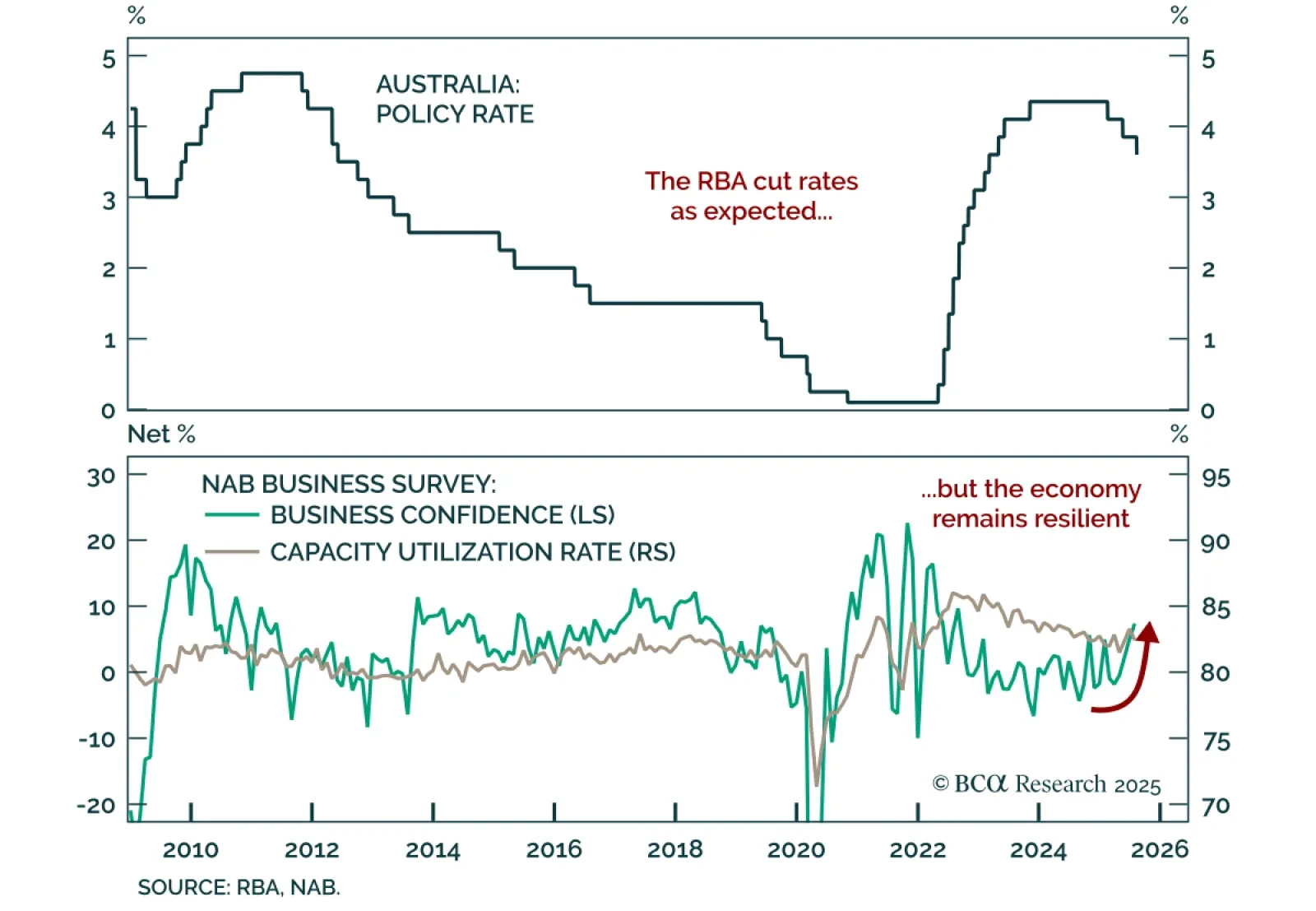

The RBA delivered a widely expected cut to 3.6%, but resilient data warrant an ACGBs underweight. The 25 bps cut was the third this year and Governor Bullock’s guidance was consistent with a cut every other meeting, keeping ACGB…

