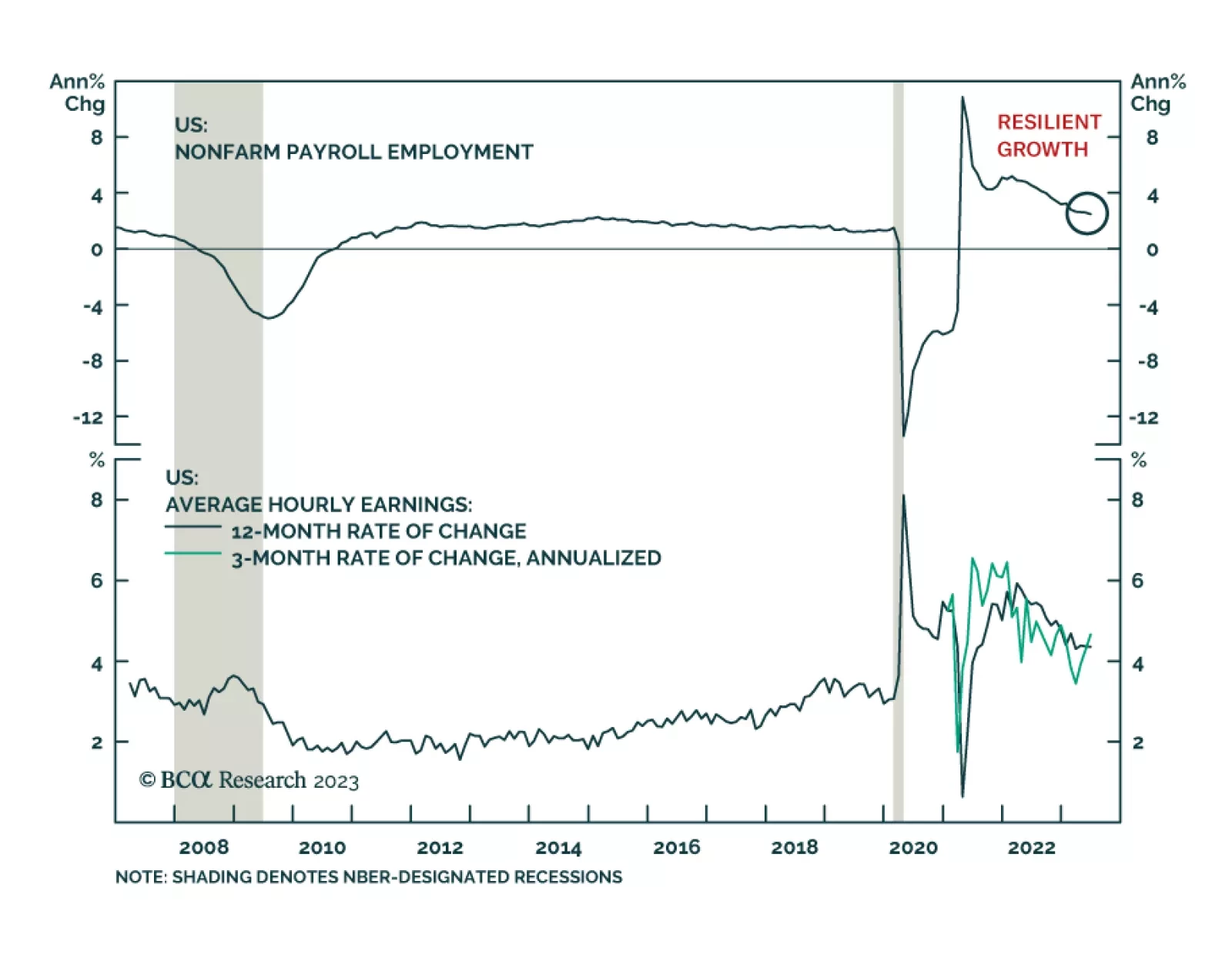

Last week’s labor market data signal that US employment conditions remain strong – solidifying the case for a 25 bps rate hike at the Fed’s next meeting later this month (see The Numbers). Yet in order for…

