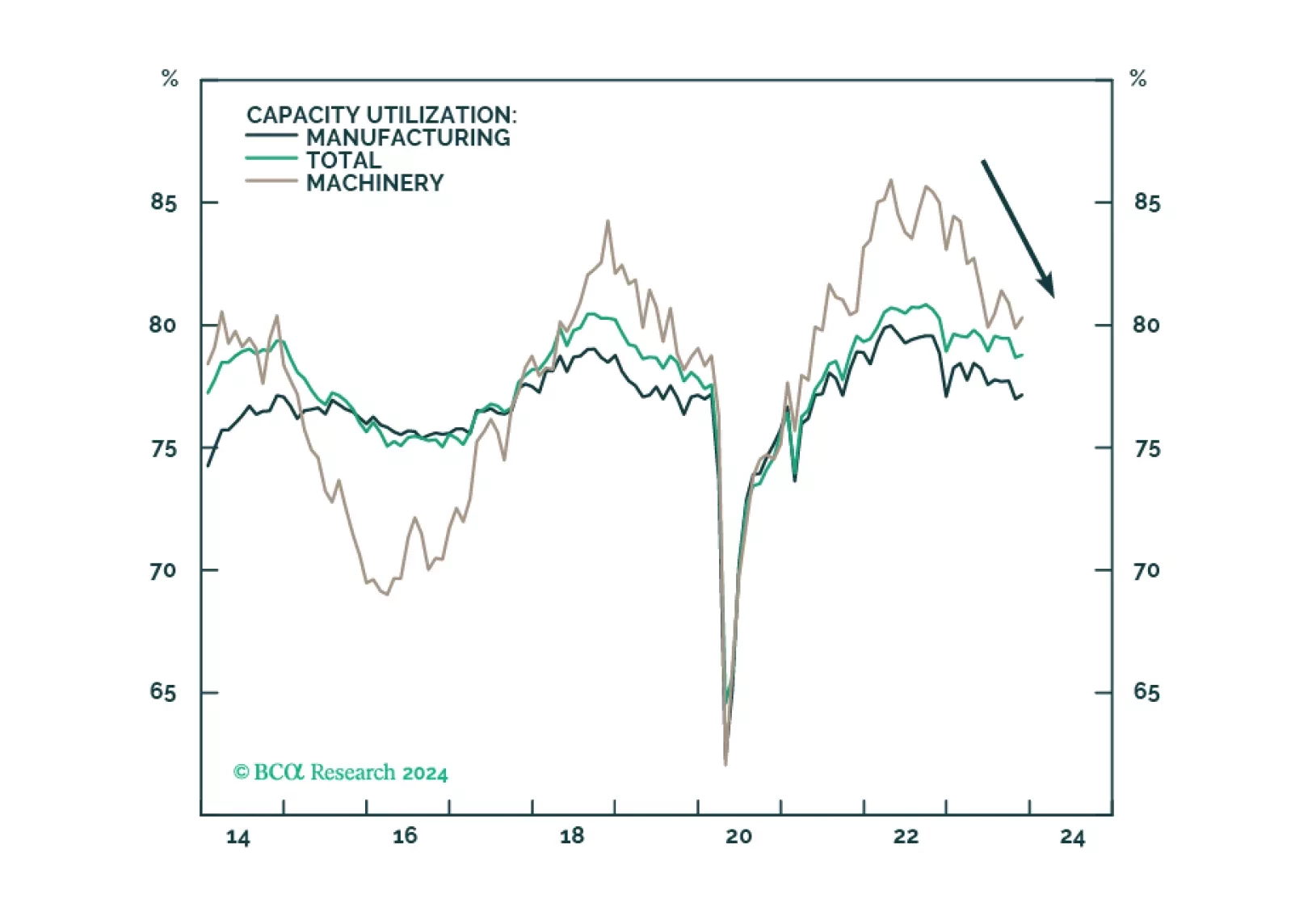

Neutral In light of the likely slowdown in Chinese data, last week we downgraded the S&P machinery index from overweight to neutral. This sub-surface industrials sector move also comes on the heels of our previous upgrade…

Highlights Portfolio Strategy China’s slowdown, a grinding higher US dollar, extremely overbought technicals and historically pricey valuations, all signal that the time is ripe to book profits and downgrade machinery to neutral…

Overweight In the coming months the market may sniff out the China driven slowdown we highlighted in recent research. This will likely present an opportunity to further augment machinery exposure as a number of macro forces…

In this Monday’s Weekly Report we reiterated our overweight stance in the S&P machinery index owing to a healthy macro backdrop. Starting from overseas, China is providing a large enough stimulus, which is on a par with the…