Highlights Economy – We agree with the Fed’s judgment that sky-high inflation readings will not last: Used-car prices won’t go up forever and neither will airline fares or hotel accommodations. Supply bottlenecks…

Dear Client, Next week, instead of our regular report, we will be sending you a Special Report from BCA Research’s MacroQuant tactical global asset allocation team. Titled “MacroQuant: A Quantitative Solution For Forecasting…

Highlights Economy – We think the current hiring logjam will prove to be temporary: Once schools fully re-open for in-person learning in August and September and enhanced unemployment benefits expire, restraints on labor supply…

Highlights Duration: The Fed will ignore inflation for the time being and focus on its “maximum employment” target to decide when to lift rates off the zero bound. As a result, bond investors should also ignore inflation…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…

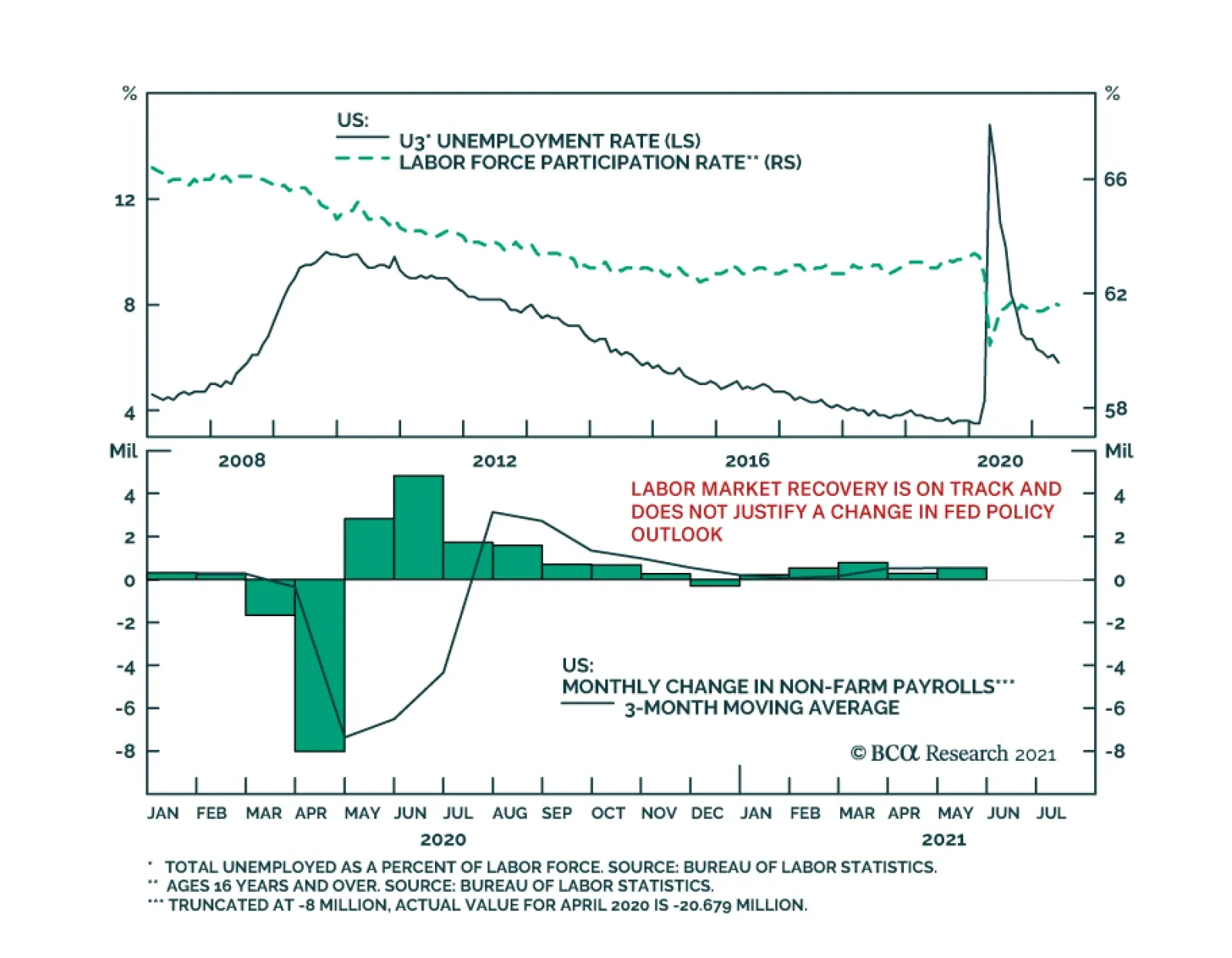

Highlights Chart 1Tracking Nonfarm Payrolls With 12-month PCE inflation already above the Fed’s 2% target, it is progress toward the Fed’s “maximum employment” goal that will determine both the timing…