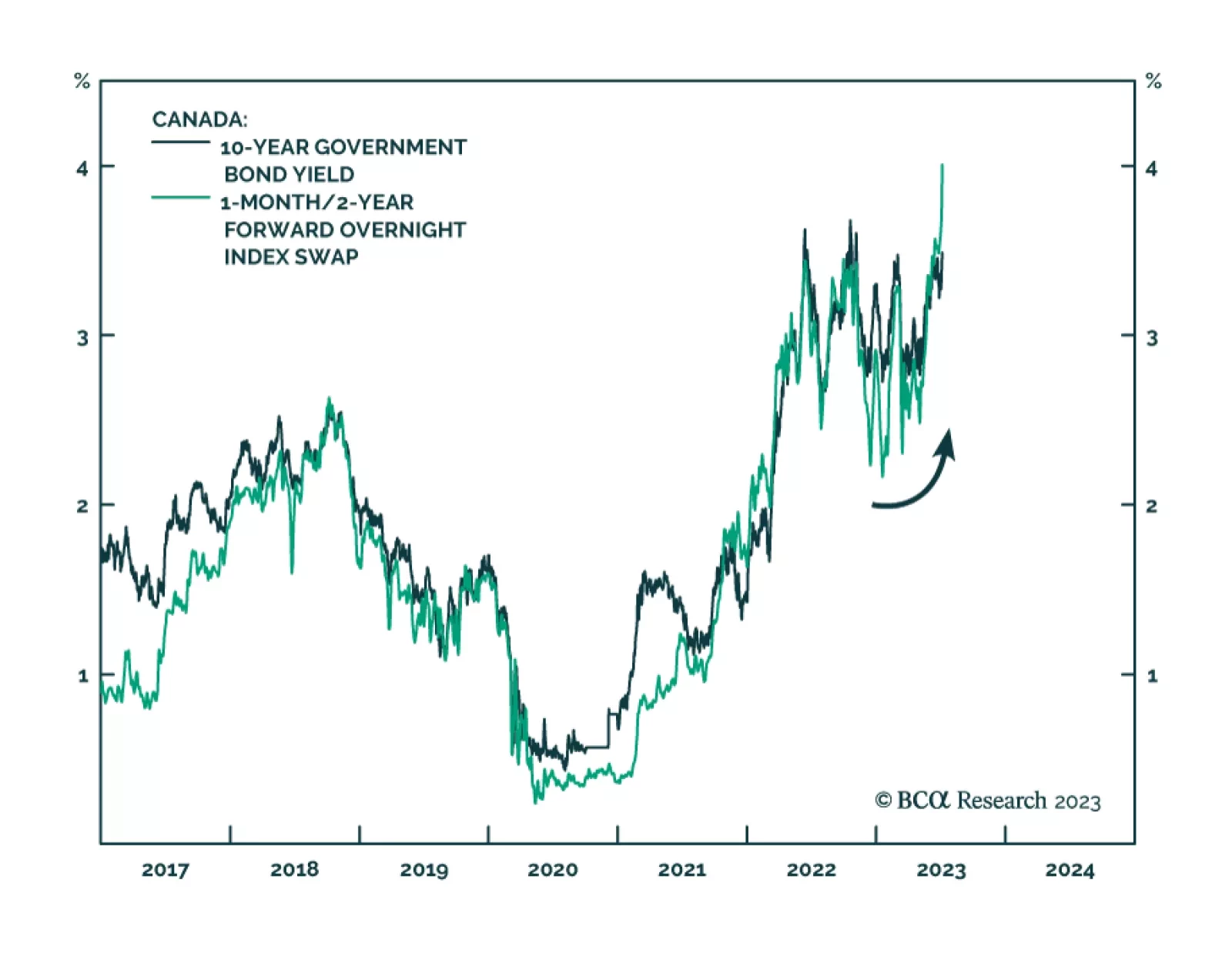

Canadian hiring surprised to the upside in June. The 60 thousand increase in employment last month – the highest since January – came in triple expectations of a 20 thousand rise and follows a 17 thousand decline in…

On the surface, the lower-than-anticipated job gains suggest that US labor market conditions softened last month. Friday’s jobs report revealed that the increase in nonfarm payrolls slowed from a downwardly revised 306…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

A perspective on the recent increase in US bond yields and this morning’s employment report.

