Highlights Globalization is recovering to its pre-pandemic trajectory. But it will fail to live up to potential, as the “hyper-globalization” trends of the 1990s are long gone. China was the biggest winner of hyper-…

Dear Client, I will be on vacation next week. In lieu of our regular report, we will be sending you a Special Report written by my colleague Arthur Budaghyan, BCA Research’s Chief Emerging Markets Strategist. Arthur’s…

Highlights Duration: The recent decline in Treasury yields is overdone. Economic growth is no longer accelerating, but it hasn’t slowed enough to justify the strength in bonds. Stronger employment data will pressure bond yields…

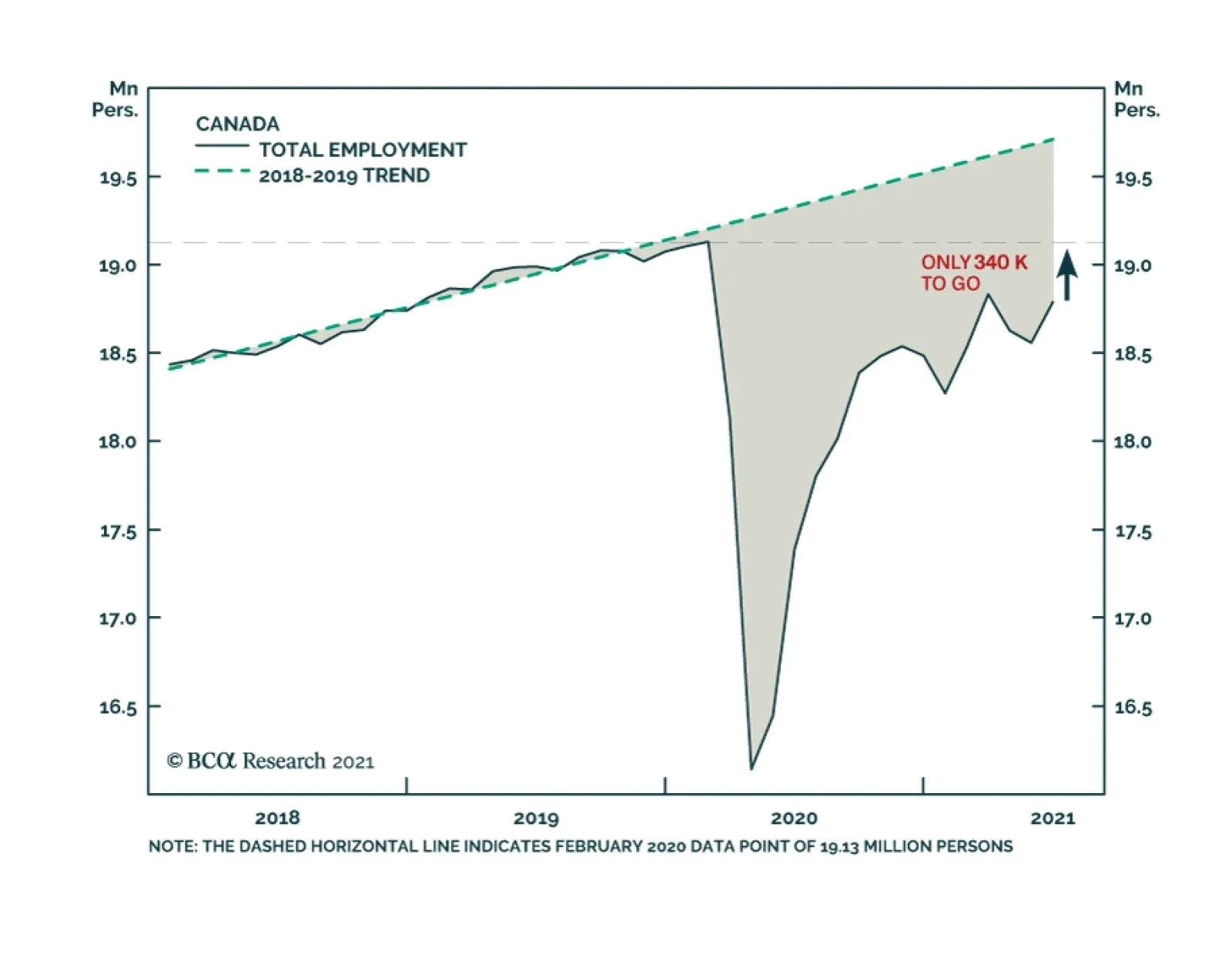

Canadian employment growth in June was robust at 231,000, a big improvement over the losses incurred over the prior two months. The latest month’s growth was driven mainly by a 264,000 increase in part-time jobs: full-time…