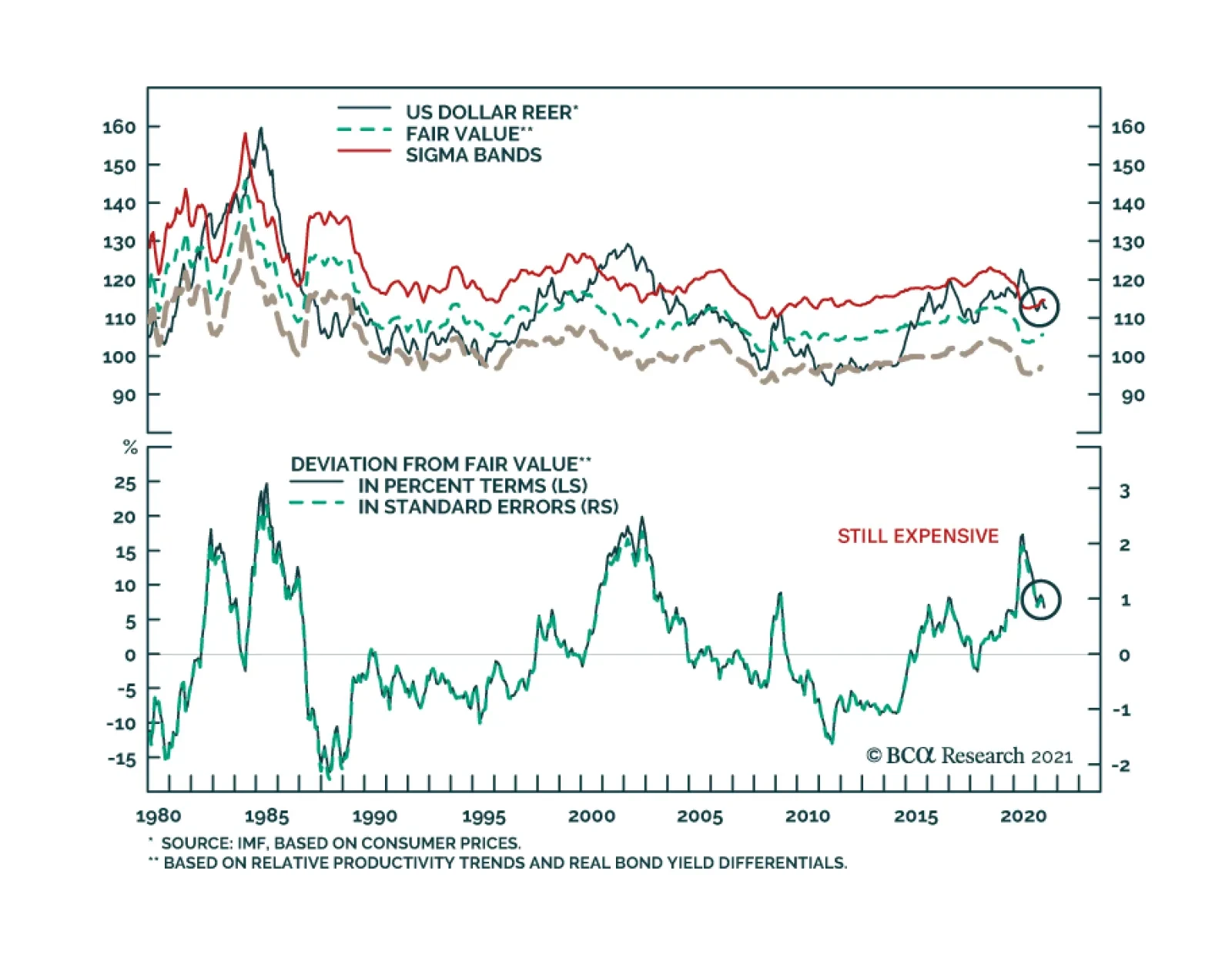

The DXY weakened following Friday’s disappointing Employment Report release, pushing the index towards 90 – near the critical technical level of 89. The dollar’s move suggests that weaker than expected job…

