Our Portfolio Allocation Summary for August 2025.

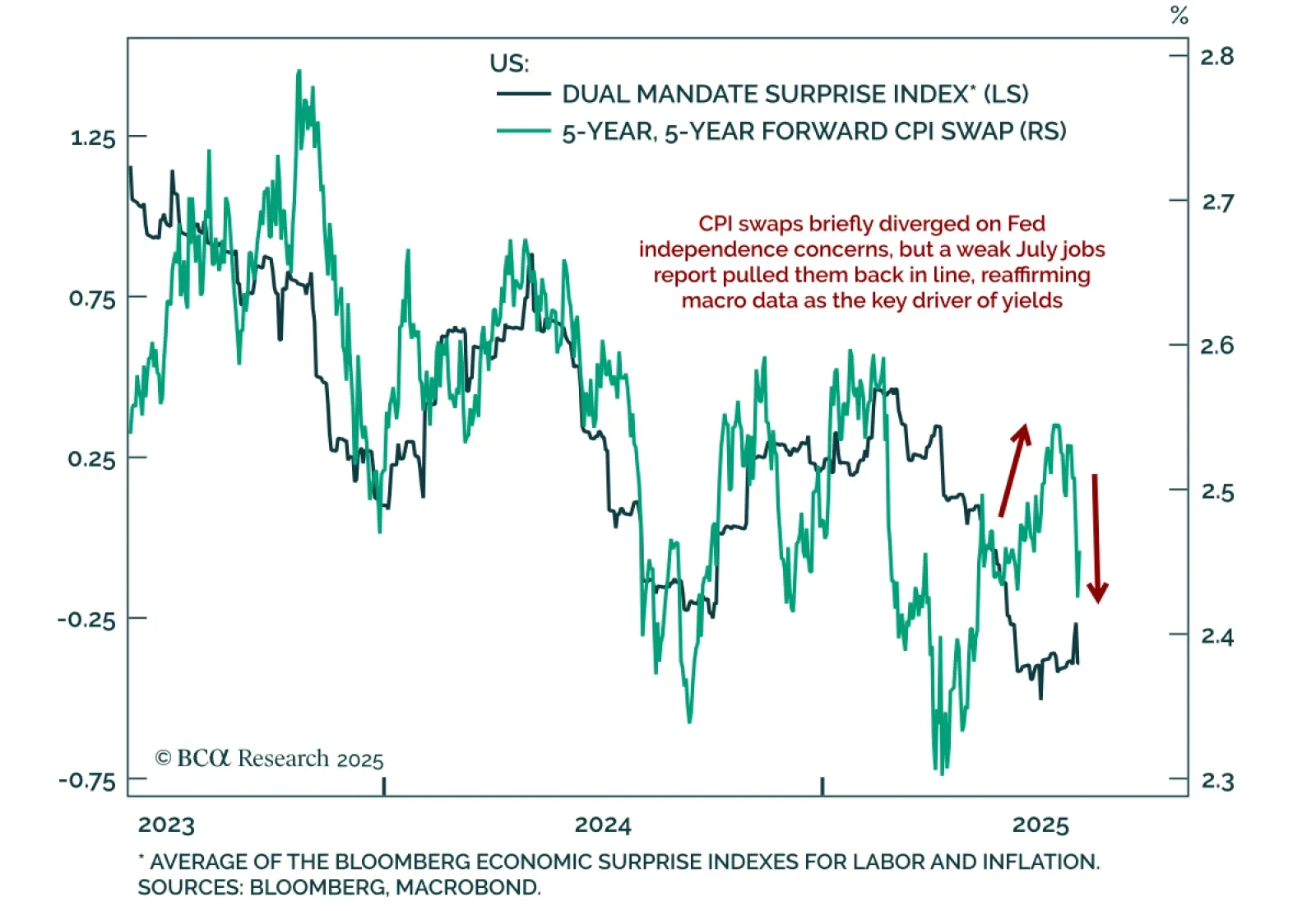

While the early resignation of Fed Gov. Kugler opened the door for a politically aligned nominee, yields will ultimately be determined by the economic outlook. Her departure triggered a further intraday DXY drop, as markets reacted…

