Highlights Chart 1Will Fed Purchases Mark The Top? Policymakers can’t do much to boost economic activity when the entire population is under quarantine, but they can take steps to contain the ongoing credit shock and…

Highlights Duration: It is too soon to call the bottom in bond yields. To help make that call we will be looking for when: daily new COVID-19 infections reach zero, global growth indicators improve, US economic indicators worsen,…

Highlights Chart 1Making New Lows While the number of daily new COVID-19 cases is falling in China, the virus is spreading rapidly to the rest of the world. It is now clear that the outbreak will not be contained, though…

Highlights Chart 1Softer PMIs In December A bond bear market looked to be underway in December, with the 10-year Treasury yield reaching as high as 1.93% just before Christmas. But two developments during the past week drove…

Highlights Chart 1Manufacturing PMIs Track Bond Yields November’s manufacturing PMI data were released yesterday, giving us an update for two of our preferred global growth indicators: the Global Manufacturing PMI and…

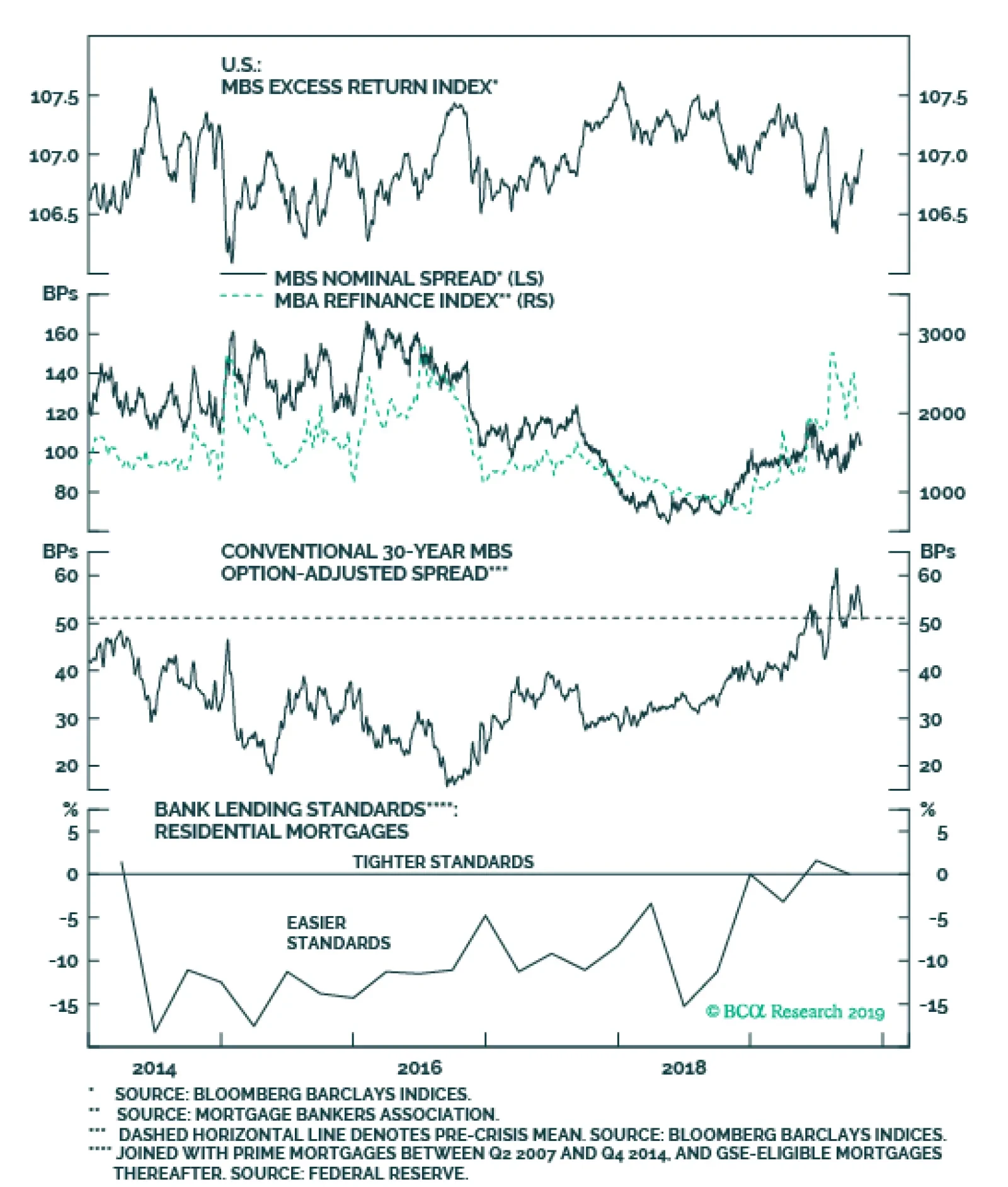

It looks like a good time for U.S. bond investors to shift some allocation into Agency MBS. In particular, our U.S. Bond Strategy service recommends favoring Agency MBS over corporate bonds rated A or higher, for three reasons…

Highlights Global: Global growth momentum is bottoming out, leading indicators are improving, inflation is subdued, and central bankers are biased to maintain accommodative monetary policies. This is a bullish “sweet spot”…

Highlights Chart 1The Fed Must Remain Dovish Many were quick to label last week’s FOMC decision a “hawkish cut”. This is somewhat true in the near-term. The Fed lowered rates by 25 basis points while…