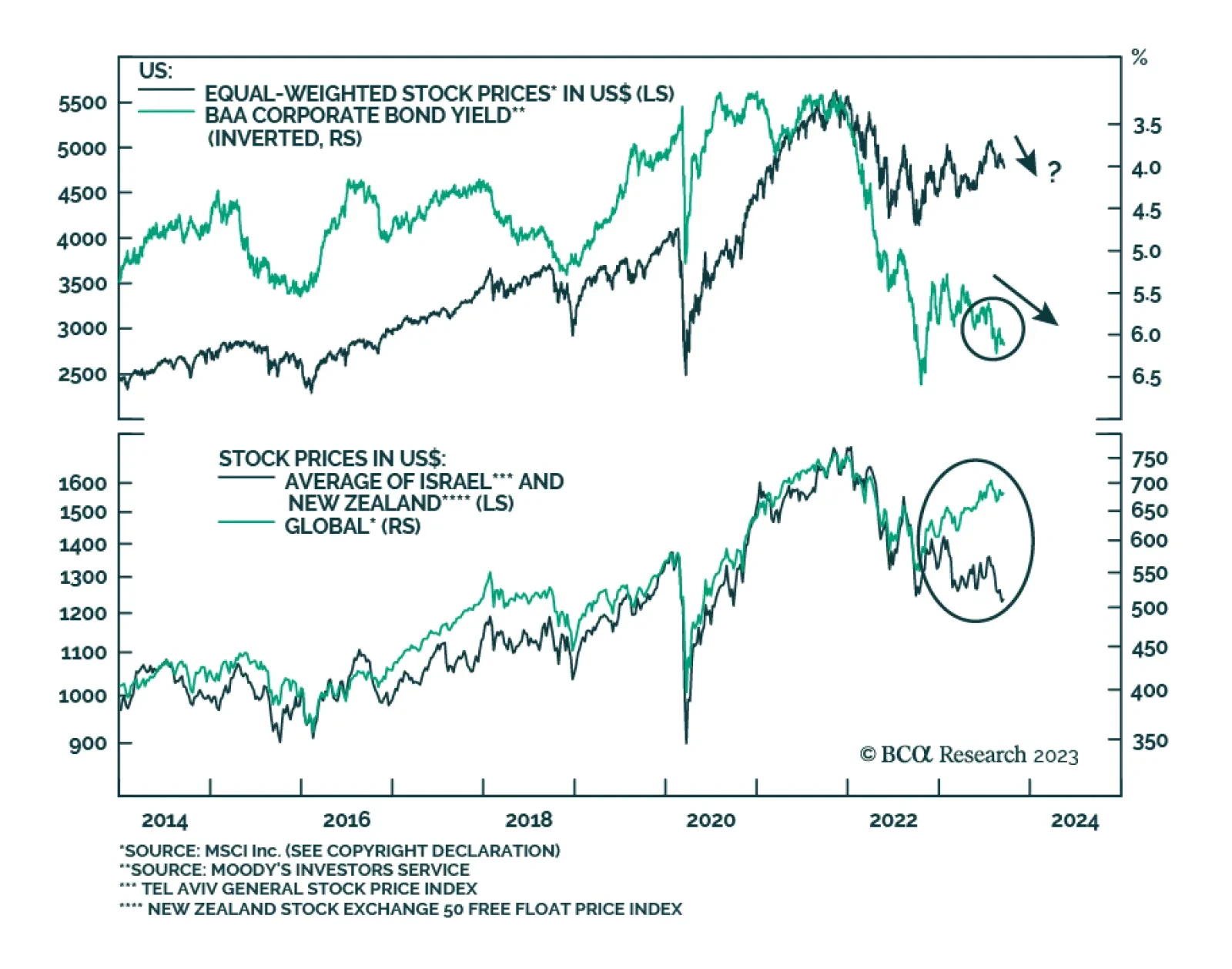

According to BCA Research’s Emerging Markets Strategy service, the combination of rising oil prices, an appreciating US dollar, and mounting US bond yields constitutes a triple whammy for US share prices. One risk that…