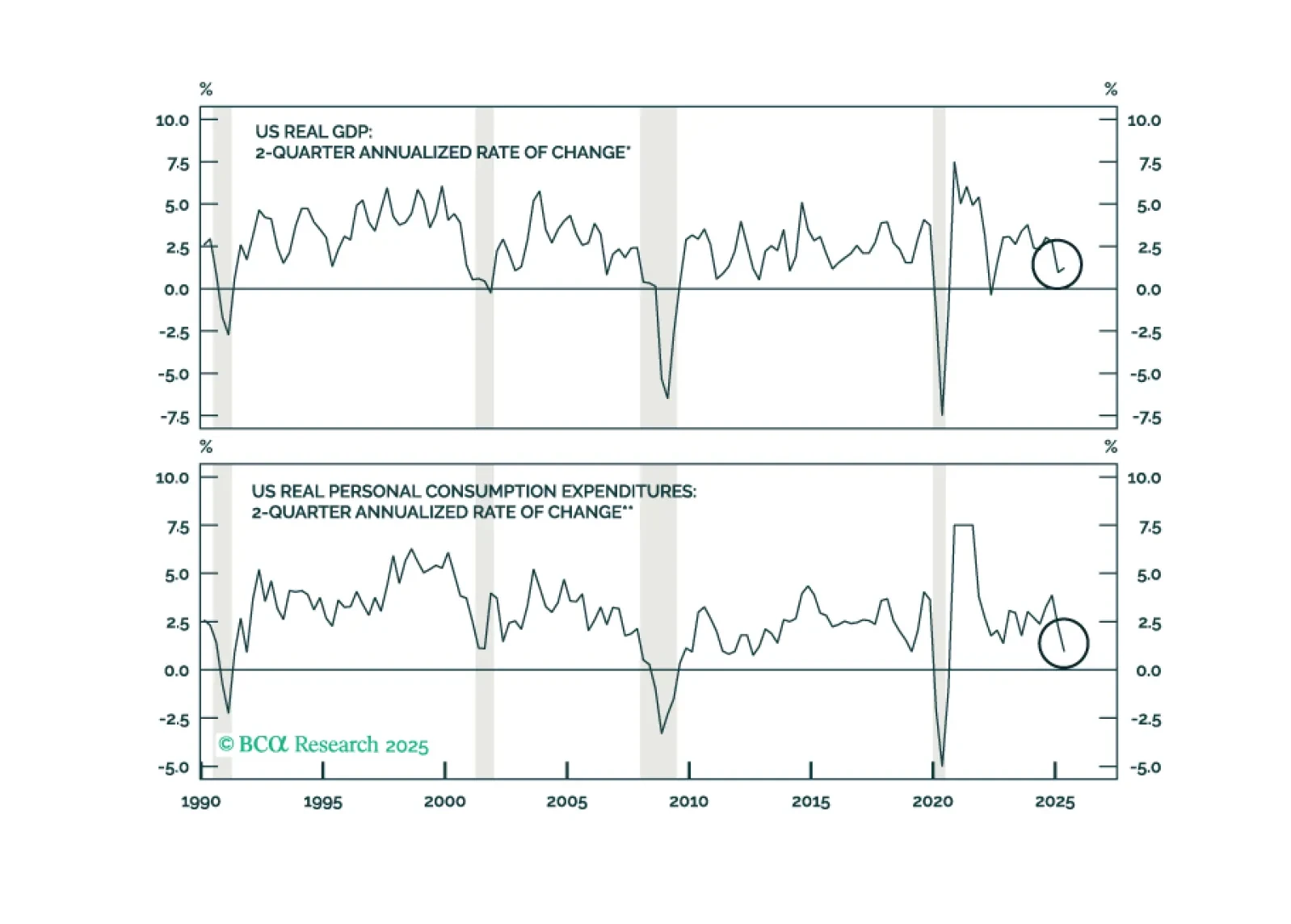

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

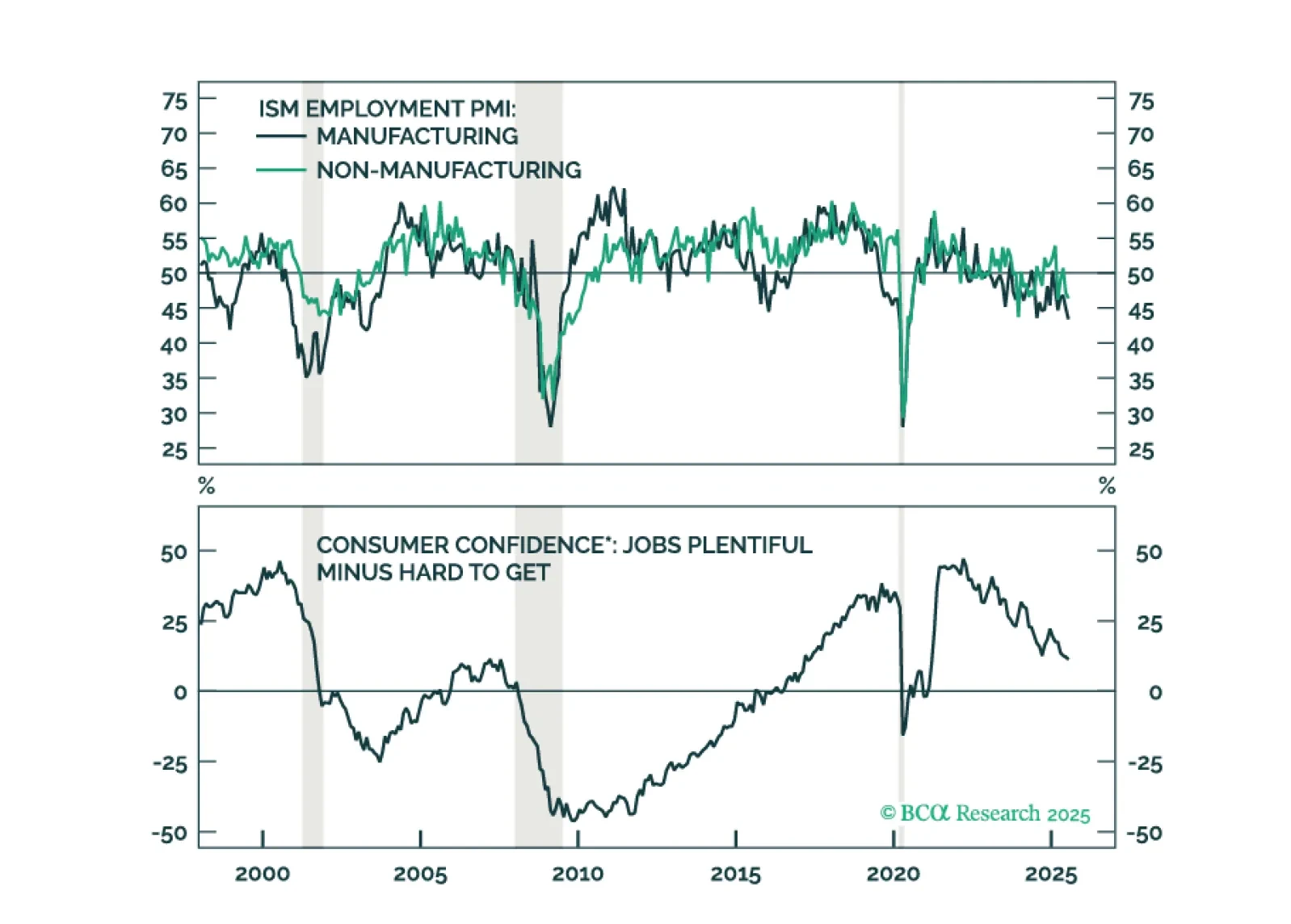

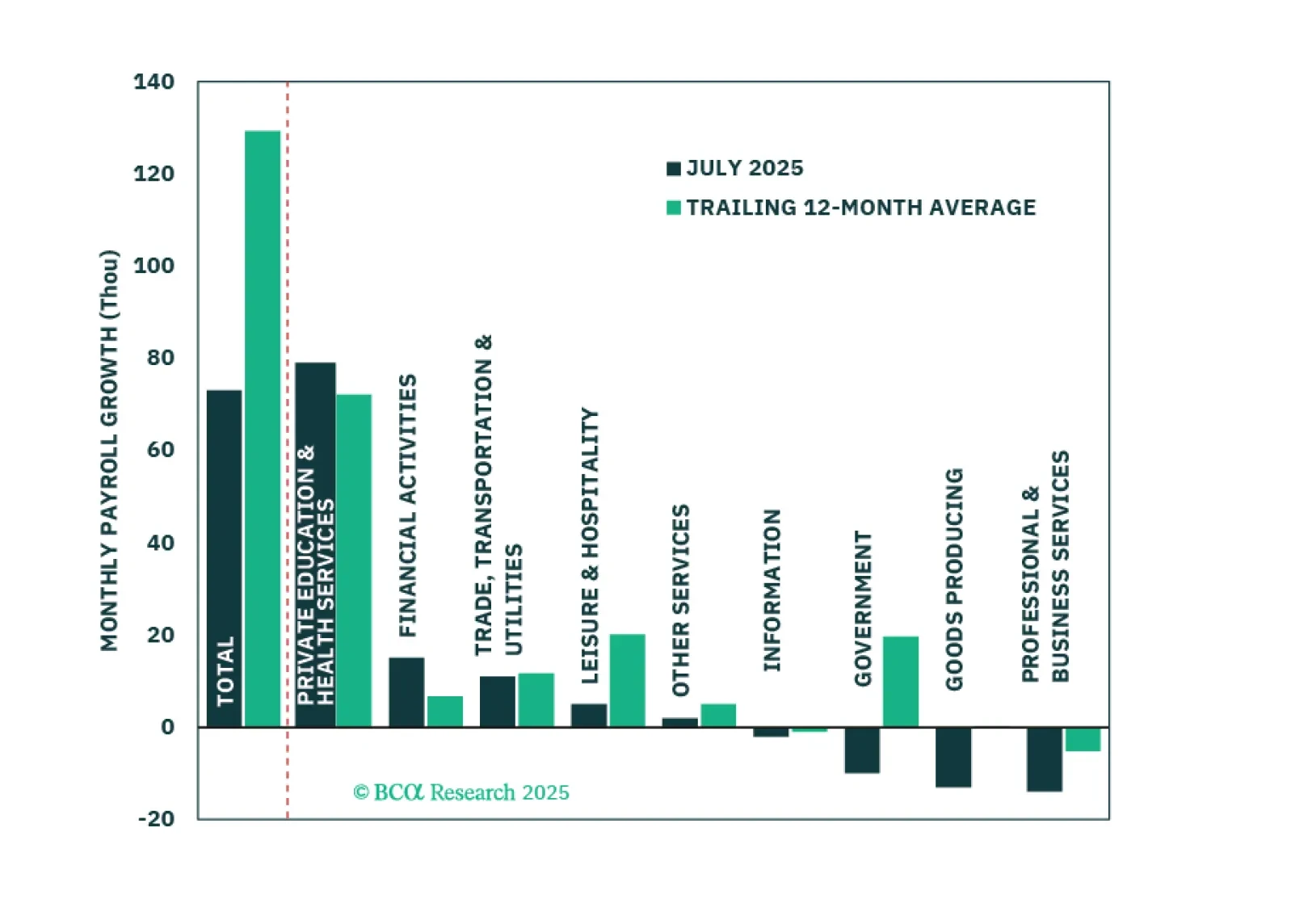