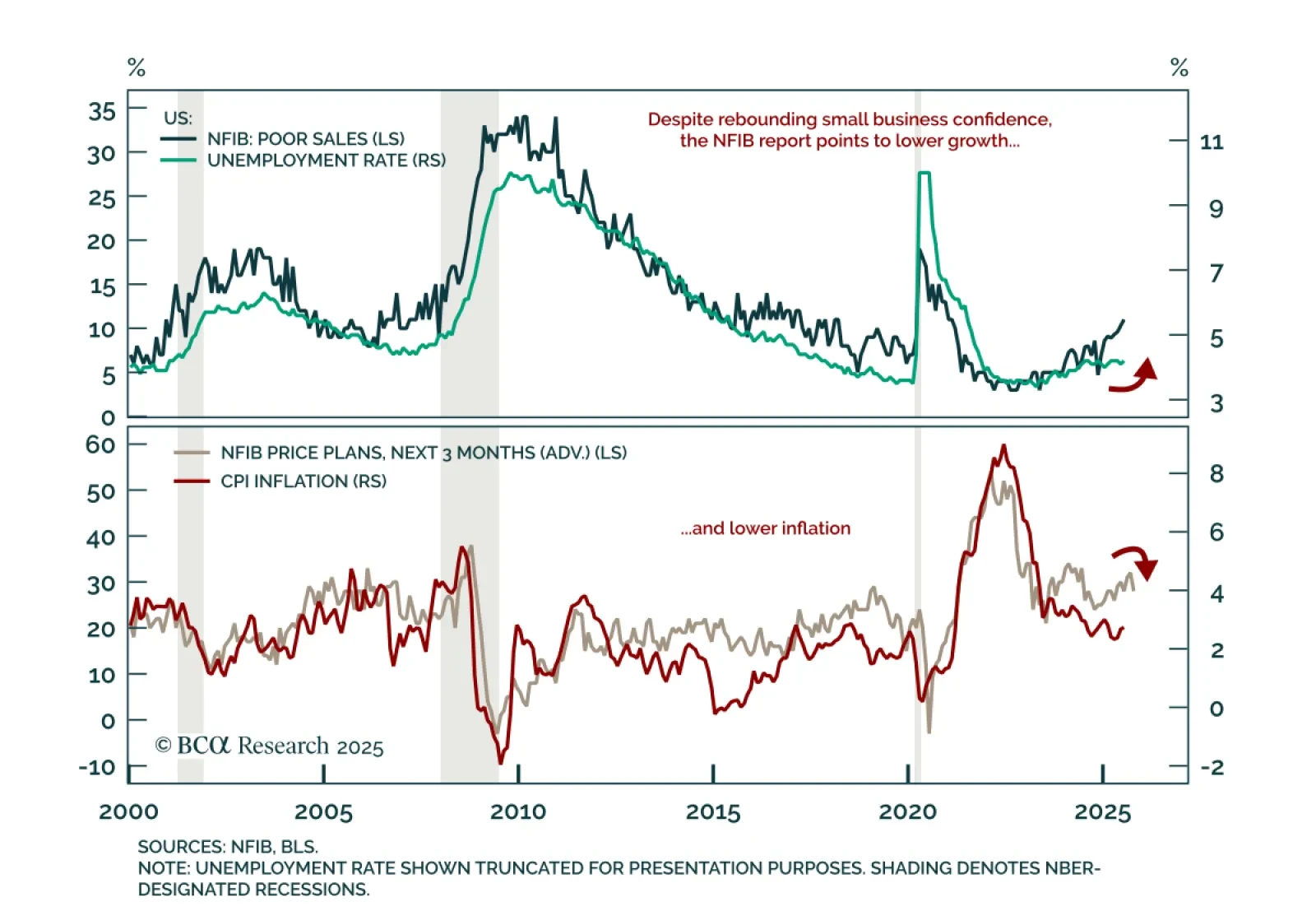

The July NFIB survey showed a rebound in expectations, but underlying weakness reinforces left-tail risks and supports a moderate risk-off allocation. The headline index rose to 100.3, a five-month high, but remains below…