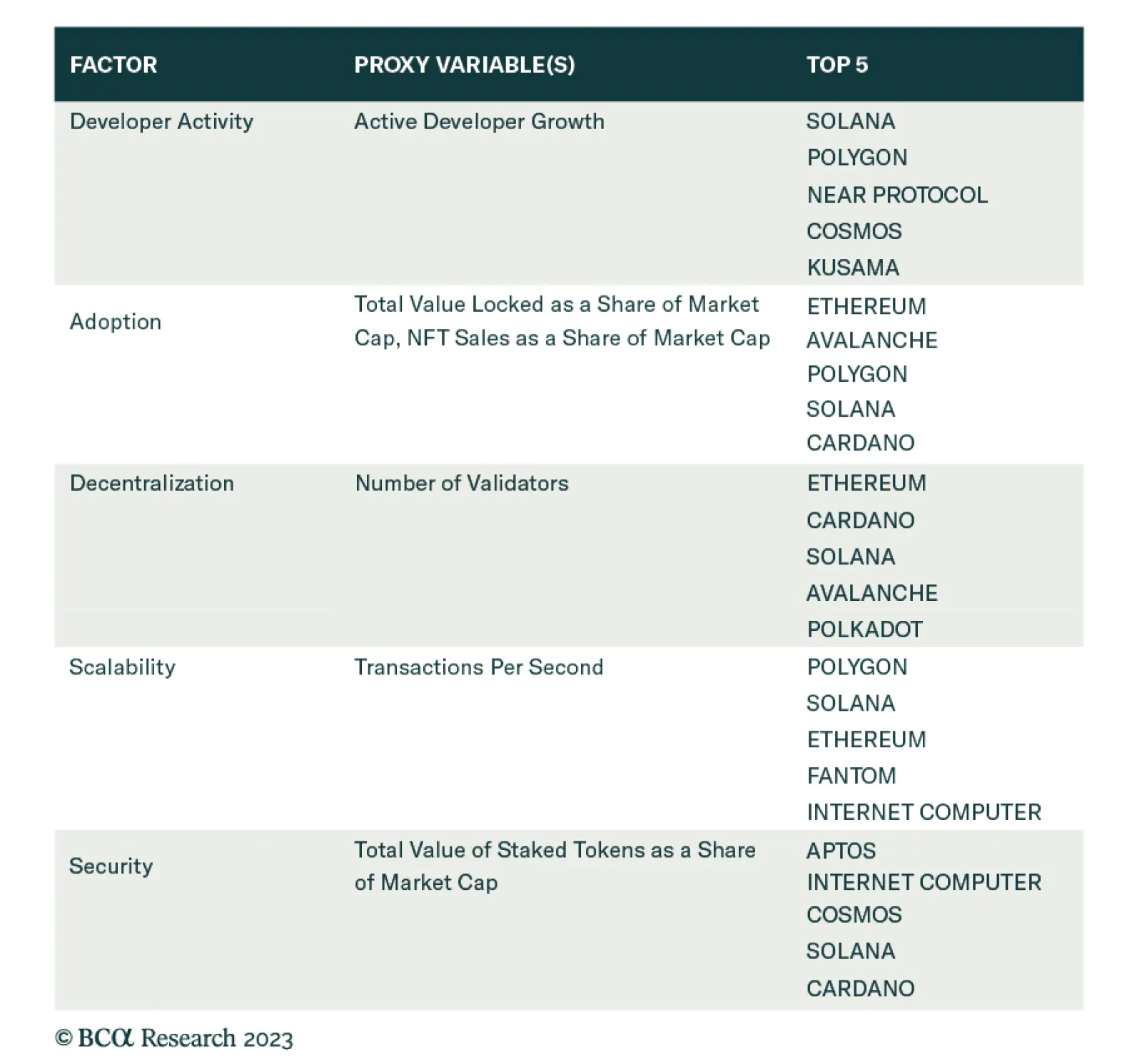

According to BCA Research’s Counterpoint service, the top five blockchains are Solana (SOL), Ethereum (ETH), Polygon (MATIC), Cardano (ADA), and Avalanche (AVAX). Investors should have a small (up to 5 percent)…