In their Q2/2021 model bond portfolio performance review, BCA Research’s Global Fixed Income Strategy team updated their recommended positioning for the next six months. Firstly, the team changed its US Treasury curve…

Highlights Chart 1Employment Growth June’s employment report revealed that 850 thousand jobs were added to nonfarm payrolls during the month. This is well above the 416k to 505k threshold that is required to hit the…

Highlights Three distinct forces are likely to make South Asia’s geopolitical risks increasingly relevant to global investors. First, India’s tensions with China stem from China’s growing foreign policy assertiveness…

Dear Client, We are sending you our Strategy Outlook today, where we outline our thoughts on the macro landscape and the direction of financial markets for the rest of 2021 and beyond. Next week, please join me for a webcast on…

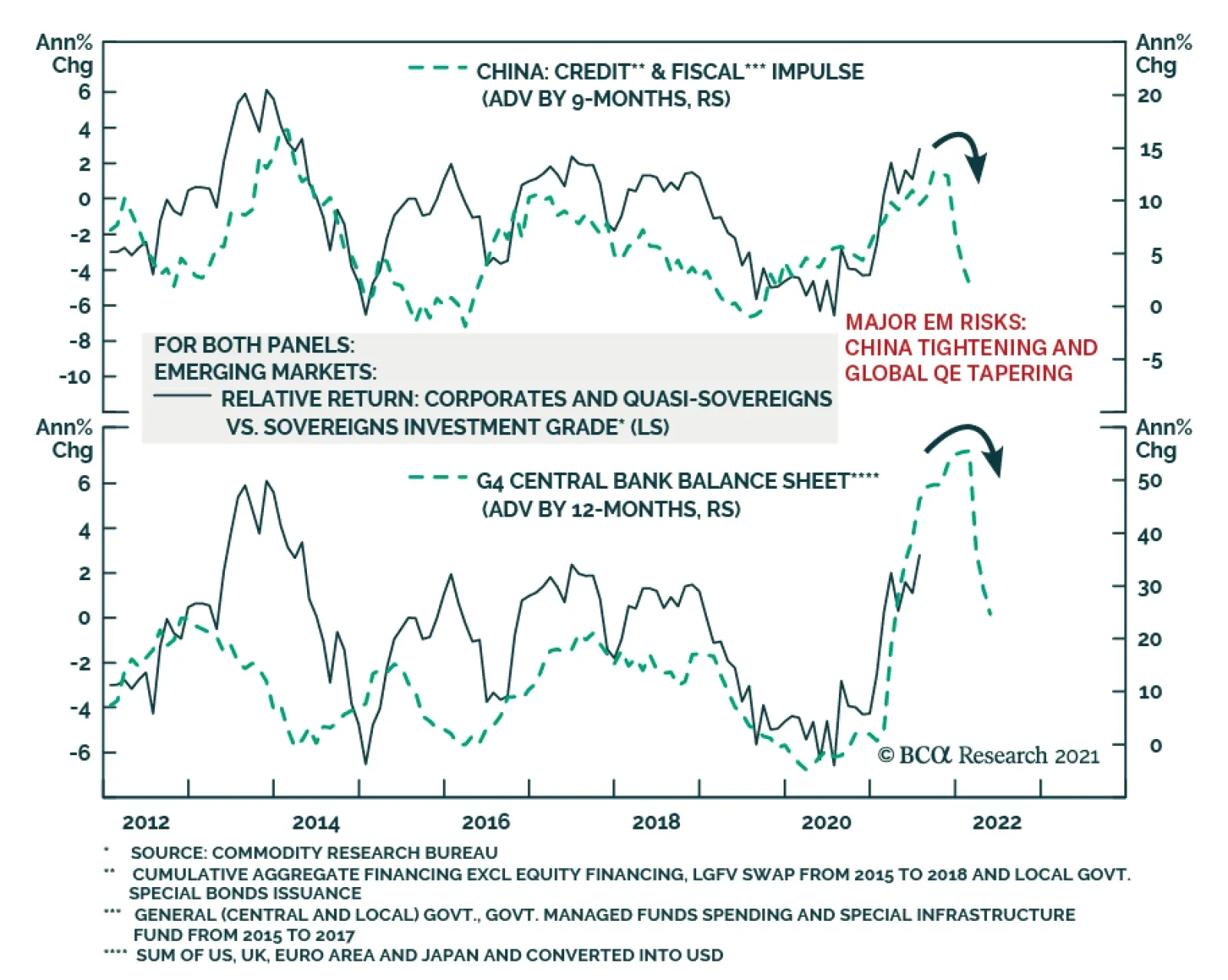

Highlights The ongoing transition to a post-pandemic state and fiscal policy are either positive or net-neutral for risky asset prices. Fiscal thrust will turn to fiscal drag over the coming year, but the negative impact this will…