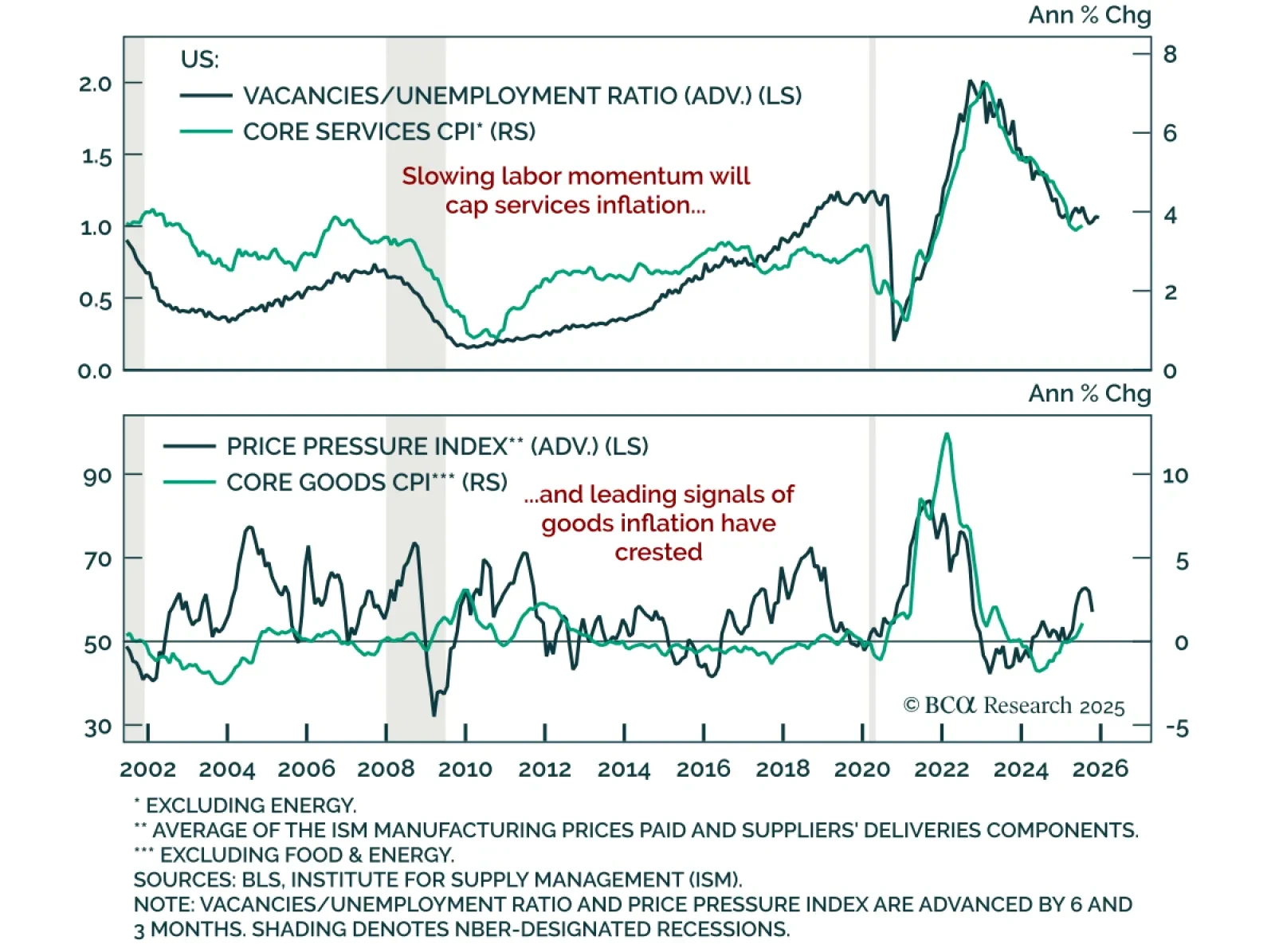

July US CPI met expectations as leading indicators point to disinflation, supporting our long duration stance and preference for 2s5s steepeners. Headline CPI rose 0.2% m/m (2.7% y/y), while core increased 0.3% m/m and…

