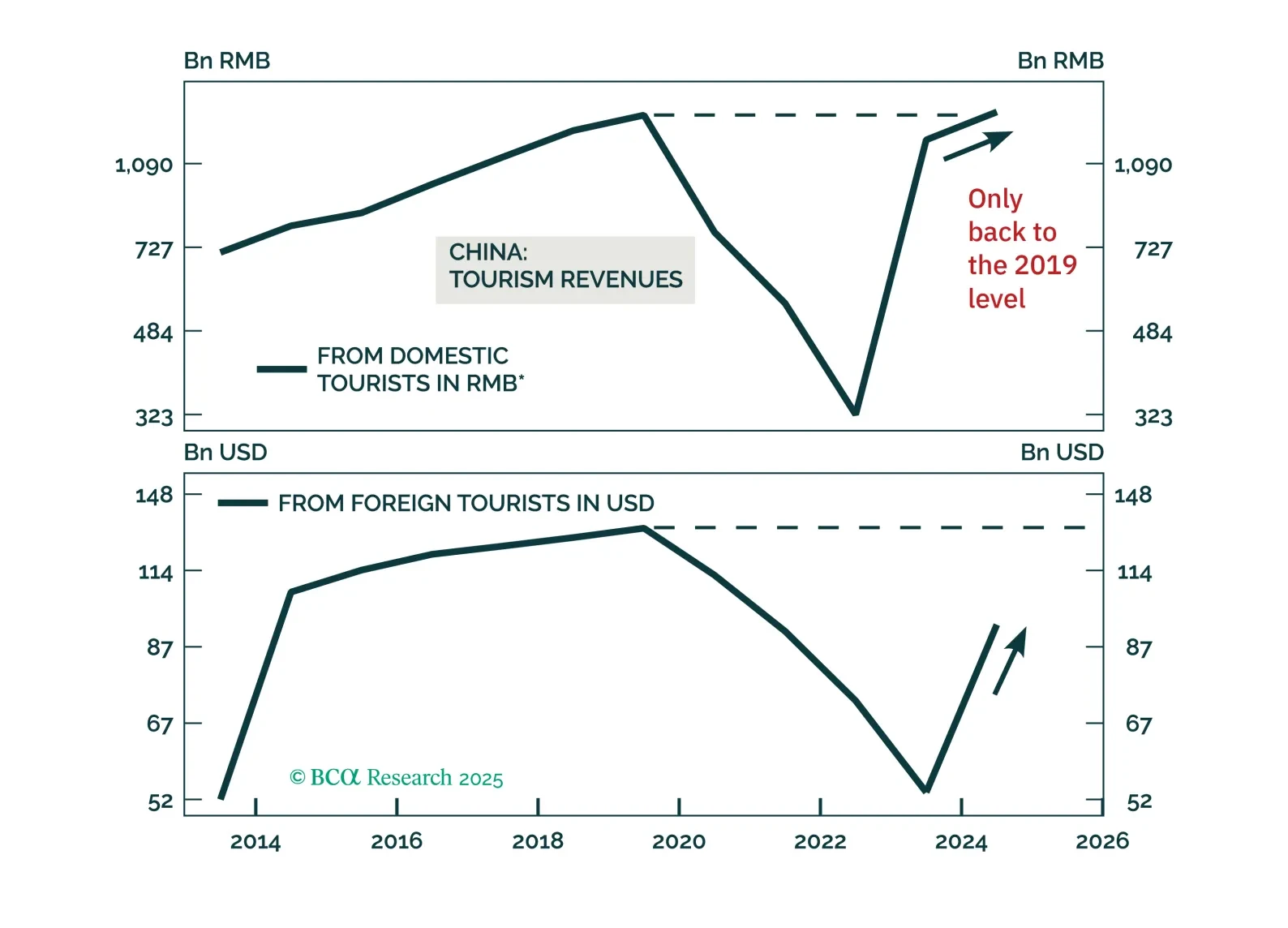

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

Highlights This is the second part of the publication, in which we provide an in-depth overview of Hotels, Restaurants, and Airlines, or the “travel complex” as we dubbed it. In last week’s report, we provided an…

