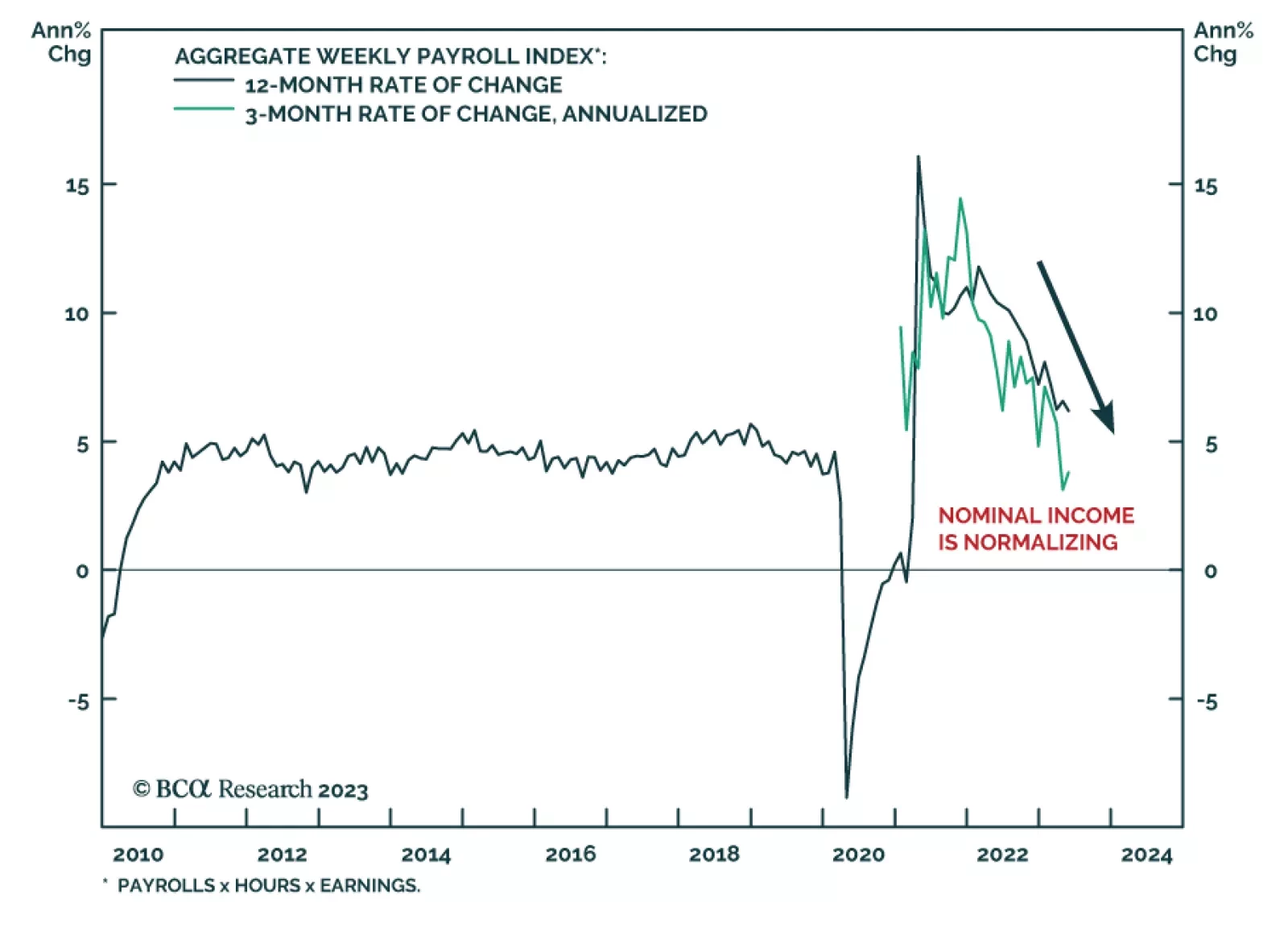

A benign disinflation will support equities over the next few quarters. Stocks will fall next year as a recession begins when investors least expect it.