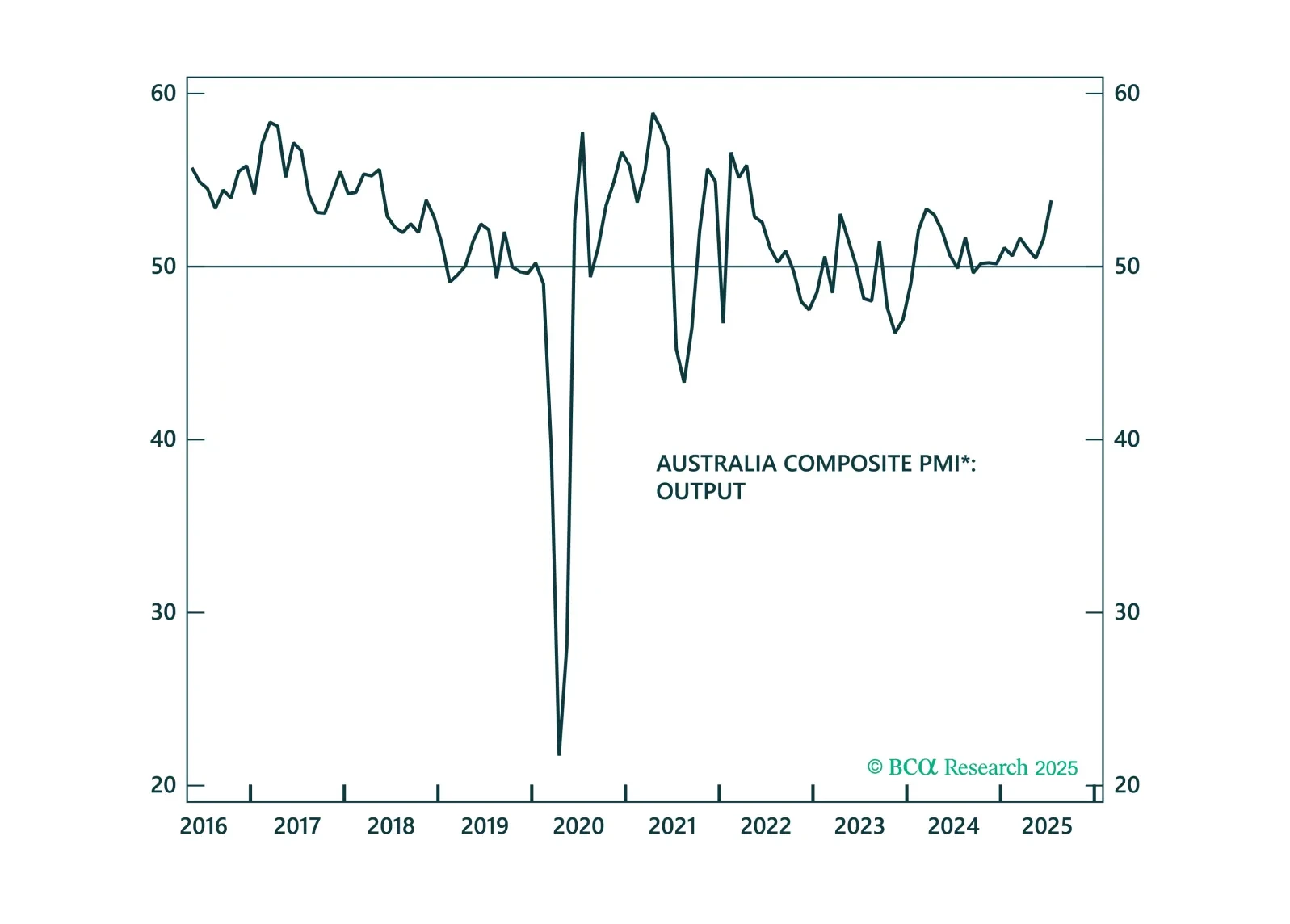

In a widely anticipated move, the RBA resumed cutting rates. However, with housing, consumption, and PMIs improving, we see little scope for the RBA to ease beyond market expectations.