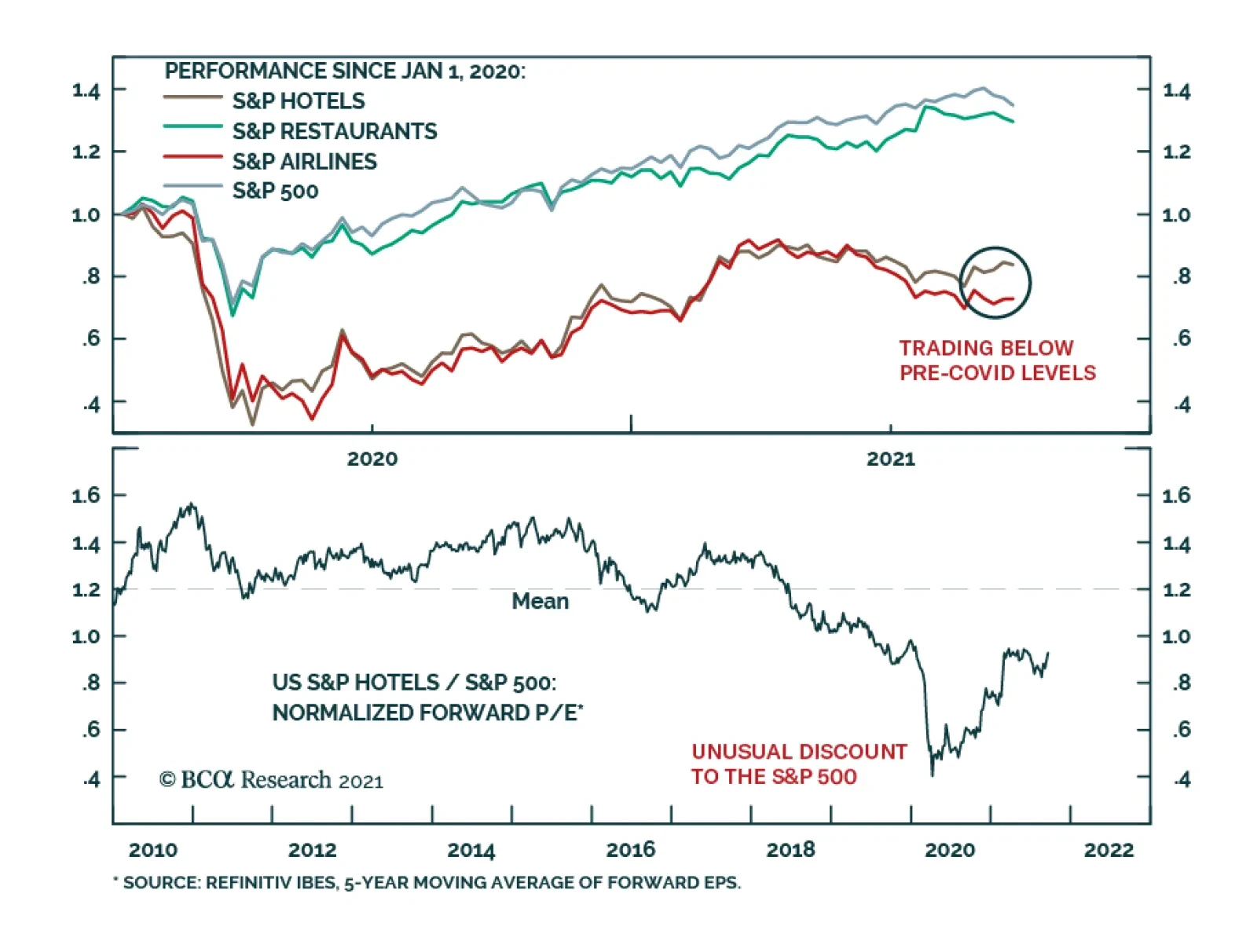

BCA Research’s US Equity Strategy service recommends overweighting the Hotels, Resorts, and Cruise Lines industry. The team summarizes this view as follows: The Delta variant is cresting. Their base case is that herd…

Leisure product stocks have taken a beating this summer to nearly their lowest level since the GFC (top panel). The slide followed a tough Q2 earnings season that saw the industry miss top line and margin estimates. Unsurprisingly,…

After vaulting out of the gate at the start of this year, leisure product stocks have endured a steady bout of profit-taking. However, there are no signs of a change in trend. In fact, relative performance is starting to rebound at a…

Leisure product relative stock performance is setting up for another leg up. The share price ratio endured a brutal bear market, becoming extremely oversold as company-specific woes caused a short selling frenzy. However, a major trend…

Stronger-than-expected profit results have propelled the S&P leisure products group higher in recent trading sessions. Despite the sharp gains that have already accrued, we continue to see meaningful upside potential. Positioning…