According to BCA Research’s US Equity Strategy service, the earnings contraction is far from over. However, rising productivity, falling costs, or a new restocking cycle could help. Earnings and sales growth beat analyst…

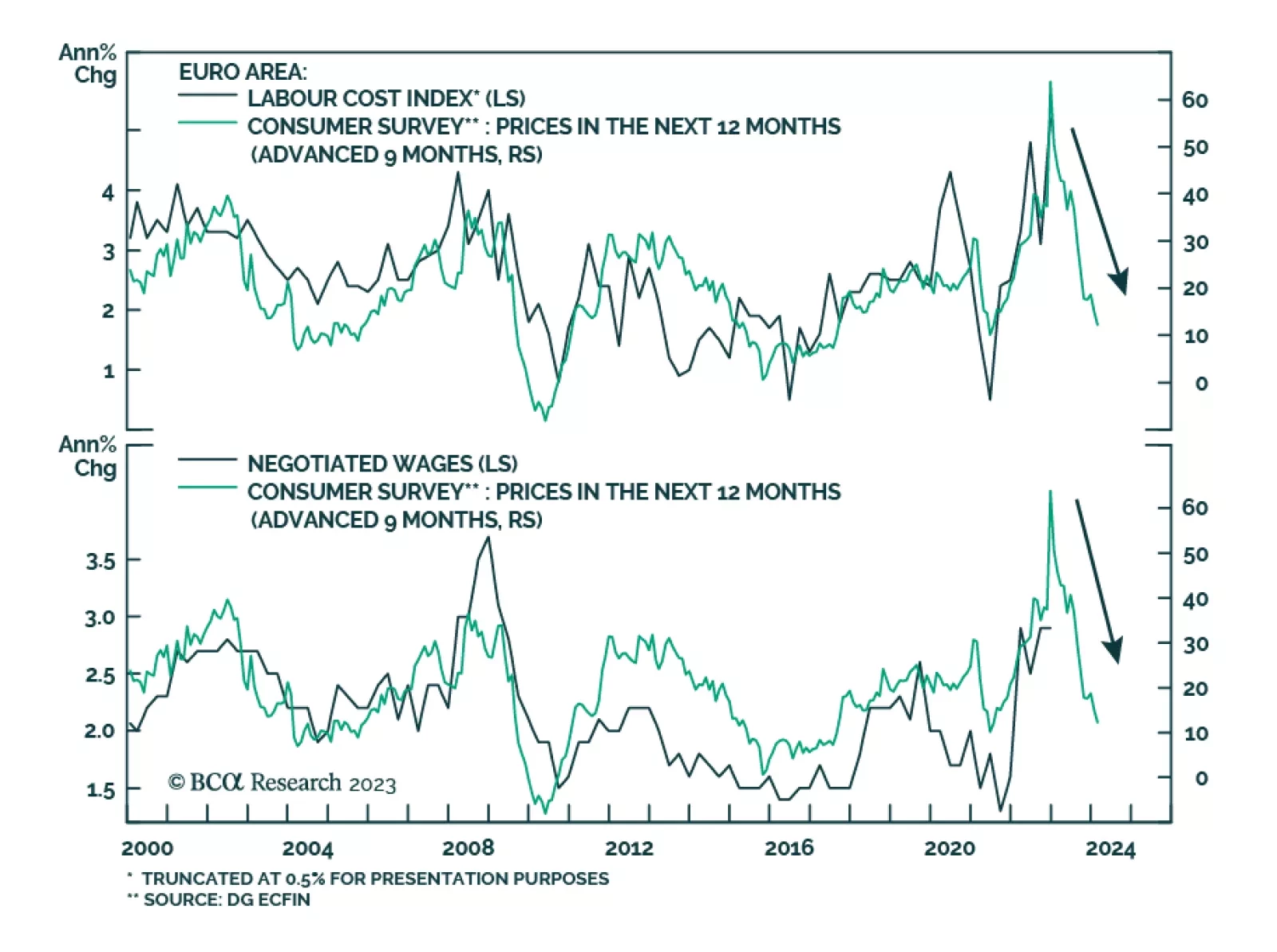

Eurozone households are becoming less concerned about the near-term outlook for inflation. The results of the latest ECB Consumer Expectations survey show a significant drop in median 12-month inflation expectations from 5.0% in…