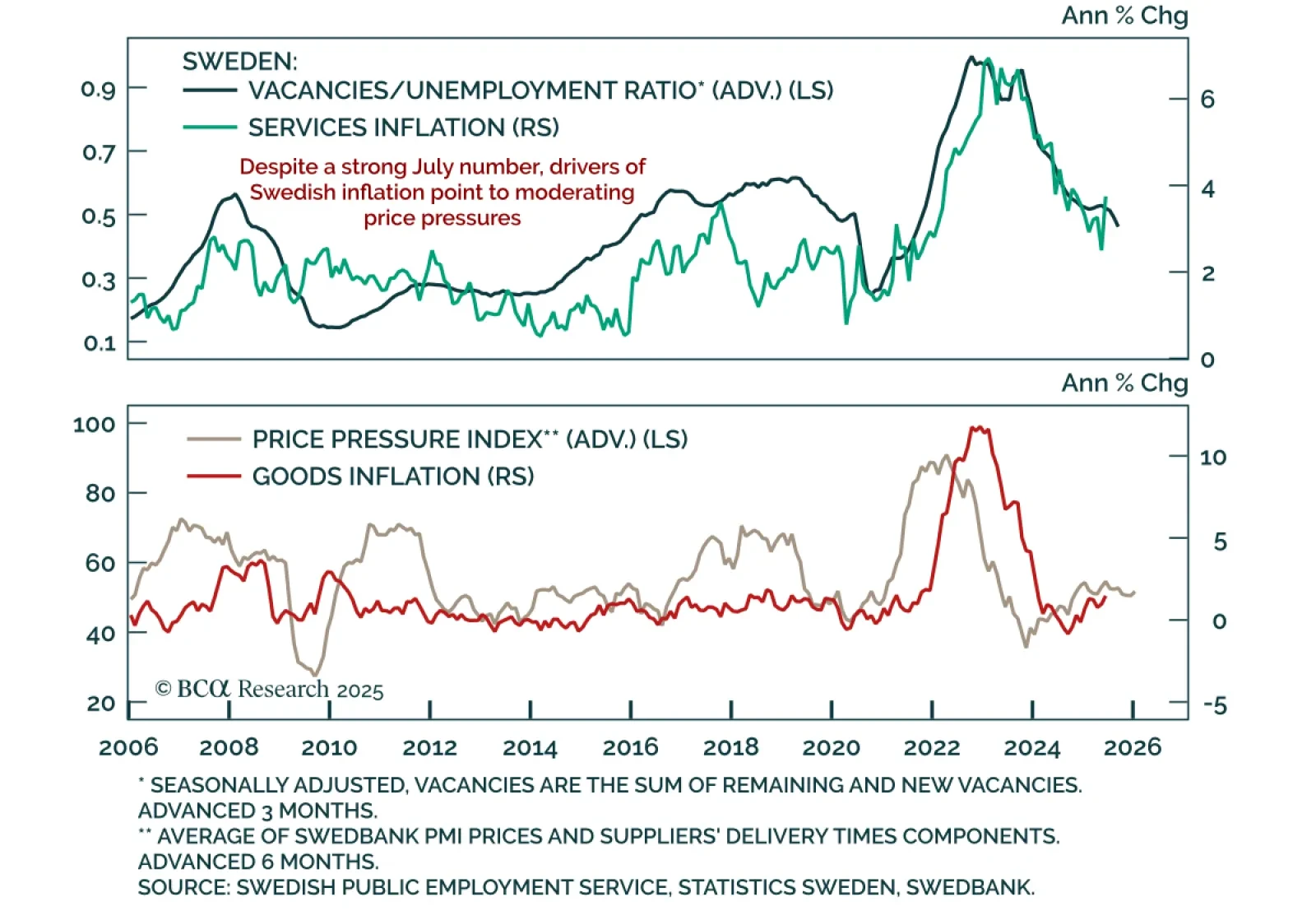

Sweden’s July inflation print came in cooler than expected, but core remains too high for an imminent Riksbank cut. CPI rose 0.8% y/y, while CPIF climbed to 3.0% and core CPIF decelerated to 3.1%, still above the Riksbank’s 2.8…