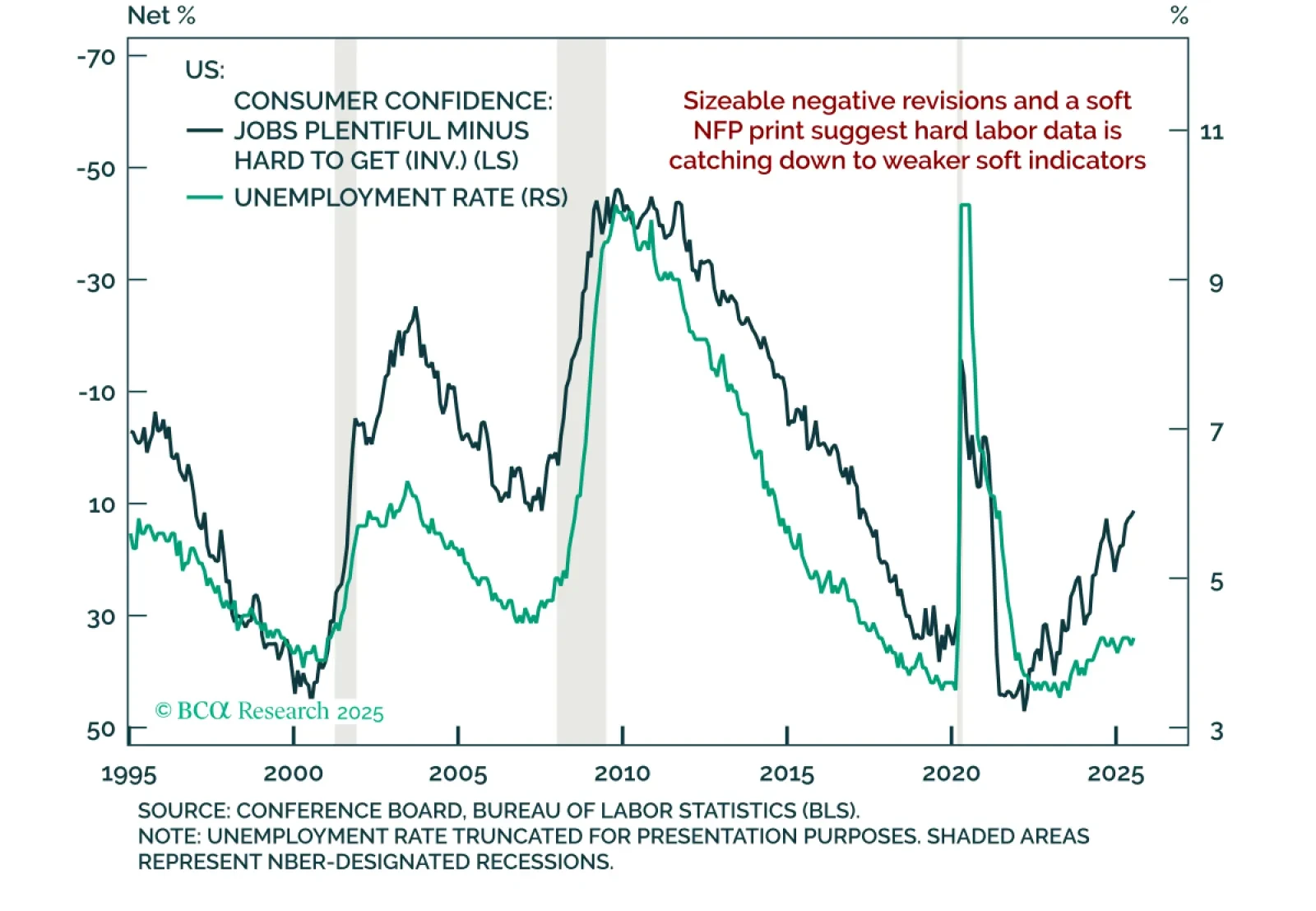

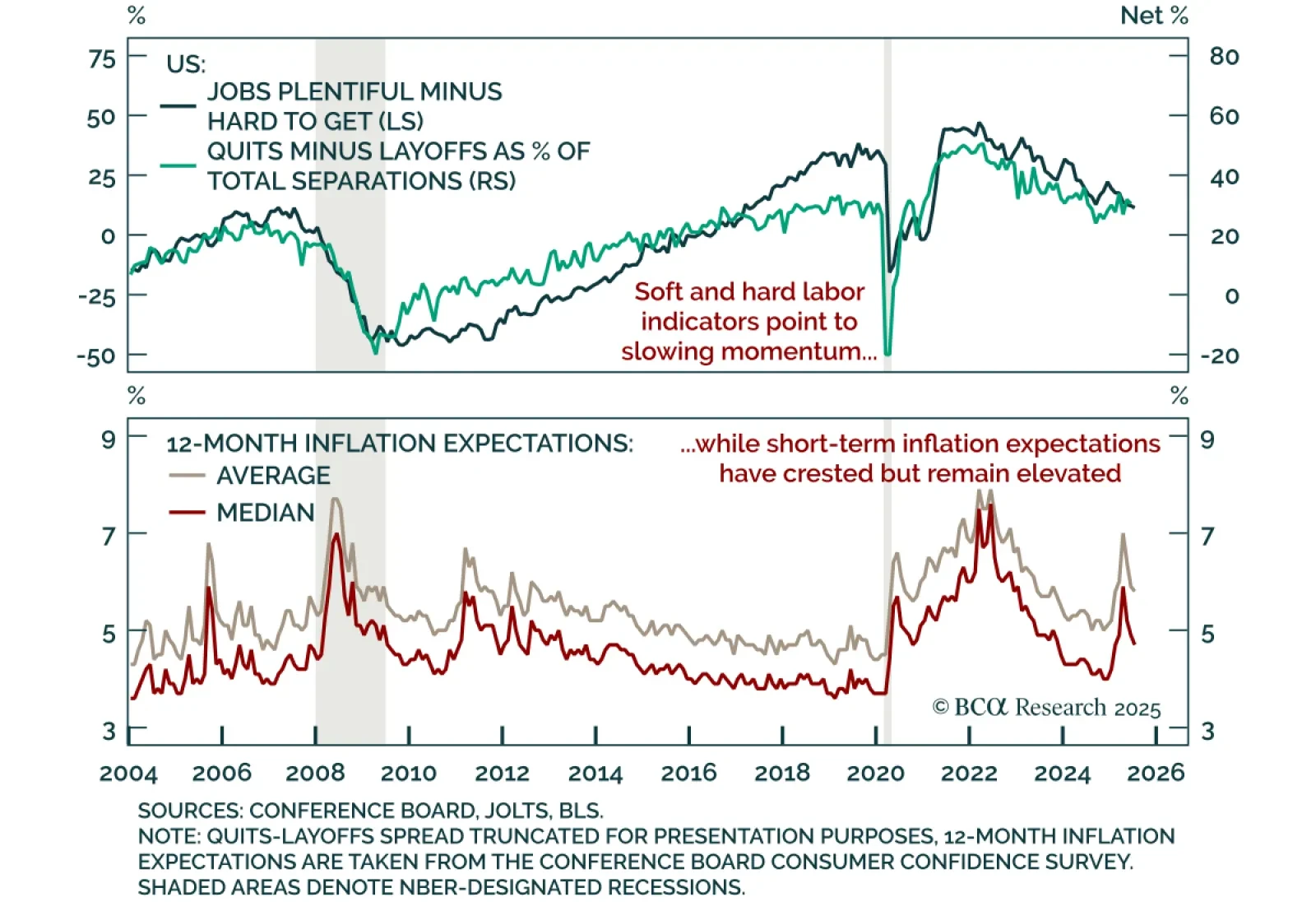

The July employment report revealed large downward revisions and slowing payroll growth, reinforcing our defensive stance. Nonfarm payrolls rose just 73k, and prior months were revised down by 258k, bringing the 3-month average to…

Economic activity and hiring cooled significantly in the first half of the year. The most important question for investors is whether this signals an imminent increase in labor market slack.