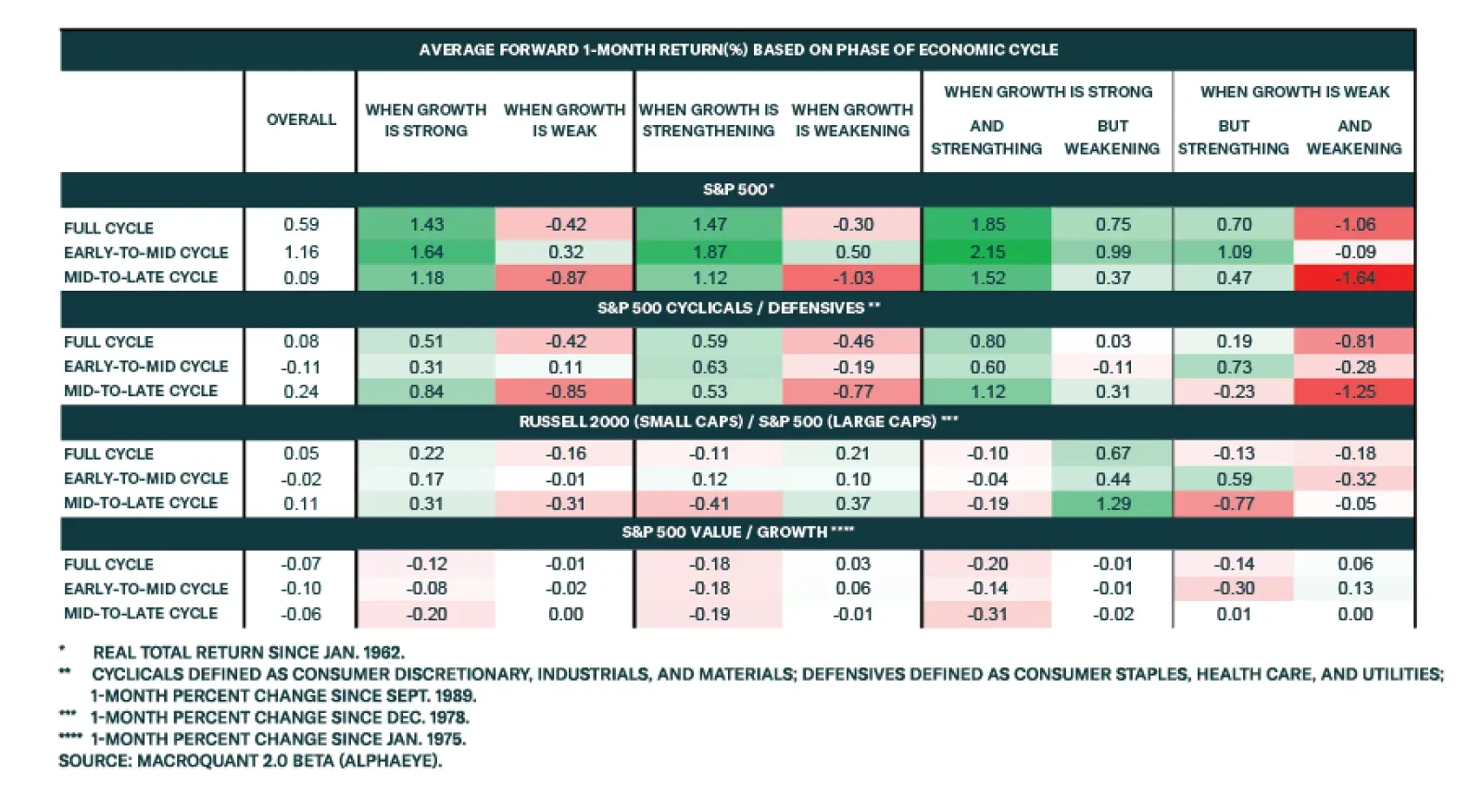

According to BCA Research’s Global Investment Strategy service, stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. In classical physics, the trajectory of an object…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…

Highlights Continued upgrades to global economic growth – most recently by the IMF this week –will support higher natgas prices. In our estimation, gas for delivery at Henry Hub, LA, in the coming withdrawal season (…

Highlights Portfolio Strategy Execute a long S&P energy/short global gold miners pair trade to take advantage of the liquidity-to-growth handoff. Initiate another new trade, long S&P materials/short S&P utilities, to…

It is dangerous to equate recent equity strength with economic vitality, as history shows that liquidity-fueled equity advances favor non-cyclicals over deep cyclicals. Take profits in gold, buy rails and sell industrial machinery.

The 35-year bond bull market is coming to an end and the downward sloping trend channel for yields is changing to flat. Asset allocators should trim duration and fixed income exposure.