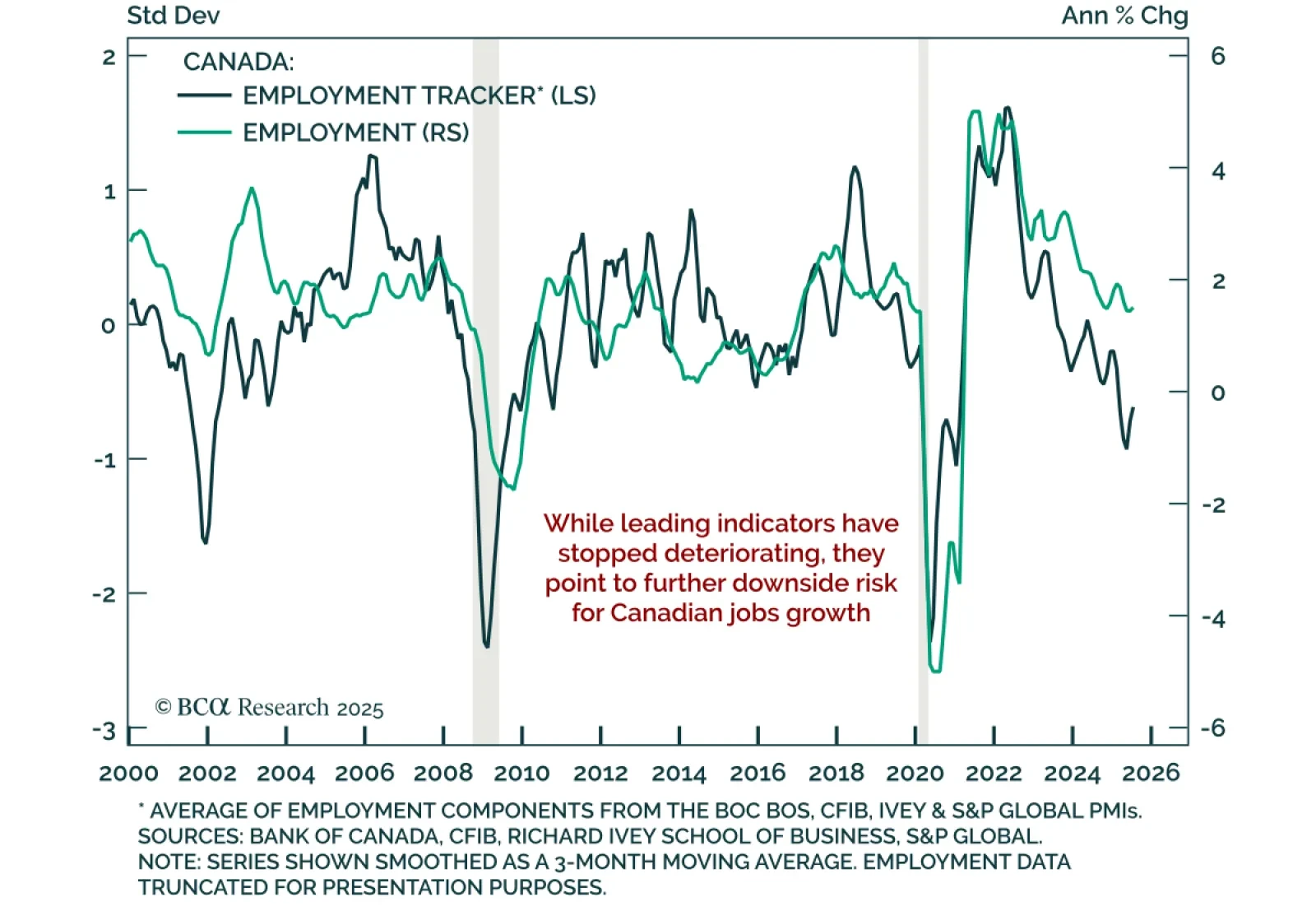

Canada’s July jobs report was mixed, but persistent slack and trade headwinds support our overweight in Canadian bonds and preference for 5s10s steepeners. Employment fell by 40.8k, driven by a 51k drop in full-time jobs, yet…