According to BCA Research’s US Investment Strategy service, the near-term consensus outlook has grudgingly improved but is still excessively bearish. Economic surprises will continue to boost stocks until a 2023 recession…

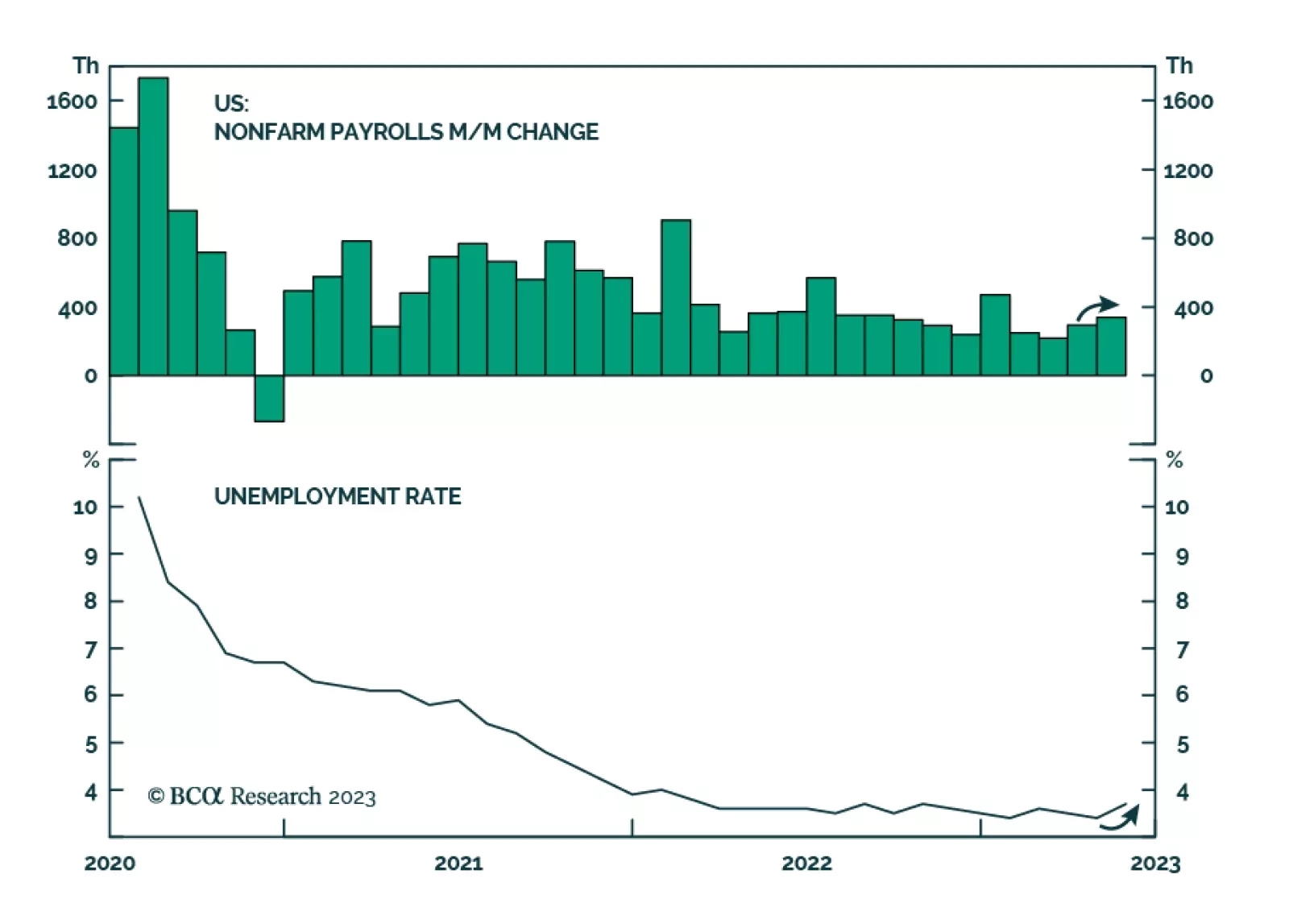

On the surface, Friday’s nonfarm payrolls report delivered a strong positive surprise. Establishment survey results reveal that employment increased by 339 thousand in May – above both the upwardly revised 294…

The Fed is still on track for a June pause, even after May’s strong nonfarm payroll print.