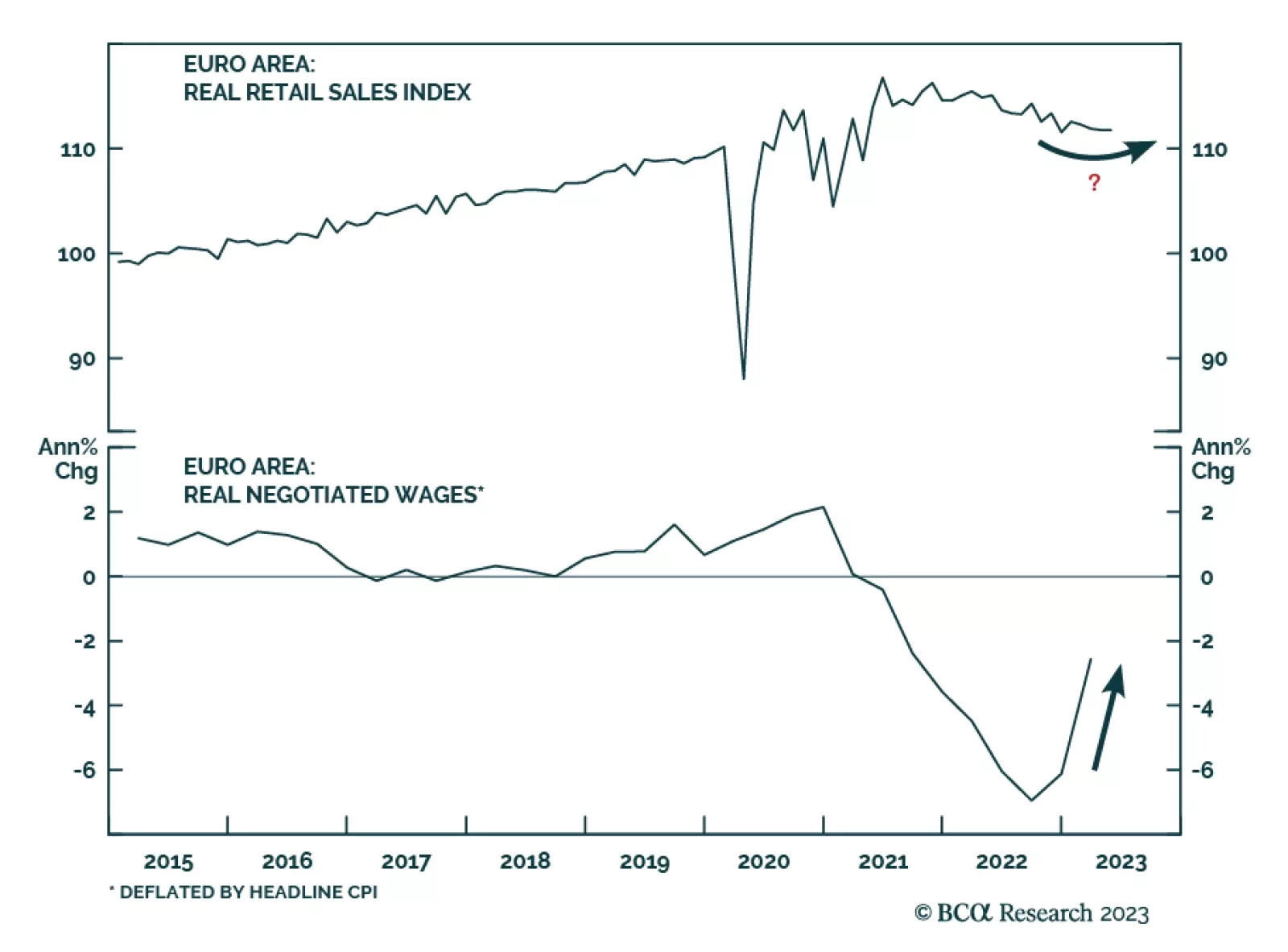

Yesterday we highlighted that falling producer prices foreshadow lower CPI inflation in the Eurozone and argued that this dynamic is positive for the bloc’s consumption outlook. Easing price pressures will ultimately lift…