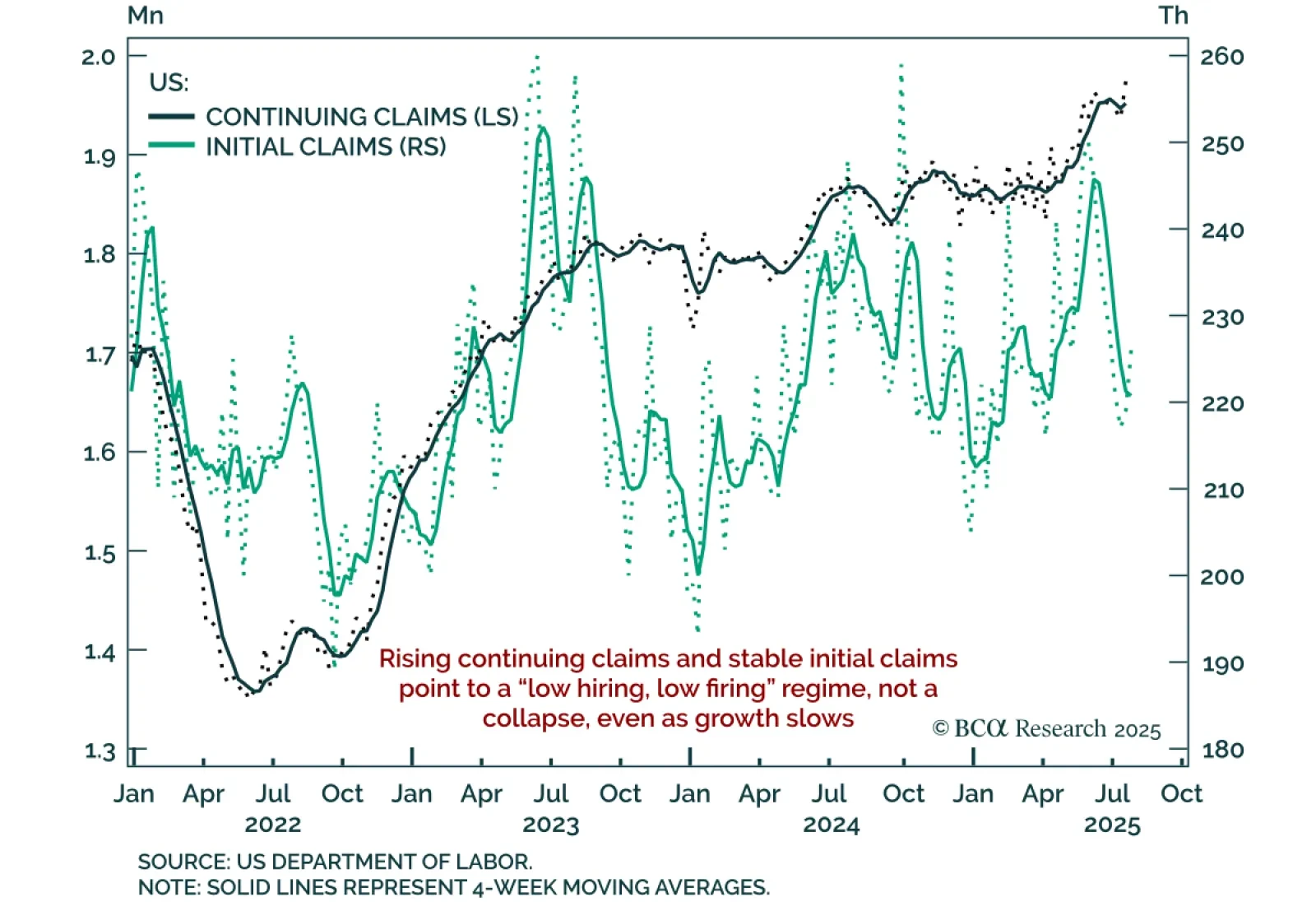

Rising continuing claims and slower job creation reinforce labor market softening, supporting a defensive stance. Continuing claims climbed to a post-COVID high of 1.974m, while initial claims held steady at 226k. Weekly claims…

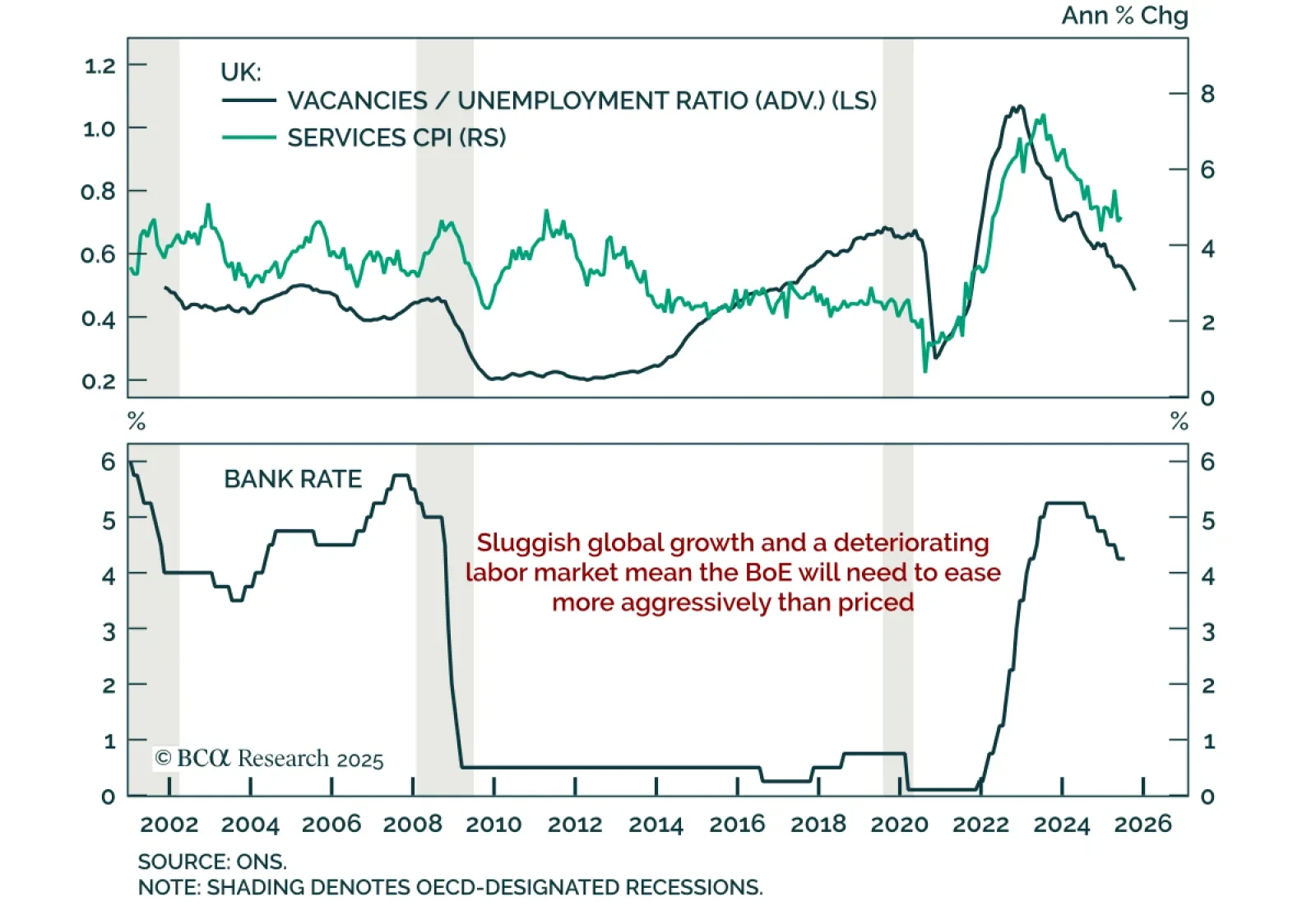

The BoE delivered a narrow rate cut to 4%, but a divided vote and fading growth momentum suggest markets are underpricing further easing. Stay overweight UK Gilts. The 5-4 split reflected concerns among dissenters about a…