Friday’s US employment report was another miss. Nonfarm payroll employment increased by 559 thousand in May, below the anticipated 675 thousand. Moreover, the labor force participation rate ticked down to 61.6% from 61.7%.…

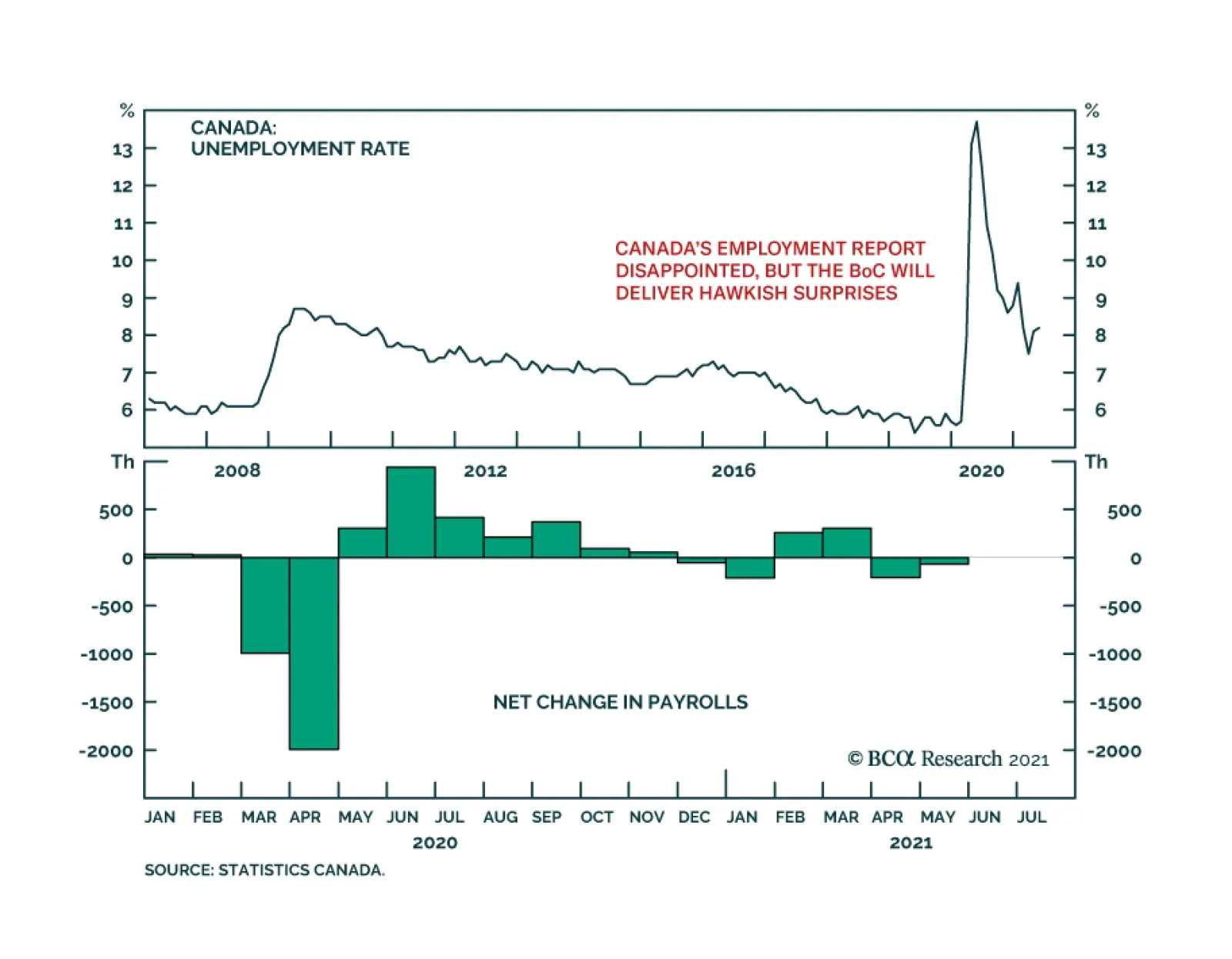

Canada’s May Employment report missed expectations on Friday, sending a downbeat message about the labor market recovery. A net 68 thousand jobs were lost in May, which is more than the 25 thousand loss expected by the…