Global stocks fell and sovereign bond yields surged on Thursday following the release of stronger-than-anticipated US labor market data. Data released by Challenger, Gray, & Christmas showed job cuts declined to 40,709…

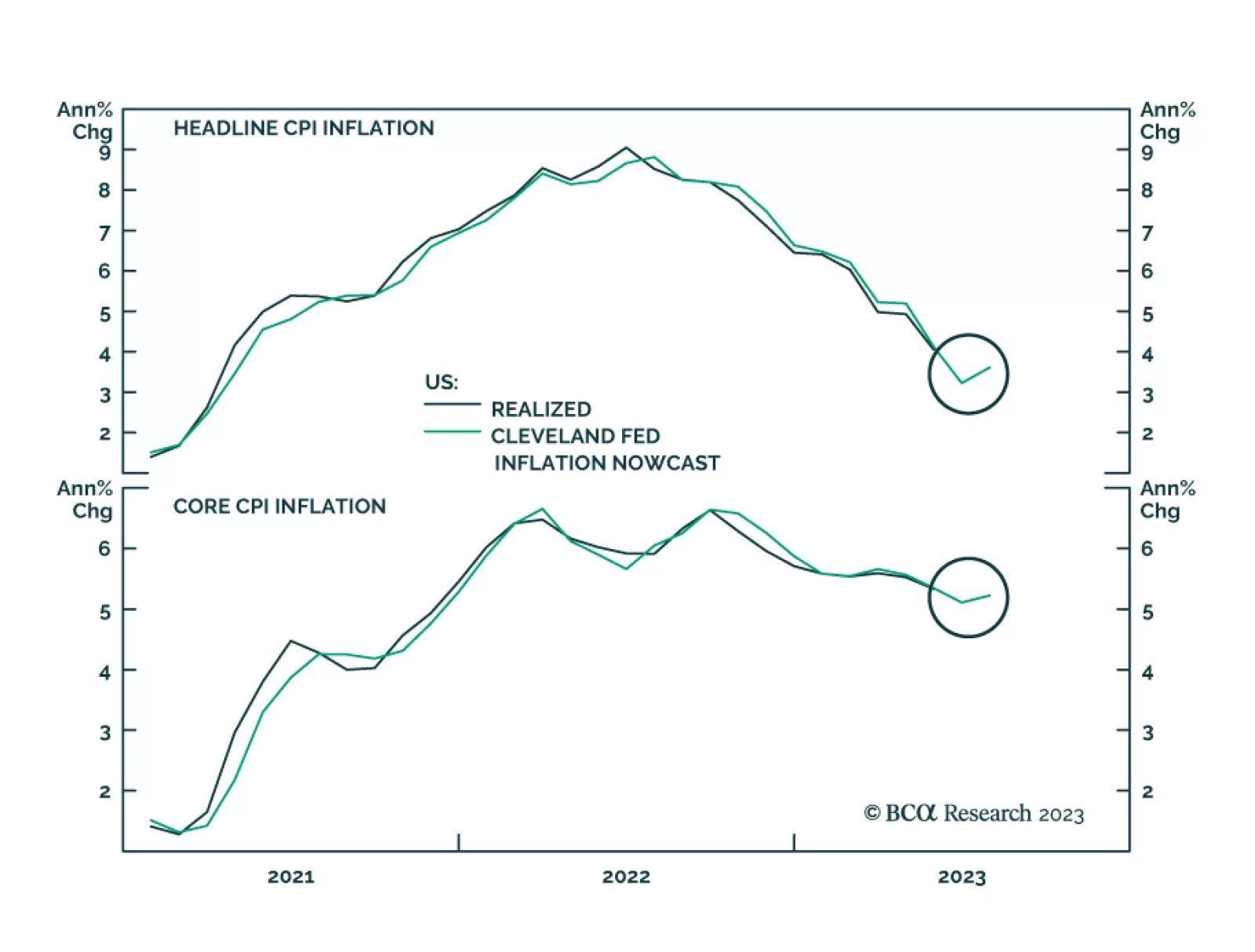

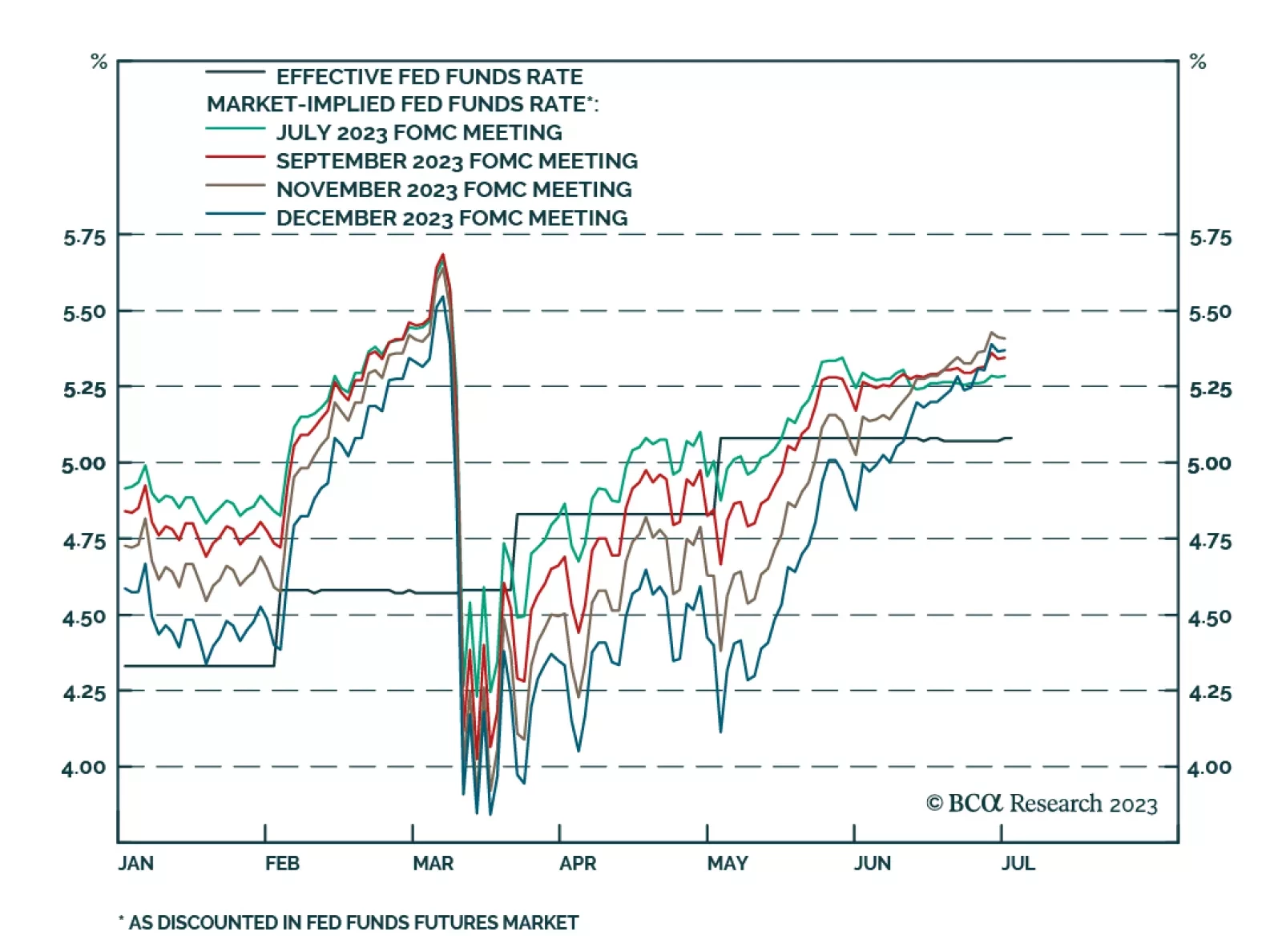

The minutes from the June FOMC meeting didn’t reveal anything that wasn’t already known. They did explicitly say that “some” participants would have preferred a 25 basis point rate hike instead of a pause…

The world economy is likely already in recession, defined as world growth dipping to sub-2 percent. So far, the world recession has been China-led, but in the coming months it will change to being developed economy-led. Hence, while…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.