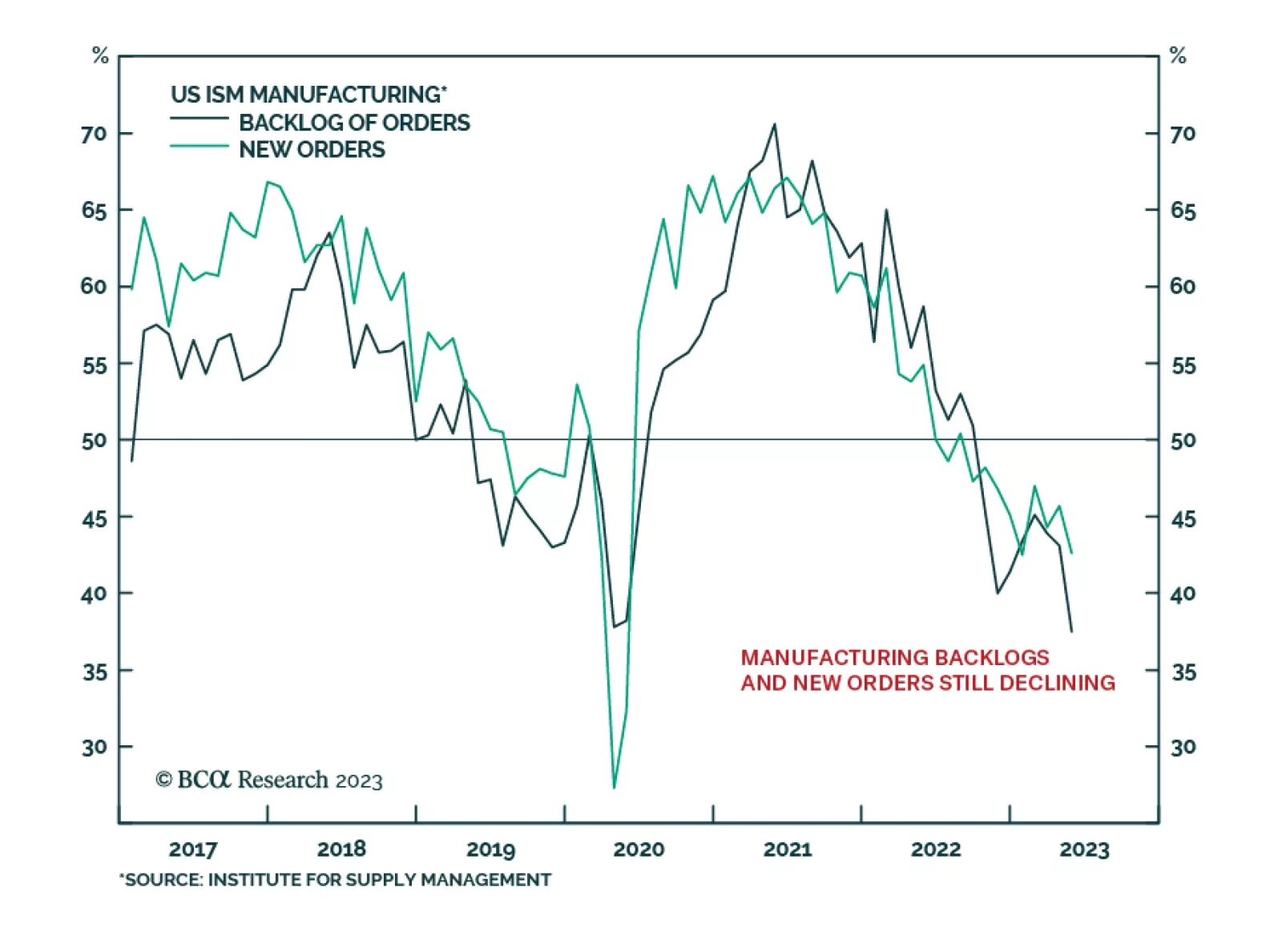

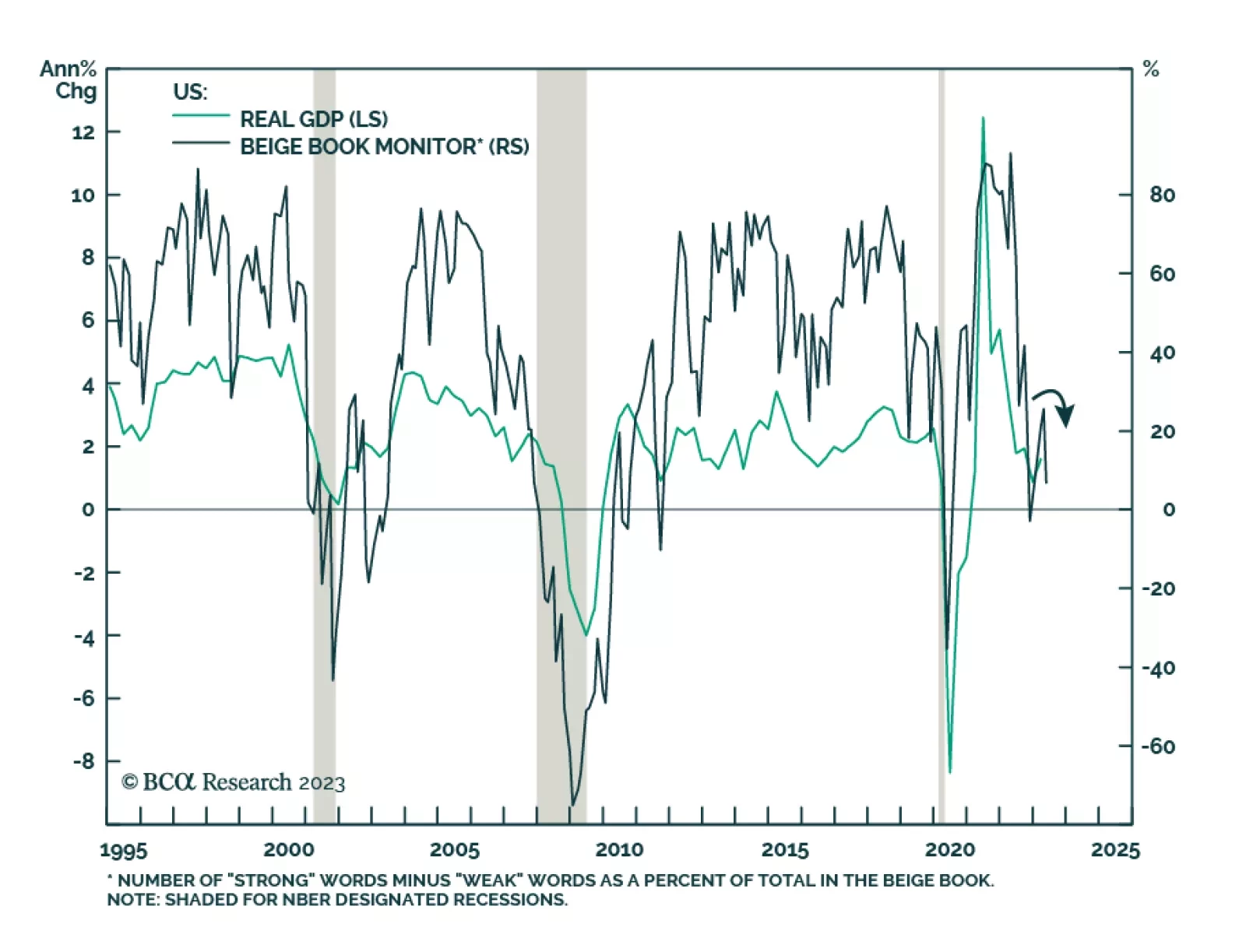

The Fed’s Beige Book is signaling that the US economy is losing steam following an improvement in momentum earlier this year. The release revealed that future growth expectations deteriorated. In particular, manufacturing…