Expectations for US inflation at 3.3 percent are inconsistent with expectations for the Fed to slash rates, so one of these expectations is likely wrong. We describe how to play this mispricing. Plus, a new position is to go…

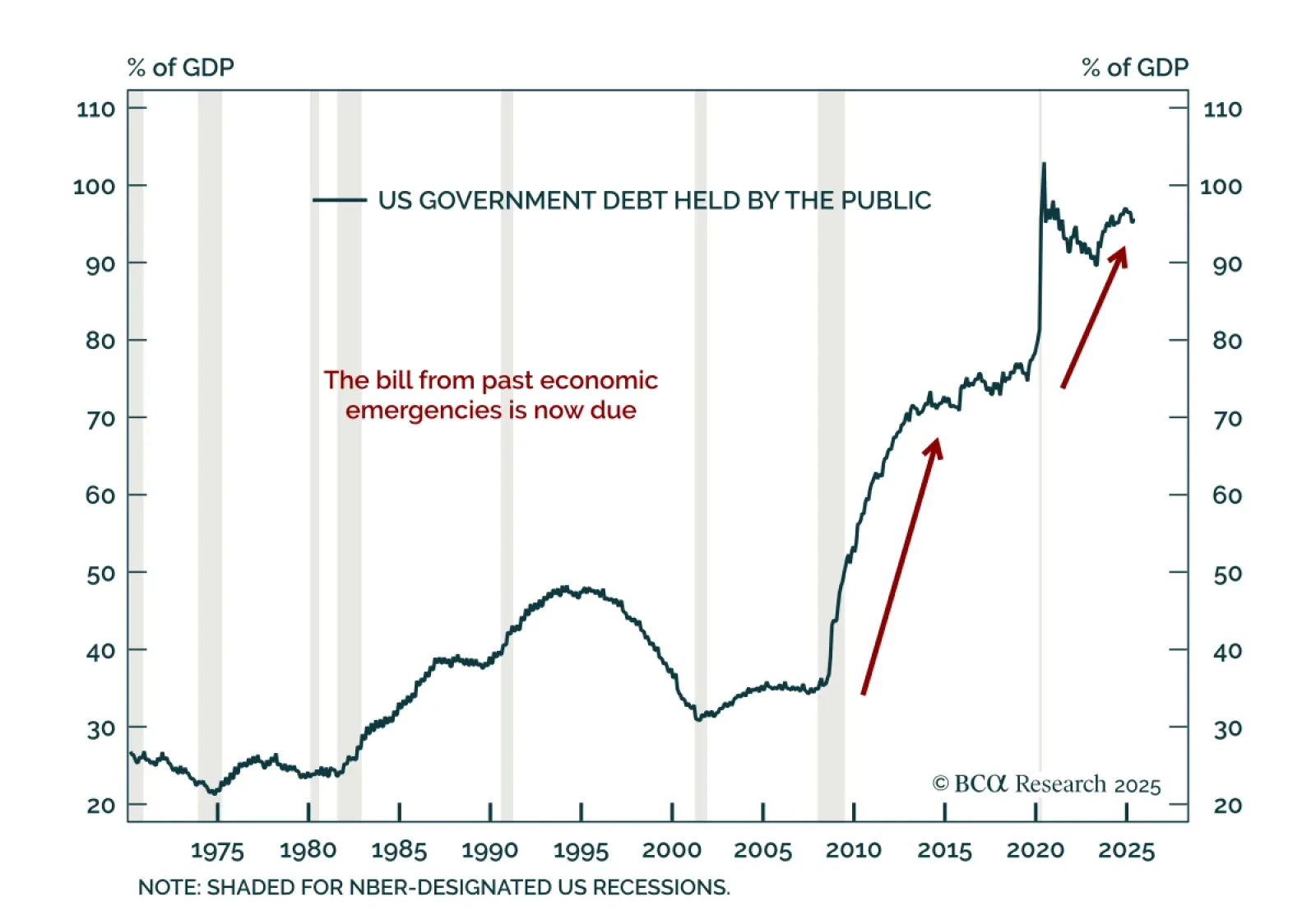

Our Bank Credit Analyst strategists argue that a US fiscal crisis should be treated as a base case over the next decade, not a tail risk. The ballooning US budget deficit reflects higher interest rates, demographic pressures, and the…