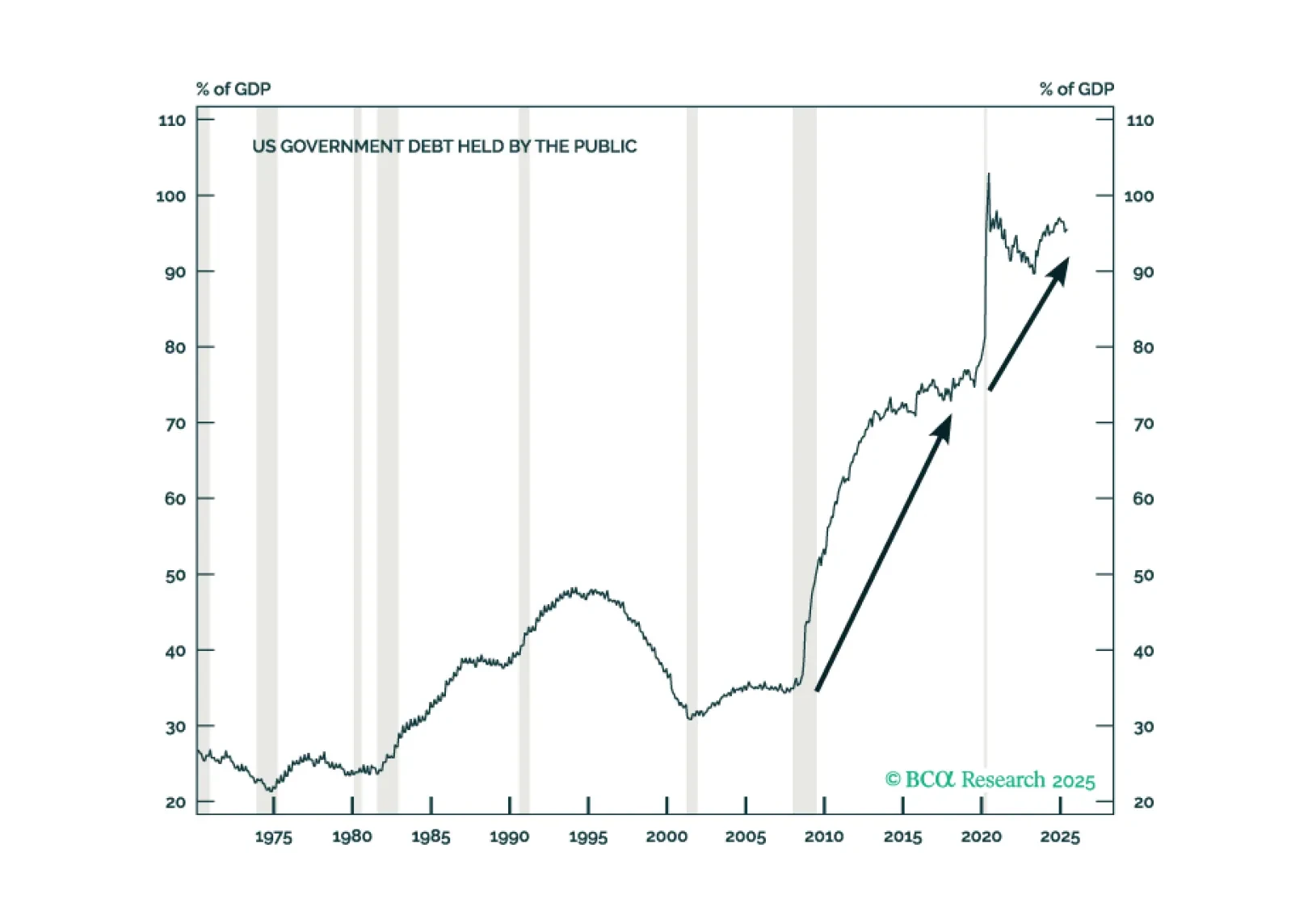

In Section I, Doug weighs the recent reduction in trade uncertainty against the clear signs of labor market and consumer weakness. In Section II, Jonathan reviews the US fiscal outlook in the wake of the passage of the OBBBA.