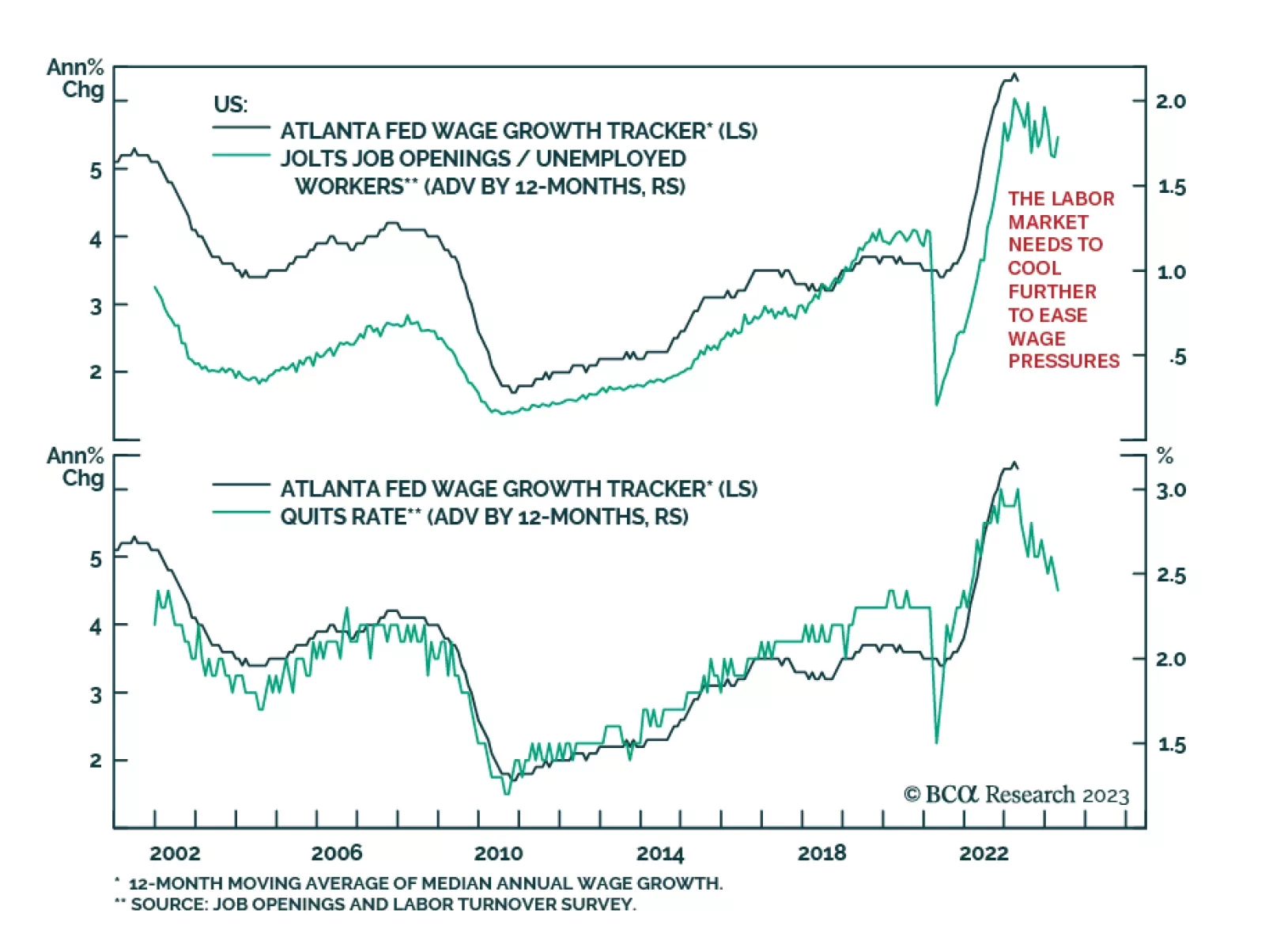

The JOLTS survey for April shows job openings unexpectedly rising from an upwardly revised 9.7 million to 10.1 million – above expectations of a decline to 9.4 million. The job openings rate inched up to 6.1% from 5.9%…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

Once the debt ceiling soap opera ends, investors will likely turn their attention to some of the tailwinds supporting stocks. These include stronger earnings growth, diminished bank stresses, better housing data, early signs of an…