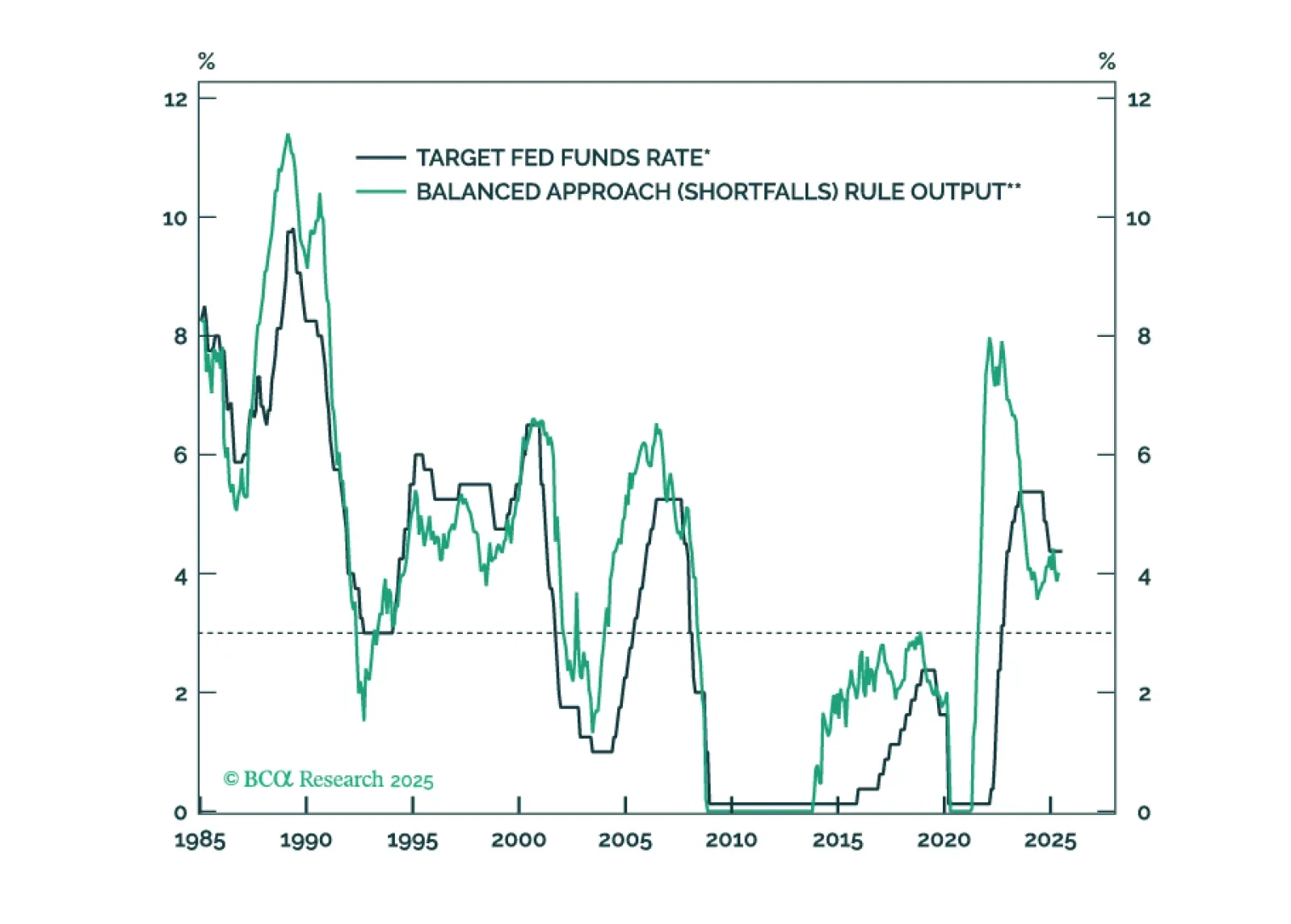

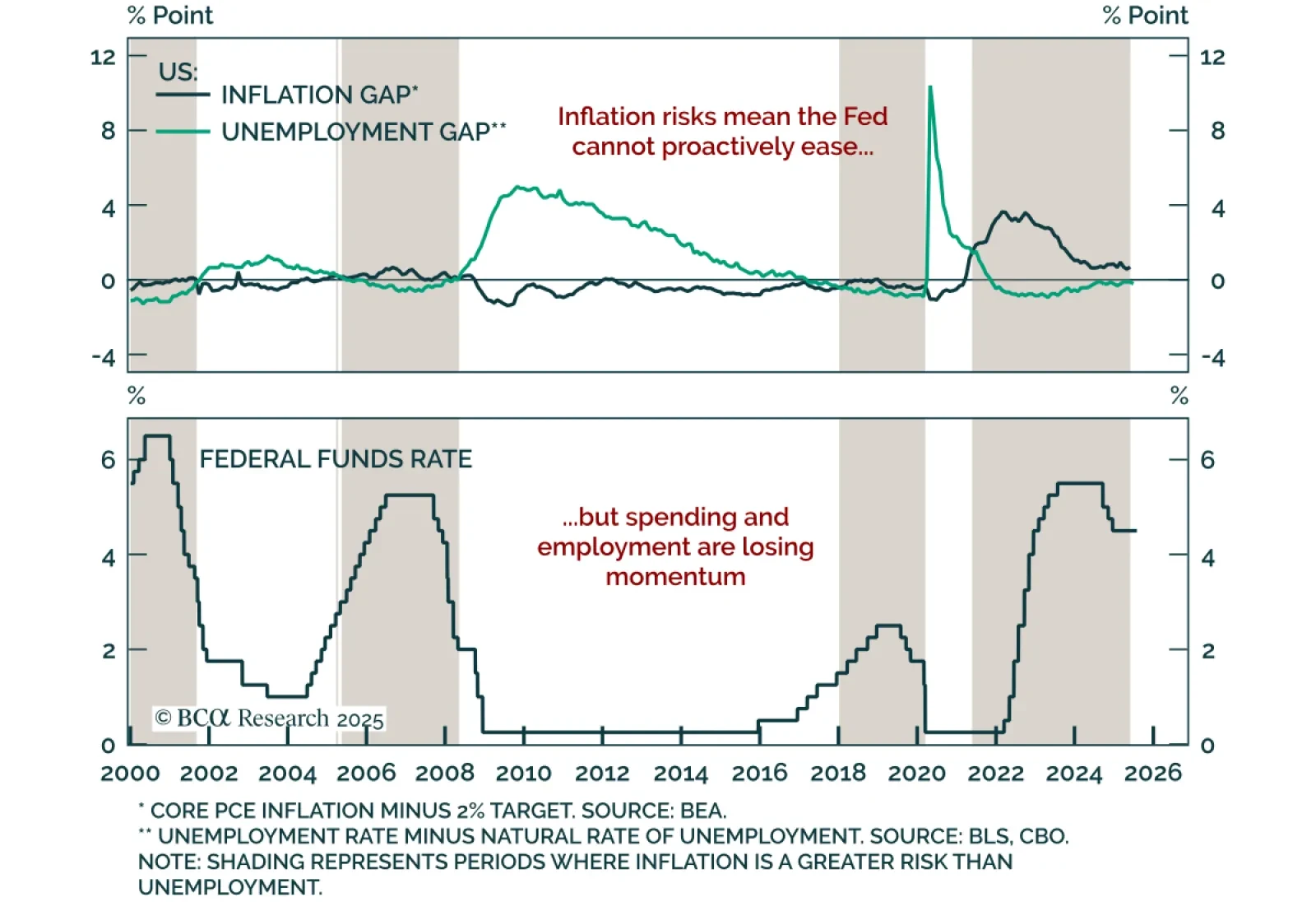

The Fed will keep rates on hold until the unemployment rate forces its hand.

The Fed held rates steady for a fifth straight meeting, with a divided FOMC and resilient growth keeping policy on hold, supporting our long-duration stance. The target range remains at 4.25%–4.50%, with the statement reflecting only…

The July Conference Board Consumer Confidence report showed improved expectations but weaker current conditions, reinforcing our defensive stance and preference for downside protection. The headline index rose to 97.2 from a revised…